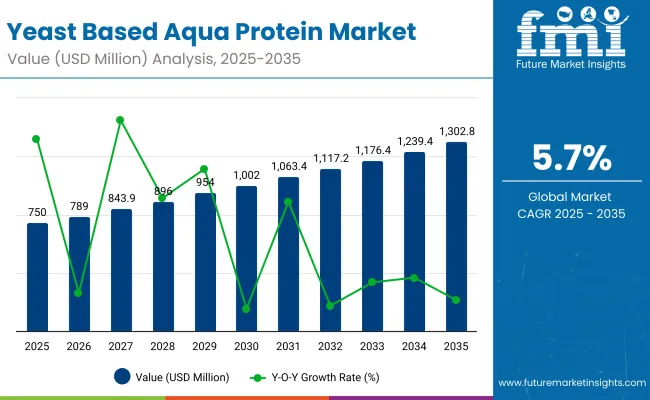

A market valuation of approximately USD 750 million is expected in 2025 for the Yeast-Based Aqua Protein industry, with the total value anticipated to reach nearly USD 1,302.8 million by 2035. This trajectory represents a consistent expansion, supported by a CAGR of 5.7% during the forecast period from 2025 to 2035. Over this decade, incremental gains of more than USD 550 million are projected, indicating the steady establishment of yeast-based proteins as a reliable alternative for aquafeed formulations.

| Metric | Value |

|---|---|

| YEAST BASED AQUA PROTEIN Market Estimated Value in (2025E) | USD 750.0 million |

| YEAST BASED AQUA PROTEIN Market Forecast Value in (2035F) | USD 1,302.8 million |

| Forecast CAGR (2025 to 2035) | 5.70% |

During the first half of the forecast window (2025 to 2030), growth is expected to be gradual, taking the market above USD 1,002.0 Million by 2030. This initial phase is likely to be shaped by gradual adoption across salmon, trout, and tilapia feed systems, particularly in developed markets where high compliance standards favor functional, traceable ingredients. In the subsequent five-year period (2030 to 2035), market expansion is projected to accelerate, with close to USD 300 million being added in value, driven by intensified adoption across emerging aquaculture hubs in Asia and the Pacific.

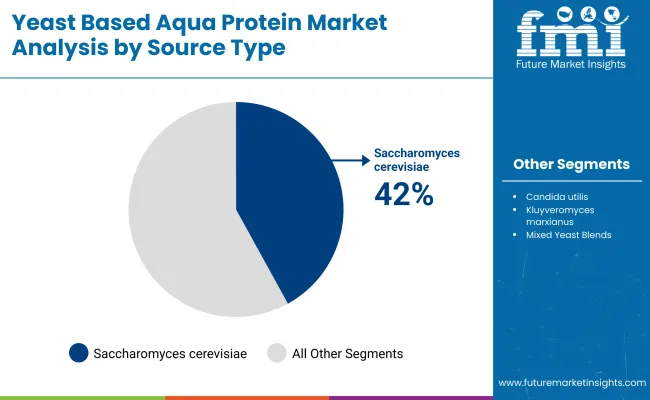

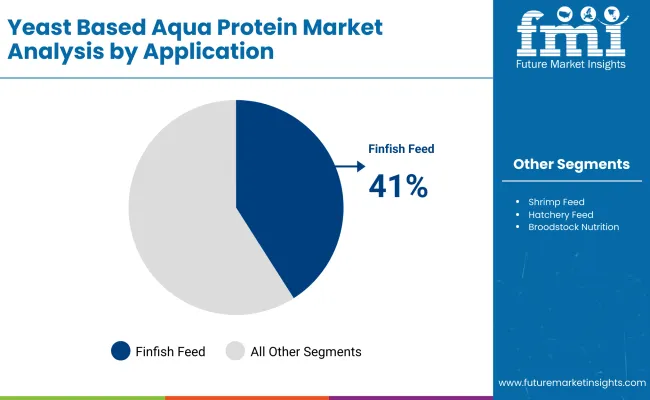

In terms of segment dominance, finfish feed applications are projected to retain the largest share at 41% in 2025, with salmon alone accounting for 16% of global demand. Regional analysis shows North America holding nearly 30% of the market share, while Europe and South Asia & Pacific collectively represent more than 50% of global value. Saccharomyces cerevisiae remains the leading source, with a projected 42% share in 2025, underscoring its critical role in both protein enrichment and functional feed additives.

From 2020 to 2024, the Yeast-Based Aqua Protein Market was expanded from USD 620 million to USD 710 million , with growth driven largely by aquaculture feed enrichment and rising adoption of sustainable protein alternatives. During this period, leading yeast producers captured a dominant revenue share, supported by their ability to supply both nutritional and functional protein solutions.

By 2025, demand is forecasted to reach USD 750.0 million , with momentum expected to be sustained by increasing regulatory support for alternative proteins in aquafeed formulations. The revenue mix is anticipated to diversify as value-added yeast derivatives, such as yeast extracts and hydrolysates, capture greater adoption across functional feed applications. Traditional producers are projected to face increasing competition from emerging biotech firms specializing in single-cell proteins and fermentation-based innovations.

Competitive advantage is expected to shift from production scale alone to ecosystem readiness, application-specific formulations, and integration with digitalized aquaculture nutrition platforms. The market landscape is likely to be reshaped by hybrid models where yeast protein offerings are bundled with digital feed optimization and performance-monitoring services.

Growth in the Yeast-Based Aqua Protein Market is being driven by rising demand for sustainable and functional alternatives in aquafeed. Increasing pressure to reduce reliance on fishmeal has accelerated the adoption of yeast-based proteins, as their consistent quality and traceability align with both regulatory and industry needs. Functional benefits such as immune stimulation, gut health modulation, and improved palatability are being recognized as critical for survival rates in early life stages, reinforcing their value proposition. Expanding aquaculture production in Asia, coupled with intensification of fish and shrimp farming, is expected to amplify uptake across developing markets. In parallel, advancements in fermentation technologies are enhancing yield efficiency, allowing cost competitiveness to improve steadily. Regulatory trends encouraging antibiotic-free aquaculture are also providing a favorable environment for wider deployment. Segment leadership is projected to remain with finfish feed, while functional feed additives are anticipated to register the fastest growth due to increasing emphasis on performance optimization.

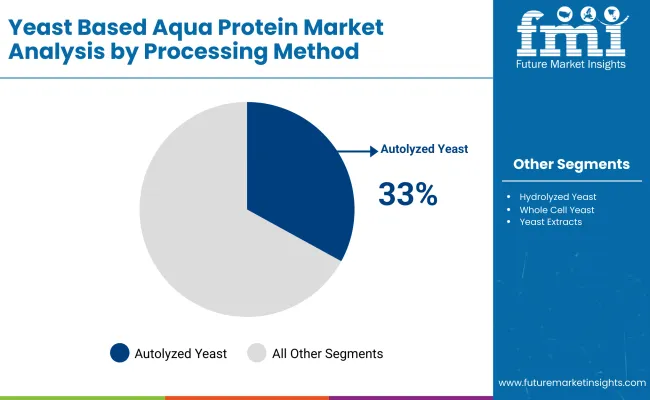

The Yeast-Based Aqua Protein Market has been structured by Source, Processing Method, and Application, reflecting the core dimensions shaping industry growth. Each segment highlights a distinct driver of adoption, from microbial strain efficiency and processing innovation to species-specific feed requirements. In 2025, Saccharomyces cerevisiae dominates by source, autolyzed yeast leads by processing, and finfish feed remains the largest application. However, segments with smaller bases such as genetically modified yeasts, yeast protein isolates, and functional feed additives are projected to advance at faster rates through 2035, supported by innovation, regulatory compliance, and the push for sustainable aquaculture solutions. This segmentation provides insight into how market share distribution is expected to evolve in response to technology shifts and aquaculture intensification.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Saccharomyces cerevisiae | 42% |

| Candida utilis | 24% |

| Kluyveromyces marxianus | 12% |

| Mixed Yeast Blends | 15% |

| Genetically Modified Yeasts | 7% |

Saccharomyces cerevisiae is anticipated to hold a commanding 42% share in 2025, reinforcing its position as the industry standard due to proven nutritional benefits and established regulatory acceptance. Candida utilis and Kluyveromyces marxianus are also expected to capture meaningful shares, particularly where protein digestibility and feed efficiency are prioritized. Mixed yeast blends, accounting for 15%, are projected to see growing uptake as aquafeed formulators diversify functional properties. Genetically modified yeasts, although representing just 7% in 2025, are forecasted to grow fastest at 8.5% CAGR, reflecting their potential to deliver tailored amino acid profiles and improved resilience in intensive aquaculture. This segment is expected to gradually shift toward innovation-driven adoption, complementing traditional yeast sources.

| Range Segment | Market Value Share, 2025 |

|---|---|

| Autolyzed Yeast | 33% |

| Hydrolyzed Yeast | 27% |

| Whole Cell Yeast | 18% |

| Yeast Extracts | 14% |

| Yeast Protein Isolates | 8% |

Autolyzed yeast is expected to remain the market leader with 33% share in 2025, widely adopted for its digestibility and functional contribution to fish and shrimp performance. Hydrolyzed yeast, holding 27% share, is projected to gain further traction, especially in immune modulation and stress resistance applications. Whole cell yeast retains relevance with 18%, primarily in regions prioritizing cost-effectiveness. Yeast extracts and protein isolates, though smaller in share at 14% and 8% respectively, are forecasted to expand faster, reflecting rising demand for concentrated protein sources and precision nutrition. By 2035, premium categories such as isolates and extracts are anticipated to capture higher influence, underscoring the industry’s movement toward high-performance feed solutions.

| Laser triangulation technology | Market Value Share, 2025 |

|---|---|

| Finfish Feed | 41% |

| Shrimp Feed | 26% |

| Hatchery Feed | 12% |

| Broodstock Nutrition | 8% |

| Larval Feed | 7% |

| Functional Feed Additives | 6% |

Finfish feed is projected to dominate applications with 41% share in 2025, supported by significant demand from salmon and trout aquaculture. Salmon alone is expected to contribute 16%, highlighting its reliance on functional protein solutions. Shrimp feed, representing 26%, is forecasted to grow faster, driven by intensification in Asia-Pacific and Latin America. Hatchery, broodstock, and larval feeds collectively form over a quarter of the market, reflecting the critical role of yeast proteins in early-stage survival and reproductive success. Functional feed additives, though accounting for only 6% in 2025, are anticipated to record the highest CAGR of 8.7%, indicating increasing recognition of yeast-based solutions for immune enhancement, gut health, and feed conversion improvements across species.

Growing aquaculture sustainability requirements are reshaping feed innovation, positioning yeast-based proteins as integral to performance-driven and compliance-focused nutrition strategies. At the same time, regulatory, technological, and consumer-driven dynamics are redefining adoption pathways and creating new opportunities across advanced aquaculture ecosystems.

Regulatory Push for Antibiotic-Free Aquaculture

Adoption of yeast-based aqua proteins is being reinforced by stringent regulations discouraging antibiotic usage in aquaculture. With producers seeking compliant, residue-free feed solutions, yeast proteins are being integrated as natural immuno stimulants and gut-health enhancers. This driver is expected to establish yeast proteins not only as alternatives but also as strategic enablers of compliance in global seafood trade, particularly in regions where export markets impose strict feed quality controls.

Precision Nutrition in Aquaculture Systems

A rising focus on precision aquaculture is shaping demand for feed formulations tailored to species-specific and life-stage requirements. Yeast proteins, through advanced processing such as isolates and extracts, are increasingly applied in micro-formulations for hatcheries, larval stages, and functional additives. This trend reflects a transition from volume-driven feed inputs to performance-optimized solutions, where yeast-based proteins are anticipated to deliver measurable outcomes in feed conversion, survival, and product differentiation across competitive export-oriented markets.

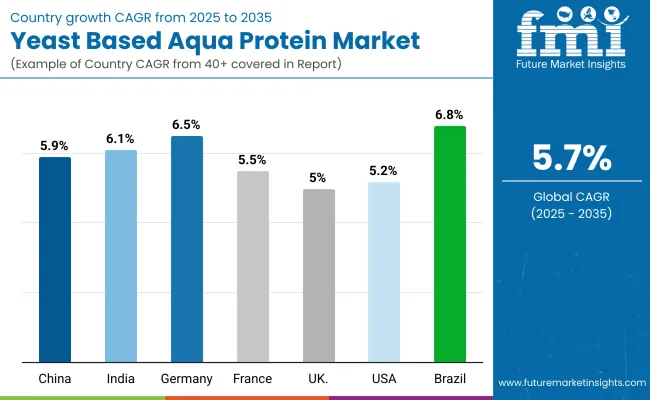

| Countries | CAGR |

|---|---|

| China | 5.97% |

| India | 6.10% |

| Germany | 6.54% |

| France | 5.55% |

| UK | 5.06% |

| USA | 5.22% |

| Brazil | 6.81% |

The Yeast-Based Aqua Protein Market exhibits clear differentiation across leading countries, influenced by aquaculture scale, feed regulation, and sustainability priorities. In Asia-Pacific, China and India are positioned as central demand drivers. China is expected to expand steadily at 5.97%, supported by large-scale aquaculture operations and rising investments in sustainable feed alternatives. India, with growth projected at 6.10%, is being driven by shrimp farming intensification and the integration of yeast proteins into hatchery and broodstock nutrition, strengthening its position as a competitive aquaculture exporter.

Europe demonstrates a strong adoption base, with Germany showing the highest growth rate at 6.54% due to robust regulatory standards and advanced aquafeed R&D. France, at 5.55%, benefits from a diverse aquaculture portfolio, while the UK, at 5.06%, reflects consistent demand anchored by compliance-driven feed practices and sustainability certifications.

North America is led by the USA, with a growth projection of 5.22%, supported by salmonid feed demand and technological innovation in protein enrichment. In Latin America, Brazil emerges as the fastest-growing market at 6.81%, driven by tilapia and shrimp production expansion. Collectively, these country-level trajectories highlight the role of yeast proteins in enabling cost-efficient, sustainable, and performance-focused aquaculture feed strategies worldwide.

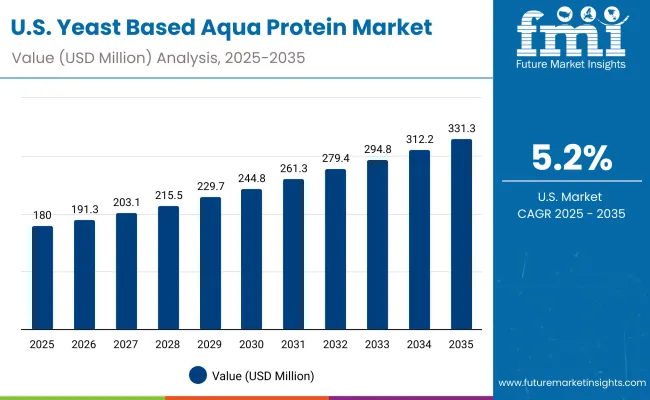

| Year | USA Yeast Based Aqua Protein Market (USD Million) |

|---|---|

| 2025 | 180.00 |

| 2026 | 191.3 |

| 2027 | 203.1 |

| 2028 | 215.5 |

| 2029 | 229.7 |

| 2030 | 244.8 |

| 2031 | 261.3 |

| 2032 | 279.4 |

| 2033 | 294.8 |

| 2034 | 312.2 |

| 2035 | 331.3 |

The Yeast-Based Aqua Protein Market in the United States is projected to advance from USD 180.0 million in 2025 to USD 331.3 million by 2035, reflecting steady expansion at a CAGR of 6.3%. Growth is being shaped by structural changes in aquafeed production, where sustainability, traceability, and performance enhancement are prioritized. Shrimp and finfish feed applications are expected to sustain consistent demand, supported by salmonid production in colder regions and intensified aquaculture systems. Functional feed additives are being integrated to strengthen immune response and support antibiotic-free compliance, which has been reinforced by evolving USA food safety standards.

Opportunities are being created through innovation in yeast extracts and protein isolates, which are increasingly deployed in hatcheries and broodstock diets to improve survival rates. Strategic adoption is also anticipated in specialty aquaculture segments where feed efficiency and high-value output remain critical. Regional feed manufacturers are likely to pursue partnerships with global yeast producers to ensure supply consistency and innovation access, shaping a competitive yet opportunity-rich environment.

Key Insights:

The Yeast-Based Aqua Protein Market in the United Kingdom is forecasted to grow at a CAGR of 5.06% between 2025 and 2035. Expansion is expected to be anchored by regulatory alignment with sustainability standards and a growing preference for traceable feed ingredients. Adoption of yeast-based proteins is anticipated to support antibiotic-free aquaculture practices, particularly in trout and salmon farming, which remain central to the UK’s aquaculture base. Broader industry integration is likely to be influenced by the country’s role in high-value seafood exports, where compliance with EU and global buyer requirements demands innovative protein solutions. Over the next decade, performance-linked formulations such as functional additives are projected to gain visibility.

The Yeast-Based Aqua Protein Market in India is projected to grow at a CAGR of 6.10% from 2025 to 2035. This momentum is expected to be supported by intensification of shrimp farming and rising hatchery-level integration of yeast proteins. Feed efficiency improvements are being sought to strengthen India’s global competitiveness as one of the largest shrimp exporters. Adoption is anticipated across broodstock and larval nutrition, where survival rates directly affect profitability. Increasing partnerships between domestic feed manufacturers and international yeast suppliers are likely to enhance access to innovative processing methods such as hydrolyzed and autolyzed formats. As India’s aquaculture output scales further, functional applications of yeast proteins are expected to grow, aligning with export-driven quality standards.

The Yeast-Based Aqua Protein Market in China is expected to advance at a CAGR of 5.97% through 2035. Growth is projected to be reinforced by large-scale aquaculture operations and government emphasis on sustainable feed alternatives. Domestic production of carp, tilapia, and shrimp provides a wide demand base, with yeast proteins increasingly used to replace fishmeal and support feed cost stability. Adoption is also being influenced by China’s position as a leading seafood exporter, where compliance with international food safety and sustainability standards is shaping feed choices. As innovation in yeast extracts and protein isolates expands, higher-value applications are expected to become mainstream.

| Countries | 2025 |

|---|---|

| UK | 18.38% |

| Germany | 20.31% |

| Italy | 10.06% |

| France | 12.97% |

| Spain | 11.28% |

| BNELUX | 6.47% |

| Nordic | 5.69% |

| Rest of Europe | 15% |

| Countries | 2035 |

|---|---|

| UK | 18.33% |

| Germany | 20.47% |

| Italy | 11.66% |

| France | 12.56% |

| Spain | 10.90% |

| BNELUX | 5.74% |

| Nordic | 5.44% |

| Rest of Europe | 15% |

The Yeast-Based Aqua Protein Market in Germany is forecasted to grow at a CAGR of 6.54% between 2025 and 2035, making it one of the strongest growth markets in Europe. Expansion is expected to be shaped by advanced aquaculture systems and strict feed regulatory frameworks that prioritize sustainable inputs. German feed producers are actively investing in R&D, enabling rapid integration of yeast-based proteins into functional and performance-driven formulations. Adoption in hatcheries and specialty feeds is anticipated to expand, reflecting emphasis on survival, growth efficiency, and compliance. With Germany serving as a hub for aquafeed innovation in Europe, the market is positioned to influence broader regional standards.

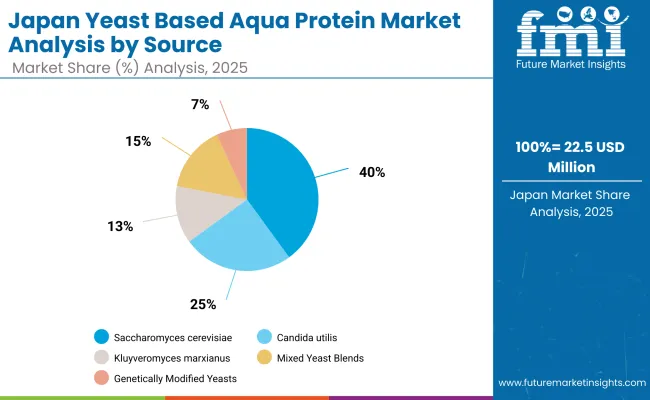

| Component Segment | Market Value Share, 2025 |

|---|---|

| Saccharomyces cerevisiae | 40% |

| Candida utilis | 25% |

| Kluyveromyces marxianus | 13% |

| Mixed Yeast Blends | 15% |

| Genetically Modified Yeasts | 7% |

The Yeast-Based Aqua Protein Market in Japan is projected at USD 22.5 million in 2025, reflecting its strong position within East Asia’s aquafeed sector. Saccharomyces cerevisiae leads with 40% share, benefiting from its established performance in protein enrichment and functional nutrition. Candida utilis follows with 25%, widely applied in high-digestibility formulations for marine aquaculture. Kluyveromyces marxianus and mixed yeast blends together contribute 28%, showcasing the country’s diversification into advanced strains. Genetically modified yeasts, though smaller at 7%, are positioned for long-term growth in specialized applications.

Japan’s aquaculture sector, centered on high-value species such as yellowtail and sea bream, requires precision nutrition and sustainable feed inputs. Regulatory oversight on food safety and antibiotic reduction reinforces the importance of yeast-based proteins, making Japan a strategic innovation-driven market.

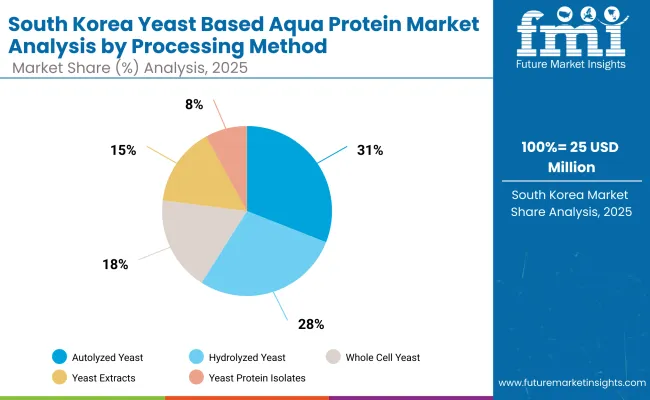

| Range Segment | Market Value Share, 2025 |

|---|---|

| Autolyzed Yeast | 31% |

| Hydrolyzed Yeast | 28% |

| Whole Cell Yeast | 18% |

| Yeast Extracts | 15% |

| Yeast Protein Isolates | 8% |

The Yeast-Based Aqua Protein Market in South Korea is projected at USD 25 million in 2025, reflecting its strong contribution to East Asia’s aquafeed economy. Autolyzed yeast leads with 31%, supported by its functional benefits in digestibility and gut health enhancement. Hydrolyzed yeast follows at 28%, positioned for broader adoption in immune-supportive formulations across finfish and shrimp aquaculture. Whole cell yeast, at 18%, remains relevant as a cost-effective protein source, while yeast extracts (15%) are increasingly favored for palatability improvement. Yeast protein isolates, though holding 8%, are expected to gain momentum in precision nutrition applications such as hatchery and broodstock diets.

South Korea’s aquaculture industry emphasizes high-value marine species such as flounder and sea bream, creating sustained demand for functional and performance-driven feed inputs. With regulatory standards focused on antibiotic-free production and food safety compliance, yeast-based proteins are projected to remain integral to the country’s aquafeed strategies.

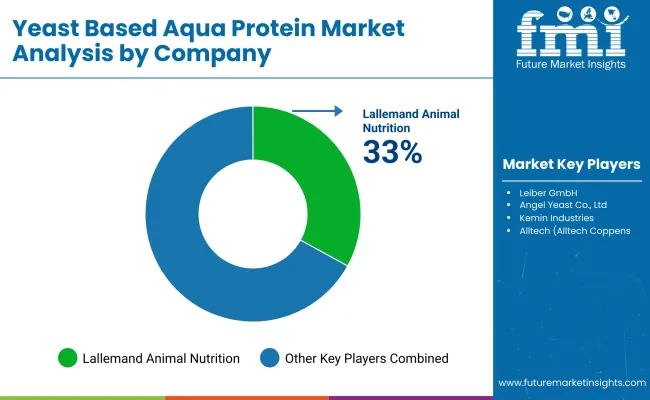

| Company | Global Value Share 2025 |

|---|---|

| Lallemand Animal Nutrition | 33% |

| Others | 67% |

The Yeast-Based Aqua Protein Market is moderately consolidated, with leading multinational players, regional specialists, and innovation-driven entrants competing across aquaculture applications. Global leaders such as Lallemand Animal Nutrition, Leiber GmbH, Angel Yeast Co., Ltd., Alltech (Alltech Coppens), and Kemin Industries (AquaScience) are positioned at the forefront, leveraging scale, bioprocessing expertise, and established distribution networks. Their strategies are increasingly oriented toward functional feed innovation, precision nutrition, and regulatory compliance, enabling greater penetration into salmon, shrimp, and hatchery feed markets.

Established mid-sized firms are focusing on specialized yeast derivatives such as hydrolyzed yeasts, extracts, and protein isolates to address emerging requirements in immune modulation, palatability, and gut health. These companies are enhancing competitiveness by integrating applied research with regional partnerships, ensuring agility in meeting species-specific and geography-specific aquaculture needs.

Smaller niche providers and contract manufacturers are also contributing, particularly in localized markets across Asia-Pacific and Europe. Their strengths lie in flexibility, cost-effective supply, and responsiveness to customer-specific formulations.

Competitive differentiation is shifting from volume-based production toward innovation-led ecosystems, where supply reliability, traceability, and performance validation in aquaculture trials determine long-term success. Strategic alliances with feed mills and integrators, combined with investments in sustainable fermentation capacity, are expected to shape the future landscape.

Key Developments In Yeast Based Aqua Protein Market

| Item | Value |

|---|---|

| Quantitative Units | USD 750.0 million (2025); USD 1,302.8 million (2035) |

| Component | Autolyzed Yeast; Hydrolyzed Yeast; Whole Cell Yeast; Yeast Extracts; Yeast Protein Isolates |

| Range (Product Form) | Powder; Liquid; Granules |

| Technology (Production Methods) | Fermentation; Autolysis; Enzymatic Hydrolysis; Spray Drying |

| Type (Application-Specific) | Finfish Feed; Shrimp Feed; Hatchery Feed; Broodstock Nutrition; Larval Feed; Functional Feed Additives |

| End-use Industry | Aquaculture (salmon, trout, tilapia, sea bass/sea bream, shrimp); Early-life stage feeds; Functional performance additives |

| Regions Covered | N orth America (30%) ; Europe (28%); South Asia & Pacific (25%); East Asia (12%); Middle East & Africa (3%); Latin America (2%) |

| Country Covered | United States; Canada; Germany; France; United Kingdom; China; Japan; India; Brazil; South Korea |

| Key Companies Profiled | Lallemand Animal Nutrition; Leiber GmbH; Angel Yeast Co., Ltd.; Alltech (Alltech Coppens); Kemin Industries (AquaScience) |

The global Yeast-Based Aqua Protein Market is estimated to be valued at USD 750.0 million in 2025.

The Yeast-Based Aqua Protein Market size is projected to reach USD 1,302.8 million by 2035.

The Yeast-Based Aqua Protein Market is expected to expand at a CAGR of 5.7% during 2025–2035.

The key product types in this market are based on yeast sources, including Saccharomyces cerevisiae, Candida utilis, Kluyveromyces marxianus, Mixed Yeast Blends, and Genetically Modified Yeasts.

The Finfish Feed segment is expected to be a major contributor in 2025, with important sub-applications such as salmon, trout, tilapia, and sea bass/sea bream.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yeast Beta Glucan Market Size and Share Forecast Outlook 2025 to 2035

Yeast Market Outlook - Size, Demand & Forecast 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast-derived Collagen Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Yeast Infection Diagnostics Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Yeast Nucleotides Market Analysis by Product Type, Nature, Form and Application Through 2035

Yeast Infection Treatment Market by Drug Type, Distribution Channel, End User, and Region, 2025 to 2035

Yeast Autolysates Market Outlook - Growth, Demand & Forecast 2024 to 2034

Yeast Flakes Market

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

UK Yeast Extract Market Report – Trends, Demand & Industry Forecast 2025–2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

GCC Yeast Market Trends – Growth, Demand & Forecast 2025–2035

USA Yeast Market Analysis – Size, Share & Forecast 2025-2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Yeast Extract Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA