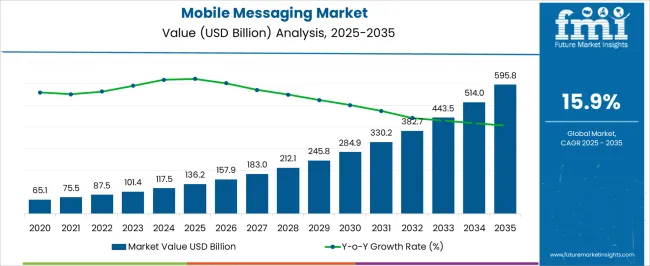

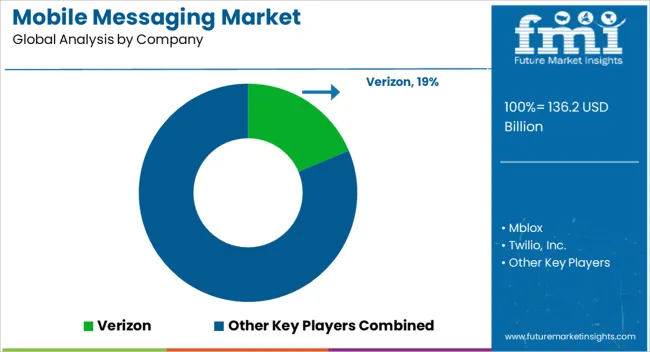

The Mobile Messaging Market is estimated to be valued at USD 136.2 billion in 2025 and is projected to reach USD 595.8 billion by 2035, registering a compound annual growth rate (CAGR) of 15.9% over the forecast period.

| Metric | Value |

|---|---|

| Mobile Messaging Market Estimated Value in (2025 E) | USD 136.2 billion |

| Mobile Messaging Market Forecast Value in (2035 F) | USD 595.8 billion |

| Forecast CAGR (2025 to 2035) | 15.9% |

The mobile messaging market is experiencing robust growth as consumers and enterprises increasingly rely on instant communication platforms for both personal and professional interactions. The shift from traditional SMS to enriched messaging services driven by internet penetration, smartphone adoption, and integration of multimedia features is expanding the market footprint.

Enterprises are leveraging mobile messaging for customer engagement, marketing automation, and service delivery, while individuals are adopting secure, real time platforms for everyday communication. Technological advancements in cloud infrastructure, artificial intelligence, and end to end encryption have enhanced the scalability, security, and personalization of messaging platforms.

Regulatory frameworks emphasizing data privacy and secure communication are further accelerating the adoption of compliant messaging solutions. The overall outlook remains positive as messaging ecosystems evolve into multifunctional platforms that integrate payments, commerce, and customer relationship tools, creating new avenues for growth across industries.

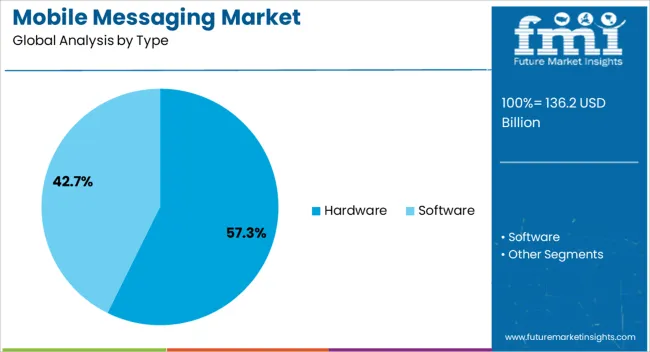

The hardware segment is projected to represent 57.30% of total revenue by 2025 within the type category, positioning it as the leading segment. Growth in this segment is attributed to the widespread adoption of advanced mobile devices that support enriched messaging applications, including multimedia sharing, video calling, and integrated business communication tools.

Increased demand for smartphones with higher processing capabilities and enhanced connectivity has strengthened hardware’s role in enabling seamless messaging experiences.

As mobile penetration deepens in both developed and emerging economies, the hardware segment continues to dominate due to its foundational role in supporting messaging applications and services.

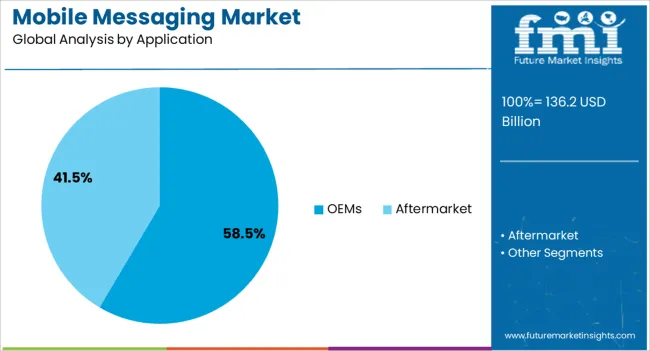

The OEMs segment is expected to account for 58.50% of total market revenue by 2025 within the application category, making it the most significant contributor. This dominance is driven by the ability of OEMs to integrate pre installed messaging applications and customized solutions that align with consumer usage patterns.

Partnerships between OEMs and messaging service providers have enhanced brand loyalty while expanding user bases. Additionally, OEMs play a critical role in embedding secure messaging protocols and ensuring compatibility with evolving mobile operating systems.

The strong influence of OEMs in shaping user experience and device ecosystems reinforces their leading position within the application segment.

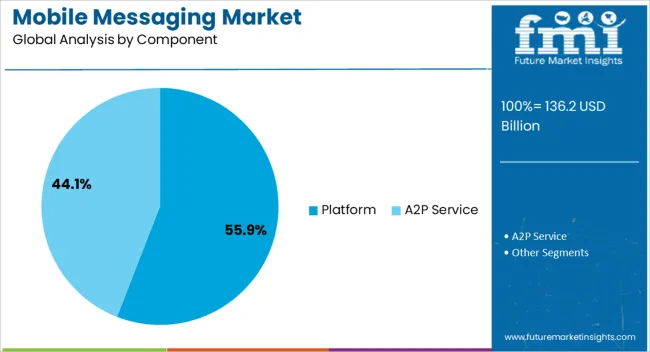

The platform segment is projected to capture 55.90% of total revenue by 2025 within the component category, highlighting its leadership in the market. Growth in this segment is underpinned by the rising need for scalable, cloud based messaging infrastructures that support billions of daily interactions.

Platforms provide advanced features such as chatbots, analytics, and payment integration, making them essential for both enterprise communication and consumer engagement. Their role in ensuring interoperability across devices and operating systems has further driven adoption.

As organizations prioritize digital transformation and omnichannel communication, the platform segment continues to solidify its dominance by delivering flexibility, scalability, and enhanced user experiences.

According to recent research by Future Market Insights, the mobile messaging market is projected to expand at a rate of 15.9% during the forecast period from 2025 to 2035. The market outlook could be divided into short-term, medium-term, and long-term.

Short term (2025 to 2025): Messaging apps are adding more advanced features such as video calling, file sharing, and group chats. These features provide a richer user experience and make messaging apps more appealing to users. The availability of advanced text messaging features is expected to continue to drive the growth of the mobile messaging market in the short term.

Medium-term (2025 to 2035): Messaging apps are becoming an essential channel for businesses to engage with their customers. Messaging allows for more personalized and targeted communication, helping businesses build stronger relationships with their customers. With the growing importance of customer engagement, messaging apps are expected to continue to play a significant role in the mobile messaging market.

Long-term (2035 to 2035): Chatbots are AI-powered conversational agents that can communicate with users through messaging apps. The integration of chatbots into text messaging apps has opened up new opportunities for businesses to provide better customer service and increase engagement. Chatbots can handle routine inquiries, freeing up customer service agents to handle more complex issues. This trend has driven the growth of chatbots, which is expected to continue in the coming years.

Growing Smartphone Penetration: The number of smartphone users worldwide is expected to reach 117.5 billion in 2024, and this number is projected to grow to over 136.2 billion by 2025. With the increasing availability and affordability of smartphones, more people have access to mobile messenger, driving the demand for mobile messaging.

Need for Instant Communication: People expect to communicate instantly with their contacts, whether it's for personal or business purposes. Mobile text messaging apps provide a convenient and fast way to communicate, especially for real-time conversations. With the popularity of messaging apps, people can stay connected with their contacts from anywhere, at any time.

Shift to Remote Work: The COVID-19 pandemic has accelerated the shift towards remote work, with many employees working from home. Messaging apps have become an essential tool for remote teams to communicate and collaborate effectively. Many businesses are relying on messaging apps to maintain communication with their employees, making the mobile messaging market more critical than ever.

Rise of Social Media: Social media platforms such as Facebook, Instagram, and Twitter have become popular communication channels, especially among younger generations. Messaging apps have evolved to incorporate social media features, making them more appealing to users. This trend has driven the growth of social messaging, which is expected to continue in the coming years.

Increasing Use of Mobile Payments: The growth of mobile payments has created new opportunities for mobile messengers. Many text messaging apps now offer payment features that allow users to transfer money to their contacts without leaving the app. This trend has driven the growth of mobile payments, which is expected to continue to grow in the coming years.

Security Concerns: Messaging apps store sensitive personal information, and as the usage of messaging apps grows, so does the potential for data breaches and privacy violations. This can lead to a loss of trust among users and businesses, resulting in lower adoption rates.

Competition from Established Players: The mobile messenger market is highly competitive, with established players such as WhatsApp, Facebook Messenger, and WeChat dominating the market. It can be challenging for new entrants to gain market share and establish themselves in such a competitive market.

Regulatory Challenges: The mobile messaging market is subject to various regulations related to data privacy, data protection, and content moderation. Complying with these regulations can be challenging and costly for messaging app providers, which may limit their growth potential.

Limited Internet Connectivity: In some parts of the world, internet connectivity is limited, which can limit the adoption of mobile messaging apps. Without access to a stable internet connection, users may not be able to use messaging apps effectively, limiting the market's growth potential in these regions.

Technological Limitations: The market is constantly evolving, with new features and technologies being introduced regularly. Messaging app providers must keep up with these changes and innovate to remain competitive. However, technological limitations, such as device compatibility and network infrastructure, can make it challenging for messaging app providers to offer new and advanced features.

User Retention: The market is highly competitive, and mobile messengers must continuously engage their users to retain them. Messaging apps that fail to provide a compelling user experience risk losing their users to competitors, which can limit their growth potential.

Monetization Challenges: Many messaging apps are free to use, which can make it challenging for messaging app providers to monetize their services. Developing sustainable revenue models can be a significant challenge for messaging app providers, which may limit their growth potential in the long term.

The USA has one of the highest smartphone penetration rates in the world, with around 81% of adults owning a smartphone as of 2024. With the increasing availability and affordability of smartphones, more people have access to text messaging, driving the demand for mobile messaging.

Social media platforms such as Facebook, Instagram, and Twitter have a strong presence in the USA, with high adoption rates among users. Messaging apps have evolved to incorporate social media features, making them more appealing to users. This trend has driven the growth of social messaging in the USA.

The USA mobile messenger market is a highly competitive space with several prominent players. Here are some of the top companies in the US market:

India has the second-largest internet user base in the world, with over 750 million users, according to the Internet and Mobile Association of India (IAMAI). With such a high number of internet users, there is a huge potential for growth in the market.

India's e-commerce market is expected to grow significantly in the coming years. Messaging apps are becoming an essential tool for e-commerce businesses in India to communicate with their customers, provide customer support, and enable transactions.

Top companies in India’s mobile messaging market:

Japan has one of the highest rates of internet penetration in the world, with over 93% of the population using the internet. With such a high number of internet users, there is a huge potential for growth in the market.

Top companies in the Japanese mobile messenger market include:

China has a very large mobile payment market, with companies like Alipay and WeChat Pay dominating the space. Messaging apps in China are integrating mobile payment features into their platforms, which has created new opportunities for businesses to reach customers and for individuals to make transactions.

Social messaging, where mobile messengers incorporate social media features, is becoming more popular in China. This trend has driven the growth of social messaging in the country.

Top companies in the Chinese mobile messenger market include:

The growth potential for the banking and financial institutions vertical in the mobile messaging industry is unparalleled. This is attributed to the surging adoption of business mobility and premium messaging services, which are propelling the expansion of the BFSI sector.

In today's digital age, customer engagement has become a key component in building brand loyalty, and the BFSI sector is no exception. With the proliferation of mobile messaging solutions, financial institutions can now communicate with customers in real-time, providing them with transaction data, retail banking activities, and support for their financial needs.

The increasing number of internet users and the widespread use of smartphones have heightened the demand for prompt and efficient customer service. This trend is driving the explosive growth of mobile messaging in the BFSI industry, enabling financial institutions to build stronger relationships with their customers and stay ahead of the competition.

The mobile messaging market is highly competitive, and the market players have adopted various strategies to gain a larger market share. Here are a few examples:

The global mobile messaging market is estimated to be valued at USD 136.2 billion in 2025.

The market size for the mobile messaging market is projected to reach USD 595.8 billion by 2035.

The mobile messaging market is expected to grow at a 15.9% CAGR between 2025 and 2035.

The key product types in mobile messaging market are hardware and software.

In terms of application, oems segment to command 58.5% share in the mobile messaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA