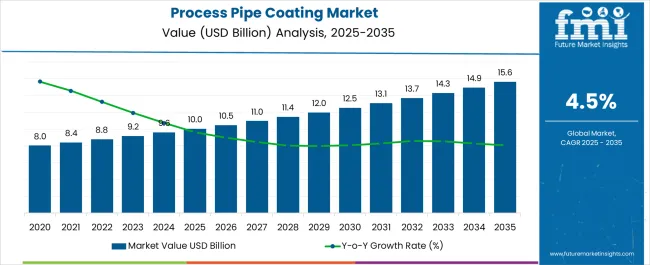

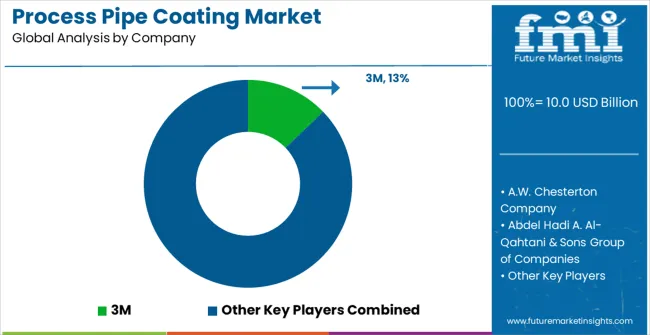

The Process Pipe Coating Market is estimated to be valued at USD 10.0 billion in 2025 and is projected to reach USD 15.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Process Pipe Coating Market Estimated Value in (2025 E) | USD 10.0 billion |

| Process Pipe Coating Market Forecast Value in (2035 F) | USD 15.6 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The Process Pipe Coating market is expanding steadily, supported by the rising demand for protective and performance-enhancing coatings in industries reliant on pipelines. The growing need to ensure corrosion resistance, enhance durability, and improve operational efficiency has placed pipe coatings at the center of infrastructure development. Increasing investment in oil and gas exploration, water transportation networks, and industrial infrastructure projects is driving consistent adoption.

Technological advancements in coating materials, such as improved polymer blends and advanced resins, are enhancing chemical resistance and extending pipeline lifespans. Environmental considerations are also shaping the market, with coatings designed to meet sustainability standards and reduce maintenance costs gaining traction. Digital monitoring systems integrated with coatings are further improving inspection efficiency and lifecycle management.

Demand growth is reinforced by stringent safety and regulatory standards, compelling industries to adopt coatings that minimize risks and ensure compliance With infrastructure modernization projects gaining momentum globally, the Process Pipe Coating market is projected to maintain long-term growth, fueled by innovation, efficiency, and the critical role coatings play in safeguarding pipelines.

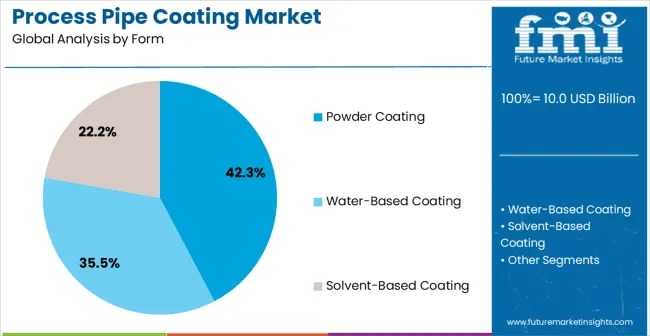

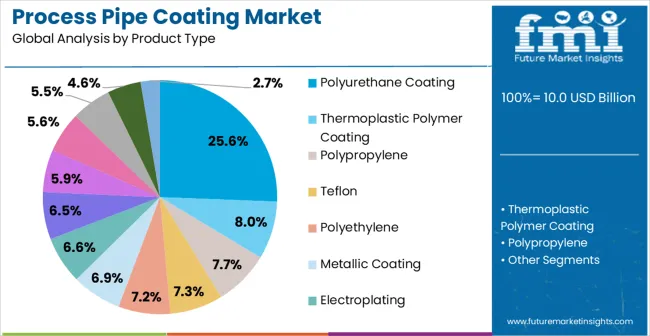

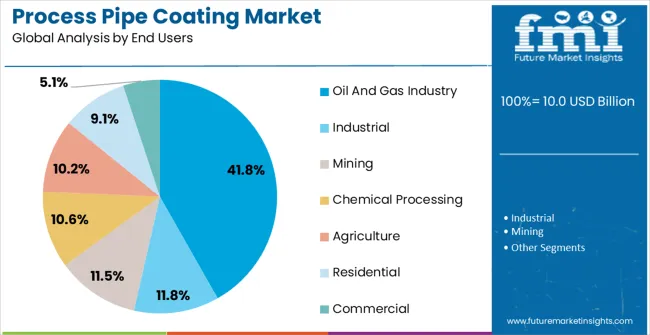

The process pipe coating market is segmented by form, product type, end users, and geographic regions. By form, process pipe coating market is divided into Powder Coating, Water-Based Coating, and Solvent-Based Coating. In terms of product type, process pipe coating market is classified into Polyurethane Coating, Thermoplastic Polymer Coating, Polypropylene, Teflon, Polyethylene, Metallic Coating, Electroplating, Galvanization, Cadmium Plating, Fusion Merged Epoxy Ash Coating, Concrete Coating, Asphalt Coating, and Coal Tar Enamel Coating. Based on end users, process pipe coating market is segmented into Oil And Gas Industry, Industrial, Mining, Chemical Processing, Agriculture, Residential, and Commercial. Regionally, the process pipe coating industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder coating form segment is anticipated to hold 42.3% of the Process Pipe Coating market revenue in 2025, positioning it as the leading form. This growth is being driven by the increasing preference for powder-based applications due to their durability, cost-effectiveness, and eco-friendly properties. Powder coatings are known for their ability to provide excellent corrosion resistance and long-term surface protection, making them a suitable choice for industries operating under harsh conditions.

The application process generates minimal waste compared to liquid coatings, aligning with growing environmental regulations and sustainability goals. Powder coatings also provide a uniform finish, enhancing both aesthetics and functionality while reducing the frequency of recoating. Industries such as oil and gas, chemical processing, and water management are particularly reliant on powder coating to ensure pipeline longevity.

The ability to enhance pipeline performance at a competitive cost continues to reinforce the dominance of this segment As pipeline infrastructure projects expand globally, the demand for powder coating is expected to remain strong, supported by technological advancements in application techniques and material composition.

The polyurethane coating product type segment is projected to account for 25.6% of the market revenue in 2025, highlighting its significance in specialized applications. Polyurethane coatings are widely recognized for their exceptional abrasion resistance, flexibility, and chemical durability, which makes them particularly suitable for pipelines exposed to aggressive environments. These coatings provide superior resistance to moisture, chemicals, and mechanical stress, reducing the likelihood of pipeline failure and extending operational lifespans.

Their ability to adhere strongly to diverse substrates and maintain performance under fluctuating temperatures adds to their versatility. The segment is also benefiting from rising demand in industries such as petrochemicals and wastewater management, where pipelines are continuously exposed to corrosive elements. Polyurethane coatings allow operators to balance performance requirements with long-term cost savings by reducing the need for frequent repairs and replacements.

As industries increasingly prioritize operational efficiency and reliability, polyurethane coatings are expected to sustain significant growth Innovations in formulation techniques, including solvent-free and low-VOC variants, are also supporting wider adoption in compliance-driven markets.

The oil and gas industry end-use segment is expected to hold 41.8% of the Process Pipe Coating market revenue in 2025, making it the largest contributor by end-user category. Growth is being fueled by the sector’s reliance on extensive pipeline networks for exploration, transportation, and refining operations. Harsh operational conditions, such as high-pressure flows, chemical exposure, and varying temperatures, necessitate advanced coatings that ensure safety and reliability.

Pipe coatings in the oil and gas sector are critical for preventing leaks, minimizing corrosion, and reducing maintenance-related downtime. Increasing exploration in offshore and remote locations has further elevated the importance of protective coatings, as pipelines in these environments face extreme challenges. Growing regulatory emphasis on environmental protection and operational safety is accelerating the adoption of advanced coating technologies.

The ability of coatings to reduce operational risks while extending asset lifespans provides significant cost advantages to oil and gas companies With rising global energy demand and continuous infrastructure expansion, the oil and gas industry segment is expected to maintain its leadership in driving the adoption of process pipe coatings.

Pipe coating is a technique which utilizes protective materials to protect a pipe from corrosion and abrasion. Based on the requirement, the coating used can either be of a single or triple layer. Pipe coatings are important to protect a pipe from harmful environmental components, such as moisture, ultra violet rays, acid, carbon dioxide, hydrogen disulfide, etc. as these components are capable of directly meddling with performance, reliability, durability and flow of a pipe. Coatings on a pipe are applied both internally and externally.

External corrosion frequently occurs in the form of oxide materialization when water comes in contact with air. Internal corrosion, on the other hand, frequently occurs due to the presence of active chemicals present in the liquid flowing through a pipe. These active chemicals react with the material of pipe, resulting in internal corrosion.

The selection of a suitable coating depends on various factors, some of which are performance, economic concerns, regulatory consideration, chemical properties of the fluid, flammability and viscosity. Powder coating offers better durability and environmental benefits as it does not emit VOCs (Volatile Organic Compounds).

The oil and gas industry is the leading end user of the global process pipe coating market as the pipes in this industry are subjected to significantly corrosive and harsh environmental conditions while oil extraction and transportation.

Though there are various other corrosion prevention methods, such as current catholic protection and sacrificial anode, these methods are not very effective. Pipe coating is perceived to be the most consistent method for corrosion prevention, which can be a major contributor to market growth.

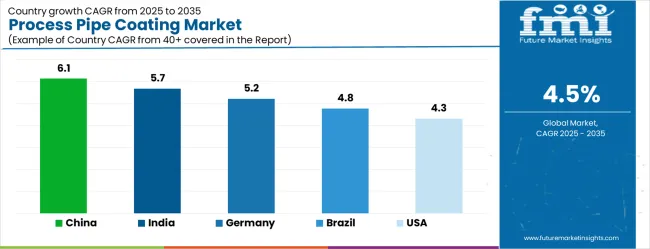

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.7% |

| Germany | 5.2% |

| Brazil | 4.8% |

| USA | 4.3% |

| UK | 3.9% |

| Japan | 3.4% |

The Process Pipe Coating Market is expected to register a CAGR of 4.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.1%, followed by India at 5.7%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.4%, yet still underscores a broadly positive trajectory for the global Process Pipe Coating Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.2%. The USA Process Pipe Coating Market is estimated to be valued at USD 3.6 billion in 2025 and is anticipated to reach a valuation of USD 3.6 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 464.3 million and USD 307.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.0 Billion |

| Form | Powder Coating, Water-Based Coating, and Solvent-Based Coating |

| Product Type | Polyurethane Coating, Thermoplastic Polymer Coating, Polypropylene, Teflon, Polyethylene, Metallic Coating, Electroplating, Galvanization, Cadmium Plating, Fusion Merged Epoxy Ash Coating, Concrete Coating, Asphalt Coating, and Coal Tar Enamel Coating |

| End Users | Oil And Gas Industry, Industrial, Mining, Chemical Processing, Agriculture, Residential, and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, A.W. Chesterton Company, Abdel Hadi A. Al-Qahtani & Sons Group of Companies, Aegion Corporation (Bayou), Akzo Nobel N.V., Allan Edwards, Inc., Axalta Coating Systems, LLC, BASF, Bauhuis B.V., Blocher Oberflachentechnik GmbH, Borusan Mannesmann, Celanese Corporation, CENERGY HOLDINGS, Dura-Bond Industries, and GBA Products Co Ltd |

The global process pipe coating market is estimated to be valued at USD 10.0 billion in 2025.

The market size for the process pipe coating market is projected to reach USD 15.6 billion by 2035.

The process pipe coating market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in process pipe coating market are powder coating, water-based coating and solvent-based coating.

In terms of product type, polyurethane coating segment to command 25.6% share in the process pipe coating market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Pipeline Integrity Market Size and Share Forecast Outlook 2025 to 2035

Pipe Market Size and Share Forecast Outlook 2025 to 2035

Process Automation and Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Pipetting Robots Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Safety Market Size and Share Forecast Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Pipe Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Process Spectroscopy Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pipette Tips Market Size and Share Forecast Outlook 2025 to 2035

Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Processed Fruit and Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pipe Screw Extruder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA