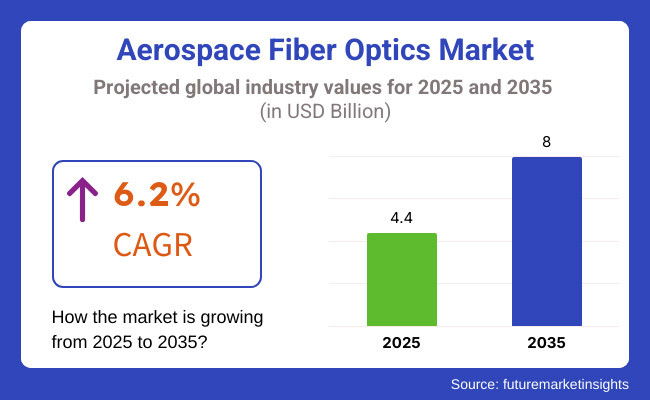

The aerospace fiber optics market is poised for steady growth from 2025 to 2035, driven by increasing demand for high-speed data transmission, enhanced communication systems, and lightweight yet durable materials in aircraft and space applications. The market is projected to grow from USD 4.4 billion in 2025 to USD 8.0 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.2%.

Factors such as advancements in fiber optic technology, growing adoption in military and commercial aviation, and stringent safety regulations promoting lightweight components will be key drivers for market expansion. The aviation industry is continually improving with an increasing dependence on fiber optics to help boost aircraft performance, communication, and safety.

The expansion of air travel coupled with the launch of more complex space missions is creating a boom for the insertion of new technologies that enable uncompromised, high-speed, and interference-free transmission. Fiber optics bring tremendous benefits which are compared to traditional copper wire such as less weight, extra bandwidth, and higher ability to resist electromagnetic interference.

The massive upsurge in the usage of state-of-the-art avionics, in-flight entertainment, and military-style communication systems is making fiber optics one of the essential components in today's aircraft and spacecraft, thus driving the sustainable market expansion throughout the forecasting period.

The aerospace field of fiber optics has proved to be very useful even in more advanced aircraft applications by facilitating a speedier data transfer, quality intero-connection, and lesser electromagnetic interference. Adoption of fiber optic cables in the aircraft has been increased with a rising demand for in-flight entertainment systems, avionics, and high-bandwidth communication. Fiber optics are believed to be commonplace in satellite communication and spacecraft operations as they are intricately used with new outer space exploration programs.

Innovation has given rise to such products as fiber optics that survive in extreme environments, next-generation optical transceivers, and multiplexing techniques which boost the market even more. The regulatory framework that motivates the aerospace sector for weight reduction and the implementation of more life-safety technologies in structural parts on the balance side welcomes the use of fiber optic technology.

The aerospace fiber optics market in North America is mainly due to its aviation and defense industry's global leadership. Their significant share is attributable to the large presence of aircraft makers like Boeing, defense contractors, space agencies such as NASA, and places to run. Consequently, the adoption of fiber optic technologies in this region is fast-tracked.

The USA Department of Defense is keen on putting fiber optics into aircraft, sensor systems, and secure communication networks to boost performance and cybersecurity. The acquisition of next-generation fighter jets, UAVs, and commercial aircraft is a driving force behind market growth.

The space industry expansion, launching new satellites, and deep-space mission’s leverages fiber optics as further capacities and capabilities are being launched. The Federal Aviation Administration (FAA) is also highly supportive and promotes lightweight fuel-efficient components, including fiber optics, which is a milestone in aerospace engineering.

One of the major players in the aerospace fiber optics market is Europe, which is supported by growing demand in commercial and defense aviation. The main companies are located in the region, including the most famous aircraft manufacturer- Airbus and major aerospace suppliers who are centered on fiber optic components.

The European Union Aviation Safety Agency (EASA) is promoting lightweight materials like fiber optics by establishing aircraft efficiency and emissions regulations, thereby influencing the demand for them. The European Space Agency's (ESA) expanded programs in satellite communication and space exploration are also promoting the use of fiber optics. The modernization of military forces in the United Kingdom, France, and Germany prompts the need for advanced avionics, and secure data transmission systems thus increasing the market sector in the region.

With the rising number of air travelers, soaring defense budgets, and robust space initiatives, Asia-Pacific is forecasted to be the fastest-growing region in the aerospace fiber optics market. Proper steps in nation-building like construction of the next-level aircraft, satellites, and robust defense communication networks will be the driving forces behind the quest for fiber optics. China’s space race and the increasing rate of its airline occupancy are opportunities for fiber optic embedding in both fields.

Nonetheless, India’s pursuit of ambitious aerospace projects such as satellite launches and indigenous fighter jet programs benefits the market by being a driver for these projects. Fiber optics are an integral technology when it comes to airborne advancements in the region, with their rising use in in-flight entertainment systems and avionics as a result of the growing adoption of low-cost carriers.

Emerging opportunities in the aerospace fiber optics market have been seen in the rest of the world, which encompasses regions like Latin America, the Middle East, and Africa. The Middle East Aerospace sector is experiencing the rapid growth of aviation and the big leap is taken by the UAE, and Saudi Arabia which are establishing new Aerospace hubs and adding aircraft equipped with fiber optics to their fleets.

Demand for modern aircraft is increasing in Latin America, especially as a result of the expansion of local aviation companies and military modernization programs in Brazil and Mexico. Africa is expected to see the growth of satellite projects and a new aviation sector that will help in the adoption of fiber optic technology in the future. Despite the fact that besides infrastructure limitations, many issues are challenging, growth in aerospace investment and technology cooperation will eventually create a market in these areas.

High Cost and Complex Integration

The aerospace fiber optics sector is faced with the primary challenge of the high cost of fiber optic components and their complex integration into aircraft systems. In contrast to using traditional copper wiring, fiber optical divers need special materials and newer process technology, leading to higher manufacturing costs. The cost and time needed to make the changes are very significant, both for legacy systems that do not support them and for those that are.

Airlines and defense solicitifications charily few spare amendments thus making big-scale integration complex. Trained professionals are needed who can install, maintain, and repair fiber optic networks which lead to incremental costs on the operational side. Fiber optics, albeit their long-run payoffs such as weight drop and performance exploitation, their upfront cost for installation still is a tough hurdle to cross.

Stringent Regulatory Compliance and Reliability Concerns

Aerospace optical fiber components have to meet the rigid standards defined by various organizations, slub-like military, FAA, EASA, and so on for ensuring the safety, survivability, and reliability in the harsh environment. Aircraft and space systems exist in harsh conditions with high levels of vibration, temperature changes, and radiation affects that all can hinder the performance of the fiber optic. The manufacturers face difficulty in aligning consistent reliability with the tough safety goal accomplishment.

Critical applications such as avionics and flight control systems are jeopardized by the possible malfunction of fiber optics that could resulted in catastrophic effects. For the same reason, the aerospace firms are bound to conduct a lot of experiments and quality assurance testing, which is the cost and time for product certification, in turn, delays the market entrance.

Rising Demand for Next-Generation Aircraft and UAVs

Market opportunities for aeroplane fiber optics are being enhanced hugely due to a significant upswing in the demand for next-generation commercial aircraft, military jets, and unmanned aerial vehicles (UAVs). To cut down on operational costs while at the same time staying within the quota of stringent environmental rules, Airlines are making the use of lightweight and fuel-efficient aircraft which in turn makes fiber optics move to a practical alternative to copper wiring already.

In the defense arena, UAVs and self-sufficient carriers need high-speed communication free-of-interference which is where fiber optics come to the play. The parallel expansion of UAM projects and eVTOL aircraft only aids in the rise of fiber optics baking. Fiber optics will, of course, at the same time play a vital part in reinforcing performance and diminishing overall structure aircraft when aviation turned to more interlinked, autonomic, and electric systems.

Advancements in Space Exploration and Satellite Communication

The flourishing business in space exploration, satellite networks, and deep-space missions is creating a high demand for fiber optics of superior quality. The government and private enterprises like NASA, SpaceX, and Blue Origin are making the next-generation satellites and crafts which are fed by optical fibers for high-speed, long distance communication.

The various constellations deployed in Low Earth orbit (LEO), such as the Starlink constellation, require integrated and superlight fiber optic cables, with radiation resistance to achieve bandwidth-efficient global connectivity. The exploration missions beyond Earth such as during Mars missions require unique fiber optics to assist the harsh environmental conditions.

Therefore, with the space agencies and privatized companies going out of their way to space science achievements, fiber optics will be essential for data transmission that is both secure and of high capacity in the rapidly growing aerospace industry.

The aerospace fiber optics market has shown consistent growth during the period from 2020 to 2024 as a result of the rising needs for high-speed data transfer, aircraft weight reduction, and the introduction of advanced communication systems.

The use of fiber optics in avionics, inflight entertainment systems, and military applications has grown, with such important developments as improved fiber optic cable durability and integration with advanced avionics. The regulatory push towards more efficient, lightweight, and durable systems has also driven market developments.

Looking forward to the years 2025 to 2035, the aerospace fiber optics market will be characterized by rapid innovative growth as a result of the introduction of cutting-edge aircraft, further space exploration, and improvements in the fiber optics themselves. The turn towards AI-driven predictive maintenance and smart aircraft networks will open up new avenues for fiber optics integration. The concerns about aviation communication security will promote investment in super-secure optical fiber networks.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Adoption of fiber optics in military and commercial aviation is mainly due to the fiber weight reduction regulations. |

| Technological Advancements | High-durability fiber which is resistant to extreme heat and vibration is being developed. |

| Industry-Specific Demand | Very high demand for communication and sensor applications from commercial aviation, military aircraft, and UAVs. |

| Sustainability & Circular Economy | Lightweight materials are being prioritized in order to achieve better fuel savings. |

| Market Growth Drivers | Surge in demand for sophisticated avionics and accelerated in-flight connectivity. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | More stringent aviation safety and cybersecurity regulations result in the use of encrypted fiber optic networks. |

| Technological Advancements | AI-driven fiber optic networks integrated for predictive maintenance and enhancing data security. |

| Industry-Specific Demand | Entering the area of urban air mobility (UAM), space exploration, and deep-space communication systems. |

| Sustainability & Circular Economy | Adoption of recyclable fiber optic materials and eco-friendly manufacturing processes is increased. |

| Market Growth Drivers | Proliferation of smart aircraft networks, incorporation of AI-based fiber optic systems, and growing investment in space communications. |

According to the aerospace fiber optic market forecasts in the USA is anticipated to witness a 6.5% CAGR, from 2025 to 2035, substitution of fiber optics in lightweight and high-performance aircraft. The alliance of reputable aerospace firms such as Boeing and Lockheed Martin inspires technological advancements, The USA Air Force's restructuring projects lead to the necessity of high-speed data transmission devices.

The provision of regulatory support from the FAA and the notion of NASA lightweight, high-performance materials almost are the same persuasions for the development of the market. The incorporation of fiber optics in UAVs and satellite communication systems also enriches the market with opportunity propositions and the USA is a leading country in the aerospace fiber optics industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

The aerospace fiber optics market in the United Kingdom is predicted to witness a compound annual growth rate of 5.8% during the period 2025 to 2035, showing the strength of the nation’s aerospace sector, particularly represented by BAE Systems and Rolls-Royce. The rising application of fiber optics in advanced avionics, defense applications, and the commercial aircraft sector, is a driving factor for market development.

The UK government places funds into the next-gen military aircraft and aerospace research projects, as well as abiding by strict safety and performance guidelines, which all together push the demand higher. Through collaboration with European aviation programs, like the Tempest fighter jet project, derivatives in fiber optic-based communication and sensor systems drive the innovation. The rising emphasis on aircraft weight reduction and fuel efficiency augmentation will still be the factors in market dynamics.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.8% |

The European aerospace fiber optics market is expected to post a CAGR of 6.0% from 2025 to 2035, primarily because of technology improvements and investment in aviation R&D. Leading companies such as the Airbus and Safran are key players in integrating the fiber optics with future aircraft. The European Space Agency's concentration on satellite communications and space exploration is central to the needs of fiber optics.

Improved environmental laws and the mission to sustainability foster the lightweight, high-performance fiber optics that are used to optimize fuel consumption. The promotion of smart aircrat systems and the widespread deployment of digital technologies in aviation are also responsible for the stable market growth. Aerospace projects among the EU nations has facilitated the innovation that makes Europe the leading region worldwide in the aerospace fiber optics market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.0% |

The Japanese aerospace fiber optics market will witness a marked elevating of 5.6% compound annual growth rate (CAGR) between 2025 and 2035, as a consequence of the nation's development of satellite technology, modernization of the defense sector, and commercial aviation projects. The Japanese aerospace sector, which includes the likes of Mitsubishi Heavy Industries, commits abundant resources to fiber optic technology applications such as high-speed data exchange and encryption.

The focus of the country on space exploration, which is endorsed by JAXA (Japan Aerospace Exploration Agency), even more, expedites the demand for this particular market. In another aspect, the increasing preferences regarding the use of lightweight and high-strength materials in aircraft production also lead to greater adoption of fiber optics.

The Japanese government promotes aerospace technical innovations by way of funding research and by having international partnerships which are well-organized, which in turn, brings about the improvements in avionics and navigation systems that utilize fiber optic technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

According to projections, the aerospace fiber optics market in South Korea will be increasing at a compound annual growth rate of 5.9% during the period from 2025 to 2035 due to the escalating defense sector, the promotion of domestic aircraft development, and the additional demand for satellite programs.

The efforts of the South Korean government, along with the participation of aerospace companies like Korea Aerospace Industries (KAI), in the development of the fiber optic technology are aimed at the installation of the fiber optics in military aircraft and uav systems. The growing number of space launches in the country, one of which is a new satellite, is another cause of the high-speed, lightweight fiber optic demand.

The strategic alliances between South Korea and foreign aerospace companies, plus the country's focus on smart avionics, have firmly laid the ground for the expansion of the fiber optics market. The trend towards investment in the new generation of aircraft communication and data systems is expected to kickstart the fiber optics usage.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

Single Mode Fiber Optics Dominate Due to High Bandwidth and Long-Distance Transmission

Lead by the outstanding bandwidth and the least signal loss transmission capability, top Single-mode fiber optics dominate the aerospace fiber optics market. These fibers find extensive applications in avionics, in-flight entertainment systems, and real-time data communication in aircraft and satellites, which are categorized as high-performance technologies.

Their increased use in next-generation aircraft and defense systems, which is mainly attributed to the demand for more advanced communication and sensor systems, is a strong driver for the adoption of single-mode fibers. Single-mode fiber standards, which are usually stricter than those in the rest of the industry, are being met by adhering to the aerospace regulations on durability and electromagnetic interference.

North America and Europe are the primary markets for aerospace applications, particularly supported by extensive R&D investments in fiber optic technology, which ensure the reliable and high-speed data transmission in aerospace applications.

Multimode Fiber Optics Maintain Demand Despite Distance Limitations

Multimode fiber optics are still able to achieve a considerable market size as they are cheaper and primarily suited for short distances. The aircraft cabin systems of these diameter include lighting and in-flight networking, as well as control systems. Their capacity to transmit large amounts of data over short comparisons of distances makes them possible to be used in signals where the integrity on long ranges is not a predominant issue.

In spite of the statement that their signal loss is more than that of single-mode fibers, because of the easy installation and maintenance, multimode fibers are still a part of modern aircraft. The growth of the commercial aviation sector and the increasing amounts of funding in connected aircraft technologies, especially in the Asia Pacific and the Middle East, play a major role in the ongoing demand for multimode fiber optics.

Civil Aviation Leads the Market Due to Rising Demand for Connectivity

Civil aviation is the foremost sector that controllers the aerospace fiber optics market driven by the increasing demands for high-speed in-flight connectivity, advanced avionics, and efficient data transmission in commercial aircraft. Airlines are focusing to improve passenger experience and the overall operation by use of fiber-optics based communication and entertainment systems.

The incorporation of the fly-by-light technology, which involves the use of fiber optics in place of the traditional electrical wiring, is another factor embedded in the fiber optic distributor. Besides, the growth in the number of manufactured aircraft, especially in new emerging markets such as China and India, further fuel the development of the sector. The regulations mandating ultralight materials and better fuel consumption back the use of fiber optics in civil aviation, which guarantees less aircraft weight and better system performance.

Defense Sector Expands with Growing Military Aircraft and UAV Applications

Aerospace fiber optics market is witness growth because of the defense sector that plays a vital role with increasing military aircraft and UAV applications. Fiber optics use in military aircraft, drones, and naval aviation is driven by the desire for secure and high-speed communication. Fiber optics make communication of essential data, persistence and secrecy in recent defense operations more efficient.

They are critical in the development of advanced avionics and radar systems in fighter jets and unmanned aerial vehicles (UAVs) because they completely eliminate the effect of electromagnetic interference. The rate of grow in the defense budgets in the USA, China and European countries, along with high-tech breakthroughs in electronic warfare and satellite communications, are accelerating the fiber optic adoption process. The requirement for low weight and better quality of the defense aircraft has also driven the usage of fiber optic in military applications.

The Aerospace Fiber Optics Market is presently going up on the back of the increased call for data transmission at high speed, lightweight materials, and enhanced safety issues in modern aircraft. The market is quite congested with the involvement of international competitors and provincial contributors who channel their resources in bringing about advancements and strategic bypasses.

Fiber optics are dominant in the field of modern aviation, which benefits from a variety of advantages like the reduced electromagnetic interference, more bandwidth, and lesser weight as compared to the conventional copper wiring.

The approval of next-generation aircraft, always-on demand for unmanned aerial vehicles (UAVs), and the integration of fiber optics in avionics and communication systems profile the market with an expansion. The fiber optic solutions are expected to be the main player in the aviation system transformation, as aerospace manufacturers are in search of greater efficiency and environmental friendliness.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amphenol Corporation | 12-16% |

| TE Connectivity | 10-14% |

| Corning Inc. | 8-12% |

| Radiall | 6-10% |

| OFS Fitel, LLC | 5-9% |

| Other Companies (Combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amphenol Corporation | Specializes in fiber optic interconnect systems for aerospace applications. Focuses on robust, high-performance solutions. |

| TE Connectivity | Offers fiber optic components with high-reliability for avionics and defense sectors. Invests in miniaturization technology. |

| Corning Inc. | Develops optical fiber solutions with a focus on durability and high bandwidth for commercial and military aircraft. |

| Radiall | Provides high-performance fiber optic connectors and harnesses for harsh aerospace environments. |

| OFS Fitel, LLC | Manufactures specialty optical fibers for precision-guided systems and avionics. Focuses on innovation and sustainability. |

Key Company Insights

Amphenol Corporation

Amphenol Corporation is the foremost supplier of optical fiber interconnection systems for the aerospace industry. The company is engaged in the design and manufacture of the best optical fiber connectors, cables, and assemblies that can meet the ultra-high to the strictest specifications of commercial and military aircraft.

Amphenol which is a strong global with a strategy of miniaturization technologies and investment in high-speed data transmission solutions is relatively new to the aerospace portfolio. The company's R&D projects aim not only for durability but also to improve performance in exceptionally harsh environments. Amphenol besides is also working with aircraft manufacturers and defense contractors to come up with custom fiber optic solutions for improvements in avionic, in-flight entertainment and communication systems.

TE Connectivity

TE Connectivity has been miles ahead with its ruggedized fiber optic components for both commercial and defense aerospace markets. The company produces high-reliability optical interconnects that are designed to work under extreme conditions, thus ensuring stable data transmission in avionics and other mission-critical devices. Considering the advancements in miniaturization and the move to lightweight products, TE Connectivity has successfully placed itself in the market.

The company, through strategic acquisitions, exponentially expands its portfolio and in that way, it harnesses the aerospace connectivity solutions expert who is already on the market. Besides that, TE is one of the pioneers in the mass production of high-density optical interconnects, the market's response to the increasing data-based aircraft systems and the consequent improvement of the aviation functional efficiency.

Corning Inc.

Corning Inc. is the top company in the field of optical fiber technology and it is also a corporation that is growing within the aerospace market. The company has come up with long-lasting, lightweight optical fiber solutions that allow aircraft to perform better and improve reliability. The specialty glass and optical physics knowledge that Corning possesses enables it to manufacture low-loss, high-bandwidth fibers, which are necessary facilities for avionics, data transmission, and in-flight networking.

The company is allocating resources to research and develop the next generation of fiber optics that will have better thermal resistance and radiation protection, especially for aerospace applications. Corning Labs partners with the biggest aircraft manufacturers and helps them with the integration of the special fiber in existing and new aviation platforms.

Radiall

Radiall is an essential contributor in the aerospace sector as a fiber-optic connectivity producer. The company provides high-performance connectors and harness systems for reliable connection/disconnection. Radiall stands out in the cargo space because of its modular fiber optic solutions available to both civil and military programs.

The company heavily emphasizes on uniqueness and application-perennial designs that promise trouble-free integration in overriding issues between aircraft communication and data networks. Radiall is now actively investigating alternative designs in aerospace fiber optic connectors, which will provide better signal integrity and durability, among other properties. Thanks to its innovation and commitment to building robust solutions, Radiall is still poderous as it bears the trust of the principal aircraft makers and suppliers in defense.

OFS Fitel, LLC

OFS Fitel, LLC is the precision-engineered optical fibers leader for avionics, military applications, and airborne communication systems. The company produces fiber solutions that resist radiation, one of the factors that matter the most in space and high-altitude aircraft applications. OFS Fitel promotes the ecology-friendly process of manufacturing fiber optics, hence its commitment to lessening the environmental footprint while achieving high performance.

The company's cutting-edge fiber optic products are extensively used in aerospace navigation, guidance systems, and surveillance devices. The company's growth in the aerospace fiber optics market which is characterized by the technical development of high-bandwidth and low-loss results from its concentrate on these two aspects.

In terms of Product Type, the industry is divided into Single Mode, Multimode

In terms of End Use, the industry is divided into Civil Aviation, Defense, Space

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Aerospace Fiber Optics market is projected to reach USD 4.4 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 6.2% over the forecast period.

By 2035, the Aerospace Fiber Optics market is expected to reach USD 8.0 billion.

The single mode fiber segment is expected to dominate the market, due to its higher bandwidth, longer transmission distances, lower attenuation, and superior signal integrity, essential for aerospace applications.

Key players in the Aerospace Fiber Optics market include Amphenol Corporation, TE Connectivity, Corning Inc., Radiall, OFS Fitel, LLC.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Kilotons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Kilotons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use Type, 2018 to 2033

Table 6: Global Market Volume (Kilotons) Forecast by End Use Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Kilotons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use Type, 2018 to 2033

Table 12: North America Market Volume (Kilotons) Forecast by End Use Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Kilotons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use Type, 2018 to 2033

Table 18: Latin America Market Volume (Kilotons) Forecast by End Use Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Kilotons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use Type, 2018 to 2033

Table 24: Western Europe Market Volume (Kilotons) Forecast by End Use Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Kilotons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use Type, 2018 to 2033

Table 30: Eastern Europe Market Volume (Kilotons) Forecast by End Use Type, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Kilotons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use Type, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Kilotons) Forecast by End Use Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Kilotons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End Use Type, 2018 to 2033

Table 42: East Asia Market Volume (Kilotons) Forecast by End Use Type, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Kilotons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use Type, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Kilotons) Forecast by End Use Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Kilotons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Kilotons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use Type, 2018 to 2033

Figure 13: Global Market Volume (Kilotons) Analysis by End Use Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Use Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Kilotons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use Type, 2018 to 2033

Figure 31: North America Market Volume (Kilotons) Analysis by End Use Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Use Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Kilotons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use Type, 2018 to 2033

Figure 49: Latin America Market Volume (Kilotons) Analysis by End Use Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End Use Type, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Kilotons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use Type, 2018 to 2033

Figure 67: Western Europe Market Volume (Kilotons) Analysis by End Use Type, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use Type, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use Type, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Use Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End Use Type, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Kilotons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use Type, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Kilotons) Analysis by End Use Type, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use Type, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use Type, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Use Type, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use Type, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Kilotons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use Type, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Kilotons) Analysis by End Use Type, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use Type, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use Type, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End Use Type, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End Use Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Kilotons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use Type, 2018 to 2033

Figure 121: East Asia Market Volume (Kilotons) Analysis by End Use Type, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use Type, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use Type, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End Use Type, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use Type, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Kilotons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use Type, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Kilotons) Analysis by End Use Type, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Type, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Type, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End Use Type, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA