The global earplugs market is projected to grow from USD 1.7 billion in 2025 to approximately USD 2.987 billion by 2035, recording an absolute increase of USD 1.287 billion over the forecast period. This translates into a total growth of 75.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.8% between 2025 and 2035. The overall market size is expected to grow by nearly 1.76X during the same period, supported by increasing workplace safety regulations, rising awareness about hearing protection, growing industrial activities, and expanding consumer awareness about noise-induced hearing loss prevention.

Between 2025 and 2030, the earplugs market is projected to expand from USD 1.7 billion to USD 2.26 billion, resulting in a value increase of USD 0.56 billion, which represents 43.5% of the total forecast growth for the decade. This phase of growth will be shaped by stringent occupational safety regulations, increasing industrial automation requiring worker protection, and growing consumer awareness about recreational hearing protection. Manufacturers are expanding their product portfolios to address diverse noise reduction requirements across industrial, consumer, and specialized applications.

From 2030 to 2035, the market is forecast to grow from USD 2.26 billion to USD 2.987 billion, adding another USD 0.727 billion, which constitutes 56.5% of the overall ten-year expansion. This period is expected to be characterized by technological advancements in active noise cancellation, development of smart earplugs with connectivity features, and expansion of e-commerce distribution channels. The growing adoption of personalized hearing protection solutions and increased focus on occupational health and safety standards will drive demand for advanced earplug technologies with enhanced comfort and protection capabilities.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.7 billion |

| Forecast Value in (2035F) | USD 3 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

Market expansion is being supported by the increasing implementation of stringent workplace safety regulations across developed and developing economies. Industrial sectors including manufacturing, construction, mining, and aviation are mandating hearing protection equipment to comply with occupational health and safety standards. The growing awareness about the long-term consequences of noise-induced hearing loss is driving both mandatory and voluntary adoption of hearing protection devices across various industries.

The rising prevalence of recreational activities involving high noise exposure, such as concerts, motorsports, and shooting sports, is creating substantial demand in the consumer segment. Modern consumers are increasingly conscious about protecting their hearing health during leisure activities, driving demand for comfortable, effective, and aesthetically appealing earplug solutions. The development of specialized earplugs for musicians, swimmers, and sleep enhancement is expanding the market beyond traditional industrial applications.

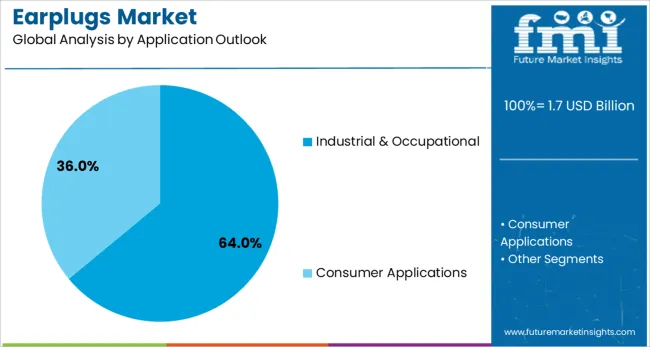

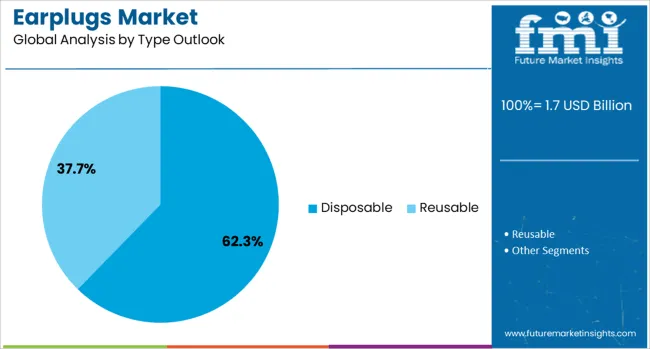

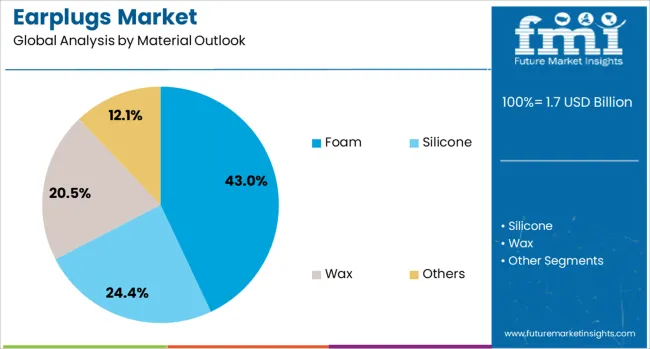

The market is segmented by material, technology, type, noise reduction rating, application, and region. By material, the market is divided into foam (43%), silicone, wax, and others. Based on technology, the market is categorized into passive earplugs (62.3%) and active earplugs. In terms of type, the market is segmented into disposable (62.3%) and reusable. By noise reduction rating, the market is classified into 10-20 dB, 21-25 dB, 26-29 dB (36%), and 30-33 dB. By application, the market is divided into industrial & occupational (64%) including automotive, construction, energy, aviation, healthcare, and mining sectors, and consumer applications. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The industrial & occupational application is projected to account for 64% of the earplugs market in 2025, reaffirming its position as the primary demand driver. This dominance is attributed to mandatory compliance with occupational safety regulations across industries with high noise exposure. Manufacturing facilities, construction sites, mining operations, and aviation sectors require workers to use hearing protection devices to prevent noise-induced hearing loss and comply with regulatory standards such as OSHA in the United States and similar frameworks globally.

The segment encompasses diverse industrial applications including automotive manufacturing, where assembly line workers face continuous exposure to machinery noise; construction sites with heavy equipment operation; energy sector facilities including power plants and oil refineries; aviation ground crews exposed to aircraft engines; healthcare workers using loud medical equipment; and mining operations with drilling and blasting activities. Each sector has specific noise reduction requirements, driving demand for specialized earplug solutions that balance protection with communication needs.

Disposable earplugs are projected to represent 62.3% of market demand in 2025, underscoring their widespread adoption in industrial and consumer applications. Hygiene considerations, convenience, and cost-effectiveness for large-scale industrial deployment drive the preference for disposable options. Organizations favor disposable earplugs for their ability to ensure consistent protection levels without maintenance requirements, eliminating concerns about product degradation or contamination that could compromise worker safety.

The segment benefits from bulk purchasing economics, making disposable earplugs the most cost-effective solution for companies with large workforces. Additionally, the convenience of single-use products eliminates the need for cleaning and storage protocols, reducing administrative burden and ensuring compliance with safety standards. As workplace safety regulations continue to strengthen globally, disposable earplugs will maintain their dominant position, particularly in industries with high worker turnover or temporary workforce requirements.

The foam material segment is forecasted to contribute 43% of the earplugs market in 2025, reflecting its optimal balance of comfort, effectiveness, and affordability. Foam earplugs, typically made from polyurethane or PVC materials, offer excellent noise reduction capabilities while maintaining user comfort during extended wear periods. The material's ability to expand and conform to individual ear canal shapes ensures effective sealing and consistent protection across diverse user populations.

This segment's success is attributed to continuous innovations in foam technology, including slow-recovery formulations that enhance insertion ease and comfort, hypoallergenic materials that reduce skin irritation, and specialized densities that optimize noise reduction ratings. The cost-effectiveness of foam materials enables manufacturers to offer competitive pricing while maintaining profit margins, making foam earplugs accessible across both developed and developing markets. The material's versatility allows for various colors and designs, supporting brand differentiation and user preference accommodation.

The earplugs market is advancing steadily due to increasing workplace safety regulations and growing awareness about hearing health protection. However, the market faces challenges including user discomfort during extended wear, communication difficulties in work environments, and competition from alternative hearing protection devices such as earmuffs. Innovation in materials science and smart technology integration continue to influence product development and market evolution patterns.

The integration of active noise cancellation technology in earplugs is revolutionizing the hearing protection industry. Smart earplugs equipped with electronic components can selectively filter harmful noise frequencies while allowing important sounds like speech and warning signals to pass through. This technology addresses the long-standing challenge of maintaining situational awareness while protecting hearing, making advanced earplugs particularly valuable in industrial settings where communication is critical for safety and productivity.

Modern earplug manufacturers are increasingly offering customized solutions tailored to individual ear canal anatomy and specific noise exposure profiles. Custom-molded earplugs provide superior comfort and protection compared to generic options, driving adoption among professional users and consumers seeking premium hearing protection. Advanced manufacturing techniques including 3D scanning and printing enable cost-effective production of personalized earplugs, expanding market accessibility and user satisfaction.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The earplugs market is experiencing varied growth rates globally, with China leading at a 7.8% CAGR through 2035, driven by rapid industrialization, expanding manufacturing sector, and strengthening workplace safety regulations. India follows at 7.3%, supported by growing industrial activities, increasing construction projects, and rising awareness about occupational health. Germany shows strong growth at 6.7%, emphasizing advanced hearing protection technologies and strict workplace safety compliance. France records 6.1%, focusing on innovation in hearing protection solutions. The UK demonstrates 5.5% growth, prioritizing worker safety and comfort. The USA shows steady growth at 4.9%, with mature market characteristics and focus on technological advancement. Brazil exhibits 4.4% growth, driven by expanding industrial sector and improving safety standards.

Revenue from earplugs in China is projected to exhibit strong growth with a CAGR of 7.8% through 2035, driven by the country's massive manufacturing sector and increasingly stringent workplace safety regulations. The rapid expansion of industrial facilities, construction projects, and infrastructure development is creating substantial demand for hearing protection equipment. Chinese manufacturers are also emerging as significant global suppliers, leveraging cost advantages and improving quality standards to compete in international markets.

Revenue from earplugs in India is expanding at a CAGR of 7.3%, supported by rapid industrialization, infrastructure development, and evolving workplace safety culture. The country's expanding manufacturing sector, particularly in automotive, textiles, and heavy industries, is creating consistent demand for hearing protection equipment. Implementation of stricter occupational safety regulations and increasing corporate focus on worker welfare are driving market growth across organized and unorganized sectors.

Revenue from earplugs in Germany is projected to grow at a CAGR of 6.7% through 2035, supported by the country's strong emphasis on workplace safety, technological innovation, and premium product adoption. German manufacturers are leading the development of advanced hearing protection technologies, including smart earplugs with selective noise filtering and communication capabilities. The market benefits from the strict enforcement of EU workplace safety directives and high awareness levels among workers and employers.

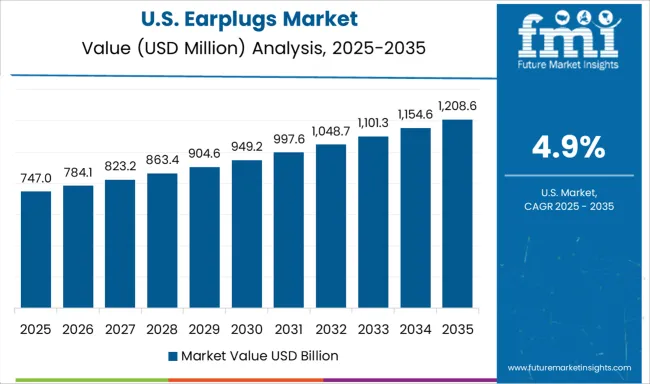

Demand for earplugs in the USA is projected to grow at a CAGR of 4.9%, reflecting market maturity combined with steady replacement demand and technological advancement. American consumers and industries are increasingly adopting premium hearing protection solutions featuring advanced materials, custom fitting, and smart technology integration. The market is characterized by strong regulatory enforcement through OSHA and high awareness about hearing conservation programs.

The earplugs market is characterized by competition among established safety equipment manufacturers, specialized hearing protection companies, and emerging technology-driven players. Companies are investing in materials research, acoustic engineering, comfort enhancement, and distribution network expansion to deliver effective, comfortable, and accessible hearing protection solutions. Product innovation, regulatory compliance, and brand reputation are central to strengthening market positions and customer loyalty.

3M, USA-based, leads the market with 25% global value share, offering comprehensive hearing protection solutions with strong focus on innovation and quality. The company leverages its extensive research capabilities and global distribution network to maintain market leadership across industrial and consumer segments. Moldex-Metric provides specialized hearing protection products with emphasis on comfort and compliance, serving industrial markets with innovative foam formulations and ergonomic designs.

Hearos focuses on consumer-oriented hearing protection solutions, offering products for musicians, concert-goers, and recreational users with emphasis on sound quality preservation. Radians Inc. delivers value-oriented hearing protection equipment for industrial and construction markets, combining affordability with reliable protection. Loop Earplugs represents the new generation of lifestyle-oriented hearing protection, targeting younger consumers with aesthetically appealing and technologically advanced products.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.7 billion |

| Material | Foam, Silicone, Wax, Others |

| Technology | Passive Earplugs, Active Earplugs |

| Type | Disposable, Reusable |

| Noise Reduction Rating | 10-20 dB, 21-25 dB, 26-29 dB, 30-33 dB |

| Application | Industrial & Occupational (Automotive, Construction, Energy, Aviation, Healthcare, Mining), Consumer Applications |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, India, Brazil, and 30+ countries |

| Key Companies Profiled | 3M, Moldex-Metric, Hearos, Radians Inc., Loop Earplugs, Lucid Hearing, Magid Glove & Safety, Allens Industrial Products, Honeywell International Inc. |

| Additional Attributes | Market share analysis by material type and technology, regional demand patterns, competitive positioning, buyer preferences for disposable versus reusable products, integration with smart technology and IoT capabilities, innovations in acoustic engineering and materials science |

The global earplugs market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the earplugs market is projected to reach USD 3.0 billion by 2035.

The earplugs market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in earplugs market are foam, silicone, wax and others.

In terms of technology outlook, passive earplugs segment to command 62.3% share in the earplugs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA