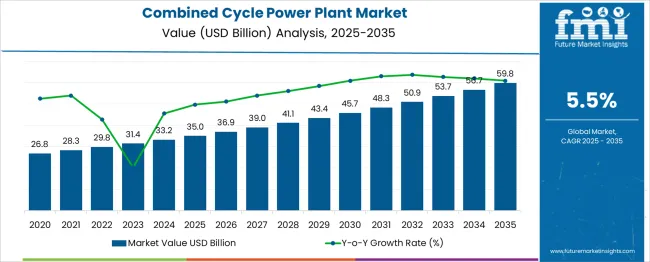

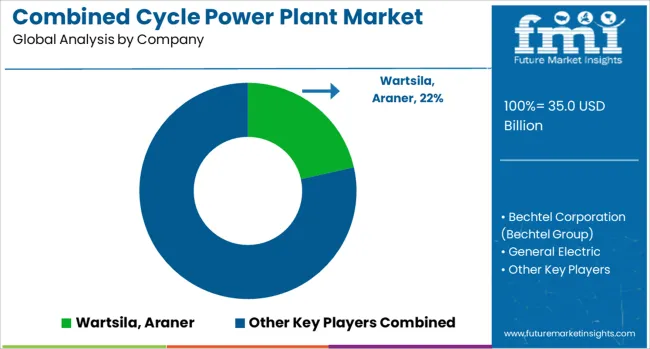

The Combined Cycle Power Plant Market is estimated to be valued at USD 35.0 billion in 2025 and is projected to reach USD 59.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. This steady growth highlights increasing investments in efficient and cleaner energy generation technologies globally. The absolute dollar opportunity, representing the incremental market value over the 15-year period, is approximately USD 33 billion. This substantial increase signals strong potential for power plant manufacturers, technology providers, and investors as demand for reliable and environmentally responsible power solutions continues to rise.

From 2020 to 2025, the market grows from USD 26.8 billion to USD 35.0 billion, showing solid initial progress supported by infrastructure development and favorable energy policies. The subsequent decade from 2025 to 2035 presents an even larger opportunity, with the market expanding by USD 24.8 billion to reach USD 59.8 billion. The modernization of existing plants characterizes this period, the adoption of advanced technologies, and rising energy needs in emerging economies. Overall, the combined cycle power plant market offers a promising growth trajectory with significant opportunities for stakeholders over the next decade and a half.

| Metric | Value |

|---|---|

| Combined Cycle Power Plant Market Estimated Value in (2025 E) | USD 35.0 billion |

| Combined Cycle Power Plant Market Forecast Value in (2035 F) | USD 59.8 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The combined cycle power plant market is expanding rapidly as energy sectors prioritize cleaner and more efficient electricity generation methods. The increasing global emphasis on reducing carbon footprints has led to significant investments in technologies that maximize fuel utilization and minimize emissions. Combined cycle power plants leverage both gas and steam turbines to achieve higher thermal efficiency, making them attractive for power producers aiming to balance sustainability with growing energy demand.

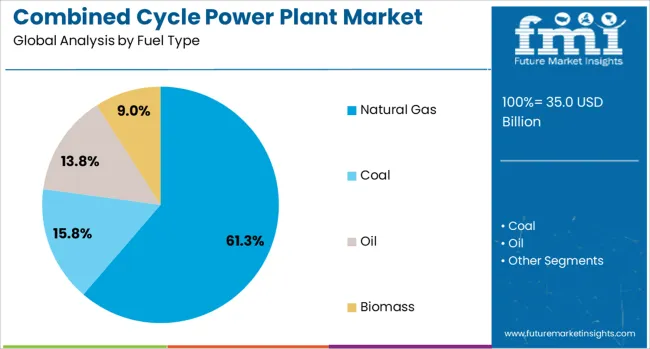

Natural gas has been favored as a primary fuel source due to its availability, lower emissions compared to coal and oil, and compatibility with flexible power generation schedules. The application of combined cycle plants is predominantly focused on electricity generation, where they are employed to meet peak and base load demands efficiently.

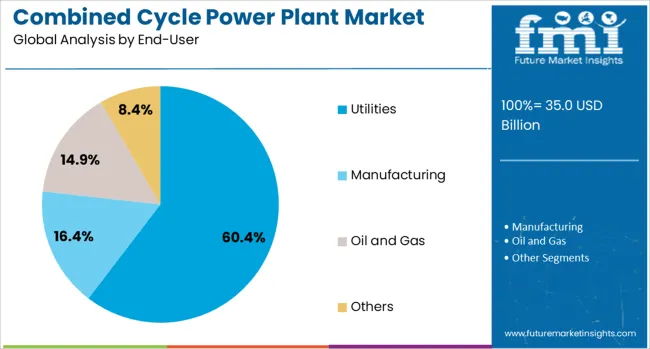

Utilities remain the largest end-user segment, driven by their role in providing reliable, scalable, and cleaner power solutions to support expanding grids and industrial growth. Technological advancements, regulatory support, and increasing gas infrastructure investments are expected to propel the market forward over the coming decade.

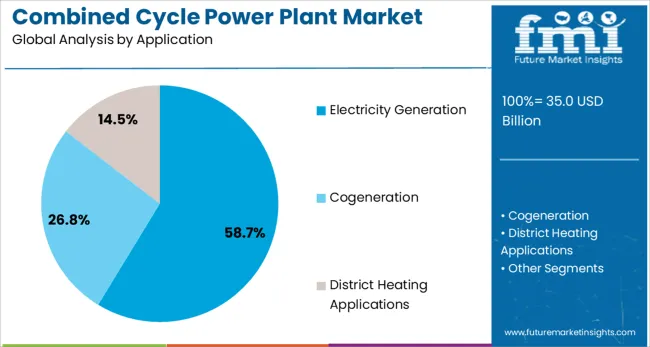

The combined cycle power plant market is segmented by fuel type, application, end-user, and geographic regions. By fuel type, the combined cycle power plant market is divided into Natural Gas, Coal, Oil, and Biomass. In terms of application, the combined cycle power plant market is classified into Electricity Generation, Cogeneration, and District Heating Applications. The end-users of the combined cycle power plant market are segmented into Utilities, Manufacturing, Oil and Gas, and others. Regionally, the combined cycle power plant industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Natural gas is expected to account for 61.3% of the combined cycle power plant market revenue share in 2025, reflecting its dominant role as a preferred fuel type. This segment’s growth is largely attributed to natural gas’s abundance, cost-effectiveness, and comparatively lower carbon emissions than other fossil fuels.

The increased availability of liquefied natural gas (LNG) and expanded pipeline infrastructure have facilitated the widespread adoption of natural gas-powered combined cycle plants. Additionally, natural gas-fired plants offer operational flexibility and quicker start-up times, which are essential for balancing intermittent renewable energy sources.

The improved combustion technologies and turbine efficiencies have further enhanced the viability of natural gas as the fuel of choice. Policy incentives and emissions regulations favoring cleaner fuels have reinforced natural gas’s leading position, promoting investments in infrastructure modernization and capacity expansions.

Electricity generation is projected to represent 58.7% of the overall revenue share in the combined cycle power plant market by 2025. This leading position is driven by the increasing global energy demand and the need for efficient power production with reduced environmental impact.

Combined cycle power plants are favored for their ability to deliver high efficiency and flexible generation capacities, making them suitable for both base load and peak load applications. The segment’s growth is supported by ongoing grid modernization efforts and the integration of renewable energy sources, where combined cycle plants provide stability and rapid response capabilities.

Advances in turbine technologies and process optimization have enabled these plants to achieve lower heat rates and emissions, aligning with stricter environmental regulations. The reliability and scalability of combined cycle power plants continue to attract utilities and independent power producers focusing on sustainable electricity generation.

Utilities are estimated to hold 60.4% of the revenue share in the combined cycle power plant market in 2025, underscoring their central role in power generation. The segment’s prominence is influenced by utilities’ responsibility to meet increasing electricity demands while adhering to evolving environmental standards.

Combined cycle power plants operated by utilities provide a cost-effective and efficient solution for large-scale electricity production, balancing renewable integration and grid stability. The flexibility of combined cycle technology allows utilities to optimize generation scheduling and reduce operational costs.

Investments in upgrading existing plants and constructing new facilities reflect utilities’ commitment to cleaner energy transition and regulatory compliance. Furthermore, utilities benefit from improved natural gas supply chains and government incentives, reinforcing their leadership in adopting combined cycle technologies across diverse geographical regions.

The combined cycle power plant market is growing steadily as energy providers seek efficient and flexible power generation solutions that reduce emissions and optimize fuel use. Combined cycle plants utilize both gas and steam turbines to maximize electricity output from natural gas or other fuels. Increasing global energy demand, stricter environmental regulations, and the transition toward cleaner energy sources drive market expansion. North America, Europe, and Asia-Pacific dominate due to established infrastructure and ongoing investments in modernizing power grids.

Combined cycle power plants differ widely in turbine designs, heat recovery steam generators (HRSGs), and fuel types, influencing efficiency and operational flexibility. Gas turbines vary from aeroderivative models suited for quick startups to heavy-duty turbines optimized for continuous base-load operation. HRSG configurations, such as single or multi-pressure systems, impact steam production and overall power output. Fuel flexibility is a growing focus—while natural gas remains dominant due to availability and cleaner combustion, some plants incorporate biogas or hydrogen blends to reduce carbon footprints. Variations in regional fuel supply and regulatory environments drive customized plant designs. Capital costs and operational complexity fluctuate with configuration choices, making modular and scalable solutions attractive for utilities managing diverse energy demands. Suppliers offering multi-fuel capabilities and adaptable configurations are better positioned to serve markets facing shifting fuel landscapes and stricter emission targets.

Thermal efficiency improvements in combined cycle power plants now regularly surpass 60%, thanks to innovations in turbine blade aerodynamics, cooling technologies, and optimized steam cycle integration. Enhanced combustion controls precisely regulate fuel-air mixtures, reducing fuel consumption and emissions. Emission control technologies, such as low-NOx burners and selective catalytic reduction, minimize nitrogen oxide formation, while carbon capture systems are increasingly integrated to meet environmental standards. Real-time performance monitoring and predictive maintenance allow operators to detect inefficiencies early, extend equipment lifespan, and reduce unplanned downtime. These technological advances not only improve environmental compliance but also lower operational costs, enhancing competitiveness against renewable energy sources. As emission regulations tighten globally, combined cycle plants that incorporate advanced efficiency and emission controls remain critical components in cleaner energy portfolios.

The growth of variable renewable energy sources like wind and solar increases the need for flexible power plants that can ramp output up or down quickly. Combined cycle power plants fulfill this role by providing fast-start capabilities and stable baseload power when renewables fluctuate. Governments worldwide are investing in new and upgraded plants to strengthen grid reliability and meet peak electricity demands. Developing economies seek reliable and efficient power to support rapid industrialization and urban growth. Financing support from public and private sectors encourages the adoption of combined cycle technology. Regional policy frameworks and grid infrastructure maturity heavily influence capacity additions. Plants designed for operational flexibility help balance supply-demand variations, ensuring consistent electricity delivery while facilitating integration of higher renewable shares.

Combined cycle power plants require substantial capital outlays for gas turbines, steam turbines, HRSGs, and auxiliary equipment, with project costs often reaching hundreds of millions of dollars. Lengthy permitting processes and environmental impact assessments add to project timelines and complexity. Compliance with stringent air quality and emission standards necessitates investment in control technologies and continuous monitoring systems. Fluctuating natural gas prices and concerns over fuel supply security affect long-term operational costs and investment decisions. Navigating regulatory approvals and grid connection requirements can delay project execution. Companies providing end-to-end project management, financing solutions, and long-term service agreements reduce risks and ease market entry. Efficient cost management and proactive regulatory engagement are essential for successful plant commissioning and sustained market growth.

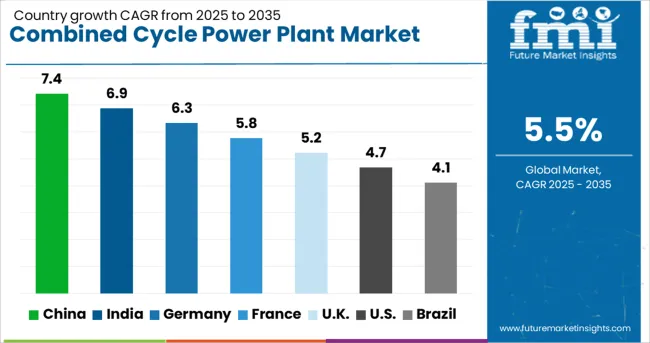

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global combined cycle power plant market is expanding at a 5.5% CAGR, driven by demand for efficient and cleaner power generation technologies. Among BRICS nations, China leads with 7.4% growth, supported by large-scale power infrastructure investments. India follows at 6.9%, fueled by increasing electricity demand and capacity expansions. In the OECD region, Germany records 6.3% growth, reflecting strong environmental regulations and modernization efforts. The United Kingdom grows at 5.2%, driven by power sector upgrades and efficiency targets. The United States, a mature market, shows 4.7% growth, shaped by replacement of aging power assets and regulatory compliance. These countries collectively influence market trends through power generation capacity, regulatory policies, and infrastructure development. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the combined cycle power plant market with a 7.4% growth rate, fueled by expanding energy demand and efforts to improve power generation efficiency. Compared to India, China invests heavily in modernizing its energy infrastructure with high-efficiency plants to reduce emissions and operational costs. The government supports projects integrating combined cycle technology to optimize fuel use, especially in industrial regions. Domestic manufacturers and international technology providers collaborate to deliver advanced turbine systems. The growing focus on cleaner energy generation solutions sustains robust market expansion in China.

India’s combined cycle power plant market grows at 6.9%, driven by rising electricity demand and efforts to enhance power generation efficiency. Compared to Germany, India faces infrastructure challenges but is rapidly adopting combined cycle technology to improve fuel efficiency and reduce emissions. Government incentives and public-private partnerships promote plant installations across growing urban and industrial areas. Manufacturers focus on adapting technology for local fuel types and operational conditions. Expansion of power capacity to meet development goals supports market growth.

Germany’s combined cycle power plant market advances at 6.3%, supported by efforts to improve power plant efficiency and reduce environmental impact. Compared to the UK, Germany invests in upgrading existing facilities with advanced combined cycle turbines. Stringent environmental regulations and emphasis on cleaner power generation drive demand. Manufacturers offer solutions compatible with renewable integration and grid stability. The market benefits from a skilled workforce and strong engineering expertise. Focus on reducing carbon footprint and operational costs sustains steady growth.

The United Kingdom combined cycle power plant market grows at 5.2%, driven by demand for efficient and cleaner electricity generation. Compared to the USA, the UK emphasizes regulatory compliance and emissions reduction, promoting upgrades to combined cycle plants. Investments target improving plant flexibility to support renewable energy integration. Manufacturers develop advanced turbine solutions focusing on operational efficiency and emission controls. Aging power infrastructure modernization supports steady market demand. Public and private sector collaboration accelerates adoption of combined cycle technology.

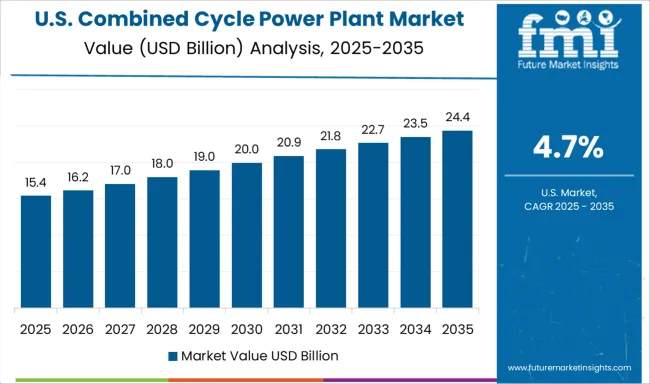

The United States combined cycle power plant market expands at 4.7%, supported by steady electricity demand and efforts to replace older fossil fuel plants. Compared to China, growth is more moderate due to diverse energy sources and regulations. Demand for flexible and efficient power generation to complement renewable sources promotes combined cycle plant installations. Manufacturers focus on turbine efficiency improvements and emission control technologies. Market growth benefits from technological innovation and strong industrial infrastructure. Public policies encouraging cleaner energy support steady development.

The combined cycle power plant market is driven by global engineering and manufacturing giants that provide advanced, efficient, and environmentally friendly power generation solutions. Wärtsilä and Araner lead by offering flexible and scalable combined cycle technologies designed for rapid deployment and integration with renewable energy sources, catering to the increasing demand for low-emission power plants. Bechtel Corporation, known for its expertise in large-scale infrastructure projects, excels in delivering turnkey combined cycle plants with a focus on optimized design and construction efficiency. General Electric (GE) and Siemens dominate with their state-of-the-art gas turbines and steam turbine technologies, emphasizing high thermal efficiency and digital monitoring systems to maximize output and reliability.

Mitsubishi Hitachi and Kawasaki Heavy Industries contribute cutting-edge turbine solutions that incorporate advanced materials and cooling technologies, enabling higher operating temperatures and improved performance. Solar Turbines (a Caterpillar subsidiary) specializes in small- to mid-scale gas turbines ideal for distributed power generation, while ATCO (Sentgraf Enterprises) focuses on project development and operations in North America. Ansaldo Energia brings strong expertise in steam turbine technology and integrated plant solutions, particularly in Europe and emerging markets. Competition in this sector is characterized by technological innovation, enhanced fuel flexibility, and comprehensive service offerings aimed at reducing emissions and operational costs while meeting growing global power demand.

A pivotal competitive edge lies in expanding hydrogen-ready gas turbine technologies: firms are actively designing turbines capable of running on 30–100% hydrogen, aligning with global decarbonization efforts. Examples include GE and Siemens Energy advancing hydrogen-compatible systems. Technological configuration plays a role as well; single-shaft combined cycle plants are favored for their balance of efficiency and cost-effectiveness. In contrast, dual- and triple-shaft setups are gaining traction in jurisdictions prioritizing higher operational flexibility and peak efficiency. Market momentum is also evident in large-scale power infrastructure moves. For instance, the U.S. Energy Information Administration forecasts developers to add around 18.7 GW of CCGT capacity by 2028, reflecting renewed confidence in the technology amid rising electricity needs. Meanwhile, power producers like Talen Energy are making bold strategic plays, acquiring multiple CCGT plants to bolster capacity and capitalize on surging demand from AI and data center expansion. This move underscores the strategic utility value of CCPP assets.

| Item | Value |

|---|---|

| Quantitative Units | USD 35.0 Billion |

| Fuel Type | Natural Gas, Coal, Oil, and Biomass |

| Application | Electricity Generation, Cogeneration, and District Heating Applications |

| End-User | Utilities, Manufacturing, Oil and Gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wartsila, Araner, Bechtel Corporation (Bechtel Group), General Electric, Siemens, Mitsubishi Hitachi, Kawasaki Heavy Industries, Solar Turbines (Caterpillar), ATCO (Sentgraf Enterprises), and Ansaldo Energia |

| Additional Attributes | Dollar sales in the Combined Cycle Power Plant Market vary by type (single-shaft, multi-shaft), fuel type (natural gas, coal, oil), application (power generation, industrial), and region (North America, Europe, Asia-Pacific). Growth is driven by rising energy demand, efficiency improvements, and focus on reducing carbon emissions. |

The global combined cycle power plant market is estimated to be valued at USD 35.0 billion in 2025.

The market size for the combined cycle power plant market is projected to reach USD 59.8 billion by 2035.

The combined cycle power plant market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in combined cycle power plant market are natural gas, coal, oil and biomass.

In terms of application, electricity generation segment to command 58.7% share in the combined cycle power plant market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Combined Cooling Heat and Power Plant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Plant-Powered Exfoliants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Chemicals Market

Combined Cycle Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Combined Heat and Power (CHP) Systems Market Growth - Trends & Forecast 2025 to 2035

Virtual Power Plant (VPP) and V2G Orchestration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Virtual Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Floating Power Plant Market Growth – Trends & Forecast 2025 to 2035

Micro Combined Heat and Power Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cycle Regulator Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Feed Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Combined Reaming Drills Market Size and Share Forecast Outlook 2025 to 2035

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA