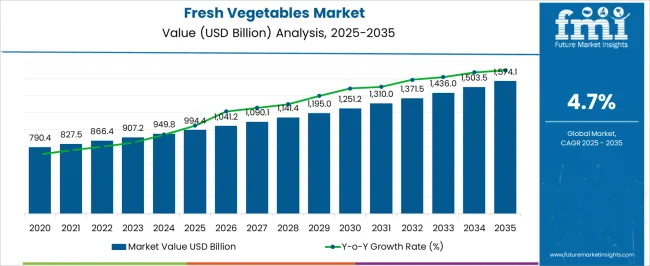

The global fresh vegetables market is projected at USD 994.4 million in 2025 and is anticipated to reach USD 1,574.1 million by 2035, expanding at a CAGR of 4.7% over the forecast period. A peak-to-trough analysis provides insight into the fluctuations and incremental growth patterns observed throughout the decade. In the initial years, from USD 790.4 million to USD 949.8 million, the market experiences moderate peaks and troughs, driven by seasonal variations, regional supply chain constraints, and changing consumer demand patterns.

The market stabilizes around USD 994.4 million to USD 1,195.0 million, reflecting a gradual recovery from troughs caused by weather-related disruptions, transportation challenges, or temporary price fluctuations. Moving into the mid-to-late phase, spanning USD 1,251.2 million to USD 1,436.0 million, the peaks become more pronounced as improvements in cold chain infrastructure, mechanized harvesting, and distribution efficiency enhance supply consistency and minimize losses. The final stage, from USD 1,503.5 million to USD 1,574.1 million, shows smaller troughs and sustained peaks, highlighting a maturing market where technological adoption, precision farming, and increasing urban consumption patterns stabilize growth.

The peak-to-trough analysis illustrates that while early and mid-period years reflect cyclical fluctuations, the long-term trend is upward, indicating steady market expansion supported by improved agricultural practices, enhanced logistics, and rising global demand for fresh vegetables, offering stakeholders actionable insights for planning production, managing supply chains, and capturing revenue opportunities through 2035.

| Metric | Value |

|---|---|

| Fresh Vegetables Market Estimated Value in (2025 E) | USD 994.4 billion |

| Fresh Vegetables Market Forecast Value in (2035 F) | USD 1574.1 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The fresh vegetables market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the commercial agriculture and farming sector, which accounts for about 40% share, as large-scale cultivation, modern farming practices, and controlled environment agriculture ensure consistent supply of high-quality fresh vegetables to meet growing consumer demand. The food retail and grocery sector contributes around 25%, driven by supermarkets, hypermarkets, and online grocery platforms that serve as primary distribution channels, offering convenience, variety, and quality assurance to end consumers. The food service and hospitality market holds close to 15% influence, supported by restaurants, catering services, and institutional kitchens that rely on fresh vegetables for menu offerings, seasonal specialties, and high-quality dining experiences.

The cold chain and logistics sector adds nearly 12%, as efficient storage, transport, and temperature-controlled handling are critical to maintaining freshness, extending shelf life, and reducing post-harvest losses. The health and wellness food market contributes close to 8%, as rising consumer awareness regarding nutrition, organic produce, and plant-based diets drives demand for fresh, minimally processed vegetables.

The distribution of market influence shows that agriculture and retail sectors form the backbone of the fresh vegetables market, while food service, cold chain infrastructure, and health-oriented consumption continue to expand their commercial reach. This interconnected ecosystem demonstrates that the market is supported by multiple industries, ensuring sustained demand, supply resilience, and consistent year-on-year growth.

The fresh vegetables market is undergoing significant transformation, influenced by shifting consumer preferences toward health-focused diets and minimally processed food options. Current market dynamics reflect increased awareness of nutritional benefits associated with vegetable consumption, further reinforced by government-led campaigns promoting healthy eating. Supply chain advancements, particularly in cold storage and logistics, have strengthened the availability of perishable vegetables across urban and semi-urban areas.

While the market continues to be driven by seasonal and regional production patterns, rising demand for year-round availability is prompting investments in greenhouse cultivation and controlled environment agriculture. Additionally, macroeconomic factors such as urbanization, rising disposable incomes, and expansion of organized retail formats are positively impacting consumption frequency and purchase volumes.

The future outlook remains optimistic, with growth expected to be sustained by dietary diversification, evolving culinary habits, and enhanced distribution networks. Strategic alignment among producers, distributors, and retailers is likely to play a critical role in maintaining freshness, reducing waste, and expanding market penetration across various demographic groups.

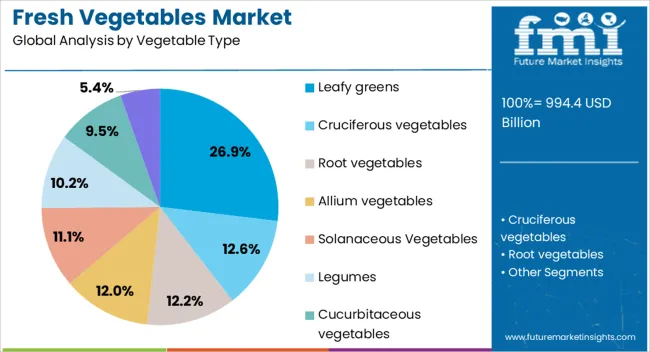

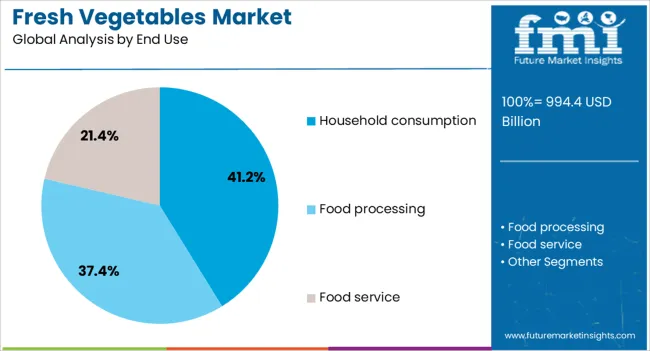

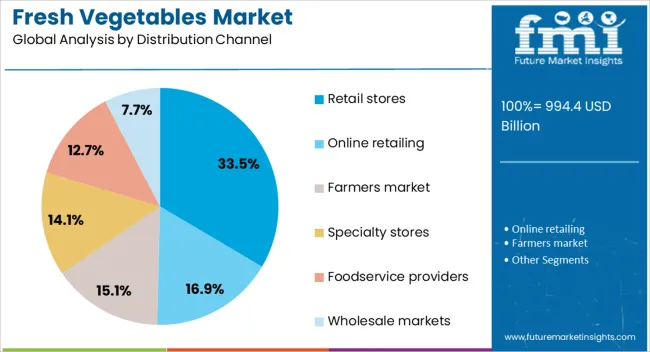

The fresh vegetables market is segmented by vegetable type, end use, distribution channel, and geographic regions. By vegetable type, fresh vegetables market is divided into Leafy greens, Cruciferous vegetables, Root vegetables, Allium vegetables, Solanaceous Vegetables, Legumes, Cucurbitaceous vegetables, and Others. In terms of end use, fresh vegetables market is classified into Household consumption, Food processing, and Food service. Based on distribution channel, fresh vegetables market is segmented into Retail stores, Online retailing, Farmers market, Specialty stores, Foodservice providers, and Wholesale markets. Regionally, the fresh vegetables industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The leafy greens segment accounts for approximately 26.9% of the fresh vegetables market, securing its position as the leading vegetable type. This segment’s prominence is attributed to heightened consumer demand for low-calorie, nutrient-dense foods, as leafy greens are rich in vitamins, minerals, and antioxidants. Consumption growth has been supported by expanding urban lifestyles where salads and green smoothies have become dietary staples.

Additionally, the segment benefits from short harvest cycles and ease of cultivation, making it attractive for both commercial growers and household gardens. Foodservice institutions have also contributed to volume growth by incorporating leafy greens across menus. Challenges related to perishability have been mitigated through improved post-harvest handling and cold chain logistics.

As health-conscious consumers increasingly prioritize plant-based and functional foods, the demand trajectory for leafy greens is expected to remain strong. Retail innovation in pre-packaged, washed, and ready-to-cook formats further augments segment performance, reinforcing its leadership in the fresh vegetables category.

Household consumption represents the largest share within the end use category, comprising approximately 41.2% of the fresh vegetables market. This dominance is driven by the essential nature of vegetables in daily home-cooked meals, reinforced by cultural eating patterns that prioritize fresh produce. Pandemic-induced shifts toward home dining and meal preparation have further entrenched this segment’s growth.

Convenience and accessibility have been key factors, with consumers increasingly purchasing vegetables through local vendors, supermarkets, and online platforms. Enhanced awareness of food safety and quality has also led to increased preference for fresh, unpackaged produce. Additionally, household demand has been supported by trends in organic and locally sourced vegetables, as well as growing interest in home gardening.

As consumers continue to adopt wellness-centric diets, vegetable intake per capita is projected to rise steadily. The segment's resilience and essential nature position it as a stable demand center, with consistent growth anticipated across both urban and rural demographics.

The retail stores segment leads the distribution channel category, holding approximately 33.5% share of the fresh vegetables market. This segment has benefited from strong consumer trust, product visibility, and the convenience of one-stop shopping experiences. Organized retail outlets offer multiple product grades, transparent pricing, and value-added services such as packaging and promotions, which enhance the appeal of fresh produce.

Innovations in cold display units and extended shelf-life technologies have improved inventory turnover and minimized spoilage rates. In-store marketing and nutritional labeling have also influenced consumer choices, supporting segment growth. Retail chains have increasingly collaborated with local farmers and cooperatives to ensure consistent supply and competitive pricing.

Urbanization and the proliferation of supermarket formats have further enhanced the role of retail stores as a preferred channel for buying. As infrastructure continues to develop and consumer preferences evolve, the retail segment is poised to maintain its leadership, supported by strategic investments in freshness assurance, traceability, and digital integration.

The fresh vegetables market is being shaped by rising consumer demand for nutritious foods, expansion of organized retail and online distribution, focus on quality farming practices, and regional production growth with export potential. Health-conscious trends and increasing awareness of nutritional benefits are driving consumption. Modern supply chains, cold storage, and e-commerce platforms are enhancing accessibility and convenience. Improved cultivation techniques and compliance with quality standards are ensuring safety and consistency. Regional production growth and international trade are expanding market reach. Together, these dynamics are promoting steady growth, improving supply reliability, and reinforcing the critical role of fresh vegetables in global food consumption and nutrition.

The market is being driven by increasing consumer preference for fresh, healthy, and minimally processed foods. Awareness of nutritional benefits, vitamins, and minerals in vegetables is influencing daily dietary habits. Urban populations and health-conscious consumers are seeking regular access to high-quality, fresh produce. Retailers and supermarkets are expanding fresh vegetable offerings, while e-commerce platforms and home delivery services are enhancing accessibility. Seasonal trends, specialty varieties, and organic options are also attracting consumer interest. The growing focus on wellness and balanced diets is driving consistent demand, encouraging farmers and suppliers to improve production, packaging, and supply chain efficiency.

Market growth is being supported by the expansion of organized retail chains, supermarkets, and online grocery platforms. Fresh vegetables are increasingly available through home delivery subscriptions, mobile apps, and e-commerce portals, ensuring convenience for consumers. Cold chain logistics, refrigerated transport, and modern storage facilities are maintaining freshness during distribution. Retailers are also leveraging inventory management systems and supply chain analytics to reduce waste and optimize availability. Integration of these channels allows farmers and suppliers to reach wider markets efficiently. The expansion of organized retail and digital platforms is enhancing market penetration, accessibility, and consumer engagement across urban and semi-urban regions.

Producers are increasingly adopting modern cultivation techniques, precision farming, and quality control measures to ensure high yield and superior quality of fresh vegetables. Nutrient management, pest control, and soil health monitoring are improving product consistency and safety. Certification programs and compliance with food safety standards, including GAP (Good Agricultural Practices), are boosting consumer confidence. Farmers are also exploring greenhouse and hydroponic cultivation to produce off-season and high-value varieties. By maintaining quality, safety, and traceability, producers are strengthening their market presence and meeting growing demand from both retail and institutional buyers, supporting steady growth and market reliability.

The fresh vegetable market is expanding due to regional production growth, particularly in Asia-Pacific, Europe, and North America. Favorable climatic conditions, fertile land, and advanced agricultural practices are boosting output. Export demand is rising from regions with limited local production but high consumption of fresh vegetables. Supply chain infrastructure, cold storage facilities, and logistics networks are being developed to maintain product freshness across borders. Collaboration between local farmers, distributors, and exporters is ensuring consistent supply and market access. Regional growth and export opportunities are driving overall market expansion, enhancing revenue potential, and strengthening the global trade footprint of fresh vegetables.

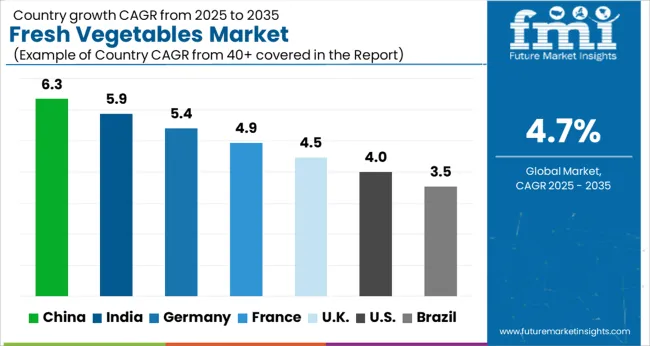

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The global fresh vegetables market is projected to grow at a CAGR of 4.7% from 2025 to 2035. China leads with 6.3%, followed by India at 5.9%, Germany at 5.4%, the UK at 4.5%, and the USA at 4.0%. Growth is driven by rising consumer demand for healthy diets, expanding retail distribution, and increasing awareness of nutritional benefits. BRICS countries, particularly China and India, are scaling greenhouse cultivation, supply chain efficiency, and local sourcing to meet domestic and export requirements. OECD nations such as Germany, the UK, and the USA focus on high-quality produce, cold chain optimization, and sustainable farming practices to enhance freshness and market competitiveness. The analysis spans over 40+ countries, with the leading markets detailed below.

The fresh vegetables market in China is projected to grow at a CAGR of 6.3% from 2025 to 2035, driven by increasing urban population, rising disposable incomes, and growing health consciousness. Expansion of modern retail chains, supermarkets, and e-commerce platforms facilitates wider distribution and access to fresh produce. Advanced farming techniques, including greenhouse cultivation, precision agriculture, and supply chain improvements, enhance yield, quality, and shelf life. Government initiatives promoting food safety, agricultural modernization, and rural development further support market growth. Rising demand for organic and high-quality vegetables from urban consumers ensures sustained adoption.

The fresh vegetables market in India is expected to grow at a CAGR of 5.9% from 2025 to 2035, supported by rising population, increasing income levels, and growing awareness of healthy eating. Expansion of organized retail and online grocery platforms enhances accessibility and availability of fresh produce. Adoption of improved farming methods such as drip irrigation, greenhouse cultivation, and cold storage systems improves productivity and reduces post-harvest losses. Government programs promoting agricultural infrastructure, farmer cooperatives, and supply chain efficiency further strengthen the market. Urbanization and changing lifestyles drive demand for convenient, high-quality vegetables in both urban and semi-urban regions.

The fresh vegetables market in Germany is projected to grow at a CAGR of 5.4% from 2025 to 2035, supported by consumer preference for healthy, fresh, and sustainably sourced produce. Supermarkets, hypermarkets, and specialty organic stores drive distribution, while foodservice channels contribute to demand from restaurants and institutions. Advanced greenhouse cultivation and controlled environment agriculture enhance quality and year-round availability. Regulatory frameworks ensuring food safety, traceability, and quality standards promote consumer confidence. Trends toward organic, local, and seasonal vegetables further support market growth, alongside innovations in packaging and cold-chain logistics.

The fresh vegetables market in the UK is expected to grow at a CAGR of 4.5% from 2025 to 2035, driven by increasing health awareness, urban population growth, and convenience-focused consumption. Retail expansion, online grocery delivery services, and farmers’ markets improve accessibility to fresh produce. Adoption of greenhouse cultivation, hydroponics, and precision agriculture enhances quality, yield, and shelf life. Government policies promoting sustainable agriculture, reduced food waste, and supply chain efficiency further support market expansion. Trends in organic, locally grown, and seasonal vegetables contribute to consumer demand across urban and suburban regions.

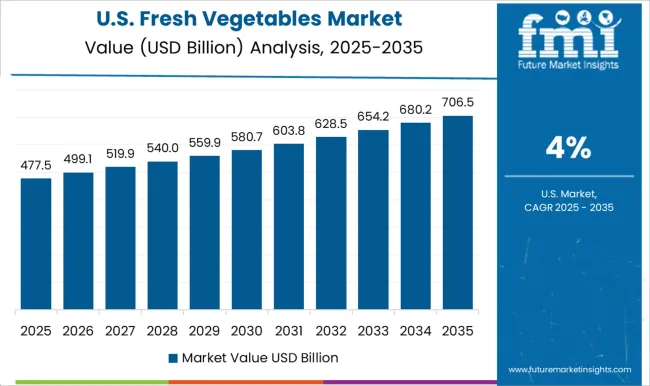

The fresh vegetables market in the USA is projected to grow at a CAGR of 4.0% from 2025 to 2035, supported by rising demand for fresh, organic, and convenient produce. Supermarkets, retail chains, and e-commerce platforms provide widespread distribution, while the foodservice sector contributes to institutional and restaurant demand. Adoption of advanced farming techniques, including controlled environment agriculture, vertical farming, and cold-chain logistics, ensures quality, extended shelf life, and year-round supply. Consumer trends emphasizing health, nutrition, and local sourcing further drive market growth. Government support for food safety, traceability, and agricultural innovation strengthens the sector’s long-term expansion.

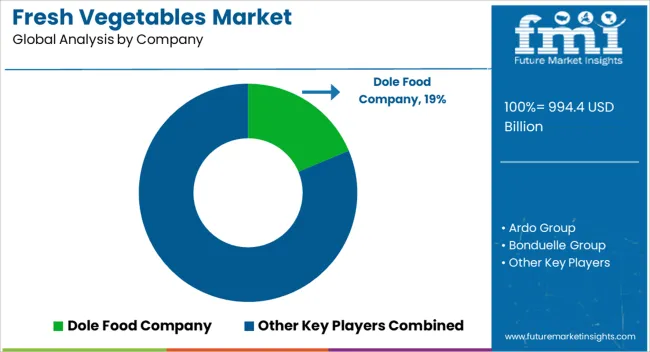

Competition in the fresh vegetables market is shaped by supply chain efficiency, product quality, and year-round availability. Dole Food Company, Ardo Group, Bonduelle Group, Calavo Growers, Conagra Brands, Church Brothers Farms, Fresh Del Monte Produce, Green Giant, Lipman Family Farms, Mann Packing Company, Nestlé S.A., SunFed, Taylor Farms, and The Kraft Heinz Company lead by offering a wide variety of fresh, packaged, and ready-to-eat vegetables to retail, foodservice, and export markets. Product differentiation is achieved through organic and conventional farming methods, pre-cut and pre-washed packaging, controlled-atmosphere storage, and innovative cold chain management, ensuring freshness, extended shelf life, and consistent quality.

Mid-tier and regional players focus on niche varieties, local sourcing, and specialty packaging, catering to consumers seeking premium, locally grown, or seasonal vegetables. Advanced logistics and traceability systems are leveraged to maintain product integrity from farm to table. Strategies across leading companies emphasize integrated supply chains, farm partnerships, and value-added offerings, including ready-to-cook and salad kits. Technology-driven sorting, grading, and packaging solutions are employed to optimize efficiency, reduce waste, and maintain product appearance and texture. Differentiation is further strengthened through sustainability certifications, farm-to-fork traceability, and consumer education programs highlighting nutritional benefits. Companies aim to balance affordability, quality, and freshness while adhering to food safety regulations and environmental standards. The market demonstrates strong competition based on product variety, freshness, and operational efficiency, where global and regional players maintain leadership by delivering high-quality, safe, and convenient fresh vegetables.

Continuous innovation in packaging, cold chain logistics, and farm management supports growth, while consumer-centric strategies, seasonal product planning, and distribution optimization reinforce market positioning. The fresh vegetables market reflects a dynamic landscape driven by quality, convenience, and reliability across diverse consumer segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 994.4 Billion |

| Vegetable Type | Leafy greens, Cruciferous vegetables, Root vegetables, Allium vegetables, Solanaceous Vegetables, Legumes, Cucurbitaceous vegetables, and Others |

| End Use | Household consumption, Food processing, and Food service |

| Distribution Channel | Retail stores, Online retailing, Farmers market, Specialty stores, Foodservice providers, and Wholesale markets |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dole Food Company, Ardo Group, Bonduelle Group, Calavo Growers, Conagra Brands, Church Brothers Farms, Fresh Del Monte Produce, Green Giant, Lipman Family Farms, Mann Packing Company, Nestlé S.A., SunFed, Taylor Farms, and The Kraft Heinz Company |

| Additional Attributes | Dollar sales, share, crop type demand, regional production, consumption trends, pricing patterns, competitor landscape, distribution channels, organic vs conventional adoption, seasonal availability, export-import dynamics, value-added product trends. |

The global fresh vegetables market is estimated to be valued at USD 994.4 billion in 2025.

The market size for the fresh vegetables market is projected to reach USD 1,574.1 billion by 2035.

The fresh vegetables market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in fresh vegetables market are leafy greens, cruciferous vegetables, root vegetables, allium vegetables, solanaceous vegetables, legumes, cucurbitaceous vegetables and others.

In terms of end use, household consumption segment to command 41.2% share in the fresh vegetables market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fresh Fruits & Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Fresh Food Packaging Market Forecast and Outlook 2025 to 2035

Freshness Indicator Label Market Size and Share Forecast Outlook 2025 to 2035

Fresh Fish Gutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fresh Figs Market Size and Share Forecast Outlook 2025 to 2035

Freshness Monitoring Packaging Market Size and Share Forecast Outlook 2025 to 2035

Freshwater Microalgae Market Analysis by Strain type and End Use Application Through 2035

Fresh Produce Trays Market Analysis - Size, Trends & Forecast 2025 to 2035

Freshwater Fish Market – Growth, Demand & Sustainable Practices

Fresh Organic Chicken Market

Air Freshener Market Analysis by Product Type, Application Type, Sales Channel, Fragrance Type, and Region from 2025 to 2035

Raw, fresh and frozen dog food Market Analysis - Size, Share & Forecast 2025 to 2035

Mouth Freshener Market Size, Growth, and Forecast for 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Gel Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Car Air Freshener Market Size and Share Forecast Outlook 2025 to 2035

Packaged Fresh Fruits Market Analysis by Berries, Citrus, Tropical Fruits, Stone Fruits, and Others Through 2035

Candle Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Electric Air Freshener Market Analysis - Trends, Growth & Forecast 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA