On the other hand, the global aerospace accumulator market is expected to reach an annual growth rate of 6% between 2025 and 2035. Hydraulic and fuel systems in modern aircraft rely heavily on Aerospace Accumulators to maintain optimal performance, energy efficiency, and safety. Also, the increasing demand for fuel-efficient systems and highly reliable products has necessitated the implementation of more sophisticated accumulator technologies in several aerospace applications.

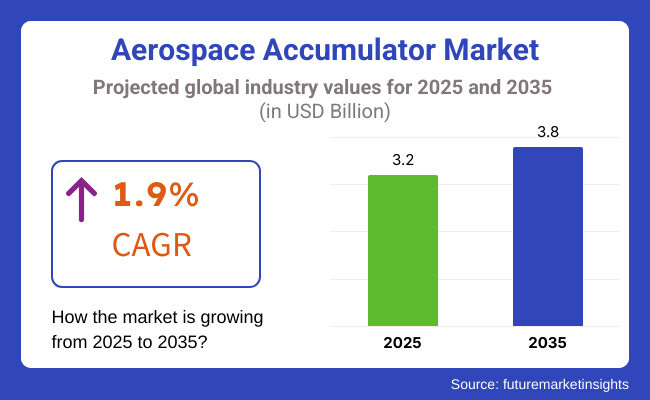

The aerospace accumulator market was valued at USD 3.2 Billion in 2025. Over the forecast period from 2025 to 2035 the market for 5G mm Wave will expand with a growth at a remarkable CAGR of 1.9% reaching a projected USD 3.8 Billion by 2035. Factors such as technological developments in hydraulic systems, growing demand for lightweight materials, and higher investments in aerospace engineering innovations are fueling the growth of this market.

North America is the leading aerospace accumulators market owing to the growth of aviation and defense sectors and an expanded application of hydraulic systems, along with significant investments in R&D. Next-gen accumulator material development and commercialization are being led by the USA and Canada.

The demand for sleek and fuel-efficient aircraft, high regulatory standards, and developing aerospace technologies provide a strong base for those that invest in Europe’s market. Germany, France, and the UK are among those countries looking to sustainability by harnessing better accumulator designs, which help aircraft fly better.

The aerospace accumulator market in the Asia-Pacific (APAC) region is expected to grow at the highest rate, owing to the rapid growth of commercial aviation and defense programs in this region. Demand is growing for aerospace manufacturing and infrastructure development in China, India, and Japan.

Steady aerospace investments and a growing demand for regional air travel is speeding up this market growth in Latin America. Brazil and Mexico are important sources, gearing up to enhance aerospace manufacturing capabilities and integrate sophisticated hydraulic systems.

The market in the Middle East & Africa region is also trending upward but at a much slower rate, with increasing investments in aircraft modernization, defense, and space programs contributing to its growth. So, South Africa and the UAE are spearheading those initiatives to build more aerospace manufacturing skills within the region.

As the technology continues to evolve and is being increasingly adopted for various applications, the market for aerospace accumulators is expected to grow at a steady pace over the next ten years and niche opportunities for the manufacturers of components, aerospace engineers, and defense contractors will be created.

Challenges

High Manufacturing Costs and Stringent Quality Standards

Constraints of the Aerospace Accumulator Market include high costs associated with precision manufacturing and stringent quality control standards. The aerospace industry has stringent aviation licensing requirements, including FAA and EASA certifications for aerospace accumulators, which guarantee safety as well as reliability. These requirements also introduce complexities in production, driving up operational spending. To be competitive, manufacturers need to invest in advanced testing procedures, automation, and cost-effective materials to meet regulatory demands.

Supply Chain Disruptions and Material Shortages

It is a supply chain that is highly dependent on the precision manufacturing of specialized materials, such as titanium, composites and high-grade alloys. Disruptions in global supply chains, trade restrictions between nations (especially the ones involving advanced nations), as well as geopolitical uncertainties, such as conflicts or unstable economies, will inevitably affect the availability and cost of these essential components as well.

Answering the hurdles, the need of the hour is for industry participants to adapt diversified supplier base, scout for alternative material and engage predictive supply chain analytics to maintain uninterrupted production and delivery processes.

Opportunities

Rising Demand for Next-Generation Aircraft and Space Exploration

Aerospace Accumulator Market: Opportunities The growing demand for fuel-efficient commercial aircraft, development of military aviation & military aircraft capabilities, and increasing space exploration programs in both governmental and private, all create significant opportunities for the Aerospace Accumulator Market.

Modern aircraft demand advanced hydraulic and pneumatic systems, which drives the need for high-performance accumulators. This growing demand helps companies that invest in lightweight and energy-efficient accumulator solutions, designed for sophisticated aerospace applications, to excel and further dominate their market.

Adoption of Smart and Maintenance-Free Accumulators

The trajectory of the aerospace sector is moving towards smart accumulator technologies that come with integrated real time monitors, predictive maintenance plans, and self-diagnostic capabilities. These improvements make the planes work better, cost less to maintain, and are safer. Adopting IoT-enabled accumulator systems, AI-driven diagnostics, and sustainable energy storage solutions will lead the market leaders towards higher competitive results.

2025 to 2035 Helicopter Market Transformations Between 2020 and 2024, the Aerospace Accumulator Market underwent dynamic changes driven by growing demand for advanced aircraft with improved performance, reduced weight as well as higher safety standards. However, post pandemic supply chain disruptions and rising prices of raw materials destabilized the market. Firms in the industry responded by streamlining production efficiency, fortifying local supply chains, and embracing lightweight accumulator technologies.

Market: 2025 to 2035 The market will see transformative developments like smart accumulators, predictive maintenance based on artificial intelligence, and environmentally friendly energy storage solutions. Additive manufacturing, nanotechnology coatings and high-efficiency hydraulic systems will spur innovation. Moreover, the push toward carbon-neutral aviation in the aerospace sector will accelerate adoption of sustainable accumulator materials and energy-efficient hydraulic systems.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with stringent aerospace safety standards |

| Technological Advancements | Growth in lightweight accumulator materials |

| Industry Adoption | Increased demand for hydraulic accumulators in commercial and military aviation |

| Supply Chain and Sourcing | Heavy reliance on traditional aerospace suppliers |

| Market Competition | Dominance of established aerospace accumulator manufacturers |

| Market Growth Drivers | Rising aircraft production and hydraulic system advancements |

| Sustainability and Energy Efficiency | Initial steps toward lightweight and low-emission materials |

| Integration of Smart Monitoring | Limited implementation of digital diagnostics |

| Advancements in Aerospace Innovation | Use of conventional hydraulic accumulators |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Integration of AI-driven compliance monitoring and green certification |

| Technological Advancements | Expansion of smart accumulators with IoT-enabled predictive maintenance |

| Industry Adoption | Rise of electric aircraft accumulators, space-grade energy storage systems, and hybrid propulsion solutions |

| Supply Chain and Sourcing | Shift toward localized production, additive manufacturing, and alternative material sourcing |

| Market Competition | Emergence of startups focusing on AI-integrated and energy-efficient accumulator solutions |

| Market Growth Drivers | Expansion of sustainable aviation technologies, electric propulsion, and green energy storage solutions |

| Sustainability and Energy Efficiency | Widespread adoption of carbon-neutral accumulator components and energy-efficient hydraulic systems |

| Integration of Smart Monitoring | Full-scale deployment of AI-driven predictive maintenance and real-time performance analytics |

| Advancements in Aerospace Innovation | Development of hybrid energy storage solutions, high-efficiency pneumatic accumulators, and self-healing materials |

North America, particularly the US, leads the aerospace accumulator market in revenue due to high developed aviation and defense sector in this region. Market growth is also being aided by major aerospace manufacturers and a rise in investments in next-generation aircraft. This increase in momentum is mainly attributed to the recent projects launched by the government along with the defence modernization projects which contribute to the demand for advanced accumulators.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.1% |

With a well-established aerospace industry and technological advancements, the United Kingdom is a prominent region in the global aerospace accumulator market. This stimulates the growth of the market for lightweight accumulator solutions and sustainable aviation fuel systems. The collaboration between research institutions and aerospace manufacturers encourages innovation in accumulator design, which further propels market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 1.8% |

The largest European aerospace accumulator market in Germany, France, and Italy are driven by a strong commercial as well as defense aviation sector. The European Union stresses reduced carbon emissions from aeronautics to drive innovation in accumulator technologies. Because of the growing development of electric and hybrid aircraft in Europe, there is a substantial demand for advanced accumulators, which is fostering growth in this region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 1.9% |

The Japanese aerospace industries market has been functioning as a major factor in bringing growth to the accumulator market, as it widely utilizes these in precision hydraulic systems and manufacturing of aircraft components. Market growth is fueled by investments made by the country on next-generation aviation technologies such as electric aircraft. Sonangol has allowed Tenaz to grow in the market, driven by government-backed aerospace development programs and partnerships with global aerospace leaders.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.0% |

The Aerospace Accumulator market in South Korea is expected to grow steadily, owing to the rising defense spending and the expansion of the commercial aviation sector. India's emphasis on indigenous aircraft manufacturing and aerospace R&D is driving demand for advanced accumulators. Market growth is further backed by strategic partnerships with global aerospace companies and investments in sustainable aviation technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.2% |

Bladder and piston accumulators are essential to the aerospace accumulator market for their energy storage, emergency backup, and hydraulic system stabilization capabilities. Building up the bladder accumulators, which are known for their fast power delivery rates, will improve the power efficiency and responsiveness of the hydraulic systems on aircraft at the end. Due to their lightweight structures and ability to withstand high pressures, they are widely used in modern aerospace environments.

While piston accumulators provide extreme durability and the ability to operate over a wide pressure spectrum, and they find their way into essential units of flight control systems. These types of accumulators continue to dominate the aerospace industry, reinforcing the need for high-performance and energy-efficient hydraulic components.

For aerospace accumulators, steel is the material of choice, due to its strength, toughness, and ability to perform well under high-pressure and temperature environments. Its hydraulic system application creates durable long-term reliability, which is why this material is a key component of aircraft accumulators.

As a result of developments in composite materials and lightweight alloys, there is a possibility for alternative materials to gain in importance. Due to the focus on fuel efficiency and weight reduction among aerospace manufacturers, research on next-generation materials used in accumulators is likely to impact the trends of the future market.

Together, the commercial and military aircraft segments represent a large portion of the aerospace accumulators market. Hydraulic accumulators are crucial in commercial aircraft as they require performance like flight control, gates, and brakes on landing gear must be high efficient as well as lightweight. The need for accumulators in commercial aircraft will also gradually increase as the aviation industry continues to grow through increasing passenger volumes and fleet renewals.

Military aircraft use rugged, high-performance accumulators to support mission-critical operations. Sustainment of hydraulic fluid and superior endurance features of accumulators are becoming a primary need for advanced hydraulic systems in fighter jets, transport aircraft, and unmanned aerial vehicles (UAV), which is anticipated to contribute toward the market growth in defense end-use sector.

Helicopters rely on aerospace accumulators to maintain hydraulic pressure in flight-critical systems, including rotor blade control, braking, and emergency operations. The increasing demand for helicopters in defense, emergency medical services, and offshore transportation has bolstered the growth of accumulators in this segment. Technological advancements in rotary-wing aircraft and the rising focus on lightweight and high-performance hydraulic components are expected to drive further adoption of accumulators in the helicopter market.

Growing demand for better hydraulic energy storage, aircraft safety systems, and advancements in lightweight, high-performance accumulator technologies are driving the aerospace accumulator market. Companies work on material innovation, meeting aerospace's challenging regulatory environment, and increased reliability for commercial and military applications. The evolution of the market is guided by factors such as composite accumulators, high-pressure gas accumulators, and advanced monitoring technologies that are powered by the Internet of Things.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Parker Hannifin Corporation | 20-25% |

| Eaton Corporation | 15-20% |

| HYDAC Technology Corporation | 10-14% |

| Triumph Group Inc. | 8-12% |

| Collins Aerospace (Raytheon) | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Parker Hannifin Corporation | Leading in high-performance hydraulic and gas accumulators for aerospace applications, focusing on lightweight and durable designs. |

| Eaton Corporation | Specializes in energy-efficient and high-reliability accumulators for commercial and defense aircraft. |

| HYDAC Technology Corporation | Provides advanced bladder, piston, and diaphragm accumulators optimized for aircraft hydraulic systems. |

| Triumph Group Inc. | Develops customized accumulators for landing gear, flight control, and emergency backup systems. |

| Collins Aerospace (Raytheon) | Innovates in composite and high-pressure accumulators, integrating real-time monitoring systems for enhanced performance. |

Key Company Insights

Parker Hannifin Corporation (20-25%)

One of the importance suppliers of aerospace accumulators is Parker Hannifin which provides weigh optimized gas and hydraulic accumulators which are robust and provide high durability.

Eaton Corporation (15-20%)

Eaton specializes in both commercial and military airplane applications and designs high-reliability energy-efficient accumulators.

HYDAC Technology Corporation (10-14%)

General Accumulators HYDAC is specialized in its wide range of aerospace accumulators: bladder, piston and diaphragm types for optimal hydraulic performance.

Triumph Group Inc. (8-12%)

Triumph Group produces mission-critical accumulators for aircraft systems, such as landing gear and flight control devices.

Collins Aerospace (Raytheon) (6-10%)

Collins Aerospace addresses the next-generation accumulators: incorporated with real-time performance monitoring and high-pressure composite materials.

Other Key Players (35-45% Combined)

Multiple Aerospace Accumulator manufacturers are globally and regionally active, with a focus on improving efficiency, safety, and the possibility of complying with aerospace regulations. Key players include:

The overall market size for Aerospace accumulator market 3.2 Billion was USD in 2025.

The Aerospace accumulator market expected to reach USD 3.8 Billion in 2035.

The demand for the aerospace accumulator market will be driven by increasing aircraft production, rising demand for fuel efficiency and weight reduction, advancements in hydraulic and pneumatic systems, growing adoption in military and commercial aviation, and the need for reliable emergency backup power solutions.

The top 5 countries which drives the development of Aerospace accumulator market are USA, UK, Europe Union, Japan and South Korea.

Bladder and Piston accumulators growth to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA