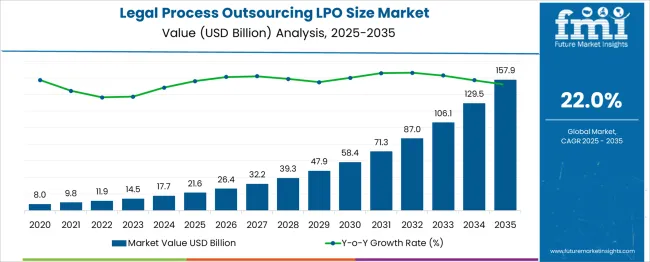

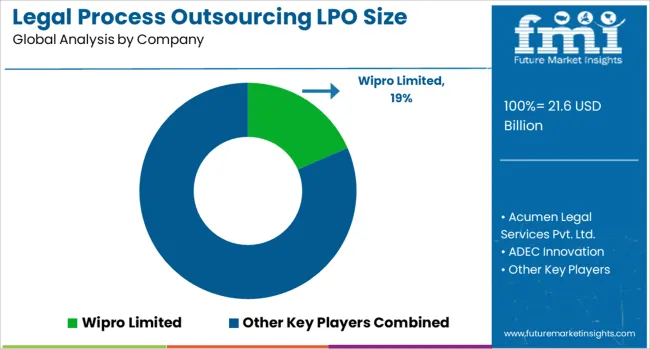

The Legal Process Outsourcing LPO Size Market is estimated to be valued at USD 21.6 billion in 2025 and is projected to reach USD 157.9 billion by 2035, registering a compound annual growth rate (CAGR) of 22.0% over the forecast period.

| Metric | Value |

|---|---|

| Legal Process Outsourcing LPO Size Market Estimated Value in (2025 E) | USD 21.6 billion |

| Legal Process Outsourcing LPO Size Market Forecast Value in (2035 F) | USD 157.9 billion |

| Forecast CAGR (2025 to 2035) | 22.0% |

The adoption of technology-driven services has transformed the delivery of legal support, allowing organizations to focus on core activities while outsourcing routine or specialized processes.

The growing demand for regulatory compliance and litigation support has driven investments in advanced digital tools, enabling more efficient and accurate service delivery. Rising globalization of legal work and the need for 24/7 operations have further contributed to the growth of outsourcing.

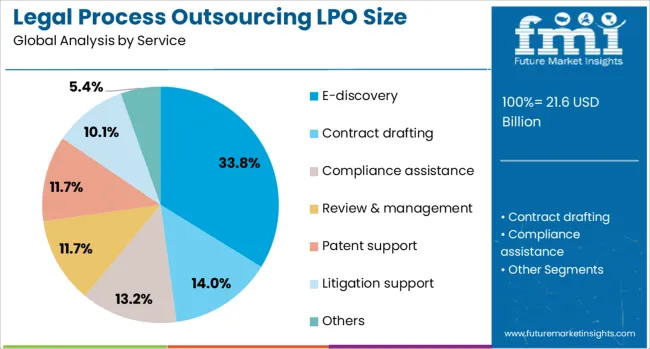

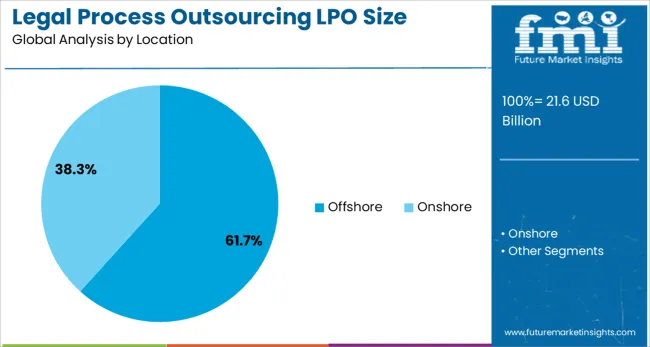

As organizations continue to optimize costs and improve service quality, the market is expected to benefit from increased adoption of offshore service centers that provide access to skilled legal professionals at competitive rates. Segmental growth is expected to be led by e-discovery services and offshore locations as the preferred outsourcing destination.

The legal process outsourcing lpo size market is segmented by service and location and geographic regions. By service of the legal process outsourcing lpo size market is divided into E-discovery, Contract drafting, Compliance assistance, Review & management, Patent support, Litigation support, and Others. In terms of location of the legal process outsourcing lpo size market is classified into Offshore and Onshore. Regionally, the legal process outsourcing lpo size industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The e-discovery segment is projected to hold 33.8% of the legal process outsourcing market revenue in 2025, maintaining its position as the leading service category. The growth of this segment is driven by the increasing complexity and volume of electronically stored information involved in litigation and regulatory investigations.

E-discovery services help legal teams efficiently collect, review, and manage large data sets while ensuring compliance with legal standards. The adoption of advanced analytics and artificial intelligence has enhanced the accuracy and speed of e-discovery processes.

Organizations have favored outsourcing e-discovery to reduce operational costs and mitigate risks associated with data management. As digital data continues to proliferate across industries, the demand for specialized e-discovery services is expected to remain strong.

The offshore segment is expected to contribute 61.7% of the legal process outsourcing market revenue in 2025, securing its dominance as the preferred location choice. Offshore destinations offer cost advantages, access to a large pool of qualified legal professionals, and time zone benefits that enable round-the-clock service delivery.

Many service providers have established robust infrastructure and compliance frameworks in offshore locations, ensuring data security and adherence to legal regulations. Companies increasingly rely on offshore centers to scale operations efficiently and tap into specialized expertise unavailable locally.

The combination of competitive pricing and skilled labor has sustained the growth of the offshore segment. As legal outsourcing evolves, offshore locations are poised to remain the primary hubs for delivering a wide range of LPO services.

Legal process outsourcing is driven by cost optimization and regulatory complexity, enabling firms to delegate repetitive tasks for efficiency. A growing focus on specialized services like IP management and compliance enhances scalability and legal accuracy.

The demand for legal process outsourcing has been influenced by the emphasis on cost reduction in corporate legal departments and law firms. Outsourcing providers have been engaged to handle repetitive and time-intensive tasks such as document review, litigation support, and contract management, enabling businesses to reduce operational overheads. Offshore centers have been preferred due to favorable pricing structures and multilingual talent availability. Increasing complexity in compliance and regulatory frameworks has further encouraged companies to delegate specialized processes to external experts. This trend has enhanced efficiency, minimized risks, and ensured timely delivery, making LPO an essential element in enterprise legal strategies.

A shift toward niche services like intellectual property management, compliance monitoring, and risk assessment has been observed in the LPO landscape. Organizations have prioritized outsourcing these functions to leverage domain-specific expertise, particularly in regions with strong legal ecosystems. Growing cross-border transactions and mergers have amplified the need for due diligence and contract abstraction services handled by skilled professionals. Scalability benefits offered by LPO providers allow businesses to respond flexibly to fluctuating workloads and litigation cycles. These factors have contributed to a competitive environment where differentiation hinges on service depth, legal accuracy, and adherence to strict confidentiality standards

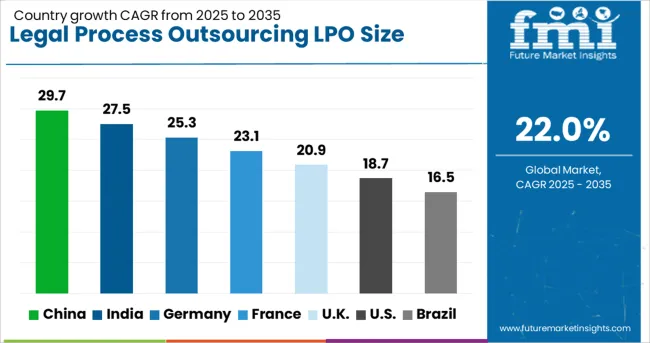

| Country | CAGR |

|---|---|

| China | 29.7% |

| India | 27.5% |

| Germany | 25.3% |

| France | 23.1% |

| UK | 20.9% |

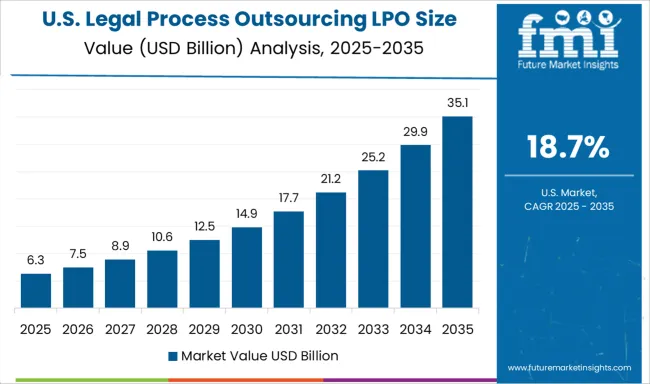

| USA | 18.7% |

| Brazil | 16.5% |

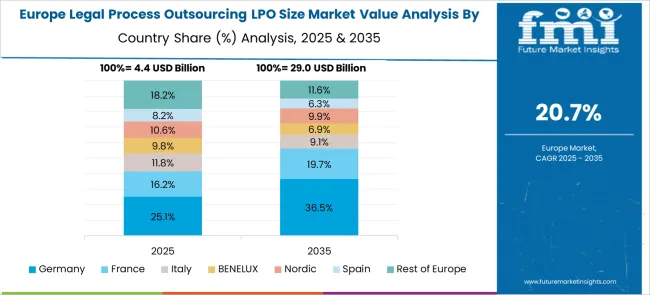

The legal process outsourcing market, expected to expand at a global CAGR of 22.0% from 2025 to 2035, demonstrates significant variation across leading economies. China, a BRICS nation, is leading with a CAGR of 29.7%, driven by large-scale digitization of legal systems, expansion of AI-enabled document review, and cost-competitive outsourcing hubs. India follows at 27.5%, supported by a talent pool, rising legal-tech integration, and growing partnerships with global law firms for litigation support and contract management. Germany records 25.3%, propelled by demand for GDPR-compliant LPO services, automation in e-discovery, and strong adoption in corporate legal departments. The UK posts 20.9%, leveraging regulatory expertise and niche capabilities in IP litigation outsourcing, though limited by data sovereignty concerns. The USA grows at 18.7%, shaped by rising in-house cost pressures and outsourcing of specialized services, despite higher reliance on hybrid delivery models. BRICS economies lead with cost efficiency and technology-driven scalability, while OECD markets focus on compliance-oriented outsourcing and innovation in AI-based legal solutions. The report provides an in-depth analysis of 40+ countries, with the five fastest-growing regions highlighted for reference.

The CAGR for the UK flexible metallic tubing market increased from approximately 6.4% during 2020–2024 to 8.7% for 2025–2035, reflecting enhanced industrial pipeline upgrades and broader retrofitting efforts in mechanical and HVAC infrastructure. Between 2020 and 2024, demand was subdued due to post-Brexit regulatory disruptions and stagnant manufacturing growth. However, as of 2025, rising investments in energy-efficient building systems and automotive exhaust management are driving renewed momentum. Industrial retrofits in Tier-2 cities, coupled with OEM contracts for aerospace-grade tubing, have contributed to long-term growth projections. British manufacturers have also scaled exports within the EU and EFTA, following harmonization with regional metal standards.

The CAGR in the United Kingdom advanced from approximately 14.1% during 2020–2024 to 20.9% for 2025–2035, expanding structural shifts in law firm economics and growing client cost sensitivity. Post-Brexit regulatory divergence increased demand for cross-jurisdictional legal research and contract compliance services. UK-based firms expanded outsourcing of back-office and litigation support to India and South Africa, leveraging labor cost arbitrage and 24/7 delivery capability. Digitalization strategies emphasized secure knowledge platforms and AI-based due diligence, creating specialized outsourcing frameworks for financial, insurance, and technology sectors. Corporate legal departments prioritized outcome-based billing models, accelerating LPO adoption beyond traditional document review services.

The CAGR in China climbed from roughly 18.2% during 2020–2024 to 29.7% during 2025–2035, driven by an upsurge in intellectual property litigation and corporate compliance mandates. Domestic legal service providers increasingly collaborated with offshore LPO vendors for patent filings, cross-border arbitration, and translation services. Government-led digital court initiatives amplified demand for AI-integrated litigation analytics. Cybersecurity compliance regulations prompted a surge in secured legal tech outsourcing platforms, safeguarding data flows for international clients. Foreign firms operating in China relied heavily on outsourcing to manage compliance documentation and bilingual due diligence, boosting specialized LPO capabilities in Shanghai and Shenzhen.

The CAGR increased from around 19.3% during 2020–2024 to 27.5% between 2025 and 2035, reinforcing India’s position as the global LPO hub. Growth was supported by abundant legal talent, competitive pricing, and investments in advanced contract review tools. Indian providers strengthened delivery through AI-based contract analytics, e-discovery platforms, and ISO/IEC-compliant cybersecurity frameworks. Offshore demand from the US and UK surged due to labor arbitrage and scalability advantages. Specialized vertical outsourcing in patent drafting, regulatory compliance, and litigation support achieved double-digit growth as law firms sought operational flexibility under competitive billing environments.

The CAGR in the United States moved from nearly 13.6% in 2020–2024 to 18.7% during 2025–2035, underpinned by rising corporate governance requirements and litigation complexity. US firms adopted LPO models to reduce fixed overheads and optimize operational scalability for fluctuating caseloads. Adoption of AI-powered legal research and automated review platforms reshaped outsourcing scope, while data privacy regulations demanded strict compliance frameworks. Increasing cost pressure on in-house legal departments encouraged outcome-based partnerships with global LPO providers. Strategic sourcing of e-discovery and compliance management services drove sustained demand as regulatory scrutiny intensified across sectors.

In the legal process outsourcing (LPO) industry, leading players are capitalizing on demand for cost efficiency, multilingual legal talent, and advanced compliance-driven workflows. Companies like Wipro Limited, Infosys Limited, and Evalueserve SEZ are expanding full-scale legal support services, including litigation review, contract lifecycle management, and regulatory documentation for corporate legal teams and law firms. Their investments in AI-powered document review and e-discovery platforms enable faster turnaround and enhanced accuracy in complex legal cases. Specialized firms such as Acumen Legal Services Pvt. Ltd., Clairvolex Knowledge Processes Pvt. Ltd., and Cobra Legal Solutions, LLC focus on intellectual property, litigation analytics, and risk management, offering tailored outsourcing solutions for cross-border legal work. Mid-sized service providers like Datascribe Technologies Inc., Lexplosion Solutions Pvt. Ltd., and Kensium BPO are strengthening contract abstraction and compliance monitoring capabilities through technology integration. Emerging companies like Morae Global Corporation, Amstar Litigation Support, and LawScribe, Inc. are expanding global delivery centers and offering hybrid legal-tech solutions targeting USA and UK firms. Strategic partnerships between LPO firms and law firms are accelerating digital transformation, ensuring scalability and data security for global clients.

In October 2024, Wipro reported its Q2 FY25 (ended Sept 30, 2024) results, citing a 6.8% QoQ net income growth, a 28.8% jump in large deal bookings, and a strategic bonus share recommendation by the Board.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.6 Billion |

| Service | E-discovery, Contract drafting, Compliance assistance, Review & management, Patent support, Litigation support, and Others |

| Location | Offshore and Onshore |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wipro Limited, Acumen Legal Services Pvt. Ltd., ADEC Innovation, Amstar Litigation Support, BODHI Global Solutions, Clairvolex Knowledge Processes Pvt. Ltd., Cobra Legal Solutions, LLC, Datascribe Technologies Inc., Elevate Services Inc., Evalueserve SEZ, Infosys Limited, Kensium BPO, LawScribe, Inc., Lexplosion Solutions Pvt. Ltd., Morae Global Corporation, and Pangea3 |

| Additional Attributes | Dollar sales, share by service type, regional demand shifts, pricing trends, cost optimization strategies, regulatory compliance impact, vendor benchmarking, client acquisition models, and AI-driven workflow adoption. |

The global legal process outsourcing lpo size market is estimated to be valued at USD 21.6 billion in 2025.

The market size for the legal process outsourcing lpo size market is projected to reach USD 157.9 billion by 2035.

The legal process outsourcing lpo size market is expected to grow at a 22.0% CAGR between 2025 and 2035.

The key product types in legal process outsourcing lpo size market are e-discovery, contract drafting, compliance assistance, review & management, patent support, litigation support and others.

In terms of location, offshore segment to command 61.7% share in the legal process outsourcing lpo size market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Legal, Risk and Compliance Solution Market Forecast and Outlook 2025 to 2035

Legal AI Market Size and Share Forecast Outlook 2025 to 2035

Legal Services Market Size and Share Forecast Outlook 2025 to 2035

LegalTech Market Analysis - Size, Share, and Forecast 2025 to 2035

AI-Driven Legal Transcription – Automating Legal Documentation

The AI Legal Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

Process Automation and Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Process Pipe Coating Market Size and Share Forecast Outlook 2025 to 2035

Process Spectroscopy Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Processed Fruit and Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Process Plants Gas Turbine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Breakdown of Processed Beef Market Share

Market Share Insights for Processed Cashew Providers

Analysis and Growth Projections for Processed Superfruit Market

Processed Meat Market Analysis by Type, Packaging, Meat Type, and Region through 2035

Process Liquid Analyzer Market Growth - Trends & Forecast 2025 to 2035

Process Instrumentation Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA