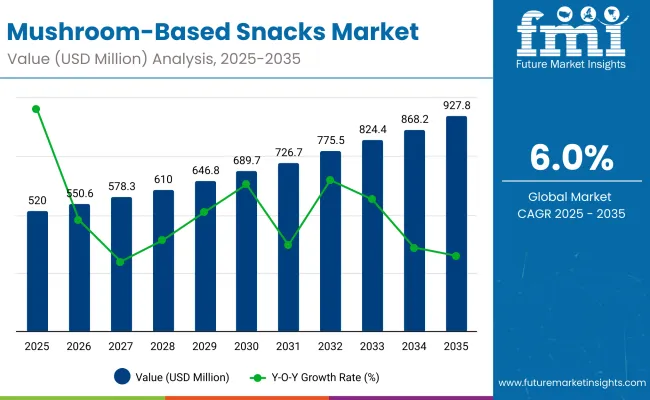

A valuation of USD 520.0 million is projected for the Mushroom-Based Snacks Market in 2025, with expansion expected to reach USD 927.8 million by 2035. The increase of USD 407.8 million across the decade reflects a near-doubling of value, supported by a 6.0% CAGR. This trajectory highlights the strengthening role of mushroom-derived products in functional snacking as demand expands from niche adoption to mainstream categories.

Mushroom-Based Snacks Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 520.0 million |

| Market Forecast Value in (2035F) | USD 927.8 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

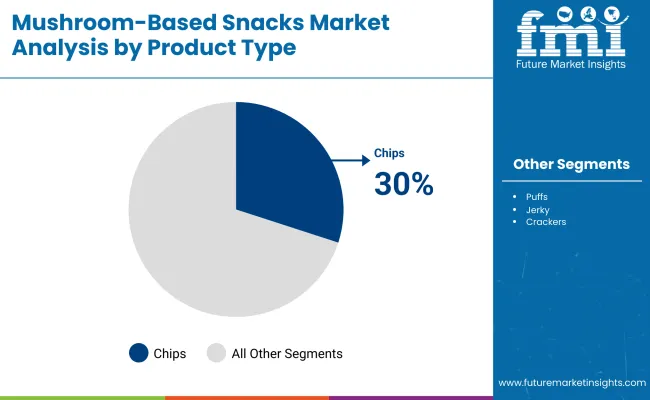

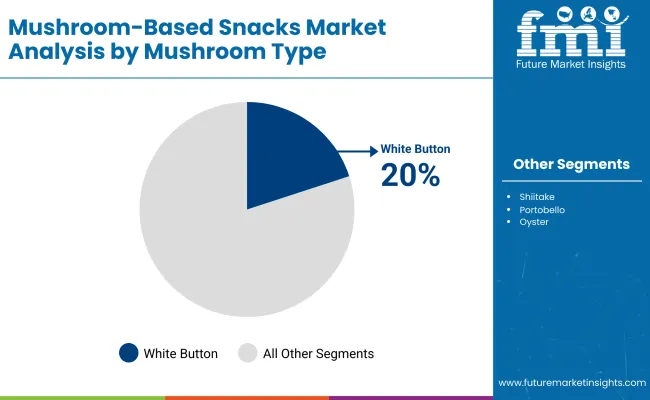

Between 2025 and 2030, the market is forecast to advance from USD 520.0 million to USD 694.0 million, delivering USD 174.0 million in additional value, which equals ~42% of the total decade growth. This initial phase is expected to capture early enthusiasm for mushroom chips, puffs, and jerky, reinforced by innovation in flavor systems and claims around immunity, cognition, and natural protein. Chips, holding 30% of share in 2025, are projected to dominate the product landscape, while shiitake mushrooms, accounting for 25% share, are anticipated to lead among ingredient types.

In the subsequent 2030 to 2035 horizon, the market is set to expand from USD 694.0 million to USD 927.8 million, adding USD 233.8 million, or nearly 58% of the total decade value creation. This later-stage acceleration is expected to be fueled by online retail scaling, the growing role of micro-markets and vending channels, and broader acceptance of Lion’s Mane and Reishi-based functional snacks, both of which are forecast to outpace the category’s average CAGR.

From 2020 to 2024, the Mushroom-Based Snacks Market expanded from an emerging niche to a recognized plant-forward snacking category, supported by the rise of functional foods and clean-label positioning. During this period, the competitive landscape was dominated by early-stage innovators and natural snack brands, which controlled the majority of revenue through chips, jerky, and puff launches. Differentiation was achieved through novel flavor systems, natural sourcing, and premium pricing, while functional claims around immunity and cognition were promoted but often without large-scale validation. Distribution was concentrated in specialty health stores and online retail, with supermarkets contributing a smaller share of total sales.

Demand for mushroom-based snacks is projected to reach USD 520.0 million in 2025, setting the foundation for long-term expansion to USD 927.8 million by 2035 at a 6.0% CAGR. The revenue mix is expected to shift steadily as functional mushrooms such as Lion’s Mane and Reishi increase penetration, adding value beyond traditional white button and shiitake formats. Chips (30% share) and shiitake (25% share) will continue to dominate in 2025, though jerky and functional blends are forecast to grow fastest.

Competitive advantage is anticipated to move away from basic product novelty toward ecosystem strength in sourcing, verified functional claims, and omnichannel distribution scale. Large CPG players are expected to pivot to hybrid models that combine mass-market indulgence with premium functional offerings, while emerging digital-first brands emphasize transparency, sustainability, and direct consumer engagement. Market leadership will increasingly depend on brand trust, scalability of mushroom supply, and recurring consumer loyalty, rather than isolated innovation in formats alone.

Growth in the Mushroom-Based Snacks Market is being propelled by rising consumer demand for plant-forward, functional, and clean-label alternatives to conventional snacks. Mushrooms are being positioned as nutrient-rich ingredients, offering natural sources of fiber, protein, and vitamins while enabling indulgence with fewer calories. Functional varieties such as Lion’s Mane and Reishi are being increasingly highlighted for cognitive and immunity benefits, supporting consumer interest in wellness-driven snacking. Expansion is being reinforced by innovations in chips, jerky, and puff formats, which provide familiar entry points while enhancing trial and acceptance.

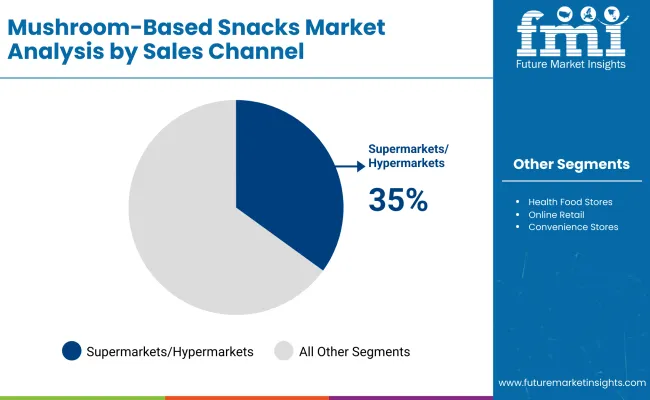

Distribution is being broadened through supermarkets, online platforms, and micro-markets, ensuring availability across mass and niche channels. Sustained investment in supply chain scalability and mushroom cultivation technology is expected to lower costs and enhance product consistency, further supporting adoption. As consumer preferences evolve toward better-for-you and sustainable snacking, mushroom-based products are projected to transition from a specialty category into a mainstream growth driver.

The Mushroom-Based Snacks Market is segmented by product type, mushroom type, sales channel, and region. Product type categories include chips, puffs, jerky, crackers, bites, and bars, reflecting the diverse range of snack formats gaining consumer traction. Mushroom type segmentation covers white button, shiitake, portobello, oyster, Lion’s Mane, Reishi, and mixed mushroom blends, highlighting both culinary and functional applications. Based on sales channels, the market is divided into supermarkets and hypermarkets, health food stores, online retail, convenience stores, and vending or micro-markets, underscoring the role of both traditional and emerging distribution pathways. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, capturing the global diffusion of mushroom-based snacking trends across developed and emerging economies.

| Product Type | 2025 Share (%) |

|---|---|

| Chips | 30% |

| Puffs | 20% |

| Jerky | 15% |

| Crackers | 15% |

| Bites | 10% |

| Bars | 10% |

The market is segmented by product type into chips, puffs, jerky, crackers, bites, and bars. In 2025, chips are projected to account for 30% of market share, followed by puffs at 20%. Jerky, although smaller in share at 15%, is projected to post the fastest CAGR of 10.5%, as mushroom dehydration and seasoning processes replicate protein-rich textures increasingly preferred by flexitarian consumers.

Chips and puffs are anticipated to remain popular as consumers seek familiar indulgent formats with healthier positioning. Over time, jerky and bites are projected to capture greater attention from health-focused buyers, supported by functional mushroom blends and portability advantages. Product innovation in bars and crackers is expected to further diversify offerings, broadening consumer engagement.

| Mushroom Type | 2025 Share (%) |

|---|---|

| White Button | 20% |

| Shiitake | 25% |

| Portobello | 15% |

| Oyster | 15% |

| Lion’s Mane | 10% |

| Reishi (functional blends) | 5% |

| Mixed Mushroom Blends | 10% |

Segmentation by mushroom type highlights shiitake, white button, portobello, oyster, Lion’s Mane, Reishi, and mixed blends. Shiitake mushrooms are expected to hold 25% of the market share in 2025, leading the segment due to their wide culinary acceptance and balanced taste profile.

Reishi and Lion’s Mane are anticipated to grow fastest, with CAGRs of 10.5% and 10.0% respectively, as immunity-support positioning for Reishi and cognitive-health association for Lion’s Mane resonate strongly with wellness-focused consumers. White button mushrooms at 20% share will continue to drive mainstream affordability, while mixed mushroom blends at 10% share are projected to grow at 9.3% CAGR, appealing to consumers seeking holistic functional benefits. The segment’s momentum is expected to shift toward functional mushrooms over the next decade as scientific validation strengthens positioning.

| Sales Channel | 2025 Share (%) |

|---|---|

| Supermarkets/Hypermarkets | 35% |

| Health Food Stores | 15% |

| Online Retail | 25% |

| Convenience Stores | 15% |

| Vending & Micro-Markets | 10% |

The market is segmented by sales channel into supermarkets/hypermarkets, health food stores, online retail, convenience stores, and vending & micro-markets. Supermarkets and hypermarkets are projected to hold 35% share in 2025, ensuring dominance through wide accessibility and established consumer trust.

However, online retail is expected to expand fastest at 10.0% CAGR, fueled by direct-to-consumer strategies and the growing role of digital-first wellness brands. Health food stores at 15% share will remain key to early adopters, while vending and micro-markets at 10% share are forecast to capture steady growth at 9.5% CAGR, catering to on-the-go snacking occasions. Convenience stores are projected to contribute 15% share as mushroom-based products penetrate mainstream retail baskets. Over time, channel diversification is expected to accelerate, with online retail strengthening consumer trial and repeat purchase.

Supply-side scaling and evolving consumer expectations are reshaping the Mushroom-Based Snacks Market, even as regulatory scrutiny and premium pricing challenge wider accessibility across mainstream channels.

Functional Positioning Reinforced by Scientific Validation

The market is expected to benefit from the gradual substantiation of health claims surrounding mushrooms such as Lion’s Mane and Reishi. As clinical studies provide evidence of cognitive and immune-support properties, regulatory approval for structure/function claims is anticipated to improve. This progression will enable snack manufacturers to position products as verifiably functional rather than anecdotal, differentiating mushroom-based snacks from other plant-based categories. Over the forecast horizon, validated claims are projected to strengthen consumer trust, justify premium pricing, and attract investment from large-scale food companies seeking to align with wellness-focused innovation.

Cost Sensitivity Linked to Processing and Distribution

Expansion is projected to be constrained by elevated costs tied to specialized cultivation, advanced dehydration, and processing methods required to retain nutrient density and flavor, making mushroom-based formats costlier than conventional savory snacks in price-sensitive markets. Distribution adds further pressure, as climate-controlled logistics and sustainable packaging inflate unit economics relative to conventional savory snacks. This premium cost structure limits affordability in price-sensitive markets, slowing volume adoption outside affluent consumer groups. Unless processing efficiencies and scalable sourcing models are developed, profitability pressures are expected to persist, restraining penetration into mainstream value-tier snacking categories.

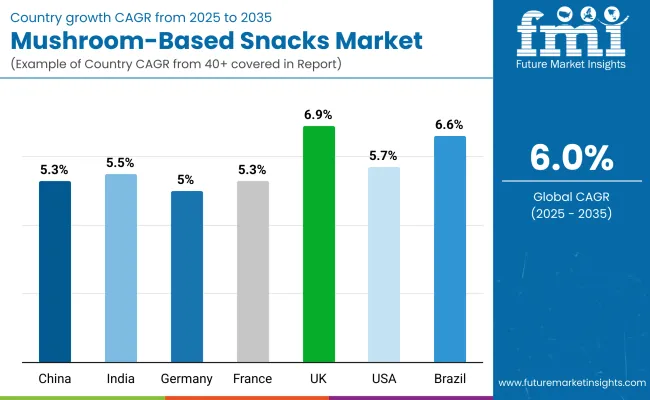

| Countries | CAGR |

|---|---|

| China | 5.32% |

| India | 5.52% |

| Germany | 5.04% |

| France | 5.33% |

| UK | 6.91% |

| USA | 5.05% |

| Brazil | 6.67% |

The global Mushroom-Based Snacks Market demonstrates varied country-level dynamics, shaped by consumer health priorities, cultivation capacity, and retail penetration strategies. Asia is projected to retain a pivotal role, with China expected to expand at 5.32% CAGR and India at 5.52% CAGR through 2035. China’s influence is reinforced by large-scale mushroom cultivation and downstream processing, which ensure reliable supply for both domestic and export-oriented snack applications. India’s outlook is supported by rising urban middle-class demand for affordable, plant-forward snacks and a strong agricultural base, positioning it as a volume growth driver in South Asia.

Europe maintains a significant role, with Germany projected at 5.04% CAGR, France at 5.33%, and the UK leading with 6.91% CAGR. Germany’s growth reflects consumer adoption of sustainable food choices, while France sustains demand for gourmet and functional varieties. The UK’s higher trajectory highlights accelerated uptake of wellness-driven snacking and strong online retail penetration.

In the Americas, the USA is forecast at 5.05% CAGR, reflecting stable demand supported by functional food trends, though price sensitivity remains a limiting factor. Brazil at 6.67% CAGR is expected to outperform regional peers, driven by an expanding health-conscious middle class and premium imports. Together, these markets illustrate how cultural familiarity, functional positioning, and affordability shape adoption across geographies.

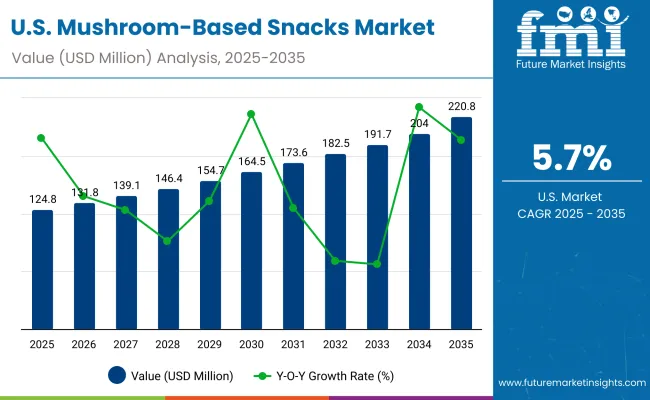

| Year | USA Mushroom-Based Snack Market (USD Million) |

|---|---|

| 2025 | 124.80 |

| 2026 | 132.9 |

| 2027 | 142.1 |

| 2028 | 149.8 |

| 2029 | 158.2 |

| 2030 | 168.8 |

| 2031 | 178.6 |

| 2032 | 188.6 |

| 2033 | 198.7 |

| 2034 | 209.1 |

| 2035 | 220.8 |

The Mushroom-Based Snacks Market in the United States is forecast to expand from USD 124.8 million in 2025 to USD 220.8 million by 2035, reflecting a CAGR of 5.9%. Growth will be driven by rising consumer alignment with functional nutrition, particularly as mushrooms gain recognition for natural protein, fiber, and cognitive-supporting compounds. Adoption is being accelerated by retail integration across supermarkets and convenience formats, alongside strong online penetration that facilitates direct engagement with wellness-oriented consumers.

Premiumization is expected to remain central, with snack formats such as jerky and bars gaining momentum for their portability and high functional value. Cost pressures tied to mushroom sourcing and processing are anticipated to moderate through supply chain scaling, which will support broader accessibility. As American consumers continue to prioritize transparency, sustainability, and clean-label attributes, mushroom-based snacks are projected to solidify their position as a mainstream option in the better-for-you segment.

The Mushroom-Based Snacks Market in the United Kingdom is projected to expand at a CAGR of 6.91% between 2025 and 2035, the highest among European peers. Growth will be anchored in the nation’s strong consumer orientation toward health and plant-forward eating. Functional mushrooms such as Lion’s Mane and Reishi are expected to gain traction, supported by consumer receptivity to cognitive and immunity claims. Premium positioning within online and specialty health channels is forecast to drive trial, while mainstream supermarkets are anticipated to accelerate accessibility. Sustainability-led purchasing behavior is projected to favor mushroom snacks, as their lower environmental footprint versus meat-based protein snacks aligns with the UK’s consumer preference for climate-conscious food choices

The Mushroom-Based Snacks Market in India is expected to grow at a CAGR of 5.52% from 2025 to 2035. Expansion is projected to be volume-driven, supported by domestic mushroom cultivation and an expanding urban middle class seeking healthier alternatives. Affordability and portability are expected to be decisive in category adoption, with puffs and chips leading initial volumes. Functional blends featuring Reishi and Lion’s Mane are anticipated to gain momentum within premium urban channels as awareness increases. Retail growth will be shaped by the dual role of supermarkets in metros and traditional convenience stores in tier-2 and tier-3 cities. Digital platforms are forecast to play a vital role in awareness campaigns and brand discovery.

The Mushroom-Based Snacks Market in China is forecast to advance at a CAGR of 5.32% from 2025 to 2035. Growth will be anchored by the country’s leadership in mushroom cultivation, ensuring a consistent and cost-efficient supply base. Traditional familiarity with mushrooms as a dietary staple is expected to support adoption, while younger demographics drive experimentation with new snack formats such as jerky and bars. Functional varieties are anticipated to expand gradually, though price sensitivity may delay large-scale penetration. Retail development in e-commerce platforms will be central to growth, with direct-to-consumer models enabling brands to scale faster than through physical channels alone.

| Countries | 2025 |

|---|---|

| UK | 19.62% |

| Germany | 21.51% |

| Italy | 11.60% |

| France | 14.65% |

| Spain | 9.43% |

| BENELUX | 6.98% |

| Nordic | 5.35% |

| Rest of Europe | 11% |

| Countries | 2035 |

|---|---|

| UK | 19.53% |

| Germany | 20.14% |

| Italy | 11.56% |

| France | 13.56% |

| Spain | 9.44% |

| BENELUX | 5.72% |

| Nordic | 5.99% |

| Rest of Europe | 14% |

The Mushroom-Based Snacks Market in Germany is projected to expand at a CAGR of 5.04% between 2025 and 2035. Growth will be driven by consumer demand for sustainable, plant-based snacking and compliance with clean-label standards. Shiitake and mixed blends are expected to lead due to their balance of flavor familiarity and functional positioning. Premium snack launches in health food stores and organic chains are forecast to gain momentum, while discount retailers are anticipated to broaden affordability for mainstream consumers. Regulatory emphasis on sustainability labeling and nutritional transparency is expected to benefit mushroom snacks relative to processed alternatives.

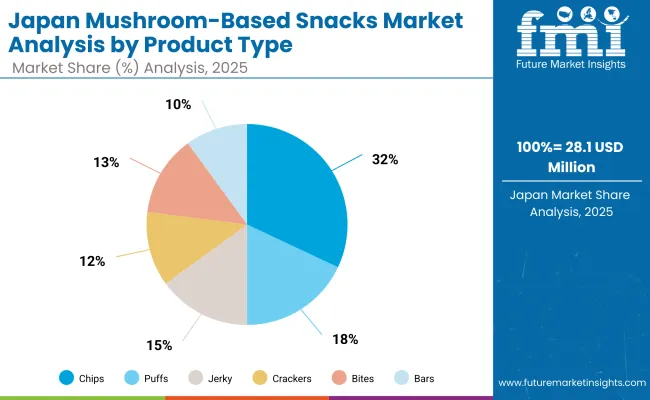

| Japan Product Type | 2025 Share% |

|---|---|

| Chips | 32% |

| Puffs | 18% |

| Jerky | 15% |

| Crackers | 12% |

| Bites | 13% |

| Bars | 10% |

The Mushroom-Based Snacks Market in Japan is estimated at USD 28.1 million in 2025 and is projected to nearly double to USD 67.5 million by 2035, advancing at a CAGR close to 9.0%. Chips, at 32% share, are expected to dominate initially, while puffs (18% share, 9.5% CAGR) are projected to outpace other categories in growth. Protein-rich formats such as jerky (15% share) and bars (10% share) are likely to see rising adoption among younger, convenience-driven consumers. Crackers and bites, together representing 25% share, will expand steadily as permissible indulgence options.

Japan’s advanced retail ecosystem and digital penetration are anticipated to accelerate product diversification. Functional mushroom blends featuring Lion’s Mane and Reishi are forecast to strengthen the category’s wellness positioning.

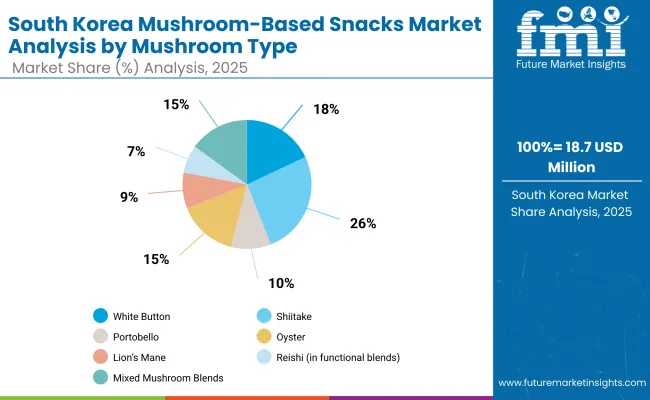

| South Korea Mushroom Type | 2025 Share% |

|---|---|

| White Button | 18% |

| Shiitake | 26% |

| Portobello | 10% |

| Oyster | 15% |

| Lion’s Mane | 9% |

| Reishi (in functional blends) | 7% |

| Mixed Mushroom Blends | 15% |

The Mushroom-Based Snacks Market in South Korea is estimated at USD 18.7 million in 2025 and is projected to expand to USD 46.0 million by 2035, recording an average CAGR of 9.0%. Shiitake at 26% share is expected to dominate the product base, reflecting its strong cultural familiarity and wide culinary use. Functional mushroom varieties, including Reishi (7% share, 9.8% CAGR) and Lion’s Mane (9% share, 9.6% CAGR), are anticipated to outperform, supported by rising consumer interest in immunity and cognitive health. Mixed mushroom blends (15% share, 9.3% CAGR) are expected to gain traction as manufacturers highlight synergy across multiple species.

South Korea’s advanced food innovation ecosystem, combined with strong urban retail penetration and high digital adoption, is projected to accelerate functional snacking uptake. Premium consumer segments are expected to drive early adoption, while mainstream growth is likely to be supported by supermarkets and online retail.

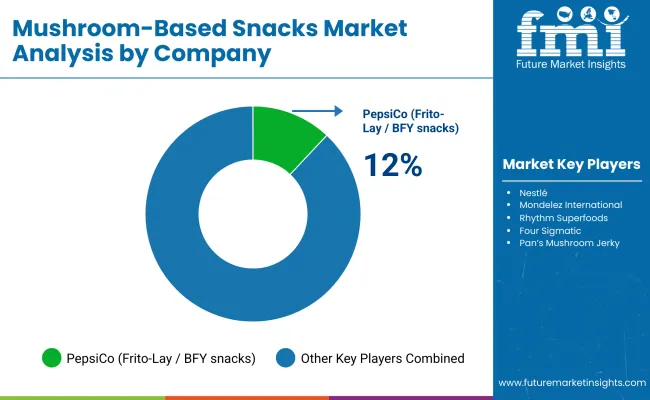

The Mushroom-Based Snacks Market is moderately fragmented, with global food corporations, mid-sized innovators, and niche-focused wellness brands competing across diverse consumer segments. Global leaders such as Mondelez International, PepsiCo, and Nestlé are projected to strengthen share by embedding mushroom-based formats into their broader plant-forward snack strategies, aligning with consumer demand for clean-label and functional innovation. Their strategies are expected to emphasize functional claims, sustainable sourcing, and cross-category innovation in chips, bars, and jerky to capture health-conscious consumers.

Established mid-sized players, including brands such as Rhythm Superfoods, Four Sigmatic, and Pan’s Mushroom Jerky, are catering to demand for clean-label and plant-forward options. These companies are anticipated to drive adoption through flavor innovation, functional blends featuring Reishi and Lion’s Mane, and strong digital-first marketing approaches that resonate with wellness-focused audiences.

Specialized providers, often local or regional, are focusing on cost-effective, application-specific products, such as shiitake chips or oyster mushroom crisps. Their strength is expected to remain in regional adaptability, artisanal branding, and direct-to-consumer channels rather than global scale.

Competitive differentiation is shifting away from novelty formats toward integrated value propositions combining functionality, transparency, and sustainability. Ecosystem strength in cultivation partnerships, digital engagement, and omnichannel distribution is projected to define long-term leadership, while price accessibility will remain crucial for mainstream penetration.

Key Developments in Mushroom-Based Snack Market

| Item | Value |

|---|---|

| Quantitative Units | USD 520.0 Million |

| Product Type | Chips, Puffs, Jerky, Crackers, Bites, Bars |

| Mushroom Type | White Button, Shiitake, Portobello, Oyster, Lion’s Mane, Reishi, Mixed Mushroom Blends |

| Sales Channel | Supermarkets/Hypermarkets, Health Food Stores, Online Retail, Convenience Stores, Vending & Micro-Markets |

| End-Use Consumers | Household/Retail, Health-conscious buyers, Functional food consumers, On-the-go snackers |

| Regions Covered | North America, Europe, Asia-Pacific (East Asia, South Asia & Pacific), Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | PepsiCo (Frito-Lay), Nestlé, Mondelez International, Rhythm Superfoods, Four Sigmatic, Pan’s Mushroom Jerky, regional innovators |

| Additional Attributes | Dollar sales by product type and mushroom variety; growth driven by functional health positioning; rising demand in online retail and micro-markets; consumer shift toward clean-label and plant-forward snacks; premiumization in North America and Europe; affordability-led growth in South Asia; innovations in functional mushrooms (Lion’s Mane, Reishi); sustainability and eco-packaging trends. |

The global Mushroom-Based Snacks Market is estimated to be valued at USD 520.0 million in 2025.

The market size for the Mushroom-Based Snacks Market is projected to reach USD 927.8 million by 2035.

The Mushroom-Based Snacks Market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in the Mushroom-Based Snacks Market are chips, puffs, jerky, crackers, bites, and bars.

In terms of product type, the chips segment is expected to command 30% share in the Mushroom-Based Snacks Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CBD Snacks Market Size and Share Forecast Outlook 2025 to 2035

Kid Snacks Market Analysis by Source, Type, and Distribution Channel Through 2035

Pet Snacks and Treats Market Analysis by Product, Pet Type, Distribution Channel, and Region Through 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Snacks Market Trends – Protein-Packed & Industry Growth 2024-2034

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Healthy Snacks Market Size and Share Forecast Outlook 2025 to 2035

Protein Snacks Market Growth - Demand, Trends & Industry Forecast 2025 to 2035

Extruded Snacks Market Size and Share Forecast Outlook 2025 to 2035

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Pregnancy Snacks Market Analysis by Product Type, Nutritional Content, Distribution Channel, Packaging Format and Stage of Pregnancy Flavors Through 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dog Food and Snacks Market Size and Share Forecast Outlook 2025 to 2035

Insect-Based Snacks Market Analysis - Size, Share & Forecast 2025 to 2035

Refrigerated Snacks Market Trends - Healthy & Fresh Innovations 2025 to 2035

Better for You Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Crunch‑textured Snacks in Spain Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA