The UK Yeast Extract market is estimated to be worth USD 117.5 million by 2024 and is projected to reach a value of USD 193.2 million by 2034, growing at a CAGR of 5.1% over the assessment period 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size in 2025 | USD 117.5 million |

| Projected UK Value in 2035 | USD 193.2 million |

| Value-based CAGR from 2025 to 2035 | 5.1% |

The growth of the UK yeast extract market is strong, and it is mainly attributed to the increased use of the flow and beverage industry. Yeast extract is a natural item extracted from yeast cells that are known to be a good source of umami flavor and can be a powerful tool for cooks to create depth and richness in their products.

Food-grade yeast extract presents itself as the biggest product category in the market since it is a safe, versatile, and approved by regulation for inclusion in food products. When it comes to taste enhancement, yeast extract has the ability to do this without artificial additives.

This is the reason why it became a must-have item for the food industry. The companies involved in this are Kerry Group, DSM, and Lallemand, which are the ones supplying food processors in the UK with regards to high-quality yeast extract.

The food and beverage industry tops the list as the biggest consumer of yeast extract with demand on the rise for flavor-enhanced, healthy, and natural products hence boosting market growth. The main drivers include the increased acceptance of vegan and vegetarian food options, the clean-label trend, as well as the rising amounts of yeast extract used in low-sodium formulations.

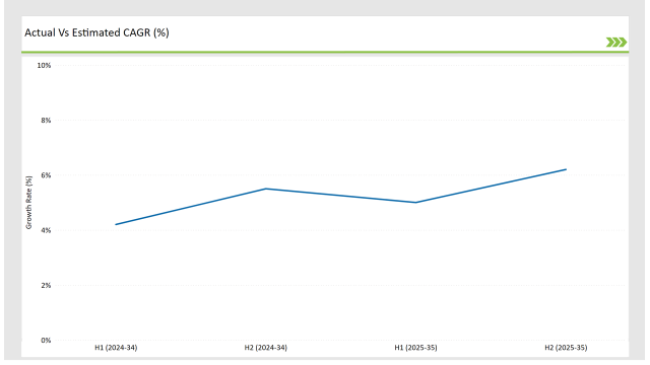

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the UK Yeast Extract market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2025 | Marmite Introduces New Flavor Variant: The iconic British brand Marmite, known for its yeast extract spread, launched a new limited-edition variant infused with chili, aiming to attract younger consumers seeking novel flavors. |

| December 2024 | Yeast Extract in Plant-Based Foods: A report highlighted the increasing use of yeast extract as a natural flavor enhancer in the UK's plant-based food sector, catering to the rising demand for vegan and vegetarian products. |

| November 2024 | Regulatory Update on Yeast Extract Labeling: The UK Food Standards Agency (FSA) updated its guidelines on labeling yeast extract in food products, emphasizing transparency to inform consumers about its presence, especially those with sensitivities. |

| October 2024 | Sustainable Production Initiatives: A major UK yeast extract manufacturer announced a commitment to sustainable production practices, including reducing carbon emissions and sourcing raw materials responsibly, aligning with the UK's environmental goals. |

| September 2024 | Yeast Extract in Nutritional Supplements: The UK's health and wellness industry saw a rise in the incorporation of yeast extract into nutritional supplements, leveraging its rich vitamin B content to appeal to health-conscious consumers. |

The trend in Clean-Label Food Products

Yeast extract plays a central role in the formulation of clean-label products as it is a response to the consumer demand for natural and minimally processed foods. Besides, it brings a flavor of savory umami to foods while off-setting the need for artificial additives like monosodium glutamate (MSG).

The leading manufacturers like DSM have developed the clean-label yeast extract solutions that are designed for ready meals, soups, and snacks, but it is food producers who apply these technologies for flavor increase on the ingredient transparency basis.

Utilization of Yeast Extract in Meat-Free Foods

The UK plant-based foods industry is witnessing a rapid growth stage, and yeast extract is a paramount factor in enriching the taste of these items. It is mostly utilized in vegan cheeses, plant-based meats, and dairy products instead of real cheese to imitate the organic and rich flavor of animal-based products.

The companies, for instance, Kerry Group are coming up with specific yeast extracts to increase the level of plant-based offerings making sure they fulfill the taste requirements of both vegetarians and flexitarians.

Sodium Reduction Achieved with Yeast Extract

Yeast extract which is well-known for its flavor enhancement capability has been playing a key role in sodium reduction in food products. The current trends in the UK regarding healthier food choices among consumers are paving the way for manufacturers to include yeast extract in their low-sodium formulations for soups, sauces, and processed foods.

Brands such as Lallemand are providing problematic solutions that keep the flavor of savory without the full amount of salt. This is how they tackle health trends alongside food production concerns.

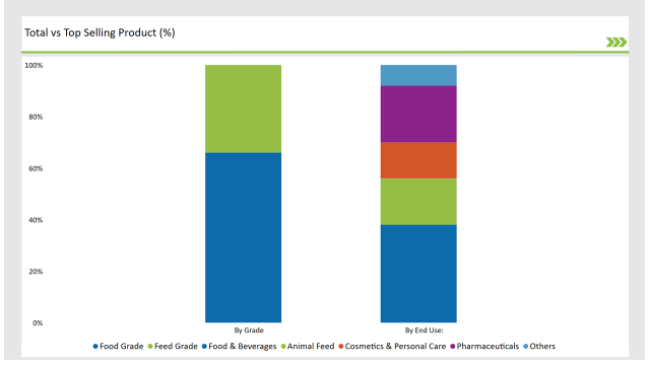

% share of Individual categories by Grade and Applications in 2025

In the UK, food-grade yeast extract is the prevalent grade because of its extremely widespread application in food products. This is the preferred ingredient if you are a safety, quality, and versatility promoter, besides it can be used in flavor boosting in soups, sauces, savory snacks, and ready meals.

Companies like DSM and Lallemand are into the production of food-grade yeast extracts and they also emphasize clean-label and non-GMO certifications to meet the needs of the market. The growing interest in plant-based and organic products besides food-grade yeast extracts has led to the widespread implementation of formulations intended to create the meaty taste and the complexity of flavors.

The food and beverage industry is the primary end-use segment for yeast extract in the UK, resulting in a major contributor to overall market demand. Yeast extract is used in savory foods like soups, sauces, and snack seasonings for the purpose of doubling the umami flavor. It is also an ingredient in plant-based foods, dairy alternatives, and low-sodium products, where it offers the flavor without any impact on health attributes.

Kerry Group is one of the biggest suppliers of yeast extract to the food processing sector, delivering yeast extract that is tailored to each customer's needs, which helps them to be very flexible in their business activities. The continual rise in the necessity for people to be surrounded by natural and functional ingredients within their food and beverage industry, simultaneously propelling this segment's traffic, is what it is about.

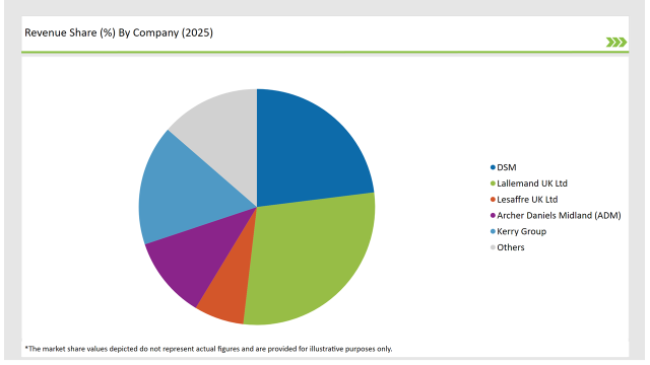

2025 Market share of UK Yeast Extract Key Players

The top performers in the UK yeast extract market are DSM, Kerry Group, and Lallemand, who display the utmost fashion and tune solutions to meet the demands of the food and beverage industry. These companies are pouring money into plant-based and clean-label formats as a way to respond to the increasing consumer demand for natural and functional ingredients.

DSM has come up with a range of non-GMO yeast extracts aimed at low-sodium and clean-label products, while Kerry Group is concentrating on plant-based and flavor-enhancing options. Development of strategic alliances with food producers, breakthroughs in fermentation technologies, as well as introduction of new products help those companies maintain their competitive edge in the UK marketplace.

The industry includes Autolyzed Yeast Extracts and Hydrolyzed Yeast Extracts.

Food Grade and Feed Grade.

Powder, Liquid, Paste, and Flakes

Food & Beverages, Animal Feed, Cosmetics & Personal Care, Pharmaceuticals, and Others.

Within the forecast period the UK Yeast Extract market is expected to grow at a CAGR of 5.1%.

By 2035, the sales value of the UK Yeast Extract industry is expected to reach USD 193.2 million.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

UK Licorice Extract Market Trends – Demand, Innovations & Forecast 2025-2035

Market Dynamics Positively Affecting UK Quillaia Extract Sales Value.

ASEAN Yeast Extract Market Growth – Trends, Demand & Innovations 2025–2035

Europe Yeast Extract Market Trends – Growth, Demand & Forecast 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Latin America Yeast Extract Market Growth – Trends, Demand & Innovations 2025–2035

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Yeast Beta Glucan Market Size and Share Forecast Outlook 2025 to 2035

Yeast Based Aqua Protein Market Size and Share Forecast Outlook 2025 to 2035

Yeast Market Outlook - Size, Demand & Forecast 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

Yeast-derived Collagen Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA