The yeast infection diagnostics market is valued at USD 470.5 million in 2025. As per FMI's analysis, the industry will grow at a CAGR of 6% and reach USD 805.2 million by 2035. In 2024, the industry for diagnostics of yeast infections saw increased momentum as a result of heightened diagnosis of recurring cases of vulvovaginal candidiasis (RVVC) in various clinical facilities.

Healthcare practitioners sought early diagnostic regimes, guided by a rise in complicated infections in Candida glabrata and Candida auris strains. Diagnostic laboratories also increased adoption of molecular testing kits compared to traditional cultures, enabling enhanced precision and quicker turnaround.

FMI’s findings suggest that public health initiatives in the United States and Europe were instrumental in raising clinical awareness of fungal infections, and as a result, increased diagnostic testing in outpatient gynecologic clinics.

Going forward in 2025, FMI’s findings indicate that the integration of technology-particularly point-of-care diagnostics, multiplex testing, and AI-based platforms-is going to revolutionize diagnostic workflows, particularly those based in hospitals.

In addition, the growth in antifungal resistance will put additional focus on accurate diagnosis; thus, diagnostic innovation will be a central driver of growth. Asia Pacific, driven by China and India, will likely be an important regional driver due to rising infection rates and growing healthcare infrastructure.

Market Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 470.5 Million |

| Industry Value (2035F) | USD 805.2 Million |

| CAGR (2025 to 2035) | 6% |

The yeast infection diagnostics industry is on a consistent growth path, fuelled by increasing infection rates and worldwide demand for quicker, more precise diagnostic equipment. Expanded use of advanced molecular testing technologies is speeding early detection, particularly in drug-resistant Candida cases. As the industry evolves diagnostic technology suppliers and clinical labs will benefit most, while manufacturers dependent on legacy culture-based systems will lose industry share.

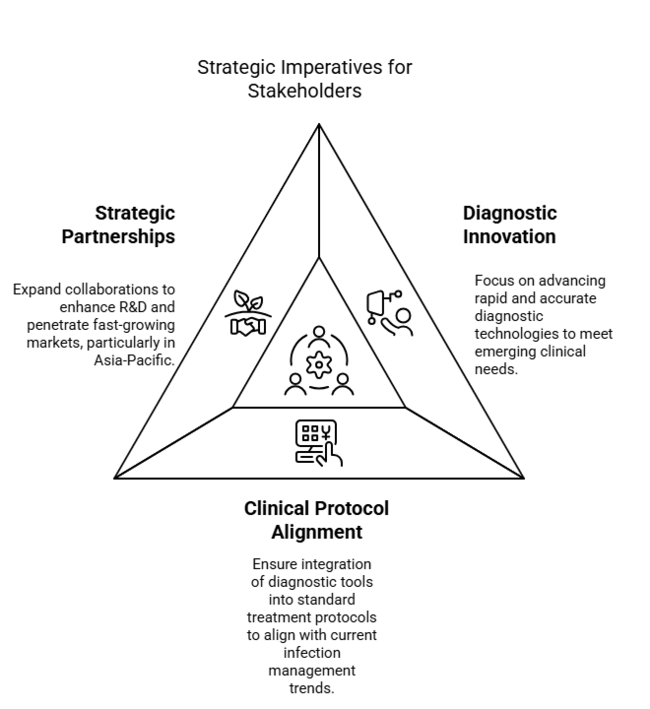

Accelerate Diagnostic Innovation

Invest in quick molecular and point-of-care diagnostic platforms to keep up with emerging fungal strains and address the growing clinical need for speedier, more precise results.

Align with Shifting Clinical Protocols

Work with healthcare facilities to include diagnostic devices in regular treatment plans, making sure the solutions match current infection management trends and the need to monitor resistance.

Broaden strategic partnerships and expand R&D efforts

Seek partnerships with educational institutions, biotechnology companies, and local distributors to upgrade R&D facilities and extend international presence, especially in untapped, fast-growing industries such as Asia-Pacific.

| Risk | Probability - Impact |

|---|---|

| Antifungal resistance outpacing diagnostic accuracy | Medium - High |

| Regulatory delays for advanced diagnostic tools | High - Medium |

| Limited adoption in low-resource healthcare settings | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| Expand Molecular Test Portfolio | Run feasibility on introducing low-cost PCR-based kits for outpatient clinics |

| Improve Clinical Adoption | Initiate hospital feedback loop on diagnostic tool usability and turnaround time |

| Strengthen Global Access | Launch distributor incentive pilot in Southeast Asia and Latin America |

To stay ahead, companies must focus on a shift toward fast, high-sensitivity diagnostic platforms that meet emerging antifungal resistance and changing clinical needs. Such insight supports the imperative to invest in next-generation molecular diagnostics and increase strategic partnerships, especially in rapidly growing geographies such as Asia-Pacific.

FMI research discovered that the traditional growth drivers are no longer sufficient; instead, companies will need to focus on innovation speed, regulatory adaptability, and the ability to deploy rapidly in diverse regions. Executives need to redefine their 12-18 month plan to encompass faster product development cycles, greater stakeholder interaction, and global access plans to achieve long-term leadership in the changing diagnostics industry.

Consensus and Divergence

Strategic Insight

| Countries | Policy and Regulatory Impact on Yeast Infection Diagnostics |

|---|---|

| United States | The CDC's diagnostic policy on fungal infections heavily informs hospital buying criteria. FDA clearance via 510(k) or De Novo pathways is required for commercial sale. Medicare/Medicaid reimbursement policies impact pricing strategy for tests. |

| United Kingdom | The MHRA requires compliance under UKCA marking for post- Brexit diagnostic devices. NHS procurement specifications highly dictate the uptake of diagnostics with established cost-effectiveness and digital connectivity. |

| France | Under the French Health Authority (HAS), diagnostics have to be CE-IVD certified and exhibit clinical utility. Public hospital adoption is consistent with national antimicrobial stewardship policies. |

| Germany | Strict application of the EU In Vitro Diagnostic Regulation (IVDR) requires third-party certification (Notified Bodies) and post- industry surveillance. Reimbursement needs to be added to the G-BA approved diagnostic catalog. |

| Italy | EU IVDR compliance is mandated. Regional public health procurement systems highlight the price-performance ratio. Public subsidization frequently accompanies locally certified molecular diagnostic tests. |

| South Korea | Regulatory approval by the Ministry of Food and Drug Safety (MFDS) is necessary for diagnostics. Government programs increasingly reward digital diagnostics, but controls on pricing are tight. |

| Japan | All diagnostics are required to obtain PMDA (Pharmaceuticals and Medical Devices Agency) approval. Stringent regulatory processes tend to hold back leading-edge diagnostics unless they demonstrate long-term cost-effectiveness. |

| China | The National Medical Products Administration (NMPA) demands certification of Class II or III for molecular diagnostics. Domestic innovation is encouraged by policies, but import approvals are time-consuming and very intrusive. |

| Australia-NZ | The TGA in Australia and Medsafe in New Zealand need to be ARTG-listed and validated. Authorities are increasingly interested in point-of-care testing, especially for rural access. |

| India | The Central Drugs Standard Control Organization (CDSCO) regulates diagnostic approvals. Critical diagnostics can apply for expedited approval, but regulatory consistency varies across states. Focus on public health deployment and affordability. |

Between 2025 and 2035, the panel test segment is expected to be the most profitable product segment, driven by the increasing clinical demand for multiplex detection formats that detect multiple pathogens simultaneously.

Amid growing regulatory clearances and cost reductions from miniaturization technologies, the segment is projected to increase at a CAGR of around 6.8% from 2025 to 2035, ahead of the global average. These tests simplify diagnostic workflows, enhance throughput, and provide more complete diagnostic results.

As clinicians shift away from one-pathogen-at-a-time testing approaches, panel tests are becoming increasingly popular in hospital laboratories as well as point-of-care applications. Additionally, their versatility for vaginal infections, STIs, and differential diagnosis fuels demand in high-prevalence geographies.

Nucleic acid amplification testing (NAAT) will be the most lucrative segment because it is better at accurately finding Candida species and other infections. FMI research estimates that the NAAT segment is expected to grow at a CAGR of around 7.1%, making it the preferred diagnostic method in developed industries.

NAATs are rapidly superseding culture-based and pH tests, particularly in high-complexity laboratories as well as in clinical research environments. The convergence of AI-facilitated diagnostics and increasing investment in molecular diagnostic platforms are also driving the transition.

The vagina segment is likely to be the most profitable, driven by the worldwide burden of vulvovaginal candidiasis and recurrence rates. FMI suggeststhat the vaginal diagnostic segment will grow at a CAGR of around 6.3%, driven by product innovation and patient-focused delivery models.

Vaginal yeast infections continue to be the primary indication for diagnostic testing, particularly among women of reproductive age. With increased awareness, more gynecological screenings, and novel home-based diagnostics for this anatomical location, this industry is seeing fast adoption of NAATs and pH self-testing kits.

The vulvovaginal candidiasis will be the most profitable indication, as recurrent yeast infections cause most of these infections worldwide. According to FMI analysis, the segment will grow at a CAGR of about 6.5%, outpacing other infectious disease testing in the yeast-related segment.

Diagnostic differentiation from sexually transmitted infections and bacterial vaginosis is creating demand for high-precision platforms. Recurrence among immunocompromised individuals and those taking antibiotic therapy contributes to testing volume. Clinical guidelines for testing prior to treatment further establish diagnostic demand.

During the forecast period, diagnostics laboratories are expected to be the most profitable end-user segment, fuelled by centralized molecular testing, improved reimbursement structures, and growing private lab networks in developed and emerging economies. FMI suggests this segment will grow at a CAGR of nearly 6.7%, as strategic alliances and automation spending solidify its position as the leading diagnostic setting.

High-throughput capabilities and alliances with OB/GYNs and primary care physicians guarantee robust sample flow. As prices for NAAT-based platforms decrease, diagnostic laboratories are ramping up testing for multiplex vaginal panels and STI differentiation.

The industryin the USA is projected to grow at a CAGR of 5.9% from 2025 to 2035. The USA still dominates diagnostic technologies due to robust reimbursement systems and the early adoption of molecular platforms. FMI analysis is of the opinion that strong awareness, active screening programs, and investment in digital health have led to the development of highly sensitive technologies for the early detection of Candida.

The CDC's fungal infection guidelines are redesigning hospital purchasing standards, particularly for immunocompromised patients. With FDA 510(k) approvals allowing advanced kits to be sold more easily, companies focusing on multiple, AI-supported solutions are in the best place to succeed and drive innovation.

UK’s salesis anticipated to grow at a CAGR of 5.3% during the assessment term. Regulatory changes following Brexit have seen diagnostics makers adapt to the new UKCA certification process in place of the EU's CE marking. FMI suggests that NHS guidelines on cost-effectiveness, infection control, and compatibility with digital record systems are restructuring the competitive dynamics.

Clinicians increasingly prefer quick point-of-care tests that minimize errors in prescriptions and are NICE compliant. Public health antimicrobial stewardship initiatives encourage the use of diagnostics to confirm infection before initiating treatment, making the UK an increasingly mature but policy-led industry.

The industryin France is projected to grow at a CAGR of 5.7% from 2025 to 2035. Primary care physicians and public hospitals focus more and more on accurate diagnosis prior to starting antifungal therapy as part of government-supported initiatives to halt drug resistance. The FMI study revealed that France's healthcare environment is biased towards diagnostics approved by the French Health Authority (HAS) and conforming to CE-IVD in the EU's IVDR regime.

Investment in molecular diagnostics fuels the growth of the industryas part of national health reforms to modernize infectious disease care. Providers that are EHR compliant and economically priced can expect tremendous institutional backing in all French public and private healthcare sectors.

In Germany, the yeast infection diagnostic industryis projected to grow at a CAGR of 5.6% during the forecast period. Being one of the most regulated diagnostics environments in Europe, Germany requires strict clinical validation, complete IVDR compliance, and third-party notified body certification. FMI suggests that Germany's strong hospital system and government healthcare payments support the use of new diagnostic tools.

This is especially for those that provide faster results and help manage antibiotic use. Integration into national health information systems and conformity to the G-BA price catalog are a given. Suppliers with quick, accurate, and EHR-friendly solutions will enjoy a competitive advantage in this efficiency-driven but compliance-laden marketplace.

In Italy, the diagnostic industryfor yeast infections is projected to grow at a CAGR of 5.4% from 2025 to 2035. The Italian healthcare system is witnessing increasing demand for early-stage diagnostics that minimize empirical antifungal therapy, especially in obstetrics and geriatrics. Centralized digital health programs and rewards for technologies that meet CE-IVD standards are helping to balance out differences in healthcare facilities across regions.

FMI estimates indicate that government buying plays a big role in how widely devices are used, and devices that focus on being fast, accurate, and affordable are more likely to succeed. Italy's involvement in EU-level monitoring of antimicrobial resistance has also boosted investment in new diagnostic technologies, giving a strong advantage to companies with products that can be easily used at the point of care.

In South Korea, the yeast infection diagnostic industryis projected to grow at a CAGR of 5.2% during the forecast period. With the country developing its digital healthcare infrastructure, diagnostic accuracy becomes more of a priority in tertiary hospitals and women's health centers. The MFDS has strict regulatory requirements, but once cleared, products have the advantage of a well-organized healthcare delivery system.

FMI analysis indicates that Korean stakeholders are interested in AI-driven, portable diagnostics with real-time results, particularly for telehealth. Price regulation and reimbursement sensitivity are major impediments, but hybrid model providers (cloud reporting + on-site testing) are gaining traction in metropolitan and suburban industries.

In Japan, the industry is projected to grow at a CAGR of 4.9% during the evaluation term. The landscape is conservative, preferring established practices and demanding rigorous validation by the Pharmaceuticals and Medical Devices Agency (PMDA). FMI suggests that adoption of rapid or AI-based diagnostics is slower compared to the West because of regulatory conservatism and an aging clinical infrastructure.

However, demand is growing in urban hospitals, led by the fight against antifungal resistance and optimal prescribing. To be successful, firms need to provide clinically validated tools with localized data and be fully compliant with Japan's strict post-industry surveillance standards.

China’s sales is projected to grow at a CAGR of 6.1% during 2025 to 2035. Increasing public investment in infectious disease testing, urbanization, and growing awareness of women's health are driving industry penetration. The National Medical Products Administration (NMPA) regulates tight approvals for diagnostic kits, particularly Class II and III devices, but encourages local innovation and scalability.

According to FMI's analysis, public hospitals in Tier I and Tier II cities are increasingly switching from culture-based techniques to molecular diagnostics. Companies offering cost-effective, scalable diagnostics tailored for high-volume testing are well positioned to dominate this high-growth but heavily controlled industry space.

In New Zealand and Australia, the yeast infection diagnostics industry is set to grow at a CAGR of 5.5% from 2025 to 2035. The two nations are investing in rural healthcare outreach, urging the move toward point-of-care and portable diagnostics. The TGA (in Australia) and Medsafe (in New Zealand) oversee diagnostic approvals through an ARTG listing with strict validation of performance and quality assurance.

FMI observes that adaptability to the environment, integration with clouds, and user-friendliness are more and more important for deployment in regions. Both private clinics and public health programs are backing AI-driven diagnostic systems that improve speed and lower uncertainty in diagnoses, creating a supportive environment for technology-based newcomers.

In India, the diagnostics industry for yeast infections is anticipated to grow at a 6.2% CAGR between 2025 and 2035. The diagnostics segment is experiencing immense government support through the Ayushman Bharat program, with public-private collaborations promoting indigenous production of low-cost test kits.

Rural penetration is still a challenge according to FMI analysis, but Tier I and II cities are spearheading demand for quick, trustworthy diagnostics as antifungal resistance increases and women's health awareness grows. CDSCO regulates diagnostics device approvals with preferential approval of key diagnostics in the National List. Low-cost, low-infrastructure kit providers with support for validated performance data are set to experience high adoption.

In the diagnostics industry for yeast infections, leading players are competing on a competing by advancing innovation and optimizing cost structures, price flexibility, and strategic growth. Leading players are introducing multiplex molecular panels with faster turnaround times and higher diagnostic sensitivity while investing in to cater to the home-based diagnostics segment.

FMI analysis revealed that global players are also increasing regional penetration through distributor collaborations and acquisitions of local diagnostic laboratories. Partnership R&D with biotech companies and universities is speeding technology transfer and biomarker verification. Pricing competitiveness is still of prime importance, especially in the emerging industries where volume-based economies and reimbursement receptivity rule success.

Abbott Laboratories

Share: ~25-30%

Abbott is a leading competitor in the diagnosis of yeast infections, thanks to its extensive portfolio of molecular diagnostics and rapid tests. Abbott has a robust industry position through ongoing innovation and strategic alliances.

F. Hoffmann-La Roche Ltd.

Share: ~20-25%

Roche boasts a strong presence with its highly advanced diagnostic platforms, such as PCR-based for fungal infections. The company lays emphasis on high-throughput and automation-based testing to improve the efficiency of labs.

Thermo Fisher Scientific Inc.

Share: ~15-20%

Thermo Fisher is a major rival, offering a diversified portfolio of diagnostic assays and next-generation sequencing (NGS) solutions for the detection of yeast infection. Thermo Fisher lays significant emphasis on precision medicine and artificial intelligence-based diagnostics.

bioMérieux SA

Share: ~10-15%

Expertise in culture-based and automated diagnostic systems for fungal infections. Significant investments are made in R&D to achieve better sensitivity and shorter turnaround time.

BD (Becton, Dickinson, & Company)

Share: ~8-12%

BD specializes in sophisticated diagnostic instruments, such as automated identification and susceptibility testing systems for yeast infections. Strong distribution channels support its industry position.

Qiagen N.V.

Share: ~5-10%

In its molecular diagnostics products, Qiagen also offers PCR-based kits for Candida auris detection of infections. The corporation is strengthening its presence in growing industries.

The market is categorized into strips, cassettes, panel test.

The industry is segmented into vaginal PH test, nucleic acid amplification testing (naat) and microbiome test.

The landscape is divided into vagina, penis, mouth, nail and skin folds.

The industry is segmented into vulvovaginal candidiasis, trichomoniasis, chlamydia, gonorrhea, bacterial vaginosis and others.

The landscape is segmented intohospitals, diagnostics laboratories, specialty clinics and homecare settings.

The market is studied across North America, Latin America, Europe, East Asia, South Asia, Oceania, The Middle East & Africa

Sales in the industry are being propelled mainly by increasing incidence of vulvovaginal candidiasis, increasing awareness regarding reproductive health, and the need for quick, home-based testing.

The industry is likely to experience steady growth owing to improvements in molecular diagnostics, increased healthcare access, and greater use of multiplex panels.

Some of the key companies are Hologic Inc., Becton, Dickinson and Company, Natureland Health, Stix's, PGYARD, myLAB Box, Juno Bio, Seroflora, PrivaPath Diagnostics, NutraBlast, Rite Aid Corporation, Home Health (UK) Ltd, Loyalbody, Savyon Diagnostics, BIOSYNEX SA, Quantbiome, Inc.

Panel test kits are likely to dominate as they can identify multiple pathogens at the same time with high sensitivity.

The industry will reach USD 805.2 million by 2035.

Table 1A: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 1B: Global Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 2: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Test Type

Table 3: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Body Part

Table 4: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Indication

Table 5: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 6: Global Market Volume (Units) Analysis and Forecast 2012 to 2033, by Region

Table 7: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Region

Table 8: North America Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 9: North America Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 11: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Test Type

Table 12: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Body Part

Table 13: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Indication

Table 14: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 15: Latin America Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 16: Latin America Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 17: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 18: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Test Type

Table 19: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Body Part

Table 20: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Indication

Table 21: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 22: Europe Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 23: Europe Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 24: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 25: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Test Type

Table 26: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Body Part

Table 27: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Indication

Table 28: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 29: South Asia Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 30: South Asia Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 31: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 32: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Test Type

Table 33: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Body Part

Table 34: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Indication

Table 35: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 36: East Asia Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 37: East Asia Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 38: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 39: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Test Type

Table 40: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Body Part

Table 41: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Indication

Table 42: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 43: Oceania Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 44: Oceania Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 45: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 46: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Test Type

Table 47: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Body Part

Table 48: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Indication

Table 49: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 50: Middle East and Africa Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 51: Middle East and Africa Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 52: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 53: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Test Type

Table 54: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Body Part

Table 55: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Indication

Table 56: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Figure 1: Global Market Volume (Units), 2012 to 2022

Figure 2: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2023 to 2033

Figure 3: Yeast Infection Diagnostic Kits, Pricing Analysis per unit (US$), in 2022

Figure 4: Yeast Infection Diagnostic Kits, Pricing Forecast per unit (US$), in 2033

Figure 5: Global Market Value (US$ Million) Analysis, 2012 to 2022

Figure 6: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 7: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022 to 2033

Figure 8: Global Market Value Share (%) Analysis 2023 and 2033, by Product

Figure 9: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Product

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, by Product

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, by Test Type

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Test Type

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, by Test Type

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, by Body Part

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Body Part

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, by Body Part

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, by Indication

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Indication

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, by Indication

Figure 20: Global Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 21: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by End User

Figure 22: Global Market Attractiveness Analysis 2023 to 2033, by End User

Figure 23: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 24: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Region

Figure 25: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 26: North America Market Value (US$ Million) Analysis, 2012 to 2022

Figure 27: North America Market Value (US$ Million) Forecast, 2023-2033

Figure 28: North America Market Value Share, by Product (2023 E)

Figure 29: North America Market Value Share, by Test Type (2023 E)

Figure 30: North America Market Value Share, by Body Part (2023 E)

Figure 31: North America Market Value Share, by Indication (2023 E)

Figure 32: North America Market Value Share, by End User (2023 E)

Figure 33: North America Market Value Share, by Country (2023 E)

Figure 34: North America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 35: North America Market Attractiveness Analysis by Test Type, 2023 to 2033

Figure 36: North America Market Attractiveness Analysis by Body Part, 2023 to 2033

Figure 37: North America Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 38: North America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 39: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 40: USA Market Value Proportion Analysis, 2022

Figure 41: Global Vs. USA Growth Comparison

Figure 42: USA Market Share Analysis (%) by Product, 2022 & 2033

Figure 43: USA Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 44: USA Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 45: USA Market Share Analysis (%) by Indication, 2022 & 2033

Figure 46: USA Market Share Analysis (%) by End User, 2022 & 2033

Figure 47: Canada Market Value Proportion Analysis, 2022

Figure 48: Global Vs. Canada. Growth Comparison

Figure 49: Canada Market Share Analysis (%) by Product, 2022 & 2033

Figure 50: Canada Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 51: Canada Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 52: Canada Market Share Analysis (%) by Indication, 2022 & 2033

Figure 53: Canada Market Share Analysis (%) by End User, 2022 & 2033

Figure 54: Latin America Market Value (US$ Million) Analysis, 2012 to 2022

Figure 55: Latin America Market Value (US$ Million) Forecast, 2023-2033

Figure 56: Latin America Market Value Share, by Product (2023 E)

Figure 57: Latin America Market Value Share, by Test Type (2023 E)

Figure 58: Latin America Market Value Share, by Body Part (2023 E)

Figure 59: Latin America Market Value Share, by Indication (2023 E)

Figure 60: Latin America Market Value Share, by End User (2023 E)

Figure 61: Latin America Market Value Share, by Country (2023 E)

Figure 62: Latin America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 63: Latin America Market Attractiveness Analysis by Test Type, 2023 to 2033

Figure 64: Latin America Market Attractiveness Analysis by Body Part, 2023 to 2033

Figure 65: Latin America Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 66: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 67: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 68: Mexico Market Value Proportion Analysis, 2022

Figure 69: Global Vs Mexico Growth Comparison

Figure 70: Mexico Market Share Analysis (%) by Product, 2022 & 2033

Figure 71: Mexico Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 72: Mexico Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 73: Mexico Market Share Analysis (%) by Indication, 2022 & 2033

Figure 74: Mexico Market Share Analysis (%) by End User, 2022 & 2033

Figure 75: Brazil Market Value Proportion Analysis, 2022

Figure 76: Global Vs. Brazil. Growth Comparison

Figure 77: Brazil Market Share Analysis (%) by Product, 2022 & 2033

Figure 78: Brazil Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 79: Brazil Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 80: Brazil Market Share Analysis (%) by Indication, 2022 & 2033

Figure 81: Brazil Market Share Analysis (%) by End User, 2022 & 2033

Figure 82: Argentina Market Value Proportion Analysis, 2022

Figure 83: Global Vs Argentina Growth Comparison

Figure 84: Argentina Market Share Analysis (%) by Product, 2022 & 2033

Figure 85: Argentina Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 86: Argentina Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 87: Argentina Market Share Analysis (%) by Indication, 2022 & 2033

Figure 88: Argentina Market Share Analysis (%) by End User, 2022 & 2033

Figure 89: Europe Market Value (US$ Million) Analysis, 2012 to 2022

Figure 90: Europe Market Value (US$ Million) Forecast, 2023-2033

Figure 91: Europe Market Value Share, by Product (2023 E)

Figure 92: Europe Market Value Share, by Test Type (2023 E)

Figure 93: Europe Market Value Share, by Body Part (2023 E)

Figure 94: Europe Market Value Share, by Indication (2023 E)

Figure 95: Europe Market Value Share, by End User (2023 E)

Figure 96: Europe Market Value Share, by Country (2023 E)

Figure 97: Europe Market Attractiveness Analysis by Product, 2023 to 2033

Figure 98: Europe Market Attractiveness Analysis by Test Type, 2023 to 2033

Figure 99: Europe Market Attractiveness Analysis by Body Part, 2023 to 2033

Figure 100: Europe Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 101: Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 102: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 103: UK Market Value Proportion Analysis, 2022

Figure 104: Global Vs. UK Growth Comparison

Figure 105: UK Market Share Analysis (%) by Product, 2022 & 2033

Figure 106: UK Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 107: UK Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 108: UK Market Share Analysis (%) by Indication, 2022 & 2033

Figure 109: UK Market Share Analysis (%) by End User, 2022 & 2033

Figure 110: Germany Market Value Proportion Analysis, 2022

Figure 111: Global Vs. Germany Growth Comparison

Figure 112: Germany Market Share Analysis (%) by Product, 2022 & 2033

Figure 113: Germany Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 114: Germany Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 115: Germany Market Share Analysis (%) by Indication, 2022 & 2033

Figure 116: Germany Market Share Analysis (%) by End User, 2022 & 2033

Figure 117: Italy Market Value Proportion Analysis, 2022

Figure 118: Global Vs. Italy Growth Comparison

Figure 119: Italy Market Share Analysis (%) by Product, 2022 & 2033

Figure 120: Italy Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 121: Italy Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 122: Italy Market Share Analysis (%) by Indication, 2022 & 2033

Figure 123: Italy Market Share Analysis (%) by End User, 2022 & 2033

Figure 124: France Market Value Proportion Analysis, 2022

Figure 125: Global Vs France Growth Comparison

Figure 126: France Market Share Analysis (%) by Product, 2022 & 2033

Figure 127: France Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 128: France Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 129: France Market Share Analysis (%) by Indication, 2022 & 2033

Figure 130: France Market Share Analysis (%) by End User, 2022 & 2033

Figure 131: Spain Market Value Proportion Analysis, 2022

Figure 132: Global Vs Spain Growth Comparison

Figure 133: Spain Market Share Analysis (%) by Product, 2022 & 2033

Figure 134: Spain Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 135: Spain Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 136: Spain Market Share Analysis (%) by Indication, 2022 & 2033

Figure 137: Spain Market Share Analysis (%) by End User, 2022 & 2033

Figure 138: Russia Market Value Proportion Analysis, 2022

Figure 139: Global Vs Russia Growth Comparison

Figure 140: Russia Market Share Analysis (%) by Product, 2022 & 2033

Figure 141: Russia Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 142: Russia Market Share Analysis (%) by Body Type, 2022 & 2033

Figure 143: Russia Market Share Analysis (%) by Indication, 2022 & 2033

Figure 144: Russia Market Share Analysis (%) by End User, 2022 & 2033

Figure 145: BENELUX Market Value Proportion Analysis, 2022

Figure 146: Global Vs BENELUX Growth Comparison

Figure 147: BENELUX Market Share Analysis (%) by Product, 2022 & 2033

Figure 148: BENELUX Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 149: BENELUX Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 150: BENELUX Market Share Analysis (%) by Indication, 2022 & 2033

Figure 151: BENELUX Market Share Analysis (%) by End User, 2022 & 2033

Figure 152: East Asia Market Value (US$ Million) Analysis, 2012 to 2022

Figure 153: East Asia Market Value (US$ Million) Forecast, 2023-2033

Figure 154: East Asia Market Value Share, by Product (2023 E)

Figure 155: East Asia Market Value Share, by Test Type (2023 E)

Figure 156: East Asia Market Value Share, by Body Part (2023 E)

Figure 157: East Asia Market Value Share, by Indication (2023 E)

Figure 158: East Asia Market Value Share, by End User (2023 E)

Figure 159: East Asia Market Value Share, by Country (2023 E)

Figure 160: East Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 161: East Asia Market Attractiveness Analysis by Test Type, 2023 to 2033

Figure 162: East Asia Market Attractiveness Analysis by Body Part, 2023 to 2033

Figure 163: East Asia Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 164: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 166: China Market Value Proportion Analysis, 2022

Figure 167: Global Vs. China Growth Comparison

Figure 168: China Market Share Analysis (%) by Product, 2022 & 2033

Figure 169: China Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 170: China Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 171: China Market Share Analysis (%) by Indication, 2022 & 2033

Figure 172: China Market Share Analysis (%) by End User, 2022 & 2033

Figure 173: Japan Market Value Proportion Analysis, 2022

Figure 174: Global Vs. Japan Growth Comparison

Figure 175: Japan Market Share Analysis (%) by Product, 2022 & 2033

Figure 176: Japan Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 177: Japan Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 178: Japan Market Share Analysis (%) by Indication, 2022 & 2033

Figure 179: Japan Market Share Analysis (%) by End User, 2022 & 2033

Figure 180: South Korea Market Value Proportion Analysis, 2022

Figure 181: Global Vs South Korea Growth Comparison

Figure 182: South Korea Market Share Analysis (%) by Product, 2022 & 2033

Figure 183: South Korea Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 184: South Korea Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 185: South Korea Market Share Analysis (%) by Indication, 2022 & 2033

Figure 186: South Korea Market Share Analysis (%) by End User, 2022 & 2033

Figure 187: South Asia Market Value (US$ Million) Analysis, 2012 to 2022

Figure 188: South Asia Market Value (US$ Million) Forecast, 2023-2033

Figure 189: South Asia Market Value Share, by Product (2023 E)

Figure 190: South Asia Market Value Share, by Test Type (2023 E)

Figure 191: South Asia Market Value Share, by Body Part (2023 E)

Figure 192: South Asia Market Value Share, by Product (2023 E)

Figure 193: South Asia Market Value Share, by End User (2023 E)

Figure 194: South Asia Market Value Share, by Country (2023 E)

Figure 195: South Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 196: South Asia Market Attractiveness Analysis by Test Type, 2023 to 2033

Figure 197: South Asia Market Attractiveness Analysis by Body Part, 2023 to 2033

Figure 198: South Asia Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 199: South Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 200: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 201: India Market Value Proportion Analysis, 2022

Figure 202: Global Vs. India Growth Comparison

Figure 203: India Market Share Analysis (%) by Product, 2022 & 2033

Figure 204: India Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 205: India Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 206: India Market Share Analysis (%) by Indication, 2022 & 2033

Figure 207: India Market Share Analysis (%) by End User, 2022 & 2033

Figure 208: Indonesia Market Value Proportion Analysis, 2022

Figure 209: Global Vs. Indonesia Growth Comparison

Figure 210: Indonesia Market Share Analysis (%) by Product, 2022 & 2033

Figure 211: Indonesia Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 212: Indonesia Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 213: Indonesia Market Share Analysis (%) by Indication, 2022 & 2033

Figure 214: Indonesia Market Share Analysis (%) by End User, 2022 & 2033

Figure 215: Malaysia Market Value Proportion Analysis, 2022

Figure 216: Global Vs. Malaysia Growth Comparison

Figure 217: Malaysia Market Share Analysis (%) by Product, 2022 & 2033

Figure 218: Malaysia Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 219: Malaysia Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 220: Malaysia Market Share Analysis (%) by Indication, 2022 & 2033

Figure 221: Malaysia Market Share Analysis (%) by End User, 2022 & 2033

Figure 222: Thailand Market Value Proportion Analysis, 2022

Figure 223: Global Vs. Thailand Growth Comparison

Figure 224: Thailand Market Share Analysis (%) by Product, 2022 & 2033

Figure 225: Thailand Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 226: Thailand Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 227: Thailand Market Share Analysis (%) by Indication, 2022 & 2033

Figure 228: Thailand Market Share Analysis (%) by End User, 2022 & 2033

Figure 229: Oceania Market Value (US$ Million) Analysis, 2012 to 2022

Figure 230: Oceania Market Value (US$ Million) Forecast, 2023-2033

Figure 231: Oceania Market Value Share, by Product (2023 E)

Figure 232: Oceania Market Value Share, by Test Type (2023 E)

Figure 233: Oceania Market Value Share, by Body Part (2023 E)

Figure 234: Oceania Market Value Share, by Indication (2023 E)

Figure 235: Oceania Market Value Share, by End User (2023 E)

Figure 236: Oceania Market Value Share, by Country (2023 E)

Figure 237: Oceania Market Attractiveness Analysis by Product, 2023 to 2033

Figure 238: Oceania Market Attractiveness Analysis by Test Type, 2023 to 2033

Figure 239: Oceania Market Attractiveness Analysis by Body Part, 2023 to 2033

Figure 240: Oceania Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 241: Oceania Market Attractiveness Analysis by End User, 2023 to 2033

Figure 242: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 243: Australia Market Value Proportion Analysis, 2022

Figure 244: Global Vs. Australia Growth Comparison

Figure 245: Australia Market Share Analysis (%) by Product, 2022 & 2033

Figure 246: Australia Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 247: Australia Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 248: Australia Market Share Analysis (%) by Indication, 2022 & 2033

Figure 249: Australia Market Share Analysis (%) by End User, 2022 & 2033

Figure 250: New Zealand Market Value Proportion Analysis, 2022

Figure 251: Global Vs New Zealand Growth Comparison

Figure 252: New Zealand Market Share Analysis (%) by Product, 2022 & 2033

Figure 253: New Zealand Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 254: New Zealand Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 255: New Zealand Market Share Analysis (%) by Indication, 2022 & 2033

Figure 256: New Zealand Market Share Analysis (%) by End User, 2022 & 2033

Figure 257: Middle East & Africa Market Value (US$ Million) Analysis, 2012 to 2022

Figure 258: Middle East & Africa Market Value (US$ Million) Forecast, 2023-2033

Figure 259: Middle East & Africa Market Value Share, by Product (2023 E)

Figure 260: Middle East & Africa Market Value Share, by Test Type (2023 E)

Figure 261: Middle East & Africa Market Value Share, by Body Part (2023 E)

Figure 262: Middle East & Africa Market Value Share, by Indication (2023 E)

Figure 263: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 264: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 265: Middle East & Africa Market Attractiveness Analysis by Product, 2023 to 2033

Figure 266: Middle East & Africa Market Attractiveness Analysis by Test Type, 2023 to 2033

Figure 267: Middle East & Africa Market Attractiveness Analysis by Body Part, 2023 to 2033

Figure 268: Middle East & Africa Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 269: Middle East & Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 270: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 271: GCC Countries Market Value Proportion Analysis, 2022

Figure 272: Global Vs GCC Countries Growth Comparison

Figure 273: GCC Countries Market Share Analysis (%) by Product, 2022 & 2033

Figure 274: GCC Countries Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 275: GCC Countries Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 276: GCC Countries Market Share Analysis (%) by Indication, 2022 & 2033

Figure 277: GCC Countries Market Share Analysis (%) by End User, 2022 & 2033

Figure 278: Türkiye Market Value Proportion Analysis, 2022

Figure 279: Global Vs. Türkiye Growth Comparison

Figure 280: Türkiye Market Share Analysis (%) by Product, 2022 & 2033

Figure 281: Türkiye Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 282: Türkiye Market Share Analysis (%) by Body part, 2022 & 2033

Figure 283: Türkiye Market Share Analysis (%) by Indication, 2022 & 2033

Figure 284: Türkiye Market Share Analysis (%) by End User, 2022 & 2033

Figure 285: South Africa Market Value Proportion Analysis, 2022

Figure 286: Global Vs. South Africa Growth Comparison

Figure 287: South Africa Market Share Analysis (%) by Product, 2022 & 2033

Figure 288: South Africa Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 289: South Africa Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 290: South Africa Market Share Analysis (%) by Indication, 2022 & 2033

Figure 291: South Africa Market Share Analysis (%) by End User, 2022 & 2033

Figure 292: Northern Africa Market Value Proportion Analysis, 2022

Figure 293: Global Vs Northern Africa Growth Comparison

Figure 294: Northern Africa Market Share Analysis (%) by Product, 2022 & 2033

Figure 295: Northern Africa Market Share Analysis (%) by Test Type, 2022 & 2033

Figure 296: Northern Africa Market Share Analysis (%) by Body Part, 2022 & 2033

Figure 297: Northern Africa Market Share Analysis (%) by Indication, 2022 & 2033

Figure 298: Northern Africa Market Share Analysis (%) by End User, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yeast Beta Glucan Market Size and Share Forecast Outlook 2025 to 2035

Yeast Based Aqua Protein Market Size and Share Forecast Outlook 2025 to 2035

Yeast Market Outlook - Size, Demand & Forecast 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast-derived Collagen Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Yeast Nucleotides Market Analysis by Product Type, Nature, Form and Application Through 2035

Yeast Autolysates Market Outlook - Growth, Demand & Forecast 2024 to 2034

Yeast Flakes Market

Yeast Infection Treatment Market by Drug Type, Distribution Channel, End User, and Region, 2025 to 2035

UK Yeast Extract Market Report – Trends, Demand & Industry Forecast 2025–2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

GCC Yeast Market Trends – Growth, Demand & Forecast 2025–2035

USA Yeast Market Analysis – Size, Share & Forecast 2025-2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Yeast Extract Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA