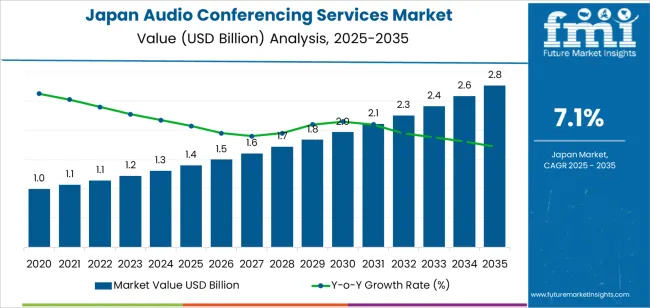

The demand for audio conferencing services in Japan is projected to grow from USD 1.4 billion in 2025 to USD 2.7 billion by 2035, reflecting a CAGR of 7.1%. As businesses continue to embrace remote work, virtual collaboration, and global communication, the need for reliable and cost-effective audio conferencing solutions is set to increase. Audio conferencing plays a vital role in facilitating virtual meetings, team collaboration, and client interactions, enabling companies to stay connected without the need for physical presence. As Japan’s business landscape continues to digitalize, these services are becoming indispensable across corporations, small businesses, and educational institutions.

The rise of cloud-based conferencing platforms, coupled with improvements in audio quality and integration capabilities, will further drive market growth. As remote work and hybrid working models gain permanence, the demand for audio conferencing as a key component of enterprise communication infrastructure will increase significantly. The adoption of video and audio integration and the continued growth of collaborative technologies will complement the expansion of audio conferencing services in Japan, offering cost-effective, efficient, and user-friendly solutions to businesses seeking to improve communication and productivity.

From 2025 to 2030, the demand for audio conferencing services in Japan will grow from USD 1.4 billion to USD 1.9 billion, contributing an increase of USD 0.5 billion in value. The early growth period will be marked by a rapid adoption of audio conferencing services, driven by the expansion of remote work, global collaboration needs, and the increased reliance on digital communication. This phase will experience a breakpoint as businesses fully transition to cloud-based audio conferencing solutions, enhancing the scalability and accessibility of services. As companies prioritize cost-effective communication and collaborative tools, the market will see strong growth, especially as audio conferencing becomes a core component of enterprise communication.

From 2030 to 2035, the market will grow from USD 1.9 billion to USD 2.7 billion, adding USD 0.8 billion in value. In this phase, growth will be steady but may experience a slower acceleration as the market matures. While demand for audio conferencing services continues to rise, market saturation and the growing focus on integrated collaboration platforms could lead to a breakpoint where innovation and additional service enhancements are required to maintain growth. Factors such as advanced audio technology, AI integration, and improved security features will be key drivers of continued adoption and will influence the market’s ability to meet the evolving needs of businesses in Japan. Despite the market's maturity, audio conferencing services will remain essential in supporting remote work and global communication, ensuring sustained growth.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1.4 billion |

| Industry Forecast Value (2035) | USD 2.7 billion |

| Industry Forecast CAGR (2025-2035) | 7.1% |

Demand for audio conferencing services in Japan is increasing as companies and public sector organisations adapt to hybrid work and remote collaboration requirements. Businesses seek solutions that enable reliable, multi party voice communication across dispersed locations and support flexible workflows. These needs are supported by rising uptake of cloud based services, mobile connectivity and multilingual capabilities suited to Japan’s international business environment.

Another factor is the growing emphasis on cost efficiency, operational continuity and user friendly interfaces. Audio conferencing platforms require lower bandwidth than video systems and integrate with unified communications tools, making them suitable for environments where visual engagement is optional. However, considerations such as data security requirements under Japan’s Act on the Protection of Personal Information, legacy infrastructure compatibility and user training remain relevant. Nonetheless, as the digital workplace evolves and collaboration tools become more embedded, the demand for audio conferencing services in Japan is expected to advance.

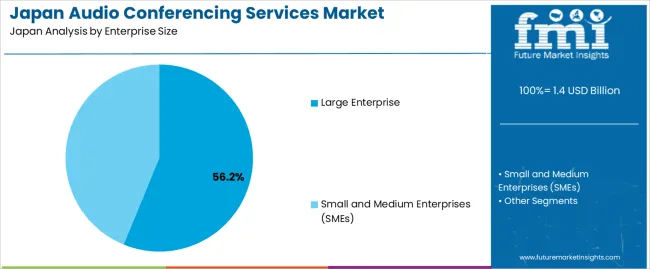

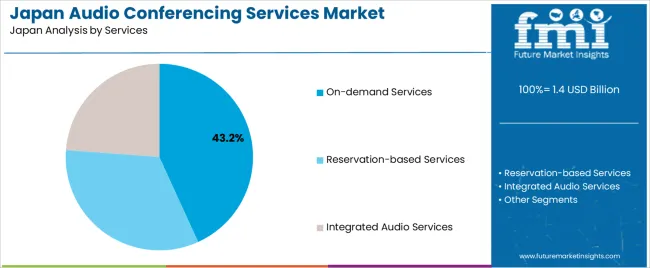

The demand for audio conferencing services in Japan is primarily driven by enterprise size and service type. The leading enterprise size is large enterprises, capturing 56% of the market share, while on-demand services are the dominant service type, accounting for 43.2% of the demand. As remote work and global collaboration continue to rise, audio conferencing services are increasingly utilized by businesses across various industries to facilitate communication and teamwork.

Large enterprises lead the market for audio conferencing services in Japan, holding 56% of the demand. Large organizations typically require robust, scalable communication solutions to connect teams across multiple locations and time zones. Audio conferencing services offer a cost-effective and efficient method for facilitating meetings, discussions, and collaboration in large-scale operations.

The demand from large enterprises is driven by the need for reliable, high-quality communication tools that support global operations and remote work. As these organizations continue to prioritize efficient communication systems, audio conferencing services play a crucial role in maintaining productivity and reducing travel costs. The scale of large enterprises, combined with the increasing need for virtual collaboration, ensures that they will remain a key driver in the audio conferencing services market in Japan.

On-demand services dominate the demand for audio conferencing services in Japan, accounting for 43.2% of the market share. On-demand audio conferencing services allow users to initiate calls whenever needed, offering flexibility and convenience for businesses and individuals who require ad-hoc, quick meetings without pre-scheduled reservations.

The demand for on-demand services is driven by the increasing need for agile, flexible communication solutions, especially in industries where time-sensitive discussions are common. These services enable businesses to connect teams and clients instantly, regardless of location, facilitating faster decision-making and smoother collaboration. As businesses continue to embrace flexible and remote work models, the preference for on-demand audio conferencing services is expected to grow, making it a critical component of the market.

Demand for audio conferencing services in Japan is shaped by shifts toward hybrid work models, rising use of mobile and cloud communication tools, and increased focus on cost effective collaboration methods. Japanese companies are investing in remote meeting infrastructure as a response to talent shortages and regional office realignments. At the same time, cultural preference for in person meetings, stringent data security requirements, and the availability of video conferencing alternatives moderate the pace of audio only conferencing service adoption. These forces define the operating landscape for audio conferencing providers in Japan.

What Are the Primary Growth Drivers for Audio Conferencing Services Demand in Japan?

Several factors support growth. First, increasing adoption of distributed teams and telework arrangements compels organisations to deploy platforms that provide reliable, real time audio communication across geographies. Second, the mobile workforce and proliferation of smart devices create demand for scalable, cloud based conferencing systems. Third, cost control motives lead firms to prefer audio conferencing over travel intensive meetings, improving cost efficiency. Fourth, integration of audio–collaboration tools with enterprise communication suites (such as unified communications and omnichannel customer support) enhances service value and broadens usage.

What Are the Key Restraints Affecting Audio Conferencing Services Demand in Japan?

Despite favourable conditions, several constraints apply. Legacy communication infrastructure and traditional meeting culture may slow transition to audio only conferencing formats among Japanese organisations. Privacy and data protection laws impose strict compliance and localisation obligations, increasing service deployment overhead. Market preference for video and hybrid audio–video conferencing may limit pure audio service uptake. Also, pricing pressure from global conferencing platforms and the relatively mature domestic telecom market reduce margin potential for specialised audio only services.

What Are the Key Trends Shaping Audio Conferencing Services Demand in Japan?

Important trends include a shift toward cloud native audio conferencing solutions that support subscription models and rapid scaling, particularly for small and mid sized enterprises (SMEs). There is also growing use of artificial intelligence enhancements such as real time transcription, language translation and noise cancellation features integrated with audio conferencing platforms. Hybrid meeting room systems are increasingly adjustable to support audio only, audio video and multi participant formats, providing flexibility for Japanese business users. Lastly, bundled communication services offering audio conferencing combined with chat, file sharing and collaboration tools are gaining traction as companies seek unified solutions.

The demand for audio conferencing services in Japan is driven by the increasing adoption of remote work, digital transformation, and the need for businesses to communicate effectively across distances. As Japan continues to embrace more flexible work environments and collaboration tools, audio conferencing has become a vital component for companies aiming to streamline communication, improve productivity, and reduce travel costs. The ongoing push for digitalization in both public and private sectors, coupled with the increasing demand for cost-effective and reliable communication solutions, continues to fuel the market for audio conferencing services.

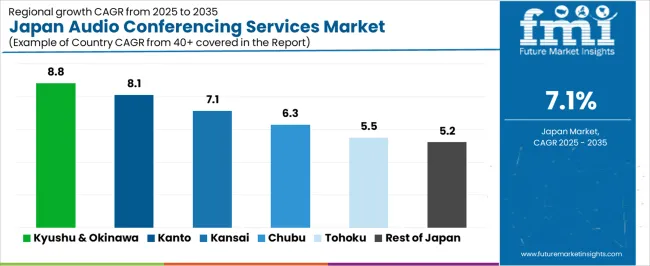

The demand for these services varies regionally, influenced by factors such as industry concentration, technological infrastructure, and the adoption rate of digital tools for communication and collaboration.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 8.8% |

| Kanto | 8.1% |

| Kinki | 7.1% |

| Chubu | 6.3% |

| Tohoku | 5.5% |

| Rest of Japan | 5.2% |

Kyushu & Okinawa leads the demand for audio conferencing services in Japan with a CAGR of 8.8%. The region's strong focus on technology adoption and improving communication infrastructure in both private and public sectors contributes significantly to this growth. Kyushu & Okinawa have seen a rise in digital transformation initiatives, particularly among small and medium-sized enterprises (SMEs) that require cost-effective ways to connect with customers and partners.

Additionally, the region’s tourism and hospitality sectors are increasingly adopting audio conferencing tools to facilitate remote meetings and collaborations, especially in a post-pandemic world. The growing trend of remote work in Kyushu & Okinawa, along with the need for accessible and reliable communication solutions, further supports the demand for audio conferencing services.

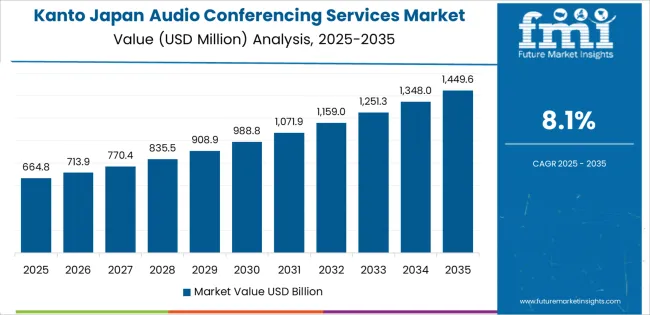

Kanto shows strong demand for audio conferencing services with a CAGR of 8.1%. As the business and economic hub of Japan, Kanto, which includes Tokyo, is home to many large corporations, government agencies, and tech companies. The region’s focus on digital transformation and enhancing remote communication is a key driver of demand for audio conferencing solutions. With many organizations in Kanto shifting to hybrid work models, the adoption of audio conferencing tools has become essential for facilitating seamless communication among teams and stakeholders.

Moreover, Kanto’s strong infrastructure, advanced technological ecosystem, and high concentration of service-oriented industries such as finance, technology, and consulting contribute to the continued growth of audio conferencing services in the region. The region’s preference for high-quality, reliable communication tools has also boosted the market for these services.

Kinki, with a CAGR of 7.1%, shows steady demand for audio conferencing services. The region, which includes major cities like Osaka and Kyoto, has a diverse industrial base with a growing focus on technology and innovation. Although the growth rate is slightly lower than in Kyushu & Okinawa and Kanto, Kinki’s demand for audio conferencing services remains strong due to the increasing need for businesses to collaborate across distances and streamline communication channels.

The region’s manufacturing and service sectors, particularly in fields such as healthcare, education, and logistics, are increasingly turning to digital tools, including audio conferencing, to improve operational efficiency. As the demand for remote work solutions continues to rise, the adoption of audio conferencing services in Kinki is expected to grow steadily.

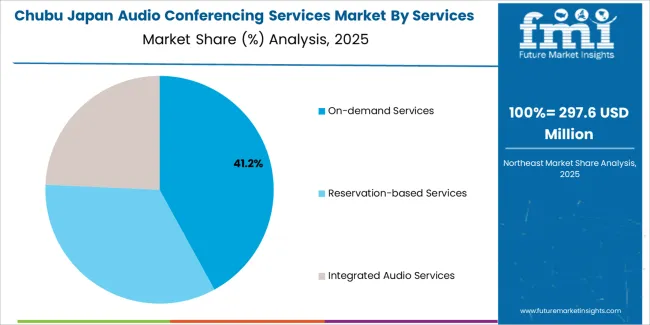

Chubu demonstrates moderate growth in the demand for audio conferencing services with a CAGR of 6.3%. The region, known for its strong industrial sector, including automotive and manufacturing, is increasingly adopting digital communication tools to facilitate remote collaboration, particularly in the wake of the COVID-19 pandemic. While the region’s demand for audio conferencing services is slower compared to more urbanized areas like Kanto and Kyushu & Okinawa, it is steadily growing as businesses realize the benefits of more efficient communication.

As Chubu’s industries modernize and shift toward more digital processes, the demand for audio conferencing services is expected to continue to rise, albeit at a moderate pace. The region’s ongoing focus on improving workplace efficiency and reducing travel costs further supports the growth of these services.

Tohoku, with a CAGR of 5.5%, and the Rest of Japan, with a CAGR of 5.2%, show slower growth in the demand for audio conferencing services. These regions tend to have fewer large-scale industries and a lower concentration of tech companies compared to more developed areas like Kanto and Kyushu & Okinawa. However, as businesses in these regions increasingly recognize the benefits of remote work solutions and digital collaboration tools, the adoption of audio conferencing services is gradually increasing.

The slower growth can be attributed to a combination of factors, including the more traditional approach to communication and the relatively lower levels of digital infrastructure development in comparison to other regions. However, as awareness of the benefits of remote communication tools continues to grow and regional businesses invest in modernizing their communication practices, demand for audio conferencing services is expected to rise at a steady pace.

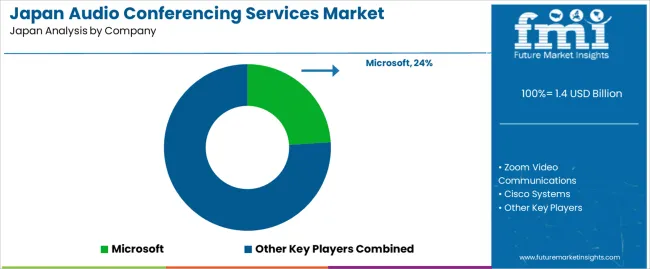

The audio conferencing services industry in Japan is gaining traction as remote work, hybrid work arrangements, and digital collaboration become more widespread. Companies such as Microsoft (holding about 24% market share), Zoom Video Communications, Cisco Systems, Tata Communications, Google Meet, and RingCentral are among the key providers in the market. Japanese businesses increasingly rely on networked voice and video platforms to connect remote teams, engage clients overseas, and support digital workflows. The shift from traditional phone systems to integrated conferencing solutions aligns with the broader move toward digital transformation across industries.

Providers in this industry compete on reliability, user experience, integration, and service coverage. One competitive area is system reliability under heavy traffic and across dispersed user groups, as enterprise users in Japan demand stable platforms during peak usage. Another focus is ease of use and cross platform integration, allowing users to switch from desk phone to mobile or web-based conferencing with minimal friction. A third competitive axis involves localised support and regulatory compliance: firms that offer Japanese language interfaces, local data centres, and strong customer support are better positioned. Product materials commonly highlight features such as latency, codec quality, concurrent connection limits, and security standards (for example encryption and authentication). By tailoring services to the needs of Japanese business users, such as clarity, seamless connectivity, and local service, they aim to maintain or expand their share in Japan’s audio conferencing services industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Enterprise Size | Large Enterprise, Small and Medium Enterprises (SMEs) |

| Services | On-demand Services, Reservation-based Services, Integrated Audio Services |

| End User | IT & Telecom, BFSI (Banking, Financial Services, and Insurance), Education, Healthcare, Government, Retail, Others |

| Key Companies Profiled | Microsoft, Zoom Video Communications, Cisco Systems, Tata Communications, Google Meet, RingCentral |

| Additional Attributes | The market analysis includes dollar sales by enterprise size, service type, and end-user categories. It also covers regional demand trends in Japan, driven by the growing adoption of audio conferencing services for remote communication across industries like IT, telecom, healthcare, and BFSI. The competitive landscape highlights key players focusing on innovations in audio conferencing solutions, particularly in integration with other collaboration tools. Trends in the increasing demand for on-demand and reservation-based services, along with the growing reliance on integrated audio services for seamless communication, are explored. |

The demand for audio conferencing services in japan is estimated to be valued at USD 1.4 billion in 2025.

The market size for the audio conferencing services in japan is projected to reach USD 2.8 billion by 2035.

The demand for audio conferencing services in japan is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in audio conferencing services in japan are large enterprise and small and medium enterprises (smes).

In terms of services, on-demand services segment is expected to command 43.2% share in the audio conferencing services in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Audio Conferencing Services Market Outlook 2025 to 2035

Demand for Audio Conferencing Services in USA Size and Share Forecast Outlook 2025 to 2035

Audiology Services Market Size and Share Forecast Outlook 2025 to 2035

Japan Managed Workplace Services Market Growth – Trends, Demand & Innovations 2025-2035

Japan Wireless Telecommunication Services Market Insights – Demand, Growth & Forecast 2025-2035

Demand for Travel Agency Services in Japan Size and Share Forecast Outlook 2025 to 2035

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Demand for Advanced Mobile UX Design Services in Japan Size and Share Forecast Outlook 2025 to 2035

Audiometer Calibration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Audio Processor Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Audio Power Amplifier IC Market Size and Share Forecast Outlook 2025 to 2035

Audio Communication Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA