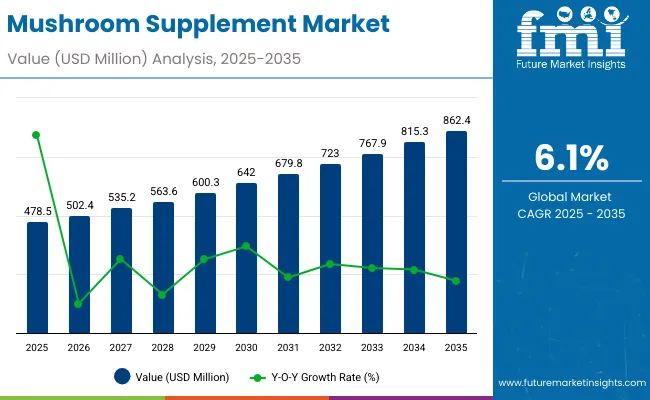

The Mushroom Supplement Market is anticipated to register a valuation of USD 478.5 Million in 2025, advancing steadily to reach USD 862.4 Million by 2035. This expansion indicates an incremental gain of nearly USD 0.384 Million over the decade, translating into a compound annual growth rate (CAGR) of 6.1%.

| Metric | Value |

|---|---|

| Mushroom Supplement Market Estimated Value in (2025E) | USD 478.5 Million |

| Mushroom Supplement Market Forecast Value in (2035F) | USD 862.4 Million |

| Forecast CAGR (2025 to 2035) | 6.1% |

During the initial five-year period from 2025 to 2030, the market is projected to rise from USD 478.5 Million to USD 862.4 , thereby contributing close to 43% of the total decade growth. This stage of adoption is expected to be supported by wider consumer awareness of mushroom-derived bioactives, growing evidence-based positioning for immunity and cognitive support, and the increasing availability of convenient delivery forms.

From 2030 to 2035, a sharper expansion is anticipated, with the market advancing from USD 862.4 to USD 862.4 Million, contributing 57% of the decade’s overall growth. This acceleration is expected to be fueled by rising demand for stress management, energy support, and anti-aging benefits, supported by expanding penetration of functional beverages and gummies as mainstream formats. While traditional capsules and tablets are projected to remain dominant by volume, newer consumption-friendly formulations are likely to expand category boundaries.

Regional growth is expected to be concentrated in North America and Europe, supported by established retail channels and regulatory clarity, while South Asia & Pacific is projected to emerge as the fastest-growing contributor. Over the decade, heightened consumer trust through transparency, standardized formulations, and clinical validation is expected to strengthen the premium positioning of mushroom supplements, ensuring steady market advancement across wellness-driven demographics.

The mushroom supplement market is projected to expand steadily as consumer preferences are reshaped by rising awareness of natural wellness solutions. A shift toward functional nutrition is expected to accelerate, with premium positioning of Reishi, Lion’s Mane, and Cordyceps driving differentiated growth. Capsules and tablets are forecast to remain dominant due to convenience, while gummies and functional beverages are anticipated to outpace the market average, reflecting lifestyle-oriented adoption.

North America is projected to retain leadership, supported by high supplement penetration and strong e-commerce adoption, while Asia-Pacific is expected to register robust momentum driven by traditional medicine integration and product diversification in Japan, South Korea, and China. European markets are likely to benefit from regulatory harmonization and increasing consumer alignment with clean-label formulations.

Competitive intensity is anticipated to increase as digital-first entrants and established herbal supplement leaders enhance their distribution networks and functional portfolios. Market leadership is projected to be reinforced through hybrid business models that integrate direct-to-consumer platforms, subscription services, and omni-channel strategies. The competitive edge is expected to shift toward ecosystem strength, brand trust, and science-backed claims rather than purely ingredient sourcing

The growth of the Mushroom Supplement Market is being propelled by rising consumer demand for natural health solutions, as immunity, cognition, and stress management continue to gain importance in wellness routines. Increasing scientific validation of mushroom bioactives such as beta-glucans, cordycepin, and hericenones has strengthened consumer trust, allowing products to be positioned with greater credibility across mainstream retail and online platforms. Functional benefits linked to energy, endurance, and anti-aging have expanded usage occasions, while delivery innovations like gummies and functional beverages have broadened accessibility, especially among younger demographics seeking convenient formats.

The market is also being supported by a global shift toward preventive healthcare, with consumers adopting supplements proactively to reduce future health risks. Retail expansion through pharmacies, e-commerce, and specialty stores has ensured greater product availability, while transparent labeling and third-party certifications are expected to enhance long-term adoption. With cultural traditions in Asia reinforcing the perception of mushrooms as wellness agents, and Western markets embracing them as adaptogens, the category is expected to accelerate further through 2035.

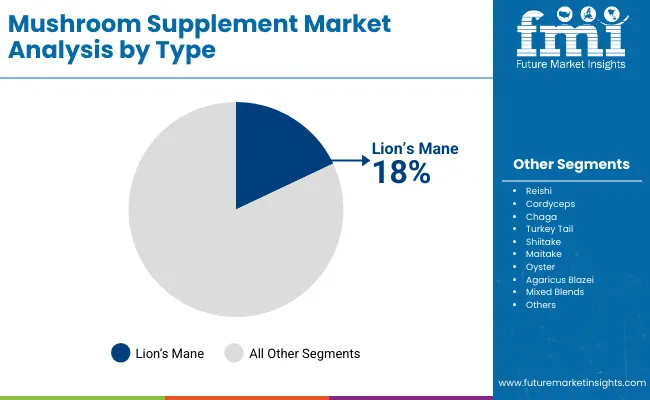

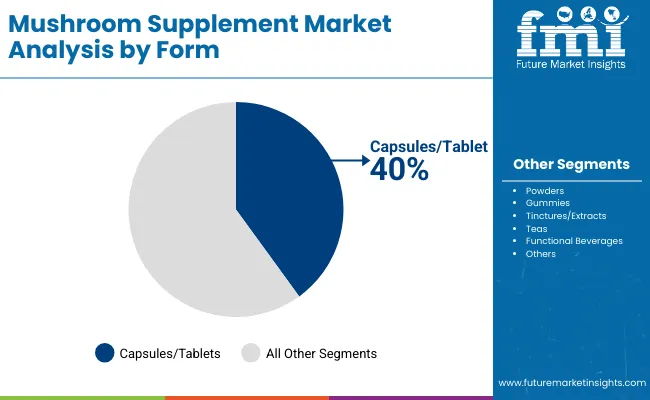

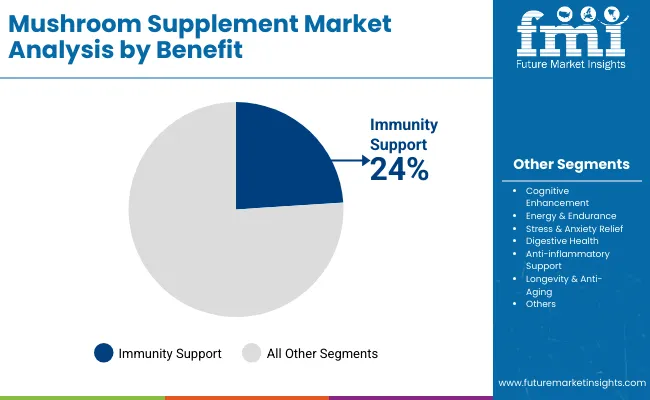

The Mushroom Supplement Market has been segmented on the basis of type, form, and health benefit, offering a comprehensive view of its growth trajectory. Each of these segments reflects a distinct consumer adoption pathway shaped by evolving wellness needs, convenience preferences, and scientific validation. By mushroom type, demand has been influenced by rising recognition of bioactive compounds linked to immunity, cognition, and energy enhancement. In terms of form, accessibility and ease of consumption have been emphasized, creating opportunities for both traditional capsules and emerging functional beverages. From a benefits perspective, market expansion has been powered by increasing consumer focus on preventive health, particularly immunity, stress relief, and cognitive well-being. Together, these segments outline the multifaceted demand drivers that will continue to shape category growth across global markets through 2035.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Lion’s Mane | 18% |

| Reishi | 16% |

| Cordyceps | 14% |

The Lion’s Mane segment is projected to account for 18% of the Mushroom Supplement Market revenue in 2025, establishing it as the fastest-growing mushroom type with a CAGR of 11%. Its appeal is strongly tied to cognitive enhancement, memory support, and neuroprotection, positioning it as a key driver of demand among working-age populations. Reishi, holding a 16% share, is expected to maintain strong relevance for immunity and stress relief, while Cordyceps at 14% is forecasted to grow steadily due to its positioning in endurance and vitality. Mixed blends, capturing 12%, are anticipated to expand further as consumers increasingly value synergistic formulations combining multiple mushroom benefits. Broader adoption is being reinforced by clinical validation, transparent sourcing, and expanding distribution networks across digital and retail ecosystems.

| Range Segment | Market Value Share, 2025 |

|---|---|

| Capsules/Tablets | 40% |

| Gummies | 14% |

| Functional Beverages | 8% |

The capsules and tablets segment is projected to account for 40% of the Mushroom Supplement Market revenue in 2025, establishing it as the dominant delivery format through 2035. Standardized dosage, consumer familiarity, and clinical trust continue to reinforce its leading position. However, functional beverages, while holding 8% share, are forecasted to grow at the fastest CAGR of 12%, as convenient, lifestyle-integrated formats become more popular among younger demographics. Gummies, with a CAGR of 11%, are anticipated to further accelerate category expansion due to their ease of use and appeal in mass-market adoption. Powders and tinctures are projected to sustain consistent growth by offering flexibility for customized consumption across diverse diet plans. Innovation in taste, portability, and packaging is expected to reinforce format diversification and expand penetration across global markets.

| Laser triangulation technology | Market Value Share, 2025 |

|---|---|

| Immunity Support | 24% |

| Cognitive Enhancement | 18% |

| Stress & Anxiety Relief | 14% |

The immunity support segment is projected to account for 24% of the Mushroom Supplement Market revenue in 2025, establishing it as the leading health benefit driving adoption. While immunity continues to anchor demand, cognitive enhancement, representing 18% share, is anticipated to expand at the fastest CAGR of 10.8%, driven by the rising need for mental performance and workplace productivity. Stress and anxiety relief, holding 14% share, is projected to grow at 10.5% CAGR, reflecting increased prioritization of holistic mental well-being. Energy and endurance supplements, with 16% share, are also expected to record strong adoption among active lifestyle users. By 2035, the benefit segment is forecasted to evolve beyond immunity-led positioning, with cognitive and stress-relief solutions shaping the next wave of consumer-driven wellness adoption.

Complex regulatory oversight and raw material variability continue to shape adoption patterns in the Mushroom Supplement Market, even as demand intensifies across wellness, functional foods, and preventive healthcare. A balance between innovation and compliance is expected to define the trajectory.

Driver - Clinical Validation and Standardization of Bioactives

The future expansion of mushroom supplements is expected to be strongly influenced by the growing clinical validation of compounds such as beta-glucans, cordycepin, and hericenones. Standardized extraction methods and transparent potency disclosure are projected to increase trust among practitioners, enabling their integration into evidence-based wellness protocols. This shift is anticipated to move mushroom supplements beyond niche adaptogen positioning into mainstream therapeutic categories, supported by regulatory acceptance and broader physician recommendations. The strategic use of randomized controlled trials and third-party certifications is expected to create differentiation, making scientifically validated formulations the central growth lever in premium and regulated markets.

Restraint - Supply Chain Volatility and Cultivation Constraints

Expansion is expected to be hindered by supply volatility, as cultivation of medicinal mushrooms remains sensitive to substrate availability, climate disruptions, and contamination risks. Heavy reliance on geographically concentrated production clusters exposes manufacturers to cost fluctuations and logistical uncertainties. Rising demand for organic-certified inputs is likely to exacerbate supply tightness, as compliance-driven farming practices require longer cultivation cycles and higher operational costs. Without robust multi-region sourcing models, scalability is expected to remain challenged. Strategic investments in controlled environment farming and biotechnology-driven cultivation are being considered as risk mitigators, but their commercial deployment may take time, delaying near-term stabilization.

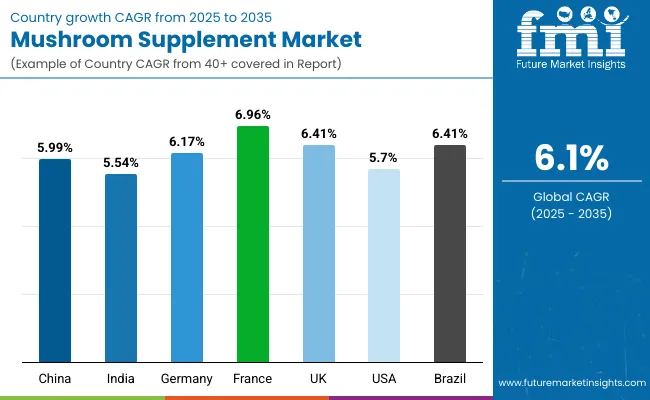

| Countries | CAGR |

|---|---|

| China | 5.99% |

| India | 5.54% |

| Germany | 6.17% |

| France | 6.96% |

| UK | 6.41% |

| USA | 5.7% |

| Brazil | 6.41% |

The global Mushroom Supplement Market demonstrates significant country-level variations in growth trajectories, influenced by regulatory frameworks, consumer adoption of natural health solutions, and the penetration of functional nutrition trends. While mature economies are shaping demand through premiumized and clinically validated products, emerging markets are expanding access through affordability and rising middle-class health consciousness.

China is projected to advance at a 5.99% CAGR (2025 to 2035), supported by traditional medicine practices integrating mushrooms into modern supplement categories. Although adoption is steady, scalability is expected to be limited by regulatory stringency and raw material consistency. India, expanding at 5.54% CAGR, is expected to benefit from increased pharmacy-led distribution and wellness tourism, though price sensitivity may restrict premium product uptake.

Europe remains a critical growth hub, with France recording the highest CAGR at 6.96%, attributed to the integration of mushroom-based supplements into the beauty-from-within and pharmacy channels. Germany (6.17% CAGR) is anticipated to strengthen through clinical validation and practitioner endorsements, while the UK (6.41% CAGR) is likely to sustain demand through online retail expansion.

North America continues to hold a strong market position, with the USA advancing at 6.66% CAGR, supported by the popularity of gummies and beverages in lifestyle-led consumption. Meanwhile, Brazil (6.41% CAGR) is emerging as a regional leader in Latin America, aided by crossovers into sports nutrition and preventive healthcare. Together, these country-level dynamics reinforce the global expansion of mushroom supplements as both traditional remedies and modern functional products.

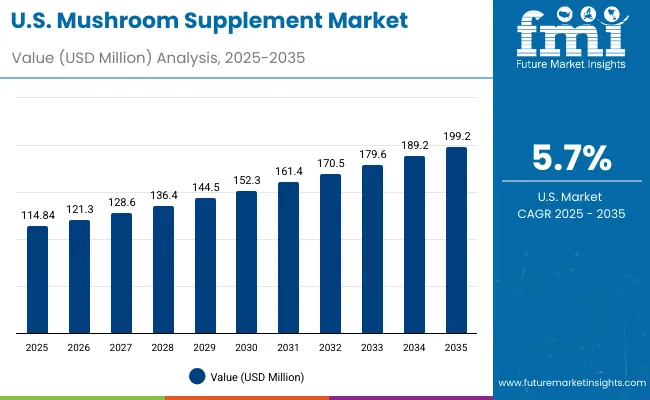

| Year | USA Mushroom Supplement Market (USD Million) |

|---|---|

| 2025 | 114.84 |

| 2026 | 121.3 |

| 2027 | 128.6 |

| 2028 | 136.4 |

| 2029 | 144.5 |

| 2030 | 152.3 |

| 2031 | 161.4 |

| 2032 | 170.5 |

| 2033 | 179.6 |

| 2034 | 189.2 |

| 2035 | 199.2 |

The Mushroom Supplement Market in the United States is projected to expand from USD 114.8 million in 2025 to USD 199.2 million by 2035, advancing at a CAGR of 5.7%. Growth momentum is expected to be sustained by increased consumer preference for natural remedies, adoption of functional nutrition, and the integration of mushroom-based products into mainstream dietary patterns. From 2025 to 2030, the market is forecast to climb steadily from USD 114.8 million to USD 152.3 million, with yearly gains driven by strong penetration of capsules, gummies, and functional beverages. In the latter half of the decade, sales are projected to accelerate further, adding USD 47 million between 2030 and 2035, reflecting heightened demand for stress-relief, cognitive wellness, and longevity solutions.

Consumer trends in the USA are anticipated to shift toward convenience-driven formats, with gummies and ready-to-drink mushroom beverages registering faster adoption than traditional supplements. Functional claims around immunity support and mental performance are projected to remain at the forefront, aligning with the preventive healthcare mindset of American consumers. Transparency in sourcing, clinical validation, and third-party certifications are expected to reinforce trust, while e-commerce and specialty retailers are anticipated to serve as dominant distribution platforms.

A 6.41% CAGR (2025 to 2035) is projected for the UK Mushroom Supplement Market. Growth is expected to be supported by pharmacy-led trust, retailer curation of clinically substantiated SKUs, and affluent consumers prioritizing cognition and stress management. Online discovery is anticipated to remain strong, while brick-and-mortar chains are expected to tighten specification checks on actives and contaminants. Beauty-from-within adjacencies are likely to lift premium formats, with cross-merchandising in beverages broadening occasions. Post-Brexit import scrutiny is expected to favor brands with robust traceability and UK/EU manufacturing footprints. Practitioner content and third-party testing are projected to shape conversion and justify premium pricing.

A 5.54% CAGR (2025 to 2035) is projected for India. Expansion is expected to be driven by pharmacy and modern trade rollouts, with sachet and small-pack economics improving trial. Price sensitivity is anticipated to steer consumers first to accessible formats, with premiumization occurring through standardized extracts endorsed by practitioners and influencers. Ayurveda compatibility is expected to aid acceptance, while FSSAI claim scrutiny is projected to reward evidence-backed communication. Domestic cultivation and extraction capabilities are expected to be scaled to mitigate import volatility and shorten lead times. Tier-2/3 city penetration through omnichannel distribution is anticipated to unlock incremental households.

A 5.99% CAGR (2025 to 2035) is projected for China. Traditional usage is expected to underpin a broad consumer base, while modernization of formulations is projected to move the category into mainstream functional nutrition. Cross-border e-commerce flows are expected to persist but may be moderated by compliance updates, favoring locally registered SKUs with transparent standardization. Hospital and pharmacy channels are anticipated to elevate products with quantified beta-glucans and clean labels. Integration into beverages and convenience formats is expected to expand usage occasions without diluting efficacy narratives. Regional cultivation clusters are projected to secure supply but will require contamination controls to meet export-grade specifications.

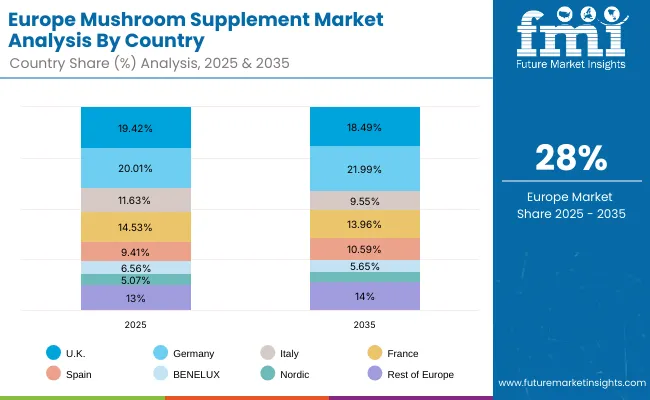

| Countries | 2025 |

|---|---|

| UK | 19.42% |

| Germany | 20.01% |

| Italy | 11.63% |

| France | 14.53% |

| Spain | 9.41% |

| BENELUX | 6.56% |

| Nordic | 5.07% |

| Rest of Europe | 13% |

| Countries | 2035 |

|---|---|

| UK | 18.49% |

| Germany | 21.99% |

| Italy | 9.55% |

| France | 13.96% |

| Spain | 10.59% |

| BENELUX | 5.65% |

| Nordic | 5.34% |

| Rest of Europe | 14% |

A 6.17% CAGR (2025 to 2035) is projected for Germany. Growth is expected to be anchored in practitioner-guided adoption and stringent retailer quality gates. Products disclosing validated actives and third-party tests are anticipated to earn premium shelf space in pharmacies and Reformhaus channels. Sustainability credentials traceable substrates, energy-efficient extraction, and recyclable packaging are expected to influence buyer choice alongside efficacy. As healthy aging and workplace performance remain priorities, cognition and anti-inflammatory platforms are projected to expand. Digital education by pharmacists and insurers is expected to normalize daily prophylaxis, while DTC brands are anticipated to leverage subscription models with evidence-led content.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Reishi | 20% |

| Lion’s Mane | 16% |

| Cordyceps | 12% |

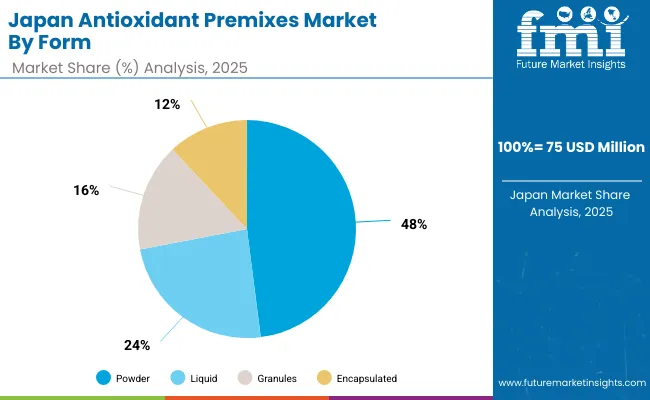

The Mushroom Supplement Market in Japan is expected to remain a strategically important contributor to global growth, with a highly diversified demand base anchored in both traditional wellness practices and modern functional nutrition. In 2025, Reishi dominates with a 20% share, reflecting its established role in immunity and longevity benefits. Lion’s Mane, holding 16% share, is projected to be the fastest-growing category, supported by increasing adoption in cognitive health and memory support, particularly among aging populations. Cordyceps, at 12% share, is anticipated to sustain steady expansion on the back of rising demand for energy and endurance benefits within sports nutrition and wellness communities.

Japan’s market dynamics are shaped by a unique blend of cultural familiarity with medicinal mushrooms and rising scientific validation, which is expected to enhance trust in standardized extracts. Pharmacy-led endorsements and integration into functional beverages are projected to drive accessibility, while premium consumers are expected to favor clinically substantiated SKUs. Regulatory consistency and demand for clean-label certifications are anticipated to reinforce category credibility.

| Range Segment | Market Value Share, 2025 |

|---|---|

| Capsules/Tablets | 38% |

| Powders | 18% |

| Gummies | 18% |

| Functional Beverages | 10% |

The Mushroom Supplement Market in South Korea is expected to advance steadily through 2035, supported by a strong convergence of beauty, wellness, and preventive healthcare trends. Capsules and tablets, holding 38% share in 2025, are projected to remain the anchor format due to consumer trust in standardized supplement delivery. However, gummies, with an 18% share, are forecast to expand fastest at 11.2% CAGR, driven by their appeal to younger demographics and alignment with lifestyle-led consumption habits. Functional beverages, at 10% share, are also expected to expand rapidly at 11.0% CAGR, reflecting South Korea’s global leadership in beauty-from-within and K-health trends.

Cultural familiarity with mushrooms as both food and medicine is expected to sustain category legitimacy, while rising demand for stress relief, energy, and anti-aging is anticipated to accelerate adoption. Pharmacies and specialty retailers are projected to play a key role in consumer education, while digital commerce platforms are expected to enhance accessibility across younger and urban populations. Regulatory scrutiny and preference for clinically backed claims are expected to reinforce premium positioning, while innovation in hybrid functional formats is anticipated to secure export opportunities across Asia.

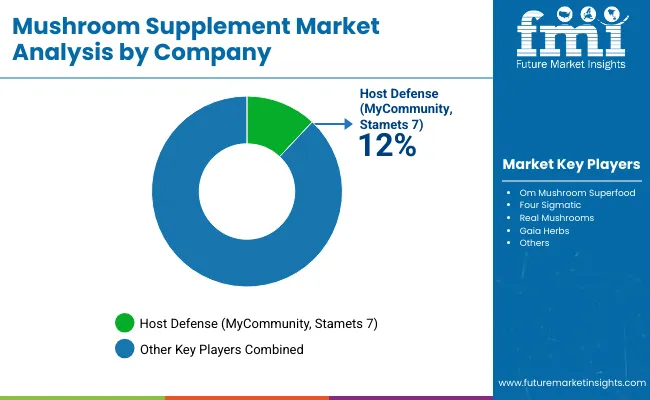

| Company | Global Value Share 2025 |

|---|---|

| Host Defense (My Community, Stamets 7) | 12% |

| Om Mushroom Superfood | 10% |

| Four Sigmatic | 9% |

| Real Mushrooms | 8% |

| Gaia Herbs | 7% |

The Mushroom Supplement Market is moderately fragmented, characterized by global leaders, mid-sized innovators, and niche-focused specialists. Leading brands such as Om Mushroom Superfood, Gaia Herbs, Host Defense, Four Sigmatic, and Real Mushrooms are projected to retain significant visibility through 2035. These players are recognized as core participants in this market, validating their presence as correct for the competitive landscape. Their strategies emphasize clinical validation of mushroom actives, standardized extraction methods, and brand differentiation through strong e-commerce and retail partnerships. Host Defense, known for its formulations like My Community and Stamets 7, is regarded as a pioneer in mushroom-based immunity and cognitive wellness, while Four Sigmatic has accelerated global adoption by embedding mushrooms into coffee and functional beverages.

Mid-sized innovators such as Gaia Herbs and Real Mushrooms are expected to expand by offering clean-label, single-species extracts, emphasizing transparency and traceability. These companies are projected to capture health-conscious consumers seeking purity and clinical substantiation. Om Mushroom Superfood, leveraging powder and capsule formats, is positioned strongly in the USA and global e-commerce ecosystems, supported by collaborations with lifestyle wellness platforms.

Competitive differentiation is expected to shift from pure product claims toward integrated consumer ecosystems involving educational content, practitioner endorsements, and subscription models. Trust-building through third-party testing and sustainability narratives is expected to determine premium positioning.

Key Developments in Mushroom Supplement Market

| Item | Value |

|---|---|

| Market Size (2025) | USD 478.5 million |

| Market Size (2035) | USD 862.4 million |

| Incremental Growth (2025 to 2035) | USD 383.9 million |

| CAGR (2025 to 2035) | 6.10% |

| Leading Form (2025) | Capsules/Tablets - 40% share |

| Fastest-Growing Forms | Functional Beverages 12.0% CAGR; Gummies 11.0% CAGR |

| Type Mix (2025) | Lion’s Mane 18%; Reishi 16%; Cordyceps 14%; Chaga 10%; Turkey Tail 9%; Shiitake 7%; Maitake 5%; Oyster 4%; Agaricus Blazei 5%; Mixed Blends 12% |

| Benefit Mix (2025) | Immunity Support 24%; Cognitive Enhancement 18%; Energy & Endurance 16%; Stress & Anxiety Relief 14%; Digestive Health 10%; Anti-inflammatory 8%; Longevity & Anti-Aging 10% |

| Fastest-Growing Benefits | Cognitive Enhancement 10.8% CAGR; Stress & Anxiety Relief 10.5% CAGR; Energy & Endurance 10.2% CAGR |

| Regional Shares (2025) | North America 30%; Europe 28%; South Asia & Pacific 25%; East Asia 12%; Middle East & Africa 3%; Latin America 2% |

The global Mushroom Supplement Market is estimated to be valued at USD 478.5 million in 2025.

The market size for the Mushroom Supplement Market is projected to reach USD 862.4 million by 2035.

The Mushroom Supplement Market is expected to expand at a CAGR of 6.1% between 2025 and 2035.

The key product types in the Mushroom Supplement Market are Reishi, Lion’s Mane, Cordyceps, Chaga, Turkey Tail, Shiitake, Maitake, Oyster, Agaricus Blazei, and Mixed Blends.

In terms of form, Capsules/Tablets are projected to command 40% share of the Mushroom Supplement Market in 2025, making it the dominant format.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mushroom Packaging Market Size and Share Forecast Outlook 2025 to 2035

Mushroom-Powered Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mushroom-Based Snacks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Mushroom Beer Market Trends - Brewing Innovation & Consumer Growth 2025 to 2035

Competitive Overview of Mushroom Packaging Companies

Mushroom Fermenter Market Growth – Production & Demand 2025 to 2035

Mushroom Materials Market Growth – Trends & Forecast 2024-2034

Mushroom Gummy Market – Consumer Trends & Functional Benefits

Mushroom Protein Market

Chaga Mushroom-Based Products Market Analysis by Antioxidant, Anti-inflammatory, Alkalizing and other Applications Through 2035

Leading Providers & Market Share in White Mushroom Industry

Dried Mushrooms Market Analysis – Trends & Forecast 2024-2034

Canned Mushroom Market Analysis by Nature, Product Type, Form, and End-Use Application Through 2035

Button Mushroom Products Market – Growth, Demand & Culinary Innovations

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Market Share Distribution Among Psychedelic Mushroom Providers

Supplements And Nutrition Packaging Market

Supplementary Protectors Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA