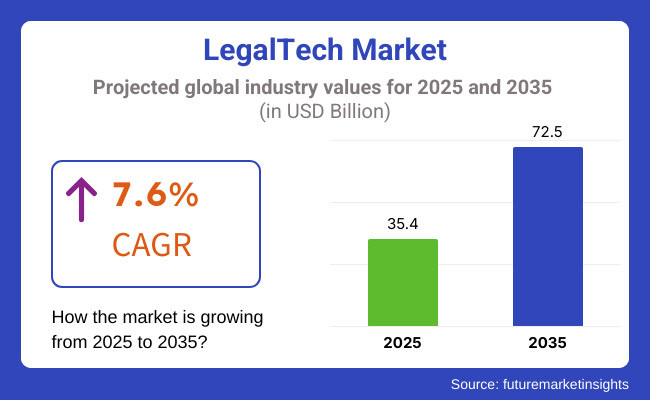

The LegalTech market is set to reach USD 35.4 billion in 2025 to grow to USD 72.5 billion by 2035, reflecting a CAGR of 7.6% through 2035.

Numerous legal firms and corporate legal departments are turning to more third-party vendors for required solutions related to legal research, case management, and compliance. The reliance on the third-party vendor network CAGR is an increasing factor for demand to come about the speedy adoption of third-party risk management solutions to reduce the potential risks tied to the third-party network with the external businesses.

Legal businesses and corporate legal departments are turning to automated compliance management systems to enforce stringent due diligence requirements to their vendors amidst regulatory compliance, such as GDPR in Europe and CCPA in California. These automated solutions allow legal practitioners to be effectively compliant with such rules and regulations and, at the same time, lower compliance risks.

The move to cloud-based legal software has meant that legal organizations have become even more reliant on the use of external technology. This external dependency calls for more progressed risk assessment tools, which can prevent the vulnerabilities attached to outsourcing legal technology services and thus keep the operation secure and properly managed.

Handling sensitive matters from clients puts law firms in a perfect position to become cyber targets. However, the use of real-time monitoring and continuous risk assessment tools can drastically lower the degree to which the data are leaked out from the consumers' machines and third-party software.

North America is the largest and most profitable region in the LegalTech third-party risk management market due to the restrictive data protection laws and the presence of the major LegalTech solution providers. In contrast, emerging markets like India and Australia, which are facing increased sector expansion as legal enterprises increase their networks and prioritize risk management, are also encountering the high level of adaptive technology of such systems.

Government initiatives have been a major contributor to this transformation. One of these is the USA federal government's "Cloud Smart" strategy, which directs agencies on cloud technology adoption while stressing security, procurement, and workforce readiness. Such policy is meant to rehabilitate the IT infrastructures, making them capable of being efficient and adapting to present-day demand better. Other governments across the world are taking similar steps by passing laws that will encourage the legal sector to embrace cloud technologies that, in turn, will enable them to provide better services and manage data more effectively.

The market is changing the legal business with the help of technology to automate, boost productivity, and spread legal services. LegalTech producers are powering innovations like using AI for contract examination, developing automated compliance systems, and creating cloud-based case management instruments. More and more law firms are switching over to such software programs in an effort to boost work automation, decrease the manual process, and deliver improved client service.

In-house legal departments, on the other hand, concentrate on being cost-efficient, minimizing risks, and addressing the issue of interfacing with existing software programs so that they become compliance-oriented as well as operationally efficient. End users, who are firms or individuals in search of legal advice, are also given an opportunity to avail of AI-powered legal research, virtual interviews, and document automation capabilities that are making legal procedures far less costly and convenient. The aforementioned factors have led to arousing interest in the development of artificial intelligence, blockchain for smart contracts, and data analytics, which have contributed to the rapid growth of the legal tech sector.

Contracts Deals Analysis

| Company | Contract Value (USA USD Million) |

|---|---|

| Texas State Government | ~USD 300 million |

| Fennemore Craig | Estimated ~USD 50-100 million |

| ZwillGen | Estimated ~USD 20-50 million |

Between 2020 and 2024, the legal tech sector experienced fast growth as a result of the growing usage of AI, automation, and cloud-based legal services. The pandemic led to digital transformation, causing law firms and in-house corporate legal teams to spend on contract management and compliance automation solutions. The need for virtual legal services and AI-driven research platforms increased, enhancing workflows and minimizing operational expenditures. Cybersecurity and data privacy issues became of prime importance, affecting software development and regulatory regimes.

Between 2025 and 2035, legal tech will develop with improvements in blockchain-based smart contracts, AI-powered case prediction, and real-time compliance tracking. The use of generative AI will improve legal research, drafting, and decision-making, making it more efficient and accessible. As regulations on legal AI become more established, ethical concerns and transparency will guide innovation. The increased need for automated conflict resolution and decentralized legal services will fuel increased adoption, change legal operations, and make technology an integral component of the international legal environment.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Greater use of legal compliance automation with changing data protection laws such as GDPR and CCPA. | AI-based regulatory compliance tools become the norm for law firms and businesses to maintain real-time responsiveness to changing regulations. |

| Emergence of AI-powered contract analysis software. Use of blockchain technology for smart contracts gains momentum. | Global adoption of AI-powered litigation prediction software. Blockchain-based decentralized legal databases enhance security and transparency. |

| Transition from paper-intensive processes to cloud-based case management and e-discovery platforms. | Virtual law firms and fully automated dispute resolution platforms become the new standard, reducing dependence on traditional legal processes. |

| Increased demand for encrypted legal communication and AI-powered data breach identification. | Quantum-resistant encryption is legal tech solutions' new standard. Privacy-centric AI models end abuse of information by unauthorized actors. |

| Market expansion was driven by digitalization, increased litigation, and regulatory compliance. | Self-driven legal AI-powered expansion, globalization of legal infrastructure, and improved access to legal tech in emerging markets fuel expansion. |

Regulatory compliance is one of the major threats existing in the LegalTech market. The legal tech solutions must comply with jurisdiction-specific laws such as GDPR in Europe, the CCPA in the USA, and other data protection regulations around the globe. Failure to comply can bring severe legal sanctions and loss of respect among attorneys and company clients as well.

Confidentiality and data security matter most. The handling of legal documents, contracts, and case files by the LegalTech platforms makes them ultra-sensitive areas and attracts cybercriminals. Any kind of data breach can trigger catastrophic effects like legal repercussions, client distrust, and image damage. The data encryption from the beginning to the end, security access controls, and compliance with the legal cybersecurity policy have to be ensured.

Risks also arise in cases where traditional law firms have barriers to entry. Many legal practitioners are reluctant to adopt automation because of the fear of mass unemployment, being complicated, and lacking technical know-how. Besides, careers are mainly changed by establishing user-friendly interfaces, integrative systems, and specific staff training, which is the evidence against their argument. Wider adoption of automatics through user-friendly interfaces, seamless integration, and targeted training programs is critical.

Economic crises and budget restrictions in law firms and corporate legal departments might negatively influence the rate at which LegalTech is adopted. Although big legal companies are capable of buying AI-contract analysis and compliance software, the smaller ones have difficulties with high implementation costs that prevent them from market penetration. The provision of scalable solutions that fit into different business sizes is paramount.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 13.8% |

| China | 11.9% |

| Germany | 7.8% |

| Japan | 8.6% |

| The USA | 9.9% |

The Indian legal ecosystem is undergoing a radical transformation at a digital level, and the primary catalyst in this acceleration is the mass adoption of cloud-based LegalTech platforms. Driven by government initiatives like "Digital India" and "Make in India," the digitization of the country's legal system has been more holistic, encouraging lawyers and special medium and small-scale law firms to adopt cloud-based solutions within the practice.

Many Central and state government ministries/designated offices have implemented Cloud-based systems to improve service delivery significantly and drive efficiency around legal cases, Active case e-filing, and document automation. The swelling ranks of legal tech startups such as VakilSearch and SpotDraft are also driving down the cost of cloud-based solutions for law firms of all sizes. The India LegalTech market is anticipated to grow by 13.8% CAGR throughout the period of assessment, according to FMI.

Growth Drivers in India

| Key Drivers | Description |

|---|---|

| Government Digital Initiatives | "Make in India" and "Digital India" have been driving legal service digitalization. |

| Cloud-Based LegalTech Growth | Law firms are increasingly turning towards cloud-based solutions for automation and case management. |

| Startup Innovation | Companies like VakilSearch and SpotDraft offer cost-effective LegalTech solutions. |

To its credit, the USA legal system is adopting an increasing amount of blockchain technology to improve the security and effectiveness of the law. Contemporary applications of smart contracts include company law, real estate law, and intellectual property rights, either in the form of legally enforceable smart contracts or automatic enforcement contracts. Second, blockchain contracts decrease the possibility of fraud, promote more transparency of transactions, and decrease the number of intermediaries needed in legal transactions.

The USA Government Accountability Office (GAO) report emphasized the potential of blockchain to create immutable legal documents, ease contract signing, and speed up regulatory compliance. Leading law firms and legal departments of Fortune 500 corporations are adopting the blockchain at scale. IBM and ConsenSys are also leading the way in blockchain-based legal tech solutions, which are driving market growth.As per FMI, the USA LegalTech market is likely to expand at a CAGR of 9.9% through the period of study.

Growth Drivers in the USA

| Key Drivers | Description |

|---|---|

| Blockchain Adoption | Law firms and institutions are adopting blockchain smart contracts. |

| Regulatory Compliance | GAO acknowledges blockchain's ability to provide tamper-proof legal documents. |

| AI and Automation | Fortune 500 companies are investing in contract management through AI. |

China is rapidly digitizing its legal system with government-backed programs and strict regulation compliance legislation. The country has applied AI-based solutions to reduce legal paperwork automation of case analysis and improve judiciary efficiency.

China's policy guidelines, such as the 2023 AI Governance Law, ensure that AI models are sanctioned by the government before release to enable the controlled and orderly rollout of LegalTech tools.Since the introduction of AI regulation policies, over 40 AI models have been cleared for legal application. Alibaba and Tencent, two of China's biggest tech giants, are integrating AI-driven contract automation into legal services, enabling law firms to increase document processing speed and accuracy.

Growth Drivers in China

| Key Drivers | Description |

|---|---|

| AI-Powered Legal Services | AI-powered case management and contract automation drive efficiency. |

| Regulatory Framework | AI Governance Law mandates compliance for LegalTech implementation. |

| LegalTech Company Expansion | Chinese technology giants Tencent and Alibaba are investing in LegalTech. |

Germany's LegalTech sector is growing because of the country's strict data protection regulations, especially the General Data Protection Regulation (GDPR). Compliance automation and artificial intelligence-driven contract management software are being used by legal service providers for regulatory compliance.

The banking, healthcare, and insurance sectors are driving the use of LegalTech software to comply with intricate legal requirements.German LegalTech companies like LECARE and Bryter are gaining greater popularity by providing AI-based contract automation, risk management, and legal analytics solutions. The push of the German government towards legal automation and cyber security is also driving investment in AI-based legal technologies.

Growth Drivers in Germany

| Key Drivers | Description |

|---|---|

| AI-based Contract Automation | Businesses can make use of AI-based contract automation solutions for achieving GDPR compliance. |

| AI in Legal | Companies like LECARE and Bryter offer AI-based legal automation. |

| Corporate LegalTech Adoption | LegalTech is driven by banking, insurance, and healthcare industries. |

As 2024 approaches, Japan's corporate Law firms have begun adopting AI-powered legal analytics and automation. Multinational corporations and financial institutions are deploying AI-powered contract review platforms in their legal departments to automate due diligence;apan's Personal Information Protection Act (PIPA) mandates secure handling of information, further driving the trend of implementing encrypted cloud LegalTech solutions in legal firms.Big Japanese tech corporations such as Fujitsu and NEC are using AI-induced legal analytics software to enhance contract analysis and risk analysis accuracy. It saves time and money in legal document processing.

Growth Drivers in Japan

| Key Drivers | Description |

|---|---|

| AI-Powered Legal Analytics | AI platforms are making due diligence and contract reading easier. |

| Data Protection Legislation | PIPA compliance is pushing the demand for safe LegalTech solutions. |

| Corporate Legal Automation | Multinational corporations employ AI to assess risk and administer contracts. |

Cloud-based LegalTech systems are making collaboration in the legal profession easier through real-time document sharing and integrated case management. The traditional legal system is prone to inefficiencies owing to the use of paperwork, lengthy approval processes, version control problems, etc. In addition, cloud-based platforms allow for a single, centralized system in which collaborative legal professionals can work in parallel on the same document, greatly eliminating many delays and achieving far greater productivity. A few of the features that ensure that sensitive legal documents remain secure while maintaining access to intelligent persons are safekeeping access controls, flexibility of audit trails, and automatic iteration tracking.

According to the Supreme People’s Court of China, in 2023, 70% of the court documents were digitized through cloud-based platforms, which improved efficiency in resolving cases. Similarly, India’s government-supported E-Courts Project has digitized millions of case records, accessible to lawyers and litigants.

Maintaining operations and providing dynamic solutions as necessary is made possible by data in their system from October 2023. These systems are also attractive because they limit outside interference since they only run from within a firm’s own facilities. However, maintaining on-premises solutions still incurs significant expenses in hardware and IT personnel, as well as ongoing updates to keep the systems running well and secure.

Private Law Firms are the largest segment in the USA LegalTech market as these law firms are increasingly reliant on technology for efficiency, compliance, and client management. Private law firms, unlike government legal agencies or corporate legal departments, compete with each other and must run as efficiently as possible.

The same will happen for all corporate legal departments,as they embrace LegalTech solutions to increase output while managing compliance and client relationship aspects of the business. These in-house teams, which are constrained by increasing matter volumes and shrinking budgets, are turning to new technologies to improve operational efficiency and reduce costs. The use of automation for menial tasks is essential to lower human workloads and speed legal processes up: AI-based legal research, digitized contract management, and cloud-based case management systems. GenAI tools have been embraced by companies like ASML, giving a huge boost in productivity to individuals with tens of hours cut from the time to complete work.

Fast-growing and competitive, LegalTechs are developing capabilities in terms of making use of AI, Cloud computing, and Blockchain technologies for enhancing legal operations, compliance, and document automation. All legal stakeholders, including law organizations, corporate legal department staff, and government institutions, have been looking for efficient, scalable, secure, and integrated solutions that will make their processes and decisions easier to make.

Some large players like Thomson Reuters, LexisNexis, Clio, Relativity, and DocuSign are leading the market with AI-based legal research, case management, e-discovery, and automated contract solutions. While Thomson Reuters and LexisNexis lead in legal analytics and research, Clio is into cloud-based practice management. While Relativity covers the breadth of e-discovery solutions, DocuSign maintains its leading position in the execution of digital contracts and compliance automation.

The market changes with evolving smart contracts, legal analytics, and digital signatures to change legal workflows. Competition has followed mergers and acquisitions (M&A), in which big companies acquire LegalTech newcomers to broaden their capabilities. Currently, North America has the highest penetration of competition through digitalization, while in the Asia Pacific, increased growth is underway due to the transformation brought by digitalization into their legal systems. Companies that are beneficiaries of investments in data safety, workflow automation, and other aspects of regulatory compliance solutions may secure stronger market positions in this evolving landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thomson Reuters | 18-22% |

| LexisNexis | 15-19% |

| Clio | 12-16% |

| Relativity | 10-14% |

| DocuSign | 8-12% |

| Other Companies (Combined) | 30-40% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Thomson Reuters | AI-driven legal research, compliance automation, and contract management solutions. |

| LexisNexis | Legal analytics, case law research, and workflow automation tools for law firms. |

| Clio | Cloud-based legal practice management software with billing and document automation. |

| Relativity | AI-powered e-discovery, litigation management, and data compliance solutions. |

| DocuSign | Digital contract management, e-signature solutions, and legal document security. |

Thomson Reuters (18-22%)

A dominant LegalTech provider offering AI-driven legal research, compliance automation, and workflow optimization for law firms and corporate legal teams.

LexisNexis (15-19%)

Specializes in legal analytics, AI-powered case law research, and practice management solutions, serving global law firms and enterprises.

Clio (12-16%)

A key player in cloud-based legal practice management, focusing on automation, billing, and client engagement tools for small and mid-sized law firms.

Relativity (10-14%)

A leader in e-discovery and litigation management, leveraging AI for document review, legal compliance, and risk mitigation.

DocuSign (8-12%)

A pioneer in digital contract management and e-signature solutions, providing secure and legally compliant digital transaction platforms.

Other Key Players (30-40% Combined)

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 35.4 billion |

| Projected Market Size (2035) | USD 72.5 billion |

| CAGR (2025 to 2035) | 7.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Solution Types Analyzed (Segment 1) | Case Management, Lead Management, Document Management, Contract Lifecycle Management, Billing & Accounting, Others |

| Deployment Modes Covered (Segment 2) | Cloud-based, On-premises |

| Services Covered (Segment 3) | Integration & Deployment, Consulting, Support & Maintenance |

| End Users Covered (Segment 4) | Law Firms, Corporate Legal Departments |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia-Pacific; Middle East & Africa |

| Countries Covered | United States, India, China, Germany, Japan, United Kingdom, Australia |

| Key Players Influencing the Market | Thomson Reuters, LexisNexis, Clio, Relativity, DocuSign, Everlaw, iManage, Wolters Kluwer, NetDocuments, Mitratech |

| Additional Attributes | Dollar sales by solution and deployment, AI and blockchain integration, regulatory impacts, digital transformation initiatives |

| Customization and Pricing | Customization and Pricing Available on Request |

The market is projected to witness a CAGR of 7.6% between 2025 and 2035.

The market is anticipated to reach USD 35.4 billion in 2025.

The market is anticipated to reach USD 72.5 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 9.4% in the assessment period.

The key players in the industry include LexisNexis, Icertis, DocuSign, Inc., RPX Corporation, Casetext Inc., Themis Solutions Inc. (Clio), Everlaw, Filevine, Inc., Checkbox Technology Pty Ltd, and CosmoLex Cloud, LLC.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: Latin America Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Western Europe Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 15: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: East Asia Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Solution, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End-User, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 17: Global Market Attractiveness by Solution, 2024 to 2034

Figure 18: Global Market Attractiveness by Type, 2024 to 2034

Figure 19: Global Market Attractiveness by End-User, 2024 to 2034

Figure 20: Global Market Attractiveness by Region, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Solution, 2024 to 2034

Figure 22: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 23: North America Market Value (US$ Million) by End-User, 2024 to 2034

Figure 24: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 28: North America Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 29: North America Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 30: North America Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 37: North America Market Attractiveness by Solution, 2024 to 2034

Figure 38: North America Market Attractiveness by Type, 2024 to 2034

Figure 39: North America Market Attractiveness by End-User, 2024 to 2034

Figure 40: North America Market Attractiveness by Country, 2024 to 2034

Figure 41: Latin America Market Value (US$ Million) by Solution, 2024 to 2034

Figure 42: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 43: Latin America Market Value (US$ Million) by End-User, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 57: Latin America Market Attractiveness by Solution, 2024 to 2034

Figure 58: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 59: Latin America Market Attractiveness by End-User, 2024 to 2034

Figure 60: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 61: Western Europe Market Value (US$ Million) by Solution, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 63: Western Europe Market Value (US$ Million) by End-User, 2024 to 2034

Figure 64: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 68: Western Europe Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 71: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 77: Western Europe Market Attractiveness by Solution, 2024 to 2034

Figure 78: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 79: Western Europe Market Attractiveness by End-User, 2024 to 2034

Figure 80: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 81: Eastern Europe Market Value (US$ Million) by Solution, 2024 to 2034

Figure 82: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 83: Eastern Europe Market Value (US$ Million) by End-User, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 97: Eastern Europe Market Attractiveness by Solution, 2024 to 2034

Figure 98: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 99: Eastern Europe Market Attractiveness by End-User, 2024 to 2034

Figure 100: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: South Asia and Pacific Market Value (US$ Million) by Solution, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 103: South Asia and Pacific Market Value (US$ Million) by End-User, 2024 to 2034

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 117: South Asia and Pacific Market Attractiveness by Solution, 2024 to 2034

Figure 118: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 119: South Asia and Pacific Market Attractiveness by End-User, 2024 to 2034

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 121: East Asia Market Value (US$ Million) by Solution, 2024 to 2034

Figure 122: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 123: East Asia Market Value (US$ Million) by End-User, 2024 to 2034

Figure 124: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 128: East Asia Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 131: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 134: East Asia Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 137: East Asia Market Attractiveness by Solution, 2024 to 2034

Figure 138: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 139: East Asia Market Attractiveness by End-User, 2024 to 2034

Figure 140: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 141: Middle East and Africa Market Value (US$ Million) by Solution, 2024 to 2034

Figure 142: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 143: Middle East and Africa Market Value (US$ Million) by End-User, 2024 to 2034

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2019 to 2034

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2024 to 2034

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2024 to 2034

Figure 157: Middle East and Africa Market Attractiveness by Solution, 2024 to 2034

Figure 158: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 159: Middle East and Africa Market Attractiveness by End-User, 2024 to 2034

Figure 160: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA