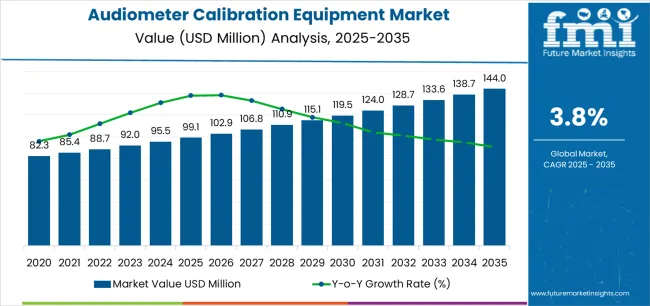

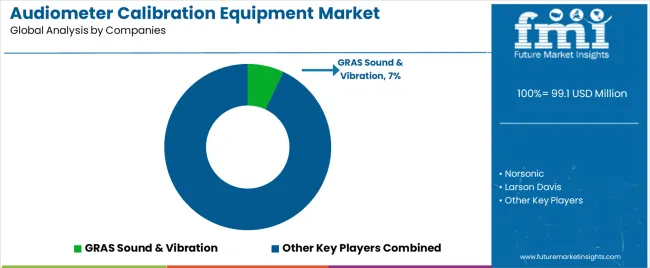

The global audiometer calibration equipment market is expected to be valued at USD 99.1 million in 2025 and reach USD 144.0 million by 2035, registering a CAGR of 3.8%. The rolling CAGR evaluations suggest steady momentum over the decade, supported by consistent upgrades to diagnostic systems and enforcement of international calibration standards in hearing assessment environments. Expansion in hospital audiology units, occupational testing programs, and educational screening centers continues to reinforce baseline demand.

Product development emphasizes integration, portability, and automation. Modern calibration units combine compact hardware with digital interfaces, allowing faster adjustment verification and reduced operator dependency. The inclusion of remote monitoring functions is broadening the practical utility of these systems for multi-site healthcare networks. Manufacturers are also aligning their designs with ISO and ANSI frameworks to ensure traceability across service operations.

Regional trends indicate sustained purchasing activity in North America and Europe, where compliance cycles and accreditation requirements drive predictable replacement demand. Growth in Asia Pacific is more incremental but reflects steady investments in clinical training and local calibration services.

Between 2025 and 2030, the Audiometer Calibration Equipment Market is projected to grow from USD 99.1 million to USD 115.1 million, representing a growth of 16.2% and accounting for 45.7% of the total market expansion expected over the decade. This period will be driven by the increasing emphasis on audiometric accuracy, stringent calibration standards, and expanding adoption of digital calibration systems across audiology clinics and hospitals. The development of automated verification technologies, improved noise measurement precision, and enhanced portability will support efficiency and compliance. Key industry players will focus on integrating advanced software platforms to ensure consistent, real-time calibration results.

From 2030 to 2035, the market is forecast to rise from USD 115.1 million to USD 144.0 million, registering a 25.1% increase and contributing 54.3% of the decade’s total growth. This stage will see a shift toward smart, AI-enabled calibration device that leverage cloud-based data analytics for performance monitoring and predictive maintenance. Growing demand from occupational health sectors, research laboratories, and mobile audiology units will expand market reach. Continuous advancements in acoustic reference standards and international certification protocols will drive adoption, reinforcing product reliability and operational efficiency across global audiology and hearing assessment environments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 99.1 million |

| Market Forecast Value (2035) | USD 144.0 million |

| Forecast CAGR (2025–2035) | 3.8% |

The audiometer calibration equipment market is growing as hearing assessment standards tighten and medical facilities prioritize traceable, high-accuracy testing instruments. Audiometers used in clinical diagnostics, research laboratories, and occupational hearing programs require periodic calibration to ensure consistent performance and compliance with international standards such as IEC 60645 and ANSI S3.6. Calibration equipment capable of delivering controlled acoustic signals and automated verification processes allows service providers to maintain device reliability and patient testing accuracy.

Manufacturers are introducing digital and portable calibration systems that incorporate microprocessor controls, self-diagnostic software, and integrated sound level analysis. These advancements reduce human error and enable faster calibration cycles for multiple audiometer types. Increased investment in audiology infrastructure, particularly across hospital networks and government-supported screening initiatives, contributes to steady product demand. The growing prevalence of age-related and noise-induced hearing loss underscores the need for consistent calibration in both preventive and diagnostic settings. Despite rising adoption, cost and maintenance challenges restrict access to advanced calibration units in smaller practices and low-resource regions. Nonetheless, regulatory pressure to maintain calibrated equipment and the emergence of compact, network-compatible calibration tools continue to define market growth across healthcare, military, and occupational testing environments.

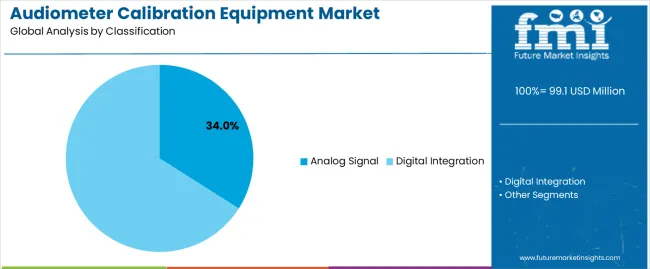

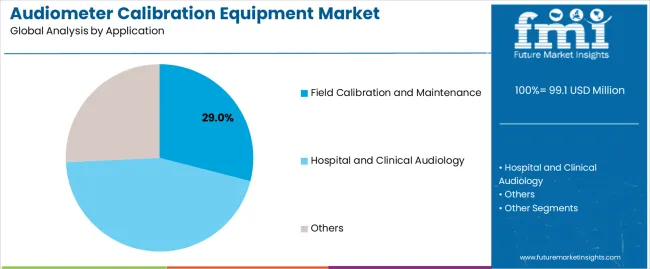

The audiometer calibration equipment market is segmented by classification, application, and region. By classification, the market is divided into analog signal and digital integration systems. Based on application, it is categorized into field calibration and maintenance, hospital and clinical audiology, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments collectively define global distribution and usage trends across institutional and service-based calibration operations.

The analog signal segment accounts for approximately 34.0% of the global audiometer calibration equipment market in 2025, representing the leading classification category. This dominance reflects its continued utility across established clinical environments and field-based calibration programs where analog audiometers remain in service. Analog calibration systems provide reliable performance, simplified configuration, and minimal maintenance requirements, supporting consistent measurement results across varied operating conditions.

Their use remains widespread in diagnostic centers, mobile testing units, and calibration laboratories prioritizing stability and cost efficiency over advanced digital features. Analog equipment offers compatibility with long-standing audiometer models, ensuring continuity of use without extensive system upgrades. Manufacturers continue to supply analog solutions aligned with international calibration standards, maintaining their relevance in both public health and industrial hearing assessment contexts. While digital integration technologies are expanding due to enhanced automation and data management capabilities, analog systems sustain strong adoption in resource-constrained markets and service operations requiring durable, field-ready calibration tools. This segment’s reliability and operational simplicity underpin its ongoing dominance within the global calibration equipment landscape.

The field calibration and maintenance segment represents about 29.0% of the total audiometer calibration equipment market in 2025, making it the leading application category. Its prominence is driven by the rising need for portable calibration systems that ensure device accuracy outside permanent laboratory settings. Field calibration activities are essential to maintain performance standards for audiometers used in occupational health, education, and community hearing programs.

Portable calibration systems enable compliance with established international standards such as ISO 8253 and ANSI S3.6, facilitating regular verification with minimal downtime. The segment benefits from growing demand among mobile service providers and regional testing organizations conducting large-scale hearing assessments. As regulatory emphasis on traceable calibration and quality assurance increases, institutions invest in compact and efficient devices designed for routine field use. The versatility and ease of deployment of these systems contribute to stable global adoption, particularly across North America and Europe, where preventive maintenance programs are well established. The field calibration and maintenance segment remains central to market demand, supporting consistent audiometric performance verification across public health and clinical environments worldwide.

The audiometer calibration equipment market is expanding as clinics, hospitals, and occupational-health providers increase use of audiometry devices and must ensure measurement accuracy. Growing prevalence of hearing impairment, stricter regulatory requirements for audiometric testing and rising demand for mobile and remote diagnostics support market growth. On the other hand, high equipment cost, need for skilled operators and variable infrastructure in lower-income regions restrain adoption. The market is trending toward automated calibration systems, portable units and digital connectivity, allowing easier deployment in field, industrial and tele-audiology contexts.

One major driver is the combination of increased hearing-loss incidence and regulatory mandates for audiometric testing and equipment calibration. Healthcare facilities treating age-related hearing disorder, noise-induced hearing loss or newborn screening use audiometers that must be regularly calibrated to maintain accuracy. Industrial workplaces monitoring employee hearing under noise-exposure rules also demand calibrated audiometric equipment. This upstream demand for calibrated devices ensures calibration-equipment uptake. Additionally, as audiometry moves to portable and remote formats, calibration systems become necessary across new settings further increasing market volume.

High initial cost and operational complexity restrict broader adoption of audiometer calibration equipment. Advanced calibration systems often require precision components, certified labs or trained technicians, raising total cost of ownership. Smaller clinics or sites in developing regions may lack budgets, technical staff or supporting infrastructure. Furthermore, competition from basic or less-frequently calibrated devices reduces perceived urgency among some users. These conditions slow penetration in cost-sensitive or under-resourced markets despite strong underlying demand for accurate audiometry.

A key trend is the shift toward automation, portability and digital connectivity in calibration systems. Manufacturers are offering calibration units with automated test-routines, cloud-based tracking of calibration history and portable field-kits for on-site use. These developments support mobile audiometry, remote clinics and industrial health-monitoring programs. Modular calibration systems and service-based models (for example, calibration as a managed service) are also emerging. As remote hearing-care and tele-audiology grow, calibration equipment that supports these models is increasingly in demand.

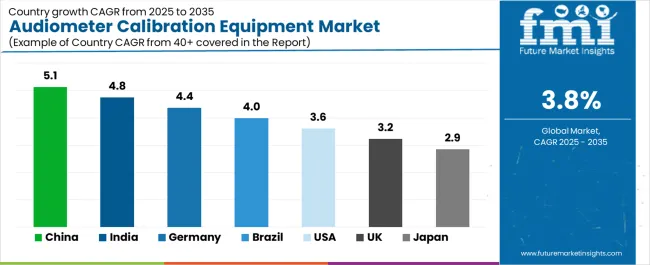

| Country | CAGR (%) |

|---|---|

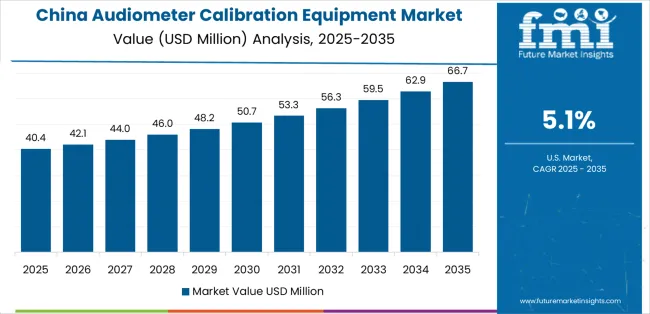

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| Brazil | 4.0% |

| USA | 3.6% |

| UK | 3.2% |

| Japan | 2.9% |

The audiometer calibration equipment market is advancing steadily worldwide, with China leading at a 5.1% CAGR through 2035, fueled by the expansion of audiological testing infrastructure, domestic manufacturing, and rising healthcare investments. India follows with 4.8%, supported by growing awareness of hearing diagnostics, increased ENT facilities, and government-backed healthcare programs. Germany posts a 4.4% CAGR, driven by technological innovation and integration of precision calibration systems. Brazil records 4.0%, reflecting improving access to healthcare and modernized audiometric centers. The USA, at 3.6%, remains a mature market emphasizing innovation, compliance, and portable calibration tools. The UK (3.2%) and Japan (2.9%) show consistent progress through process standardization, R&D collaborations, and advanced testing device optimization.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from audiometer calibration equipment in China is projected to grow at a CAGR of 5.1% through 2035, supported by the expansion of diagnostic infrastructure and steady growth in audiology service facilities. Government initiatives to modernize healthcare testing environments are increasing procurement of calibration devices across hospitals, research laboratories, and hearing centers. Domestic manufacturers are improving precision standards and compliance with international certification. Rising investment in audiology training and community hearing programs is strengthening equipment utilization.

Revenue from audiometer calibration equipment in India is increasing at a CAGR of 4.8%, driven by the modernization of diagnostic laboratories and establishment of audiology programs across educational and clinical institutions. Expanding public healthcare infrastructure and government-led hearing screening initiatives are generating consistent demand. Importers and local distributors are focusing on portable, easy-to-calibrate systems suitable for regional service centers. Investment in medical device manufacturing under national development programs is improving product availability.

Revenue from audiometer calibration equipment in Germany is advancing at a CAGR of 4.4%, supported by the country’s strong engineering base and established medical device calibration standards. Hospitals, universities, and industrial laboratories maintain high adoption of advanced calibration instruments to ensure testing accuracy and compliance with European regulations. Manufacturers emphasize precision measurement, digital integration, and automation. Continued development of sound measurement technologies supports replacement and system upgrades.

Revenue from audiometer calibration equipment in Brazil is projected to grow at a CAGR of 4.0%, supported by government investment in hearing healthcare and diagnostic capacity. Expansion of hospital infrastructure and community-based hearing programs are creating demand for portable calibration systems. Private clinics and research facilities are adopting advanced calibration tools to meet procedural and accuracy requirements. Partnerships between international suppliers and local distributors are improving product access and technical training.

Revenue from audiometer calibration equipment in the United States is expanding at a CAGR of 3.6%, supported by stringent regulatory frameworks governing medical device calibration and testing accuracy. Healthcare facilities, research organizations, and military institutions maintain regular calibration schedules in compliance with national standards. Demand for automated, software-integrated calibration systems is increasing as part of broader digital health infrastructure modernization.

Revenue from audiometer calibration equipment in the United Kingdom is increasing at a CAGR of 3.2%, supported by standardized calibration practices within the National Health Service and private healthcare networks. Consistent emphasis on equipment certification and periodic verification maintains steady product turnover. Research institutions continue to apply calibration systems in clinical acoustics studies and device validation. Importers and service providers are maintaining stable supply chains through established European distribution channels.

Revenue from audiometer calibration equipment in Japan is growing at a CAGR of 2.9%, supported by precision engineering, strong regulatory oversight, and established audiology practices. Hospitals, research facilities, and medical device manufacturers use calibration systems to ensure measurement accuracy across clinical and industrial applications. Domestic companies prioritize miniaturized, efficient, and stable calibration technologies. Market growth remains steady through ongoing product refinement and institutional compliance requirements.

The global audiometer calibration equipment market is characterized by diversified competition among acoustic measurement specialists, audiometric system developers, and laboratory calibration providers. GRAS Sound & Vibration occupies a leading position through its portfolio of precision calibration devices and reference microphones designed for clinical and industrial testing. Norsonic and Larson Davis maintain strong competitive standings by focusing on integrated sound level and calibration systems with traceable accuracy for audiometric verification.

Aussco and Kiversal emphasize portable calibration units tailored for hearing healthcare and diagnostic facilities, supporting compliance with international acoustic standards. Brüel & Kjær continues to serve as a benchmark in sound measurement technology, complementing the broader HBK group’s acoustic instrumentation range. Tremetrics and Grason-Stadler supply calibration-enabled audiometric systems used in occupational hearing testing and medical diagnostics.

Benson Medical and Hangzhou AIHUA Instruments Co., Ltd. focus on practical calibration tools and regional manufacturing strength in the Asia–Pacific market. Listen, Inc. and NTi Audio develop digital calibration platforms that integrate measurement software and hardware automation. Precision Acoustics and PCB Piezotronics provide laboratory-grade calibration reference devices supporting research and metrology applications. Svantek and Frye Electronics target specific industrial and clinical segments, while Rion Co., Ltd. sustains a steady presence in portable acoustic calibration solutions across Asian markets. Competition in this sector is defined by precision, calibration repeatability, and adherence to international audiometric standards, while future differentiation depends on digital signal integration, miniaturization, and automated verification capabilities.

| GRAS Sound & Vibration |

|---|

| Norsonic |

| Larson Davis |

| Aussco |

| Kiversal |

| Brüel & Kjær |

| Tremetrics |

| Grason-Stadler |

| Benson Medical |

| Hangzhou AIHUA Instruments Co., Ltd. |

| Listen, Inc. |

| NTi Audio |

| Precision Acoustics |

| PCB Piezotronics |

| Svantek |

| Frye Electronics |

| Rion Co., Ltd. |

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type (Classification) | Analog Signal, Digital Integration |

| Application | Field Calibration and Maintenance, Hospital and Clinical Audiology, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | GRAS Sound & Vibration, Norsonic, Larson Davis, Aussco, Kiversal, Brüel & Kjær, Tremetrics, Grason-Stadler, Benson Medical, Hangzhou AIHUA Instruments Co. Ltd., Listen Inc., NTi Audio, Precision Acoustics, PCB Piezotronics, Svantek, Frye Electronics, Rion Co. Ltd. |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across East Asia, Europe, and North America; competitive landscape involving calibration equipment manufacturers, audiometric technology providers, and research laboratories; assessment of precision engineering, digital signal integration, and automation trends; analysis of cost barriers, regulatory frameworks, and tele-audiology integration shaping equipment deployment. |

The global audiometer calibration equipment market is estimated to be valued at USD 99.1 million in 2025.

The market size for the audiometer calibration equipment market is projected to reach USD 144.0 million by 2035.

The audiometer calibration equipment market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in audiometer calibration equipment market are analog signal and digital integration.

In terms of application, field calibration and maintenance segment to command 29.0% share in the audiometer calibration equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calibration Management Software Market Size and Share Forecast Outlook 2025 to 2035

ADAS Calibration-as-a-Service Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ADAS Calibration Equipment Market Growth – Innovations, Trends & Forecast 2025 to 2035

Instrument Calibration Services Market Size and Share Forecast Outlook 2025 to 2035

Finger Blood Calibration Free Glucose Meter Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA