Federal decarbonization policy, rising demand for green hydrogen, and the pooling of investment in renewable infrastructure will spur explosive growth of the USA hydrogen electrolyzer market between 2025 and 2035.

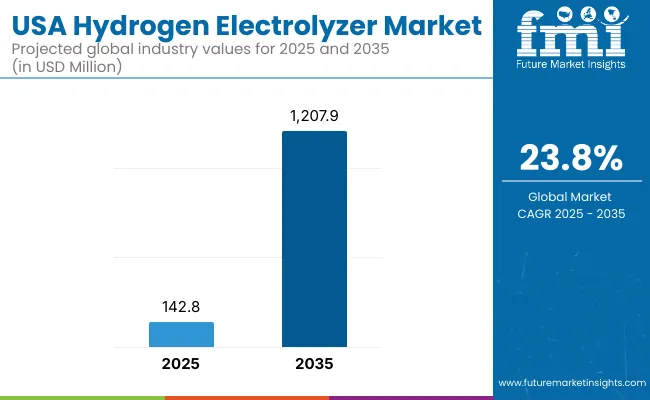

With a technology platform ready for the production of clean hydrogen using renewable energy through water electrolysis, the market will be an enabler to enable the nations net zero vision become a reality in transport, industry and the power sector. Market Insights the United States Hydrogen Electrolyzers market was USD 142.8 million in 2025 and is forecasted to be USD 1,207.9 million by 2035 with a growth rate of 23.8% in the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 142.8 Million |

| Projected Market Size in 2035 | USD 1,207.9 Million |

| CAGR (2025 to 2035) | 23.8% |

From PEM through to alkaline and solid oxide technology to meet exponentially increases demand for cost-effective, scalable, low-cost electrolyzer systems to support state-by-state utility-scale deployment of renewables and hydrogen hubs in planning. Incentives such as those in the Inflation Reduction Act (IRA), local clean hydrogen hubs (H2Hubs), and Department of Energy (DOE) funding programs are spurring deployment and local manufacturing of hydrogen electrolyzers.

The growing domestic supply chain of electrolyzer systems, adoption of technology, and company greenhouse gas targets are driving demand and innovation. Green hydrogen has an increasing role in hard-to-abate industries as steelmaking, ammonia production, aviation fuel, heavy transport etc. The market opportunity in electrolyzers across the country is supported by hydrogen fleet conversion and mass-scale energy storage.

The Northeast corridor including New York, Massachusetts, and Pennsylvania is becoming a green hydrogen innovation hub. State-level clean energy policy support and partnership with utilities are spurring electrolyzer pilot projects and integrating offshore wind. Urban high density in the region also favors green hydrogen as a solution to balance industrial and transport emissions.

Texas, Arizona, and New Mexico are leading in green hydrogen development because they have a ready source of solar energy and have extensive land cover. The Southwest is drawing large-scale renewable hydrogen projects with in-place electrolyzers, especially hydrogen fueling stations and ammonia production. The region belongs to the installed energy facilities of Texas as well as to hydrogen pipelines.

California, Oregon, and Washington lead the adoption of hydrogen. Demand for hydrogen fuel cell industrial vehicles, buses, and trucks in California is fueled by low-carbon fuel standards and zero-emission vehicle regulations calling for mass deployment of electrolyzers. Solar and wind farm integration is a regional practice, notably in Central California.

The Southeast corridor Georgia, the Carolinas, and Florida is in the initial-stage deployment phase, supported to a large extent by private-public partnerships and DOE-funded hydrogen research and development projects. Industrial clusters and logistics corridors within this region are starting to use hydrogen fuel as a source of clean energy, with electrolyzer projects starting to take off in port cities and industrial parks.

The Midwest namely Illinois, Ohio, and Michigan is riding its industrial foundation and wind resource potential to build hydrogen hubs. The region is seeing investment in the production and incorporation of electrolyzers at steel mills, refineries, and heavy-duty trucking fleets. Continued coordination between manufacturing sectors and utilities is driving project pipelines.

Initial Capital Costs and Infrastructure Challenges

The USA Hydrogen Electrolyzer Market is affected by high initial capital costs, long gestation times, and fragmented infrastructures. Electrolyzer technologies especially Proton Exchange Membrane (PEM) and Solid Oxide Electrolyzers (SOE) continue to be expensive, driven by expensive materials (how e.g. iridium, platinum) and unfavorable economies of scale.

In addition, the decentralized nature of renewable energy sources used for green hydrogen production hampers a broader rollout. Both state and national levels have disorganized management making financing, long-term planning and ease of grid integration further difficult besides management of water resources and safety precautions in off grid or remote locations.

Federal Assistance and Decarbonization Policies

All this has not prevented one of the biggest, most monumental momentum drivers - the Inflation Reduction Act (IRA), Bipartisan Infrastructure Law and USA Department of Energy's Hydrogen Shot initiative. The major federal grants and incentives are making electrolyzer projects bankable, particularly for green hydrogen applications in ammonia production, steelmaking, heavy-duty transport and aviation fuel.

The USA also has an abundance of renewable resources solar and wind particularly and growing numbers of regional hydrogen hubs (e.g., California, Texas, Midwest) that are fueling localized adoption of electrolyzers. As industrial decarbonization continues to become more of a necessity, partnerships between utilities, oil & gas operators, and tech firms are unlocking new commercial opportunities for electrolyzers in on-site, grid-connected, and off-grid applications.

From 2020 to 2024, the USAelectrolyzer market experienced a dramatic shift from pilot demonstrations to early commercial rollout. New entrants later came in the shape of foreign companies like Nel Hydrogen, ITM Power, Plug Power, and Cummins, and domestic players like Ohmium, Sun Hydrogen, and Bloom Energy. Then targeted attention zeroed in on PEM and Alkaline technologies, pilot plants of these in hydrogen fuel depots and the production of green ammonia. But high prices, regulatory risks and fragile supply chains had slowed rollout by numbers.

2025 to 2035 of the periodHzmodular, scale-up electrolysis and theIndustry will find a likelydigital platforms and AI energy OPTIMISATION. Vast amounts of hydrogen, within existing systems, lead to the emergence of cleaner hydrogen and oil mobility driven by co-location with renewable power, as well as grid-matching platforms. Technology development will completely be led by the high temperature SOEC (solid oxide) and the low temperature anion exchange membrane (AEM) electrolyzers. And domestic capacity production will do all this and more under the DOE national clean hydrogen program, which is ensuring resilience for too and community jobbing.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 20 24 Trends |

|---|---|

| Regulatory Landscape | Patchwork of state-level incentives and federal pilot grants |

| Market Penetration | Limited to pilots and early-stage commercial installations |

| Technology Evolution | Focus on PEM and Alkaline Electrolyzers |

| Material Sourcing | Dependence on rare metals (iridium, platinum) |

| Market Competition | Led by global OEMs with select USA startups |

| Customer Preferences | Early adopters in refueling and small-scale industry |

| Integration with Renewables | Partial co-location with solar/wind for test beds |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Unified federal tax credits (e.g., 45V), hydrogen hubs, and clean hydrogen certifications |

| Market Penetration | Widespread deployment across power-to-gas, mobility, and industrial sectors |

| Technology Evolution | Rapid scaling of AEM and SOEC technologies for high-efficiency production |

| Material Sourcing | Shift toward low-cost, earth-abundant catalysts and recycled materials |

| Market Competition | Growth in USA -based OEMs, system integrators, and utility partnerships |

| Customer Preferences | Mass-market demand from steel, fertilizer, marine, and aviation fuel producers |

| Integration with Renewables | Full integration into large renewable parks, microgrids , and virtual power plants |

California is responsible for over half of the seven gigawatts of USA hydrogen electrolysis on the grid thanks to aggressive clean energy goals, pioneering hydrogen infrastructure investment, and strong government support. Such climate policy leadership including its zero-emission vehicle mandate and heavy industry decarbonization makes it a green hydrogen hotspot.

Public-private initiatives in the likes of Southern California and the Bay Area are leading to large scale deployment of electrolyzers, particularly in transport, port operations and grid storage applications. The extensive dense hydrogen fueling station network across California as well as the state-wide green hydrogen pilot projects leave the state well positioned to be a testbed for scalable electrolyzer technology.

| State | CAGR (2025 to 2035) |

|---|---|

| California | 25.1% |

New York has become a surefire target market for hydrogen electrolyzers, especially as the state aims to transition its power sector to zero-emission fuels under the Climate Leadership and Community Protection Act. South of the City and North of the New York Harbor, there is interest in using green hydrogen to decarbonize industrial processes while serving as a clean energy carrier to grid stabilize.

The high density of New York City and its power requirements will make investment in next-generation electrolysis technologies for reserve power and cleaner energy storage attractive. But regional players are zooming in on adding electrolyzers for long-duration energy storage applications and transport as well, largely for mass transit and freight transport systems.

| State | CAGR (2025 to 2035) |

|---|---|

| New York | 23.4% |

Texas is a hydrogen heavyweight thanks to its robust energy infrastructure, abundant renewable resources and a strong industrial base. With its vast solar and wind resources on its West Texas plains, the state is flooded with interest in developing green hydrogen processing using massive electrolyzers for petrochemical plants, refineries and heavy-duty transport corridors.

Houston and other cities are angling to become global hydrogen hubs backed by oil and gas giants as the majors transition to cleaner energy. In addition, Texas has a favorable regulatory framework and land suitable for commercial-scale installation of electrolyzers, making it one of the most commercially attractive markets in the United States.

| State | CAGR (2025 to 2035) |

|---|---|

| Texas | 24.6% |

Although the hydrogen electrolyzer industry is in its infancy in Florida, it has been bolstered as demand rises for renewable, stable energy sources. Because weather-obsolete grid disruptions and increasing energy demands, stakeholders have pursued green hydrogen as a type of long-term and storage and energy backup.

With its planned ports, expanding electric transportation network and clean city land use planning all the more so in places like Miami and Tampa Florida is quietly laying the groundwork for a future powered by hydrogen. A multitude of pilot projects and public-private initiatives are expected to ramp up across the next few years.

| State | CAGR (2025 to 2035) |

|---|---|

| Florida | 22.9% |

The Polymer Electrolyte Membrane (PEM) electrolyzers are the most common product segment in the USA hydrogen electrolyzer market since they are more efficient, have shorter response times, and can integrate with intermittent renewable energy sources such as solar and renewable energy.

With the USA accelerating its green hydrogen endeavors through federal initiatives such as Hydrogen Energy Earth shot and the Infrastructure Investment and Jobs Act (IIJA), polymer electrolyte membrane (PEM) technology has emerged as the most suitable technology for grid-scale and distributed hydrogen production, due in part to its low areal footprint, high current density transport, and the ability to rapidly modulate power inputs in dynamic renewable-based systems.

Moreover, PEM electrolyzers are also more broadly applicable for industrial decarbonization and mobility because they can be scaled larger and integrated into infrastructure relatively easily. Market leaders such as PEM systems already see increasing demand under the growing interest in these systems in California, Texas, and New York: zero-emission industrial clusters, hydrogen fueling stations, and clean transportation corridors. More than 1 MW of hydrogen electrolyzers lead due to utility-scale hydrogen production projects.

Gig scale systems are being supported by increased private investment in gigawatt-scale manufacturing of electrolyzers and the Hydrogen Hubs initiative from the USA Department of Energy. These gig scale electrolyzers create economies of scale, lower the cost of hydrogen production and are a clear preference in large renewable energy farms and industrial clusters-based projects.

Their ability to run 24/7 and be centrally produced also makes them suitable for hydrogen and ammonia infrastructure for export readiness. Evangelizing states like Texas and Utah are emerging as major hydrogen production centers, thanks to lubricating state policies, copious amounts of renewable resources to tap for generation, and massive networks of pipes.

The national economy in hydrogen within the USA is being led by high-capacity electrolyzers, which continue to drive the industry forward even as both overall demand for green hydrogen grows across sectors and cross-border partnerships start to emerge.

The American hydrogen electrolyzer industry is gaining momentum as the nation moves toward decarbonization, clean energy self-sufficiency, and mass production of hydrogen for industrial and transportation applications. Federal investments such as the Inflation Reduction Act (IRA) and state-initiated hydrogen hubs are creating real momentum.

Firms in this sector are competing to scale up gigawatt-level manufacturing, enhance electrolyzer efficiency, and reduce manufacturing costs through innovation. Regardless of PEM (Proton Exchange Membrane), Alkaline, or new SOEC (Solid Oxide Electrolyzer Cell) technology, the playing field is full of both domestic competition and international conglomerates coming in by way of joint ventures or American-based plants.

Critical trends dictating the competitive landscape are the speedy localization of production of electrolyzers, increased green hydrogen project investments, and integrating digital monitoring system technology to achieve peak performance.

Recent Developments

Market Share Analysis by Key Players

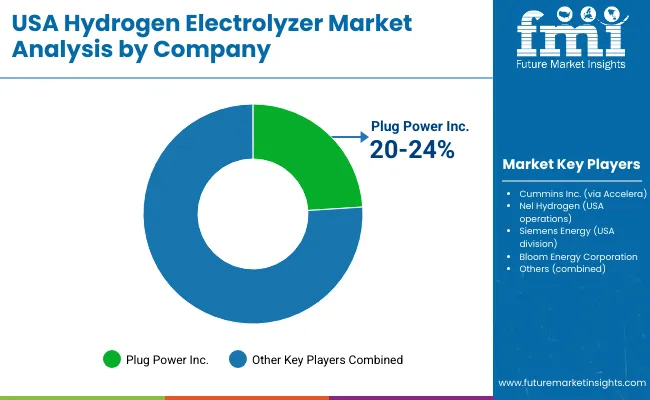

| Company Name | Estimated Market Share (%) |

|---|---|

| Plug Power Inc. | 20 - 24% |

| Cummins Inc. (via Accelera) | 14 - 18% |

| Nel Hydrogen (USA operations) | 10 - 14% |

| Siemens Energy (USA division) | 8 - 12% |

| Bloom Energy Corporation | 6 - 10% |

| Other Companies & Emerging Players (combined) | 25 - 35% |

| Company Name | Key Offerings |

|---|---|

| Plug Power Inc. | A leader in PEM electrolyzers; expanding large-scale hydrogen production plants in New York and Georgia. Integrates electrolyzers with fuel cell systems. |

| Cummins Inc.(Accelera) | Through its Accelera brand, Cummins delivers alkaline and PEM systems, manufacturing out of Minnesota and focusing on clean heavy-duty mobility and industrial decarbonization. |

| Nel Hydrogen (USA) | Norwegian-based but heavily invested in USA manufacturing capacity; their PEM electrolyzers are used in mobility and renewable hydrogen hubs. |

| Siemens Energy | Offers high-efficiency PEM electrolyzers for industrial-scale projects; active in DOE-supported hydrogen hubs across Texas and California. |

| Bloom Energy | Focused on Solid Oxide Electrolyzer Cells (SOEC), known for high efficiency at high temperatures. Operates pilot projects with utility and aerospace partners. |

Other Key Players

On the basis of Capacity, the USAhydrogen electrolyzer marketis categorized into Low(<= 150 kW), Medium (150kW to 1mW) and High (> 1mW).

On the basis of Product Type, the USAhydrogen electrolyzer marketis categorized into Polymer Electrolyte Membrane (PEM) Electrolyzer, Alkaline Electrolyzer, Solid Oxide Electrolyzer.

On the basis of Outlet Pressure, the USAhydrogen electrolyzer marketis categorized into Low (≤10 bar), Medium (10 bar to 40 bar), High (≥ 40 bar).

On the basis of End-use Industry, the USAhydrogen electrolyzer marketis categorized into Ammonia, Methanol, Refinery/Hydrocarbon Processing, Electronics, Energy, Power to Gas, Transport, Metal Production & Fabrication, Pharma & Biotech, Food & Beverages, Glass Industry, and Others.

The overall market size for USA hydrogen electrolyzer market was USD 142.8 Million in 2025.

The USA hydrogen electrolyzer market is expected to reach USD 1,207.9 Million in 2035.

The increasing demand for green hydrogen, and the pooling of investment in renewable infrastructure drive the demand for USA hydrogen electrolyzer market.

The top states which drive the development of USA hydrogen electrolyzer market are California, New York, Texas, and Florida.

Large-capacity electrolyzers (>1 MW) and PEM Electrolyzers are the leading segment in the USA hydrogen electrolyzer market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Hydrogen Bus Market Growth – Innovations, Trends & Forecast 2025-2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Demand for Hydrogen Buses in USA Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA