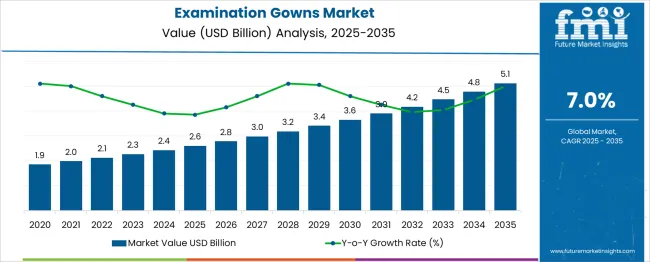

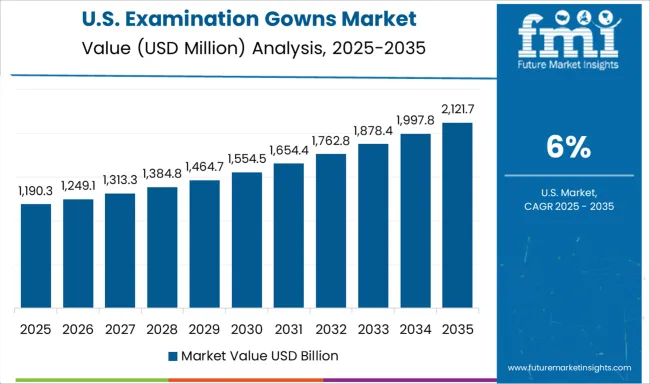

The Examination Gowns Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 5.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. An Absolute Dollar Opportunity analysis assesses the total incremental revenue potential by quantifying the annual and cumulative market value additions over the forecast period. From 2025 to 2026, the market expands by USD 0.2 billion, while the 2026–2027 period adds another USD 0.2 billion. These early-stage gains, though moderate, are critical as they establish the base for sustained growth. Between 2028 and 2030, yearly increments increase to USD 0.2–0.3 billion, reflecting a steady acceleration in demand from healthcare facilities.

The most significant absolute gains occur in the later years, especially from 2032 to 2035, where annual additions reach USD 0.3 billion consistently. This late-stage growth surge may be linked to increased procedural volumes, higher patient throughput, and broader adoption of disposable gowns in both hospital and outpatient settings. The cumulative absolute dollar opportunity over the decade totals USD 2.5 billion, underscoring a substantial revenue expansion potential. The data suggests that while early years deliver foundational growth, the greatest revenue impact materializes in the latter half of the forecast, favoring long-term investment strategies and capacity expansion plans.

| Metric | Value |

|---|---|

| Examination Gowns Market Estimated Value in (2025E) | USD 2.6 billion |

| Examination Gowns Market Forecast Value in (2035F) | USD 5.1 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The examination gowns market is witnessing sustained growth, propelled by increasing healthcare infrastructure expansion, heightened awareness of infection prevention, and rising patient volumes globally. Demand has been reinforced by stringent hygiene protocols and regulatory compliance requirements across healthcare settings, compelling consistent procurement of gowns that meet safety and comfort standards.

Advances in material science are enabling lighter, more breathable, and cost-effective products, addressing both clinician and patient needs while reducing environmental impact. Future growth is expected to be supported by growing surgical procedures, preparedness for pandemics, and institutional preference for standardized protective gear.

Additionally, innovations in biodegradable materials and improvements in supply chain resilience are paving the path for broader adoption and competitive differentiation within the market.

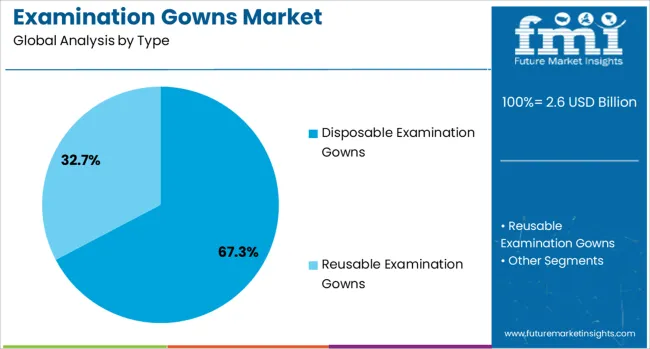

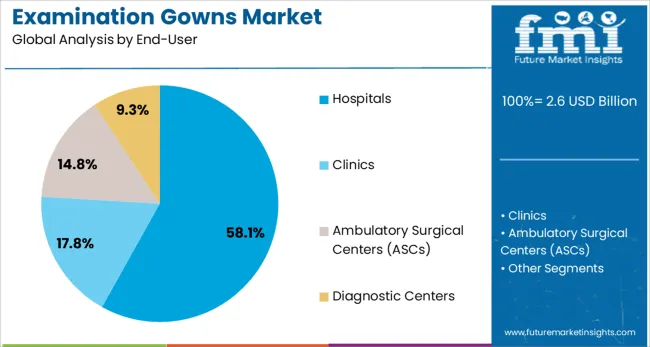

The examination gowns market is segmented by type, end-user, material, and geographic regions. By type, the examination gowns market is divided into Disposable Examination Gowns and Reusable Examination Gowns. In terms of end-users, the examination gowns market is classified into Hospitals, Clinics, Ambulatory Surgical Centers (ASCs), and Diagnostic Centers. Based on material, the examination gowns market is segmented into Polypropylene (PP), Cotton, Polyester, Polyethylene (PE), and Others (blended fabrics, SMS, etc.). Regionally, the examination gowns industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, disposable examination gowns are expected to account for 67.3% of the total market revenue in 2025, positioning them as the leading segment. This leadership is being driven by the increasing prioritization of infection control measures and the convenience of single-use garments in minimizing cross-contamination risks.

Hospitals and clinics have been adopting disposable gowns to comply with evolving hygiene standards and to eliminate the logistical burden of laundering and sterilizing reusable options. The cost-effectiveness of mass-produced disposable gowns, coupled with their assured sterility and consistent availability, has enhanced their appeal for high-volume healthcare environments.

The shift toward disposable solutions has also been reinforced by heightened awareness of occupational health risks among healthcare workers, which has encouraged the adoption of reliable, ready-to-use protective wear.

Segmenting by end user reveals that hospitals are projected to hold 58.1% of the market revenue in 2025, solidifying their position as the primary consumers of examination gowns. This dominance is attributed to the high patient turnover, diverse care settings, and rigorous infection control protocols maintained within hospitals.

Growing surgical and diagnostic procedure volumes have increased gown consumption rates, while the need to safeguard healthcare staff and patients has reinforced institutional commitment to standardized protective apparel. Hospitals’ ability to implement centralized procurement strategies and maintain inventory levels aligned with regulatory requirements has further supported this segment’s growth.

The role of hospitals as critical nodes in public health systems, coupled with their direct exposure to infectious disease risks, has ensured sustained demand for examination gowns, securing their leading share in the market.

When segmented by material, polypropylene is anticipated to command 42.6% of the total market revenue in 2025, maintaining its status as the preferred material. This leadership is being shaped by polypropylene’s unique combination of affordability, durability, and barrier properties against fluids and microorganisms.

The material’s lightweight and breathable characteristics have made it suitable for prolonged use, enhancing comfort without compromising on protection. The widespread availability and ease of fabrication into nonwoven textiles have also contributed to its prevalence in disposable gown manufacturing.

Polypropylene’s adaptability to various manufacturing processes and ability to meet diverse quality standards have ensured its continued preference among manufacturers and healthcare providers alike, reinforcing its position as the leading material in the examination gowns market.

The market has been experiencing steady expansion as healthcare facilities continue to prioritize patient hygiene, infection prevention, and procedural convenience. These gowns have been widely used in hospitals, diagnostic centers, and outpatient clinics to maintain sterile environments while ensuring patient comfort. Growing patient volumes, coupled with increased awareness of healthcare-associated infection control, have been driving the adoption of disposable and reusable gowns. Material innovations, including lightweight, breathable, and fluid-resistant fabrics, have been enhancing the functionality and comfort of these gowns. Regulatory guidelines regarding infection prevention in medical settings have been influencing product standards and manufacturing practices.

The rising demand for examination gowns has been driven by the expanding number of hospital admissions, outpatient visits, and diagnostic procedures worldwide. Healthcare providers have been adopting gowns designed to minimize contamination risks while facilitating ease of movement for patients during examinations. The use of disposable gowns has been increasing in settings requiring stringent infection control, while reusable gowns have been preferred in facilities focused on cost optimization and sustainability goals. The growth of ambulatory care centers and specialty clinics has also been contributing to demand, as these facilities require constant gown replenishment to maintain patient flow. Moreover, healthcare systems in emerging markets have been expanding procurement to meet growing patient loads, creating opportunities for manufacturers offering affordable yet compliant gown solutions.

Technological advancements in fabric engineering have been playing a crucial role in the development of high-performance examination gowns. Manufacturers have been incorporating materials that balance durability, fluid resistance, and breathability, enabling comfort without compromising protection. Nonwoven fabrics have been widely used for disposable gowns, offering lightweight designs with strong barrier properties. Reusable gowns have been produced with treated fabrics that withstand repeated laundering while retaining protective qualities. Design improvements, including adjustable closures, reinforced seams, and ergonomic cuts, have been aimed at enhancing both fit and functionality. Color-coding and labeling features have been integrated for better gown identification in busy clinical environments. These innovations have been addressing the evolving needs of healthcare facilities, ensuring compliance with safety standards while improving patient experience.

The market has been strongly influenced by evolving regulations and standards designed to reduce the spread of healthcare-associated infections. Guidelines issued by agencies such as the World Health Organization and national health ministries have been mandating the use of gowns in various clinical procedures. Compliance with specifications regarding barrier performance, sterility, and flammability has been a critical consideration for healthcare procurement teams. Facilities have been increasingly adopting gowns tested for fluid penetration resistance, especially in high-risk departments such as surgery, infectious disease wards, and emergency care. Regulatory oversight has been driving manufacturers to improve quality assurance processes, implement traceability in production, and conduct rigorous product testing. As awareness of cross-contamination risks grows, examination gowns are expected to remain a frontline defense in infection control strategies, particularly in both developed and developing healthcare systems.

Beyond hospitals, examination gowns have been widely adopted in private clinics, dental offices, physiotherapy centers, and mobile medical units. The growth of preventive health checkups, home healthcare services, and vaccination drives has been contributing to increased growth usage outside traditional hospital environments. These settings require gowns that are quick to don, cost-effective, and easy to dispose of or sanitize. Portable healthcare operations, including humanitarian medical missions and rural health outreach programs, have been relying on lightweight, compact gowns that can be distributed and used efficiently. The versatility of examination gowns has enabled their integration into diverse care models, from large urban medical facilities to small community health centers. This broad adoption across healthcare environments has been reinforcing the market’s resilience and expanding its long-term growth potential globally.

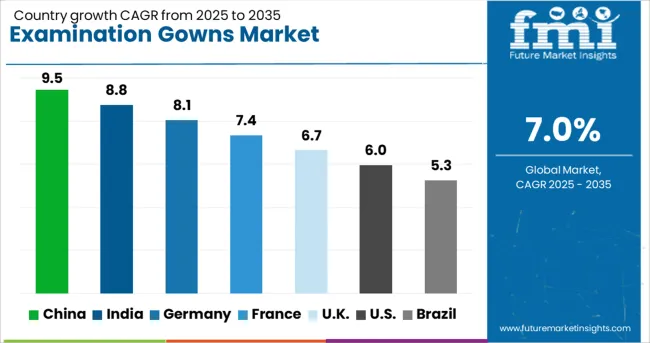

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The market is anticipated to grow at a CAGR of 7.0% between 2025 and 2035, supported by rising demand for infection control apparel, increasing hospital admissions, and advancements in medical textile manufacturing. China is projected to lead with a 9.5% CAGR, driven by expanding healthcare facilities and high-volume production capabilities. India follows at 8.8%, with growth influenced by the rise in public health programs and local manufacturing initiatives. Germany, at 8.1%, benefits from stringent healthcare safety standards and consistent imports of high-quality gowns. The UK, with a 6.7% CAGR, experiences steady adoption in both public and private healthcare settings. The USA, at 6.0%, shows demand linked to regulatory compliance and heightened infection prevention measures. This report includes insights on 40+ countries; the top markets are shown here for reference.

The Examination Gowns market in China is anticipated to grow at a CAGR of 9.5% from 2025 to 2035, supported by rising patient footfall in hospitals and clinics, along with increased awareness of hygiene standards. Public healthcare investments and expansion of private medical facilities are boosting procurement volumes. Manufacturers are focusing on producing disposable and reusable gowns with improved fabric quality and barrier protection. Domestic production capabilities are expanding to meet both local consumption and export demand, strengthening supply chain resilience.

India’s Examination Gowns market is projected to register a CAGR of 8.8%, propelled by growing outpatient services and enhanced infection control protocols in medical facilities. Demand is rising across urban and semi-urban regions due to increased diagnostic and preventive care services. Local manufacturers are leveraging cost-effective materials and expanding distribution networks to cater to public and private healthcare institutions. Import of specialized gowns with advanced protective coatings is also contributing to market growth.

Germany’s Examination Gowns market is expected to expand at a CAGR of 8.1%, driven by strict hygiene compliance in healthcare settings. Hospitals and diagnostic centers are procuring gowns with enhanced antimicrobial properties and fluid resistance. Domestic and international suppliers are introducing innovative designs for better comfort and durability, catering to both short-term and extended-use applications. Increased focus on patient experience and operational efficiency is influencing procurement decisions in the sector.

The United Kingdom is forecast to see a CAGR of 6.7% in the Examination Gowns market, supported by modernization of hospital facilities and expansion of primary care networks. Emphasis on infection prevention and control is leading to higher gown consumption in both NHS and private healthcare providers. Suppliers are focusing on sustainable materials and recyclable options to meet environmental goals while maintaining protective performance.

The United States Examination Gowns market is projected to grow at a CAGR of 6.0%, driven by higher patient admissions and outpatient visits. The shift toward value-based healthcare is encouraging investment in quality medical apparel to improve patient safety and comfort. Manufacturers are developing gowns with breathable fabrics and improved fit to enhance user experience while meeting regulatory safety standards. Increased reliance on domestic production is also improving supply stability.

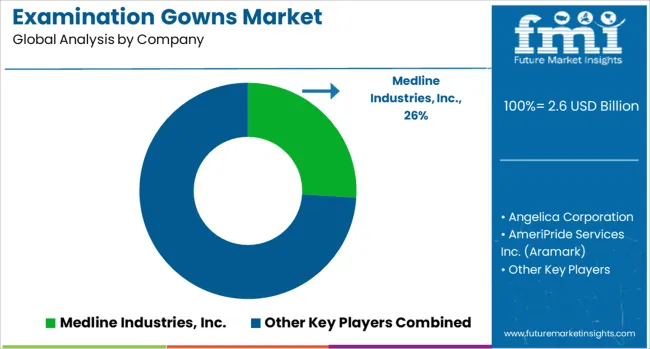

The examination gowns market exhibits a structured competitive matrix where established multinational players and emerging regional manufacturers pursue distinct historical and forecast strategies to capture healthcare demand. Historically, leaders such as Medline Industries, Cardinal Health, and Kimberly-Clark focused on scaling production, ensuring regulatory compliance, and developing high-barrier gowns for surgical and non-surgical applications, leveraging strong distribution networks in North America and Europe. Halyard Health prioritized innovation in fabric technologies and ergonomic design to differentiate offerings, while regional players concentrated on cost-efficient, locally tailored solutions. Forecast strategies indicate continued investment in high-performance, fluid-resistant, and reusable gown technologies, alongside digital inventory and supply-chain optimization to meet escalating global hospital requirements.

Differentiation levers include material innovation, certification adherence, patient and clinician comfort, and operational efficiency, which are increasingly critical in infection prevention protocols. Growth opportunities are concentrated in emerging markets across Asia, Latin America, and the Middle East, where rising healthcare infrastructure spending and procedural standardization create demand for both disposable and reusable gowns. Strategic collaborations, co-development with healthcare institutions, and expansion of localized manufacturing capabilities are expected to enhance market penetration.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| Type | Disposable Examination Gowns and Reusable Examination Gowns |

| End-User | Hospitals, Clinics, Ambulatory Surgical Centers (ASCs), and Diagnostic Centers |

| Material | Polypropylene (PP), Cotton, Polyester, Polyethylene (PE), and Others (blended fabrics, SMS, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Medline Industries, Inc., Angelica Corporation, AmeriPride Services Inc. (Aramark), Standard Textile Co., Inc., and Cardinal Health |

| Additional Attributes | Dollar sales by gown type and end user, demand dynamics across hospitals, diagnostic centers, and outpatient clinics, regional trends in adoption within high-volume healthcare facilities, innovation in fabric technology and antimicrobial coatings, environmental impact of disposable versus reusable gowns, and emerging use cases in home healthcare, telemedicine-supported procedures, and emergency preparedness stockpiling. |

The global examination gowns market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the examination gowns market is projected to reach USD 5.1 billion by 2035.

The examination gowns market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in examination gowns market are disposable examination gowns and reusable examination gowns.

In terms of end-user, hospitals segment to command 58.1% share in the examination gowns market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examination Gloves Market Insights – Growth & Forecast 2025 to 2035

Medical Examination Lights Market Size and Share Forecast Outlook 2025 to 2035

Protective Gowns Market

Gynecological Examination Chairs Market Size and Share Forecast Outlook 2025 to 2035

Gynaecological Examination Chairs Market Size and Share Forecast Outlook 2025 to 2035

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA