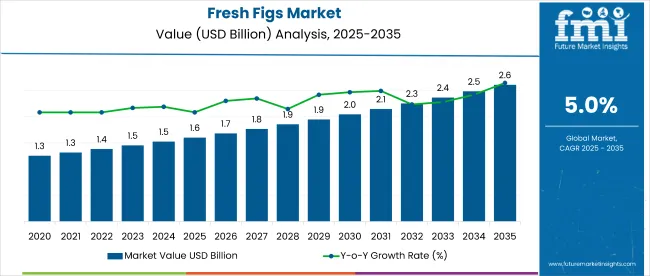

The global fresh figs market is projected to grow from USD 1.6 billion in 2025 to USD 2.6 billion by 2035, registering a CAGR of 5%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.6 billion |

| Industry Value (2035F) | USD 2.6 billion |

| CAGR (2025 to 2035) | 5% |

Consumers are seeking nutrient-dense fruits rich in fiber, antioxidants, potassium, and other essential minerals, with figs emerging as a preferred choice due to their versatility in fresh and processed applications. Their usage in health-oriented food products such as protein bars, shakes, desserts, and salads is fueling consistent demand across households and the food processing industry.

The fresh figs market holds approximately 1.8% share of the global fresh fruits market and about 4.5% within the organic fruits segment, driven by rising consumer preference for clean-label produce. In the functional food ingredients market, fresh figs contribute nearly 0.5%, primarily through use in protein bars, desserts, and health snacks.

They account for around 3% of the Mediterranean fruits market, reflecting their cultural and regional significance. Within the health and wellness food market, their share is estimated at 1.2%, while in the specialty crops market and natural sweeteners segment, their respective shares are approximately 1.5% and 0.8%.

Government policies impacting the market include food safety standards, organic certification regulations, and agricultural export incentives. Agencies such as the USDA (United States Department of Agriculture), FSSAI (Food Safety and Standards Authority of India), and EFSA (European Food Safety Authority) promote the production and distribution of organic and minimally processed fruits. Supportive frameworks like India’s National Horticulture Mission and global sustainable agriculture guidelines encourage the cultivation and export of fresh figs, enabling farmers and producers to adopt organic farming methods and strengthen global supply chains.

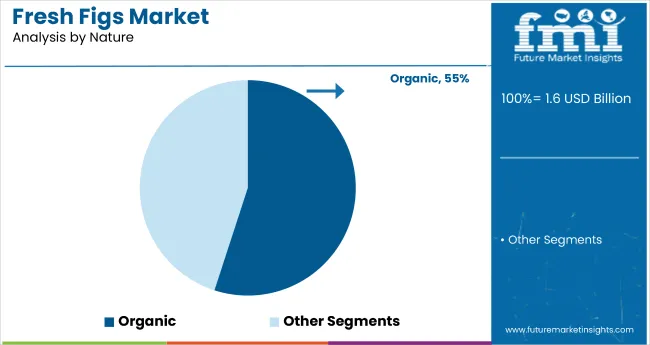

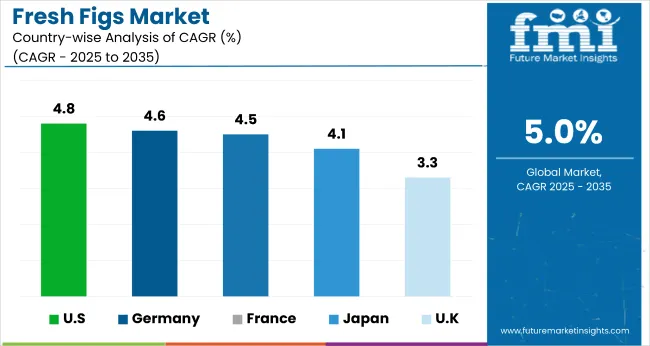

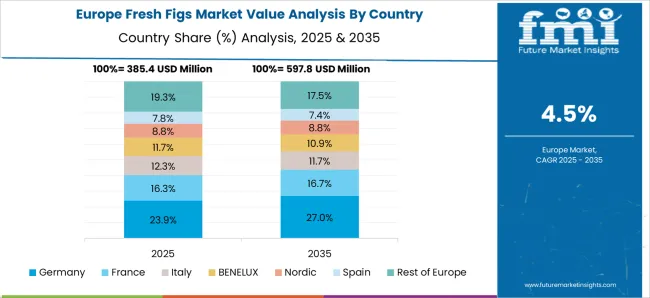

The USA is projected to be the fastest-growing market, expanding at a CAGR of 4.8% from 2025 to 2035. Organic fresh figs will lead the nature segment with a 55% share, while supermarkets and hypermarkets will dominate the distribution channel segment with a 42% share. The Germany and France markets are also expected to grow steadily at CAGRs of 4.6% and 4.5%, respectively, while Japan is projected to grow at 4.1% and the UK at 3.3%.

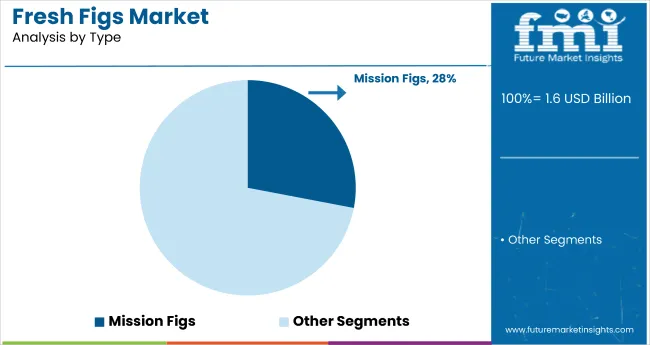

The global market is segmented by nature, type, distribution channel, and region. By nature, the market is divided into organic and conventional. In terms of type, the market includes smyrna figs, black figs, sari lop figs, mission figs, kadota figs, and others (calimyrna figs, adriatic figs, brown turkey figs, desert king figs).

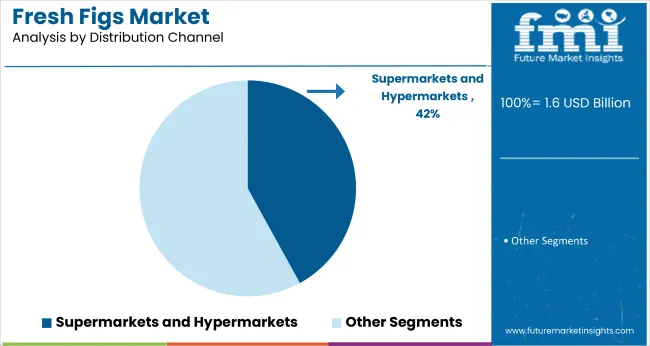

Based on distribution channel, the market is categorized into supermarkets and hypermarkets, specialty stores, and online retail. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

Organic fresh figs are expected to lead the nature segment with a 55% market share in 2025. Rising consumer demand for clean-label, chemical-free fruits is driving this growth, supported by health trends, organic certifications, and premium positioning. Increased awareness of natural food benefits further boosts market preference for organic figs.

Mission figs are projected to dominate the type segment with a 28% market share in 2025. Their popularity stems from rich flavor, soft texture, and high nutritional value. Widely used in fresh consumption and food applications, Mission figs are favored for their availability, health benefits, and familiarity among global consumers.

Supermarkets and hypermarkets are projected to lead the distribution channel segment with a 42% market share in 2025. Their dominance is driven by wide product availability, convenient access, and increased consumer preference for one-stop grocery shopping, making them key outlets for both fresh and packaged fig products across urban markets.

The global fresh figs market is experiencing consistent growth, fueled by rising health awareness and increased demand for organic and functional foods. Fresh figs are valued for their nutritional benefits, including high fiber, antioxidants, and essential minerals, making them popular among health-conscious consumers and food manufacturers.

Recent Trends in the Fresh Figs Market

Challenges in the Fresh Figs Market

The USA demand is driven by rising interest in healthy snacking, expanding online retail, and strong domestic production, especially in California. Germany and France continue to maintain stable consumption, supported by EU organic farming subsidies and health food regulations. Developed markets such as the USA (4.8% CAGR), UK (3.3%), and Japan (4.1%) are growing at a steady 0.66-0.96x of the global average. Japan’s demand is shaped by high-end consumer preferences, culinary innovation, and a growing shift toward natural sweeteners and organic products.

The USA shows the highest growth in the fresh figs market among leading OECD nations, driven by demand for healthy snacking and strong retail distribution. Germany follows with consistent expansion supported by organic food trends and intra-EU imports. France maintains stable growth due to local cultivation and culinary usage. Japan sees rising demand for high-quality imported figs linked to health and diet trends.

The United Kingdom records the slowest pace, limited by high import dependence and low domestic production. While all five countries show positive momentum, their growth remains moderate compared to the global average, reflecting their mature market dynamics.

The report includes a comprehensive analysis of over 40+ countries; below are five top-performing OECD nations.

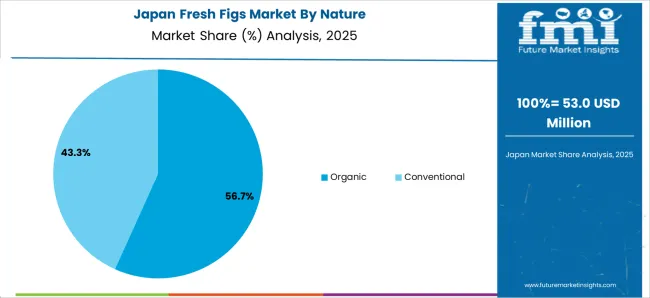

The Japan fresh figs market is projected to grow at a CAGR of 4.1% from 2025 to 2035. Growth is influenced by premium consumption trends, high awareness of Mediterranean diets, and the popularity of natural fruit-based products. Figs are used in desserts, artisanal jams, and functional snacks. Japan favors high-grade imported figs due to its limited domestic cultivation and demand for visual and nutritional quality.

The fresh figs market in Germany is projected to expand at a CAGR of 4.6% during the forecast period. The demand is largely driven by strong consumer focus on organic, plant-based, and nutrient-rich foods. Figs are increasingly used in gourmet applications, vegan products, and wellness diets. Germany benefits from both domestic and intra-EU imports under relaxed trade tariffs.

The French fresh figs market is projected to register a CAGR of 4.5% from 2025 to 2035. The country’s Mediterranean climate supports regional production, especially in Provence. Figs are a staple in traditional cuisine, and their growing use in processed health foods further boosts consumption. Government initiatives to support organic farming and regional supply chains enhance market growth.

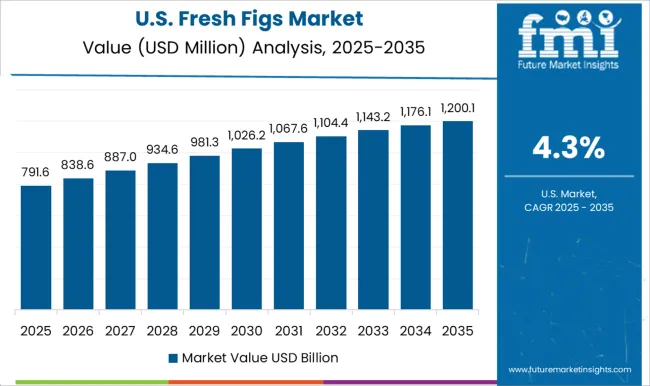

The USA fresh figs market is expected to grow at a CAGR of 4.8% between 2025 and 2035, slightly below the global average. Growth is being fueled by expanding retail distribution, the rise of functional snacking, and consumer interest in whole, unprocessed fruits. California remains the central production hub, while organic imports support demand across major cities.

The UK fresh figs market is forecast to grow at a CAGR of 3.3% from 2025 to 2035, representing the slowest growth among leading OECD countries at 0.66 times the global rate. Demand is supported by baking, premium foodservice, and health foods. However, high import dependency and limited local production restrain volume expansion.

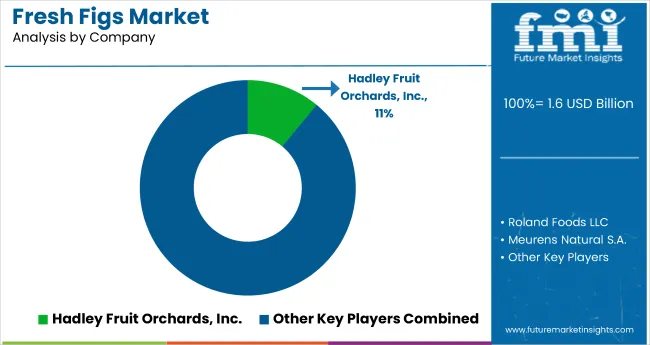

The global market is moderately fragmented, with several established players such as Hadley Fruit Orchards, Inc., Roland Foods LLC, Meurens Natural S.A., FruitLips, and Jiaherb, Inc. leading global supply and innovation. These companies offer premium-grade fresh figs for retail, foodservice, and processing applications. Hadley Fruit Orchards, Inc. focuses on sun-ripened California figs, while Roland Foods LLC distributes specialty fig-based culinary products worldwide.

Meurens Natural S.A. emphasizes clean-label fig ingredients for functional foods. FruitLips is known for its artisanal and preservative-free fig offerings, and Jiaherb, Inc. provides high-purity fig extracts for nutraceuticals. Other prominent contributors like Athos Agricola S.A., Earl's Organic Produce, Alara Agri, Isik Tarim A.S., and Valley Fig Growers, Inc. continue to support market diversity with organic, regional, and export-oriented products.

Recent Fresh Figs Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.6 billion |

| Projected Market Size (2035) | USD 2.6 billion |

| CAGR (2025 to 2035) | 5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value / volume in Metric Tons |

| Nature Analyzed | Organic and Conventional |

| Type Analyzed | Smyrna Figs, Black Figs, Sari Lop Figs, Mission Figs, Kadota Figs, others (Calimyrna Figs, Adriatic Figs, Brown Turkey Figs, Desert King Figs) |

| Distribution Channel Analyzed | Supermarket and Hypermarkets, Specialty Stores, Online Retail |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players Influencing the Market | Hadley Fruit Orchards, Inc., Roland Foods LLC, Meurens Natural S.A., FruitLips , Jiaherb , Inc., Athos Agricola S.A., Earl's Organic Produce, Alara Agri, Isik Tarim A.S., Valley Fig Growers, Inc., Kirlioglu Figs, Yabanfood , National Raisin Company, Torres Tropical Fresh B.V. |

| Additional Attributes | Market share by fig type, sales by nature, regional trade trends, import-export analysis, organic certification impact, competitive profiling |

The global fresh figs market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the fresh figs market is projected to reach USD 2.6 billion by 2035.

The fresh figs market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in fresh figs market are organic and conventional.

In terms of variety, smyrna figs segment to command 38.6% share in the fresh figs market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fresh Food Packaging Market Forecast and Outlook 2025 to 2035

Freshness Indicator Label Market Size and Share Forecast Outlook 2025 to 2035

Fresh Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Fresh Fish Gutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fresh Fruits & Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Freshness Monitoring Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fresh Produce Trays Market Analysis - Size, Trends & Forecast 2025 to 2035

Freshwater Microalgae Market Analysis by Strain type and End Use Application Through 2035

Freshwater Fish Market – Growth, Demand & Sustainable Practices

Fresh Organic Chicken Market

Air Freshener Market Analysis by Product Type, Application Type, Sales Channel, Fragrance Type, and Region from 2025 to 2035

Raw, fresh and frozen dog food Market Analysis - Size, Share & Forecast 2025 to 2035

Mouth Freshener Market Size, Growth, and Forecast for 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Gel Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Car Air Freshener Market Size and Share Forecast Outlook 2025 to 2035

Packaged Fresh Fruits Market Analysis by Berries, Citrus, Tropical Fruits, Stone Fruits, and Others Through 2035

Candle Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Electric Air Freshener Market Analysis - Trends, Growth & Forecast 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA