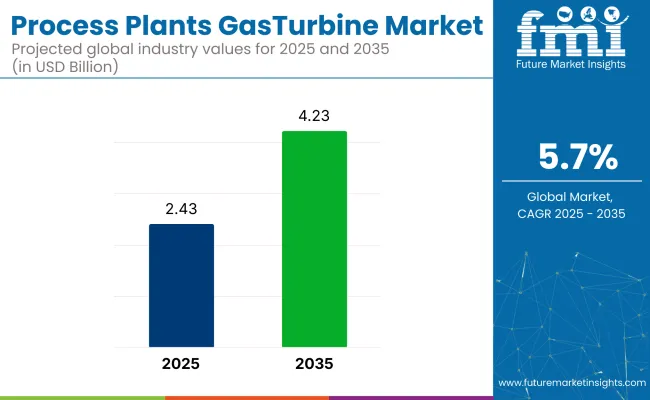

The global process plants gas turbine market is forecasted to grow from USD 2.43 billion in 2025 to USD 4.23 billion by 2035, registering a CAGR of 5.7% during the forecast period.

Market expansion is being driven by increasing demand for efficient power generation solutions in various process industries, including oil and gas, petrochemicals, and chemical manufacturing. The growing need for reliable, high-performance gas turbines that comply with stringent environmental regulations is further accelerating market adoption. Process plants are increasingly focusing on reducing operational costs and improving energy efficiency, which is fueling the deployment of advanced gas turbine technologies.

Advanced gas turbines with improved thermal efficiency, reduced emissions, and greater fuel flexibility are being developed and deployed to optimize energy consumption in process plants. The integration of gas turbines into combined-cycle power plants and cogeneration systems is being encouraged to enhance overall plant efficiency and reduce carbon footprint.

Investments are also being directed toward modernization and retrofitting of existing infrastructure to meet evolving energy demands and environmental standards. “With increasing power generation demand driven by growing electrification needs and more renewables coming online every day, operators and municipalities, like City Utilities, need to ensure grid reliability with high efficiency, while delivering cheaper and faster power for their end users,” said Dave Ross, CEO of GE Vernova’s Gas Power Americas region.

Major players such as General Electric, Siemens Energy, Mitsubishi Power, and AnsaldoEnergia are intensifying efforts in research and development to introduce innovative gas turbine models tailored for process plant applications.

Strategic alliances and collaborations with process industry end users are being established to enhance service capabilities and customize solutions according to specific operational requirements. Product portfolios are being expanded to include advanced maintenance, repair, and overhaul (MRO) services to increase the lifespan and reliability of gas turbine assets.

Strong investments are being made in the process plants gas turbine market, with attention centered on mid-capacity turbines, heavy-duty units, and combined cycle systems. Growth is being propelled by rising demand for industrial efficiency and decarbonization.

Gas turbines in the 1 MW to 30 MW capacity range are expected to account for 45% of the market share in 2025. These turbines are preferred for industrial operations such as refineries, chemical plants, and fertilizer units due to their scalability and decentralized energy generation capabilities. Compact design, thermal efficiency, and hydrogen fuel compatibility drive their adoption in modular and phased infrastructure expansion.

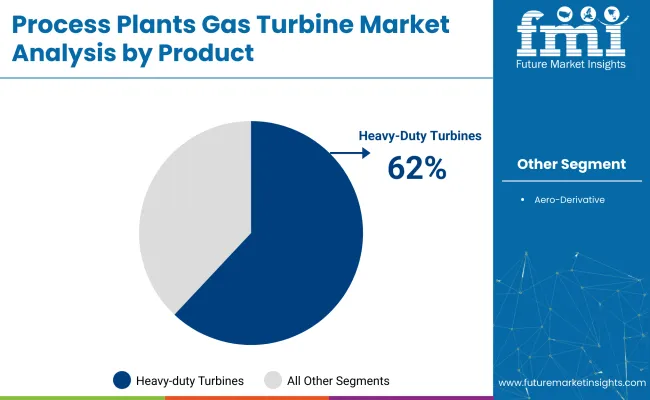

Heavy-duty turbines are projected to capture 62% of the market share in 2025, supported by their deployment in energy-intensive industries like petrochemicals and metals. Their ability to offer high output, durability, and continuous operation under demanding conditions makes them essential for large industrial setups.

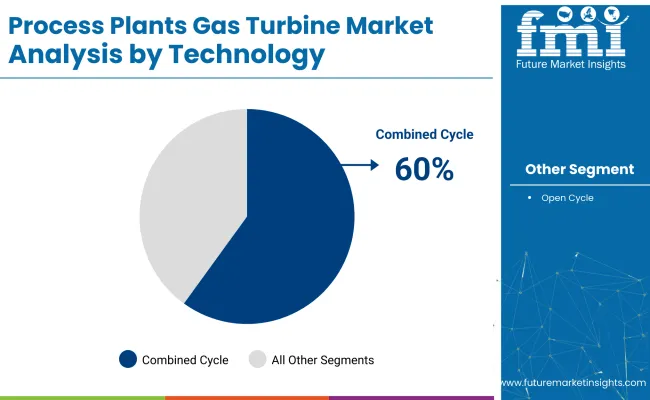

Combined cycle gas turbines (CCGT) are forecast to secure 60% of the market share in 2025, owing to superior thermal efficiency and emission reduction benefits. By utilizing exhaust heat to produce additional steam-based power, these turbines offer a cost-effective solution for process plants aiming to decarbonize operations. Their integration into ammonia, methanol, and petrochemical manufacturing is accelerating adoption.

The process plants gas turbine market is experiencing growth driven by increasing demand for reliable on-site power generation and advancements in turbine technology. However, challenges such as high capital costs and regulatory complexities are impacting market expansion.

Increasing demand for reliable on-site power generation is driving market growth

The demand for reliable and efficient on-site power generation within process plants is being significantly increased. Gas turbines are being preferred as dependable energy sources that reduce reliance on unstable grid power. Industries including chemicals, oil and gas, and manufacturing are integrating gas turbine systems to maintain continuous operations and optimize energy use.

Combined heat and power (CHP) configurations are being adopted to simultaneously generate electricity and thermal energy, enhancing overall efficiency. These factors collectively contribute to the expanding deployment of gas turbines, driving sustained growth in the process plants gas turbine market.

High capital costs and regulatory complexities are limiting market expansion

High initial capital costs and stringent regulatory frameworks are being recognized as key challenges limiting the growth of the process plants gas turbine market. Significant investments are required for purchasing, installing, and maintaining gas turbine equipment, which can be prohibitive for small and medium-sized enterprises.

Additionally, compliance with environmental regulations and emission control standards is being mandated, increasing operational complexities and costs. These factors are slowing down project approvals and market penetration, especially in regions with strict regulatory oversight. Overcoming these obstacles through cost optimization and streamlined compliance is critical for future market development.

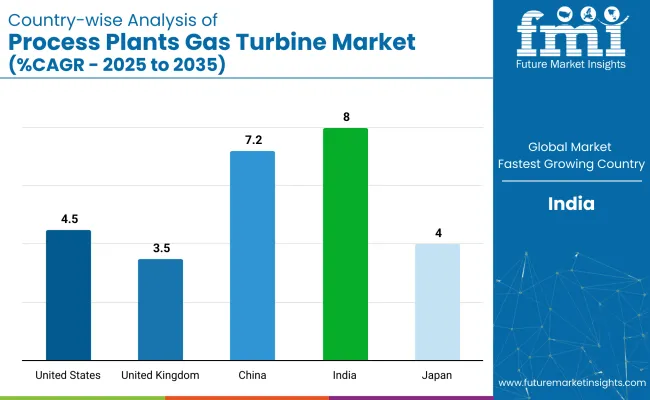

The process-plants gas turbine market is projected to grow steadily through 2035. Growth is driven by industrial expansion and energy demand in India and China. Mature markets like the US and UK focus on technological upgrades and sustainability.

| Countries | CAGR (%) |

|---|---|

| United States | 4.5% |

| United Kingdom | 3.5% |

| China | 7.2% |

| India | 8.0% |

| Japan | 4.0% |

The United States process-plants gas turbine market is forecasted to grow at a CAGR of 4.5% through 2035. Growth is fueled by technological advancements, turbine efficiency improvements, and regulatory measures favoring clean energy. Increasing retrofit and upgrade activities to boost plant performance and emission control capabilities further support market expansion.

The United Kingdom market for process-plants gas turbines is projected to expand at a CAGR of 3.5% through 2035. Growth is sustained by plant modernization efforts, emission reduction mandates, and industrial decarbonization policies. Reliability improvements via advanced monitoring and control systems are also supporting steady market progress.

Process-plants gas turbine market in China is expected to achieve a CAGR of 7.2% from 2025 to 2035. Growth is driven by rapid industrial expansion, increasing energy needs, and supportive government policies encouraging clean and efficient energy technologies. Digitalization and smart turbine systems are being widely deployed to improve plant productivity.

Process-plants gas turbine market in India is projected to grow at a CAGR of 8.0%, the fastest among key markets, during the forecast period. Demand is being propelled by large-scale industrial infrastructure projects and government support for energy-efficient, low-emission technologies. The trend toward digital monitoring and predictive maintenance solutions enhances plant reliability and efficiency.

Process-plants gas turbine market is expected to rise at a CAGR of 4.0% through 2035. Growth is underpinned by technological advancements and stringent government regulations aimed at reducing industrial emissions. Ongoing R&D and facility upgrades are also driving market development.

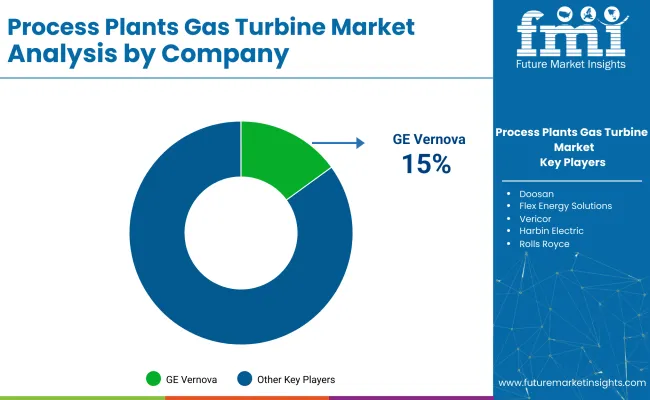

The process plants gas turbine market is structured across several tiers. Dominant players such as General Electric (GE Vernova), Siemens Energy, Mitsubishi Heavy Industries, and Rolls Royce lead the market with their broad product portfolios, large-scale manufacturing capacities, and substantial investments in advanced R&D.

These companies are setting industry standards by launching high-efficiency gas turbines with lower emissions. Key players, including Baker Hughes, AnsaldoEnergia, and Wärtsilä, focus on delivering specialized turbine solutions and catering to regional demands.

Emerging players such as Capstone Green Energy and Destinus Energy are emphasizing sustainable and innovative turbine technologies aimed at next-generation energy solutions. Market entry remains challenging due to high R&D investment requirements, strict regulatory standards, and the technical expertise needed for large-scale turbine production.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.43 billion |

| Projected Market Size (2035) | USD 4.23 billion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand units for volume |

| Capacity Analyzed (Segment 1) | ≤ 50 kW; > 50 kW to 500 kW; > 500 kW to 1 MW; > 1 MW to 30 MW; > 30 MW to 70 MW; > 70 MW to 200 MW; > 200 MW |

| Product Types Analyzed (Segment 2) | Aero-derivative; Heavy duty |

| Technologies Analyzed (Segment 3) | Open cycle; Combined cycle |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada; Mexico; United Kingdom; France; Germany; Russia; Italy; Netherlands; Finland; Greece; Denmark; Romania; Poland; Sweden; China; Australia; Japan; South Korea; Indonesia; Thailand; Malaysia; Bangladesh; Saudi Arabia; UAE; Qatar; Kuwait; Oman; Egypt; Turkey; Bahrain; Iraq; Jordan; Lebanon; South Africa; Nigeria; Algeria; Kenya; Ghana; Brazil; Argentina; Peru |

| Key Players Influencing the Market | Ansaldo Energia; Baker Hughes; Bharat Heavy Electricals; Capstone Green Energy; Destinus Energy; Doosan; Flex Energy Solutions; GE Vernova; Harbin Electric; IHI Corporation; Kawasaki Heavy Industries; MAN Energy Solutions; Mitsubishi Heavy Industries; Nanjing Turbine & Electric Machinery; Rolls-Royce; Shanghai Electric Gas Turbine; Siemens Energy; Solar Turbines; Vericor; Wärtsilä |

| Additional Attributes | Dollar share by capacity band; Product-type sales mix (aero-derivative vs. heavy duty); Cycle-type adoption trends (open vs. combined); Regional installation growth rates; Impact of emissions and efficiency regulations; Fuel-flexibility and hydrogen-ready technology uptake; Aftermarket services and maintenance contract trends |

The process plants gas turbine market is segmented by capacity into ≤ 50 kW, > 50 kW to 500 kW, > 500 kW to 1 MW, > 1 MW to 30 MW, > 30 MW to 70 MW, > 70 MW to 200 MW, and > 200 MW.

By product, the market includes aero-derivative and heavy-duty gas turbines.

By technology, the market is categorized into open cycle and combined cycle.

The market covers North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The market is expected to reach USD 4.23 billion by 2035.

The market is projected to be valued at USD 2.43 billion in 2025.

GE Vernova is the leading players in the market with 15% market Share.

The CAGR is 5.7% from 2025 to 2035.

India is the fastest growing country in the market with CAGR 8%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Market - Size, Share, and Forecast 2025 to 2035

Micro Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Shale Gas Processing Equipment Market

Aviation Gas Turbines Market

Multifuel Gas Turbine Market Growth – Trends & Forecast 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Fire-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Turbine Market

Combined Cycle Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Aeroderivative Gas Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Power Generation Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Open Cycle Aeroderivative Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA