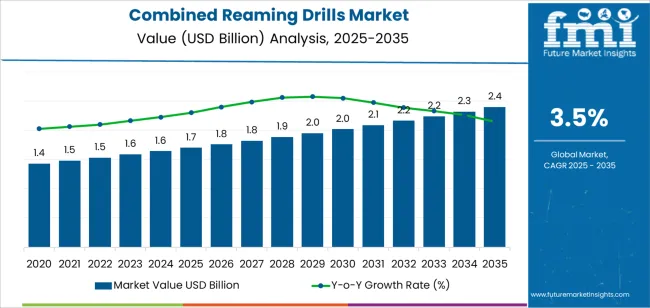

The global combined reaming drills market is projected to grow from USD 1.7 billion in 2025 to approximately USD 2.4 billion by 2035, recording an absolute increase of USD 698.5 million over the forecast period. This translates into a total growth of 41.0%, with the market forecast to expand at a CAGR of 3.5% between 2025 and 2035. The market size is expected to grow by nearly 1.4X during the same period, supported by increasing precision machining requirements across manufacturing operations, growing adoption of advanced cutting tool technologies in metal fabrication processes, and rising automation demands driving efficient material removal procurement across various industrial metalworking applications.

The market exhibits distinct regional dynamics with Asia Pacific emerging as the fastest-growing region, led by China's expanding manufacturing infrastructure and India's metalworking sector development. Europe maintains substantial market presence through established precision engineering capabilities and advanced machining technology adoption. North America demonstrates growing demand driven by aerospace component manufacturing and automotive production modernization. The combined reaming drill segment demonstrates particular strength in applications requiring simultaneous drilling and reaming operations, including automotive engine block production, aerospace structural component manufacturing, and industrial equipment fabrication where process consolidation reduces cycle times and improves hole quality.

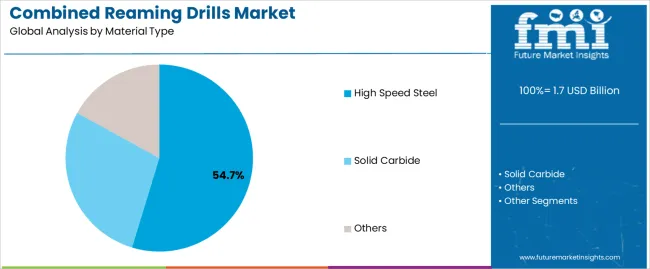

Technology evolution continues toward solid carbide tooling offering superior wear resistance and higher cutting speeds compared to conventional high-speed steel alternatives. Market participants increasingly focus on coating technology advancement, geometry optimization for specific materials, and expanding distribution networks to support growing demand across automotive assembly operations, aerospace machining centers, and general metalworking facilities.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,701.3 million |

| Market Forecast Value (2035) | USD 2,399.8 million |

| Forecast CAGR (2025-2035) | 3.5% |

| MANUFACTURING EFFICIENCY DRIVERS | PRECISION ENGINEERING REQUIREMENTS | TECHNOLOGY ADVANCEMENT FACTORS |

|---|---|---|

| Process Consolidation Demands Manufacturing operations seeking to reduce cycle times by combining drilling and reaming operations into single-tool processes eliminating tool changes and setup time. Labor Cost Optimization Automated machining systems requiring efficient tooling solutions that minimize operator intervention and maximize unattended production capabilities. Production Throughput Enhancement High-volume manufacturing environments demanding tools that deliver consistent performance while reducing total processing time per component. | Hole Quality Standards Precision machining applications requiring tight dimensional tolerances, superior surface finish, and minimal geometric deviation in single-pass operations. Automotive Powertrain Specifications Engine block and transmission housing production demanding precise hole dimensions for bearing installations and shaft alignments. Aerospace Component Requirements Aircraft structural elements requiring holes meeting stringent quality standards for fastener installation and assembly integrity. | Coating Technology Evolution Advanced surface treatments including TiAlN, AlCrN, and diamond-like carbon coatings extending tool life and enabling higher cutting parameters. Solid Carbide Development Fine-grain carbide substrates offering superior hardness and wear resistance supporting increased productivity in difficult-to-machine materials. Geometry Optimization Computer-aided design enabling flute configurations, point geometries, and edge preparations tailored to specific workpiece materials and machining conditions. CNC Integration Compatibility Tool designs optimized for automated tool changers, through-spindle coolant delivery, and adaptive machining control systems. |

| Category | Segments Covered |

|---|---|

| By Material Type | High Speed Steel, Solid Carbide, Others |

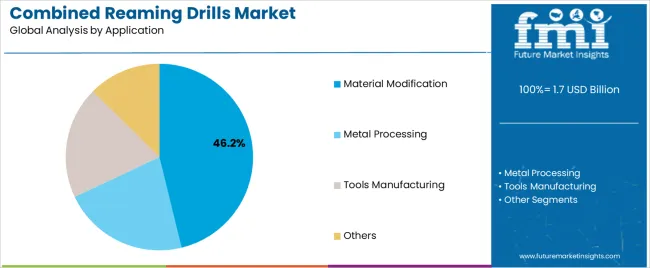

| By Application | Material Modification, Metal Processing, Tools Manufacturing, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| High Speed Steel |

|

| Solid Carbide |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Material Modification |

|

| Metal Processing |

|

| Tools Manufacturing |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Automotive Production Expansion Global vehicle production growth and manufacturing capacity investments driving demand for efficient machining tools in engine, transmission, and chassis component production. Aerospace Manufacturing Recovery Commercial aircraft production increases and defense sector activity expansion requiring precision hole-making tools for structural component fabrication and assembly preparation. Manufacturing Automation Advancement CNC machining center proliferation and automated production system implementation requiring reliable, long-life tooling minimizing manual intervention and maximizing unattended operation. | Initial Cost Considerations Solid carbide combined reaming drills requiring higher capital investment compared to separate HSS drilling and reaming tools affecting adoption in cost-sensitive applications and low-volume operations. Application Limitations Combined tool geometry compromises versus optimized separate drilling and reaming operations affecting performance in extreme precision requirements or difficult material combinations. Market Fragmentation Diverse hole size requirements, material variations, and application specifications necessitating extensive inventory and limiting economies of scale in distribution and manufacturing. | Advanced Coating Development Multilayer PVD coatings and nanocomposite surface treatments extending tool life, enabling higher cutting parameters, and improving performance in difficult materials including titanium and high-temperature alloys. Geometry Optimization Software Computer simulation tools enabling cutting edge design, chip evacuation modeling, and force prediction supporting application-specific tool development and performance optimization. Through-Coolant Technology Internal coolant delivery systems improving chip evacuation, reducing thermal stress, and enabling higher metal removal rates in production environments. Reconditioning Service Expansion Specialized regrinding operations offering carbide tool restoration extending usable life, reducing total cost of ownership, and supporting green initiatives through material conservation. |

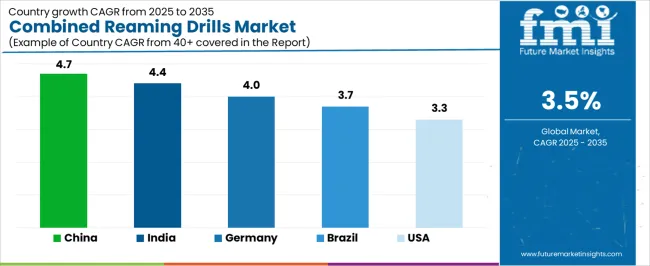

| Country | CAGR (2025-2035) |

|---|---|

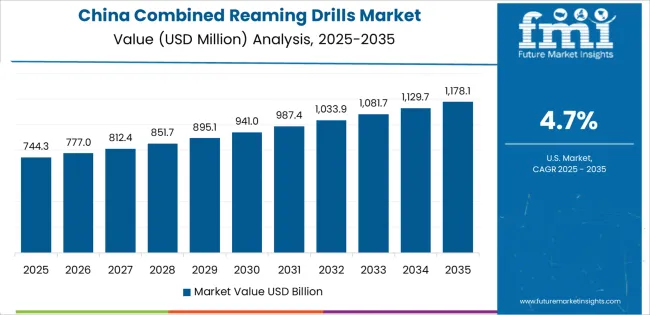

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| Brazil | 3.7% |

| United States | 3.3% |

Combined reaming drills market in China is projected to grow at a CAGR of 4.7% from 2025 to 2035. Revenue from combined reaming drills in China is expected to exhibit strong growth, reaching significant levels by 2035, driven by extensive automotive manufacturing capacity expansion and comprehensive industrial production modernization programs. These developments create substantial opportunities for cutting tool suppliers across engine component machining operations, transmission housing production, and general metalworking facilities. The country's established manufacturing ecosystem and expanding precision machining capabilities are creating significant demand for both high-speed steel and solid carbide tooling solutions.

Major automotive component manufacturers and industrial equipment producers are establishing advanced machining centers supporting demand for efficient material removal technologies. Automotive production expansion and electric vehicle component manufacturing are supporting widespread adoption of combined reaming drills across powertrain machining applications, driving demand for productive tooling with competitive pricing. Export-oriented manufacturing growth and domestic consumption expansion are creating substantial opportunities for cutting tool suppliers offering comprehensive product ranges and technical support capabilities. Manufacturing modernization initiatives and automation adoption are facilitating implementation of advanced tooling solutions throughout major industrial production regions.

Combined reaming drills market in India is expected to grow at a CAGR of 4.4% from 2025 to 2035. Revenue from combined reaming drills in India is expanding substantially by 2035, supported by automotive component manufacturing growth and comprehensive industrial development programs creating constant demand for precision cutting tools across diverse machining applications and metalworking operations. The country's growing manufacturing capabilities and expanding technical expertise are driving demand for combined reaming drills that provide operational efficiency while supporting cost-competitive production requirements. International tool manufacturers and domestic distributors are investing in technical service capabilities to support application development and machining process optimization.

Automotive component production expansion and general engineering manufacturing growth are creating opportunities for combined reaming drills across diverse applications requiring efficient hole-making capabilities. Manufacturing skill development and precision machining capability advancement are driving investments in productive tooling supporting quality improvement and cycle time reduction throughout automotive supply chain and general industrial sectors. Infrastructure development and capital equipment production are enhancing demand for reliable cutting tools throughout primary manufacturing regions.

Combined reaming drills market in Germany is forecasted to grow at a CAGR of 4.0% from 2025 to 2035. Demand for combined reaming drills in Germany is expected to reach substantial levels by 2035, supported by the country's leadership in automotive engineering and advanced manufacturing technologies requiring sophisticated cutting tools for premium vehicle production, aerospace component machining, and precision industrial equipment fabrication. German manufacturers are implementing advanced combined reaming drill technologies that support tight tolerances, superior surface finish, and comprehensive process control.

The market is characterized by focus on productivity optimization, quality excellence, and compliance with stringent automotive and aerospace machining standards. Premium automotive powertrain production and aerospace component manufacturing are prioritizing advanced cutting tool technologies that demonstrate superior performance and reliability while meeting German engineering and quality standards. Electric vehicle component production and lightweight material machining initiatives are driving adoption of solid carbide tooling with advanced coatings supporting efficient processing of aluminum alloys and composite materials. Research and development programs for machining technology enhancement are facilitating adoption of optimized tool geometries and coating systems throughout major automotive and aerospace manufacturing centers.

Combined reaming drills market is the United States is expected to expand at a CAGR of 3.3% from 2025 to 2035. Revenue from combined reaming drills in the United States is projected to grow significantly by 2035, driven by aerospace component production and automotive manufacturing modernization creating continued opportunities for cutting tool suppliers serving both aircraft structural component manufacturers and automotive powertrain producers. The country's extensive aerospace engineering expertise and established automotive manufacturing presence are creating demand for combined reaming drills that support precision machining requirements and productivity optimization objectives.

Tool manufacturers and distributors are developing comprehensive application support capabilities to address aerospace qualification requirements and automotive production demands. Aerospace structural component machining and aircraft assembly preparation operations are facilitating adoption of precision combined reaming drills capable of supporting stringent quality requirements and material specifications including titanium alloys and high-strength steels. Automotive manufacturing modernization and electric vehicle component production are enhancing demand for efficient tooling that supports aluminum machining and cycle time reduction objectives. Reshoring initiatives and domestic manufacturing capacity expansion are creating opportunities for cutting tool suppliers with comprehensive technical support and rapid delivery capabilities across American manufacturing facilities.

Combined reaming drills market in Brazil is anticipated to expand at a CAGR of 3.7% from 2025 to 2035. Demand for combined reaming drills in Brazil is expected to reach meaningful levels by 2035, driven by automotive production activity and general industrial manufacturing supporting gradual cutting tool adoption in component fabrication and metalworking operations. The country's established automotive manufacturing presence and developing precision machining capabilities are creating demand for combined reaming drill solutions that support production requirements while maintaining cost competitiveness.

International tool suppliers and regional distributors are maintaining technical service capabilities to support application development and machining process optimization. Automotive component manufacturing and general engineering operations are supporting demand for combined reaming drills that meet production quality and efficiency standards. Manufacturing technology advancement and machining capability development are creating opportunities for productive cutting tools that provide operational reliability and performance consistency. Industrial equipment production and metal fabrication operations are facilitating selective adoption of advanced tooling solutions throughout manufacturing regions.

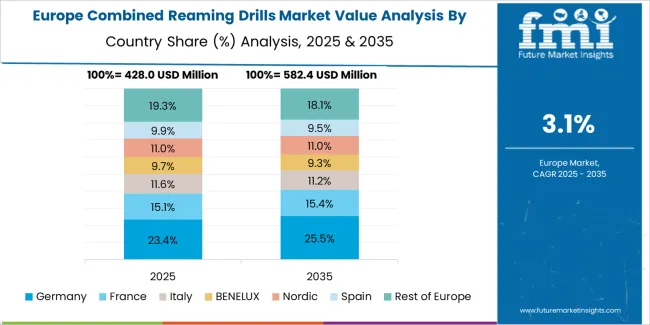

The combined reaming drills market in Europe is projected to grow from USD 635.9 million in 2025 to USD 849.8 million by 2035, registering a CAGR of 2.9% over the forecast period. Germany is expected to maintain its leadership position with a 42.3% market share in 2025, declining slightly to 41.1% by 2035, supported by its advanced automotive manufacturing infrastructure and comprehensive precision machining capabilities serving premium vehicle production and aerospace component fabrication.

France follows with a 19.8% share in 2025, projected to reach 20.4% by 2035, driven by aerospace manufacturing concentration including Airbus component production and automotive supplier base operations. The United Kingdom holds a 14.6% share in 2025, expected to maintain 14.3% by 2035 with aerospace engineering focus and general industrial manufacturing presence. Italy commands a 12.7% share, while Spain accounts for 7.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 3.4% to 4.5% by 2035, attributed to increasing precision machining adoption in Nordic automotive component manufacturing and emerging Eastern European automotive supply chain participation implementing advanced metalworking technologies.

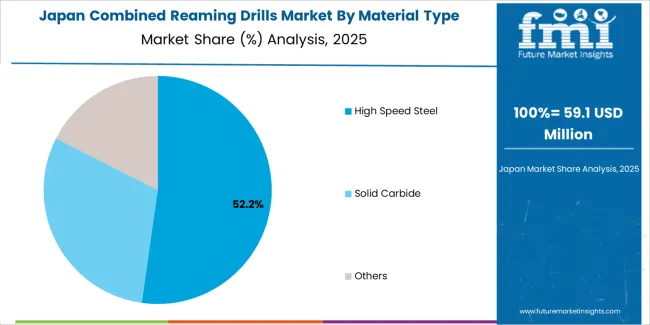

Japanese combined reaming drill operations reflect the country's precision manufacturing standards and sophisticated automotive production requirements. Major automotive manufacturers including Toyota, Honda, and Nissan maintain rigorous cutting tool qualification processes emphasizing dimensional accuracy, surface finish consistency, and extended tool life performance. This creates structured market conditions favoring established tool manufacturers with proven track records and comprehensive technical support capabilities.

The Japanese market demonstrates advanced machining technology adoption, with significant investment in high-precision CNC equipment and automated production systems requiring reliable cutting tools optimized for unattended operation. Companies require detailed tool performance data and application development support that align with Japanese manufacturing excellence standards, driving demand for sophisticated technical service capabilities and continuous improvement collaboration.

Regulatory oversight emphasizes workplace safety and environmental compliance, with manufacturing standards requiring comprehensive documentation and quality management systems. The cutting tool procurement framework creates advantages for suppliers with established ISO certifications, comprehensive traceability systems, and proven quality management capabilities.

Supply chain relationships focus on long-term technical partnerships rather than transactional procurement approaches. Japanese manufacturers typically maintain multi-year supplier agreements with cutting tool producers, emphasizing collaborative application development, joint process optimization, and continuous performance improvement rather than competitive pricing cycles. This stability supports application-specific tool development and coating optimization investments tailored to Japanese automotive production requirements and machining performance expectations.

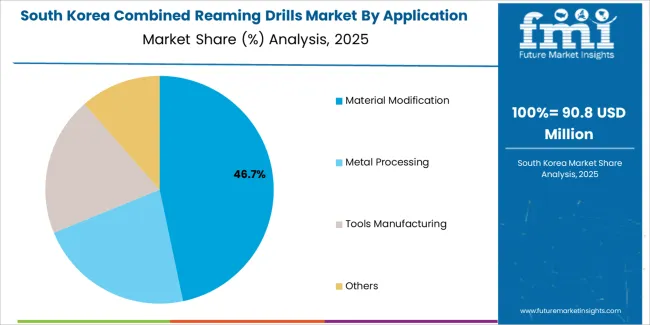

South Korean combined reaming drill operations reflect the country's advanced automotive and shipbuilding manufacturing sectors. Major automotive manufacturers including Hyundai Motor, Kia Corporation, and automotive component suppliers drive sophisticated cutting tool procurement strategies, establishing technical partnerships with global tool manufacturers to secure performance-validated tooling for domestic vehicle production and component export operations targeting international automotive platforms.

The Korean market demonstrates particular strength in applying combined reaming drills to automotive powertrain component production, with companies integrating efficient hole-making solutions into engine block machining, transmission housing production, and chassis component fabrication. This manufacturing focus creates demand for tooling optimized for aluminum alloy machining reflecting lightweighting initiatives and solid carbide solutions supporting productivity requirements in mass production environments.

Regulatory frameworks emphasize manufacturing safety standards and environmental compliance, with automotive industry quality management systems requiring comprehensive process validation and tooling qualification protocols. Cutting tool selection processes require extensive performance testing and durability validation, creating structured evaluation frameworks that favor established manufacturers with technical expertise and proven application experience.

Engineering collaboration between Korean automotive manufacturers and cutting tool suppliers focuses on productivity optimization and quality improvement, with joint development projects targeting cycle time reduction and process reliability enhancement. Korean companies invest in advanced machining simulation capabilities and process monitoring technologies supporting tool selection optimization and performance validation, positioning the market for continued advancement as automotive production evolves and manufacturing sophistication increases.

Profit pools consolidate around manufacturers demonstrating tool design expertise and comprehensive distribution networks supporting customer accessibility. Value migrates from commodity high-speed steel products toward specialized solid carbide solutions where coating technology, geometry optimization, and application engineering support command premiums. Several operational models define competitive positioning: global cutting tool manufacturers offering comprehensive product portfolios and technical support infrastructure; specialized drilling tool producers focusing on application expertise and niche market segments; private label suppliers providing cost-competitive alternatives through manufacturing partnerships; and regional distributors offering inventory availability and localized technical service.

Switching costs remain moderate for standard applications where dimensional interchangeability enables supplier transitions with minimal disruption. Optimized production applications involving customized tool specifications, established machining parameters, and proven performance create barriers to supplier changes through requalification requirements and productivity risk. Competitive advantages accrue to manufacturers maintaining broad product range enabling single-source procurement convenience while offering technical support capabilities assisting application optimization and troubleshooting.

Market structure demonstrates concentration among established global manufacturers controlling significant share through brand recognition, distribution network breadth, and technical reputation while numerous regional producers and private label suppliers compete in price-sensitive segments. Distribution complexity creates multi-tier channel structures with master distributors, regional suppliers, and direct sales coexisting depending on customer size and application complexity. Technology differentiation focuses on coating advancement, geometry optimization for specific materials, and manufacturing consistency supporting predictable performance. Strategic partnerships between tool manufacturers and machine tool builders create preferred supplier relationships and integrated solutions marketing while automotive and aerospace tier-one suppliers increasingly pursue global agreements consolidating cutting tool procurement and standardizing specifications across manufacturing facilities.

| Items | Values |

|---|---|

| Quantitative Units | USD 1.7 billion |

| Material Type | High Speed Steel, Solid Carbide, Others |

| Application | Material Modification, Metal Processing, Tools Manufacturing, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Key Countries Covered | United States, Germany, China, India, Brazil, Japan, South Korea, and other countries |

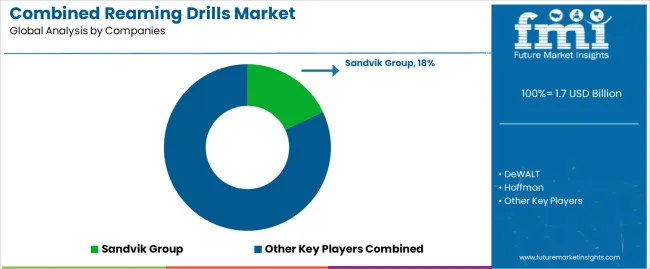

| Key Companies Profiled | Sandvik Group, DeWALT, Hoffman, Atrax, Harvey Performance Company, Cle-Line, Monster Tool, DORMER, Guhring, Metal Removal, Hertel, Komet, Link Industries, M.A. Ford, Precision Twist Drill, Magafor, Value Collection, Walter-Titex, National Twist Drill, Chicago-Latrobe |

| Additional Attributes | Revenue analysis by material type and application segment, regional market dynamics, competitive landscape assessment, manufacturing technology evolution, coating advancement trends, and geometry optimization innovations driving productivity enhancement, precision improvement, and operational efficiency |

The global combined reaming drills market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the combined reaming drills market is projected to reach USD 2.4 billion by 2035.

The combined reaming drills market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in combined reaming drills market are high speed steel, solid carbide and others.

In terms of application, material modification segment to command 46.2% share in the combined reaming drills market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Combined Charging System Market Size and Share Forecast Outlook 2025 to 2035

Combined Cycle Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Combined Cycle Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Combined Cooling Heat and Power Plant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Combined Heat and Power (CHP) Systems Market Growth - Trends & Forecast 2025 to 2035

Recombined Milk Market

Micro Combined Heat and Power Market Size and Share Forecast Outlook 2025 to 2035

Streaming Analytics Market Analysis by Solution, Application, Enterprise Size, Industry, and Region Through 2035

Streaming Media Services Market Insights - Growth & Forecast through 2035

Video Streaming Market Growth – Innovations, Trends & Forecast 2025-2035

AI-Powered Video Streaming – Future of Digital Entertainment

Sports Streaming Platform Market Size and Share Forecast Outlook 2025 to 2035

Music and Streaming Service Market Size and Share Forecast Outlook 2025 to 2035

eSports & Games Streaming Market – Trends & Forecast 2023-2033

Blasthole Drills Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA