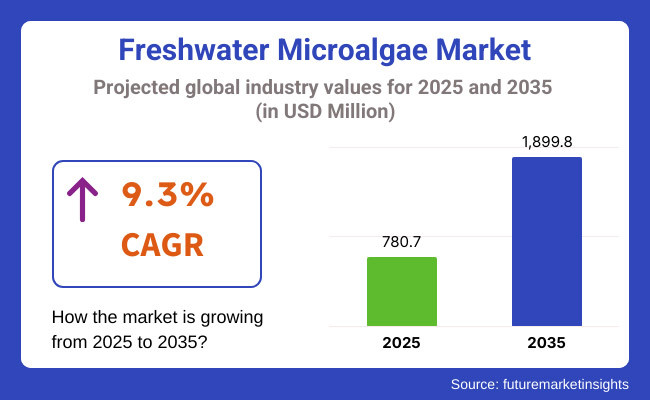

World market value of freshwater microalgae was USD 658.7 million in 2023. World demand for freshwater microalgae in 2024 was 8.8% higher than the previous year ago, and world market value was USD 780.7 million in 2025. Foreign sales would be USD 1,899.8 million after growing at a growth rate of 9.3% CAGR in 2025 to 2035.

Rapid use of microalgae as plant proteins, foodstuffs, and dietary supplements has propelled the freshwater microalgae industry to a gigantic level. Spirulina and Chlorella are among the top microalgae with extremely high rates of value-added content. They have extremely high contents of proteins, vitamins, and antioxidants and are best suited to be utilized in the animal feed, diet supplement, and food and beverage industries.

By performing this way, there is also a wider health problem in the line of ecologies that is targeting the market. Microalgae are grown in an environment-friendly condition with less water and thus become a choice crop in contrast to others. Apart from this, microalgae application in the pharmaceutical and cosmetics sector is also propelling growth because these products that are being formulated from microalgae are anti-aging and anti-inflammatory and are used for diversified medicine applications.

Increasing demand for natural food for well-being and functional food also generates increasing demand for freshwater microalgae. Microalgae are consumed in massive amounts as superfoods and this has made them favourite among well-being consumers, but even more among vegetarians and vegans. Increasing demand for plant-based nutrition also offers new opportunities to the use of freshwater microalgae in fortified food and protein supplement.

The market is also being propelled because freshwater microalgae are eco-friendly to grow at low prices than other crops. They use less water and land, and by this alone, they are in higher demand by green consumers and institutions as well.

Below given table is describing the comparison study of base year six months (2024) and current year (2025) difference in the CAGR of global freshwater microalgae market. Analysis has been carried out in the guise of the larger variation in the performance and as representing the trend in the attainment of the revenue, thus creating a better indication to the future stakeholders regarding the trend in the growth for the year. Half 1 or H1 is January to June. Half 2, H2, is July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 8.8% |

| H2 (2024 to 2034) | 9.0% |

| H1 (2025 to 2035) | 9.1% |

| H2 (2025 to 2035) | 9.3% |

The firm will increase at 9.1% in half-year H1 of period 2025 to 2035 and growth rate of increasing growth of 9.3% for half-year H2 of the same period. Projected scenario until second phase, i.e., H1 2025 until H2 2035, CAGR of H1 would be 9.1% and high, i.e., 9.3%, for H2. Already in H1, the industry was 30 BPS, but the company was even experiencing more 20 BPS growth by H2.

Microalgae freshwater industry will even experience runaway growth because of multiconcept's magnanimity in delivering usability and nature-friendliness. Firms will need to adopt diversified environments so that they can engage in strategic positioning as a process towards opportunity for growth infused in such business with dynamic character.

Global Microalgae Leaders in Production and Innovation - It consists of multinational companies with international supply chains, advanced culture techniques, and high-tech manufacturing facilities. They lead the way in R&D to create new products from freshwater microalgae. Cyanotech Corporation (USA), as one of the top microalgae product producers worldwide, Cyanotech is involved in spirulina and astaxanthin manufacturing for dietary supplement and functional foods.

Exporting premium microalgae products worldwide utilizing advanced cultivations techniques on Hawaii. DIC Corporation (Japan), Earthrise Nutritionals, whose parent company is one of the world's leading producers of spirulina-based health supplements, has DIC Corporation as its holding company, a world leader in microalgae culture and R&D.

Regional Powerhouses Expanding Their Market Reach - This phase comprises firms present in certain geographical locations but extending more with alliances, green production, and new products. E.I.D. Parry (India) Ltd., With the largest production capacity of organic spirulina and chlorella, E.I.D. Parry has leadership in Asia and North America.

By introducing freshwater culture microalgae in an environmentally friendly manner, it provides raw material to supplement and functional food product companies. AlgoSource, a prominent European microalgae biotech company, AlgoSource is a specialist in the use of microalgae for nutraceuticals and cosmetics.

Tier 3 Emerging Innovators and Specialized Producers - This tier consists of small, rapidly growing companies that specialize in new uses of freshwater microalgae like personalized nutrition, plant protein, and green biofuels. AlgaEnergy, A fast-expanding biotech firm, AlgaEnergy is a leader in microalgae uses in agriculture, cosmetics, and biofuel.

AlgaEnergy manufactures added-value biostimulants from microalgae to boost crop yield and enhance soil quality. Inner Mongolia Rejuve Biotech (China): One of the new pioneers of mass culture of chlorella and spirulina, Rejuve Biotech is expert in mass breeding and processing microalgae with high quality for functional food and dietary supplements. The firm is growing globally through the export of bulk microalgae powder and extracts worldwide.

Rising Demand for Microalgae-Derived Protein for Alternative Foods & Drinks

Shift: Replace traditional use of animal and resource-dense protein sources with freshwater microalgae as a whole food, high-protein ingredient to become of growing interest. Consumers seeking non-GMO, allergen-free, and whole proteins are turning to microalgae in meat alternatives, plant milk, and functional foods and beverages. The presence of essential amino acids, omega-3s (DHA & EPA), and bioavailable iron in algae proteins makes them the first choice for athletes, vegans, and health-conscious consumers.

Strategic Response: Sophie's Bionutrients (Singapore) launched microalgae-based plant-based seafood and meat substitutes, with demand increasing by 27% among plant-based consumers in 2024. Duckweed Labs (USA) developed algae protein-enriched smoothies and energy drinks, resulting in a 15% increase in e-commerce subscription.

Nestlé R&D Division has been testing trials with algae-based dairy products, in the form of algal milk with high calcium and protein content, for lactose-intolerant and plant-based consumers. Triton Algae Innovations (USA) introduced microalgae-based egg replacers, growing its market share of the vegan bakery market by 18%.

Microalgae Expansion in the Beauty & Skincare Market for Anti-Aging & Hydration

Shift: High-antioxidant, high-chlorophyll, high-astaxanthin freshwater microalgae is a luxury ingredient trend in clean beauty skincare. Consumers are shifting towards biotech-formulated skincare with the addition of hydration, anti-aging, and sun protection. Microalgae-laden serums, moisturizers, and face masks are on the rise among K-beauty, J-beauty, and clean European skincare brands.

Strategic Response: L'Oréal and Estée Lauder launched anti-aging creams infused with microalgae, which raised their skincare segment revenue by 19% in 2024. Blue microalgae-derived moisturizing serums by French player Seppic generated rising demand in luxury organic skincare space.

BASF and Givaudan Active Beauty introduced algal extracts in SPF products, which raised sales of UV protection products by 11%. Biotherm Blue Therapy product range employed microalgae's repairing ability for the skin, which led to 14% sales growth in Asian markets.

Growing Use of Microalgae as a Sustainable Source of Omega-3 in Nutraceuticals

Shift: As demands for overfishing and the necessity of plant-derived options of vegan omega-3 grow stronger, microalgae-derived DHA and EPA are increasingly accepted in dietary supplements. Customers are increasingly seeking more bioavailable, sustainable, and plant-based forms of omega-3s for brain function, heart health, and prenatal care. The trend is strong among North America, Europe, and Asia, where double-digit growth in plant-based nutraceuticals is observed.

Strategic Response: Corbion and DASM expanded their Nourishomega microalgae-based omega-3 products, registering a 21% increase in revenues from sustainable supplement consumers. Qualitas Health (Iwi Life) launched algal DHA supplements for heart, registering a 17% increase in plant-based supplement business.

Nordic Naturals launched soft gel versions of algae-based omega-3, holding a 14% market share of plant-based health supplements. NaturesAid and NOW Foods increased their microalgae-based omega-3 capsules, growing their customers by 12% in 2024.

Microalgae as a Natural Coloring Agent & Food Processing Functional Ingredient

Shift: Food manufacturers are embracing microalgae-derived plant colors such as phycocyanin (blue from spirulina) and beta-carotene (orange from Dunaliella) as more regulation against man-made additives and chemical food colorings is put in place.

The hues offer clean-label, plant-based, antioxidant-rich alternatives to the confectionery, beverage, and plant-based milk alternative industries. Demand is shifting strongly upward in the USA, Europe, and Japan, where food transparency and regulatory evolution are forcing brands to switch from artificial colors to nature-based shades.

Strategic Response: GNT Group (EXBERRY®) launched microalgae-based natural blue and green color dyes, which took a 20% market share for beverage companies. Kerry Company's DDW launched phycocyanin as a blue soft drink food colorant, and its volume sales grew 15% in clean-label markets.

PepsiCo and Nestlé substituted microalgae pigments with artificial colors for reformulated sweets and plant-based beverages. Functional dairy made from algae by Japanese industry leaders Meiji and Morinaga saw selling rise 13% in the natural foods segment.

Increasing Demand for Microalgae as Livestock & Aquaculture Sustainable Feed

Shift: Microalgae demand is being fuelled to provide the role of an alternate protein and a source of omega-3 based on aquaculture and livestock feed shifting to sustainable animal feed. Conventional fishmeal and soy feed are having environmentally degrading issues like overfishing, deforestation, and carbon footprint.

As more European and North American regulations are being implemented to limit the application of non-sustainable feedstocks, companies are leveraging microalgae-based feeds with high concentrations of essential amino acids, DHA, and EPA in an attempt to improve livestock welfare, fish growth, and overall sustainability.

Strategic Response: Corbion and Cargill transformed microalgae fish feed, which made it possible for 22% reduced usage of wild-caught fishmeal in 2024. Veramaris and Skretting (Norway) transformed High-DHA algae aquaculture feed, increasing fish growth and health by 15%.

Microalgae poultry feed was launched by ADM Animal Nutrition, which lowered the usage of soybean meal by 18%. Unibio and Innovafeed are building the integration of algal protein into animal feed, hence lowering the carbon footprint by 30% compared to traditional feeds.

Microalgae as Biofuel & Industrial Applications for Carbon Reduction

Shift: Governments and businesses are investing in microalgae biofuels as a low-carbon alternative to fossil fuels. Algae are lipids and thus ideal for biodiesel, and they absorb CO₂ when grown, reducing greenhouse gases.

The USA, China, and Germany are accelerating algal biofuel production for air, sea, and industrial power needs to reach 2050 net-zero carbon emissions. Algae bioplastics and wastewater treatment products are also on the rise as companies look for sustainable industrial applications.

Strategic Response: ExxonMobil and Synthetic Genomics have invested over USD 300 million in research and development on microalgae biofuel commercialization by 2030. Airbus and Boeing are performing test flights with microalgae aviation fuel, reducing carbon emissions by up to 50% per flight.

Algenol and Algix developed bioplastic from freshwater algae, capturing a 12% market share in green packaging. Japanese firm Euglena Co. has collaborated with airlines to produce jet fuel from microalgae, which will be expanded for the full commercial production by 2028.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of freshwater microalgae through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 10.4% |

| Germany | 8.8% |

| China | 7.9% |

| Japan | 9.3% |

| India | 8.5% |

Increasing demand for plant-based sources of protein, functional foods, and nutraceuticals in the United States is driving the freshwater microalgae market. Spirulina and chlorella are gaining popularity with anyone a little timid of the protein content, packed with protein, omega-3 and antioxidants.

Additionally, a growing trend towards sustainable agriculture, biocombustible, and biofuels research is further driving the demand for biomass solutions from microalgae-based biomass.

Germany’s freshwater microalgae market is growing steadily alongside stringent EU food safety regulations and a strong consumer demand for organic and clean label products. The market is also benefitting from increasing usage of microalgae in vegan protein powders, functional drinks, and dietary supplements.

With healthy government policies encouraging sustainable food systems and bio-based materials, microalgae generates significant investment.

The main engine of the Chinese freshwater microalgae market lies in the demand for the production of functional food ingredients, aquafeed, and algal-based pharmaceutical applications that are being produced. Tapping into the government-led promotion of sustainable aquaculture and research into biopharmaceuticals, local manufacturers have ramped up production of chlorella and spirulina.

Algae-based health drinks and supplements are likely to find a ready customer base as the concept of immunity-boosting and detoxifying food products gain consumer cognizance.

Japan has a strong focus on its biotechnology sector, fermentation science, and high-quality nutraceuticals, gains from this for the freshwater microalgae market in the country, the report adds. JapanMicroalgae-based anti-aging and skin health supplements are among the most sought-after product categories among Japanese consumers, driving demand for chlorella, spirulina, and astaxanthin-rich products in the land of the rising sun.

Meanwhile, Japan is advancing algae fermentation technology for the high-value bioactive compounds targeted to functional skincare and pharmaceuticals.

The market for freshwater microalgae in India is growing, driven by increasing consumer interest in plant-based nutrition, sustainable agriculture, and organic aquafeed. Microalgae are amongst the sources of sustainable protein for dietary supplements, fortifying atta (flour) and for livestock feed.

Government incentives for algae-based biofuels and sustainable agriculture solutions are enabling manufacturers to industrial scale and high yield cultivations of microalgae in a cost-efficient manner.

| Segment | Value Share (2025) |

|---|---|

| Nutraceuticals & Dietary Supplements (By Application) | 68.2% |

The freshwater microalgae market is dominated by the dietary supplement and nutraceutical segment due to its high nutritional value, protein content, and functional health benefits. Spirulina and chlorella are microalgae commonly used as a rich source of vitamins, antioxidants, and essential amino acids in protein shakes, energy bars, and detox supplements. The popularity of bee products among health-conscious consumers is not surprising given their immune health benefits, energy-boosting properties, and detoxification support.

Increase in superfood and natural health supplement demand become a common phenomenon, as potentially beneficial product manufacturers are now targeting organic-certified, sustainably grown microalgae. With progressive cultivation methods such as closed-loop bioreactors and controlled-environment agriculture being implemented, even higher purity and nutrient content retention are ensured.

In addition, growing trend toward plant proteins and clean-label products has been driving microalgae use in functional foods and beverages. This trend, fueled by growing consumer recognition and further uptake, bodes well for long-term growth of the freshwater microalgae market of the global nutraceuticals industry.

| Segment | Value Share (2025) |

|---|---|

| Biofuels & Sustainable Feed (By Application) | 31.8% |

Microalgae are used in large-scale bioethanol production, aqua feed, and animal nutrition owing to their increasing demand for sustainable biofuel as well as eco-friendly animal feed. Their richness in omega-3 fatty acids and proteins makes microalgae also an attractive replacement for fish meal and chemical feed supplements, which can lead to a change in agricultural practices to more resource-saving methods.

There are also feed options based on microalgae which can be beneficial in terms of animal health, growth performance and reduce dependence on overexploited marine resources, thus contributing to environmental conservation. All of these advancements in algal biotechnology are helping to develop potential new methods for producing biofuels, with microalgae being an attractive substrate for the generation of bioethanol, biodiesel and biogas.

As bioeconomy programs proliferate, research into the industrial uses of algal biomass is picking up speed. Advanced cultivation methods, biomass processing and genetic transformation also increase the microalgae industrial feasibility and create the foundation for their realization in future sustainable farming, green energy and circular economy's strategies.

The freshwater microalgae market is highly competitive, and prominent players are investing heavily in the development of sustainable production for high-value bioactive compounds and expanded applications for functional foods. Businesses are, these days, make big investments in photobioreactor cultivation, bio-certification and high-quality extraction methods.

Some of the leading manufacturers active in the industry include DIC Corporation, Cyanotech, EID Parry, AlgaTech, and Fuqing King Dnarmsa Spirulina, specializing in microalgae cultivation, biotechnology, and mass distribution. Mounting demand for algae-based nutraceuticals and biofuels is driving many companies to bolster their Asia-Pacific and European operations.

Select from strategic agreements with pharmaceutical and food manufacturers, productive investment in algae bioengineering, and patented extraction techniques of high-purity microalgae extracts. Others are focusing on carbon-neutral production and regenerative algae farming methods.

For instance

The market includes various strains such as Chlorella spp., Spirulina spp., Nannochloropsis, Dunaliella, Haematococcus spp., Scenedesmus spp., Euglena spp., and Tetraselmis spp., each offering unique benefits and applications.

These strains are utilized across multiple sectors, including the food & beverage sector, health & medical sector, animal feed sector, biofuel production, cosmetics & personal care sector, fertilizers sector, and pet food sector.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global freshwater microalgae industry is projected to reach USD 780.7 million in 2025.

Key players include Allmicroalgae; Cyanotech Corporation; Earthrise Nutritionals; Ecoduna; Fermentalg; Fujifilm Corporation; Heliae Development, LLC; Lyxia Corporation.

Asia-Pacific is expected to dominate due to high demand for functional foods, biofuels, and sustainable aquafeed applications.

The industry is forecasted to grow at a CAGR of 9.3 % from 2025 to 2035.

Key drivers include rising demand for high-protein, plant-based foods, increasing use in nutraceuticals and biofuels, and advancements in algae cultivation technology.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Strain Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Strain Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Strain Type, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Strain Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Strain Type, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Strain Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Strain Type, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Strain Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Strain Type, 2018 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Strain Type, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 30: East Asia Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Strain Type, 2018 to 2033

Table 34: South Asia Market Volume (MT) Forecast by Strain Type, 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 36: South Asia Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Strain Type, 2018 to 2033

Table 40: Oceania Market Volume (MT) Forecast by Strain Type, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 42: Oceania Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 43: Middle East & Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East & Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: Middle East & Africa Market Value (US$ Million) Forecast by Strain Type, 2018 to 2033

Table 46: Middle East & Africa Market Volume (MT) Forecast by Strain Type, 2018 to 2033

Table 47: Middle East & Africa Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 48: Middle East & Africa Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Figure1: Global Market Value (US$ Million) by Strain Type, 2023 to 2033

Figure2: Global Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure8: Global Market Value (US$ Million) Analysis by Strain Type, 2018 to 2033

Figure9: Global Market Volume (MT) Analysis by Strain Type, 2018 to 2033

Figure10: Global Market Value Share (%) and BPS Analysis by Strain Type, 2023 to 2033

Figure11: Global Market Y-o-Y Growth (%) Projections by Strain Type, 2023 to 2033

Figure12: Global Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure13: Global Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure14: Global Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure15: Global Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure16: Global Market Attractiveness by Strain Type, 2023 to 2033

Figure17: Global Market Attractiveness by End Use Application, 2023 to 2033

Figure18: Global Market Attractiveness by Region, 2023 to 2033

Figure19: North America Market Value (US$ Million) by Strain Type, 2023 to 2033

Figure20: North America Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure26: North America Market Value (US$ Million) Analysis by Strain Type, 2018 to 2033

Figure27: North America Market Volume (MT) Analysis by Strain Type, 2018 to 2033

Figure28: North America Market Value Share (%) and BPS Analysis by Strain Type, 2023 to 2033

Figure29: North America Market Y-o-Y Growth (%) Projections by Strain Type, 2023 to 2033

Figure30: North America Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure31: North America Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure32: North America Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure33: North America Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure34: North America Market Attractiveness by Strain Type, 2023 to 2033

Figure35: North America Market Attractiveness by End Use Application, 2023 to 2033

Figure36: North America Market Attractiveness by Country, 2023 to 2033

Figure37: Latin America Market Value (US$ Million) by Strain Type, 2023 to 2033

Figure38: Latin America Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure44: Latin America Market Value (US$ Million) Analysis by Strain Type, 2018 to 2033

Figure45: Latin America Market Volume (MT) Analysis by Strain Type, 2018 to 2033

Figure46: Latin America Market Value Share (%) and BPS Analysis by Strain Type, 2023 to 2033

Figure47: Latin America Market Y-o-Y Growth (%) Projections by Strain Type, 2023 to 2033

Figure48: Latin America Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure49: Latin America Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure50: Latin America Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure51: Latin America Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure52: Latin America Market Attractiveness by Strain Type, 2023 to 2033

Figure53: Latin America Market Attractiveness by End Use Application, 2023 to 2033

Figure54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure55: Europe Market Value (US$ Million) by Strain Type, 2023 to 2033

Figure56: Europe Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure62: Europe Market Value (US$ Million) Analysis by Strain Type, 2018 to 2033

Figure63: Europe Market Volume (MT) Analysis by Strain Type, 2018 to 2033

Figure64: Europe Market Value Share (%) and BPS Analysis by Strain Type, 2023 to 2033

Figure65: Europe Market Y-o-Y Growth (%) Projections by Strain Type, 2023 to 2033

Figure66: Europe Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure67: Europe Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure68: Europe Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure69: Europe Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure70: Europe Market Attractiveness by Strain Type, 2023 to 2033

Figure71: Europe Market Attractiveness by End Use Application, 2023 to 2033

Figure72: Europe Market Attractiveness by Country, 2023 to 2033

Figure73: East Asia Market Value (US$ Million) by Strain Type, 2023 to 2033

Figure74: East Asia Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure75: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure76: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure77: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure80: East Asia Market Value (US$ Million) Analysis by Strain Type, 2018 to 2033

Figure81: East Asia Market Volume (MT) Analysis by Strain Type, 2018 to 2033

Figure82: East Asia Market Value Share (%) and BPS Analysis by Strain Type, 2023 to 2033

Figure83: East Asia Market Y-o-Y Growth (%) Projections by Strain Type, 2023 to 2033

Figure84: East Asia Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure85: East Asia Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure86: East Asia Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure87: East Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure88: East Asia Market Attractiveness by Strain Type, 2023 to 2033

Figure89: East Asia Market Attractiveness by End Use Application, 2023 to 2033

Figure90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure91: South Asia Market Value (US$ Million) by Strain Type, 2023 to 2033

Figure92: South Asia Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure93: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure94: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure95: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure98: South Asia Market Value (US$ Million) Analysis by Strain Type, 2018 to 2033

Figure99: South Asia Market Volume (MT) Analysis by Strain Type, 2018 to 2033

Figure100: South Asia Market Value Share (%) and BPS Analysis by Strain Type, 2023 to 2033

Figure101: South Asia Market Y-o-Y Growth (%) Projections by Strain Type, 2023 to 2033

Figure102: South Asia Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure103: South Asia Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure104: South Asia Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure105: South Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure106: South Asia Market Attractiveness by Strain Type, 2023 to 2033

Figure107: South Asia Market Attractiveness by End Use Application, 2023 to 2033

Figure108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure109: Oceania Market Value (US$ Million) by Strain Type, 2023 to 2033

Figure110: Oceania Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure111: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure112: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure113: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure116: Oceania Market Value (US$ Million) Analysis by Strain Type, 2018 to 2033

Figure117: Oceania Market Volume (MT) Analysis by Strain Type, 2018 to 2033

Figure118: Oceania Market Value Share (%) and BPS Analysis by Strain Type, 2023 to 2033

Figure119: Oceania Market Y-o-Y Growth (%) Projections by Strain Type, 2023 to 2033

Figure120: Oceania Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure121: Oceania Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure122: Oceania Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure123: Oceania Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure124: Oceania Market Attractiveness by Strain Type, 2023 to 2033

Figure125: Oceania Market Attractiveness by End Use Application, 2023 to 2033

Figure126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure127: Middle East & Africa Market Value (US$ Million) by Strain Type, 2023 to 2033

Figure128: Middle East & Africa Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure129: Middle East & Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure130: Middle East & Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure131: Middle East & Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure132: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure133: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure134: Middle East & Africa Market Value (US$ Million) Analysis by Strain Type, 2018 to 2033

Figure135: Middle East & Africa Market Volume (MT) Analysis by Strain Type, 2018 to 2033

Figure136: Middle East & Africa Market Value Share (%) and BPS Analysis by Strain Type, 2023 to 2033

Figure137: Middle East & Africa Market Y-o-Y Growth (%) Projections by Strain Type, 2023 to 2033

Figure138: Middle East & Africa Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure139: Middle East & Africa Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure140: Middle East & Africa Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure141: Middle East & Africa Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure142: Middle East & Africa Market Attractiveness by Strain Type, 2023 to 2033

Figure143: Middle East & Africa Market Attractiveness by End Use Application, 2023 to 2033

Figure144: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Freshwater Fish Market – Growth, Demand & Sustainable Practices

Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Microalgae in Fertilizers Market Analysis - Size, Share, and Forecast 2025 to 2035

Microalgae-Based Aquafeed Market – Growth & Sustainable Feed Trends

Microalgae DHA Market

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Microalgae Market - Demand & Future Innovations 2025 to 2035

Health and Medical Microalgae Market – Innovations & Industry Trends 2025 to 2035

Personal Care and Cosmetics Microalgae Market - Beauty & Skincare Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA