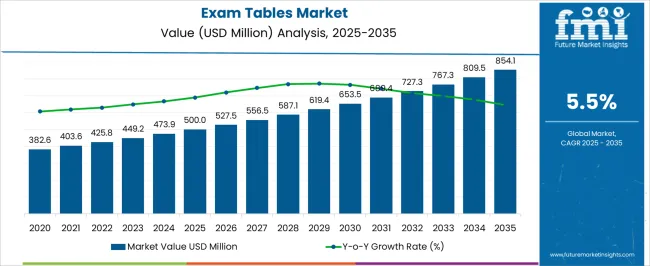

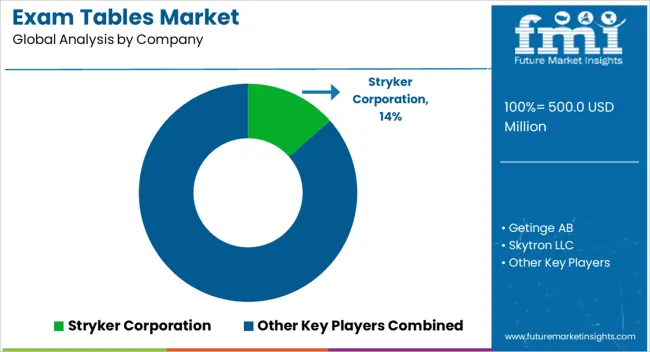

The Exam Tables Market is estimated to be valued at USD 500.0 million in 2025 and is projected to reach USD 854.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Exam Tables Market Estimated Value in (2025 E) | USD 500.0 million |

| Exam Tables Market Forecast Value in (2035 F) | USD 854.1 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The exam tables market is witnessing steady growth driven by the expanding demand for modernized healthcare infrastructure and the increasing focus on patient comfort and clinical efficiency. Hospitals and diagnostic centers are prioritizing the adoption of ergonomic and durable examination furniture to improve workflow and patient care experiences. Investments in hospital modernization and expansion projects are supporting demand for tables that combine flexibility, reliability, and ease of maintenance.

Advancements in design and materials, including antimicrobial coatings and lightweight yet durable frames, are enhancing product functionality and lifespan. Rising patient awareness and the need for safe, hygienic, and adaptable clinical environments are further driving market expansion.

The trend toward multipurpose tables that can accommodate diverse medical examinations and procedures is influencing product development strategies As healthcare providers aim to optimize operational efficiency and comply with regulatory and safety standards, the exam tables market is expected to experience continued growth, with manufacturers focusing on innovations in materials, adjustability features, and cost-effective solutions for hospitals and clinics worldwide.

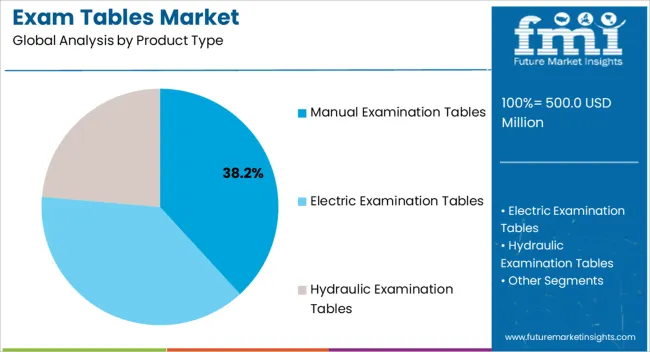

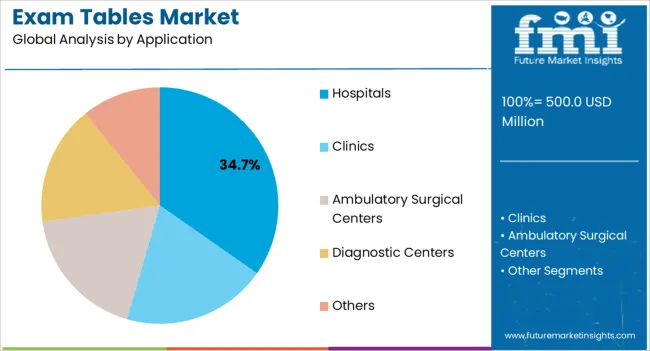

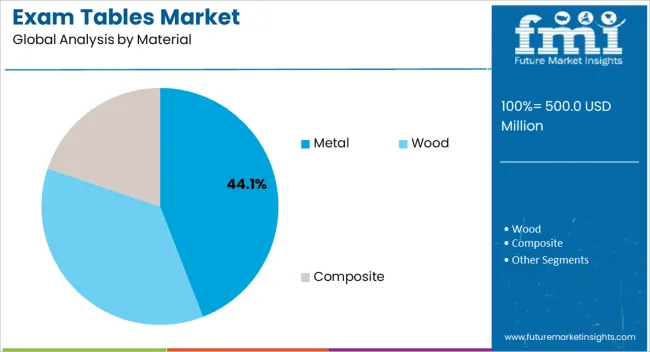

The exam tables market is segmented by product type, application, material, end-user, and geographic regions. By product type, exam tables market is divided into Manual Examination Tables, Electric Examination Tables, and Hydraulic Examination Tables. In terms of application, exam tables market is classified into Hospitals, Clinics, Ambulatory Surgical Centers, Diagnostic Centers, and Others. Based on material, exam tables market is segmented into Metal, Wood, and Composite. By end-user, exam tables market is segmented into Adult, Pediatric, and Geriatric. Regionally, the exam tables industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manual examination tables segment is projected to hold 38.2% of the exam tables market revenue share in 2025, making it the leading product type. Its dominance is being driven by the cost-effectiveness, reliability, and simplicity of manual adjustment mechanisms, which are preferred in many hospitals and clinics. The absence of complex electronics reduces maintenance requirements and downtime, while ensuring long-term usability under high-frequency use.

This segment is benefiting from the widespread preference for durable tables that can withstand heavy clinical workloads while remaining easy to operate by medical personnel. Manufacturers are focusing on optimizing ergonomics, load capacity, and stability in manual tables, improving both patient comfort and practitioner efficiency.

Additionally, the adaptability of manual tables for various examination procedures has strengthened their adoption, particularly in healthcare facilities seeking cost-efficient solutions without compromising safety or operational performance These factors collectively support the segment’s leading position within the exam tables market.

The hospitals application segment is anticipated to account for 34.7% of the exam tables market revenue share in 2025, establishing it as the leading application area. Its prominence is being reinforced by the growing need for reliable and versatile examination furniture in diverse clinical departments, including outpatient care, emergency, and diagnostic units.

Hospitals require tables that support frequent patient turnover and enable efficient examination procedures while maintaining safety and hygiene standards. The segment is further driven by hospital expansion projects, upgrades of older infrastructure, and adherence to regulatory guidelines for patient care equipment.

Multi-functional features, including adjustable heights and sections, are increasingly being incorporated into exam tables to accommodate a broad range of medical examinations and treatments Rising emphasis on ergonomics, infection control, and operational efficiency in hospitals continues to stimulate demand for advanced exam tables, ensuring the segment’s sustained growth and leadership in the market.

The metal material segment is expected to hold 44.1% of the exam tables market revenue share in 2025, positioning it as the dominant material category. Its leadership is being supported by the strength, durability, and longevity offered by metal frames, which are well-suited to the high-frequency usage and heavy loads encountered in hospital settings.

Metal construction provides structural stability while enabling easy cleaning and sterilization, a critical requirement for healthcare facilities prioritizing infection control. The segment is further supported by the ability to incorporate adjustable mechanisms, reinforced supports, and modular designs without compromising durability or safety.

Manufacturers are increasingly choosing metal materials for their resistance to wear and corrosion, as well as their compatibility with diverse coatings and finishes that enhance aesthetics and hygiene The widespread adoption of metal exam tables across hospitals and clinics is reinforcing the segment’s market dominance, driven by performance, reliability, and compliance with stringent healthcare standards.

Several developing nations like India and few African countries are pumping in millions into the healthcare sector. The healthcare markets spread across India, Middle-East and South-East Asia are skyrocketing. Several healthcare global giants are re-strategizing to foray into this massive emerging virgin markets spread in these regions of the world.

As the healthcare industry globally is passing through a crucial juncture, and it is also complimenting the development of the medical equipment industry. According to a study, the average growth rate of the healthcare ancillary industry might touch almost 12 billion by 2025.This growth wave will thrust a considerable impact on different segments of healthcare which also includes exam Tables. The sale and growth of exam tables market are stringed with the expansion of the global healthcare market.

The exam tables are mostly used mostly in the clinical environments and they are used for a plethora of examinations, such as normal health exams, gynecological treatments, to conduct pediatric examinations, dental and aesthetic examinations and much more.

They are hugely procured by medical institutions, private practitioners, government and private healthcare joints, medical training facilities, spread across the world. The price of these tables depends on the quality. Some of the advanced exam tables makers are based in USA and other western markets of the world.

Over the years they have created a strong export channel to penetrate into the developing markets of the globe. Though markets of Middle-East, Singapore, China, Afghanistan, Taiwan, Vietnam, Myanmar, Sri Lanka, Germany, Brazil and Chile are some of the prospective markets for these leaders of the healthcare markets.

But local market players and price difference and thin budget in healthcare which is paralyzing the growth of healthcare in the developing nations of the world are blockading the upsurge of the exam tables market in these regions.

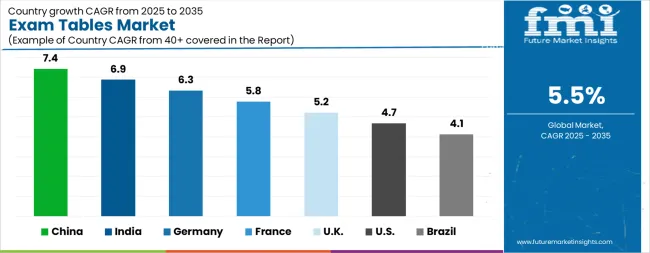

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The Exam Tables Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Exam Tables Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Exam Tables Market is estimated to be valued at USD 186.7 million in 2025 and is anticipated to reach a valuation of USD 294.8 million by 2035. Sales are projected to rise at a CAGR of 4.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 24.5 million and USD 14.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 500.0 Million |

| Product Type | Manual Examination Tables, Electric Examination Tables, and Hydraulic Examination Tables |

| Application | Hospitals, Clinics, Ambulatory Surgical Centers, Diagnostic Centers, and Others |

| Material | Metal, Wood, and Composite |

| End-User | Adult, Pediatric, and Geriatric |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stryker Corporation, Getinge AB, Skytron LLC, STERIS plc, Midmark Corporation, Invacare Corporation, GF Health Products, Inc., Oakworks, Inc., United Metal Fabricators, Inc., Clinton Industries, Inc., Cardinal Health, Inc., Hamilton Medical AG, Blickman Industries, LLC, Promotal SAS, Harloff Company, Inc., and Lemi Group |

The global exam tables market is estimated to be valued at USD 500.0 million in 2025.

The market size for the exam tables market is projected to reach USD 854.1 million by 2035.

The exam tables market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in exam tables market are manual examination tables, electric examination tables and hydraulic examination tables.

In terms of application, hospitals segment to command 34.7% share in the exam tables market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examination Gowns Market Size and Share Forecast Outlook 2025 to 2035

Examination Gloves Market Insights – Growth & Forecast 2025 to 2035

Exam Management Software Market

Hexamethylenediamine Market

Medical Examination Lights Market Size and Share Forecast Outlook 2025 to 2035

Vaginal Exam Specula Market

Gynecological Examination Chairs Market Size and Share Forecast Outlook 2025 to 2035

Gynaecological Examination Chairs Market Size and Share Forecast Outlook 2025 to 2035

Steam Tables & Food Wells Market – Hot Food Service Solutions 2025 to 2035

Rotary Tables with Torque Motor Drive Market Size and Share Forecast Outlook 2025 to 2035

IQF Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Fresh Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Interactive Tables Market Size and Share Forecast Outlook 2025 to 2035

Equine Operating Tables Market Size and Share Forecast Outlook 2025 to 2035

IQF Fruits & Vegetables Market Size, Growth, and Forecast for 2025 to 2035

Freeze-Dried Vegetables Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fresh Fruits & Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Microparticle Injectables Market

Stereotactic Biopsy Tables Market

Pain Therapeutic Injectables Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA