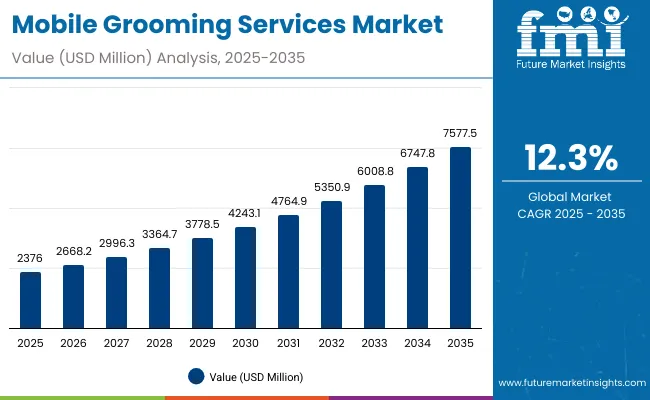

The Mobile Grooming Services Market is expected to record a valuation of USD 2,376.0 Million in 2025 and USD 7,577.5 Million in 2035, with an increase of USD 5,201.5 Million, which equals a growth of 219% over the decade. The overall expansion represents a CAGR of 12.3% and a 3.2X increase in market size.

Mobile Grooming Services Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Market Value in 2025E | USD 2,376.0 Million |

| Forecast Market Value in 2035F | USD 7,577.5 Million |

| Forecast CAGR (2025 to 2035) | 12.3% |

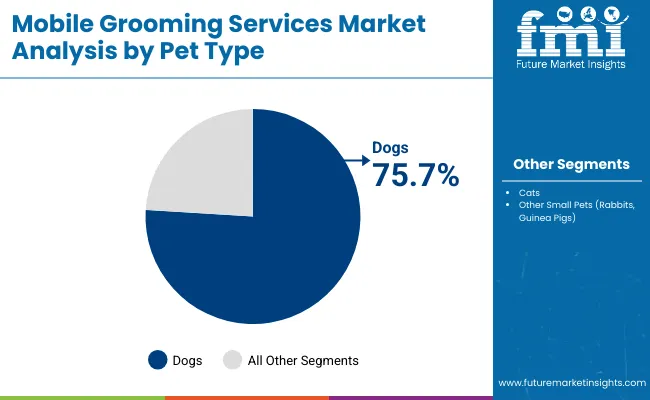

During the first five-year period from 2025 to 2030, the market increases from USD 2,376.0 Million to USD 4,243.1 Million, adding USD 1,867.1 Million, which accounts for 36% of the total decade growth. This phase records steady adoption across urban households, driven by rising pet humanization, demand for convenience, and increased spend on premium grooming services. Dogs dominate this period with a 75.7% share, supported by strong demand for full groom/haircut and add-on services such as nail, ear, and dental care.

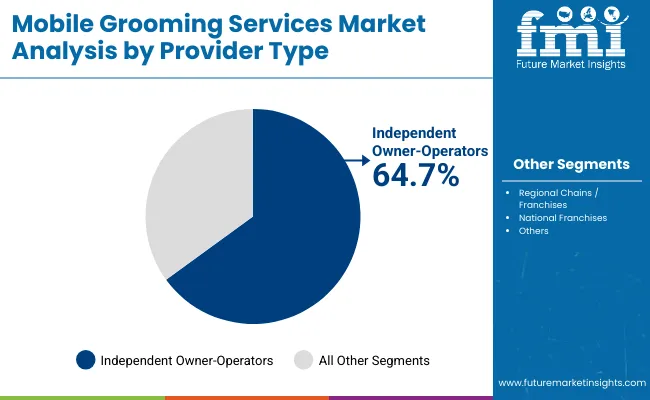

The second half from 2030 to 2035 contributes USD 3,334.4 Million, equal to 64% of total growth, as the market jumps from USD 4,243.1 Million to USD 7,577.5 Million. This acceleration is powered by the expansion of regional and national franchises, digital booking platforms, and growing penetration in emerging economies such as China and India. Service diversification, including medicated and flea-tick care, enhances revenue streams, while independent operators retain 64.7% share in 2025, highlighting the importance of localized and personalized grooming services.

From 2020 to 2024, the Mobile Grooming Services Market experienced strong momentum, fueled by rising urbanization, pet humanization, and convenience-driven services. During this period, independent owner-operators dominated, capturing nearly 65% of market revenue, while regional and national franchises expanded gradually. Competitive differentiation was driven by service quality, customer convenience, and pricing flexibility, with add-on services such as nail, ear, and dental care gaining popularity.

Demand for mobile grooming services will expand to USD 2,376.0 Million in 2025, and the revenue mix will increasingly shift towards digital booking channels and premium service packages. Traditional van-based service leaders face rising competition from tech-enabled players leveraging apps, subscription-based grooming packages, and digital customer engagement platforms. Leading providers are pivoting to hybrid modelscombining in-home services with mobile spa vansto enhance reach and customer stickiness. The competitive advantage is moving away from price and accessibility alone to brand trust, personalized services, and digital convenience.

The Mobile Grooming Services Market is expanding as pet ownership increasingly mirrors human lifestyle choices. Owners now treat pets as family members, driving demand for premium services such as medicated baths, flea-tick treatments, and customized grooming packages. Growing awareness of hygiene and preventive care further boosts uptake. With dogs accounting for over 75% of service demand in 2025, households are spending more on routine grooming and add-ons, accelerating market penetration in urban centers and suburban communities.

Growth is also propelled by the convenience-driven shift in consumer behavior. Mobile grooming eliminates the stress of transporting pets to salons, offering door-to-door services through van-based spas and in-home grooming. The rise of digital booking channels apps, websites, and subscription packages is streamlining access and repeat purchases. Independent operators, who command nearly two-thirds of the market, are leveraging technology for scheduling, payments, and personalized reminders. This integration of mobility and digital engagement is reshaping competitive dynamics and fueling sustained growth globally.

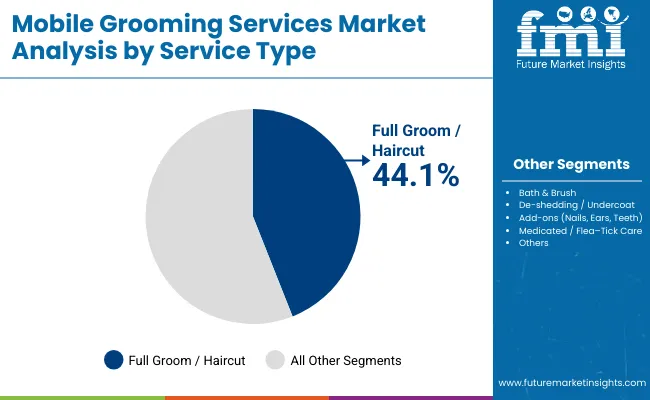

The Mobile Grooming Services Market is segmented by pet type, service type, service mode, provider type, booking channel, and region. By pet type, the market covers dogs, cats, and other small pets such as rabbits and guinea pigs. Service type spans full groom/haircut, bath & brush, de-shedding/undercoat, add-ons including nails, ears, and teeth, and specialized services like medicated or flea-tick care. Service modes include van-based mobile spas and in-home grooming. Provider categories are divided into independent owner-operators, regional chains/franchises, and national franchises. Booking channels consist of phone, websites, and apps, with digital platforms gaining rapid traction. Regionally, the market scope covers North America, Europe, Asia-Pacific, and emerging markets such as Latin America and the Middle East & Africa, with the USA, China, India, the UK, Germany, and Japan being key countries driving overall industry growth.

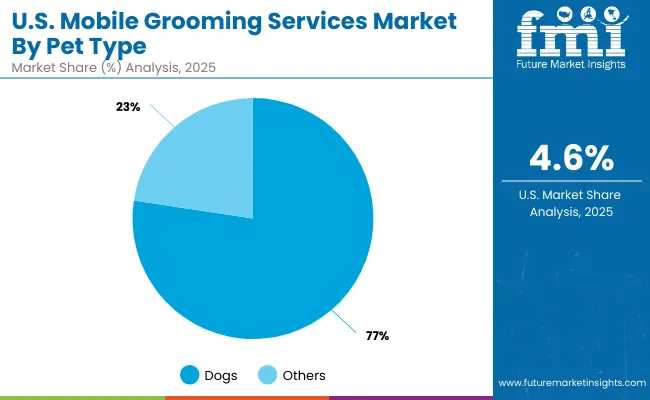

| Pet Type | Value Share% 2025 |

|---|---|

| Dogs | 75.7% |

| Others | 24.3% |

The dogs segment is projected to contribute 75.7% of the Mobile Grooming Services Market revenue in 2025, maintaining its lead as the dominant pet category. This growth is driven by the strong cultural trend of pet humanization, with dogs regarded as companions requiring regular hygiene, grooming, and premium care. Demand for full grooming and styling services, flea-tick treatments, and add-on hygiene packages is especially pronounced among dog owners, fueling higher spend per visit.

The segment’s strength is further reinforced by urbanization and rising disposable incomes, which make professional grooming more accessible. As mobile grooming expands into suburban and semi-urban regions, dogs remain the primary focus due to their grooming-intensive needs compared to cats and small pets. This ensures that the dogs category continues to anchor overall industry growth through the forecast period.

| Service Type | Value Share% 2025 |

|---|---|

| Full groom / haircut | 44.1% |

| Others | 55.9% |

The full groom/haircut segment is forecasted to hold 44.1% of the market share in 2025, driven by its central role in comprehensive pet care. Full grooming includes trimming, coat styling, hygiene maintenance, and overall appearance enhancement, making it the most sought-after service among pet owners, particularly dog households.

Its strong adoption is supported by the rising demand for premium grooming packages that combine style and health benefits, addressing both aesthetic appeal and wellness. Mobile grooming providers also integrate full grooming with add-ons such as nail clipping, ear cleaning, and dental care, creating bundled offerings that increase customer spend and loyalty.

As pet owners continue prioritizing convenience and professional grooming standards, the full groom/haircut segment is expected to retain its dominance and remain the anchor revenue driver in the Mobile Grooming Services Market.

| Provider Type | Value Share% 2025 |

|---|---|

| Independent owner-operators | 64.7% |

| Others | 35.3% |

The independent owner-operators segment is projected to account for 64.7% of the Mobile Grooming Services Market revenue in 2025, establishing it as the leading provider type. These small-scale operators dominate due to their localized presence, personalized services, and competitive pricing, which strongly appeal to pet owners seeking convenience and trust.

Their flexibility in offering customized packages ranging from full grooms to add-on services like nail, ear, and dental care has further strengthened their position. Many independents also leverage digital booking channels and word-of-mouth referrals, enabling them to build loyal customer bases.

Given their adaptability and cost-effectiveness, independent owner-operators are expected to maintain their dominance, even as regional and national franchises expand and bring greater standardization to the market.

Subscription-Based Grooming Packages

The adoption of subscription-based grooming models is a strong driver for market growth. Providers are offering monthly or quarterly packages that include full grooming, medicated baths, and add-ons like nail trimming or dental cleaning. This model ensures recurring revenue streams and builds customer loyalty while providing cost savings for pet owners. With growing demand for predictable, convenient services, subscription models are gaining traction among urban households, making them a cornerstone of sustained revenue expansion in the mobile grooming space.

Expansion into Emerging Pet Markets

Rapid growth in pet adoption across emerging economies such as India and China is creating new opportunities for mobile grooming services. First-time pet owners in these regions are highly receptive to convenience-based services that eliminate the need for travel to salons. The combination of rising disposable incomes, urban apartment living, and greater awareness of pet hygiene is fueling this demand. Providers expanding into these markets can capitalize on untapped segments, particularly among millennial and Gen Z pet owners driving new grooming habits.

Operational Cost Pressures in Van-Based Services

A major restraint lies in the high operational costs of running van-based mobile spas. Fuel, maintenance, and equipment costs continue to rise, eroding margins for independent operators who dominate the market. Unlike in-home grooming, van services also require initial capital investment for customized vehicles and professional setups. For small-scale providers, balancing affordability for customers with rising expenses is a challenge, potentially limiting scalability. These cost pressures may deter new entrants or slow expansion, especially in price-sensitive regions and suburban markets.

Digital Integration of Booking and Loyalty Platforms

A key trend reshaping the industry is the integration of digital booking platforms with loyalty and customer engagement tools. Mobile grooming providers are increasingly using apps and websites not just for scheduling, but also to track grooming history, send personalized reminders, and reward repeat clients with discounts or add-ons. This digital engagement builds stronger relationships and encourages repeat purchases, while also generating valuable customer data for service customization. As digital adoption accelerates, tech-enabled grooming is setting the benchmark for future growth.

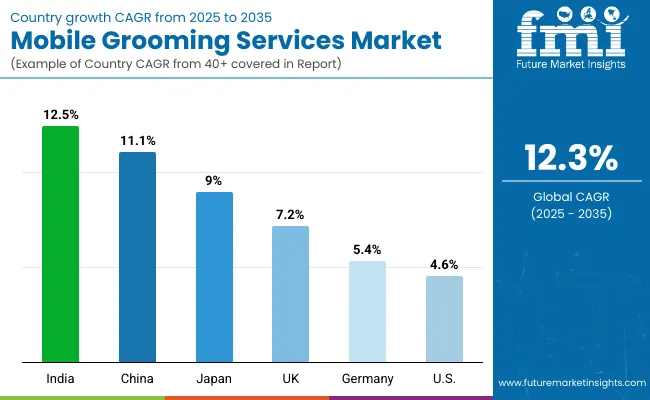

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 11.1% |

| USA | 4.6% |

| India | 12.5% |

| UK | 7.2% |

| Germany | 5.4% |

| Japan | 9.0% |

The global Mobile Grooming Services Market shows varied growth dynamics, shaped by pet ownership trends, disposable incomes, and digital service adoption. Asia-Pacific is emerging as the fastest-growing region, anchored by China (11.1%) and India (12.5%). China’s expansion is driven by a surge in pet humanization and growing demand for professional grooming among urban households, while India’s rapid growth reflects first-time pet ownership, rising middle-class incomes, and adoption of convenient mobile services in metro and tier-2 cities.

Europe maintains strong momentum, with the UK (7.2%) and Germany (5.4%) advancing on the back of well-established pet care cultures and demand for premium grooming. Japan (9.0%) is witnessing rapid adoption of grooming-on-demand services, supported by high pet care expenditure and a growing elderly population seeking convenient pet services. The USA (4.6%) shows steady but slower expansion, reflecting a mature pet care market where growth is now being driven more by premiumization and digital booking platforms than by basic service penetration.

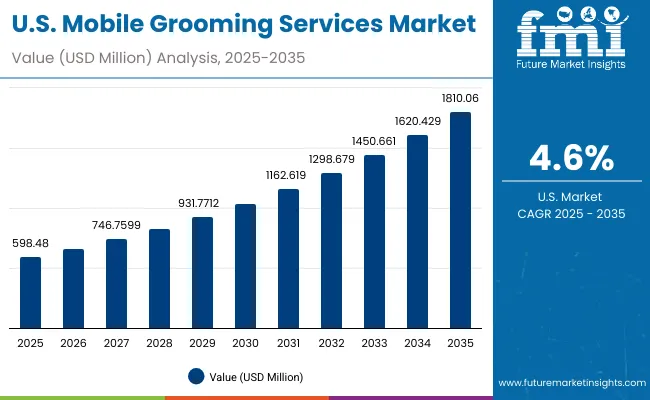

| Year | USA Mobile Grooming Services Market |

|---|---|

| 2025 | 598.48 |

| 2026 | 668.52 |

| 2027 | 746.75 |

| 2028 | 834.15 |

| 2029 | 931.77 |

| 2030 | 1040.81 |

| 2031 | 1162.61 |

| 2032 | 1298.67 |

| 2033 | 1450.66 |

| 2034 | 1620.42 |

| 2035 | 1810.06 |

The USA Mobile Grooming Services Market is projected to grow steadily at a CAGR of 4.6%, reflecting the maturity of the country’s pet care sector. Growth is led by rising demand for premium grooming services and the shift toward subscription-based grooming packages that include add-ons such as medicated baths and dental care. Digital booking platforms are reshaping customer engagement, making app- and web-based reservations the preferred mode. Independent operators dominate service delivery, while national franchises are scaling operations to capture suburban markets and enhance brand visibility.

The UK Mobile Grooming Services Market is projected to grow at a CAGR of 7.2%, driven by rising urban pet ownership and the growing preference for doorstep grooming convenience among busy households. Premium full-groom and styling packages are witnessing strong uptake, particularly in metropolitan areas such as London, Manchester, and Birmingham. Partnerships between grooming startups and pet retail chains are expanding service reach, while eco-friendly mobile grooming vans and water-saving technologies are gaining traction. The market is further supported by government incentives around small-business growth and an increasing cultural focus on pet wellness.

The India Mobile Grooming Services Market is set to grow at a CAGR of 12.5% through 2035, supported by the rising pet adoption trend in urban and semi-urban households. Demand is particularly strong in tier-1 and tier-2 cities where busy lifestyles drive preference for doorstep grooming solutions. Local startups are expanding aggressively with affordable service packages, while premium grooming vans offering spa-like experiences are emerging in metro regions. Increasing digital adoption, with mobile apps and online booking platforms, is streamlining service accessibility and fueling market expansion.

The China Mobile Grooming Services Market is projected to grow at a CAGR of 11.1%, the highest among leading economies. Growth is supported by the rising pet ownership boom in urban households, especially single professionals and aging populations seeking companionship. Premium grooming vans offering luxury spa treatments, styling, and organic products are gaining traction in tier-1 cities like Shanghai and Beijing. Local service providers are innovating with subscription-based packages and AI-enabled booking apps, making grooming more affordable and accessible. Government push for pet welfare regulations further strengthens organized market expansion.

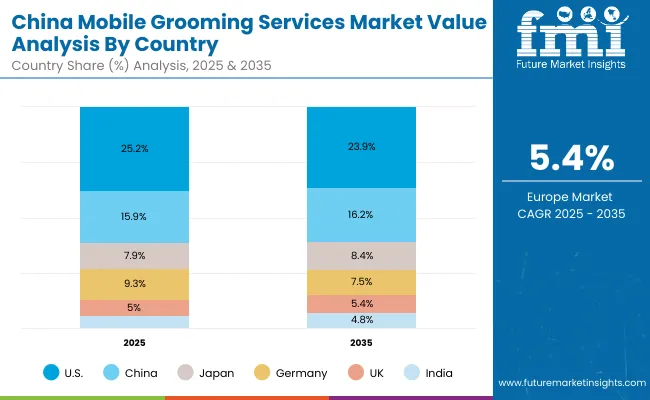

| Countries | 2025 Share (%) |

|---|---|

| USA | 25.2% |

| China | 15.9% |

| Japan | 7.9% |

| Germany | 9.3% |

| UK | 5.0% |

| India | 3.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 23.9% |

| China | 16.2% |

| Japan | 8.4% |

| Germany | 7.5% |

| UK | 5.4% |

| India | 4.8% |

The Germany Mobile Grooming Services Market is projected to grow at a CAGR of 5.4%, anchored by the country’s pet-focused consumer culture and premium grooming standards. Urban pet owners are increasingly turning to mobile salons for convenience, stress-free care, and sustainable grooming practices. Groomers are offering organic shampoos, hypoallergenic treatments, and breed-specific styling, aligning with Germany’s strong preference for eco-conscious products. Rising demand from aging pet populations and dual-income households continues to accelerate adoption. Service expansion is further supported by collaborations with veterinary clinics and pet wellness brands.

| USA By Pet Type | Value Share% 2025 |

|---|---|

| Dogs | 77.4% |

| Others | 22.6% |

The Mobile Grooming Services Market in the United States is projected at USD 598.5 million in 2025. Full grooming and haircut services contribute the largest share at 64.2%, while add-on wellness treatments such as flea control, teeth cleaning, and aromatherapy hold 35.8%, signaling a clear shift toward holistic, wellness-driven grooming packages. This wellness-oriented dominance reflects growing awareness among USA pet owners who prioritize health, safety, and premium care over basic grooming needs.

Demand is particularly fueled by aging pet populations requiring specialized handling, and by dual-income households seeking convenience and time efficiency. Urban markets are seeing rapid uptake, with subscription-based grooming models gaining traction. Furthermore, partnerships between mobile groomers and veterinary clinics are creating hybrid wellness packages that go beyond aesthetic care, driving steady recurring revenue.

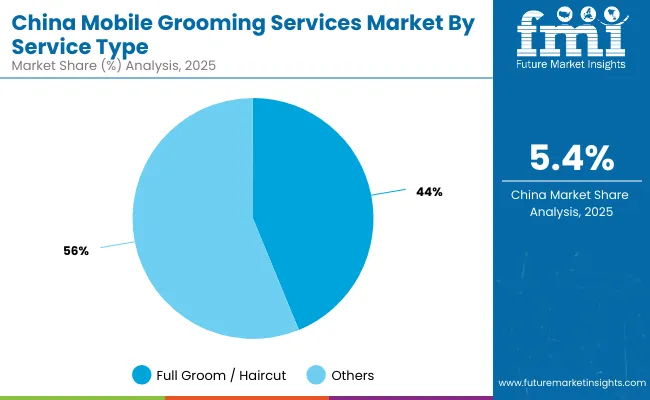

| China By Service Type | Value Share% 2025 |

|---|---|

| Full groom / haircut | 43.8% |

| Others | 56.2% |

The Mobile Grooming Services Market in China is projected at USD 1,250.7 million in 2025, with wellness-driven services such as spa treatments, de-shedding, flea/tick control, and styling add-ons leading at 56.2%, followed by full groom and haircut packages at 43.8%. This dominance of non-core grooming stems from rising urban pet ownership and growing influence of premium wellness culture among China’s millennial and Gen-Z pet parents.

Rapid adoption is being accelerated by e-commerce integration (WeChat/Alibaba-linked grooming bookings), increasing demand from luxury pet hotels and boutiques, and rising awareness of preventive pet healthcare. Subscription grooming apps are expanding in Tier-1 cities, while local entrepreneurs are piloting AI-driven scheduling and tracking to improve customer convenience.

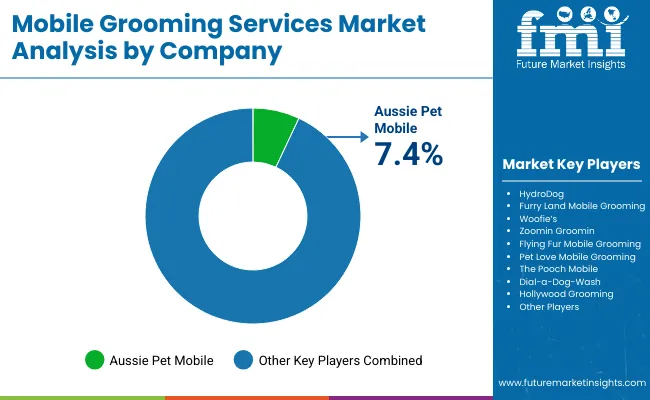

The Mobile Grooming Services Market is highly fragmented, with global leaders, regional franchises, and independent specialists competing across urban and suburban areas. Market leader Aussie Pet Mobile retains visibility with its strong franchise model, eco-friendly grooming vans, and premium service packages, while steadily expanding into newer USA and international territories.

Mid-sized regional players, including Wag’n Tails and local boutique chains, are focusing on fleet expansion and subscription-based offerings. Their strategies emphasize convenience, bundled wellness add-ons, and digital scheduling platforms to attract dual-income households and urban pet parents.

Independent groomers and niche specialists dominate smaller markets, leveraging strong community connections, social media marketing, and customized services like breed-specific styling or aromatherapy grooming. Their adaptability and localized approach allow them to thrive without the scale of larger brands.

Competitive differentiation is shifting toward wellness integration, digital-first booking, and eco-friendly operations rather than just traditional grooming services. Partnerships with veterinary clinics and pet wellness platforms are emerging as a key growth lever for sustained competitive advantage.

Key Developments in Mobile Grooming Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,376.0 Million |

| Pet Type | Dogs, Cats, Other small pets (rabbits, guinea pigs) |

| Service Type | Full groom / haircut, Bath & brush, De-shedding / undercoat, Add-ons (nails, ears, teeth), Medicated / flea-tick care |

| Service Mode | Van-based mobile spa, In-home (no van) |

| Provider Type | Independent owner-operators, Regional chains / franchises, National franchises |

| Booking Channel | Phone, Website, App |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aussie Pet Mobile, Hydro Dog, Furry Land Mobile Grooming, Woofie’s, Zoomin Groomin, Flying Fur Mobile Grooming, Pet Love Mobile Grooming, The Pooch Mobile, Dial-a-Dog-Wash, Hollywood Grooming |

| Additional Attributes | Dollar sales by service type and pet category, Adoption trends in wellness-oriented add-ons (teeth cleaning, flea-tick care, aromatherapy), Rising demand for subscription-based grooming packages, Sector-specific growth in urban households, senior pet care, and premium services, Revenue segmentation by independent operators vs. franchise chains, Integration with digital booking apps, GPS tracking, and cashless payments, Regional trends influenced by pet ownership density and urbanization, Innovations in eco-friendly vans, portable grooming equipment, and pet-safe product formulations |

The global Mobile Grooming Services Market is estimated to be valued at USD 2,376.0 Million in 2025.

The market size for the Mobile Grooming Services Market is projected to reach USD 7,577.5 Million by 2035.

The Mobile Grooming Services Market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key Services types in Mobile Grooming Services Market are Full groom / haircut, Bath & brush, De-shedding / undercoat, Add-ons (nails, ears, teeth), Medicated / flea-tick care

In terms of Pet Type, Dogs segment to command 75.7% share in the Mobile Grooming Services Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Food Services Market Analysis - Growth & Forecast 2025 to 2035

Advanced Mobile UX Design Services Market Outlook 2025 to 2035

Evaluating Market Share in Restaurants & Mobile Food Services

Restaurants & Mobile Food Services Market Trends – Forecast 2025 to 2035

Demand for Advanced Mobile UX Design Services in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Advanced Mobile UX Design Services in USA Size and Share Forecast Outlook 2025 to 2035

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA