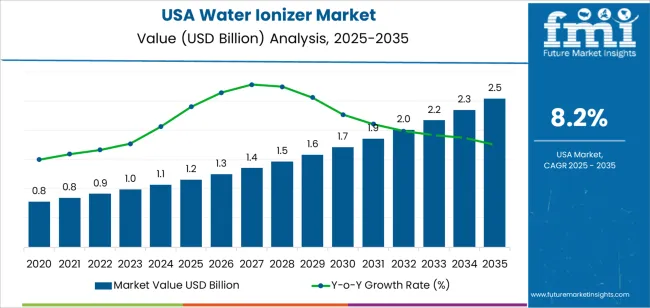

The absolute dollar opportunity for water ionizers in the USA between 2025 and 2035 is projected to be USD 1.3 billion. Starting from USD 1.2 billion in 2025, the demand will grow to USD 2.5 billion by 2035. This increase reflects the rising consumer shift toward health-conscious products and home water filtration systems. The industry opportunity is expected to expand significantly, particularly in the latter part of the forecast period.

Between 2025 and 2030, the industry will grow at a steady pace, adding USD 0.5 billion to the overall demand. The demand during this period will be driven by consumers' increasing interest in water ionization as part of a broader health and wellness lifestyle. This phase will also see more people adopting water ionizers as part of their daily routine, given their potential health benefits.

From 2030 to 2035, the growth will accelerate, with an addition of USD 0.8 billion to the demand, as technological improvements, rising awareness, and a more mature industry lead to increased adoption. During this period, water ionizers will become more common in households, driven by both a heightened focus on individual health and environmental concerns around traditional water consumption methods. The absolute dollar opportunity over these five years will be significant, marking a transition to widespread adoption of these systems in homes across the USA.

Between 2025 and 2030, the demand for water ionizers is expected to increase from USD 1.2 billion to approximately USD 1.7 billion, adding USD 0.5 billion. This phase will experience steady growth, driven by a combination of factors such as increasing health-consciousness, growing interest in home-based water filtration systems, and the expanding availability of water ionizers in the retail and online marketplaces. As more consumers seek cleaner, healthier drinking water, demand will rise, particularly among those looking for alternatives to traditional bottled water and other filtration systems.

From 2030 to 2035, the demand for water ionizers is expected to surge, growing from USD 1.7 billion to USD 2.5 billion, adding USD 0.8 billion. This acceleration will be driven by continued advancements in water ionization technology, as well as growing regulatory support for sustainable products. As consumers become more aware of the potential health benefits of alkaline water, the demand for high-quality water ionizers will increase. Technological advancements, such as smarter systems that offer enhanced filtration and more convenient features, will also contribute to market growth.

| Metric | Value |

|---|---|

| Demand for Water Ionizer in USA Value (2025) | USD 1.2 billion |

| Demand for Water Ionizer in USA Forecast Value (2035) | USD 2.5 billion |

| Demand for Water Ionizer in USA Forecast CAGR (2025-2035) | 8.20% |

The demand for water ionizers in the USA is rising as consumers increasingly focus on health, wellness, and water quality. These systems, which often produce alkaline or ionized water, appeal to individuals looking for improved hydration, antioxidant effects, and alternatives to bottled water. As households become more conscious of water purity and wellness trends gain strength, water ionizers are becoming more common in home environments.

Another key driver is the expansion of commercial applications such as fitness centres, wellness spas, and premium office spaces, which are integrating water ionizers to cater to health‑oriented clients. These spaces value the perceived benefits of ionized water and view these systems as lifestyle or value‑added features, which helps boost overall device demand.

Technological innovation is also contributing significantly. Modern water ionizers now include multi‑stage filtration, smart connectivity, portable designs, and enhanced monitoring of water quality. As prices fall and features improve, the barrier to adoption is lowering. Combined with eco‑friendly motives such as reducing plastic bottle usage and increasing consumer interest in advanced home appliances, demand for water ionizers in the USA is expected to grow steadily through 2035.

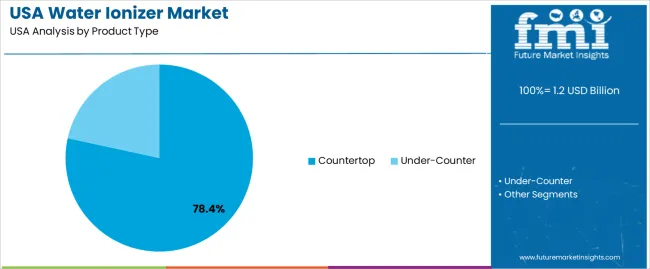

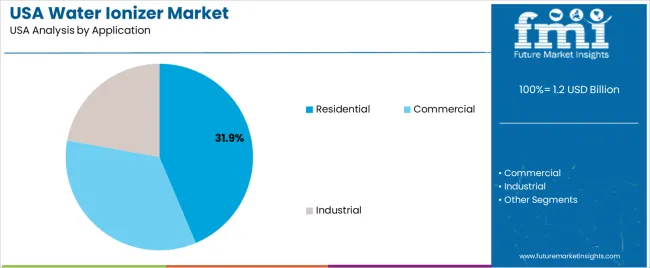

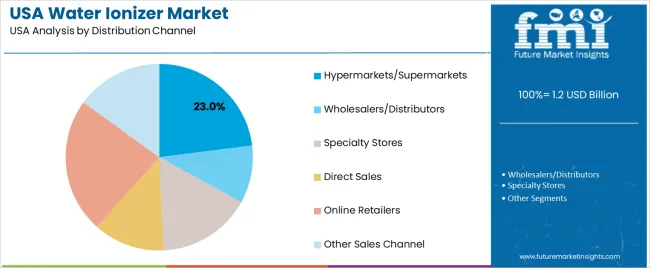

Demand is segmented by product type, application, and distribution channel. By product type, demand is divided into countertop and under-counter water ionizers, with countertop holding the largest share. In terms of application, the industry is categorized into residential, commercial, and industrial, with residential accounting for the largest share. The industry is also segmented by distribution channel, including online retailers, wholesalers/distributors, specialty stores, direct sales, hypermarkets/supermarkets, and other sales channels, with online retailers leading the demand. Regionally, demand is divided into West, South, Northeast, and Midwest.

Countertop water ionizers account for 78% of the demand for water ionizers in the USA. These units are preferred for their convenience, ease of installation, and ability to be used immediately without requiring significant modifications to the plumbing system. Countertop ionizers are typically more affordable and accessible to consumers, making them the go-to choice for residential use.

The demand for countertop water ionizers is driven by the increasing consumer awareness of the benefits of alkaline water, such as improved hydration and potential health benefits. The ease of installation and portability also contribute to their popularity, particularly in households where consumers want to have access to high-quality drinking water without extensive setup. As the trend for healthier lifestyles and home wellness solutions grows, countertop water ionizers will continue to lead the industry in the USA, offering an attractive solution for residential consumers.

Residential applications account for 31.9% of the demand for water ionizers in the USA. The residential industry is the largest consumer of water ionizers, driven by growing interest in improving water quality for drinking and cooking. Consumers are increasingly opting for water ionizers to provide clean, alkaline water, which is believed to offer various health benefits, such as better hydration, detoxification, and antioxidant properties.

The demand for water ionizers in residential settings is also fueled by the rising awareness of the potential risks of tap water contamination and the desire for more control over the water quality in the home. As more consumers prioritize wellness and health-conscious living, residential water ionizers have become a popular addition to homes, contributing to their growth in the industry. With the continued focus on health and sustainability, the residential sector is expected to maintain its strong demand for water ionizers.

Online retailers account for 23.4% of the demand for water ionizers in the USA. The rise of e-commerce and online shopping has significantly contributed to the demand for water ionizers, as consumers find it more convenient to research, compare, and purchase these devices online. Online platforms offer a wide variety of water ionizers, often with customer reviews and detailed product information, making it easier for buyers to make informed purchasing decisions.

The convenience of home delivery, the ability to find competitive pricing, and the availability of a broad selection of brands and models drive the demand for water ionizers through online retailers. As consumers increasingly prefer shopping online for health and wellness products, the role of online retailers in distributing water ionizers will continue to grow, reinforcing their dominance in the industry.

Demand in the USA is increasing as consumers show growing interest in health, wellness and hydration quality. These systems position themselves as offering alkaline or ionized water that may aid digestion, improve hydration and encourage healthier lifestyles. Key drivers include rising health‑awareness (including interest in alkaline or “antioxidant‑rich” water), greater spending on home wellness appliances, and growth in e‑commerce which makes these devices more accessible. Restraints include the higher upfront cost of ionizer systems compared to simple filters, mixed scientific consensus about health claims of ionized water, and competition from bottled alkaline water or standard filtration systems that may satisfy much of the consumer need without the premium ionizer cost.

In the USA, the demand for water ionizers is growing as more consumers are prioritizing health and wellness, particularly when it comes to water quality. As people seek more advanced water filtration solutions beyond traditional filters, ionizer systems offering features like adjustable pH, antioxidant/ORP claims, and multi-stage filtration are increasingly popular. These devices cater to consumers who want additional health benefits from their water, such as improved hydration or detoxification. In addition, commercial spaces like gyms, spas, and wellness centers are incorporating water ionizers to provide "premium hydration" experiences for their clients. The growing emphasis on wellness, coupled with increased consumer access to information through digital marketing, influencers, and e-commerce platforms, makes it easier for consumers to learn about and purchase ionizers.

Technological innovations are significantly driving the growth of water ionizers in the USA by enhancing both the functionality and consumer appeal of these systems. Advances in electrode materials, such as platinum-coated titanium plates, have made ionizers more efficient and durable. The inclusion of smart diagnostic features, such as real-time monitoring of filter health and Total Dissolved Solids (TDS) sensors, adds value by allowing users to track the system's performance and ensure optimal water quality. The development of more compact countertop and under-counter designs has made these systems more practical for modern kitchens where space is limited. The integration of connectivity features such as apps that provide alerts and remote control functions has made water ionizers more user-friendly and convenient. These technological upgrades reduce maintenance complexity and justify the premium pricing of these systems.

One of the key barriers is cost: high-end ionizer systems, often priced significantly higher than traditional water filters, are considered a premium product and may be seen as non-essential by many consumers. Another challenge is consumer skepticism. Although ionizers often make claims about health benefits, such as providing antioxidant-rich water, scientific consensus on the actual health effects is still evolving, making some consumers hesitant to invest in these systems. Many households already have standard water filtration systems that meet their needs, making the incremental benefit of an ionizer less compelling for those who are satisfied with basic water purification. Another limitation is the complexity of installation, training, and maintenance. Some consumers are deterred by the need for professional installation or by the perceived hassle of regular maintenance, especially if the system is not seen as essential.

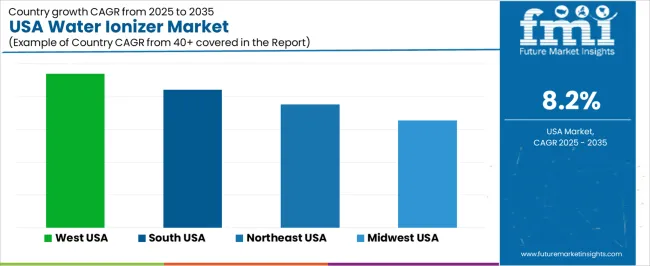

| Region | CAGR (%) |

|---|---|

| West | 9.4% |

| South | 8.4% |

| Northeast | 7.5% |

| Midwest | 6.5% |

The demand for water ionizers in the USA is growing across all regions, with the West leading at a 9.4% CAGR. This growth is driven by increasing consumer interest in health and wellness, including the adoption of alkaline water for its purported health benefits. The South follows with an 8.4% CAGR, supported by the rising popularity of water ionizers in households and wellness-focused communities. The Northeast shows a 7.5% CAGR, driven by urban demand for home filtration and wellness products. The Midwest experiences moderate growth at 6.5%, with demand increasing as awareness of health-focused water systems grows.

The West is experiencing the highest demand for water ionizers in the USA, with a 9.4% CAGR. This can be attributed to the region's strong health-conscious culture and the increasing focus on wellness and natural living. Cities like Los Angeles and San Francisco are hubs for the wellness industry, where consumers are increasingly seeking products like water ionizers for their purported health benefits, such as detoxification, enhanced hydration, and better overall wellness.

The West’s progressive attitudes toward environmental sustainability plays a role, as consumers opt for eco-friendly, energy-efficient home appliances like water ionizers. The region's higher disposable income and emphasis on healthy lifestyles further contribute to the growing adoption of these products. As awareness of the health benefits of alkaline water continues to spread, the West is likely to remain a leader in water ionizer demand.

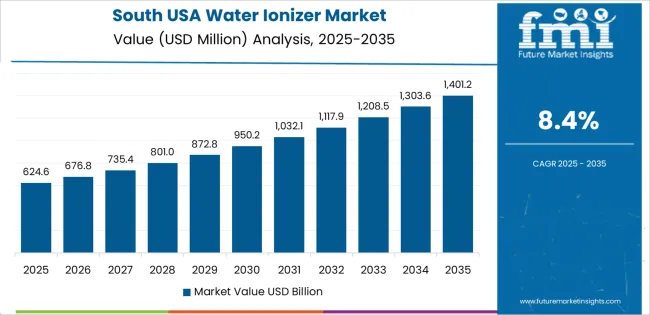

The South is seeing strong demand growth for water ionizers, with an 8.4% CAGR. This growth is influenced by the increasing number of health-conscious consumers in the region who are adopting wellness trends, including the use of alkaline water for its potential health benefits. States like Texas, Florida, and Georgia are experiencing rising interest in water purification systems, particularly in households that prioritize clean, healthy drinking water.

As consumers in the South become more aware of the benefits of water ionizers, including their ability to enhance hydration and provide a better taste, demand for these systems is expected to continue to rise. The growing interest in alternative health solutions, including home water filtration systems, is driving the popularity of water ionizers. The increasing focus on clean and sustainable living is supporting the trend toward eco-friendlier, efficient home appliances in the South.

The Northeast is experiencing steady demand for water ionizers, with a 7.5% CAGR. The region’s growing interest in health and wellness, especially in urban centers like New York City and Boston, is fueling this demand. As consumers in the Northeast become more focused on fitness, nutrition, and overall well-being, the appeal of water ionizers, which promise enhanced hydration and detoxification, is increasing.

The Northeast’s dense, health-conscious population, along with higher disposable incomes, allows for the adoption of premium home appliances like water ionizers. As awareness of the potential benefits of alkaline water spreads, the demand for water ionizers is expected to grow steadily. The region’s emphasis on sustainability and clean living, combined with the increasing availability of water ionizer models, supports the ongoing growth of this industry.

The Midwest is seeing moderate growth in demand for water ionizers, with a 6.5% CAGR. While the growth rate is slower compared to other regions, the Midwest’s growing focus on health and wellness, particularly in states like Illinois and Michigan, is contributing to the rising popularity of water ionizers. As consumers become more aware of the potential health benefits of alkaline water, such as improving hydration and supporting detoxification, demand is steadily increasing.

The region's strong agricultural background and focus on food and health also play a role in the growing adoption of water ionizers. As more households in the Midwest prioritize clean, healthy drinking water, the demand for home water filtration and ionization systems will likely continue to rise. With increasing access to education about the benefits of water ionizers and rising awareness of alternative health solutions, the demand for these products in the Midwest is expected to grow at a steady pace.

The demand for water ionizers in the United States is growing at a noteworthy clip, driven by expanding health‑and‑wellness trends, a rising focus on home water filtration, and increased interest in alkaline drinking water. With consumers becoming more conscious of water quality and seeking devices that provide pH‑adjusted or mineral‑enhanced water, water ionizers have increasingly found a place in both residential and commercial settings. This shift is supported by the broader move toward smart‑home appliances, direct‑to‑consumer distribution, and wellness‑focused product positioning.

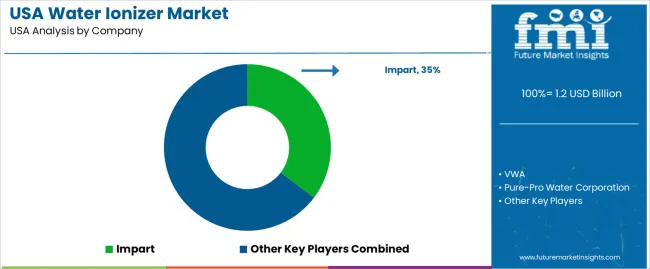

In the USA demand landscape, Kangen Water Ionizer targets a strong ~25-35% share, reflecting its leadership position among ionizer brands serving the American consumer. Other notable competitors in the space include VWA, Pure‑Pro Water Corporation, Ayana Water, and Emco Tech Co. Ltd., each focused on alkaline or ionization‑based water treatment solutions. These firms support growth by offering high‑end countertop or under‑counter units, emphasizing features like smart connectivity, mineralization enhancements, and wellness applications.

Key drivers of USA demand include growing consumer interest in alkaline and ionized water, a rise in health‑aware home‑appliance purchases, and the integration of smart‑home features that facilitate monitoring and control of water‑quality parameters. At the same time, challenges such as higher purchase cost relative to traditional water filters, questions around clinical efficacy of ionization claims, and the need for consumer education may moderate adoption. The USA demand outlook for water ionizers remains positive, especially as wellness‑ and home‑health trends continue to strengthen.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Product Type | Countertop, Under-Counter |

| Application | Residential, Commercial, Industrial |

| Sales Channel | Hypermarkets/Supermarkets, Wholesalers/Distributors, Specialty Stores, Direct Sales, Online Retailers, Other Sales Channels |

| Key Players Profiled | Impart, VWA, Pure-Pro Water Corporation, Ayana Water, Emco Tech Co. Ltd., Enagic |

| Regions Covered | West, South, Northeast, Midwest |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and regional trends focusing on residential and commercial sectors |

The global demand for water ionizer in USA is estimated to be valued at USD 1.2 billion in 2025.

The market size for the demand for water ionizer in USA is projected to reach USD 2.5 billion by 2035.

The demand for water ionizer in USA is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in demand for water ionizer in USA are countertop and under-counter.

In terms of application, residential segment to command 31.9% share in the demand for water ionizer in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Ionizer Market Analysis & Forecast 2025 to 2035

USA Sea Water Pumps Market Trends – Growth, Demand & Forecast 2025-2035

Reusable Water Bottle Market Forecast and Outlook 2025 to 2035

Demand for Water Ionizer in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Water Treatment System in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Electrolyzed Water Generator in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Solar Water Heaters in USA Size and Share Forecast Outlook 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA