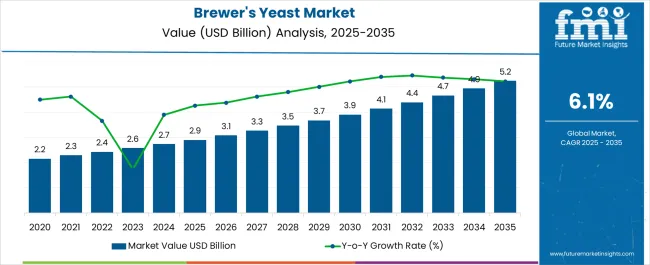

The Brewer's Yeast Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Brewer's Yeast Market Estimated Value in (2025 E) | USD 2.9 billion |

| Brewer's Yeast Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The Brewer's Yeast market is experiencing steady growth driven by its widespread application in the food and beverage industry and its role as a natural source of proteins, vitamins, and minerals. The future outlook for this market is shaped by increasing consumer preference for natural and functional ingredients, particularly in health-conscious diets. The growing demand for nutritional supplements and fortified food products has further accelerated the adoption of brewer's yeast in various formulations.

Expansion of the food and beverage industry in both developed and emerging markets is also contributing to market growth. Continuous investments in product innovation and processing technologies are enabling the production of high-quality yeast with enhanced nutritional profiles. Additionally, the rising awareness regarding digestive health and immunity support has reinforced the use of brewer's yeast as a functional ingredient.

The market is further supported by the increasing incorporation of yeast in bakery, dairy, and beverage applications, providing opportunities for product diversification As consumer demand for natural, nutrient-rich ingredients grows, brewer's yeast is anticipated to remain a key functional component in global food systems.

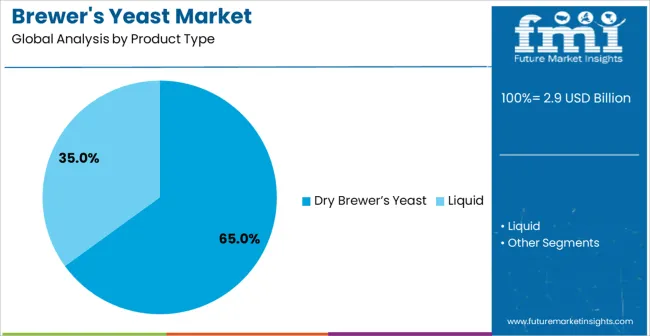

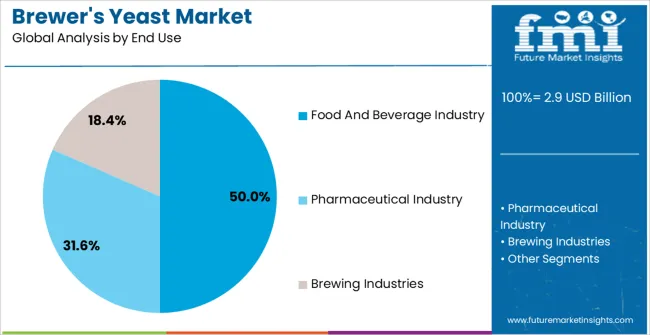

The brewer's yeast market is segmented by product type, end use, and geographic regions. By product type, brewer's yeast market is divided into Dry Brewer’s Yeast and Liquid. In terms of end use, brewer's yeast market is classified into Food And Beverage Industry, Pharmaceutical Industry, and Brewing Industries. Regionally, the brewer's yeast industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dry brewer’s yeast segment is projected to hold 65.00% of the Brewer's Yeast market revenue share in 2025, establishing it as the leading product type. The dominance of this segment is driven by the ease of storage, extended shelf life, and versatility of dry yeast in diverse food and beverage applications.

The processing and packaging of dry yeast allow consistent quality and convenient usage for manufacturers in bakery, brewing, and nutritional supplement sectors. High demand for ready-to-use and standardized yeast products has reinforced the adoption of dry brewer's yeast.

Furthermore, advancements in drying and preservation technologies have improved the stability and functional properties of yeast, supporting its widespread use The segment’s growth is further enhanced by the rising need for efficient and scalable fermentation processes in commercial food production, as well as increasing consumer demand for nutrient-dense ingredients that can be incorporated into a variety of products.

The food and beverage industry segment is expected to account for 50.00% of the Brewer's Yeast market revenue in 2025, positioning it as the leading end-use sector. This growth is driven by the rising demand for nutritional fortification in processed foods, beverages, and bakery products. Brewer's yeast provides essential proteins, B vitamins, and minerals, which are increasingly sought after in health-focused formulations.

The segment has benefited from the expansion of commercial food production and growing awareness of functional foods that support immunity, digestive health, and overall wellness. Additionally, the adaptability of brewer's yeast in various recipes and product formats has reinforced its adoption in both traditional and modern food manufacturing.

Increasing consumer inclination towards natural and clean-label ingredients further supports the growth of this segment As the food and beverage sector continues to expand globally, the demand for brewer's yeast is expected to remain strong, cementing its role as a critical ingredient in the industry.

Brewer's yeast, a byproduct of brewing operations, is used as a flavoring component in the food industry and as a feed ingredient for pigs, poultry, fish, and ruminants. In order to augment the protein in animal feed, brewer's yeast, which is often harvested from big breweries, is employed. The inactivated version of this product is a very valuable source of protein, phosphorus, and vitamin B.

According to trends in raw materials, manufacturers, raw material suppliers, applications, and distribution channels make up the market value chain. There are various commercially accessible variations of the product, including fresh, dried, and instant. It is used in a variety of industries, including the production of beer, wine, dietary supplements, and animal feed.

In our new study, ESOMAR-certified market research and consulting firm Future Market Insights (FMI) offers insights into key factors driving demand for Brewer’s Yeast.

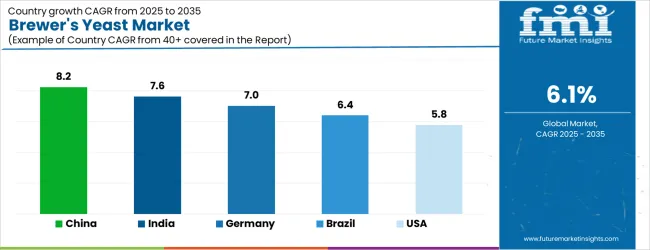

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| Brazil | 6.4% |

| USA | 5.8% |

| UK | 5.2% |

| Japan | 4.6% |

The Brewer's Yeast Market is expected to register a CAGR of 6.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.2%, followed by India at 7.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.6%, yet still underscores a broadly positive trajectory for the global Brewer's Yeast Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.0%. The USA Brewer's Yeast Market is estimated to be valued at USD 1.0 billion in 2025 and is anticipated to reach a valuation of USD 1.0 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 145.0 million and USD 82.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Product Type | Dry Brewer’s Yeast and Liquid |

| End Use | Food And Beverage Industry, Pharmaceutical Industry, and Brewing Industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

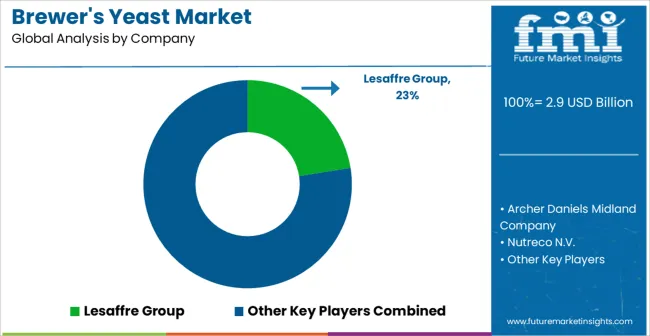

| Key Companies Profiled | Lesaffre Group, Archer Daniels Midland Company, Nutreco N.V., Alltech Inc., Cargill Incorporated, Leiber GmbH, Associated British Food Plc., AB Mauri India Pvt. Ltd., Kothari Fermentation and Biochem Ltd., Angel Yeast Company, Oriental Yeast Co., Ltd, Hansen Holding A/S, Koninklijke DSM N.V., Bruchem Inc, Scandinavian Formulas, Omega Yeast Labs, Lallemand Inc., and Synergy Flavors |

The global brewer's yeast market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the brewer's yeast market is projected to reach USD 5.2 billion by 2035.

The brewer's yeast market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in brewer's yeast market are dry brewer’s yeast and liquid.

In terms of end use, food and beverage industry segment to command 50.0% share in the brewer's yeast market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yeast Beta Glucan Market Size and Share Forecast Outlook 2025 to 2035

Yeast Based Aqua Protein Market Size and Share Forecast Outlook 2025 to 2035

Yeast Market Outlook - Size, Demand & Forecast 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast-derived Collagen Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Yeast Infection Diagnostics Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Yeast Nucleotides Market Analysis by Product Type, Nature, Form and Application Through 2035

Yeast Infection Treatment Market by Drug Type, Distribution Channel, End User, and Region, 2025 to 2035

Yeast Autolysates Market Outlook - Growth, Demand & Forecast 2024 to 2034

Yeast Flakes Market

UK Yeast Extract Market Report – Trends, Demand & Industry Forecast 2025–2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

GCC Yeast Market Trends – Growth, Demand & Forecast 2025–2035

USA Yeast Market Analysis – Size, Share & Forecast 2025-2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA