The global market for food service equipment is relatively moderately fragmented with the presence of global players, regional players as well as niche manufacturers. ITW Food Equipment Group, Middle by Corporation, Ali Group, Welbilt, and Rational AG are the five major players that hold about 45% of the food service equipment market and capture the market share in cooking and refrigeration equipment.

Regional players, including Hoshizaki Corporation (Japan) and Haier Smart Home (China), account for 30% market share, engaging in specific localized preferences and competitive pricing. The company also comprises emerging brands and niche manufacturers that include Vollrath and Hatco Corporation, capturing the remaining 25% through offering specific product types such as heating and holding devices and preparation equipment.

The diverse structure ensures that competition crosses all tiers-from multinational corporations basing their successes on technological lead and economies of scale to smaller entities thronged by innovation and specialization at the regional level.

| Global Market Share, 2025 | Industry Share % |

|---|---|

| Top Multinationals (ITW Food Equipment Group, Middleby Corporation, Ali Group) | 35% |

| Rest of Top 5 ( Welbilt, Rational AG) | 10% |

| Regional Leaders ( Hoshizaki Corporation, Haier Smart Home, Electrolux Professional) | 30% |

| Startups and Niche Brands ( Vollrath, Hatco Corporation, Avantco Equipment) | 25% |

This market is moderately fragmented where significant contributions came from top players while regional players and niche brands have maintained sufficient competition.

Cooking equipment holds the share at 43.4% due to the importance of ranges, flyers, and combi ovens within most commercial and institutional kitchens. ITW's Vulcan range and Rational AG's combi oven are best-selling models that express what creativity and reliability are all about.

Refrigeration and chilling equipment take up 10.2%, led by Hoshizaki and Haier in the field of energy-efficient smart refrigerators. Food preparation equipment accounts for 15.9%, which is driven by high demand for mixers, slicers, and food processors in catering and fast food industries, and Vollrath leads in this category.

Baking equipment accounts for 9.5%, supported by the growing popularity of artisanal baked goods. Heating and holding equipment (8.1%) ensure food safety and quality during service, while dishwashing and sanitation solutions (4.7%) focus on meeting hygiene regulations.

High-end dining demand is met through brands such as ITW's Hobart and Middleby'scombi ovens. Fast food restaurants account for 20.5%, and they prefer compact and high-speed cooking appliances such as deep fryers and grills, provided by Welbilt and Rational AG.

Commercial kitchens (14.0%), including catering services, demand large-capacity equipment like food processors and bulk chillers to handle high-volume food preparation efficiently. Bakeries, holding 18.4%, require specialized ovens and proofers from companies like Hoshizaki and Vollrath to meet the growing demand for artisanal and ready-to-eat baked goods.

2024 has been one of the landmark years for global food service equipment. Companies around the world have released some innovative products and strategies, some focused on partnership building, while others have been built on sustainability measures.

ITW, Middleby Corporation, and Ali Group have had their market reach consolidated through new acquisitions and innovative products. In regions, it is Hoshizaki in Asia and Haier Smart Home in China. There are even small brands focusing on niche sectors such as portable equipment and those using energy conservatively, Vollrath, and Hatco.

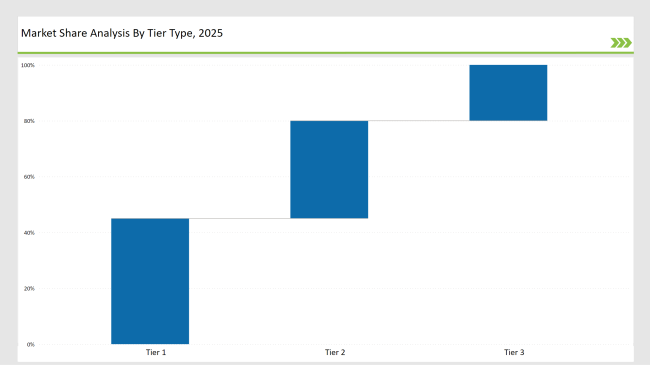

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 45% |

| Example of Key Players | ITW Food Equipment Group, Middleby Corporation, Ali Group |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 35% |

| Example of Key Players | Hoshizaki Corporation, Haier Smart Home, Electrolux Professional |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Vollrath, Hatco Corporation, Avantco Equipment |

| Brand | Key Focus |

|---|---|

| ITW’s Sustainability Efforts | launched energy-efficient dishwashers under the Hobart brand to reduce water and energy consumption. |

| Middleby’s Smart Solutions | Developed IoT -enabled cooking ranges for seamless integration with kitchen management systems. |

| Ali Group’s Expansion | Strengthened its global presence through strategic acquisitions and partnerships. |

| Hoshizaki’s Innovations | Introduced AI-powered ice makers for optimized performance and maintenance. |

| Welbilt’s Customization | Partnered with QSRs for tailored equipment designs to enhance service efficiency. |

| Rational AG’s AI Integration | Launched AI-equipped combi ovens for automated cooking processes. |

| Electrolux’s Water-Saving Dishwashers | Focused on sustainability by reducing water usage in commercial dishwashing solutions. |

| Vollrath’s Induction Cooktops | Designed portable solutions for flexible food service operations. |

| Haier’s Smart Refrigerators | Expanded IoT -enabled product lines for enhanced kitchen connectivity. |

The next decade is going to see IoT-enabled food service equipment - smart ovens, smart refrigerators, and other equipment - be the market dominator. Here, ITW and Middleby can capitalize on the trend by putting advanced connectivity features and real-time monitoring into the products, addressing efficiency and automation needs in commercial kitchens.

Sustainability will remain a top priority, with the environment-friendly equipment being the energy-efficient dishwashers and biodegradable packaging solutions. Rational AG can exploit this by upgrading its product lines to meet stringent environmental regulations and consumer expectations.

Asia-Pacific and Latin America are expected to see significant growth due to urbanization and the expansion of quick-service restaurants. Manufacturers can benefit by targeting these markets with affordable and compact solutions tailored to regional preferences, such as Hoshizaki’s modular systems.

Region-specific equipment demand will be higher, like tandoor ovens in South Asia and compact sushi equipment in East Asia. Companies can investigate localization strategies that cater to the diverse culinary requirements and strengthen their market presence.

E-commerce platforms will continue to grow, which would give manufacturers a direct line to customers. Subscription models and customized offerings can help brands like Vollrath and Hatco tap into niche markets and ensure steady revenue growth.

ITW Food Equipment Group, Middleby Corporation, Ali Group, Welbilt, and Rational AG collectively hold 45% of the market share.

Regional leaders such as Hoshizaki Corporation and Haier Smart Home contribute 30%, focusing on localized needs and competitive pricing.

Niche brands, including Vollrath and Hatco Corporation, account for 25%, targeting specialized equipment like heating and preparation tools.

Cooking equipment holds the largest share at 43.4%, driven by high demand from commercial kitchens and institutional canteens.

IoT-enabled solutions are expected to grow significantly, with major players integrating connectivity and automation features into their products.

Offering robust after-sales services, including extended warranties and maintenance, can help manufacturers build long-term customer relationships.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

UK Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

USA Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Competitive Overview of Foodservice Paper Bag Companies

ASEAN Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Europe Food Service Equipment Market Outlook – Size, Trends & Forecast 2025–2035

Examining Food Testing Services Market Share & Industry Outlook

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Commercial Food Service Equipment Market Growth – Trends & Forecast 2024-2034

Latin America Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Market Share Insights of Compostable Foodservice Packaging Providers

Industry Share & Competitive Positioning in Electronic Equipment Repair Service

Evaluating Market Share in Restaurants & Mobile Food Services

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Europe Foodservice Disposables Market Insights – Growth & Trends 2024-2034

Foodservice Disposable Market Growth & Trends Forecast 2024-2034

Food Service Industry - Size, Share, and Forecast 2025 to 2035

Food Service Coffee Market Analysis by Type and End User Through 2035

Food Holding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Serving Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA