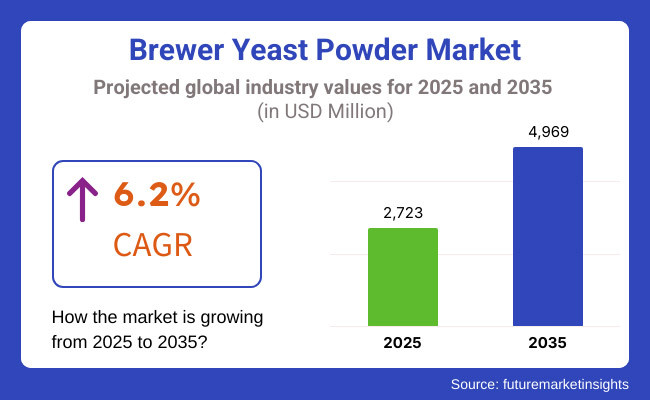

Global consumption of brewer yeast powder stood at around USD 2,723 million in 2025 and is slated to increase at a CAGR of 6.2% to reach a value of USD 4,969 million by 2035.

This anticipated expansion has been shaped by a growing confluence of health-conscious consumer behavior and the increasing functional applications of brewer yeast in food, feed, and nutraceutical sectors. The market has garnered notable attention due to its rich protein content, immune-modulating properties, and contribution to gut health-traits that have led to its rising incorporation in dietary supplements and fortified food formulations.

It has been observed that consumer interest in plant-based and naturally sourced protein alternatives has bolstered the adoption of brewer yeast powder, especially among vegan and vegetarian populations. Regulatory agencies across developed economies have also fostered this growth by enabling clearer claims for protein, B-vitamin content, and probiotic-supporting roles-further reinforcing the product's credibility in both human and animal nutrition.

Moreover, the shift toward sustainable and circular bioeconomy models has intensified the valorization of brewing industry by-products, such as brewer yeast, into functional food ingredients-thereby reducing waste while opening up high-margin opportunities.

From a processing standpoint, companies have been investing in optimizing drying and fermentation techniques to improve the organoleptic and nutritional profiles of brewer yeast powder. As consumer demand becomes more segmented, end-users are actively seeking specific formulations-such as debittered variants or customized blends-tailored for bakery, savory applications, or pet food formulations.

Notably, the animal feed and pet nutrition industries are increasingly recognizing the prebiotic and digestive benefits offered by brewer yeast, encouraging deeper integration into livestock and companion animal diets.

Strategically, industry leaders such as Lesaffre, Lallemand, and Angel Yeast have retained their competitive edge by expanding production capacities and entering into collaborative R&D to develop differentiated yeast derivatives.

The market is expected to evolve toward functional, label-friendly, and customized yeast powders that support gut health, immunity, and metabolic wellness, reinforcing its position as a valuable bioactive ingredient across diverse application sectors.

The food and beverage segment is projected to account for 45% of global brewer yeast powder sales in 2025, maintaining its lead position as the market expands at a 6.2% CAGR through 2035. Demand growth within this segment is being underpinned by an intensifying shift toward functional, clean-label, and bioactive ingredients.

This trajectory reflects the compound influence of health-driven consumer preferences and the ingredient’s versatile nutritional profile, especially its high protein concentration and B-vitamin content. Brewer yeast powder has increasingly been positioned as a multi-functional enhancer, aligning with both sensory and health objectives in processed and health-forward foods.

Its prebiotic potential and immune-modulating properties continue to generate interest among formulators seeking gut-health-aligned, non-animal alternatives. The preference for natural fermentation-derived ingredients has further strengthened adoption across bakery, plant-based, and savory platforms. Moreover, regional regulatory allowances around labeling and health claims have accelerated innovation pipelines around debittered and fortified formats.

As demand for traceable, circular-economy-based ingredients rises, brewer yeast powder is expected to gain greater foothold in consumer-packaged goods. Market leaders are likely to intensify investments in application-specific R&D, creating tailored, value-added formats that reflect the nuanced nutritional and sensory demands of next-generation food consumers.

The animal feed and pet nutrition segment is anticipated to grow steadily, accounting for an estimated 28% share of the global brewer yeast powder market by 2025. This share is expected to expand further as the market progresses at a CAGR of 6.2% through 2035, driven by increasing reliance on functional, sustainable inputs in livestock and companion animal diets.

Brewer yeast powder has gained strong traction in animal nutrition owing to its digestibility, protein density, and prebiotic effects, which support gut health, immune response, and feed conversion efficiency. Its favorable amino acid profile, combined with bioactive components such as beta-glucans and nucleotides, has made it a preferred supplement for swine, poultry, aquafeed, and pet food applications.

As antibiotic use in animal production continues to face regulatory restrictions, natural immunomodulators such as brewer yeast are being positioned as credible, science-backed alternatives.

Pet food brands are also embracing yeast-based ingredients to meet premiumization trends and growing consumer awareness of digestive wellness in pets. Leading producers are refining processing technologies to enhance palatability and nutrient retention, while expanding downstream partnerships with feed integrators. This segment’s sustained performance signals its pivotal role in circular, welfare-oriented, and high-performance animal nutrition systems

Challenge

Fluctuations in Raw Material Availability and Cost

The accessibility together with price of brewer’s yeast powder depends on beer manufacturing since it emerges from the brewing process. The supply chain of brewer’s yeast remains directly affected by all beer market fluctuations such as changes in beer stock demand and brewery plant closures and disruptions in delivery networks. The ability to standardize products becomes hard for producers because inconsistent quality arises from different fermentation methods.

To guarantee reliable supply and consistent quality companies should enter secure agreements with breweries and enhance their yeast cultivation technology and purification system development. Suppliers should establish multiple channels and enhance their storage methods to create stable market prices while decreasing dependence on beer market trends.

Opportunity

The expanding usage of brewer's yeast by nutrition sector as well as animal feed markets drives its growing demand

Consumer understanding of brewer's yeast powder nutritional assets creates expanding demand for both human and animal nutrition segments. Plants and functional foods gained popularity because vegan consumers along with health-oriented individuals demanded yeast-based protein supplements. Natural use of brewer’s yeast powder in animal feed serves two purposes: it stimulates animal digestive processes and strengthens their immune system.

Manufacturers should use this market opportunity to develop both fortified yeast-based supplements and enhance their bioavailability through fermentation techniques. Market growth of brewer's yeast powder as a sustainable nutrition ingredient will be accelerated through strategic alliances with health brands and animal nutrition companies.

Overview growing demand from the food and beverage, animal feed, and dietary supplement industries is driving the USA brewer yeast powder market. Market growth is also being bolstered by the increasing demand for functional foods and plant-based protein alternatives.

Pet nutrition, livestock feed: increasing consumption of brewer yeast powder for these categories also propels the market growth. Moreover, the increasing demand for natural probiotics and immune-boosting ingredients is spurring yeast-based supplements innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

As increasingly health-conscious consumers look for more natural and nutrient-rich ingredients in their foods, the UK wheat yeast powder market is witnessing promising growth. The market growth is anticipated to be further supported by the yeast-based supplements demand in the vegan and plant-based nutrition segment. Brewer yeast powder is gaining prominence in brewing, baking, and animal nutrition as well. Moreover, increasing consumer inclination towards products that are beneficial for gut health is further fuelling the adoption of yeast-based formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

EU Brewer Yeast Powder Market: demand growth for imposes in Germany, France and Belgium the EU Brewer Yeast Powder Market is experiencing robust demand. Some of the key factors identified by the report, driving the growth of the yeast market are the growing craft brewing industry and increasing application of yeast based ingredients in dietary supplements. Brewer yeast powder a natural protein source is gaining acceptance in the animal feed industry. Further growing market demand is the rising production of fermented food products and functional beverages.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.2% |

Japan brewer yeast powder market at a glance The Japan brewer yeast powder market is expected grow steadily in the coming years, aided by rising demand for nutritional supplements and functional food products in the region. Consumer preference for fermented foods in the traditional Japanese diet is driving the use of brewer yeast powder in food & beverage formulations. Also, the increasing emphasis on gut health, and immunity boosters are driving the yeast-based dietary supplements are used. Increased pet ownership in Japan is also driving use of yeast-based feed ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

Growing interest in functional foods, probiotics, and natural dietary supplements is spurring growth in South Korea’s yeast powder market. Demand is also rising due to the rising use of brewer yeast powder in sports nutrition and protein-based formulations. Fermented drinks, like kombucha and brown rice wine, are rising in popularity, promoting yeast-based ingredients. Highlighting, innovations in livestock feed formulations to promote health and well-being of animals is propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

Lesaffre Group (18-22%)

It is a leading producer of brewer’s yeast powder, producing probiotic and functional yeast derivatives for human nutrition, fermentation and animal feed.

Angel Yeast Co., Ltd. (15-19%)

Angel Yeast focuses on the high-grade and organic brewer’s yeast powder to meet the needs of the increasing natural and pontificated nutritional raw materials.

Lallemand Inc. (12-16%)

Lallemand develops brewer’s yeast in a powdered form that can be fortified with protein and B-vitamins fit for application in dietary supplements and fermented foods.

Archer Daniels Midland (ADM) (9–13%)

ADM leverages brewer’s yeast powder for use in food processing, pet nutrition, and agricultural products, with a focus on sustainability and functional ingredient solutions.

Alltech Inc. (7-11%)

Alltech provides yeast-based feed additives, targeting animal health with probiotic-rich and immune-supportive formulations for livestock and poultry industries.

Other Key Players (30-40% Combined)

Several other manufacturers contribute to the brewer’s yeast powder market, offering diverse formulations and specialized applications. Notable players include:

The overall market size for Brewer Yeast Powder Market was USD 2,723 Million in 2025.

The Brewer Yeast Powder Market expected to reach USD 4,969 Million in 2035.

The demand for the brewer yeast powder market will grow due to increasing adoption in the food and beverage industry, rising demand for nutritional supplements, expanding applications in animal feed, and growing consumer awareness of its health benefits, including probiotics and protein content.

The top 5 countries which drives the development of Brewer Yeast Powder Market are USA, UK, Europe Union, Japan and South Korea.

Beer Dry Yeast and Brewing lead market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (MT) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brewery Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Brewery Equipment Market Analysis by Fermentation equipment, Brew house equipment, Carbonation and other Product Type Through 2025 to 2035

Brewer's Yeast Market Size and Share Forecast Outlook 2025 to 2035

Microbrewery Equipment Market Size and Share Forecast Outlook 2025 to 2035

Microbrewery Supplies Market Size and Share Forecast Outlook 2025 to 2035

Small Brewery Equipment Market – Industry Analysis & Forecast 2025-2035

Coffee Brewers Market

Yeast Beta Glucan Market Size and Share Forecast Outlook 2025 to 2035

Yeast Based Aqua Protein Market Size and Share Forecast Outlook 2025 to 2035

Yeast Market Outlook - Size, Demand & Forecast 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast-derived Collagen Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Yeast Infection Diagnostics Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Yeast Nucleotides Market Analysis by Product Type, Nature, Form and Application Through 2035

Yeast Infection Treatment Market by Drug Type, Distribution Channel, End User, and Region, 2025 to 2035

Yeast Autolysates Market Outlook - Growth, Demand & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA