The global Processed Superfruit Market will grow to a value of USD 140326.8 Million during 2025 and it is expected to reach USD 209723.89 Million by 2035 with a projected compound annual growth rate of 4.1% throughout 2025 to 2035.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025) | USD 140326.8 Million |

| Projected Industry Value (2035) | USD 209723.89 Million |

| Value-based CAGR (2025 to 2035) | 4.1% |

The processed superfruit market is on a path of growth due mainly to the increase of customers' knowledge regarding the pros of these fruits. Superfruits, like acai, goji berries, and pomegranates, provide antioxidants, vitamins, and minerals which are the reasons why they are the main consideration to be taken in the equational of the diet.

The market is full of choices which offer juices, powders, purees, and extracts that provide means for the easy and practical consumption of these high nutrient fruits. The increase in natural and organic demands, in addition, to the popularity of functional food and drinks, is one more driving force for the market's expansion.

The market is classified as product type, application, and region. Product types consist of powders, juices, concentrates, purees, and extracts, each being aimed for different consumer tastes and needs. Processed superfruits can be available in manifold applications besides food and beverages, dietary supplements, cosmetics, and pharmaceuticals. The ripe condition of superfruits results in the situations of fruits to be used in a variety of products including functional beverages, snacks, skincare creams, and health supplements.

Facing mainly North America and Europe, the market areas are primarily established, due to the high level of consumer awareness and interest in health-promoting products in those regions. On the flip side, the region of Asia-pacific has a good chance of achieving the highest growth and its increase in per capita income, healthier lifestyle consciousness, and infrastructure improvement will surely lead to that.

Product innovation, sustainable sourcing, and strategic partnerships are the main approaches that the leading players in the processed superfruit industry use to survive competition. With the changing perspectives of consumers, companies are allocating to the research and development of producing products that are totally new and different. The decreasing of packaging materials and using recyclable ones in the supply chain is one of the main features of sustainable sour.

Increasing consumer awareness about the health benefits of soluble fiber

The market easily realizes the trend of the consumer s relationship to the health advantages of soluble fiber. The consumer's attention is driven by the fact that soluble fiber has many benefits on human health. One of the main benefits is that it helps to control blood sugar levels, and thus it is important for diabetic patients. Soluble fiber absorbs sugar and prevents its absorption by the intestines, which is a tangible benefit, thus making the blood sugar levels not peak and the glycemic control is better.

Another major plus of soluble fiber is that it helps to lower the levels of cholesterol. The enzymatic activity that forms the gel-like material in the gut shows cholesterol particles while they are not being absorbed into the blood. Everything together leads to a drop in cholesterol and that subsequently leads to a decreased risk of heart disease. The heart disease is still one of the primary causes of death in the world so people are increasingly seeking food that is good for the heart.

In addition, soluble fiber and the good bacteria in the gut act as probiotics which boost digestive health. The gut bacteria are the ones who ferment the soluble fiber and produce short-chain fatty acids that are used to nourish the colon cells. This way, the gut is healthier and the body is less prone to diseases due to the stronger immune system.

Moreover, the soluble fiber might help in the management of weight by making you feel full for longer, which is a consequence of its being fibrous in nature and its promotion of less energy intake. The public is mostly shifting their focus to the increased consumption of high-fiber products as a single measure in combating obesity which has become an uncontrollable pandemic.

Continuous innovation in product formats, such as powders, juices, and snacks

The innovation of product formats, such as powders, juices, and snacks, is a driving force of the growth of the processed superfruit market. It proves the need to meet a variety of consumer preferences and lifestyles thus, making it easy for people to add superfruit nutrition into their diets without any effort.

They are especially popular due to the fact that they are both utilitarian and convenient. Just mix them with smoothies, yogurts, and baked goods, and the intake of nutrition comes very easy; thus, those are speed meals. Superfruit powders are often presented as a form of vitamins, minerals, and antioxidants found in nature and are not synthesized which are preferred by health-oriented users and whom the companies positively think of as supplement users who are seeking easy-to-handle alternatives.

Aside from juices, drinks containing superfruits are also another propitious line. These items exist as a triple edifier - promoting the benefits of eating superfruits in a refreshing form and being a delicious drink at the same time; hence, they are basically marketed as functional beverages.

Cold-pressed juices, a new way of beverage that does not destroy the nutrients and flavors of superfruits, have much more to offer. Moreover, superfruit drinks that do not require any preparation with the busy ones looking for both practical and good nutrition while being on the move are becoming more and more famous.

Increasing use of superfruits in dietary supplements

Consumer demand for natural and nutrient-packed components fueling through health and wellness has also contributed to the growth of the superfruit in dietary supplements. Foods that are termed superfruits are types of acai berries, pomegranates, blueberries, and goji berries, which are honored for their high content of antioxidants, vitamins, minerals, and phytonutrients. Including these fruits in the dietary supplement where emphasis is on the welfare of body functions is rightfully known as one of the best options on the market.

The other most prominent reason related to the superfruit-supplement boom is their potential of oxidative stress and inflammation countermeasure. Superfruits contain antioxidants that through free radical free processes optimize free radicals which are the unstable molecules that may cause deleterious effect to cells and are linked with chronic diseases and aging. The small quantity of superfruit supplements reducing oxidative stress and consequently supporting on the moral health, skin health along with immune system too.

In addition, the particular health outcomes recognized by consumers have greatly influenced the popularity of superfruits. As an instance, consumers often reach for acai berries because they have been linked to improved cognitive performance and weight management capabilities, while goji berries are most commonly mentioned due to their immune system enhancement properties.

Pomegranates have been benefiting the heart, and blueberries have been proven to be good for the brain. These affirmations about health benefits are attached to superfruit products and are of great interest to people who are willing to treat their ailments the natural way.

Growing incorporation of superfruit extracts in cosmetics and personal care products

The rapid increase in the application of superfruit extracts in cosmetics and toiletries has testified to the truth that the natural and efficient ingredient market is in an uptrend, as mentioned above by the changing consumer preferences.

Superfruits such as acai, pomegranate, goji berry, and blueberry are antioxidant, vitamin and fatty acid-rich fruits that can easily be utilized for improving the skin and hair conditions. The nutrients above work synergistically to protect the skin from environmental factors, improve the appearance of wrinkles and fine lines and contribute to the longevity of the skin.

One of the other benefits of the superfruit extracts is their moisturizing and nourishing properties. Acai and goji berries are among the best sources for comfrey A, C, and E vitamins that are the skin barrier moisture loss reparative agents. A, which is among the vitamins, supports the cell turnover process by producing new cells while C and E are best known for their anti-inflammatory effects. These vitamins also help promote collagen, a protein responsible for the elasticity of the skin, in the process.

As a result, the combination of these, the skin may be firmer and smoother. In addition, superfruits also carry fatty acids like omega-3 and omega-6 that balance the skin and hair moisture levels and promote the healing of dry or damaged conditions.

During the period 2020 to 2024, the sales grew at a CAGR of 3.9% and it is predicted to continue to grow at a CAGR of 4.1% during the forecast period of 2025 to 2035.

The processed superfruit market has been demonstrating notable upward trend the past 10 years mainly due to consumer consumption consciousness and the recognition of the health benefits brought by superfruits. Initially, the market resembled almost a small company having few applications it had with its main target being the food and beverage sector. However, as research showed the world high content of nutrients such as antioxidants, vitamins, and minerals, the popularity of these fruits grew.

In addition to this, the main expansion from the very start of the 2010s has been that superfruits were included in different types of products such as juices, powders, and dietary supplements. This development was also affected by the increasing number of diseases due to unhealthy lifestyles and the trend for people to eat healthier. The half-year formations were the time when the market was further no longer meagre since superfruits were utilized in cosmetics, personal care products, and nutraceuticals.

The consequent ascendancy of consumer demand for natural and organic goods was also a vital driving factor towards the market growth, given that the superfruits are often regarded as clean-labeled products which are healthy and eco-friendly lifestyles to the customers.

The processed superfruit market will maintain its upward trajectory primarily fueled by a multitude of critical factors. The global market's forecast presumes a growth achieved through a 4.1% CAGR, beginning from 2025 and reaching 2035; it is expected to be valued at 20,9723.8 million by the year mentioned. The presumed rise is addressed by the expansion of the sales of functional foods and drinks as well as the circulation of information about the superfruits health value.

Food technology innovations and product development shall keep on driving the market acre high from this road new products such as superfruit-packed offerings will be launched to different consumers' wants. The happened trends are anticipated to wane demand as cleanliness and sustainability are declared first-priority item by the customers thus they tend to look more for the products that include clear ingredient sourcing and low processing.

At a regional level, the Asia-Pacific region will be the fastest-growing zone, supported by better disposable incomes, rising health concerns, and an increase in urban dwellers. All in all, the processed superfruit sector shall experience strong advantages, the central themes being innovation, sustainability, and health.

Tier 1: They are the prime actors in the field, claiming large parts of the market and being present across the globe. PepsiCo Inc., Kerry Group plc, and Ocean Spray Cranberry Inc. are known to be part of that group. They dominate with the help of a large portfolio of items, powerful brands, and extensive distribution networks. Their financial resources are high enough; besides, they are investing in R&D which causes the fact of being always a step ahead of competitors as well as the creation of new market trends.

Tier 2: These companies have many characteristics that are similar to Tier 1 companies but they are not as strong. Symrise AG, SunOpta Inc., and Agrana Beteiligungs-AG are examples of the companies that belong to this group.

They are central to the regions they are present at and they are putting their trust mainly in innovation and strategic partnerships in order to expand their market share. Diversifying and transforming their way of doing business are the key components of their successful strategy in addressing the issues that the market brings to them.

Tier 3: They are the minor players in the market with less participation and revenue generation. Companies like Dabur India Ltd., Uren Food Group Limited, and Frutarom Industries Ltd. belong to the category of Tier 3. They sell very few products and thus have low presence on the market as opposed to larger companies that are selling the same goods.

They have learned that their broad knowledge of the local market and the availability of exclusive products are the key reasons they stay in the contest in the processed superfruit market. Quality and customer relationship have always been their main aims during the training of the employees.

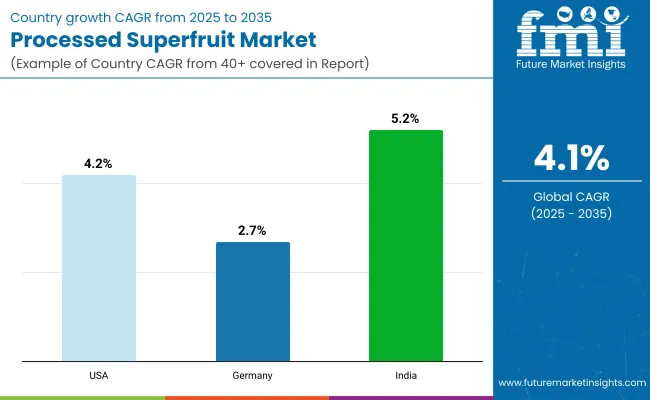

The following table shows the estimated growth rates of the significant three geographies sales. USA and Germany are set to exhibit high consumption, recording CAGRs of 4.2% and 2.7% respectively, through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

| Germany | 2.7% |

| India | 5.2% |

Health and wellness' Superfruit's mainstream thoughts: More than ever, the people of the USA give preference to antioxidant-rich superfruits. Outlining fruits: The best known are the blueberries, acai, and pomegranates of these superfruits which have high oxidants. Acai is a naturally loaded berry, and pomegranate is a plant rich in these benefits. These super-berries have the power to diminish the occurrence of several diseases, improve the immune system, and of course, make health the priority.

Consequently, the products that are made with superfruits such as juice, smoothie, and bar have become much trendier. The Clean label trend, naturalness, and the dry farming product have the extra advantages of being sought-after by the people who are on the quest for looking for the healthier and more balanced options Retailer sales also factor in this equation as they not only represent the channel through which these products are distributed, but have also become web-based, thus making them available to be brought/distributed on an empty break-even cost to everyone else.

Germany's consumers appear to have turned in particular to the exotic and functional foods people consider the consumption of which will improve the state of health. Advent of the trend is basically the result of the rise in the level of education regarding nutrition and the health of the whole being. Obstacles by a more balanced diet are being removed by the Germans who form health- and nutrition-oriented patterns and daily ingest food that is both the source of essential nutrients and the source of additional health factors.

Acai, goji, and dragon fruit are the exceptional tastes that add the fun to fruits which are the most liked among the exotic fruits that humans eat. It is to be noted that probiotics, vitamins, and minerals enriched functional foods are the most sought-after since people pursue the ways of improving their overall health factors connected to digestion, immunity, and other aspects of life.

In addition to the great variety of such foods, the sort of trend that advocates organic and sustainable products is another reason as to why such foods are trendy because a multitude of people are being educated about the environmental repercussions of their eating habits. The growing liking for the strange and functional food represents in fact not only a logical but also a quite revolutionary step towards the full transformation of the society in terms of the exclusive and the self-aware eating style the Germans are adopting.

The infiltration of Western food habits and practices in India is literally breathtaking not only in terms of its rate but also in terms of change in the culinary map as well. Since myriad Indians are having more interactions with the Western cultures via various means such as mass media, tourism, and the establishment of multinational companies, they are more and more turquiose to Western food habits.

Likenesses in lifestyle changes can be especially sensed in urban areas: where never-ending schedule of work and the elevation in income become the root causes of easy cooking meals, dehydrated items, fast meals in the market. Besides, eating food like quinoa, having vitamins, and purchasing organic food are becoming

norms among health-oriented consumers with the trends of Western values. It is a matter of fact that Western food preferences such as more attention to protein food, carbohydrate-restraining diets, and the experiment of different cultures in dishes are being more and more adopted in daily life.

Actually, it has been the fast-food national and international chains that are mostly responsible for the beginning of the process that leads to the same integration of the USA and Indian cultures. Likewise, the impressive fast-food chains that have managed to find their place in India serve as another example of this internationalization. To put it differently, the unifying of Western and Indian cultures in eating gives a lively and broad food culture in the nation.

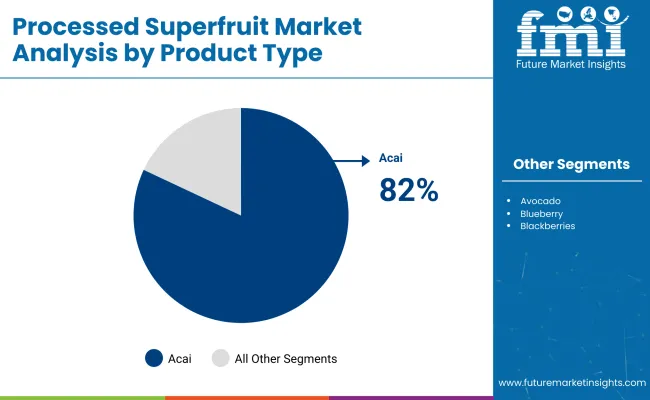

| Segment | Value Share (2025) |

|---|---|

| Acai (Product Type) | 82% |

The Acai berries, which are now available everywhere, are a high-grade nutritious food product and have excellent potential to boost general health. Acai berries that are typically found in the Amazon rainforest are rich in antioxidants, fiber, healthy fats, and essential vitamins. These are among the main reasons why they are hailed as such superfoods besides things like increasing energy levels, improving gut health, and, of course, protecting the heart.

The superfood acai berries are linked to the demand of consumers for food that is only and entirely natural and those that are loaded with nutrients. More than just being the newest health fad, acai bowls, smoothies, and dietary supplements are sought-after commodities in communities worldwide that are concerned about health.

The berry's exotic allure and unique taste, coupled with aggressive and social networking marketing have facilitated its rapid rise in world trade. As a result, acai products are now found in practically every supermarket, health food store, and caffeate; by that, you have better chances to include the fruit in your daily diet.

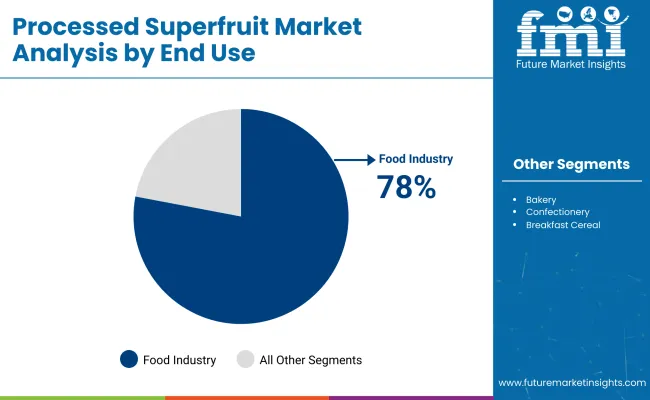

| Segment | Value Share (2025) |

|---|---|

| Food industry (end use) | 78% |

Given its indispensable contribution to humans, food, and beverage industry is a giant and is the chief actor in the global market. This mammoth sector encompasses everything from crop production and food processing to transportation and retailing. The demand for food is not only veering toward constant but also numerically high because of some factors like population growth, urbanization, and diet changes. Along with the food technology revolution, the progress in sustainable production, and the establishment of global supply chains, the food sector has grown.

Worldwide presence of large global brands affects the market paradigm by spinning price and even customer behavior out of gear. Moreover, the tendency for the availability of easy-to-cook, packed, and ready-to-eat food has been a prime reason for the food industry's pride. The industry also plays a significant role in the world economy as it is a source of job and value in GDP. The food sector, with its intrinsic quality and continuous innovation, will remain a global market player irrespective of all other conditions.

The processed superfruit market, with Symrise AG, SunOpta Inc., Kerry Group plc, and Agrana Beteiligungs-AG at the top, is not only an innovation-driven battleground but also a fierce competitive market. Symrise AG, the producer of superfruit products that are unique, uses its capability in flavor and nutrition to the fullest degree; on the other hand, SunOpta Inc. is totally absorbed with organic and non-GMO products, thus, they are profitably dealing with the rising demand for food produced naturally.

Kerry Group plc is the popular supplier of flavor and nutrition solutions that can offer a wide range of products that are made of superfruits to the confectioners and bakers. Agrana Beteiligungs-AG is a fruit preparation and concentrate company that provides a broad selection sufficiently addressing the divergent needs of consumers.

These companies with the help of research and development, the formation of strategic partnerships, and the use of sustainable practices, always try to be the first and capture a big share in the processed superfruit market, which is the fastest-growing one.

By Product type the industry has been categorised into Acai, Avocado, Blueberry, Blackberries, CamuCamu, Cherries, Coconut, Copoazu, Cranberry, Dragon fruit, Figs, Goji berry, Jackfruit, Kiwi, Kumquats, Mangosteen, Passion fruit, Pomegranate, Raspberry, Soursop, Strawberry

By End use the industry has been categorised into Food Industry, Bakery, Confectionery, Breakfast Cereals, Snacks, Baby Food, Dairy Products, Jams & Jellies, Powder Premixes, Beverages, RTD Juices, Energy Drinks,Functional Water, Carbonated Beverages, Sorbets and Smoothies, Probiotic Drinks, Retail (Household)

As per nature the industry has been categorized Organic, Natural, Conventional

Form further includes Liquid, Frozen, Powder, Canned, Dried, Pulp & Puree

By Sales Channel the industry has been categorised into HoReCa, Retail Sales, Hypermarkets/ Supermarkets, Discount Stores, Wholesale Stores, Grocery Stores, Specialty food Stores, Online Retail, Others

The market spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The market is expected to grow at a CAGR of 4.1% throughout the forecast period.

By 2035, the market is projected to reach a value of USD 209723.89 million.

North America is expected to dominate global consumption in this market.

BASF SE, Divi’s Laboratories Ltd., Cyanotech Corporation, and DSM N.V are the major manufacturers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Processed Fruit and Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Breakdown of Processed Beef Market Share

Market Share Insights for Processed Cashew Providers

Processed Meat Market Analysis by Type, Packaging, Meat Type, and Region through 2035

Analysis and Growth Projections for Processed Cheese Market

Processed Cashew Market Trends – Snack Innovation & Industry Growth 2025 to 2035

Processed Meat Packaging Market Growth & Trends 2024 to 2034

Processed Eucheuma Seaweed Market

Reprocessed Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Brief Outlook of Growth Drivers Impacting Consumption of UK Processed Cashew.

Analysis of the USA Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

USA Processed Cashew Market Analysis – Growth & Industry Trends 2025-2035

Europe Processed Cashew Market by Conventional and Organic Varieties Through 2035

Analysis of the Europe Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

Chilled Processed Food Market Analysis by Ready Meal, Processed Meat, Processed Fish or Seafood Through 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Brief Outlook of Growth Drivers Impacting Consumption of Asia Pacific Processed Cashew.

Asia Pacific Processed Beef Market Outlook - Size, Share & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA