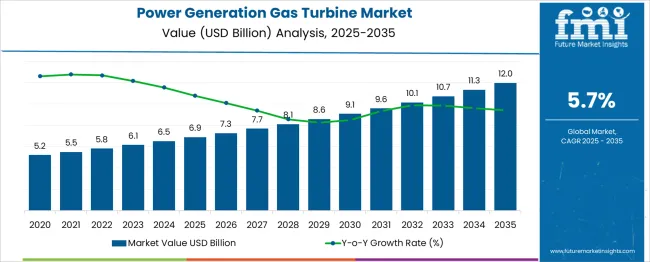

The Power Generation Gas Turbine Market is estimated to be valued at USD 6.9 billion in 2025 and is projected to reach USD 12.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. The absolute dollar opportunity highlights the significant growth potential over the forecast period, driven by increasing demand for efficient and reliable power generation solutions. From 2025 to 2030, the market value rises from USD 6.9 billion to USD 9.1 billion, representing an increase of USD 2.2 billion. This growth phase reflects rising investments in power infrastructure and a gradual shift toward gas turbines due to their efficiency and lower emissions compared to traditional power sources. Between 2030 and 2035, the market expands further from USD 9.1 billion to USD 12.0 billion, adding USD 2.9 billion in absolute terms.

The increasing adoption of gas turbines in emerging economies and the replacement of older technologies contribute to this growth. The market is projected to add approximately USD 5.1 billion in value during the 10-year period. This substantial absolute dollar opportunity underscores the sector’s expanding role in global power generation. Industry players focusing on innovation, efficiency improvements, and service solutions are likely to benefit from this sustained market expansion.

| Metric | Value |

|---|---|

| Power Generation Gas Turbine Market Estimated Value in (2025 E) | USD 6.9 billion |

| Power Generation Gas Turbine Market Forecast Value in (2035 F) | USD 12.0 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The power generation gas turbine market is witnessing strong momentum, driven by the global shift toward cleaner energy sources, increasing electricity demand, and the transition from coal-based plants to flexible, gas-based power generation. Major economies are prioritizing gas turbine deployments as part of decarbonization strategies, supported by government-backed investments in LNG infrastructure and combined cycle power projects.

OEMs are increasingly focusing on advanced turbine designs with higher thermal efficiency, lower emissions, and fuel flexibility to accommodate hydrogen blending. Additionally, reliability in peaking power generation, grid stability, and faster startup capabilities continue to make gas turbines indispensable in hybrid power systems.

The future outlook remains positive, bolstered by the integration of digital twin technologies, predictive maintenance analytics, and expansion of distributed power generation in industrial clusters and remote locations.

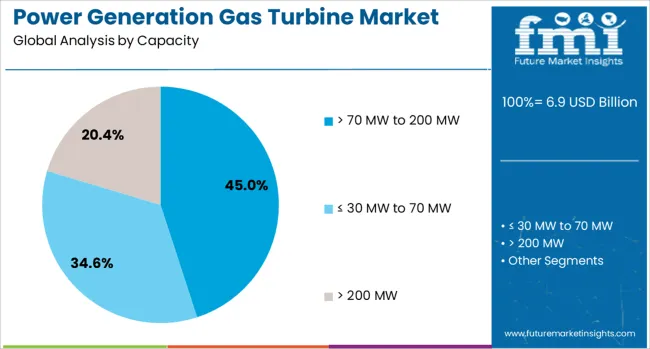

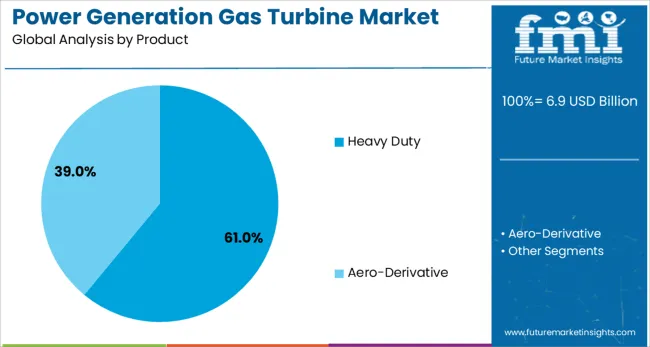

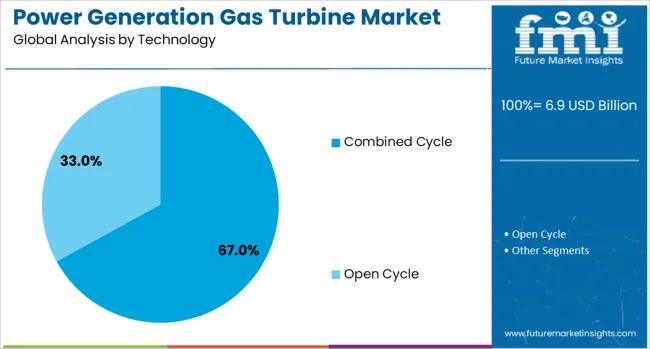

The power generation gas turbine market is segmented by capacity, product technology, and geographic regions. By capacity of the power generation gas turbine market is divided into > 70 MW to 200 MW, ≤ 30 MW to 70 MW> 200 MW. In terms of the product, the power generation gas turbine market is classified into Heavy Duty Aero-Derivative. Based on technology, the power generation gas turbine market is segmented into Combined Cycle and Open Cycle. Regionally, the power generation gas turbine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 70-200 MW capacity range is projected to account for 45.00% of the total market share in 2025, making it the dominant segment by capacity. Growth in this range is being shaped by its suitability for mid-scale industrial power plants, urban utilities, and regional grid support operations.

These turbines provide an optimal balance between capital expenditure, efficiency, and operational scalability, making them ideal for combined heat and power (CHP) applications. Utility providers and independent power producers are increasingly favoring this capacity range due to its modularity and lower installation footprint compared to larger units.

Moreover, energy security initiatives in emerging economies are accelerating deployment in this capacity class, particularly in areas with inconsistent grid access and fluctuating demand profiles.

Heavy-duty turbines are expected to capture a leading 61.00% market share in 2025, maintaining their dominance among product types. This leadership is being supported by their long operational life, high efficiency under base load conditions, and adaptability to varied fuel compositions.

Heavy-duty turbines are commonly deployed in large-scale utility settings and industrial plants where reliability and minimal maintenance downtime are critical. Technological enhancements such as advanced cooling systems, upgraded turbine blades, and low-NOx combustors have significantly boosted performance metrics.

Their proven track record in high-temperature, high-load environments has made them the preferred choice for utilities focused on consistent power output, even under fluctuating grid demands. Investments in hydrogen co-firing capabilities are further reinforcing the segment’s long-term value in decarbonized power systems.

Combined cycle technology is projected to dominate with a 67.00% market share by 2025, solidifying its role as the most efficient gas turbine technology. This dominance is being driven by the technology’s ability to achieve thermal efficiency levels exceeding 60%, significantly lowering fuel costs and emissions.

Combined cycle plants utilize waste heat from gas turbines to power steam turbines, making them ideal for base load generation in deregulated power markets. The increasing emphasis on carbon intensity reduction and grid optimization has made combined cycle systems attractive for both retrofits and greenfield projects.

Advancements in turbine inlet temperature control, HRSG (heat recovery steam generator) integration, and digital performance optimization have further widened their adoption. As nations prioritize resilient and flexible generation capacity, combined cycle systems remain a cornerstone of modern gas-based energy infrastructure.

The power generation gas turbine market has experienced considerable growth due to the global emphasis on efficient and flexible electricity production. Gas turbines have been widely adopted for their ability to provide rapid start-up, high power output, and relatively low emissions compared to traditional fossil fuel-based systems. They are employed across combined cycle power plants, peaking power units, and distributed generation setups to meet variable electricity demand. Technological advancements have improved turbine efficiency, reliability, and fuel flexibility, enabling the use of natural gas, hydrogen blends, and other fuels.

Improvements in aerodynamic blade design, materials science, and combustion technology have enhanced gas turbine thermal efficiency, allowing greater electricity generation from the same fuel quantity. The capability to operate on diverse fuels, including natural gas, synthetic gases, and emerging hydrogen blends, has increased turbine applicability in various regions. Fuel flexibility has also supported integration with renewable energy systems by providing backup and balancing power during intermittent supply. Combined cycle gas turbines (CCGT) have become popular for their superior efficiency by harnessing waste heat for additional power generation. These features have made gas turbines favorable for both baseload and peaking applications, encouraging utilities and independent power producers to invest in modern units that meet evolving energy policies.

The integration of advanced control systems, sensors, and digital monitoring has allowed operators to optimize gas turbine performance and predictive maintenance. Real-time data analytics have enabled rapid detection of performance deviations and potential faults, reducing downtime and extending equipment life. Remote operation capabilities have improved flexibility in managing power plant output according to grid demand fluctuations. The deployment of digital twins and AI-based optimization algorithms has further refined combustion stability and emissions control. These technologies have enhanced operational transparency, enabling compliance with environmental regulations and cost-efficient power generation. Smart grid initiatives and distributed energy resource management systems have leveraged gas turbines for fast-ramping support, contributing to grid stability amid increasing renewable penetration.

Stringent emission regulations targeting nitrogen oxides (NOx), carbon monoxide (CO), and greenhouse gases have compelled manufacturers to develop low-emission combustion systems and exhaust treatment technologies. Compliance with international standards such as those set by the International Maritime Organization (IMO) and local environmental authorities has increased development and operational costs. Fuel price volatility, particularly for natural gas, has affected operational economics, influencing investment decisions. The emergence of competitive technologies like battery energy storage and advanced combined heat and power (CHP) systems has introduced alternative options for grid balancing and decentralized power generation. Additionally, the transition toward decarbonization has pressured the market to incorporate renewable fuels and hybrid solutions to meet climate targets.

Rapid economic development and electrification efforts in Asia-Pacific, Latin America, and Africa have driven demand for reliable and efficient power generation technologies, boosting gas turbine installations. Governments have prioritized infrastructure upgrades and cleaner energy systems to support growing industrial and residential consumption. The adoption of hydrogen-ready turbines and modular designs suited for distributed generation has expanded market opportunities. Collaborations between turbine manufacturers, energy companies, and research institutions have accelerated innovation focused on sustainability and performance enhancements. Investment incentives and policies promoting low-carbon technologies are expected to stimulate market growth further. The evolving energy landscape, emphasizing flexibility, efficiency, and environmental compliance, positions gas turbines as a critical component of the future power generation mix globally.

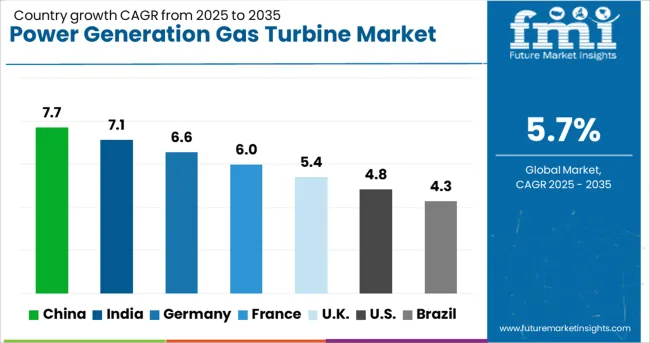

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The market is expected to grow at a CAGR of 5.7% from 2025 to 2035, driven by increasing demand for efficient and cleaner power generation technologies. China leads with a 7.7% CAGR, supported by expanding power infrastructure and investments in combined cycle plants. India follows at 7.1%, fueled by growing electricity demand and modernization of thermal power assets. Germany, growing at 6.6%, focuses on integrating advanced turbine technologies and emission control. The UK, with a 5.4% CAGR, benefits from upgrading aging power plants and transitioning to gas-based power. The USA, expanding at 4.8%, is influenced by power sector reforms and adoption of high-efficiency turbines. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 7.7% from 2025 to 2035 in the power generation gas turbine market, driven by investments in high-efficiency combined cycle power plants. Efforts to upgrade aging coal-fired plants with gas turbines aim to reduce emissions while meeting rising energy demand. Leading manufacturers such as Harbin Electric and Shanghai Electric are collaborating with global technology providers to introduce turbines with improved thermal efficiency and lower nitrogen oxide emissions. The market benefits from government incentives promoting cleaner energy and grid modernization projects.

India is expected to record a CAGR of 7.1% in the power generation gas turbine market, supported by expanding natural gas infrastructure and increasing demand for flexible power generation. Investment in combined cycle and open cycle gas turbine projects is accelerating in industrial and urban centers. Domestic manufacturers are partnering with international firms to deploy advanced turbine models optimized for local fuel quality. The government’s emphasis on cleaner energy and grid stability is fostering growth in this segment.

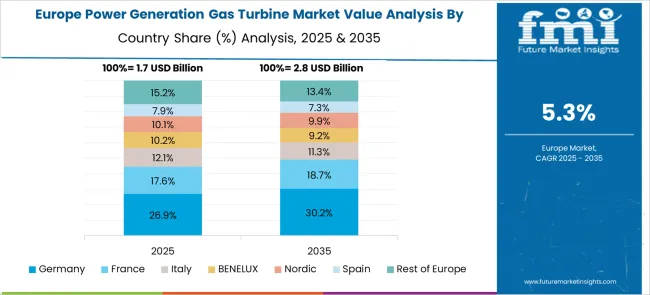

Germany is forecasted to grow at a CAGR of 6.6% in the power generation gas turbine market, focusing on integrating low-emission turbine technologies to meet strict environmental regulations. Combined heat and power plants incorporating gas turbines are gaining prominence for industrial and district heating applications. The market is supported by R&D efforts to improve turbine efficiency and reduce carbon footprints. Collaboration between turbine manufacturers and energy utilities is enhancing the adoption of smart monitoring systems.

The United Kingdom is anticipated to grow at a CAGR of 5.4% in the power generation gas turbine market, driven by demand for flexible and fast-start turbines to balance intermittent renewable energy sources. Gas turbine plants are increasingly utilized as peaking power stations to support grid reliability. Investments in turbine upgrades for enhanced efficiency and reduced emissions are ongoing. Collaboration with technology providers is facilitating implementation of digital diagnostics and predictive maintenance tools.

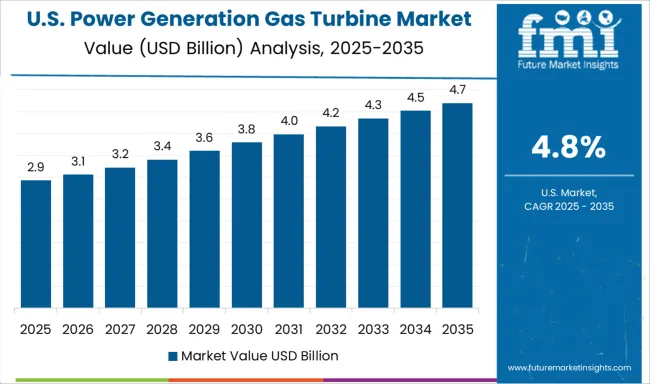

The United States is projected to grow at a CAGR of 4.8% in the power generation gas turbine market, with focus on adopting next-generation turbine designs offering higher efficiency and operational flexibility. The market is driven by demand for combined cycle plants and upgrades to existing power generation facilities. Innovations such as advanced blade cooling and combustion technologies are improving performance. Increasing integration of turbines with smart grid infrastructure supports operational optimization and emissions management.

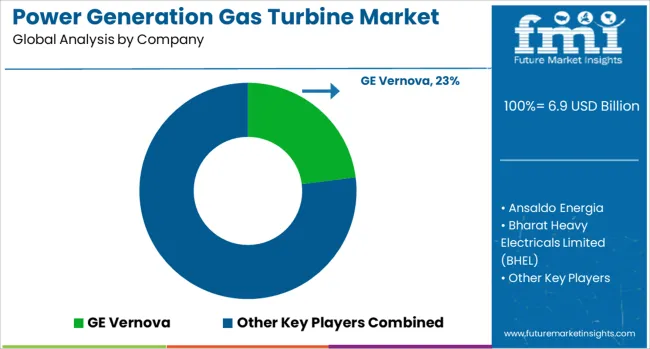

The market is critical to meeting global energy demand with efficient, flexible, and low-emission power solutions. These turbines are integral to combined cycle power plants, industrial cogeneration, and peak load management. Market dynamics are shaped by fuel flexibility, output efficiency, emission standards compliance, and the ability to integrate with renewable energy systems. The competitive field includes multinational manufacturers offering a range of turbines from small-scale industrial units to large utility-scale installations. GE Vernova and Siemens are dominant players delivering advanced gas turbines with high efficiency and low nitrogen oxide emissions, backed by extensive service networks. Mitsubishi Heavy Industries and Ansaldo Energia offer a diverse portfolio, including heavy-duty and aeroderivative models, optimized for combined cycle and simple cycle applications.

Rolls Royce and Kawasaki Heavy Industries focus on aeroderivative turbines, known for rapid start-up capabilities and high power-to-weight ratios. Bharat Heavy Electricals Limited (BHEL) and Harbin Electric serve emerging markets with cost-effective, reliable turbine systems tailored for local energy infrastructure needs. MAN Energy Solutions and Wärtsilä integrate gas turbines with hybrid power plants to support grid stability and renewable integration. Opra Turbines specializes in small-scale units suitable for decentralized power generation. JSC United Engine, Zorya-Mashproekt, and Flex Energy Solutions contribute niche technology and customized solutions. TotalEnergies enhances market presence through operational expertise and hybrid system development. Ongoing innovation focuses on improving thermal efficiency, reducing carbon footprints, and enabling hydrogen fuel compatibility, positioning these providers to address evolving energy transition challenges.

Key strategies in the Power Generation Gas Turbine Market concentrate on improving turbine efficiency and lowering emissions to comply with evolving environmental regulations. Industry players allocate resources to R&D for performance enhancement via advanced materials and innovative designs. Collaborations with technology firms facilitate the integration of digital monitoring and predictive maintenance systems. Expanding service capabilities and after-sales support help increase customer retention and maximize equipment longevity. Furthermore, focusing on emerging markets with rising energy needs supports market expansion. Together, these strategies drive operational excellence, regulatory compliance, and growth in the gas turbine industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.9 Billion |

| Capacity | > 70 MW to 200 MW, ≤ 30 MW to 70 MW, and > 200 MW |

| Product | Heavy Duty and Aero-Derivative |

| Technology | Combined Cycle and Open Cycle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GE Vernova, Ansaldo Energia, Bharat Heavy Electricals Limited (BHEL), Flex Energy Solutions, Harbin Electric, JSC United Engine, Kawasaki Heavy Industries, MAN Energy Solutions, Mitsubishi Heavy Industries, Opra Turbines, Rolls Royce, Siemens, Solar Turbines, TotalEnergies, Wärtsilä, and Zorya-Mashproekt |

| Additional Attributes | Dollar sales by turbine type and power capacity, demand dynamics across utility-scale power plants, industrial cogeneration, and distributed generation, regional trends in deployment across North America, Europe, and Asia-Pacific, innovation in combined cycle efficiency, fuel flexibility including hydrogen blending, and advanced materials for high-temperature operation, environmental impact of emissions, fuel consumption, and lifecycle carbon footprint, and emerging use cases in renewable hybrid power systems, microgrid integration, and offshore power generation. |

The global power generation gas turbine market is estimated to be valued at USD 6.9 billion in 2025.

The market size for the power generation gas turbine market is projected to reach USD 12.0 billion by 2035.

The power generation gas turbine market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in power generation gas turbine market are > 70 mw to 200 mw, ≤ 30 mw to 70 mw and > 200 mw.

In terms of product, heavy duty segment to command 61.0% share in the power generation gas turbine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steam Turbine For Power Generation Market

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Market - Size, Share, and Forecast 2025 to 2035

Power Generation Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Power Equipment Market Size and Share Forecast Outlook 2025 to 2035

Micro Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Low Power Next Generation Display Market

Aviation Gas Turbines Market

Multifuel Gas Turbine Market Growth – Trends & Forecast 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Turbine Market

Standby Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Blood Gas Monitors System Market

Waste Heat Power Generation Boiler Market Size and Share Forecast Outlook 2025 to 2035

Combined Cycle Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Aeroderivative Gas Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Process Plants Gas Turbine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA