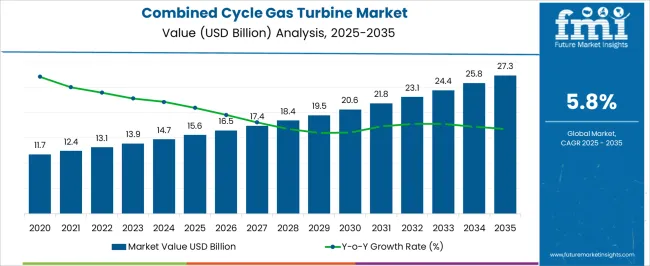

The combined cycle gas turbine market is estimated to be valued at USD 15.6 billion in 2025 and is projected to reach USD 27.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. This growth translates into an absolute dollar opportunity of USD 11.7 billion over the decade. Beginning at USD 11.7 billion in the early years, the market demonstrates steady expansion, reaching USD 20.6 billion by 2030. For companies in the energy and power generation sectors, this consistent growth offers substantial revenue potential, enabling strategic investments in manufacturing, supply chain, and deployment of gas turbine solutions to capture incremental market value effectively.

The absolute dollar opportunity from 2025 to 2035 emphasizes gradual but consistent annual gains, with the market moving from USD 15.6 billion to USD 27.3 billion over the decade. Incremental growth increases steadily from USD 16.5 billion in 2026 to USD 25.8 billion in 2034, culminating at USD 27.3 billion in 2035. This predictable expansion pattern allows businesses to plan production, partnerships, and market entry strategies with a focus on long-term returns. Capturing market share during this period can deliver significant absolute dollar value and strengthen positioning in the evolving CCGT market.

| Metric | Value |

|---|---|

| Combined Cycle Gas Turbine Market Estimated Value in (2025 E) | USD 15.6 billion |

| Combined Cycle Gas Turbine Market Forecast Value in (2035 F) | USD 27.3 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

A breakpoint analysis of the Combined Cycle Gas Turbine (CCGT) market highlights phases where growth accelerates and strategic focus is essential. From 2025 to 2028, the market grows from USD 15.6 billion to USD 16.5 billion, reflecting a modest early stage with annual increments of around USD 0.9 billion.

This period represents a low-risk phase where companies can establish a foothold, optimize production, and assess demand trends. Understanding this initial breakpoint allows businesses to allocate resources efficiently, plan partnerships, and build a foundation for capturing larger market opportunities as growth intensifies in the following years. The second breakpoint occurs between 2030 and 2035, when the market expands from USD 20.6 billion to USD 27.3 billion, showing higher annual increments averaging USD 1.2–1.5 billion.

This stage represents accelerated growth, offering substantial absolute dollar opportunity and making strategic positioning crucial. Companies scaling operations or entering the market at this point can secure meaningful market share and long-term revenue gains. Recognizing these breakpoints helps stakeholders optimize timing for investments, plan expansion strategies, and focus on capturing maximum value in the rapidly growing CCGT market.

The combined cycle gas turbine (CCGT) market is expanding steadily, driven by the increasing demand for high-efficiency power generation solutions and stricter global emission regulations. Industry reports and energy sector announcements have pointed to CCGT’s ability to deliver significantly higher thermal efficiency compared to conventional power generation methods, making it a preferred choice for both developed and emerging economies. Technological advancements in turbine design, materials, and cooling systems have improved operational performance, fuel flexibility, and lifecycle cost efficiency.

The shift toward natural gas as a transitional fuel in decarbonization strategies has further supported CCGT adoption, especially in regions phasing out coal-fired plants. Additionally, the growing integration of renewable energy sources into national grids has increased the need for flexible and responsive power generation systems, where CCGTs excel in balancing intermittent renewable supply.

Future market growth is expected to be reinforced by modernization projects, replacement of aging thermal plants, and infrastructure investments in natural gas transmission and storage networks.

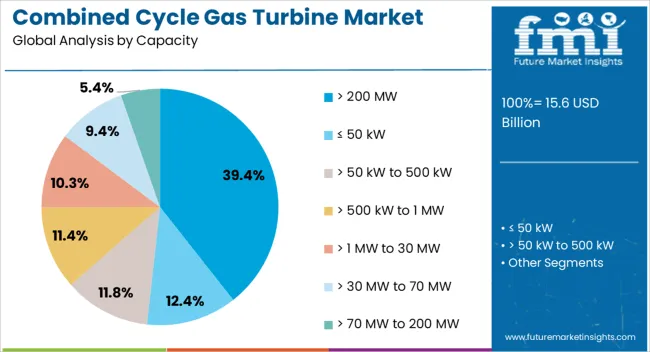

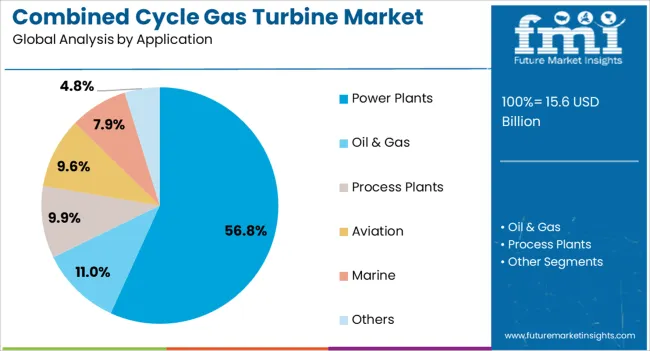

The combined cycle gas turbine market is segmented by capacity, application, and geographic regions. By capacity, combined cycle gas turbine market is divided into > 200 MW, ≤ 50 kW, > 50 kW to 500 kW, > 500 kW to 1 MW, > 1 MW to 30 MW, > 30 MW to 70 MW, and > 70 MW to 200 MW. In terms of application, combined cycle gas turbine market is classified into power plants, oil & gas, process plants, aviation, marine, and others. Regionally, the industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The > 200 MW capacity segment is projected to hold 39.4% of the combined cycle gas turbine market revenue in 2025, reflecting strong demand for large-scale power generation units. Growth in this segment has been driven by its suitability for utility-scale operations, where high output and efficiency are critical to meeting base-load electricity demand. Energy sector data has shown that turbines in this capacity range can achieve optimal fuel utilization, lower per-unit generation costs, and enhanced reliability, making them attractive for national grid operators. Furthermore, infrastructure investments in regions with rapidly growing electricity consumption, particularly in Asia-Pacific and the Middle East, have favored the deployment of high-capacity CCGTs. Their ability to integrate with advanced heat recovery steam generators (HRSGs) for combined cycle operation enhances overall efficiency, supporting their continued preference in large power projects. This capacity range is expected to remain a core segment as governments and utilities prioritize energy security and grid stability.

The power plants segment is projected to contribute 56.8% of the combined cycle gas turbine market revenue in 2025, underscoring its role as the primary application for CCGT technology. This dominance is driven by the increasing replacement of older, less efficient thermal power plants with modern CCGT facilities capable of meeting both efficiency and environmental standards. Power plant operators have favored CCGTs for their ability to deliver high-capacity output while reducing emissions of CO₂, NOx, and particulates. Additionally, their operational flexibility allows them to ramp up or down quickly, complementing renewable energy sources and stabilizing grid operations. Reports from energy utilities have indicated that long-term cost savings, fuel efficiency, and reduced maintenance downtime are major factors influencing adoption. As national energy policies continue to target lower carbon intensity in power generation, the use of CCGTs in power plants is expected to expand further, supported by both public and private investment in advanced gas-based generation infrastructure.

The combined cycle gas turbine market is growing as global energy demand rises and the focus on efficient, low-emission power generation increases. CCGT systems integrate gas and steam turbines to produce electricity with higher efficiency and lower carbon emissions compared to conventional single-cycle plants. Rising demand for reliable base-load and flexible power generation in utilities, industrial facilities, and independent power producers drives adoption. Manufacturers offering high-efficiency, modular, and grid-compatible CCGT systems with advanced control technologies gain competitive advantages. Additionally, increasing investments in natural gas infrastructure, power plant modernization, and hybrid renewable integration support market expansion. Global emphasis on energy transition, decarbonization, and regulatory incentives for cleaner energy technologies further reinforce the growth of the CCGT market.

Market growth is restrained by the high capital costs and operational complexity of combined cycle gas turbines. CCGT plants require substantial upfront investment for turbines, heat recovery steam generators, and balance-of-plant systems. Integration with existing grids, combined heat and power systems, or renewable energy sources adds design and engineering complexity. Skilled operators are essential for efficient plant performance, including load-following and maintenance optimization. Long project development timelines, regulatory permitting, and financing constraints further increase barriers for new entrants. Additionally, operational challenges such as thermal cycling, start-stop efficiency losses, and maintenance of high-temperature components can impact plant reliability. Until capital costs decline and operational complexity is simplified through modular and standardized solutions, market adoption may remain concentrated among large-scale power producers.

Market trends are driven by technological innovation, advanced materials, and digital optimization in combined cycle gas turbines. High-efficiency turbines, improved combustion systems, and advanced heat recovery steam generators increase plant efficiency and reduce fuel consumption and emissions. Additive manufacturing and advanced alloys extend component lifespan and enable higher operating temperatures. Digital twin technologies, predictive maintenance, and IoT-enabled monitoring optimize performance, reduce downtime, and enhance lifecycle management. Integration with renewable energy sources, battery storage, and smart grid systems supports flexible and sustainable power generation. These technological advancements highlight the importance of efficiency, sustainability, and digital intelligence in shaping global CCGT adoption across utilities, industrial, and independent power generation sectors.

Opportunities in the combined cycle gas turbine market are driven by rising global electricity demand, industrial growth, and the transition toward cleaner fuels. Natural gas is increasingly adopted as a bridge fuel for energy transition due to lower carbon emissions compared to coal and oil. Expanding energy infrastructure in emerging economies, grid modernization initiatives, and government incentives for low-emission power generation boost demand for CCGT systems. Manufacturers offering modular, flexible, and high-efficiency solutions can capture new projects in both base-load and peak-load applications. Additionally, hybrid systems combining CCGT with renewables, such as solar or wind, present growth opportunities by enhancing grid stability and reducing carbon intensity. Long-term prospects remain strong amid the global push for sustainable and reliable power.

Market growth is restrained by intense competition, fuel price volatility, and regulatory compliance challenges. Multiple global turbine manufacturers compete on price, efficiency, and technology, impacting margins and market share. Fluctuations in natural gas prices can affect operating costs and investment decisions for new projects. Environmental regulations, emission limits, and permitting requirements vary across regions, adding compliance complexity and potential delays. Long payback periods and financing challenges can deter smaller or resource-constrained developers. Until fuel supply stability improves and regulatory frameworks are streamlined, adoption may remain concentrated among large utilities, industrial operators, and regions with supportive policy incentives for cleaner energy generation technologies.

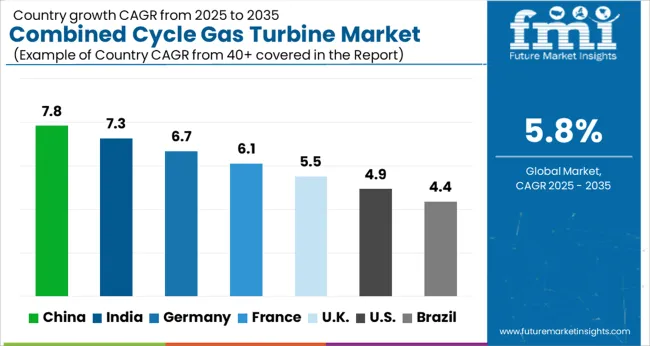

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

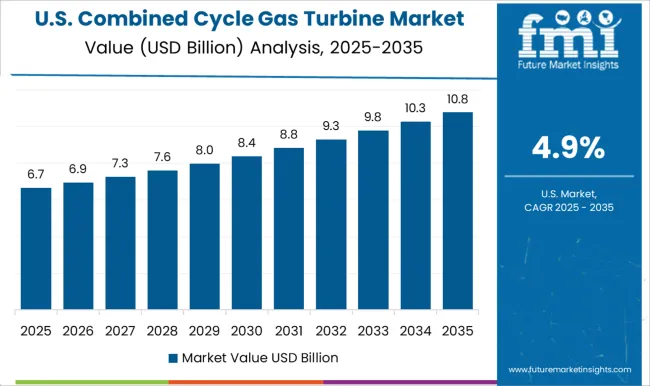

| USA | 4.9% |

| Brazil | 4.4% |

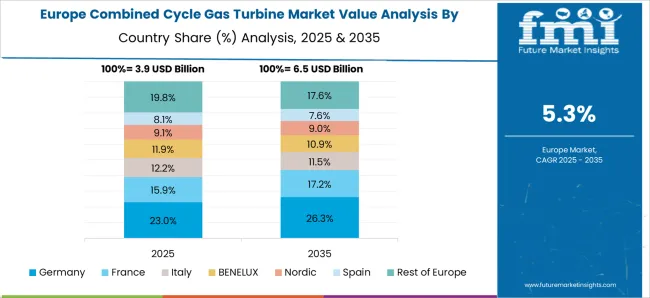

The global combined cycle gas turbine (CCGT) market was projected to grow at a 5.8% CAGR through 2035, driven by demand in power generation, industrial facilities, and utility projects. Among BRICS nations, China recorded 7.8% growth as large-scale manufacturing and deployment projects were executed and compliance with energy and safety standards was enforced, while India at 7.3% growth saw expansion of production facilities to support rising regional electricity demand. In the OECD region, Germany at 6.7% maintained substantial output under strict energy and industrial regulations, while the United Kingdom at 5.5% relied on moderate-scale operations for utility and industrial installations. The USA, expanding at 4.9%, remained a mature market with steady demand in power generation, supported by adherence to federal and state-level energy and safety regulations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Combined cycle gas turbine market in China is expanding at a CAGR of 7.8%, driven by rapid industrialization and increasing energy demand. The government is promoting cleaner energy solutions, encouraging utilities to adopt high efficiency gas turbines to reduce carbon emissions. Investment in natural gas infrastructure and power generation capacity supports the deployment of CCGT plants. Domestic manufacturers are improving turbine efficiency and reliability while reducing operational costs. Integration with smart grid technology and combined heat and power systems enhances energy utilization. Rising electricity demand in urban and industrial areas is driving adoption, while policies favoring natural gas over coal strengthen market growth. Research and development in advanced turbine designs further positions China as a leading market in Asia for combined cycle gas turbines.

Combined cycle gas turbine market in India is growing at a CAGR of 7.3%, supported by increasing electricity demand and government initiatives for cleaner power generation. Natural gas based power plants are encouraged to reduce reliance on coal and lower carbon emissions. Manufacturers and utilities are investing in high efficiency turbines with improved reliability and lower operating costs. Industrial sectors and urban centers are driving demand for stable and continuous electricity supply. Combined heat and power applications further enhance energy utilization. Policies promoting natural gas expansion, infrastructure development, and private investment create favorable market conditions. Research and development in turbine technology and operational optimization continues to support long term growth in the Indian combined cycle gas turbine market.

Combined cycle gas turbine market in Germany is growing at a CAGR of 6.7%, supported by energy transition policies and increasing focus on reducing carbon emissions. Utilities are investing in high efficiency gas turbines to complement renewable energy sources and provide flexible power generation. Integration with combined heat and power systems enhances overall energy utilization. Domestic manufacturers focus on improving turbine efficiency, reliability, and compliance with strict European emission standards. Demand for gas turbines is supported by the need for stable electricity supply in industrial and urban areas. Research and development in advanced turbine designs and digital monitoring improves performance and reduces operational costs. Germany market growth reflects the combination of energy policy support, advanced technology adoption, and industrial energy demand.

Combined cycle gas turbine market in the United Kingdom is expanding at a CAGR of 5.5%, supported by growing electricity demand and government policies favoring cleaner energy sources. Utilities are investing in high efficiency gas turbines to reduce carbon emissions and supplement renewable energy production. Deployment focuses on stable, flexible, and reliable power supply for industrial and urban centers. Advanced turbine designs and digital monitoring systems improve operational efficiency and reduce maintenance costs. Integration with combined heat and power applications enhances energy utilization. Government initiatives promoting natural gas infrastructure and private investment create favorable conditions for growth. The United Kingdom market demonstrates gradual adoption of CCGT technology driven by policy support, industrial electricity demand, and efficiency improvements.

Combined cycle gas turbine market in the United States is growing at a CAGR of 4.9%, driven by modernization of power generation infrastructure and demand for cleaner energy. Utilities are adopting high efficiency gas turbines to replace aging coal plants and integrate with renewable energy sources. Combined heat and power systems are utilized in industrial sectors to improve energy efficiency. Domestic manufacturers focus on reliability, operational optimization, and emissions compliance. Regulatory frameworks encourage natural gas based electricity generation to reduce environmental impact. Investments in digital monitoring, predictive maintenance, and advanced turbine designs enhance performance and reduce downtime. The market growth reflects stable electricity demand, technological innovation, and government support for cleaner energy in the United States.

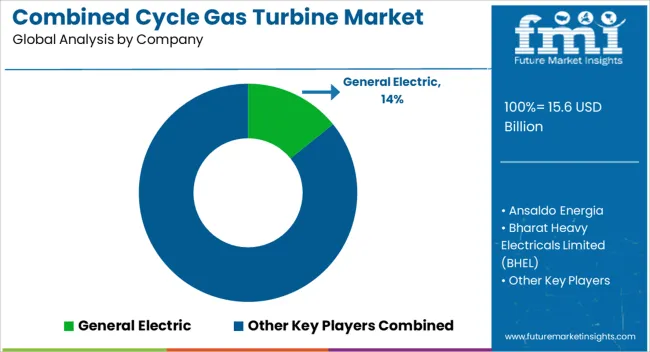

The combined cycle gas turbine market is supplied by General Electric, Ansaldo Energia, Bharat Heavy Electricals Limited (BHEL), Doosan, Harbin Electric Corporation Co., Ltd., Kawasaki Heavy Industries, Ltd., MAN Energy Solutions, Mitsubishi Heavy Industries Ltd., Opra Turbines, Rolls Royce PLC, Siemens, Solar Turbines Incorporated, UEC-Saturn, VERICOR, Wartsila, and Zorya-Mashproekt, with competition shaped by efficiency, modularity, and operational reliability.

GE and Siemens brochures highlight turbines with high thermal efficiency, flexible operation ranges, and fast startup times. BHEL and Ansaldo Energia emphasize power output capacity, emission control, and grid compatibility, providing datasheets with heat rate curves, NOx emission levels, and load-following capabilities. Mitsubishi and Kawasaki feature turbines optimized for large-scale utility and industrial plants, with documentation specifying rated output, operational flexibility, and auxiliary system integration. Observed industry patterns indicate rising demand for turbines that combine fuel efficiency with reduced environmental impact and integration into hybrid power systems.

Market strategies focus on differentiating through efficiency, modular construction, and service support. GE and Siemens invest in high-efficiency blade and combustion chamber technologies to maximize output while minimizing fuel consumption. Rolls Royce and other companies target smaller-scale distributed generation with compact turbines suitable for industrial and decentralized applications. BHEL, Harbin Electric, and MAN Energy Solutions emphasize long-term service agreements, predictive maintenance, and global installation support. Observed trends indicate suppliers are increasingly integrating digital monitoring, remote diagnostics, and flexible fuel operation to improve reliability and reduce downtime.

VERICOR and Opra Turbines focus on specialized applications such as offshore power generation and combined heat and power (CHP) systems. Product brochures and technical datasheets communicate critical specifications including rated output, heat rate, fuel type, startup time, emissions, and operational limits. Siemens and GE provide detailed performance curves, efficiency maps, and auxiliary system requirements, while Mitsubishi and Kawasaki emphasize durability and load-following capabilities. BHEL and Ansaldo Energia include maintenance schedules, lubrication requirements, and vibration tolerance data. Solar Turbines, VERICOR, and Opra offer technical documentation for compact, modular turbines with high operational flexibility. Clear technical information enables engineers, plant operators, and project developers to assess suitability, ensuring adoption based on verified efficiency, reliability, and compliance with regional grid and emission standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.6 billion |

| Capacity | > 200 MW, ≤ 50 kW, > 50 kW to 500 kW, > 500 kW to 1 MW, > 1 MW to 30 MW, > 30 MW to 70 MW, and > 70 MW to 200 MW |

| Application | Power Plants, Oil & Gas, Process Plants, Aviation, Marine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Electric, Ansaldo Energia, Bharat Heavy Electricals Limited (BHEL), Doosan, Harbin Electric Corporation Co., Ltd., Kawasaki Heavy Industries, Ltd., MAN Energy Solutions, Mitsubishi Heavy Industries Ltd., Opra Turbines, Rolls Royce PLC, Siemens, Solar Turbines Incorporated, UEC-Saturn, VERICOR, Wartsila, and Zorya-Mashproekt |

| Additional Attributes | Dollar sales vary by turbine type, including single-shaft and multi-shaft CCGTs; by application, such as power generation, industrial cogeneration, and district heating; by end-use industry, spanning utilities, industrial facilities, and independent power producers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising electricity demand, renewable energy integration, and the need for high-efficiency, low-emission power solutions. |

The global combined cycle gas turbine market is estimated to be valued at USD 15.6 billion in 2025.

The market size for the combined cycle gas turbine market is projected to reach USD 27.3 billion by 2035.

The combined cycle gas turbine market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in combined cycle gas turbine market are > 200 mw, ≤ 50 kw, > 50 kw to 500 kw, > 500 kw to 1 mw, > 1 mw to 30 mw, > 30 mw to 70 mw and > 70 mw to 200 mw.

In terms of application, power plants segment to command 56.8% share in the combined cycle gas turbine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Combined Charging System Market Size and Share Forecast Outlook 2025 to 2035

Combined Cooling Heat and Power Plant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Combined Heat and Power (CHP) Systems Market Growth - Trends & Forecast 2025 to 2035

Combined Cycle Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Recombined Milk Market

Micro Combined Heat and Power Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Crankset Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Drivetrain Cassette Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Frames Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Upcycled Pet Ingredients Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Pipes Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Saddle Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Electronic Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Device Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA