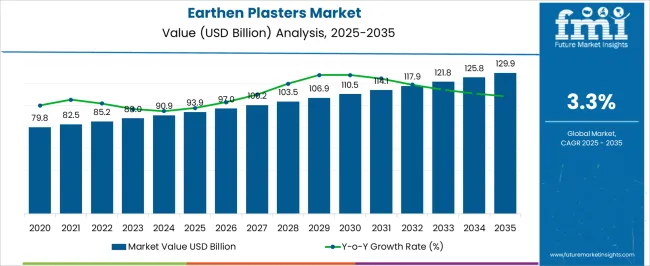

The earthen plasters market is estimated to be valued at USD 93.9 billion in 2025 and is projected to reach USD 129.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period. This early-stage growth is driven by increasing demand for environmentally friendly construction materials, particularly in residential and commercial projects. As the construction industry continues to focus on more natural and non-toxic alternatives, earthen plasters gain traction for their aesthetic, functional, and eco-friendly properties. This phase sees a notable rise in the use of earthen plasters in interior design and restoration projects, as well as increased awareness of the health and environmental benefits of using natural materials.

Continued adoption in residential and commercial construction, particularly in regions prioritizing eco-conscious building practices, will drive significant absolute dollar opportunity during this period. The compound dollar opportunity grows steadily, underlining the increasing use of earthen plasters in diverse applications globally.

| Metric | Value |

|---|---|

| Earthen Plasters Market Estimated Value in (2025 E) | USD 93.9 billion |

| Earthen Plasters Market Forecast Value in (2035 F) | USD 129.9 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The construction materials market is the largest contributor, accounting for approximately 30-35%. Earthen plasters are increasingly used in both residential and commercial construction as an alternative to traditional plastering materials, particularly in environmentally conscious projects. The natural building materials market follows with about 25-30%, as earthen plasters are a key component of building techniques that focus on using non-synthetic, natural materials. As demand for low-impact building materials grows, earthen plasters gain popularity due to their minimal environmental footprint and ability to create natural finishes.

The interior design and decoration market contributes around 15-20%, with earthen plasters becoming increasingly popular in residential and commercial spaces. Their unique texture and aesthetic appeal make them an ideal choice for modern interior designs that prioritize natural finishes. The renovation and restoration market adds approximately 10-12%, with earthen plasters being widely used in the restoration of historic buildings. These plasters are often preferred for maintaining the authenticity of older structures, especially in eco-conscious restoration projects. Finally, the agricultural and farming market accounts for 8-10%, as earthen plasters are utilized in farm buildings, such as barns and storage facilities, where they provide insulation and create natural, cost-effective finishes.

The earthen plasters market is gaining traction as sustainable construction practices become more mainstream across both developed and emerging economies. The shift toward eco-friendly and non-toxic building materials has positioned earthen plasters as a preferred choice for architects and builders focused on environmental impact and indoor air quality.

Their natural composition, breathability, and thermal regulation capabilities have driven usage in modern construction, particularly in residential and restoration projects. Growing awareness of green certifications and the circular economy is expected to further fuel market growth.

Technological refinements in mixing and application techniques, along with supportive government regulations promoting sustainable materials, are contributing to broader acceptance. Looking ahead, the market is projected to grow steadily, anchored by the push for low-carbon alternatives in both new constructions and refurbishments across residential, commercial, and institutional settings.

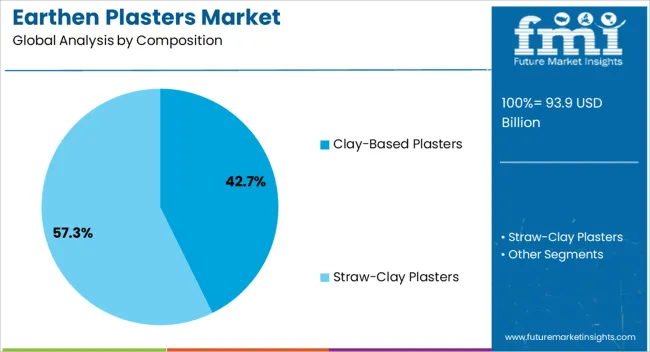

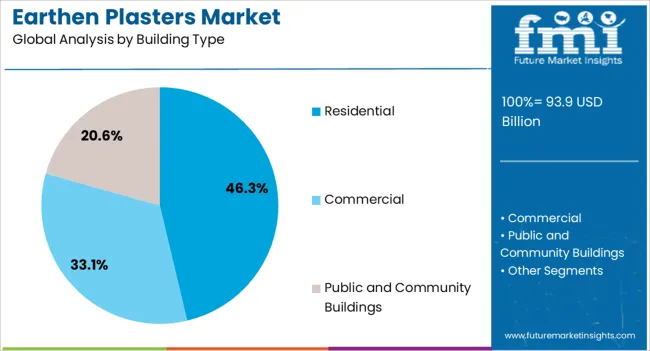

The earthen plasters market is segmented by composition, building type, application, and geographic regions. By composition, earthen plasters market is divided into Clay-Based Plasters and Straw-Clay Plasters. In terms of building type, earthen plasters market is classified into Residential, Commercial, and Public and Community Buildings.

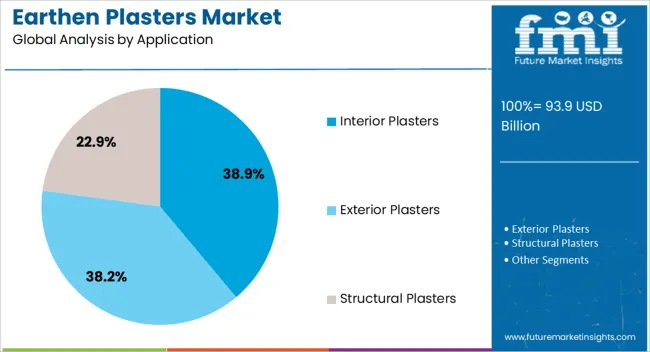

Based on application, earthen plasters market is segmented into Interior Plasters, Exterior Plasters, and Structural Plasters. Regionally, the earthen plasters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Clay-based plasters dominate the composition category with a 42.7% market share, driven by their environmental compatibility, ease of use, and wide aesthetic appeal. These plasters are increasingly chosen for their ability to regulate humidity, reduce indoor pollutants, and deliver a natural finish that supports biophilic design trends.

Their application requires minimal processing and emits significantly lower carbon compared to cement-based alternatives, making them ideal for sustainable construction practices. The segment has witnessed growth due to rising consumer preference for artisanal finishes and healthier indoor environments.

Additionally, improved product availability and standardization have helped clay-based plasters move from niche markets into broader construction applications. As demand for durable, repairable, and energy-efficient materials grows, this segment is expected to remain a core contributor to market expansion.

The residential segment leads with a 46.3% market share in the building type category, reflecting the widespread adoption of earthen plasters in private homes, apartments, and housing projects. Homeowners are increasingly drawn to earthen finishes for their aesthetic warmth, sustainability credentials, and ability to improve indoor comfort through natural insulation and air purification.

Growth in green home certifications and the DIY renovation movement has further propelled this segment. Earthen plasters also align well with rural and semi-urban construction trends, where traditional building practices are being revitalized with modern techniques.

As consumers continue to seek low-impact living solutions, the residential sector is expected to maintain its dominance, supported by increasing investment in energy-efficient and eco-conscious housing developments across regions.

The interior plasters segment holds a 38.9% market share under the application category, driven by the increasing use of earthen materials for wall and ceiling finishes in indoor spaces. This segment benefits from growing demand for natural textures, earthy tones, and breathable surfaces that enhance indoor air quality.

Interior applications offer greater flexibility for customization and are generally less exposed to weathering, making earthen plasters an ideal solution for long-term performance and aesthetic retention. Architects and designers are actively incorporating earthen plasters into eco-luxury interiors, boutique accommodations, and sustainable office spaces.

Additionally, the health-conscious consumer base continues to prioritize materials free from VOCs and synthetic additives, reinforcing the relevance of earthen finishes in interior design. As awareness of wellness-focused building materials grows, this segment is positioned for continued expansion across both residential and commercial interiors.

The earthen plasters market is experiencing growth as demand for natural, eco-friendly building materials rises in both residential and commercial construction. Driven by the need for sustainable and breathable wall finishes, earthen plasters are increasingly being used in green building projects, eco-homes, and renovation works. Challenges include the limited availability of raw materials, regional variations in composition, and the need for skilled labor in application.

Opportunities exist in developing ready-to-use formulations, enhancing product durability, and expanding into new geographic markets. Trends emphasize the use of recycled materials, enhanced aesthetics, and compatibility with modern building techniques.

The growing interest in green construction and eco-conscious materials is driving the demand for earthen plasters. These plasters, made from natural materials like clay, sand, and straw, offer a non-toxic, breathable alternative to traditional wall finishes. As awareness about environmental impact increases, builders, architects, and homeowners are turning to earthen plasters for residential, commercial, and renovation projects. These plasters provide thermal insulation and sound absorption, making them ideal for eco-homes and green buildings.

The focus on energy efficiency and improving indoor air quality is also driving demand. With the growing popularity of natural materials in construction, earthen plasters have emerged as a key product, offering both aesthetic value and practical benefits for modern construction projects that prioritize healthy and efficient living spaces.

Constraints in the earthen plasters market stem from fluctuations in the price and availability of key raw materials, such as clay, sand, and natural binders, which can increase production costs. The regional nature of these materials limits their availability in some areas, restricting widespread adoption. Additionally, applying earthen plasters requires skilled labor, which can complicate installation and raise costs. While these materials are widely recognized for their benefits, meeting regulatory standards in some regions can add complexity to the production and application processes. Manufacturers and buyers are seeking ready-to-use formulations that simplify the application process and maintain product consistency, making them more accessible for broader adoption in different regions and construction projects.

The strongest opportunities in the earthen plasters market lie in the development of ready-to-use, pre-mixed formulations that simplify the application process for both professionals and DIY enthusiasts. These solutions reduce labor costs, improve consistency, and make earthen plasters accessible to a broader market. As demand for natural building materials grows, emerging regions such as Asia-Pacific, Latin America, and parts of Africa, where urbanization and construction are on the rise, present significant growth potential. Earthen plasters are well-positioned to meet the demand for cost-effective, natural alternatives to conventional building materials. Suppliers who offer easy-to-apply products and expand distribution into these emerging markets are well-positioned to capture growth opportunities and cater to the increasing demand for natural wall finishes.

Innovations in material formulations are making earthen plasters more durable, making them better suited to modern construction standards. The use of natural pigments, textures, and finishes is rising as consumer preferences shift toward visually appealing and unique wall finishes. Furthermore, interest in using recycled and upcycled materials in earthen plaster formulations is growing, helping to reduce waste and improve performance. The growing use of earthen plasters in urban environments, where there is an increasing focus on performance and design, is opening up new market opportunities. Manufacturers that innovate to improve the aesthetic, technical, and functional properties of earthen plasters are poised to capture increased demand in higher-end construction markets.

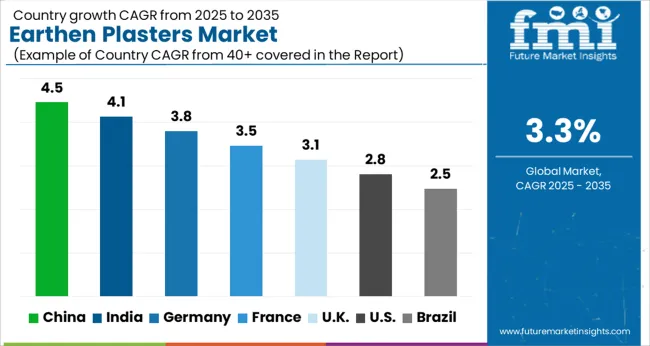

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

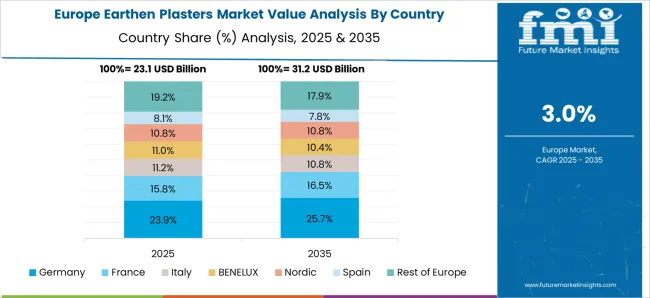

The global earthen plasters market is growing at a CAGR of 3.3% from 2025 to 2035. Among the leading countries, China shows the highest growth at 4.5%, followed by India at 4.1%, and Germany at 3.8%. The UK and the USA have moderate growth rates of 3.1% and 2.8%, respectively. Market growth is driven by increased demand for natural building materials, improved insulation properties, and the growing interest in non-toxic, eco-friendly construction alternatives. The construction boom, especially in residential buildings, supports the adoption of earthen plasters in both new and retrofitted homes. The analysis includes over 40+ countries, with the leading markets detailed below.

The earthen plasters market in China is expected to grow at a CAGR of 4.5% from 2025 to 2035. The increasing demand for natural building materials, driven by urbanization and rapid industrialization, is one of the key factors propelling this growth. The construction industry, particularly in rural areas and smaller towns, is shifting toward traditional building materials like clay and lime-based plasters, which offer thermal insulation and moisture regulation. Furthermore, the expanding residential and commercial construction sectors are fueling the demand for these materials. China’s focus on revitalizing its cultural heritage and building techniques, including the use of earthen plasters, also supports the market's growth. The increasing preference for eco-friendly housing, which can help reduce energy consumption, is boosting the adoption of these materials.

The earthen plasters market in India is forecasted to grow at a CAGR of 4.1% from 2025 to 2035. The rise in construction activities, particularly in rural areas, is driving demand for clay-based plasters. Traditional building techniques are gaining popularity as they offer better temperature regulation, especially in hot and humid climates. India’s growing middle class and their preference for natural, affordable building materials is further contributing to market growth.The increased focus on rural development and the push to use indigenous materials for construction are supporting the demand for earthen plasters. As urban areas expand, the demand for these materials in residential projects is expected to rise, particularly as people seek alternatives to synthetic materials.

The earthen plasters market in Germany is expected to grow at a CAGR of 3.8% from 2025 to 2035. The country has a strong construction sector that is increasingly incorporating natural materials in both residential and commercial buildings. Earthen plasters are gaining traction due to their excellent insulation properties, which are particularly appealing in energy-efficient construction projects. The demand is also supported by the country’s cultural inclination toward using eco-friendly materials that help in regulating indoor temperatures, reducing energy costs. Germany’s regulations on reducing emissions and increasing the efficiency of buildings further push the market for materials that contribute to these goals, like earthen plasters.

The UK earthen plasters market is expected to grow at a CAGR of 3.1% over the forecast period. With growing interest in non-toxic and natural materials for both new construction and renovation projects, earthen plasters are being increasingly adopted in residential buildings. Their use in improving indoor air quality and enhancing the aesthetic appeal of homes is driving market demand. The UK also has a rising trend of retrofitting buildings with traditional materials to increase energy efficiency and reduce dependence on artificial heating and cooling systems. These factors, along with the increasing popularity of green and natural homes, support the continued growth of earthen plasters in the country.

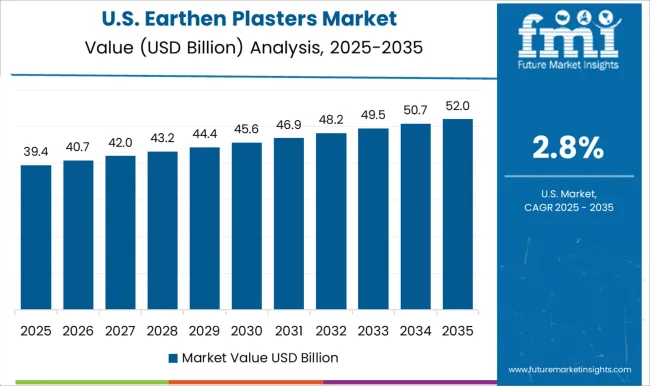

The USA earthen plasters market is projected to grow at a CAGR of 2.8% from 2025 to 2035. The market is primarily driven by the increasing demand for natural materials in residential and commercial buildings. As more people look for eco-friendly alternatives in construction, the use of earthen plasters is growing due to their durability and ability to regulate temperature. In the USA, the trend toward retrofitting buildings to improve energy efficiency and reduce artificial heating and cooling systems is also boosting the demand for earthen plasters. Regions with hot and dry climates are more likely to adopt these materials, given their natural insulation properties.

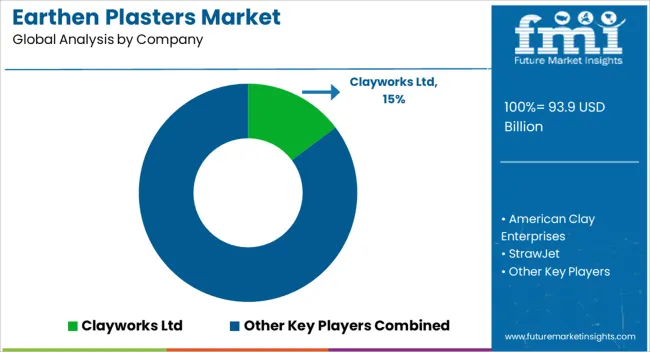

In the earthen plasters market, competition is centered around the quality and functionality of natural, non-toxic building materials. Clayworks Ltd leads with a variety of clay-based plasters that are highly breathable, contributing to both aesthetic appeal and the overall performance of buildings. Their products are known for enhancing interior and exterior finishes with a focus on durability and ease of maintenance. American Clay Enterprises competes by offering a range of plasters that are user-friendly and come in various textures and colors. Their emphasis is on providing sustainable, high-quality options that are adaptable to residential and commercial applications. StrawJet stands out by combining straw with clay to create plaster systems with superior insulation properties, catering to builders looking for energy-efficient and visually appealing solutions. Natural Building Technologies (NBT) differentiates itself by offering unique blends of earth-based plasters, incorporating lime and sand alongside clay for enhanced strength and resilience. Claylin focuses on traditional, simple plaster formulations, promoting easy application and the adaptability of clay to various construction styles.

Cobworks, Earthen Shelter, and Cob Cottage Company, all specializing in cob building, integrate earthen plasters into the core of their natural construction methods. These companies emphasize traditional building techniques while highlighting the functional benefits of earth-based materials for creating energy-efficient and healthy living spaces. The strategy across these players revolves around offering customizable plaster finishes that appeal to a wide range of builders and homeowners. Many companies focus on the breathable and non-toxic properties of earthen plasters, with a growing emphasis on improving indoor air quality and temperature regulation.

| Item | Value |

|---|---|

| Quantitative Units | USD 93.9 Billion |

| Composition | Clay-Based Plasters and Straw-Clay Plasters |

| Building Type | Residential, Commercial, and Public and Community Buildings |

| Application | Interior Plasters, Exterior Plasters, and Structural Plasters |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Clayworks Ltd, American Clay Enterprises, StrawJet, Natural Building Technologies (NBT), Claylin, Cobworks, Earthbags, Straw Bale Gardens, Build Naturally, Earthen Shelter, Cob Cottage Company, Seven Generations Natural Builders, Barefoot Builder, Cob Works, and Adobe in Action |

| Additional Attributes | Dollar sales by product type (clay-based, straw-based, adobe, cob), application (residential, commercial, community, eco-tourism), and finish type (smooth, textured, polished). Demand dynamics are fueled by growing interest in sustainable building practices, environmental concerns, and the need for energy-efficient homes. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, where eco-friendly and self-sustaining construction practices are gaining popularity. |

The global earthen plasters market is estimated to be valued at USD 93.9 billion in 2025.

The market size for the earthen plasters market is projected to reach USD 129.9 billion by 2035.

The earthen plasters market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in earthen plasters market are clay-based plasters and straw-clay plasters.

In terms of building type, residential segment to command 46.3% share in the earthen plasters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA