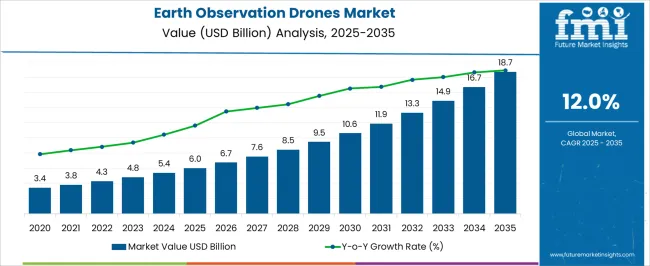

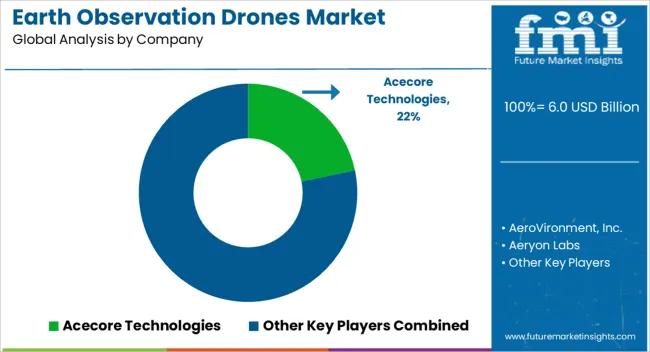

The earth observation drones market is projected to reach USD 18.7 billion by 2035 from an estimated USD 6.0 billion in 2025, growing at a CAGR of 12.0% during the forecast period. Early-stage growth has been driven primarily by government and defense adoption, as surveillance, border monitoring, disaster management, and environmental observation create high-value use cases.

Late-stage growth is anticipated to accelerate due to commercial and industrial applications, including agriculture monitoring, forestry management, urban planning, and infrastructure inspection, where high-resolution imaging, multispectral sensors, and real-time data analytics enhance operational efficiency. Early adopters invested in platform development, regulatory approvals, and pilot deployments, building technological expertise and establishing service networks. In contrast, the later phase emphasizes market expansion, cost optimization, and integration with AI-driven analytics, enabling broader adoption across SMEs, utility operators, and precision agriculture firms. Strategic partnerships between drone manufacturers, satellite imaging providers, and geospatial analytics companies are shaping competitive differentiation.

| Metric | Value |

|---|---|

| Earth Observation Drones Market Estimated Value in (2025 E) | USD 6.0 billion |

| Earth Observation Drones Market Forecast Value in (2035 F) | USD 18.7 billion |

| Forecast CAGR (2025 to 2035) | 12.0% |

The earth observation drones market is strongly influenced by five interconnected parent markets, each contributing uniquely to overall demand and growth. The defense and government surveillance sector holds the largest share at 35%, driven by border monitoring, disaster management, environmental observation, and intelligence-gathering missions requiring high-resolution imaging and real-time data collection. The agriculture and precision farming market contributes 25%, as drones are increasingly deployed for crop monitoring, soil health assessment, irrigation management, and yield optimization. The infrastructure and construction segment accounts for 15%, leveraging drones for site surveying, structural inspections, and progress tracking to enhance operational efficiency and safety. The environmental and forestry management market holds a 15% share, where drones support wildlife monitoring, deforestation tracking, pollution assessment, and ecosystem management initiatives.

The commercial and logistics sector represents 10%, utilizing drones for asset inspection, mapping, and emerging delivery and geospatial services. Defense, agriculture, and infrastructure applications account for 75% of overall demand, highlighting that security, precision farming, and industrial monitoring remain the primary growth drivers, while environmental management and commercial applications provide complementary opportunities for market expansion globally.

The earth observation drones market is experiencing notable growth due to the rising need for high resolution aerial imagery, real time environmental monitoring, and advanced geospatial data collection. Expanding applications in agriculture, infrastructure inspection, disaster management, and defense are driving adoption globally.

Technological advancements in autonomous navigation, AI powered data analytics, and high endurance flight systems are enhancing operational efficiency and data accuracy. Increasing investments from both government agencies and private enterprises are supporting the integration of drones into long term observation programs.

Regulatory developments that streamline drone operations for commercial and research purposes are further accelerating market expansion. The future outlook remains promising as stakeholders seek scalable, cost effective, and precise observation solutions to address climate change monitoring, urban planning, and strategic surveillance needs.

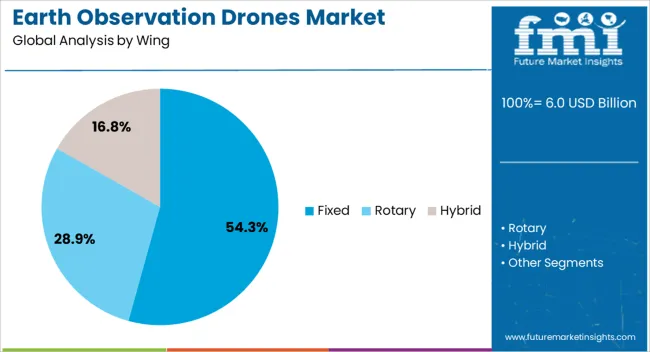

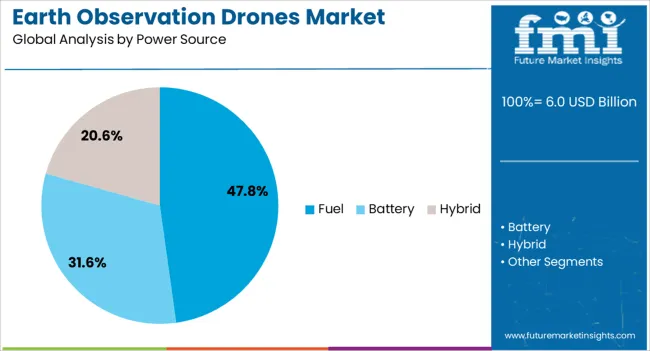

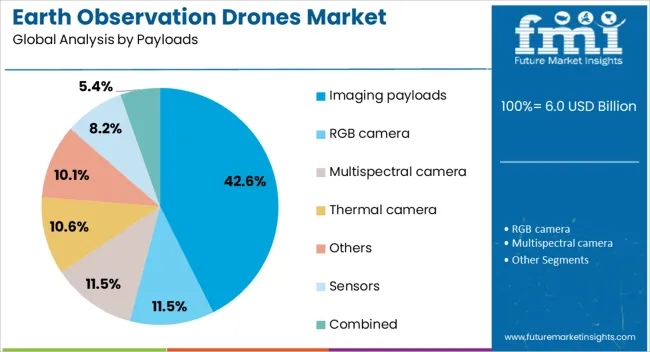

The earth observation drones market is segmented by wing, power source, payloads, mode of operation, application, and geographic regions. By wing, earth observation drones market is divided into Fixed, Rotary, and Hybrid. In terms of power source, earth observation drones market is classified into Fuel, Battery, and Hybrid. Based on payloads, earth observation drones market is segmented into Imaging payloads, RGB camera, Multispectral camera, Thermal camera, Others, Sensors, and Combined.

By mode of operation, earth observation drones market is segmented into Remote, Semi-autonomous, and Autonomous. By application, earth observation drones market is segmented into Agriculture & forestry, Energy & utilities, Construction, Environmental monitoring, Mining & exploration, Others, and End-user. Regionally, the earth observation drones industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed wing segment is projected to account for 54.30% of total market revenue by 2025 within the wing category, making it the leading configuration. This growth is supported by the ability of fixed wing drones to cover larger areas in a single flight, higher endurance, and improved aerodynamic efficiency compared to other wing types.

Their capability to operate in diverse weather conditions and over extended distances has made them highly suitable for large scale mapping, border surveillance, and environmental monitoring.

The reduced operational cost per square kilometer surveyed and compatibility with advanced payload systems further strengthen their dominance in the wing category.

The fuel power source segment is expected to hold 47.80% of total revenue by 2025 within the power source category, positioning it as the leading segment. The preference for fuel powered drones is driven by their extended flight duration, higher payload capacity, and reliability in long range operations.

These attributes are crucial for missions that require continuous coverage without frequent refueling or battery changes. Fuel powered systems are also favored for their performance in remote and off grid areas where charging infrastructure may be limited.

This combination of endurance, operational flexibility, and payload support capabilities ensures the continued leadership of fuel power sources in the market.

The imaging payloads segment is projected to capture 42.60% of total revenue by 2025 within the payload category, making it the most significant segment. Demand is being driven by the need for high quality visual data across sectors such as agriculture, infrastructure assessment, defense intelligence, and environmental monitoring.

Imaging payloads offer precise spatial resolution and can be integrated with multispectral, hyperspectral, and thermal sensors to deliver advanced analytical insights. Their role in enabling accurate decision making, resource management, and rapid situational assessment has positioned them as the preferred choice in earth observation drone missions.

Continuous innovation in camera technology and sensor miniaturization is further reinforcing the dominance of imaging payloads in this market.

Defense, agriculture, and infrastructure sectors dominate demand in the earth observation drones market. Environmental and commercial applications provide complementary growth opportunities globally.

The defense and government surveillance segment drives substantial growth in the earth observation drones market. Border monitoring, intelligence gathering, disaster response, and environmental observation are key use cases requiring high-resolution imaging, multispectral sensors, and real-time data transmission. Investments in secure communication, payload flexibility, and long-endurance flight platforms enable governments to enhance situational awareness and operational efficiency. Defense agencies are deploying drones for persistent surveillance, rapid disaster assessment, and tactical reconnaissance missions. Adoption is further supported by partnerships between drone manufacturers and government organizations, ensuring compliance with regulatory frameworks and data security standards. The segment remains the largest market contributor, representing over one-third of overall demand globally, while fostering continuous innovation in performance, endurance, and operational reliability.

Agriculture and precision farming contribute significantly to market growth as drones enable crop health monitoring, irrigation management, soil assessment, and yield prediction. Farmers and agritech companies increasingly rely on multispectral, thermal, and hyperspectral sensors to enhance decision-making and improve productivity. Drone-based imaging reduces manual labor, optimizes input usage, and allows for timely interventions against pests, diseases, and nutrient deficiencies. Integration with farm management software and GIS platforms enhances data analysis and actionable insights. High adoption rates are observed in large-scale commercial farms, horticulture, and plantation sectors. The agriculture segment represents approximately one-quarter of overall market share, supporting consistent revenue growth and providing opportunities for specialized service models, precision analytics, and drone-as-a-service solutions globally.

The infrastructure and construction sector is fueling adoption as earth observation drones are deployed for surveying, mapping, structural inspections, and project monitoring. High-resolution imaging, 3D modeling, and aerial LiDAR facilitate rapid assessment of bridges, roads, power plants, and industrial sites. Drones reduce human risk, enhance project timelines, and enable accurate progress tracking. Construction firms and industrial operators are adopting drones for preventive maintenance, safety audits, and site documentation. Government and private projects are increasingly mandating aerial inspections for compliance and operational efficiency. Industrial and infrastructure applications account for roughly 15% of overall market share, highlighting that operational optimization, risk reduction, and cost efficiency are primary drivers for drone adoption in this segment globally.

Environmental management, forestry, and commercial sectors present new growth avenues for earth observation drones. Wildlife tracking, pollution monitoring, deforestation assessment, and ecosystem analysis are increasing the adoption of drones in environmental programs. Commercial enterprises are leveraging drones for asset inspection, geospatial mapping, urban planning, and emerging delivery solutions. Integration with AI-driven analytics, cloud-based data platforms, and mapping software enhances operational capabilities and predictive insights. These applications demand high-precision sensors, extended flight durations, and scalable data processing solutions. Combined, environmental and commercial applications account for approximately 25% of total market demand, creating incremental opportunities and fostering specialized service offerings and partnerships between technology providers, government agencies, and private organizations worldwide.

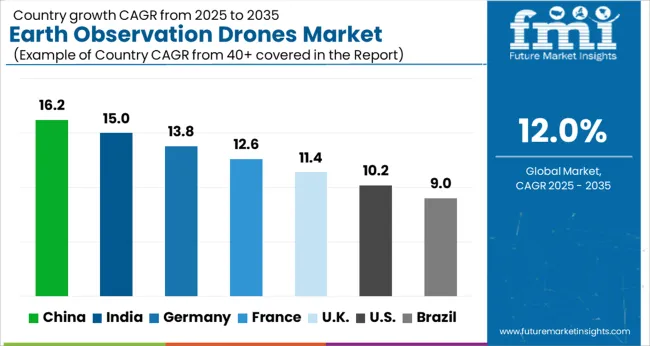

| Country | CAGR |

|---|---|

| China | 16.2% |

| India | 15.0% |

| Germany | 13.8% |

| France | 12.6% |

| UK | 11.4% |

| USA | 10.2% |

| Brazil | 9.0% |

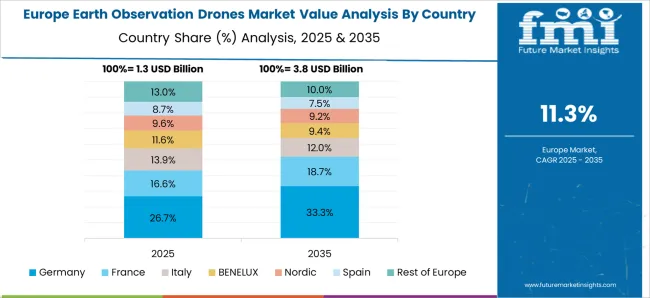

The global earth observation drones market is projected to grow at a CAGR of 12.0% from 2025 to 2035. China leads at 16.2%, followed by India at 15.0%, Germany at 13.8%, the UK at 11.4%, and the USA at 10.2%. Growth is driven by defense and surveillance, precision agriculture, industrial inspections, and environmental monitoring applications requiring high-resolution imaging, real-time data analytics, and extended flight endurance. Adoption is supported by infrastructure development, smart farming initiatives, and urban and industrial asset monitoring. Asia shows rapid expansion due to government and commercial investments, while Europe and North America emphasize data accuracy, safety, and operational reliability. Strategic collaborations, sensor integration, and AI-powered analytics are key growth enablers. The analysis includes over 40+ countries, with the leading markets detailed below.

The earth observation drones market in China is projected to grow at a CAGR of 16.2% from 2025 to 2035, driven by extensive government investments in defense, border surveillance, disaster management, and environmental monitoring. Rapid expansion of commercial applications in precision agriculture, infrastructure inspections, and industrial asset monitoring further supports demand. Manufacturers are scaling production of high-end drones with multispectral, thermal, and LiDAR sensors to provide high-resolution data and real-time analytics. Strategic collaborations between domestic drone makers and international technology providers accelerate innovation in autonomous flight systems, payload capacity, and data processing. Adoption is further enhanced by smart city initiatives, infrastructure development projects, and large-scale agricultural monitoring programs.

The earth observation drones market in India is expected to expand at a CAGR of 15.0% from 2025 to 2035, supported by government initiatives in agriculture, disaster management, and urban planning. High-resolution drones are increasingly deployed for crop monitoring, soil health assessment, irrigation management, and yield optimization. Infrastructure inspection, forestry monitoring, and environmental applications also contribute to market growth. Domestic manufacturers are enhancing capabilities in payload versatility, flight endurance, and autonomous operation, while partnerships with global drone and sensor providers improve technology access. E-commerce and precision farming sectors are creating additional demand, and emerging commercial applications such as industrial asset monitoring and geospatial services are expected to grow.

The earth observation drones market in Germany is projected to grow at a CAGR of 13.8% from 2025 to 2035, driven by industrial, agricultural, and environmental applications. German operators are increasingly deploying drones for infrastructure inspections, surveying, urban planning, and precision farming. High demand exists for high-resolution imaging, LiDAR, and thermal sensors capable of supporting engineering, construction, and environmental assessment projects. Manufacturers are focusing on flight autonomy, sensor integration, and data analytics to meet stringent quality and safety standards. Commercial adoption in logistics, asset inspection, and industrial monitoring continues to grow, while defense and environmental surveillance projects contribute steadily to demand. Strategic collaborations and technology partnerships ensure high-performance drone platforms and efficient operational capabilities.

The earth observation drones market in the UK is anticipated to grow at a CAGR of 11.4% from 2025 to 2035, fueled by defense surveillance, industrial inspections, environmental monitoring, and precision agriculture. Adoption is enhanced by government-backed drone programs, commercial industrial applications, and research in autonomous flight and sensor integration. Infrastructure monitoring, construction surveying, and energy sector inspections are significant contributors. High-end drones with multispectral, thermal, and LiDAR capabilities are deployed to improve data collection and operational efficiency. Strategic collaborations with European and international technology providers accelerate innovation, platform reliability, and scalability. Emerging commercial applications such as logistics, mapping services, and geospatial analytics further support market growth.

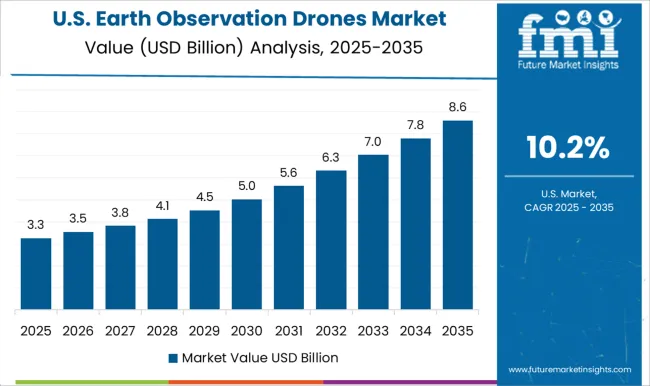

The earth observation drones market in the USA is projected to grow at a CAGR of 10.2% from 2025 to 2035, led by government, defense, agriculture, and infrastructure applications. TiO₂-related commercial adoption is supported by high-resolution imaging, LiDAR, and multispectral sensors for precision agriculture, urban planning, industrial inspections, and environmental monitoring. Manufacturers are focusing on autonomous flight, extended battery life, and payload versatility to enhance operational efficiency. Partnerships with defense contractors, commercial enterprises, and geospatial analytics firms strengthen market presence. Emerging applications in logistics, disaster assessment, and asset inspection drive incremental growth. Regulatory frameworks, safety compliance, and AI-powered analytics continue to influence market expansion and technology deployment.

Competition in the earth observation drones market is defined by flight endurance, payload versatility, imaging resolution, and autonomous capabilities for defense, commercial, and industrial applications. DJI leads with a wide portfolio of high-performance drones offering advanced flight stabilization, multispectral and LiDAR sensors, and integrated AI-driven data analytics for surveillance, agriculture, and infrastructure monitoring. AeroVironment, Inc. competes with lightweight, tactical UAVs optimized for government, defense, and commercial missions requiring rapid deployment and operational reliability. Skydio differentiates through autonomous navigation, obstacle avoidance, and AI-based mission planning, targeting industrial inspections and environmental monitoring. Autel Robotics focuses on high-resolution imaging, thermal sensing, and modular payload systems for precision agriculture and infrastructure applications, while Teledyne Technologies emphasizes integrated sensor platforms and real-time geospatial data processing capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.0 Billion |

| Wing | Fixed, Rotary, and Hybrid |

| Power Source | Fuel, Battery, and Hybrid |

| Payloads | Imaging payloads, RGB camera, Multispectral camera, Thermal camera, Others, Sensors, and Combined |

| Mode of Operation | Remote, Semi-autonomous, and Autonomous |

| Application | Agriculture & forestry, Energy & utilities, Construction, Environmental monitoring, Mining & exploration, Others, and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Acecore Technologies, AeroVironment, Inc., Aeryon Labs, Autel Robotics, DJI, FLIR Systems, Parrot Drone SAS., Skydio, Inc., Teledyne Technologies Incorporated, and Yuneec |

| Additional Attributes | Dollar sales by drone type (fixed-wing, rotary-wing, hybrid), share by end-use segment (defense, agriculture, infrastructure, environmental, commercial mapping), regional adoption trends, sensor and payload demand, flight endurance, autonomy features, regulatory frameworks, service models, and emerging applications. |

The global earth observation drones market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the earth observation drones market is projected to reach USD 18.7 billion by 2035.

The earth observation drones market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in earth observation drones market are fixed, rotary and hybrid.

In terms of power source, fuel segment to command 47.8% share in the earth observation drones market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Earth Anchors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Earthen Plasters Market Size and Share Forecast Outlook 2025 to 2035

Earthworm Meal Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Earthmoving Equipment Undercarriage Market

Rare-earth Barium Copper Oxide (REBCO) Wire Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Rare Earth Elements Companies

Rare Earth Metals Market Demand & Trends 2024-2034

Medium Earth Orbit (MEO) Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Protective Earth Resistance Meter Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Activated Bleaching Earth Market Growth - Trends & Forecast 2025 to 2035

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Medical Drones Market Report – Growth & Forecast 2025-2035

Consumer Drones Market

Commercial Drones Market by Type ,Application ,End Use & Region Forecast till 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA