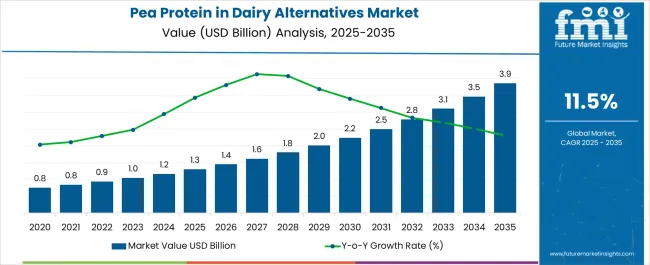

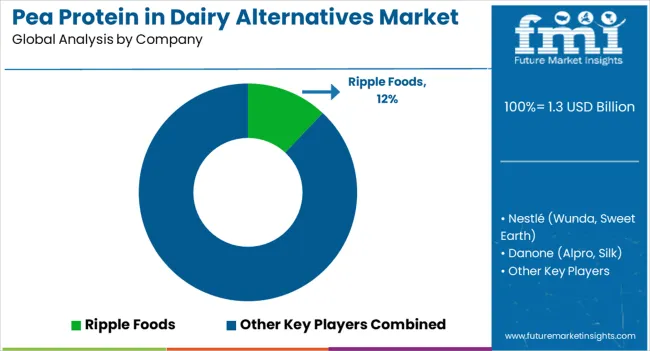

Global demand for pea protein in dairy alternatives is estimated at USD 1.3 billion in 2025, with projections indicating a rise to USD 3.9 billion by 2035, reflecting a CAGR of approximately 11.5% over the forecast period. This growth reflects both expanding consumer adoption and increased per capita consumption across major economies. The rise in demand is linked to growing lactose intolerance awareness, sustainability preferences, and the functional advantages of pea protein in alternative dairy formulations. By 2025, per capita consumption in leading countries such as the United States, China, and Germany averages between 2.1 to 2.8 kilograms, with projections reaching 3.5 kilograms by 2035. India leads among developing economies, expected to generate substantial growth in pea protein-based dairy alternatives by 2035, driven by rising plant-based beverage adoption and health consciousness.

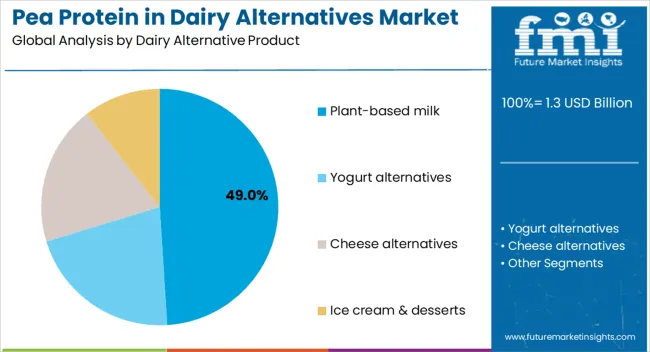

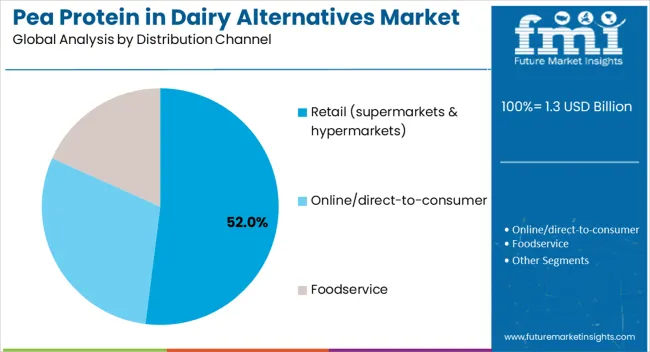

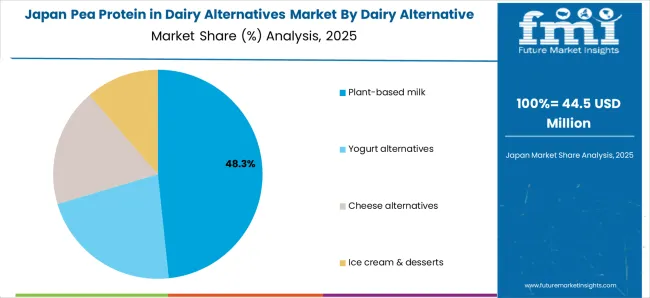

The largest contribution to demand continues to come from plant-based milk products, which are expected to account for 49% of total consumption in 2025, owing to mainstream retail penetration, consumer familiarity, and technological improvements in taste and texture. By distribution channel, retail outlets including supermarkets and hypermarkets represent the dominant sales format, responsible for 52% of all transactions, while online and direct-to-consumer platforms are expanding rapidly.

Consumer adoption is particularly concentrated among health-conscious millennials and lactose-intolerant populations, with urbanization and disposable income emerging as significant drivers of demand. While cost remains a consideration, the price differential between pea protein dairy alternatives and conventional dairy products has narrowed significantly. Continued improvements in processing technology and supply chain efficiency are expected to accelerate affordability and access across middle-income households. Regional disparities persist, but per capita demand in emerging Asian economies is closing the gap with established Western consumption patterns.

The rising consumer demand for plant-based, allergen-free, and sustainable protein sources is driving the adoption of pea protein in dairy alternatives. Pea protein delivers a clean-label, non-GMO, and lactose-free option that appeals to health-conscious consumers as well as those with dairy or soy allergies. Its neutral taste, creamy texture, and strong nutritional profile-rich in essential amino acids and easily digestible-make it highly suitable for applications in plant-based milk, yogurt, cheese, and ice cream.

Food manufacturers are increasingly leveraging pea protein to enhance functionality, mouthfeel, and protein content in dairy alternatives without compromising on flavor or quality. The growing popularity of vegan and flexitarian diets, coupled with sustainability benefits such as lower water use and reduced carbon footprint compared to animal dairy, is fueling market expansion.

Investments in processing technologies and product innovation are improving solubility, taste masking, and fortification capabilities, further accelerating adoption. Broader retail availability and consumer preference for environmentally responsible choices are providing competitive advantages for brands incorporating pea protein into next-generation dairy alternatives.

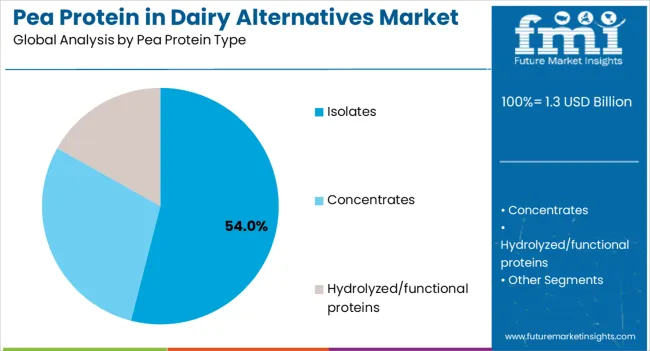

The pea protein dairy alternatives segment globally is classified across several categories. By dairy alternative product, the key segments include plant-based milk, yogurt alternatives, cheese alternatives, and ice cream and desserts. By pea protein type, formulations span isolates, concentrates, and hydrolyzed functional proteins. By distribution channel, the segment covers retail outlets, online and direct-to-consumer platforms, and foodservice establishments. By country, the segmentation is as India, China, USA, Germany, along with other countries.

Plant-based milk products are projected to dominate consumption in 2025, supported by widespread retail availability, consumer acceptance, and continuous product innovation. Other categories including yogurt alternatives, cheese alternatives, and frozen desserts are gaining momentum across diverse demographic segments.

Pea protein dairy alternatives globally utilize various protein processing levels, selected for functionality, cost efficiency, and nutritional density. Isolates remain the most widely adopted protein input due to their high protein content and versatility across product applications.

Pea protein dairy alternatives reach consumers through diverse sales channels, each serving distinct shopping behaviors and demographic preferences. Retail outlets maintain dominance while digital platforms and foodservice segments expand rapidly.

Pea protein is emerging as a leading base ingredient in dairy alternatives such as milk, yogurt, cheese, and creamers, fueled by the global surge in plant-based diets, lactose intolerance awareness, and vegan lifestyles. It offers high-quality amino acid profiles, allergen-free properties (soy- and dairy-free), and good digestibility, making it appealing for health-conscious and flexitarian consumers. Major food brands are investing in fortified pea protein beverages and yogurts to compete with soy, almond, and oat-based alternatives. The ingredient’s sustainability profile—low water use, nitrogen-fixing crop benefits, and minimal land footprint—positions pea protein as a climate-resilient solution in the future protein landscape. Regulatory support for clean-label and allergen-free claims further accelerates adoption.

Despite strong momentum, pea protein faces sensory and formulation hurdles. Its beany flavor and chalky texture can limit consumer acceptance in dairy alternative products compared to creamier oat or almond bases. Formulation with high pea protein content often requires masking agents, flavor enhancers, or blending with other proteins, increasing costs. Production and processing remain more expensive than some competing plant proteins, restricting price competitiveness in mass-market segments. Variability in functional properties across suppliers (solubility, emulsification) creates challenges for product developers. Scaling also depends on stable pea supply chains, which can be impacted by agricultural fluctuations and regional availability.

Key trends include the blending of pea protein with oat, rice, or fava proteins to achieve superior taste, texture, and nutritional balance in dairy alternatives. Precision fermentation and enzymatic processing are being used to reduce off-flavors, improve creaminess, and mimic dairy mouthfeel. Fortification with calcium, vitamins, and probiotics is aligning pea-based alternatives with traditional dairy’s nutritional value while supporting clean-label claims. AI-driven formulation tools are helping brands optimize flavor profiles, reduce sugar, and predict consumer acceptance. Sustainability-driven innovation is linking pea protein with regenerative agriculture and circular economy models, where crop by-products are valorized. These advancements position pea protein as a next-generation backbone of the dairy alternatives market.

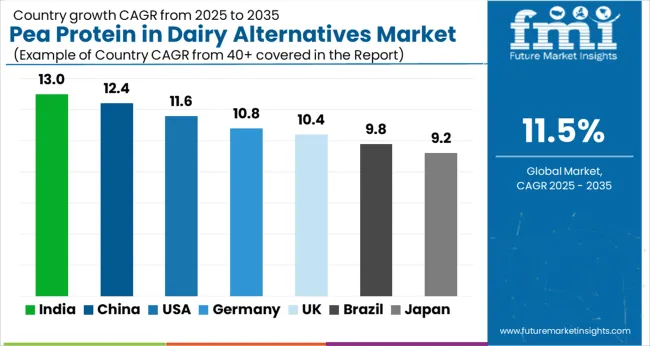

Rising health awareness and expanding middle-class populations in Asian economies give India and China measurable advantages, while mature Western economies grow steadily from established consumption bases. The table below shows the compound annual growth rate (CAGR) each of the seven major countries is expected to record between 2025 and 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 13.0% |

| China | 12.4% |

| USA | 11.6% |

| Germany | 10.8% |

| UK | 10.4% |

| Brazil | 9.8% |

| Japan | 9.2% |

Between 2025 and 2035, demand for pea protein in dairy alternatives is projected to expand across all major economies, but growth rates will vary significantly based on dietary transitions, regulatory environments, and infrastructure development. Among the seven countries analyzed, India and China are expected to register the fastest compound annual growth rates at 13.0% and 12.4% respectively, driven by substantial population bases and evolving consumption patterns.

India leads global growth projections with rising lactose intolerance awareness driving consumer shifts toward plant-based alternatives. The country's expanding urban population increasingly adopts Western dietary patterns while maintaining traditional preferences for dairy-like products. Domestic manufacturers are investing heavily in pea protein sourcing and processing capabilities to meet growing demand from both established and emerging beverage brands. Per capita consumption of pea protein dairy alternatives is projected to triple between 2025 and 2035, supported by improving distribution networks and declining product costs.

China follows closely with 12.4% projected growth, fueled by expanding middle-class demand for fortified dairy alternatives and health-focused consumption trends. The country's sophisticated manufacturing ecosystem supports rapid scaling of pea protein processing for both domestic consumption and export production. Urban consumers increasingly prioritize functional nutrition and ingredient transparency, driving adoption of clearly labeled pea protein products. E-commerce platforms facilitate widespread product availability across tier-one through tier-three cities, supporting consistent demand growth.

United States maintains strong growth momentum at 11.6% CAGR, driven by established consumer acceptance and continuous product innovation from leading brands. Pea protein adoption in alternative milk brands such as Ripple and Silk demonstrates mainstream retail success and consumer satisfaction with taste and nutritional profiles. The country's mature retail infrastructure supports extensive product placement and promotional activities that drive trial and repeat purchases. Foodservice adoption continues expanding through coffee chains and restaurant partnerships that incorporate pea protein alternatives into standard menu offerings.

Germany projects 10.8% growth supported by European Union sustainability policies and strong consumer preference for clean-label ingredients. The country's advanced food processing infrastructure enables sophisticated pea protein formulations that meet stringent quality and nutritional standards. Retail chains actively promote plant-based alternatives through dedicated shelf space and private label development that increases category visibility and accessibility. Consumer education campaigns highlight environmental benefits of pea protein production compared to traditional dairy farming methods.

United Kingdom anticipates 10.4% growth driven by supermarket private-label alternative dairy expansion and changing consumer preferences following dietary guideline updates. The country's concentrated retail landscape enables efficient product launches and promotional campaigns that reach broad consumer segments. Health-conscious demographics increasingly adopt flexitarian eating patterns that include regular consumption of plant-based dairy alternatives. Brexit-related supply chain adjustments encourage domestic sourcing and processing of pea protein ingredients.

Brazil expects 9.8% growth facilitated by dairy import substitution strategies and expanding health-focused consumer segments. The country's agricultural infrastructure supports domestic pea cultivation that reduces ingredient costs and supply chain dependencies. Urban populations increasingly adopt international dietary trends including plant-based alternatives while maintaining preferences for familiar flavors and textures. Local manufacturers develop region-specific formulations that cater to traditional taste preferences while delivering nutritional benefits associated with pea protein.

Japan projects 9.2% growth through functional dairy alternatives in convenience retail and continued innovation in specialized nutritional products. The country's aging population seeks easily digestible protein sources that support healthy aging and muscle maintenance. Convenience store distribution channels enable widespread access to single-serve pea protein dairy alternatives that appeal to busy urban lifestyles. Technology-forward food processing capabilities support development of novel textures and flavor profiles that satisfy demanding Japanese consumer preferences.

The competitive landscape features established food conglomerates alongside specialized plant-based companies and ingredient suppliers. Distribution reach and formulation expertise rather than brand recognition alone determine success factors, with leading suppliers achieving global retail placement and consistent product quality.

Ripple Foods maintains the largest single-brand presence with 12% share in 2025, focusing exclusively on pea protein-based plant milk products. The company's direct-to-consumer strategy and retail partnerships with major grocery chains establish strong consumer loyalty through consistent taste profiles and nutritional positioning. Ripple's manufacturing partnerships enable national distribution while maintaining quality control and sustainable sourcing practices.

Nestlé leverages its global infrastructure through Wunda and Sweet Earth brands, integrating pea protein into broader plant-based product portfolios. The company's research and development capabilities support continuous formulation improvements that address taste, texture, and nutritional optimization across diverse product categories. Distribution through existing retail relationships provides immediate access to international grocers and foodservice operators.

Danone utilizes Alpro and Silk brands to capture European and North American consumption through established dairy alternative product lines. The company's manufacturing scale enables cost-effective pea protein incorporation while maintaining premium positioning and organic certification where applicable. Strategic acquisitions and partnerships expand formulation capabilities and geographic reach across developed economies.

Oatly develops pea protein blend formulations in research and development initiatives that combine oat and pea proteins for enhanced nutritional profiles and texture characteristics. The company's innovation focus addresses specific consumer demands for multi-functional plant proteins that deliver complete amino acid profiles and improved sensory experiences.

Ingredient suppliers including Roquette Frères, Ingredion, ADM, and Cargill provide specialized pea protein processing and supply chain management that supports brand manufacturers across geographic regions. These companies invest in processing technology improvements and sustainable sourcing practices that reduce costs and environmental impact while ensuring consistent quality specifications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 billion |

| Dairy Alternative Product | Plant-based milk, yogurt alternatives, cheese alternatives, and ice cream & desserts |

| Pea Protein Type | Isolates, concentrates, and hydrolyzed/functional proteins |

| Distribution channel | Retail (supermarkets & hypermarkets), foodservice, and online/direct to consumer |

| Regions Covered | North America, Latin America, Europe, Asia-Pacific, Middle East & Africa |

| Countries Covered | India, China, Brazil, USA, Germany, UK, Japan and 40+ Countries |

| Key Companies Profiled | Ripple Foods, Nestlé (Wunda, Sweet Earth); Danone (Alpro, Silk); Oatly (pea-protein blends in R&D); Roquette Frères; Ingredion; ADM; Cargill; Beyond Better Foods; SunOpta. |

| Additional Attributes | Dollar sales by CAGR (2025-2035), Share by segment, Country growth rates, Usage patterns by dairy alternative product, distribution channel, and pea protein type, Competitive landscape, Regulatory environment |

The global demand for pea protein in dairy alternatives is estimated to be valued at USD 1.3 billion in 2025.

The market size for the demand for pea protein in dairy alternatives is projected to reach USD 3.9 billion by 2035.

The demand for pea protein in dairy alternatives is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in demand for pea protein in dairy alternatives are plant-based milk, yogurt alternatives, cheese alternatives and ice cream & desserts.

In terms of pea protein type, isolates segment to command 54.0% share in the demand for pea protein in dairy alternatives in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA