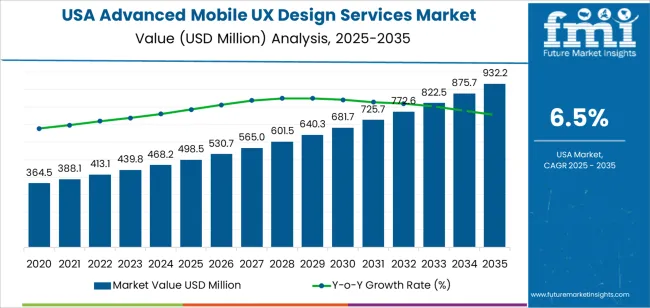

The demand for advanced mobile UX design services in USA is valued at USD 498.5 million in 2025 and is projected to reach USD 932.2 million by 2035, reflecting a compound annual growth rate of 6.5%. Growth is influenced by rising expectations for intuitive, high-performance mobile interfaces across consumer apps, enterprise tools and digital service platforms. As businesses expand mobile offerings, the need for structured user research, interaction modeling and responsive interface development increases.

Mobile ecosystems continue to diversify with features such as gesture controls, personalized navigation flows and adaptive screen layouts, prompting stronger reliance on specialized UX teams. Broader digital transformation initiatives across finance, healthcare, retail and media also reinforce sustained demand for refined mobile user experiences during the forecast period.

The growth pattern shows a smooth upward trajectory, beginning at USD 364.5 million in earlier years and rising to USD 498.5 million in 2025 before advancing to USD 932.2 million by 2035. Annual increases follow consistent spacing, moving from USD 530.7 million in 2026 to USD 565.0 million in 2027, with similar increments continuing through the timeline. This curve reflects steady adoption driven by continuous app development cycles, frequent interface updates and increased focus on mobile-centric customer engagement.

As organizations refine digital strategies, demand for UX design services strengthens across both established and emerging sectors. The predictable rise in yearly values highlights a maturing yet expanding services landscape supported by ongoing improvements in design workflows, prototyping tools and user testing practices across USA.

Demand in USA for advanced mobile UX design services is expected to rise from USD 498.5 million in 2025 to USD 932.2 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 6.5%. Starting from USD 364.5 million in 2020, demand climbs steadily to USD 468.2 million in 2024 and USD 498.5 million in 2025. Between 2025 and 2030 the value is projected to grow to around USD 640.3 million, and by 2035 it is anticipated to reach USD 932.2 million. This growth is driven by increasing enterprise investment in mobile first strategies, rising user expectations for seamless and immersive mobile experiences, and the incorporation of advanced technologies such as AI, AR, and voice into mobile applications.

Over the forecast period the uplift of USD 433.7 million (from USD 498.5 million to USD 932.2 million) underscores both volume expansion in design service engagements and rising average value per engagement. In the early phase, growth is largely volume led as more companies commission UX design work across mobile platforms. In the later years, value growth becomes more significant as design services evolve into higher complexity projects, including advanced research driven UX, custom interaction design, and integration with emerging technologies. As organizations shift from basic mobile app design to fully personalised, connected mobile experiences, the service spend per user escalates, supporting the upward trend toward USD 932.2 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 498.5 million |

| Forecast Value (2035) | USD 932.2 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The demand for advanced mobile UX design services in USA is shaped by the expanding use of mobile applications across industries such as e-commerce, healthcare, finance and entertainment. As companies rely more on mobile channels to engage customers, they are seeking design services that deliver intuitive, efficient and enjoyable mobile experiences. User expectations around speed, ease-of-use and personalization are rising, which motivates businesses to invest in UX services tailored for mobile platforms. Firms are also leveraging data-driven insights and mobile-specific behaviour to optimise interfaces, streamline workflows and reduce drop-off rates. Space constraints, device variety and mobile-first consumer habits further emphasise the relevance of mobile-centric design.

In parallel, structural trends within organisations support growth in UX services. As digital transformation programmes mature, enterprises are replacing legacy mobile apps or upgrading them with renewed focus on user experience and cross-platform design. The proliferation of mobile devices and OS versions compels teams to partner with specialist UX designers who understand mobile constraints and human-device interaction. While smaller organisations sometimes face budget or skill-set limitations, the overall momentum in mobile adoption and consumer sophistication means demand for advanced mobile UX design services in USA is expected to continue growing.

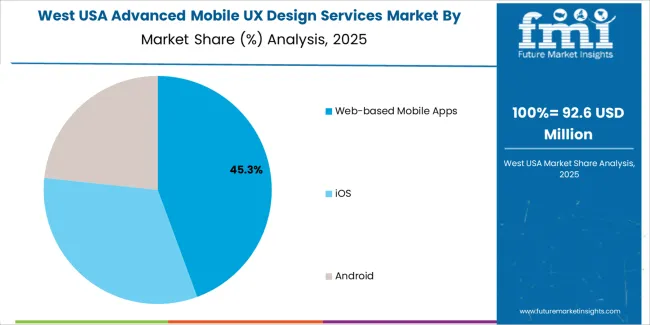

The demand for advanced mobile UX design services in USA is shaped by the platforms businesses target and the service types they require to support product development. Platforms include web-based mobile apps, iOS and Android, each presenting different design standards, device behaviors and user expectations. Service types such as user research and testing, UI/UX design consulting, wireframing and prototyping, interactive design and visual design and branding guide how teams refine usability and overall product direction. As companies emphasize consistent digital experiences, the combination of platform selection and specialized service needs influences how organizations plan and execute mobile UX projects across the country.

Web-based mobile apps account for 43% of total demand for advanced mobile UX design services in USA. Their leading share reflects interest in platform-agnostic solutions that function smoothly across devices without requiring separate development cycles. Many businesses choose web-based mobile apps to streamline updates and reach wider audiences through browsers. UX teams focus on navigation clarity, responsive layouts and smooth transitions that maintain consistency despite varied screen sizes. This flexibility appeals to companies seeking efficient deployment while minimizing maintenance costs, supporting ongoing reliance on web-based designs for both consumer and enterprise applications.

Demand for web-based mobile apps also grows as organizations integrate cloud services and browser-based workflows more deeply into daily operations. Businesses value the ability to present unified experiences without mandatory downloads, helping users access services quickly on personal or shared devices. UX design for web-based apps emphasizes accessible controls, reduced loading delays and familiar visual structures that encourage repeat use. These advantages support adoption across sectors such as finance, education and retail. As browser performance continues improving, web-based mobile apps maintain a strong role within advanced UX design priorities in the USA.

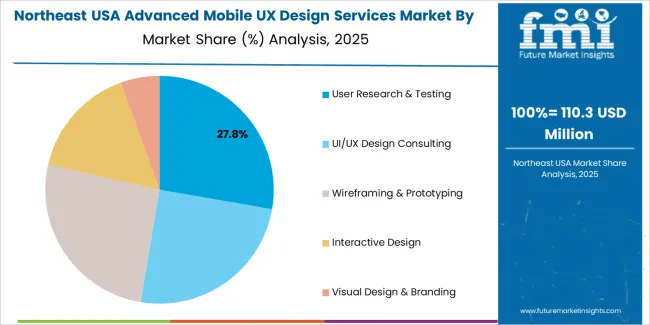

User research and testing account for 27.5% of total demand for mobile UX service types in USA. Their leading position reflects the need to validate assumptions and understand user behavior before finalizing design decisions. Teams rely on structured interviews, usability sessions and task analyses to refine app flows and reduce friction. This early-stage insight helps companies avoid design errors that may otherwise affect engagement or retention. User research and testing guide improvements in clarity, responsiveness and accessibility, forming a foundation for iterative UX development across diverse mobile platforms.

Demand for research and testing grows as organizations adopt data-driven design practices to support long-term product performance. Businesses invest in structured evaluation cycles to ensure mobile interfaces match user expectations across different environments and devices. These activities guide updates, feature placement and interaction patterns that influence satisfaction. Testing also supports inclusive design by identifying barriers that affect different user groups. As companies emphasize evidence-based design over assumption-driven development, user research and testing remain central to advanced UX design service offerings throughout the USA.

Demand for advanced mobile UX design services in the USA is rising as businesses prioritise mobile-first strategies and aim to deliver user-centric applications across sectors such as e-commerce, healthcare, fintech, and entertainment. Growth is supported by higher expectations for seamless interactions, rapid digital transformation, and the integration of technologies such as AI, AR, and analytics in mobile experiences. At the same time, barriers include the high cost of specialised design services, integration challenges with legacy systems, and a shortage of skilled UX professionals. These dynamics shape how fast and how widely advanced mobile UX services are adopted in the USA.

American consumers expect intuitive, responsive, and engaging mobile apps as their first point of interaction with brands and services. The proliferation of smartphones, tablets, and 5G networks enables richer mobile experiences, which in turn compels organisations to invest in advanced UX design to improve user retention, satisfaction and conversion. Businesses responding to these expectations invest in user research, prototyping, testing, and iteration cycles tailored to mobile ecosystems. As mobile usage continues to dominate daily digital interaction, the demand for high-quality mobile UX design services in the USA remains strong.

Opportunities are especially strong with cross-platform mobile apps, progressive web apps (PWAs), and mobile applications in business-to-business (B2B) and enterprise settings where usability and productivity rely heavily on interface design. Further growth is found in sectors such as telehealth, mobile banking, subscription media and on-demand services where mobile UX is a competitive differentiator. Service firms that offer full lifecycle UX design user research, interaction design, usability testing, and analytics are well positioned to capture demand from US businesses upgrading their mobile presence.

Despite strong demand, some challenges slow broader adoption of advanced mobile UX design services in the USA. Cost remains a key barrier since custom UX design consulting, research and testing services often require significant investment and are more accessible to larger enterprises. Integration with legacy application architecture or cross-device compatibility adds complexity and cost. Furthermore, measuring return on investment (ROI) of UX design remains difficult for many organisations, which may delay or constrain spend. These factors moderate how quickly mobile UX services move from specialised to mainstream use in the USA.

| Region | CAGR (%) |

|---|---|

| West | 7.4% |

| South | 6.7% |

| Northeast | 5.9% |

| Midwest | 5.2% |

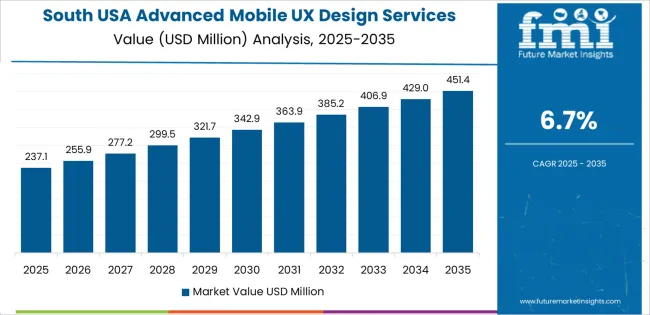

Demand for advanced mobile UX design services in the USA is increasing across regions, with the West leading at 7.4%. Growth in this region reflects strong activity among technology firms and steady investment in improving mobile interfaces for consumer and enterprise applications. The South follows at 6.7%, supported by expanding digital service providers and rising adoption of mobile-first platforms among mid-sized companies. The Northeast records 5.9%, shaped by financial, healthcare, and education organizations that regularly update mobile user experiences. The Midwest grows at 5.2%, where regional businesses focus on improving app usability to support customer engagement. These trends show broad adoption of mobile UX design as companies refine digital interaction across services.

West USA is projected to grow at a CAGR of 7.4% through 2035 in demand for advanced mobile UX design services. California and neighboring states are adopting sophisticated user interface solutions for mobile applications across technology, finance, and e-commerce sectors. Rising focus on enhancing user experience, customer engagement, and digital interaction drives adoption. Service providers offer responsive, intuitive, and accessible mobile UX designs tailored to consumer behavior. The presence of tech hubs, high smartphone penetration, and innovation-focused enterprises supports steady growth in mobile UX design services across West USA.

South USA is projected to grow at a CAGR of 6.7% through 2035 in demand for advanced mobile UX design services. Urban centers including Houston, Miami, and Atlanta increasingly integrate intuitive and user-friendly interfaces for mobile applications in banking, healthcare, and retail sectors. Rising consumer expectations for seamless mobile experiences accelerate adoption. Providers are delivering customized, responsive, and visually appealing UX solutions. Enterprise digital strategies focus on improving retention, engagement, and conversion through optimized mobile design. The combination of growing smartphone usage, digital transformation initiatives, and technology adoption supports steady growth in mobile UX service demand across South USA.

Northeast USA is projected to grow at a CAGR of 5.9% through 2035 in demand for advanced mobile UX design services. Cities such as New York, Boston, and Philadelphia are adopting responsive, user-focused interfaces for mobile applications across finance, technology, and professional services. Rising demand for customer engagement, improved digital interactions, and seamless mobile navigation drives adoption. Service providers are developing visually appealing, accessible, and functional designs. Urban enterprises leverage mobile UX design to improve retention and brand experience. High population density, digital transformation efforts, and technology-focused businesses ensure steady growth in mobile UX design services across Northeast USA.

Midwest USA is projected to grow at a CAGR of 5.2% through 2035 in demand for advanced mobile UX design services. Urban and suburban centers, including Chicago, Detroit, and Minneapolis, are increasingly integrating user-focused interfaces for mobile applications in finance, technology, and healthcare sectors. Rising consumer expectations for efficient navigation, engagement, and intuitive interaction accelerate adoption. Providers offer customized, responsive, and visually optimized UX solutions. Growing smartphone penetration, enterprise digital initiatives, and technology adoption support steady demand. The combination of industry requirements and regional urbanization ensures continued growth in advanced mobile UX design service adoption across Midwest USA.

The demand for advanced mobile UX design services in the USA is driven by increasing pressure on businesses to deliver seamless, intuitive experiences on mobile applications. Organisations across e-commerce, fintech, healthcare and entertainment are investing in user research, accessibility, personalised interfaces and AI-driven design to retain users and reduce churn. The proliferation of mobile-first strategies and the shift toward voice, AR and immersive interfaces heighten the need for specialist UX services. High smartphone penetration, advanced digital infrastructure and strong competitive pressures in the USA market make mobile UX a key differentiator. Consequently, demand for consulting, prototyping, testing and visual design services is growing steadily in this region.

Key companies shaping the advanced mobile UX design services landscape in the USA include IDEO, Mindtree IT Solutions, DXC Technology, Infoneotech, Techahead and Zensar Technologies. These firms provide expertise in mobile UI/UX consulting, interactive design, user testing and cross-platform workflows. They work with enterprise clients to integrate design systems, manage user-centric workflows and deploy mobile solutions that align with business goals and technical constraints. Their regional presence, design capabilities and service portfolios position them to influence how mobile UX services evolve and are delivered within the USA digital-transformation ecosystem.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Platform | Web-based Mobile Apps, iOS, Android |

| Service Type | User Research & Testing, UI/UX Design Consulting, Wireframing & Prototyping, Interactive Design, Visual Design & Branding |

| Application | E-Commerce, Healthcare, Banking & Finance, Social Media, Entertainment & Media, Travel & Hospitality |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | IDEO, Mindtree IT Solutions, DXC Technology, Infoneotech, Techahead, Zensar Technologies |

| Additional Attributes | Dollar by sales by platform, service type, application, and region; regional CAGR and adoption trends; cross-platform design integration; user-centered and data-driven design methodologies; mobile-first strategies; advanced technology adoption (AI, AR, voice, gesture); service complexity tiers and pricing; iterative design cycles; usability testing and prototyping frequency; enterprise adoption by sector; digital transformation alignment; scalability of UX solutions; design efficiency and user engagement improvements; ROI tracking for UX interventions; integration with app development pipelines. |

The global demand for advanced mobile UX design services in USA is estimated to be valued at USD 498.5 million in 2025.

The market size for the demand for advanced mobile UX design services in USA is projected to reach USD 932.2 million by 2035.

The demand for advanced mobile UX design services in USA is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in demand for advanced mobile UX design services in USA are web-based mobile apps, ios and android.

In terms of service type, user research & testing segment to command 27.5% share in the demand for advanced mobile UX design services in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Mobile UX Design Services Market Outlook 2025 to 2035

Demand for Advanced Mobile UX Design Services in Japan Size and Share Forecast Outlook 2025 to 2035

USA Mobile Phone Accessories Market Report – Growth, Innovations & Industry Trends 2025-2035

Evaluating USA Luxury Fine Jewelry Market Share & Provider Insights

Mobile Food Services Market Analysis - Growth & Forecast 2025 to 2035

USA Home Care Services Market Trends – Growth, Demand & Analysis 2025-2035

Mobile Grooming Services Market Size and Share Forecast Outlook 2025 to 2035

USA Food Testing Services Market Outlook – Share, Growth & Forecast 2025–2035

USA Travel Agency Services Market Analysis – Size, Share & Forecast 2025-2035

USA Managed Workplace Services Market Insights – Trends, Demand & Growth 2025-2035

USA Wireless Telecommunication Services Market Growth – Trends, Demand & Forecast 2025-2035

Evaluating Market Share in Restaurants & Mobile Food Services

Restaurants & Mobile Food Services Market Trends – Forecast 2025 to 2035

Demand for Audio Conferencing Services in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Advanced Driver Assistance System (ADAS) Testing Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Advanced Process Control Market Size and Share Forecast Outlook 2025 to 2035

Designer Sneaker Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA