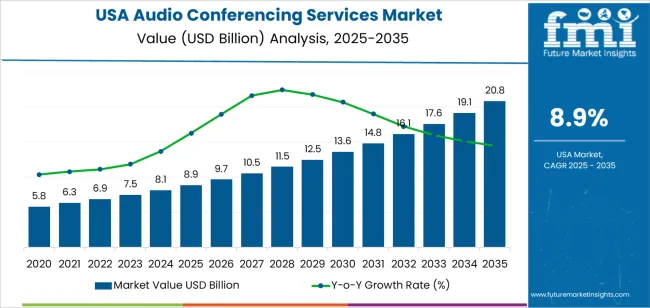

The demand for audio conferencing services in USA is valued at USD 8.9 billion in 2025 and is projected to reach USD 20.8 billion by 2035, reflecting a compound annual growth rate of 8.9%. Growth is shaped by ongoing shifts toward remote communication across corporate, educational and public sector environments. As organizations continue to integrate flexible work arrangements and hybrid meeting formats, audio conferencing remains a core tool for routine collaboration. Its reliability, ease of use and compatibility with varied devices reinforce adoption across both large enterprises and small businesses. Expanding service offerings that include noise reduction, multi-speaker clarity and integration with workplace platforms continue to support broader use through the forecast period.

The growth curve moves consistently upward, beginning at USD 5.8 billion in earlier years and rising to USD 8.9 billion in 2025 before advancing to USD 20.8 billion by 2035. Annual gains remain steady, with demand increasing from USD 9.7 billion in 2026 to USD 10.5 billion in 2027 and continuing at regular intervals throughout the timeline. This smooth progression reflects stable use of audio conferencing as an accessible communication channel that supports daily operations across industries. As service providers refine technology and enhance platform integration, adoption expands across sectors that require dependable voice-based communication. The predictable growth pattern signals a strengthening role for audio conferencing within long-term communication frameworks across USA.

Demand in USA for audio conferencing services is forecast to grow from USD 8.9 billion in 2025 to USD 20.8 billion by 2035, representing a compound annual growth rate (CAGR) of approximately 8.9%. Starting from USD 5.8 billion in 2020, the value rises steadily to USD 8.1 billion in 2024 and then reaches USD 8.9 billion in 2025. Between 2025 and 2030, demand will increase to around USD 13.6 billion, and by 2035 it is projected to reach USD 20.8 billion. Growth is driven by the expansion of hybrid and remote work models, increased enterprise investment in collaboration tools, and the need for cost efficient, robust audio communication solutions across distributed teams.

Over the 2025 2035 decade, the value uplift of USD 11.9 billion underscores both volume growth and rising average revenue per user or per service unit. In the early part of the period, the increase is primarily volume led more organisations adopting audio only conferencing and scaling usage. Later in the decade, value growth becomes more important as providers bundle advanced features (cloud native services, AI powered noise cancellation, enterprise grade security) and monetise premium tiers. As integration with unified communications platforms deepens and organisations upgrade their collaboration stacks, higher per unit spending will support the climb toward USD 20.8 billion by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 8.9 billion |

| Forecast Value (2035) | USD 20.8 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The demand for audio conferencing services in USA is driven by the transition of many organisations to hybrid and remote work models. Teams spread across multiple locations require reliable, flexible audio platforms that allow them to connect without relying on travel. Enterprises are increasingly seeking conferencing services that are cloud-based and scalable, enabling them to add or reduce capacity as their meeting needs change. The ability to host large conferences with high-quality audio and secure connections is becoming a standard requirement across sectors such as IT, finance, healthcare and education.

Corporate cost pressures are another major force. Businesses aim to reduce travel expenses, streamline meeting logistics and support distributed teams more efficiently. Audio-only conferencing remains a cost-effective choice when video is not needed, which keeps it relevant for routine meetings, workshops and multi-party calls. Service providers responding to demand are offering enhanced value through integrations with collaboration tools, real-time transcription, mobile access and multi-platform support. While competition from video conferencing and free tools poses a challenge, the ongoing need for dependable business-grade audio conferencing solutions in USA supports continuing growth.

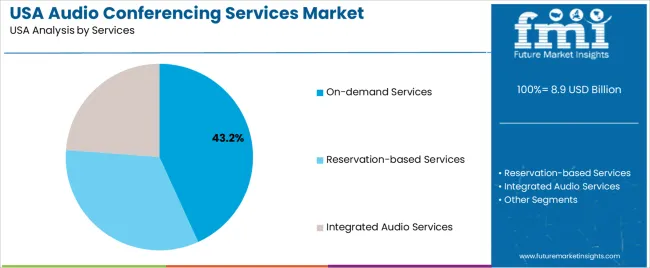

The demand for audio conferencing services in USA is shaped by enterprise size requirements and the service formats companies adopt. Large enterprises and small and medium enterprises use audio conferencing differently based on team size, communication frequency and collaboration needs. Service formats including on-demand services, reservation-based services and integrated audio services offer varied levels of flexibility and control. These segments reflect increasing reliance on remote communication tools for routine coordination, client interactions and cross-site collaboration. As organizations streamline workflows and support dispersed teams, the combination of adaptable service structures and varied enterprise needs influences audio conferencing adoption across the country.

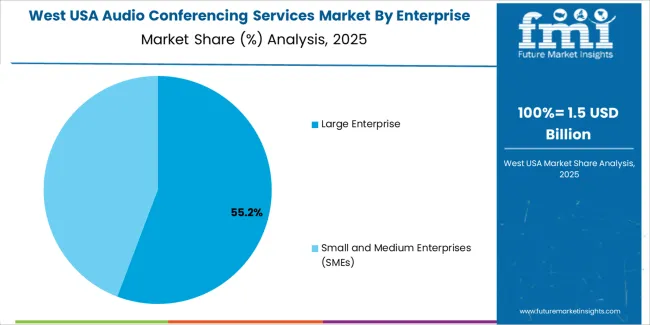

Large enterprises account for 56% of total demand for audio conferencing services in USA. This leading share reflects the extensive communication requirements of organizations operating multiple departments and regional offices. Large enterprises rely on audio conferencing to support frequent internal meetings, client interactions and cross-functional coordination. These companies prioritize tools that deliver consistent call quality, predictable uptime and reliable access across diverse teams. The ability to scale services for large user bases and integrate conferencing into daily communication routines strengthens dependence on audio conferencing solutions across enterprise environments.

Demand from large enterprises also grows as companies incorporate structured communication systems into long-term operational planning. Routine briefings, project updates and cross-department calls require predictable platforms that support repeated use throughout the workweek. Audio conferencing remains essential for teams that rely on voice communication for clarity and shared decision-making. Many large enterprises also maintain hybrid or distributed workforce arrangements, which further increases reliance on dependable conferencing systems. As these organizations continue prioritizing efficient communication channels, large enterprises remain the dominant driver of demand in the audio conferencing landscape.

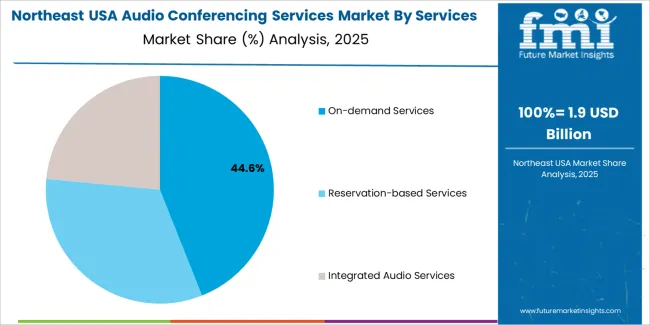

On-demand services account for 43.2% of total demand for audio conferencing in USA. Their strong position reflects the need for immediate access to conferencing without advance scheduling. These services suit teams that hold spontaneous meetings or require quick communication across departments. On-demand systems reduce administrative tasks by eliminating reservation steps, which supports fast decision-making. Many companies value the ability to launch calls quickly when coordinating time-sensitive tasks. This flexibility aligns with daily operational patterns in various industries, making on-demand services a preferred choice for streamlined communication.

Demand for on-demand services also increases as organizations shift toward dynamic workflows supported by cloud-based tools. Teams that collaborate across time zones or manage project-based workloads depend on conferencing services that adjust easily to changing schedules. On-demand platforms help maintain continuity across distributed teams by supporting immediate connectivity. Their compatibility with existing communication applications enhances usability and encourages routine adoption. As businesses continue favoring flexible communication options, on-demand services remain central to audio conferencing preferences across USA.

Demand for audio conferencing services in the USA is driven by the rise of hybrid and remote work models, increasing need for unified communication platforms and growth in cloud-based collaboration tools. Enterprises of all sizes seek reliable, scalable audio conferencing as part of broader remote-team infrastructure. At the same time, adoption is constrained by security concerns, budget pressures and competition from video and integrated collaboration platforms. These factors combine to influence how widely and how quickly audio conferencing services are adopted within the US corporate environment.

In the USA, the shift toward remote and distributed teams has heightened reliance on audio conferencing for internal meetings, customer interactions and cross-geography collaboration. Cloud-native services and integrated platforms make audio conferencing faster to deploy and easier to scale. Organisations prioritising agility and low deployment overhead favour on-demand audio conferencing solutions. At the same time, technologies like AI-enhanced voice quality and voice-to-text transcription are making these services more attractive, thereby boosting uptake in US enterprises supporting flexible working.

Growth opportunities in the USA exist in sectors like healthcare, financial services and education where secure, reliable audio conferencing is critical. For example, telehealth audio calls, remote client advisory services and virtual classrooms open new demand. Moreover, small and medium-sized enterprises (SMEs) adopting hybrid work and seeking cost-effective collaboration tools present a large growth segment. Vendors who offer flexible pricing, global dial-in options and enterprise-grade security are well positioned to capture this opportunity in the US service landscape.

Several constraints slow broader adoption of audio conferencing services in the USA. One major challenge is the perception that video conferencing offers richer interaction, which may reduce preference for audio-only services. Security and compliance requirements (for example in finance or healthcare) require more advanced service features and certification, which increases cost. In addition, older legacy systems and user habits may slow migration to cloud audio conferencing. These issues moderate how quickly audio conferencing becomes standard in all enterprise settings.

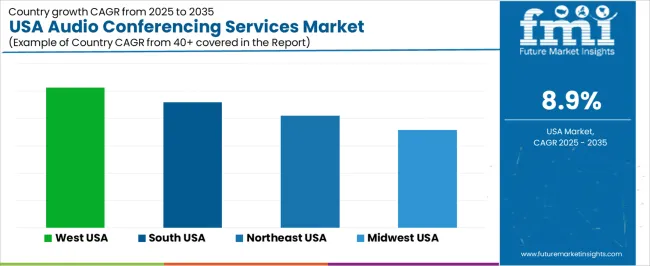

| Region | CAGR (%) |

|---|---|

| West | 10.3% |

| South | 9.2% |

| Northeast | 8.2% |

| Midwest | 7.1% |

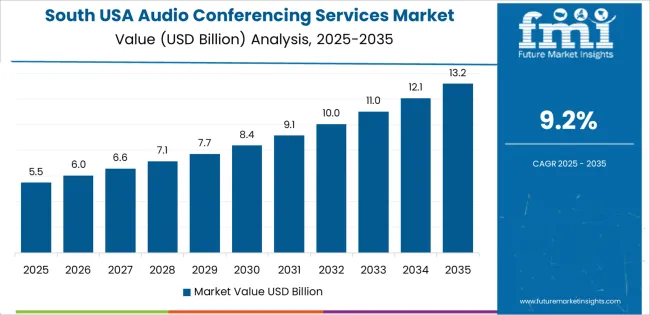

Demand for audio conferencing services in the USA is rising across all regions, with the West leading at 10.3%. Growth in this region reflects strong adoption of hybrid work practices and steady use of communication platforms across technology and service industries. The South follows at 9.2%, supported by expanding corporate activity and widespread reliance on remote communication tools across mid-sized businesses. The Northeast records 8.2%, shaped by dense business districts where financial, legal, and consulting firms continue to use audio conferencing for daily operations. The Midwest grows at 7.1%, where regional enterprises integrate audio solutions to support distributed teams. Together, these regions show consistent use of audio conferencing as organizations maintain flexible work arrangements.

West USA is projected to grow at a CAGR of 10.3% through 2035 in demand for audio conferencing services. California and neighboring states are adopting cloud-based, secure, and high-quality audio conferencing platforms to support corporate communication, remote work, and virtual collaboration. Businesses in technology, finance, and professional services increasingly integrate audio conferencing to enhance efficiency. Providers are offering scalable solutions with advanced connectivity, security, and recording features. Rising adoption of hybrid and remote work, combined with urban business density, drives steady growth in audio conferencing usage across West USA corporate and enterprise environments.

South USA is projected to grow at a CAGR of 9.2% through 2035 in demand for audio conferencing services. Urban and suburban centers, including Houston, Miami, and Atlanta, are adopting secure, cloud-based platforms for corporate, educational, and healthcare communications. Rising hybrid work adoption, distributed teams, and virtual collaboration requirements drive usage. Providers are supplying scalable, reliable audio conferencing solutions with recording and integration capabilities. Regional businesses, professional services, and educational institutions increasingly rely on audio conferencing to maintain productivity and efficiency. Infrastructure upgrades and high-speed connectivity in southern states further support adoption.

Northeast USA is projected to grow at a CAGR of 8.2% through 2035 in demand for audio conferencing services. Cities like New York, Boston, and Philadelphia increasingly integrate cloud-based audio platforms in finance, professional services, and education sectors. Rising remote work, hybrid office structures, and virtual collaboration needs accelerate adoption. Providers are offering high-quality, secure, and scalable conferencing solutions with recording and analytical features. Businesses and educational institutions leverage these services to maintain operational efficiency and reduce travel costs. Urban population density and strong corporate presence in Northeast USA support steady growth in audio conferencing adoption.

Midwest USA is projected to grow at a CAGR of 7.1% through 2035 in demand for audio conferencing services. Urban and suburban centers, including Chicago, Detroit, and Minneapolis, are increasingly using cloud-based audio platforms for corporate, educational, and healthcare communications. Rising hybrid work adoption, distributed teams, and collaboration across states drive growth. Providers are supplying secure, reliable, and scalable audio conferencing solutions with recording and integration capabilities. Businesses and institutions leverage these technologies to reduce travel costs, enhance productivity, and improve communication efficiency. Midwest infrastructure improvements support steady growth in adoption across regional enterprises.

The demand for audio conferencing services in the USA is driven by the widespread adoption of hybrid and remote work models, as organisations seek reliable platforms for voice collaboration across distributed teams. Many businesses favour audio-only calls for flexibility, lower bandwidth usage and faster setup compared to full video sessions. Enterprises increasingly integrate audio conferencing into unified communication ecosystems alongside video, chat and collaboration tools. Advances in cloud-based conferencing platforms, enterprise mobility and global connectivity also support uptake. As cost-efficiency, accessibility and scalability become priorities, audio conferencing continues to hold strategic value for firms managing hybrid operations and global teams.

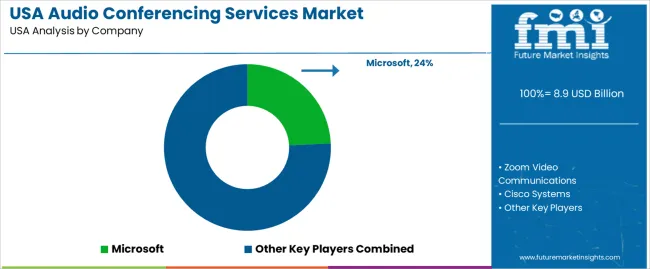

Key players shaping the audio conferencing services sector include Microsoft Corporation, Zoom Video Communications, Cisco Systems, Tata Communications, Google Meet (Google LLC) and RingCentral Inc. These providers deliver platforms, infrastructure and services that enable voice-based collaboration for enterprises across sectors. Microsoft, Cisco and Google integrate audio services within broader collaboration suites that include video and messaging.

Zoom and RingCentral focus on unified communication-as-a-service offerings, while Tata Communications supports global audio backbone and managed conferencing services. Their competitive strategies emphasise platform reliability, enterprise grade security and seamless integration with hybrid work environments, positioning them to lead how audio conferencing services evolve in the USA industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Enterprise Size | Large Enterprise, Small and Medium Enterprises (SMEs) |

| Services | On-demand Services, Reservation-based Services, Integrated Audio Services |

| End Users | IT & Telecom, BFSI (Banking, Financial Services, and Insurance), Education, Healthcare, Government, Retail, Others |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Microsoft, Zoom Video Communications, Cisco Systems, Tata Communications, Google Meet, RingCentral |

| Additional Attributes | Dollar by sales by enterprise size, services, end users, and region; regional CAGR and adoption trends; integration with unified communication platforms; cloud-based and on-premises solutions; AI-powered noise cancellation; enterprise-grade security; multi-device compatibility; premium tier offerings; on-demand versus reservation-based usage patterns; adoption by industry verticals; cost-efficiency metrics; hybrid and remote work adoption; subscription and licensing models; workflow integration; scalability and flexibility across distributed teams; performance tracking and analytics features. |

The global demand for audio conferencing services in USA is estimated to be valued at USD 8.9 billion in 2025.

The market size for the demand for audio conferencing services in USA is projected to reach USD 20.8 billion by 2035.

The demand for audio conferencing services in USA is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in demand for audio conferencing services in USA are large enterprise and small and medium enterprises (smes).

In terms of services, on-demand services segment to command 43.2% share in the demand for audio conferencing services in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Audio Conferencing Services Market Outlook 2025 to 2035

Demand for Audio Conferencing Services in Japan Size and Share Forecast Outlook 2025 to 2035

Audiology Services Market Size and Share Forecast Outlook 2025 to 2035

USA Home Care Services Market Trends – Growth, Demand & Analysis 2025-2035

USA Food Testing Services Market Outlook – Share, Growth & Forecast 2025–2035

USA Travel Agency Services Market Analysis – Size, Share & Forecast 2025-2035

USA Managed Workplace Services Market Insights – Trends, Demand & Growth 2025-2035

USA Wireless Telecommunication Services Market Growth – Trends, Demand & Forecast 2025-2035

Demand for Advanced Mobile UX Design Services in USA Size and Share Forecast Outlook 2025 to 2035

Audiometer Calibration Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Audio Processor Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Audio Power Amplifier IC Market Size and Share Forecast Outlook 2025 to 2035

Audio Communication Monitoring Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA