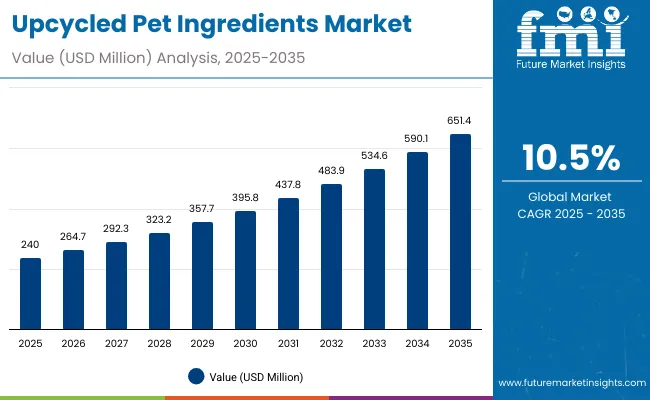

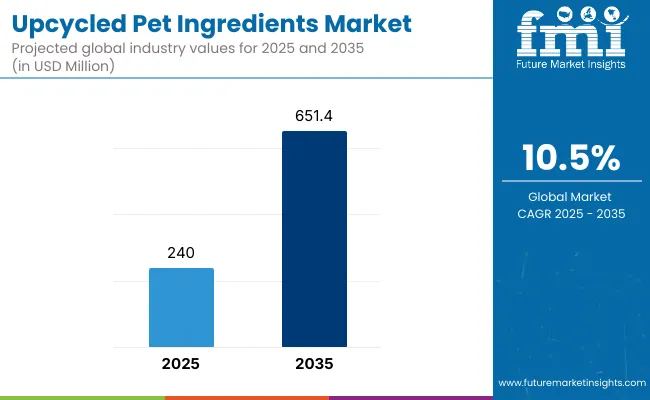

The upcycled pet ingredients market is projected to be valued at USD 240 million in 2025, expanding to USD 651.4 million in 2035, reflecting an absolute increase of USD 411.4 million over the assessment period. This expansion represents a 10.5% CAGR, resulting in nearly a 2.7X increase in overall market size within the decade.

Upcycled Pet Ingredients Key Takeaways

| Metric | Value |

|---|---|

| Upcycled Pet Ingredients Estimated Value in (2025E) | USD 240.0 million |

| Upcycled Pet Ingredients Forecast Value in (2035F) | USD 651.4 million |

| Forecast CAGR (2025 to 2035) | 10.5% |

During the first half of the forecast horizon (2025 to 2030), the market is anticipated to expand from USD 240 million to approximately USD 395.8 million, generating USD 155.8 million in incremental revenue, equivalent to nearly 38% of the decade’s total growth. This phase is expected to be characterized by steady mainstreaming of upcycled proteins, fibers, and oils in pet food formulations, supported by greater alignment with sustainability narratives and increasing acceptance among premium product categories. Market adoption is likely to be driven by regulatory incentives and stronger partnerships between food processors and pet nutrition companies.

In the second phase (2030 to 2035), the market is forecasted to accelerate significantly, adding USD 255.6 million, which represents 62% of the decade’s growth. Expansion is expected to be catalyzed by advancements in upcycling technologies, stronger consumer trust in circular economy models, and integration of functional health benefits into ingredient positioning. By 2035, demand for high-value formulations and transparency-driven labeling is projected to elevate market appeal, positioning upcycled pet ingredients as a mainstream growth pillar within the global pet nutrition industry.

From 2020 to 2024, the upcycled pet ingredients market expanded from a niche sustainability-driven concept into a structured commercial category, supported by increasing adoption of circular economy practices. During this period, global leaders such as Darling Ingredients and SARIA Group consolidated share through acquisitions, broad rendering networks, and sustainability certifications. Competitive positioning was determined by raw material access, processing innovation, and integration into global pet food supply chains.

By 2025, demand is expected to reach USD 240 million, with revenue distribution led by dry pet food and treats. The decade ahead will witness a structural shift toward premiumization, functional additives, and supplements, with faster growth in Asia-Pacific and Europe. Competitive differentiation is projected to move from scale and feedstock control toward traceability, ESG compliance, and innovation in functional formulations, enabling recurring partnerships with leading pet food manufacturers.

Growth in the upcycled pet ingredients market is being propelled by rising awareness of sustainability and the circular economy in pet nutrition. Increasing emphasis on waste valorization within food supply chains is being translated into viable ingredient opportunities, positioning by-products as value-added resources rather than liabilities. Consumer demand for transparency and eco-conscious purchasing is being reflected in the acceptance of upcycled inputs across premium pet food segments. Regulatory encouragement of sustainable sourcing practices is also being anticipated to reinforce adoption over the coming decade.

Innovation in processing technologies is being recognized as a catalyst for enhancing safety, palatability, and nutrient retention, allowing broader integration into diverse pet food formats. Partnerships between food processors and pet nutrition manufacturers are being leveraged to secure consistent supply streams, ensuring scalability. With sustainability commitments becoming non-negotiable, the adoption of upcycled ingredients is being forecasted to accelerate as a strategic response to industry and consumer expectations.

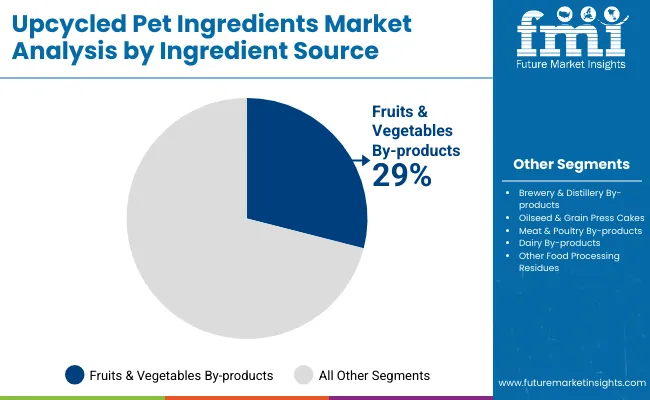

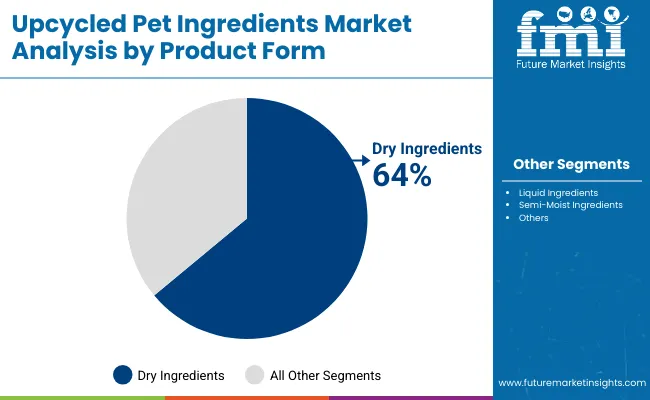

The upcycled pet ingredients market has been segmented across multiple strategic dimensions to reflect evolving consumer preferences and sustainability drivers. Key segmentation has been performed by ingredient source, ingredient type, product form, and end-use application. Ingredient sources include fruits and vegetables, brewery residues, oilseed cakes, meat and poultry by-products, dairy-by products, and other food processing residues, each offering distinct nutritional and functional benefits. Ingredient types are classified into proteins, fibers, fats, starches carbohydrates, mineral & micronutrients, and functional blends to highlight diverse formulation roles. Product forms are differentiated as dry, liquid, and semi-moist, depending on stability and application suitability. End-use applications encompass kibble, wet food, treats, and supplements, ensuring comprehensive coverage of growth opportunities across the global pet nutrition industry.

| Ingredient Source Segment | Market Value Share, 2025 |

|---|---|

| Fruits & Vegetables By-products (pomace, peels, pulps) | 29% |

| Brewery & Distillery By-products (spent grains, yeast) | 24% |

The ingredient source landscape is projected to be dominated by fruits and vegetable by-products, which account for 29% of the 2025 market value. Their prevalence is being reinforced by abundant availability, nutritional richness, and consumer alignment with plant-forward pet food formulations. Brewery and distillery by-products follow closely, benefitting from consistent supply streams and protein density. Growth within oilseed cakes, dairy, and meat by-products is anticipated to accelerate as sustainability frameworks integrate circular economy models more firmly into pet nutrition. Over the next decade, ingredient diversification is expected to deepen as functional blends from multiple sources are innovated. The emphasis on valorizing underutilized streams is projected to expand the scope of both plant- and animal-based upcycled inputs.

| Product Form | 2025 Share% |

|---|---|

| Dry Ingredients | 64% |

| Liquid Ingredients | 22% |

| Semi-Moist Ingredients | 15% |

The product form outlook reveals a clear dominance of dry ingredients, which account for 64% of the 2025 market value. Their stronghold is being attributed to cost-efficiency, ease of storage, and flexibility across kibble and treat formulations. Liquid ingredients are projected to register faster growth, supported by their integration into functional blends, oils, and hydrolysates that enhance palatability and nutritional absorption. Semi-moist formats are anticipated to rise as consumer interest in fresh and minimally processed offerings strengthens. The decade is expected to witness increased innovation in hybrid formats that combine stability of dry forms with functional benefits of liquids and semi-moist options. This progression is projected to support diversification across pet food and supplement categories globally.

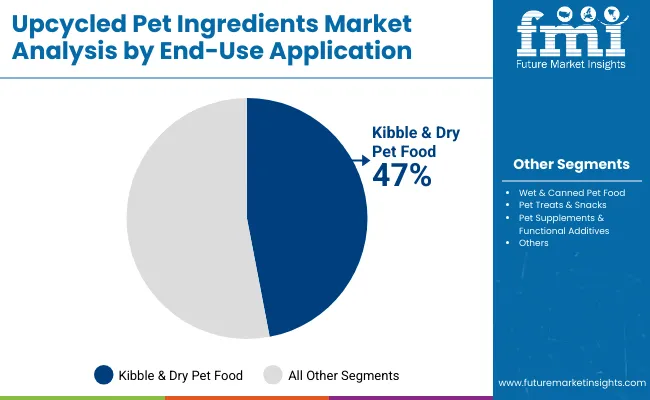

| End-Use Application | 2025 Share% |

|---|---|

| Kibble & Dry Pet Food | 47% |

| Wet & Canned Pet Food | 23% |

| Pet Treats & Snacks | 19% |

The end-use application outlook indicates that kibble and dry pet food will dominate with 47% of 2025 market revenues. Adoption in this segment is being supported by high-volume consumption patterns and the suitability of dry formulations for integrating protein-rich meals, fibers, and oils. Wet and canned formats are anticipated to expand steadily, leveraging their compatibility with semi-moist and liquid by-products. Pet treats and snacks are forecasted to provide agile growth avenues, driven by rising demand for natural, sustainable indulgence options. Supplements and functional additives are projected to achieve above-average growth rates, supported by consumer preferences for targeted health benefits. Over the decade, the expansion of upcycled inputs into supplements is expected to reshape premium positioning across the category.

Rising concerns around waste reduction and sustainable sourcing are reshaping ingredient strategies, even as supply variability and cost barriers challenge broader integration of upcycled inputs into pet food and supplements.

Growing Alignment with Circular Economy and Sustainability Goals

Market growth is being reinforced by the increasing alignment of pet food production with global sustainability commitments and circular economy models. Food and beverage by-products that previously represented disposal costs are now being revalorized into high-quality inputs for pet nutrition. This dynamic is being strengthened by policy incentives, consumer demand for eco-conscious choices, and corporate ESG frameworks that prioritize waste minimization. As transparency becomes a defining factor in brand trust, upcycled pet ingredients are expected to gain further acceptance as a visible proof point of sustainability action. Over the forecast period, the ability to communicate carbon reduction and resource efficiency through ingredient selection is projected to act as a catalyst for mainstream adoption across diverse product categories.

Supply Chain Variability and Standardization Challenges

Despite positive momentum, growth potential is being constrained by the variability of supply chains for upcycled ingredients. Availability and consistency are being influenced by agricultural cycles, brewery output, or meat processing volumes, resulting in fluctuating ingredient quality and reliability. Manufacturers face challenges in achieving standardized nutrient profiles, which complicates product formulation and regulatory compliance. The absence of harmonized guidelines for upcycled certification in some markets is further delaying adoption, as consumer and industry stakeholders demand assurance of safety and authenticity. Without predictable supply chains and robust quality assurance mechanisms, scalability of the category may be hindered. Addressing these limitations through strategic partnerships, traceability systems, and technology-led processing innovation is being recognized as essential for unlocking the full market potential.

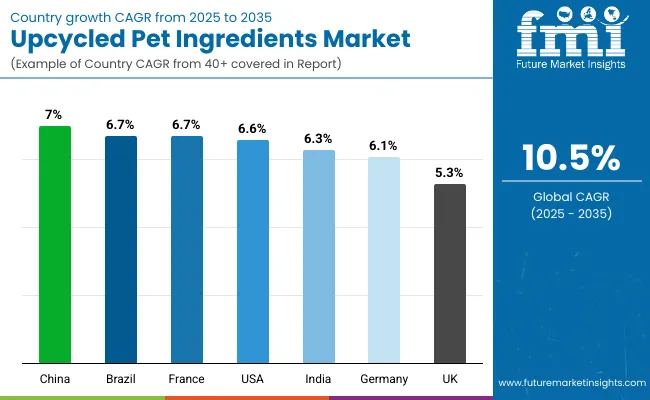

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

| India | 6.3% |

| Germany | 6.1% |

| France | 6.7% |

| UK | 5.3% |

| USA | 6.6% |

| Brazil | 6.9% |

The global upcycled pet ingredients market is expected to reflect significant country-level variations in adoption, shaped by regulatory landscapes, consumer behavior, and resource availability. In Asia, China is projected to expand at a 7.1% CAGR, supported by abundant access to agricultural and food processing by-products, along with strong government backing for circular economy initiatives. India’s growth, forecasted at 5.3%, is being reinforced by a rising organized pet food industry and gradual integration of sustainability-driven product positioning.

In Europe, Germany (6.1%), France (6.7%), and the UK (5.3%) are expected to remain central growth hubs, influenced by strict sustainability frameworks, pet humanization trends, and the presence of leading manufacturers with established supply partnerships. Regulatory pressure for food waste reduction is being translated into consistent investment in upcycled ingredient utilization across pet nutrition categories.

North America, led by the United States at 6.6%, is anticipated to demonstrate steady expansion, driven by consumer demand for premium and eco-conscious products and strong participation from established rendering companies. Brazil, with a 6.9% CAGR, is projected to emerge as a Latin American growth leader, benefiting from robust livestock and oilseed processing sectors that ensure consistent feedstock availability.

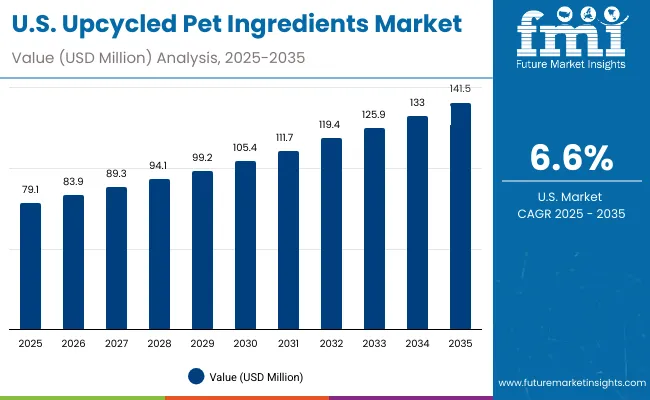

| Year | USA Upcycled Pet Ingredients Market (USD Million) |

|---|---|

| 2025 | 79.1 |

| 2026 | 83.8 |

| 2027 | 89.3 |

| 2028 | 94.7 |

| 2029 | 101.2 |

| 2030 | 107.3 |

| 2031 | 114.7 |

| 2032 | 122.4 |

| 2033 | 128.7 |

| 2034 | 136.7 |

| 2035 | 144.9 |

The upcycled pet ingredients market in the United States is projected to grow from USD 79.1 million in 2025 to USD 144.9 million by 2035, reflecting steady expansion at a CAGR of 6.6%. Growth is being reinforced by strong consumer awareness of sustainability, rising adoption of premium pet food, and the presence of established rendering and recycling infrastructure. Mainstream pet food brands are increasingly incorporating upcycled proteins, fibers, and oils to align with consumer demand for eco-conscious formulations.

Opportunities are expected to arise from functional positioning of upcycled ingredients, particularly in digestive health, joint support, and weight management. Partnerships between food processors and pet food manufacturers are being leveraged to secure consistent raw material streams. Regulatory support for food waste reduction is also anticipated to strengthen market penetration.

The upcycled pet ingredients market in the UK is projected to expand steadily at a CAGR of 5.3% through 2035. Growth is being influenced by heightened consumer demand for eco-conscious products, alongside government targets for food waste reduction. Premium pet food manufacturers are integrating proteins and fibers from brewery by-products and vegetable residues, aligning with rising sustainability narratives. Established retail chains are increasingly featuring eco-labeled pet food brands, enhancing visibility and consumer acceptance. Despite slower growth compared to continental Europe, the UK’s innovation-driven food sector is expected to sustain long-term adoption.

The upcycled pet ingredients market in India is forecasted to expand at a CAGR of 6.3% between 2025 and 2035. Growth is being driven by rapid urbanization, rising pet adoption, and the expansion of organized retail channels. Abundant availability of oilseed press cakes and fruit residues is supporting cost-effective ingredient sourcing. However, variability in raw material consistency and limited consumer awareness of upcycled claims remain challenges. Increasing entry of multinational pet food brands and government interest in waste valorization are expected to create favorable conditions for market penetration. By the end of the forecast period, premium pet nutrition incorporating upcycled blends is projected to gain stronger traction in metropolitan centers.

The upcycled pet ingredients market in China is projected to grow at a CAGR of 7.1%, marking the fastest expansion among major economies. This growth is being supported by large-scale agricultural and food processing industries that provide abundant by-product streams. Consumer adoption of sustainable pet food is being reinforced by government emphasis on circular economy models. Urban pet owners are showing strong willingness to adopt eco-conscious formulations, particularly in premium pet nutrition segments. Domestic manufacturers are actively investing in traceability and processing innovation to ensure global competitiveness. China’s position as both a major consumer and exporter of pet food products is expected to further strengthen market expansion.

China’s dual emphasis on food safety and health positioning is expected to support widespread biotic flavor adoption across F&B, pharma, and nutraceutical sectors.

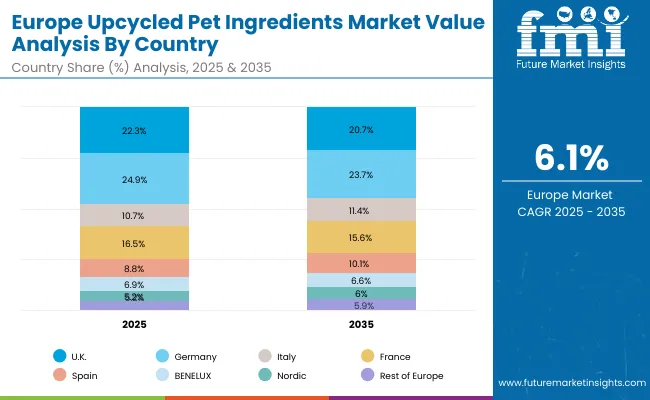

| Country | 2025 |

|---|---|

| UK | 22.3% |

| Germany | 24.9% |

| Italy | 10.7% |

| France | 16.5% |

| Spain | 8.8% |

| BENELUX | 6.9% |

| Nordic | 5.2% |

| Rest of Europe | 4.7% |

| Country | 2035 |

|---|---|

| UK | 20.7% |

| Germany | 23.7% |

| Italy | 11.4% |

| France | 15.6% |

| Spain | 10.1% |

| BENELUX | 6.6% |

| Nordic | 6.0% |

| Rest of Europe | 5.9% |

Germany’s upcycled pet ingredients market is anticipated to expand at a CAGR of 6.1% through 2035, maintaining its position as a European leader. Growth is being underpinned by stringent regulations on food waste reduction and the high penetration of sustainability-driven consumer preferences. Meat and poultry by-products, as well as dairy residues, are being increasingly valorized into protein-rich inputs for premium pet food. Established partnerships between food processors and pet nutrition companies are ensuring supply chain stability. Germany’s advanced R&D ecosystem is fostering innovation in processing technologies, supporting the creation of functional blends. By the end of the forecast horizon, the German market is expected to remain a benchmark for sustainable pet food practices in Europe.

| Ingredient Source | 2025 Share% |

|---|---|

| Fruits & Vegetables By-products (pomace, peels, pulps) | 29% |

| Brewery & Distillery By-products (spent grains, yeast) | 24% |

| Oilseed & Grain Press Cakes (soybean meal, sunflower cake) | 17% |

| Meat & Poultry By-products (rendered meals, organs, fats) | 14% |

| Dairy By-products (whey, casein, lactose) | 9% |

| Other Food Processing Residues (eggshells, root vegetable starches) | 7% |

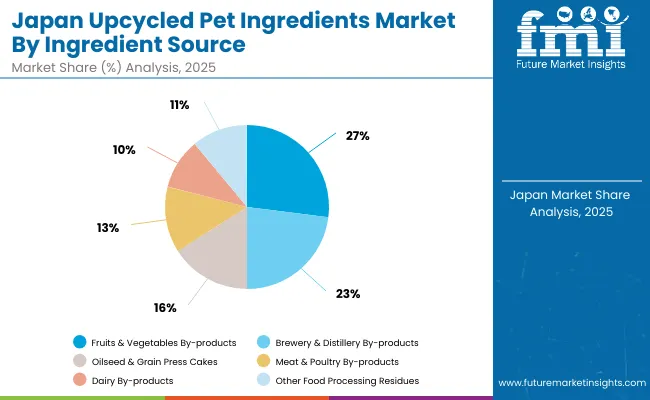

The upcycled pet ingredients market in Japan is projected at USD 9.83 million in 2025, with fruits and vegetable by-products contributing 29% and brewery residues accounting for 24%. This distribution highlights Japan’s reliance on plant-based and fermentation-derived sources, reflecting consumer trust in natural and sustainable formulations. Growth is being accelerated by regulatory emphasis on food waste reduction and strong consumer preference for transparency in sourcing.

A shift toward diversified sources such as dairy residues (9%) and other food processing by-products (7%) is being observed, signaling expanding acceptance of novel inputs. Functional blends leveraging oilseed cakes and meat-derived proteins are expected to gain traction, especially in premium pet nutrition lines. Over the forecast horizon, adoption is anticipated to be supported by Japan’s advanced processing technologies, which ensure nutrient consistency and safety. Integration of traceability platforms and AI-enabled quality monitoring is likely to strengthen consumer confidence, positioning Japan as a high-value market in Asia.

| End-Use Application | Market Value Share, 2025 |

|---|---|

| Kibble & Dry Pet Food | 46% |

| Wet & Canned Pet Food | 22% |

| Pet Treats & Snacks | 18% |

| Pet Supplements & Functional Additives | 13% |

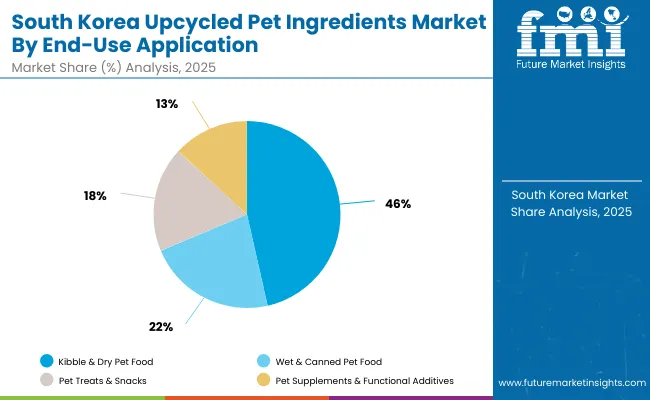

The upcycled pet ingredients market in South Korea is projected at USD 5.62 million in 2025, with kibble and dry pet food contributing 46% of demand. This dominance is being supported by strong consumer reliance on packaged dry formats, which provide convenience and affordability. Wet and canned pet food, representing 22%, is expected to expand steadily, benefiting from rising demand for premiumization and freshness in urban households.

Pet treats and snacks, holding an 18% share, are forecasted to achieve faster growth, reinforced by consumer interest in natural and functional indulgence options. Supplements and functional additives, at 13%, are anticipated to record the highest CAGR at 9.9%, reflecting South Korea’s advanced pet healthcare culture and demand for tailored nutrition. Over the decade, integration of upcycled proteins, fibers, and oils into functional applications is expected to position South Korea as a high-value innovation hub within Asia.

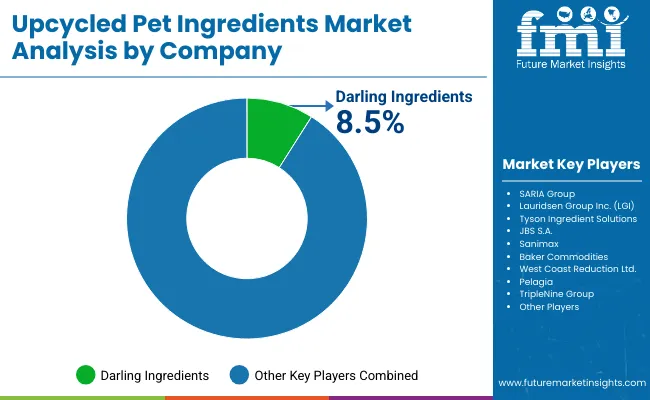

| Company | Global Value Share 2025 |

|---|---|

| Darling Ingredients | 8. 5% |

| Others | 91 .5% |

The upcycled pet ingredients market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across sourcing, processing, and distribution channels. Global rendering and by-product leaders such as Darling Ingredients (US), SARIA Group (Germany), and Lauridsen Group Inc. (US) hold significant market share, driven by expansive collection networks, established processing expertise, and integration with global pet food manufacturers. Their strategies are being directed toward sustainability certifications, traceability systems, and expansion into functional blends.

Established players such as Tyson Foods – Tyson Ingredient Solutions (US), JBS S.A. (Brazil), and Sanimax (Canada/US) are catering to the rising demand for protein meals, oils, and organ-based inputs. These companies are being positioned as critical suppliers to both multinational and regional pet food processors, leveraging scale advantages and vertical integration within meat and poultry industries.

Specialized providers, including Baker Commodities (US), West Coast Reduction Ltd. (Canada), Pelagia (Norway), and TripleNine Group, are focusing on marine, dairy, and niche by-products to meet functional requirements. Their strength lies in customization and alignment with regional regulatory frameworks rather than global scale.

Competitive differentiation is shifting from basic supply capabilities toward innovation in upcycling technologies, functional positioning, and partnerships with pet food brands. Greater emphasis on transparency, ESG alignment, and premium-grade formulations is expected to shape competitive advantage over the coming decade.

Key Developments in Upcycled Pet Ingredients

| Item | Value |

|---|---|

| Quantitative Units | USD 240.0 million |

| Ingredient Source | Fruits & vegetables by-products, Brewery & distillery by-products, Oilseed & grain press cakes, Meat & poultry by-products, Dairy by-products, Other food processing residues |

| Ingredient Type | P roteins & meals, Fibers, Fats & oils, Starches & carbohydrates, Minerals & micronutrients, Functional blends |

| End-Use Application | Kibble & D ry Pet Food, Wet & Canned Pet Food, Pet Treats & Snacks, Pet Supplements & Functional Additives |

| Product Form | Dry Ingredient s (meals, powders, dried pulps), Liquid Ingredien ts (oils, hydrolysates, syrups), and Semi-Moist Ingredients (fresh pulps, slurries) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Darling Ingredients, SARIA Group, Lauridsen Group Inc. (LGI), Tyson Ingredient Solutions, JBS S.A., Sanimax, Baker Commodities, West Coast Reduction Ltd., Pelagia, TripleNine Group |

| Additional Attributes | Dollar sales by ingredient source and end-use application; adoption trends in premium and functional pet food; rising demand for eco-conscious and sustainable formulations; sector-specific growth in treats, supplements, and wet food; integration with ESG and waste valorization frameworks; regional adoption influenced by sustainability policies; innovations in upcycling technologies and traceability systems. |

The global Upcycled Pet Ingredients is estimated to be valued at USD 240.0 million in 2025.

The market size for the Upcycled Pet Ingredients is projected to reach USD 651.4 million by 2035.

The Upcycled Pet Ingredients is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product forms in the Upcycled Pet Ingredients Market are dry ingredients, liquid ingredients, and semi-moist ingredients.

In terms of end-use application, Kibble & Dry Pet Food is forecasted to hold the largest share at 47% of the global market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Upcycled Vegetable Snacks Market Size and Share Forecast Outlook 2025 to 2035

Upcycled Banana Flour Market Size, Growth, and Forecast 2025 to 2035

Upcycled Cosmetic Ingredients Market Insights & Trends 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA