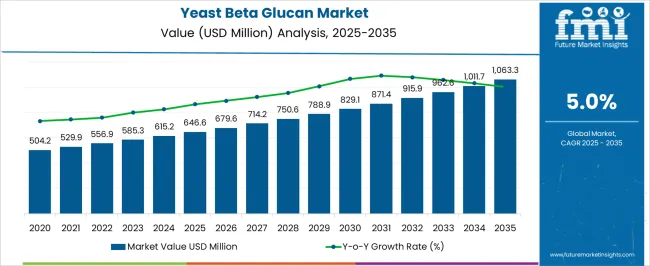

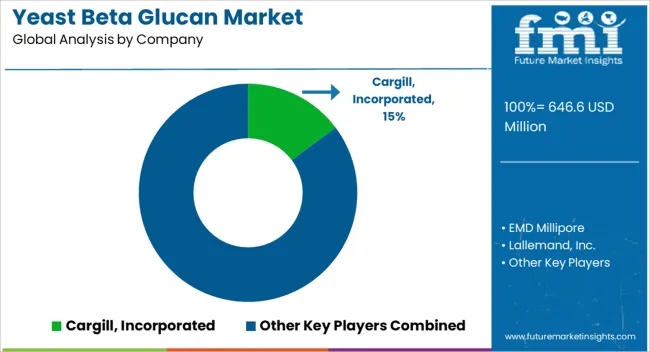

The Yeast Beta Glucan Market is estimated to be valued at USD 646.6 million in 2025 and is projected to reach USD 1063.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Yeast Beta Glucan Market Estimated Value in (2025 E) | USD 646.6 million |

| Yeast Beta Glucan Market Forecast Value in (2035 F) | USD 1063.3 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The yeast beta glucan market is expanding rapidly, supported by rising demand for natural, functional ingredients with immune-boosting and cholesterol-lowering properties. Derived from yeast cell walls, beta glucans have gained strong acceptance in food, nutraceutical, and pharmaceutical applications due to their scientifically validated health benefits.

The market is currently shaped by increasing consumer preference for clean-label and plant-based dietary supplements, as well as the rising incorporation of beta glucans in fortified food products. Technological advancements in extraction and purification processes have improved product quality and functionality, further supporting market expansion.

Looking forward, the outlook remains favorable as health-conscious consumers drive demand for functional foods and dietary supplements, while pharmaceutical applications expand into oncology and metabolic health therapies.

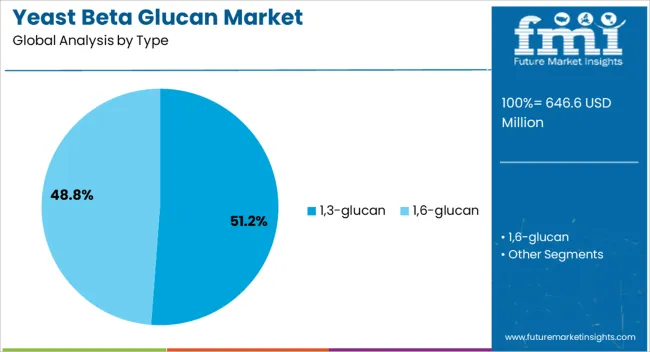

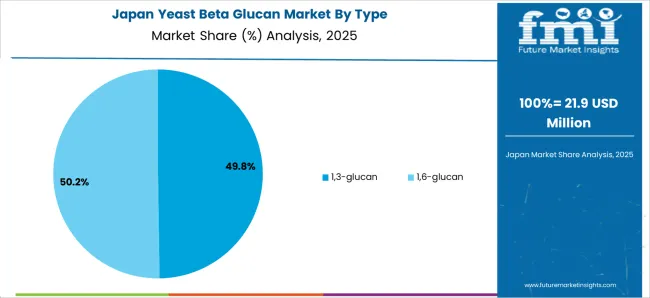

The 1,3-glucan segment leads the type category with approximately 51.20% share, owing to its superior bioactivity and established role in immune system modulation. This structural form is widely researched and validated for its efficacy, strengthening its adoption in dietary supplements and functional foods.

The segment benefits from clinical evidence supporting its role in enhancing macrophage activity and promoting immune resilience, which aligns with consumer interest in preventive healthcare. Pharmaceutical applications are also contributing to its share, particularly in therapies related to immune disorders.

With sustained research investments and increasing availability in high-purity forms, the 1,3-glucan segment is expected to maintain its dominance.

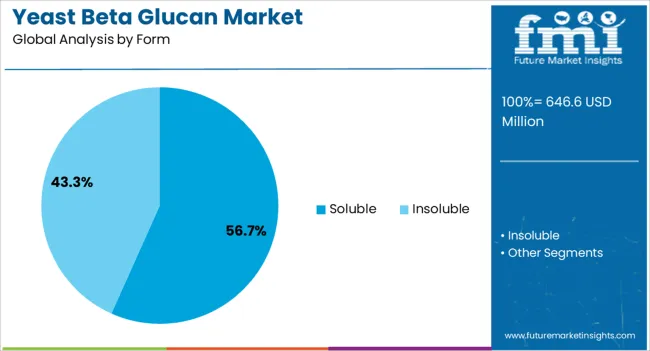

The soluble segment accounts for approximately 56.70% share of the form category, reflecting its ease of integration into beverages, supplements, and functional food formulations. Soluble yeast beta glucans are valued for their ability to dissolve uniformly, offering versatility across multiple applications without altering product texture.

The segment benefits from strong demand in the beverage and nutraceutical industries, where ease of incorporation into liquid formats is highly prioritized.

With rising consumer interest in functional drinks and dietary supplements, the soluble segment is expected to sustain its market leadership through continuous innovation in product development.

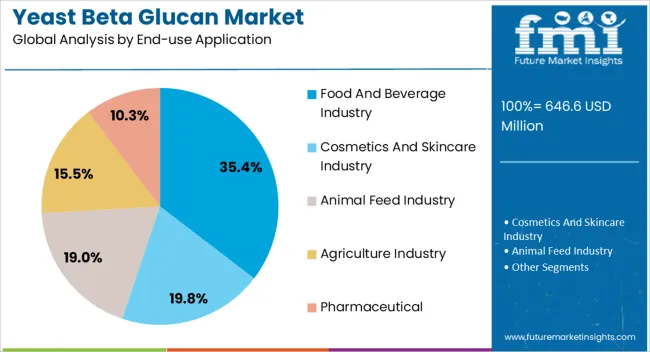

The food and beverage industry segment dominates the end-use application category with approximately 35.40% share, driven by increasing incorporation of beta glucans in fortified products, dairy alternatives, and functional snacks. The segment’s growth is reinforced by the rising trend of health-focused eating and the demand for natural ingredients with scientifically supported health claims.

Food manufacturers are utilizing beta glucans to enhance the nutritional value of mainstream products, catering to a broader base of health-conscious consumers.

With regulatory approvals in multiple regions and strong alignment with clean-label trends, the food and beverage industry segment is positioned to retain its leading role in the yeast beta glucan market.

Demand for Functional Food and Effective Skincare Products Drive Sales

| Attribute | Details |

|---|---|

| Key Trends |

|

| Challenges |

|

Between 2020 and 2025, the global yeast beta glucan market experienced a dynamic sales outlook marked by robust demand and adoption of functional food across industries.

From 2025 to 2035, the yeast beta glucan market is poised for an even more significant sales outlook of USD 1063.3 million by 2035.

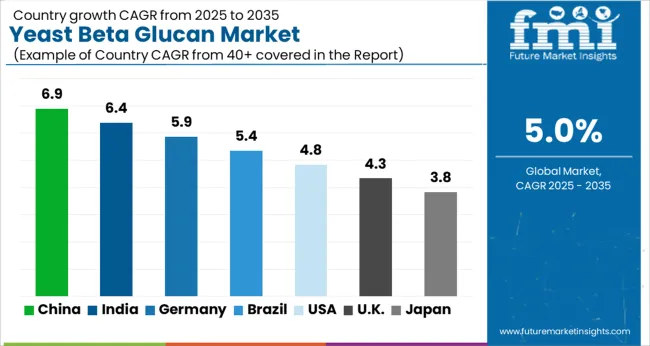

The table below shows the estimated growth rates of the top four countries. The United States, China, and Japan are set to record high CAGRs of 6.7%, 8.1%, and 5.7%, respectively, through 2035.

The United States market is projected to have a hold of 27% and reach a valuation of USD 1063.3 million by 2035. The market expansion is led by the robust efforts of key players in the field of research and development. The players are also raising awareness about the product, thus fostering a culture of yeast beta-glucan adoption.

China is anticipated to capture a value share of 13.2%, reaching a valuation of USD 81.2 million by 2035. The market is led by rising health consciousness among consumers. Additionally, strategic initiatives by players to expand their footprint in this burgeoning market are also improving the market growth. Further, the expanding middle-class population and rising disposable income are expected to raise demand for health-promoting products like yeast beta-glucan.

The rising consumer demand for natural, clean-label ingredients is positioning yeast beta-glucan as a key industry in the country’s evolving health and nutrition landscape.

The United Kingdom is expected to stake a 22.0% market share, reaching a valuation of USD 646.6 million by 2025. The main factors supporting the yeast beta glucan market growth in the country are, increasing fitness and sports nutrition trends among consumers are influencing yeast beta-glucan adoption in the United Kingdom.

Collaborations with local health and wellness brands is elevating the visibility of yeast beta glucan, contributing to its market prominence. The United Kingdom’s environmentally conscious consumer base appreciates yeast beta-glucan as a sustainable and eco-friendly ingredient, aligning with the nation's broad sustainability and ethical consumption trends.

The market in Japan is expected to exhibit a CAGR of 5.7% through 2035. The demand for yeast beta-glucan in Japan is driven by the rising use of functional substances in food and supplements. The use of yeast beta-glucan is driven by its varied health advantages. Further, manufacturers and suppliers are taking proactive steps to enlighten consumers about the benefits of yeast beta-glucan and increase its popularity. The proactive efforts of yeast beta-glucan manufacturers and suppliers to educate consumers about the benefits of yeast beta-glucan contribute to their popularity in Japan.

The primary factors bolstering the yeast beta glucan market size in South Korea are, the yeast beta-glucan market benefits from a progressive wellness culture in South Korea, where consumers prioritize preventive health measures. The ingredient's versatility is harnessed in traditional food & beverages and the rapidly expanding nutraceutical sector.

The section below shows the 1,3-glucan segment dominating by type. It is predicted to hold a market share of 51.2% in 2025. Based on form, the soluble segment is anticipated to generate a dominant share through 2025. It is set to hold a share of 56.7% in 2025.

| Segment | Market Share (2025) |

|---|---|

| 1,3-glucan (Type) | 51.2% |

| Soluble (Form) | 56.7% |

| Food and beverage Industry (End Use Application) | 35.4% |

The 1,3-glucan is set to take the spotlight in the market, a trend authenticated by factors such as:

Soluble form is anticipated to lead the way, holding an impressive yeast beta glucan market share. Factors supporting its sales are as follows:

Based on the end-use application, the food and beverage industry is projected to rise at a significant CAGR through 2035. Key factors propelling the growth of the segment are:

The yeast beta-glucan market has a diverse and dynamic competitive landscape. Leading companies specializing in diverse fields are focusing on research & development, sustainable sourcing, and new formulations.

Leading players are strongly emphasizing product certifications, ecologically friendly processes, and meeting the growing demand for natural & sustainable products. Further, they prioritize quality and innovation and cater to customer preferences to maintain their market position and take advantage of the rising demand.

Product Launches and Key Developments

The global yeast beta glucan market is estimated to be valued at USD 646.6 million in 2025.

The market size for the yeast beta glucan market is projected to reach USD 1,063.3 million by 2035.

The yeast beta glucan market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in yeast beta glucan market are 1,3-glucan and 1,6-glucan.

In terms of form, soluble segment to command 56.7% share in the yeast beta glucan market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yeast Based Aqua Protein Market Size and Share Forecast Outlook 2025 to 2035

Yeast Market Outlook - Size, Demand & Forecast 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast-derived Collagen Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Yeast Infection Diagnostics Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Yeast Nucleotides Market Analysis by Product Type, Nature, Form and Application Through 2035

Yeast Infection Treatment Market by Drug Type, Distribution Channel, End User, and Region, 2025 to 2035

Yeast Autolysates Market Outlook - Growth, Demand & Forecast 2024 to 2034

Yeast Flakes Market

UK Yeast Extract Market Report – Trends, Demand & Industry Forecast 2025–2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

GCC Yeast Market Trends – Growth, Demand & Forecast 2025–2035

USA Yeast Market Analysis – Size, Share & Forecast 2025-2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Yeast Extract Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA