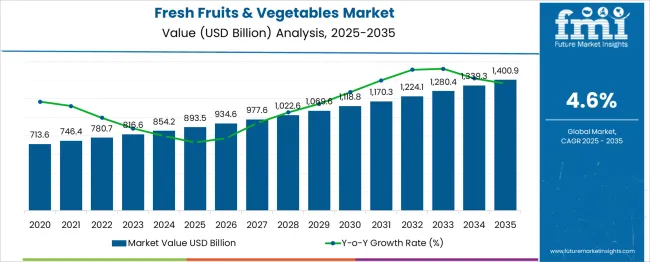

The global fresh fruits & vegetables market is set to grow from USD 893.5 billion in 2025 to approximately USD 1,400.9 billion by 2035, recording an absolute increase of USD 507.4 billion over the forecast period. This translates into a total growth of 56.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.6% between 2025 and 2035. The overall market size is expected to grow by nearly 1.57X during the same period, supported by increasing health consciousness, rising population, growing population, and expanding retail infrastructure.

Between 2025 and 2030, the fresh fruits & vegetables market is projected to expand from USD 893.5 billion to USD 1,118.8 billion, resulting in a value increase of USD 225.3 billion, which represents 44.4% of the total forecast growth for the decade. This phase of growth will be shaped by rising health awareness, increasing demand for organic produce, and growing adoption of convenience food formats. Food retailers and producers are expanding their fresh produce portfolios to address the growing demand for nutritious, ready-to-consume fruit and vegetable products.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 893.5 billion |

| Forecast Value in (2035F) | USD 1,400.9 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

From 2030 to 2035, the market is forecast to grow from USD 1,118.8 billion to USD 1,400.9 billion, adding another USD 282.1 billion, which constitutes 55.6% of the overall ten-year expansion. This period is expected to be characterized by expansion of e-commerce platforms, development of advanced packaging technologies, and growing demand for exotic and premium produce varieties. The increasing adoption of environmentally optimized farming practices and farm-to-table concepts will drive demand for fresh, locally sourced fruits and vegetables with enhanced quality and traceability.

Between 2020 and 2025, the fresh fruits & vegetables market experienced steady growth, driven by increasing consumer focus on healthy eating and growing awareness of nutritional benefits. The market developed as consumers recognized the importance of incorporating fresh produce into their daily diets for maintaining optimal health. COVID-19 pandemic accelerated the trend toward home cooking and healthy eating, emphasizing the critical role of fresh fruits and vegetables in immune system support and overall wellness.

Market expansion is being supported by the increasing consumer awareness about the health benefits of fresh produce consumption and the corresponding demand for nutritious, natural food options. Modern consumers are increasingly focused on preventive healthcare measures through diet, driving demand for fresh fruits and vegetables rich in vitamins, minerals, antioxidants, and fiber. The growing emphasis on weight management, disease prevention, and overall wellness is creating substantial opportunities for fresh produce suppliers and retailers.

The rising trend of plant-based diets and flexitarian eating patterns is driving demand for diverse fruit and vegetable varieties, including exotic and specialty produce. Consumer preference for convenience foods that maintain nutritional value is creating opportunities for pre-cut, packaged, and ready-to-eat fresh produce formats. The increasing influence of social media health trends, nutritionist recommendations, and wellness influencers is also contributing to increased fresh produce consumption across different age groups and demographics.

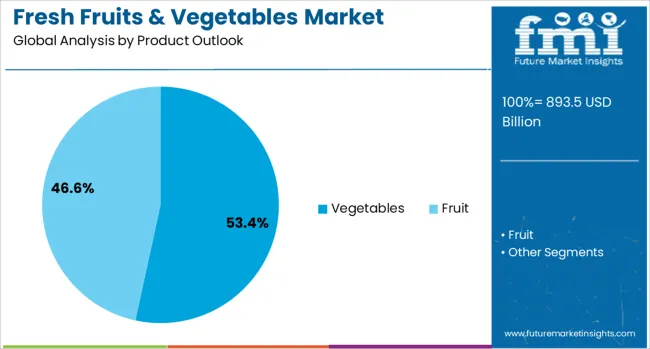

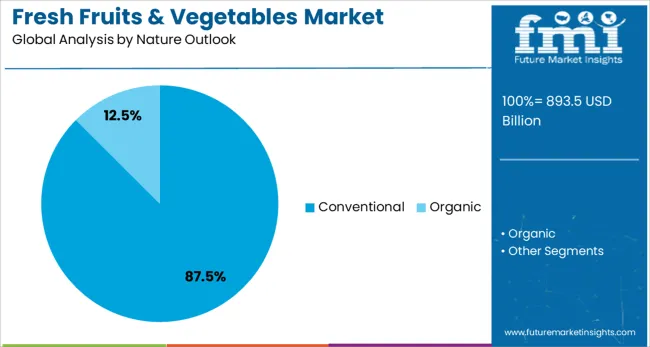

The market is segmented by product, nature, end use application, and region. By product, the market is divided into vegetables and fruits. Based on nature outlook, the market is categorized into conventional and organic. In terms of end use application, the market is segmented into retail/household, food & beverage processing, and foodservice. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The vegetables segment is projected to account for 53.4% of the fresh fruits & vegetables market in 2025, maintaining its position as the dominant product category. Consumers increasingly recognize vegetables as essential components of healthy diets, with growing awareness of their role in disease prevention, weight management, and overall nutritional wellness. The diverse range of vegetable varieties, including cruciferous vegetables, root vegetables, leafy vegetables, and specialty options, provides extensive choices for different culinary applications and dietary preferences.

This segment benefits from year-round availability through global supply chains and greenhouse production systems. The growing popularity of plant-based diets, vegetarian and vegan lifestyles, and flexitarian eating patterns continues to drive vegetable consumption. Additionally, the increasing use of vegetables in processed foods, juices, and ready-to-eat meals expands market opportunities beyond traditional fresh consumption, making vegetables the cornerstone of the fresh produce industry.

Conventional produce is projected to represent 87.5% of fresh fruits & vegetables demand in 2025, underscoring its continued dominance in global food systems. Conventional farming methods enable large-scale production, consistent supply, and competitive pricing that makes fresh produce accessible to diverse consumer segments worldwide. The established infrastructure, distribution networks, and agricultural expertise supporting conventional production systems ensure reliable availability and affordability for mass market consumption.

The segment benefits from advanced farming technologies, efficient supply chain management, and economies of scale that enable producers to meet growing global demand. While organic produce is gaining popularity, conventional fruits and vegetables remain the primary choice for price-conscious consumers and large-scale food processing applications. Continuous improvements in environmentally optimized conventional farming practices, reduced pesticide usage, and enhanced food safety protocols are maintaining consumer confidence in conventional produce quality and safety.

The retail/household application is forecasted to contribute 61.9% of the fresh fruits & vegetables market in 2025, reflecting the fundamental role of fresh produce in home cooking and family nutrition. Consumers increasingly prioritize fresh, nutritious foods for daily meal preparation, snacking, and maintaining healthy eating habits. This segment encompasses direct consumer purchases through various retail channels for home consumption, meal preparation, and family nutrition needs.

The segment benefits from growing health consciousness, home cooking trends, and consumer desire for control over food quality and preparation methods. The COVID-19 pandemic significantly accelerated home cooking and fresh produce consumption, establishing lasting changes in consumer behavior. Additionally, the increasing availability of diverse produce varieties, convenience formats like pre-cut vegetables and fruit packages, and improved retail accessibility continue to drive household fresh produce consumption across all demographic segments.

The fresh fruits & vegetables market is advancing rapidly due to increasing health consciousness, growing population, and expanding retail infrastructure. However, the market faces challenges including supply chain complexities, seasonal variations, perishability concerns, and climate change impacts. Innovation in packaging technologies, cold chain logistics, and environmentally optimized farming practices continue to influence market development and expansion patterns.

The growing adoption of online grocery shopping is transforming fresh produce retail, enabling consumers to access wider variety selections and convenient delivery options. Digital platforms offer detailed product information, nutritional data, and customer reviews that influence purchasing decisions. The integration of advanced logistics systems, cold chain management, and same-day delivery services is making online fresh produce shopping more attractive and practical for busy consumers.

Modern fresh produce suppliers are implementing environmentally optimized farming practices, water-efficient irrigation systems, and eco-friendly packaging materials to address environmental concerns. These initiatives improve crop yields while reducing environmental impact and appealing to environmentally conscious consumers. Advanced packaging technologies extend shelf life, reduce food waste, and maintain product freshness during transportation and storage.

The implementation of blockchain technology, IoT sensors, and digital tracking systems is enhancing supply chain transparency and food safety throughout the fresh produce industry. These technologies enable real-time monitoring of product quality, origin tracking, and rapid response to contamination issues. Advanced logistics systems optimize transportation routes, reduce delivery times, and minimize product loss during distribution.

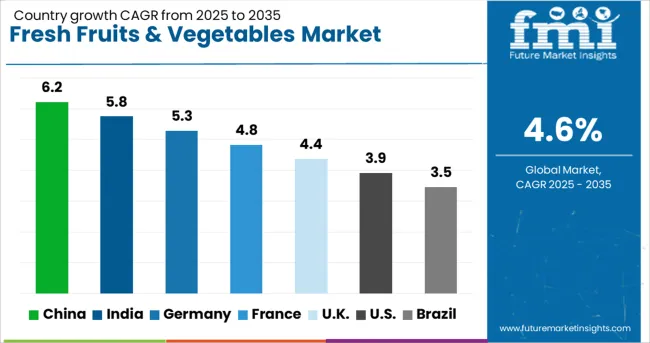

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The fresh fruits & vegetables market is experiencing robust growth globally, with China leading at a 6.2% CAGR through 2035, driven by rising population, increasing health awareness, and expanding retail infrastructure. India follows closely at 5.8%, supported by large population growth, rising disposable incomes, and growing modern retail adoption. Germany shows strong growth at 5.3%, emphasizing organic produce and eco-efficient farming practices. France records 4.8%, focusing on premium quality and local sourcing initiatives. The UK demonstrates 4.4% growth, prioritizing food safety and diverse product offerings.

Revenue from fresh fruits & vegetables in China is projected to exhibit strong growth with a CAGR of 6.2% through 2035, driven by rising middle class, and increasing health consciousness among consumers. The country's massive population, expanding retail infrastructure, and government support for agricultural modernization are creating significant opportunities for fresh produce suppliers. Major domestic and international companies are establishing comprehensive distribution networks to serve the growing demand for quality fresh fruits and vegetables.

Revenue from fresh fruits & vegetables in India is expanding at a CAGR of 5.8 %, supported by large population growth, increasing population, and rising health awareness among consumers. The country's young demographic profile, growing middle class, and expanding organized retail sector are driving demand for diverse produce varieties and quality fresh foods. International suppliers and domestic producers are investing in cold chain infrastructure to serve the growing market demand.

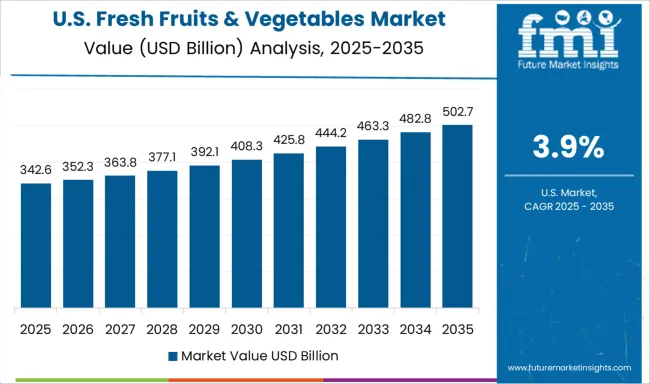

Demand for fresh fruits & vegetables in the USA is projected to grow at a CAGR of 3.9%, supported by consumer preference for organic produce, premium quality standards, and diverse variety selections. American consumers prioritize food safety, nutritional value, and convenient shopping experiences. The market is characterized by strong demand for ready-to-eat formats, exotic varieties, and locally sourced produce options.

Revenue from fresh fruits & vegetables in Germany is projected to grow at a CAGR of 5.3% through 2035, driven by strong consumer preference for organic produce, environmentally optimized farming practices, and high-quality standards. German consumers consistently demand environmentally responsible, locally sourced, and premium fresh produce options. The market benefits from well-established retail networks, strict quality regulations, and comprehensive food safety protocols.

Revenue from fresh fruits & vegetables in France is projected to grow at a CAGR of 4.8% through 2035, supported by culinary traditions, premium quality expectations, and strong preference for local and seasonal produce. French consumers value freshness, flavor, and artisanal quality, positioning fresh fruits and vegetables as essential components of daily cuisine and lifestyle.

Revenue from fresh fruits & vegetables in the UK is projected to grow at a CAGR of 4.4% through 2035, supported by strong health consciousness, diverse population preferences, and expanding retail accessibility. British consumers prioritize nutritional value, food safety, and convenient access to fresh produce through multiple retail channels.

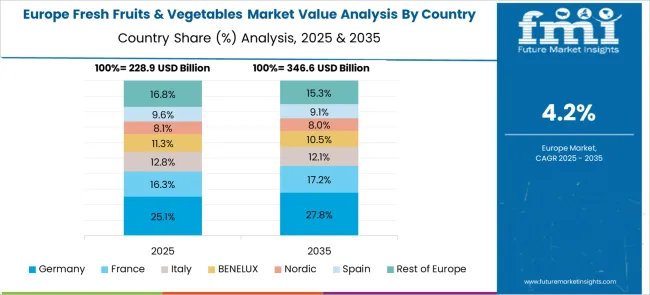

The European fresh fruits & vegetables market demonstrates sophisticated development across major economies with Germany leading through its precision agricultural excellence and advanced distribution capabilities, supported by companies emphasizing organic produce and environmentally optimized farming practices while maintaining strict quality standards and food safety protocols. The UK shows strength in diverse product offerings and regulatory compliance, with retailers specializing in exotic varieties and premium fresh produce that meets stringent hygiene standards and provides consistent quality outcomes.

France contributes through its culinary excellence and local sourcing initiatives, delivering premium seasonal produce that combines traditional farming methods with modern agricultural science. Sweden and Nordic countries emphasize environmentally optimized farming practices and organic produce varieties. Italy and Spain demonstrate growth in specialized Mediterranean produce and traditional agricultural products. The market benefits from stringent EU food safety regulations, established agricultural infrastructure, and growing consumer demand for locally sourced, environmentally optimized fresh produce that provides superior nutritional value.

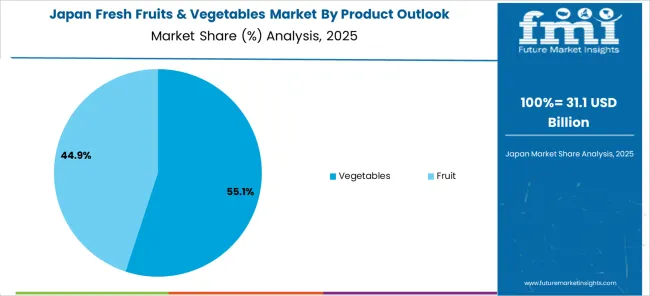

The Japanese fresh fruits & vegetables market demonstrates steady growth driven by precision agricultural focus, advanced farming technologies, and consumer preference for high-quality produce that ensures superior freshness and safety compliance throughout distribution operations. Japanese consumers prioritize premium produce quality and food safety standards, creating demand for fresh fruits and vegetables featuring optimal nutritional content, perfect visual appearance, and traceable origins that align with Japanese quality expectations.

The market emphasizes technological innovation in agriculture, cold chain logistics, and packaging excellence that reflects Japanese attention to detail in food production and distribution processes. Growing investment in smart farming technologies supports intelligent agricultural systems with optimal growing conditions, harvest timing, and supply chain efficiency. Japanese retailers focus on product freshness, seasonal variety availability, and premium positioning, creating opportunities for high-quality domestic and imported produce that delivers exceptional taste, nutritional benefits, and visual appeal while maintaining the highest safety standards expected by discerning Japanese consumers.

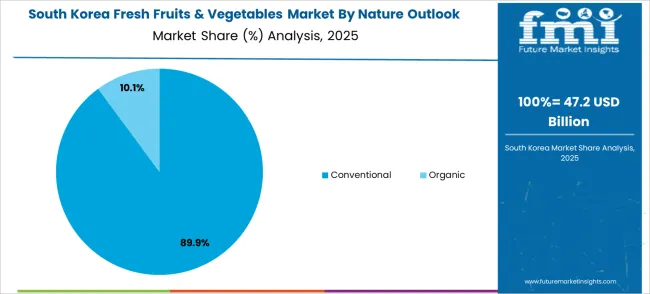

The South Korean fresh fruits & vegetables market shows exceptional growth potential driven by expanding modern retail adoption, increasing health consciousness, and growing consumer demand for diverse produce varieties requiring efficient cold chain logistics and quality assurance systems. The market benefits from South Korea's technological advancement in retail infrastructure and increasing focus on healthy lifestyle trends that drive investment in premium fresh produce meeting international quality standards. Korean consumers increasingly adopt convenience-focused shopping patterns, seeking pre-packaged produce, exotic varieties, and year-round availability while ensuring food safety compliance and nutritional value.

Growing influence of health and wellness trends supports demand for organic produce, superfood varieties, and functional foods that ensure quality assurance while maintaining competitive pricing. The integration of e-commerce platforms and digital grocery services creates opportunities for direct-to-consumer fresh produce delivery with real-time quality monitoring, inventory management, and consumer convenience. Rising food safety awareness and lifestyle modernization drive adoption of premium fresh produce solutions that combine nutritional benefits with comprehensive quality assurance.

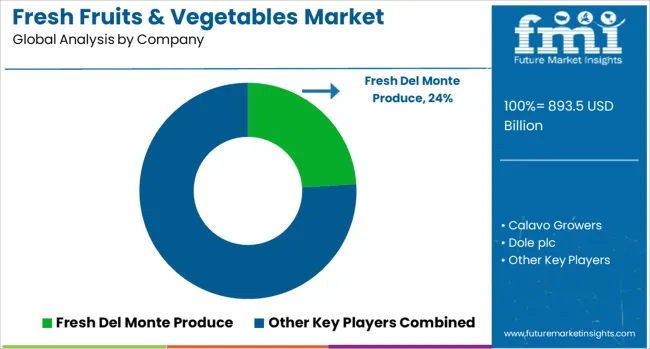

The fresh fruits & vegetables market is characterized by competition among large-scale producers, regional suppliers, retail chains, and specialty distributors. Companies are investing in environmentally optimized farming practices, advanced packaging technologies, cold chain logistics, and digital marketing strategies to deliver fresh, high-quality, and accessible produce solutions. Brand positioning, quality assurance, supply chain efficiency, and distribution network expansion are central to strengthening market presence and consumer loyalty.

Fresh Del Monte Produce Inc. leads the market with significant global presence, offering comprehensive fresh fruit and vegetable portfolios with focus on quality, sustainability, and innovative packaging solutions. Calavo Growers, Inc. specializes in avocados and premium produce varieties with emphasis on year-round availability and supply chain excellence. Dole plc provides extensive tropical and temperate fruit offerings with global distribution capabilities and environmentally optimized farming initiatives. Chiquita Brands International, Inc. focuses on bananas and tropical fruits with strong brand recognition and quality assurance programs.

Driscoll’s, Inc. dominates the berry segment with proprietary varieties, advanced growing techniques, and premium positioning. Unifrutti Group operates comprehensive fresh produce supply chains across multiple regions and product categories. Bonduelle S.A. combines fresh and processed vegetable offerings with focus on convenience and nutrition. Zespri International Ltd. leads the global kiwi market with innovative varieties and comprehensive marketing programs. Nature’s Pride B.V. and Greenyard NV provide diverse fresh produce portfolios with emphasis on sustainability and quality standards.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 893.5 billion |

| Product | Vegetables, Fruits |

| Nature | Conventional, Organic |

| End Use Application | Retail/Household, Food & Beverage Processing, Foodservice |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Fresh Del Monte Produce Inc., Calavo Growers, Inc., Dole plc, Chiquita Brands International, Inc., Driscoll’s, Inc., Unifrutti Group, Bonduelle S.A., Zespri International Ltd., Nature’s Pride B.V., and Greenyard NV |

| Additional Attributes | Dollar sales by product category and organic/conventional split, regional consumption patterns, competitive landscape, consumer preferences for local versus imported produce, integration with environmentally optimized farming practices, innovations in packaging technology, cold chain logistics, and traceability systems |

The global fresh fruits & vegetables market is estimated to be valued at USD 893.5 billion in 2025.

The market size for the fresh fruits & vegetables market is projected to reach USD 1,400.9 billion by 2035.

The fresh fruits & vegetables market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in fresh fruits & vegetables market are vegetables, cruciferous vegetables, root vegetables, leafy vegetables, and others.

In terms of nature outlook, conventional segment to command 87.5% share in the fresh fruits & vegetables market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fresh Food Packaging Market Forecast and Outlook 2025 to 2035

Freshness Indicator Label Market Size and Share Forecast Outlook 2025 to 2035

Fresh Fish Gutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fresh Figs Market Size and Share Forecast Outlook 2025 to 2035

Freshness Monitoring Packaging Market Size and Share Forecast Outlook 2025 to 2035

Freshwater Microalgae Market Analysis by Strain type and End Use Application Through 2035

Fresh Produce Trays Market Analysis - Size, Trends & Forecast 2025 to 2035

Freshwater Fish Market – Growth, Demand & Sustainable Practices

Fresh Organic Chicken Market

Fresh Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Air Freshener Market Analysis by Product Type, Application Type, Sales Channel, Fragrance Type, and Region from 2025 to 2035

Raw, fresh and frozen dog food Market Analysis - Size, Share & Forecast 2025 to 2035

Mouth Freshener Market Size, Growth, and Forecast for 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Gel Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Car Air Freshener Market Size and Share Forecast Outlook 2025 to 2035

Packaged Fresh Fruits Market Analysis by Berries, Citrus, Tropical Fruits, Stone Fruits, and Others Through 2035

Candle Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Electric Air Freshener Market Analysis - Trends, Growth & Forecast 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA