The global artificial ear simulator market is valued at USD 117.4 million in 2025 and is projected to reach USD 180.6 million by 2035, expanding at a CAGR of 4.4%. Rolling CAGR assessment shows gradual and sustained growth driven by continued advancements in acoustic measurement systems, hearing aid testing, and electroacoustic calibration standards. Artificial ear simulators are critical components in the evaluation of hearing instruments, headphones, and communication devices that replicate the human ear’s acoustic impedance characteristics with precision.

Manufacturing trends emphasize material consistency, precision machining, and digital signal integration to ensure accurate and repeatable measurements across wide frequency ranges. The increasing use of coupler-based and anthropometric simulators in R&D and compliance testing supports greater product standardization in both consumer audio and medical device industries.

North America and Europe continue to lead in adoption due to the presence of accredited testing laboratories and established electroacoustic certification procedures. Asia Pacific is displaying rising production capacity as regional firms expand calibration and testing capabilities. Component quality, dimensional stability, and standard conformity remain central to product acceptance. The market’s upward trajectory through 2035 reflects steady institutional investment in auditory measurement reliability and device validation infrastructure.

Between 2025 and 2030, the Artificial Ear Simulator Market is projected to expand from USD 117.4 million to USD 145.6 million, reflecting a 24.0% increase and accounting for 45.8% of the decade’s total growth. This expansion will be fueled by rising demand for precise acoustic measurement systems used in testing hearing aids, earphones, and audio devices. Increasing regulatory standards for electroacoustic performance validation, coupled with the growth of audiological research and hearing technology development, will accelerate adoption. Manufacturers are enhancing simulator accuracy through improved frequency response, better ear canal replication, and integration with advanced digital analysis software.

From 2030 to 2035, the market is forecast to grow from USD 145.6 million to USD 180.6 million, registering a 24.0% increase and contributing 54.2% of the decade’s overall expansion. Growth during this phase will be driven by advancements in calibration technology, automation, and hybrid simulation systems that combine physical and digital modeling. The proliferation of wireless audio devices, miniaturized hearing solutions, and personalized sound systems will further boost the demand for high-precision artificial ear simulators. Strategic partnerships between acoustic research institutions and measurement equipment manufacturers will foster innovation, standardization, and global market competitiveness across the audio testing industry.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 117.4 million |

| Market Forecast Value (2035) | USD 180.6 million |

| Forecast CAGR (2025–2035) | 4.4% |

The artificial ear simulator market is expanding as precision requirements in acoustic measurement, hearing aid testing, and audio device certification increase. These simulators replicate the acoustic impedance and sound transmission characteristics of the human ear, allowing manufacturers and researchers to evaluate earphones, hearing aids, and communication headsets under standardized test conditions. The widespread implementation of international performance standards, such as IEC 60318, drives demand for calibrated and reproducible ear simulation systems that ensure measurement consistency across laboratories and production facilities.

Growth in the hearing aid and consumer audio sectors strengthens market adoption, particularly as miniaturized in-ear devices and true wireless products require accurate low-volume sound field assessment. Research institutions and acoustic engineering firms employ artificial ear systems for product validation, signal response optimization, and noise reduction analysis. Advancements in sensor technology and 3D ear geometry modeling improve simulation realism and measurement precision. Manufacturers prioritize durable materials, stable coupling mechanisms, and digital interface compatibility to streamline calibration and data acquisition. However, high equipment costs and the need for regular calibration limit accessibility among smaller testing entities. Continued progress in auditory modeling and rising emphasis on device performance verification support sustained market development across medical, industrial, and consumer acoustics domains.

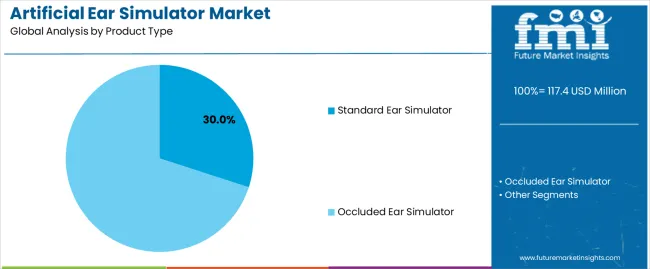

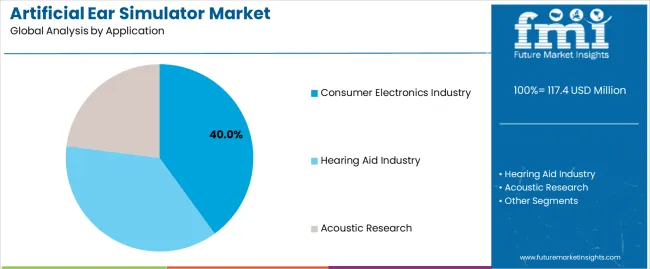

The artificial ear simulator market is segmented by product type, application, and region. By product type, the market is divided into standard ear simulator and occluded ear simulator. Based on application, it is categorized into consumer electronics industry, hearing aid industry, and acoustic research. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions outline usage trends and technological adoption across diverse sectors involved in acoustic testing and device validation.

The standard ear simulator segment accounts for approximately 30.0% of the global artificial ear simulator market in 2025, representing the leading product category. Its dominance stems from its established use in the calibration and testing of audio devices, including headphones, microphones, and communication equipment. Standard ear simulators replicate the acoustic impedance and frequency response of the human ear canal, providing consistent reference conditions for electroacoustic measurements in laboratory and production environments.

These simulators are integral to performance evaluation within consumer electronics testing, ensuring compliance with international acoustic standards such as IEC 60318. Their broad applicability and ease of integration into automated testing setups contribute to their sustained demand. Manufacturers rely on standard ear simulators to verify device sound quality, sensitivity, and distortion characteristics across product lines. The segment also benefits from widespread acceptance by regulatory bodies and certification organizations, making it the default reference device for many testing protocols. Continued growth in portable audio and smart device production further supports the use of standard ear simulators, reinforcing their central role in maintaining measurement accuracy within global acoustic testing frameworks.

The consumer electronics industry segment represents about 40.0% of the total artificial ear simulator market in 2025, making it the largest application category. This leadership reflects the growing need for precise acoustic testing during the development and quality assurance of headphones, smartphones, earbuds, and other audio-enabled devices. Artificial ear simulators are essential tools in this sector, ensuring accurate measurement of sound pressure levels, frequency response, and distortion performance under conditions replicating human auditory characteristics.

Manufacturers in the consumer electronics industry use ear simulators to optimize acoustic designs and validate product performance in alignment with global measurement standards. The segment’s demand is reinforced by continuous expansion of audio device production in East Asia and rising product quality requirements across North American and European markets. Rapid product development cycles and miniaturization trends have increased reliance on standardized testing equipment capable of ensuring repeatable acoustic data. The segment’s prominence also reflects its direct connection to mass-market production, where consistent sound verification influences consumer experience and product reliability. As personal audio technologies evolve, the consumer electronics industry will continue to drive dominant demand for artificial ear simulators across global testing and manufacturing operations.

The artificial ear simulator market is expanding as auditory device testing, calibration and acoustic research demand greater accuracy. These simulators replicate human ear acoustics to assess headphones, hearing-aids and other transducers in controlled environments. Growth is supported by rising hearing impairment prevalence, increased headphone and wearable device usage, and stricter regulatory or industry standards for measurement performance. At the same time, high-precision equipment costs, calibration complexity and competition from alternative measurement methods restrict broader adoption. A notable trend is the move toward more automated, miniaturised and digitally integrated simulators, allowing higher throughput and remote or field-based testing.

Growth is driven by the rising deployment of hearing aids, earbuds and other in-ear audio devices paired with the need for reliable testing of acoustic performance. As consumer audio consumption expands and hearing health receives greater attention, measurement accuracy becomes a priority for manufacturers and regulators alike. Furthermore, the aging global population and increase in hearing disorders elevate demand for audiometric equipment and quality control systems. The adoption of comprehensive test standards in audio and medical sectors also stimulates demand for ear simulators equipped to deliver compliant results.

Adoption is constrained by the high cost of advanced ear simulators and the operational demands of calibration and maintenance. These devices often require specialised labs, trained personnel and frequent calibration to ensure measurement validity. Some regions or smaller device manufacturers may lack resources or infrastructure to deploy advanced simulators. Additionally, alternative lower-cost measurement tools or less rigorous testing protocols may suffice for some applications, reducing the urgency to invest in premium simulators. These economic and implementation challenges hinder faster market penetration.

The market is trending toward automation, modularity and digital connectivity in ear simulators. Systems with remote calibration capability, cloud-based data tracking and integration with test software simplify workflows and support higher throughput. Manufacturers are developing smaller footprint simulators suitable for rapid testing of earbuds, wearables and mobile devices. Growth in emerging regions is notable as audio-device manufacturing expands and regulatory frameworks evolve. As test requirements and device complexity increase, simulators that offer flexibility, reproducibility and integration with digital ecosystems are becoming increasingly preferred.

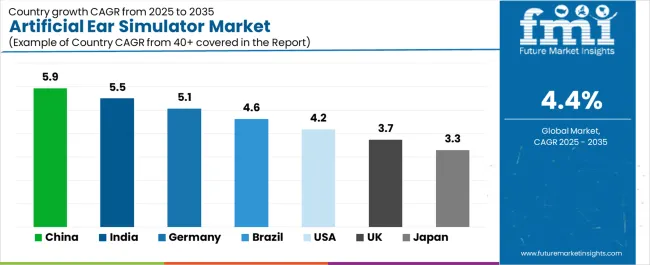

| Country | CAGR (%) |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| Brazil | 4.6% |

| USA | 4.2% |

| UK | 3.7% |

| Japan | 3.3% |

The artificial ear simulator market is showing steady global advancement, with China leading at a 5.9% CAGR through 2035, driven by expanding audiology research, domestic manufacturing growth, and increased clinical testing adoption. India follows at 5.5%, supported by rising healthcare investments, medical device innovation, and broader audiological awareness. Germany records 5.1%, leveraging engineering excellence and precision acoustics technology. Brazil grows at 4.6%, reflecting the development of healthcare infrastructure and diagnostic modernization. The USA, with a 4.2% CAGR, remains a mature market emphasizing R&D and calibration accuracy. The UK (3.7%) and Japan (3.3%) sustain steady growth through innovation in simulation equipment, product refinement, and adherence to international acoustic testing standards.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

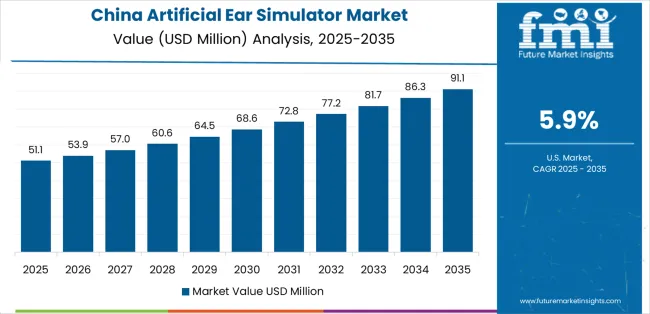

Revenue from artificial ear simulators in China is projected to grow at a CAGR of 5.9% through 2035, supported by rapid development in electroacoustic testing, consumer electronics manufacturing, and hearing device calibration. Expanding production of smartphones, headsets, and hearing aids is driving consistent adoption of ear simulators for performance verification. Government initiatives promoting domestic acoustics research and laboratory accreditation are strengthening technical capacity. Domestic manufacturers are improving measurement accuracy and standard compliance to align with international benchmarks.

Revenue from artificial ear simulators in India is increasing at a CAGR of 5.5%, driven by growing production of hearing aids, communication devices, and medical testing systems. Expansion in healthcare technology manufacturing and diagnostic equipment testing facilities is promoting adoption. Government initiatives to advance local electronic component production and medical device standardization support consistent market development. Partnerships between academic institutions and technology suppliers are expanding access to measurement and calibration systems.

Revenue from artificial ear simulators in Germany is advancing at a CAGR of 5.1%, supported by established acoustic research institutions, precision engineering culture, and regulatory compliance in electroacoustic testing. Manufacturers of hearing devices and consumer electronics maintain consistent testing requirements aligned with international standards. Continuous innovation in acoustic transducer design and material technology supports product advancement. Integration of digital data acquisition and calibration automation further enhances testing reliability.

Revenue from artificial ear simulators in Brazil is projected to grow at a CAGR of 4.6%, supported by modernization of medical device production and testing facilities. Expanding demand for certified hearing aids and consumer acoustic devices is creating steady procurement opportunities. Local distributors are enhancing partnerships with global equipment manufacturers to improve access to standardized testing systems. Investment in acoustic measurement laboratories across research institutions is strengthening regional capability.

Revenue from artificial ear simulators in the United States is increasing at a CAGR of 4.2%, supported by regulatory standards in medical device testing and consumer electronics performance verification. Manufacturers of hearing aids, headsets, and audio systems employ ear simulators for precise electroacoustic measurements. Federal laboratory certification programs maintain consistent demand for accredited testing systems. Ongoing R&D in miniaturized acoustic sensors continues to expand the functional scope of simulators.

Revenue from artificial ear simulators in the United Kingdom is advancing at a CAGR of 3.7%, supported by research collaboration among universities, testing laboratories, and medical device manufacturers. Standardized calibration practices across hearing and audio technology testing are ensuring steady market activity. Ongoing academic projects in acoustic measurement science contribute to incremental improvements in simulator accuracy. Stable demand from healthcare and consumer electronics testing sectors supports long-term utilization.

Revenue from artificial ear simulators in Japan is growing at a CAGR of 3.3%, supported by precision manufacturing standards and the country’s leadership in acoustic measurement technology. Demand from hearing device producers, electronics firms, and research institutions remains steady. Domestic manufacturers prioritize miniaturization, component reliability, and calibration accuracy. Continuous refinement in acoustic transducer design ensures high-quality data acquisition and long-term product stability.

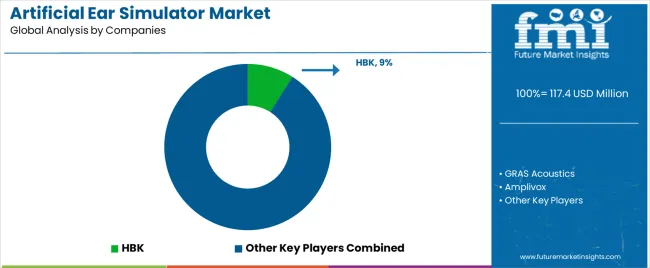

The global artificial ear simulator market shows moderate concentration, characterized by established acoustic instrumentation manufacturers and specialized hearing simulation system providers. HBK leads the market through its integrated product range combining GRAS Acoustics and Brüel & Kjær (NSK Ltd), offering precision ear simulators for audiometric, electroacoustic, and research applications. GRAS Acoustics contributes specialized expertise in ear coupler design and standardized acoustic impedance systems supporting IEC and ANSI compliance. Amplivox and Larson Davis provide portable and laboratory-grade simulators targeting audiometer calibration and hearing protection testing. Respond Technology and HEAD acoustics focus on psychoacoustic evaluation and binaural simulation platforms designed for audio device testing.

Klippel GmbH maintains a strong position in electroacoustic characterization systems with integration of ear simulator modules for loudspeaker and headphone performance assessment. ACO Pacific and Durham Instruments emphasize modular acoustic measurement hardware supporting industrial and laboratory environments. Starkey Hearing Technologies applies simulation technology within hearing aid R&D, aligning product validation with clinical performance standards. BSWA Technology, CRYSOUND, and Fangbo Technology (Shenzhen) strengthen regional competition in Asia through cost-effective precision manufacturing and digital acoustic calibration.

Hangzhou AIHUA Instruments and Listen, Inc. expand competitiveness through integrated measurement systems combining hardware, signal analysis, and calibration software. Market differentiation is driven by acoustic accuracy, repeatability, and conformity to international testing standards, while strategic advantage relies on innovation in digital signal modeling, multi-channel calibration, and compatibility with automated testing environments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type (Product Type) | Standard Ear Simulator, Occluded Ear Simulator |

| Application | Consumer Electronics Industry, Hearing Aid Industry, Acoustic Research |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | HBK, GRAS Acoustics, Amplivox, Brüel & Kjær (NSK Ltd), Larson Davis, Respond Technology, HEAD acoustics, Klippel GmbH, ACO Pacific, Durham Instruments, Starkey Hearing Technologies, BSWA Technology, CRYSOUND, Fangbo Technology, Hangzhou AIHUA Instruments, Listen, Inc. |

| Additional Attributes | Dollar sales by product type and application; regional adoption trends across East Asia, North America, and Europe; compliance with IEC/ANSI acoustic standards; integration with automated test sequences and digital data acquisition; calibration and maintenance requirements; drivers such as in-ear device miniaturization, stricter certification standards, and high-throughput production testing; restraints including equipment cost and lab infrastructure needs. |

The global artificial ear simulator market is estimated to be valued at USD 117.4 million in 2025.

The market size for the artificial ear simulator market is projected to reach USD 180.6 million by 2035.

The artificial ear simulator market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in artificial ear simulator market are standard ear simulator and occluded ear simulator.

In terms of application, consumer electronics industry segment to command 40.0% share in the artificial ear simulator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Retail Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (AI) in Automotive Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Healthcare Market Size, Growth, and Forecast for 2025 to 2035

Artificial Ventilation and Anaesthesia Masks Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence In Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Artificial Pancreas Device Market Size and Share Forecast Outlook 2025 to 2035

Artificial Flower Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Artificial Preservative Market Outlook by Product, Type, Form, End Use Application and Others Through 2035

Artificial Hair Integration Market Growth - Trends & Forecast 2025 to 2035

Artificial Intelligence in Military Market Analysis - Size & Forecast 2025 to 2035

Analysis and Growth Projections for Artificial Sweetener Business

Artificial Turf Market Growth & Trends 2024-2034

Artificial Plants Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA