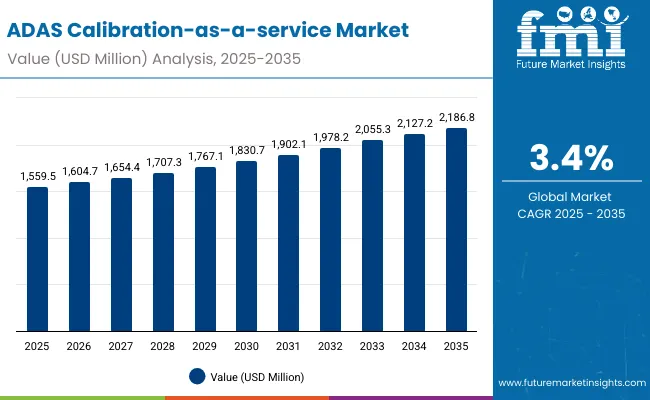

The ADAS calibration-as-a-service market is projected to grow from USD 1,559.5 million in 2025 to approximately USD 2,186.8 million by 2035, recording an absolute increase of USD 627.3 million over the forecast period. This translates into a total growth of 40.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.4% between 2025 and 2035. The overall market size is expected to grow by nearly 1.40X during the same period, supported by the rising adoption of advanced driver assistance systems and increasing demand for specialized calibration services following vehicle repairs and maintenance.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,559.5 million |

| Industry Value (2035F) | USD 2,186.8 million |

| CAGR (2025 to 2035) | 3.4% |

Between 2025 and 2030, the ADAS Calibration-as-a-Service market is projected to expand from USD 1,559.5 million to USD 1,830.7 million, resulting in a value increase of USD 271.2 million, which represents 43.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of ADAS-equipped vehicles in global automotive fleets, increasing collision repair activities requiring post-repair calibration, and growing awareness among vehicle owners about the importance of proper ADAS functionality. Service providers are expanding their calibration capabilities to address the growing complexity of modern vehicle sensor systems.

From 2030 to 2035, the market is forecast to grow from USD 1,830.7 million to USD 2,186.8 million, adding another USD 356.1 million, which constitutes 56.8% of the overall ten-year expansion. This period is expected to be characterized by expansion of mobile calibration services, integration of advanced diagnostic equipment, and development of standardized calibration protocols across different vehicle manufacturers. The growing adoption of Level 3 and Level 4 autonomous vehicles will drive demand for more sophisticated calibration services and specialized technical expertise.

Between 2020 and 2025, the ADAS Calibration-as-a-Service market experienced steady expansion, driven by increasing ADAS adoption rates in new vehicle sales and growing awareness of calibration requirements following windshield replacements and collision repairs. The market developed as automotive repair facilities recognized the need for specialized equipment and training to properly service ADAS-equipped vehicles. Insurance companies and vehicle manufacturers began emphasizing proper calibration procedures to maintain vehicle safety systems and warranty coverage.

Market expansion is being supported by the rapid increase in ADAS-equipped vehicles on roads worldwide and the corresponding need for specialized calibration services after repairs, maintenance, or component replacement. Modern vehicles rely on precise sensor alignment and calibration to ensure proper functioning of safety systems including automatic emergency braking, lane keeping assistance, and adaptive cruise control. Even minor adjustments or replacements can require comprehensive recalibration to maintain optimal system performance and vehicle safety.

The growing complexity of ADAS technologies and increasing liability concerns are driving demand for professional calibration services from certified providers with appropriate equipment and expertise. Insurance companies are increasingly requiring proper calibration documentation following repairs to maintain coverage and ensure vehicle safety compliance. Regulatory requirements and vehicle manufacturer specifications are establishing standardized calibration procedures that require specialized tools and trained technicians.

The market is segmented by calibration type, vehicle class, provider type, commercial model, and region. By calibration type, the market is divided into static (target-based), dynamic (drive-in), and hybrid/mobile setups. Based on vehicle class, the market is categorized into passenger cars, light commercial vehicles, and heavy commercial vehicles/buses. In terms of provider type, the market is segmented into specialized centers, collision centers, OEM dealerships, and mobile specialists. By commercial model, the market is classified into per-job pricing, fleet service level agreements, and OEM bundled. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

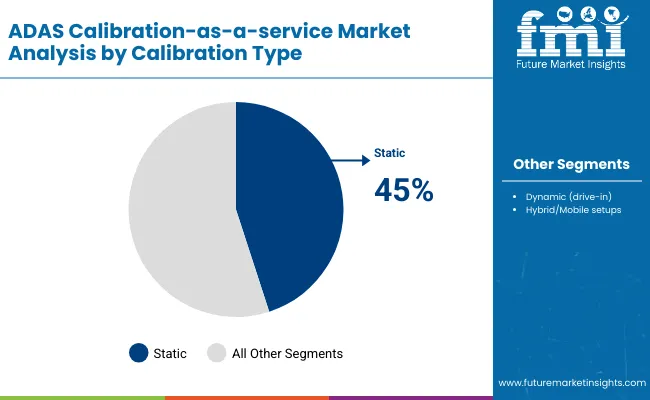

Static (target-based) calibration is projected to account for 45% of the ADAS Calibration-as-a-Service market in 2025. This leading share is supported by the widespread adoption of this calibration method for camera-based ADAS systems, which represent the majority of current vehicle safety technologies. Static calibration provides precise alignment using specialized targets and controlled environments, making it the preferred method for most windshield-mounted cameras and radar sensors. The segment benefits from established calibration procedures and comprehensive equipment availability from multiple suppliers.

The static calibration approach offers several advantages including consistent results, reduced variability in calibration outcomes, and compatibility with existing workshop infrastructure. Service providers prefer this method due to its controlled environment requirements and ability to achieve precise sensor alignment without road testing. The technology supports various ADAS components including forward collision warning systems, lane departure warning systems, and automatic emergency braking systems. Market growth in this segment is driven by increasing adoption of camera-based safety systems in passenger vehicles and expanding collision repair activities requiring windshield-mounted sensor recalibration.

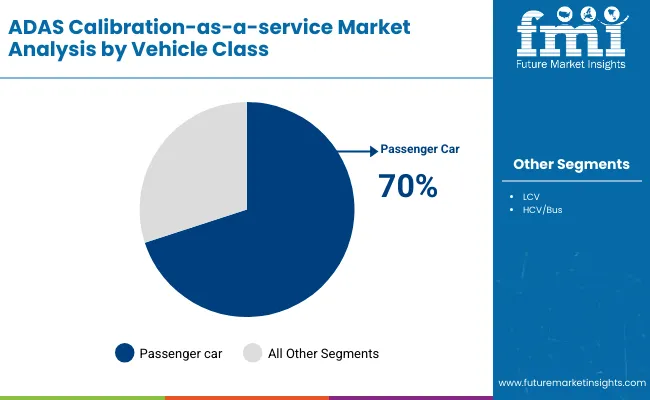

Passenger cars are expected to represent 70% of ADAS calibration service demand in 2025. This dominant share reflects the high penetration of ADAS technologies in the consumer vehicle segment and the large population of passenger vehicles requiring calibration services. Modern passenger cars increasingly feature multiple ADAS systems that require coordinated calibration following repairs or maintenance activities. The segment benefits from growing consumer awareness of ADAS functionality and increasing insurance requirements for proper calibration documentation.

The passenger car segment encompasses various vehicle types including sedans, SUVs, crossovers, and hatchbacks, all increasingly equipped with advanced safety systems. These vehicles typically feature forward-facing cameras, radar sensors, and ultrasonic sensors that require precise calibration to function properly. Consumer demand for safety features and regulatory mandates for advanced safety systems are driving ADAS adoption in this segment. Service providers focus on passenger car calibration due to the high volume of vehicles, frequent service requirements, and established repair infrastructure supporting consumer vehicle maintenance and collision repair activities.

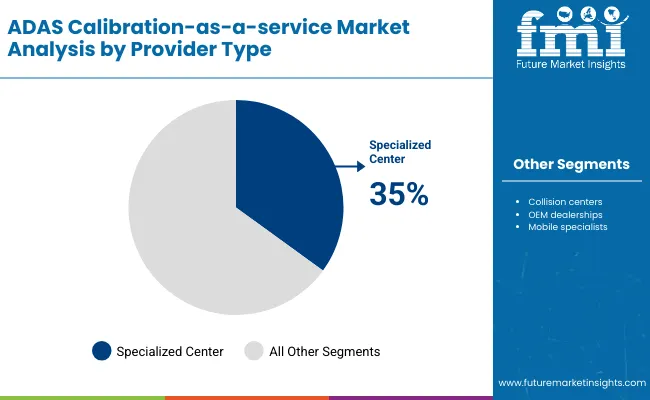

Specialized centers are projected to contribute 35% of the market in 2025, representing dedicated facilities focused exclusively on ADAS calibration services. These providers offer comprehensive calibration capabilities, specialized equipment, and trained technicians specifically for ADAS systems. Specialized centers typically serve multiple vehicle brands and maintain up-to-date calibration procedures and equipment. The segment is supported by growing demand for expert calibration services and the complexity of modern vehicle sensor systems.

Specialized calibration centers provide several advantages including dedicated equipment, technical expertise, and standardized procedures across different vehicle manufacturers. These facilities invest in advanced calibration technology and maintain certifications for various ADAS systems. The centers offer both static and dynamic calibration services, supporting comprehensive vehicle safety system requirements. Market expansion in this segment reflects increasing recognition of calibration complexity and the need for specialized technical capabilities beyond traditional automotive repair facilities.

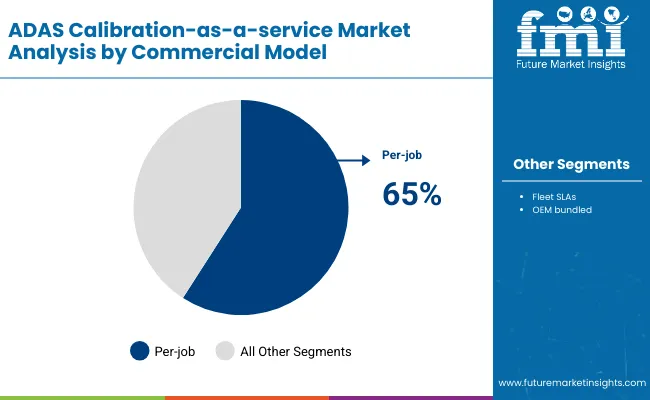

Per-job commercial models are estimated to hold 65% of the market share in 2025. This dominance reflects the project-based nature of most calibration services and customer preference for transparent, service-specific pricing. Individual vehicle owners and collision repair facilities typically prefer per-job pricing that allows cost control and service customization based on specific vehicle requirements. The model provides flexibility for both service providers and customers while supporting diverse calibration service needs.

The per-job pricing model offers several benefits including cost transparency, service customization, and payment flexibility for customers. This approach allows service providers to adjust pricing based on calibration complexity, vehicle type, and specific ADAS systems requiring attention. The model supports both individual consumers and business customers seeking calibration services without long-term commitments. Market growth in this segment is driven by diverse customer needs, varying calibration requirements, and preference for transparent pricing structures that allow customers to understand service costs and requirements.

The ADAS Calibration-as-a-Service market is primarily propelled by the accelerating adoption of advanced driver-assistance systems across both passenger and commercial vehicles. Modern vehicles equipped with sensors, cameras, radar, and LiDAR require highly precise calibration to ensure safety-critical features such as lane-keeping assist, adaptive cruise control, collision avoidance, and emergency braking operate as intended. Every time a vehicle undergoes repair, windshield replacement, or bodywork, recalibration is mandatory creating recurring demand for calibration services.

Rising regulatory pressure for stricter road safety standards in Europe, North America, and parts of Asia further strengthens this demand, as failure to calibrate can result in system errors, increased accident risk, and liability for repair facilities. The growing size of connected fleets also drives steady volumes, as operators seek routine, accurate calibration to minimize downtime and enhance driver safety. Moreover, consumer awareness around ADAS reliability is rising, and customers are increasingly viewing calibration not as an optional add-on but as an essential post-repair service.

Despite strong growth drivers, the market faces significant hurdles. High costs of advanced calibration equipment especially those supporting LiDAR, multi-mode radar, and next-generation camera systems remain a barrier for smaller workshops and independent service providers. These systems demand not only capital investment but also regular updates and licensing for OEM-specific software, raising the financial burden.

Another critical restraint is the skill gap. Technicians need continuous training to handle evolving calibration protocols, vehicle platforms, and diagnostic requirements. With each OEM prescribing its own standards, lack of harmonization makes cross-platform servicing complex and time-consuming. This absence of universal standardization often deters independent workshops from competing with OEM-authorized centers. Finally, service quality inconsistency across providers erodes customer trust in non-certified players, limiting adoption outside major urban hubs.

A defining trend is the rapid rise of mobile calibration services. Instead of requiring customers to bring vehicles to specialized centers, service providers are deploying portable calibration units to collision repair shops, glass replacement facilities, fleet yards, and even customer homes. This model dramatically reduces vehicle downtime, offers logistical convenience, and extends the provider’s service reach. Fleet operators, in particular, value the ability to calibrate multiple vehicles onsite without incurring transportation delays, making mobile calibration an attractive business model for scaling providers.

Another pivotal trend is the integration of next-generation diagnostic and calibration tools. Service providers are investing in automated, camera-guided calibration rigs that improve precision while reducing labor intensity. Cloud-based calibration databases and AI-powered diagnostic software are enabling real-time updates, remote assistance, and streamlined documentation, ensuring compliance with both OEM guidelines and regulatory requirements. Importantly, these tools are being designed to handle emerging ADAS components such as LiDAR-based perception and multi-frequency radar systems, future-proofing service portfolios.

As a result, providers that integrate automation, cloud connectivity, and predictive diagnostics are gaining competitive advantage by delivering faster, more reliable, and fully documented calibration services strengthening both customer trust and scalability.

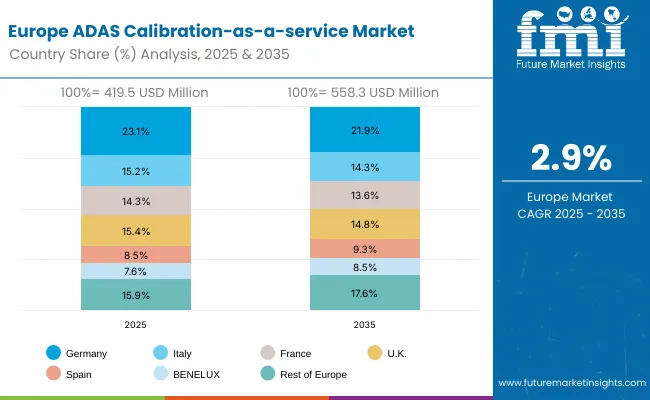

The ADAS Calibration-as-a-Service market in Europe is projected to grow from USD 419.5 million in 2025 to USD 558.3 million by 2035, registering a CAGR of 2.9% over the forecast period. Germany is expected to maintain its leadership despite a slight reduction in share from 23.1% in 2025 to 21.9% by 2035, supported by its expansive automotive service ecosystem and Tier-1 supplier network. The Rest of Europe region is projected to gain ground, expanding its share from 15.9% to 17.6%, attributed to rising calibration mandates in Eastern and Nordic regions. BENELUX and Spain will also see minor gains, while France, the UK, and Italy show marginal declines, likely due to mature calibration infrastructure and slower growth in ADAS retrofitting centers.

Static (target-based) calibration dominates the European ADAS calibration-as-a-service market with a 48% share in 2025, higher than the global average due to established workshop infrastructure and preference for controlled calibration environments. Dynamic (drive-in) calibration accounts for 32% of the market, particularly popular in Germany and Nordic countries where extensive test tracks and driving facilities support this method. Hybrid/mobile setups represent 20% of the European market, with growing adoption in the UK and France where mobile service convenience appeals to both consumers and fleet operators.

Passenger cars dominate the European market with a 72% share in 2025, slightly above the global average due to high ADAS penetration in European vehicle fleets and stringent safety regulations. Light commercial vehicles account for 21% of the market, driven by growing e-commerce and last-mile delivery requirements in urban centers. Heavy commercial vehicles and buses represent 7% of the market, with significant growth potential as commercial fleet operators increasingly adopt advanced safety systems to comply with European Union safety mandates.

Specialized centers hold a 38% share in the European market, reflecting the region's emphasis on technical expertise and standardized service quality. OEM dealerships account for 28% of the market, higher than global averages due to strong manufacturer networks and customer loyalty to authorized service providers. Collision centers represent 24% of the market, while mobile specialists account for 10%, with growth concentrated in urban areas where convenience and efficiency are prioritized by customers.

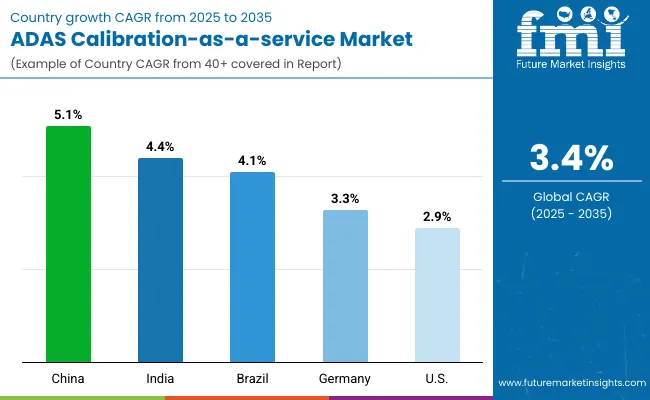

The ADAS calibration-as-a-service market is growing rapidly, with China leading at a 5.1% CAGR through 2035, driven by strong ADAS adoption, government mandates, and expanding calibration networks. India follows at 4.4%, supported by rising ADAS penetration in premium and mid-segment vehicles and increasing certified service availability. Brazil grows steadily at 4.1%, integrating calibration into its established repair industry. Germany records 3.3%, emphasizing precision, quality standards, and advanced expertise. The USA shows the slowest growth at 2.9%, focusing on accessibility, standardization, and insurance-backed compliance. Overall, China and India emerge as the leading drivers of global ADAS calibration market expansion.

Revenue from ADAS calibration-as-a-service in China is projected to exhibit the highest growth rate with a CAGR of 5.1% through 2035, driven by rapid adoption of ADAS technologies in domestic vehicle production and increasing consumer demand for advanced safety features. The country's expanding automotive aftermarket and growing collision repair industry are creating significant demand for calibration services. Major automotive manufacturers and service providers are establishing comprehensive calibration networks to support the growing population of ADAS-equipped vehicles across urban and rural markets. The Chinese government's commitment to automotive safety regulations and smart vehicle development is accelerating ADAS adoption across all vehicle segments. Domestic vehicle manufacturers are integrating advanced safety systems as standard equipment, while international brands are expanding ADAS offerings to remain competitive in the world's largest automotive market.

Revenue from ADAS calibration-as-a-service in India is expanding at a CAGR of 4.4%, supported by increasing ADAS penetration in premium and mid-segment vehicles and growing awareness of calibration service requirements. The country's expanding automotive aftermarket and increasing collision repair activities are driving demand for professional calibration services. Authorized service centers and specialized calibration facilities are gradually establishing capabilities to serve the growing population of ADAS-equipped vehicles. The Indian automotive industry is experiencing rapid modernization with domestic manufacturers adopting advanced safety systems to meet evolving consumer expectations and regulatory requirements. International automotive brands are introducing ADAS-equipped vehicles across multiple price segments, creating diverse calibration service opportunities for local service providers.

Static (target-based) calibration holds a 42% share in the Japanese ADAS calibration-as-a-service market in 2025, reflecting the country's emphasis on precision and controlled calibration environments. Dynamic (drive-in) calibration accounts for 35% of the market, supported by Japan's advanced automotive technology infrastructure and extensive testing facilities. Hybrid/mobile setups represent 23% of the Japanese market, with significant adoption in urban areas where space constraints and convenience factors drive mobile service preference among consumers and fleet operators.

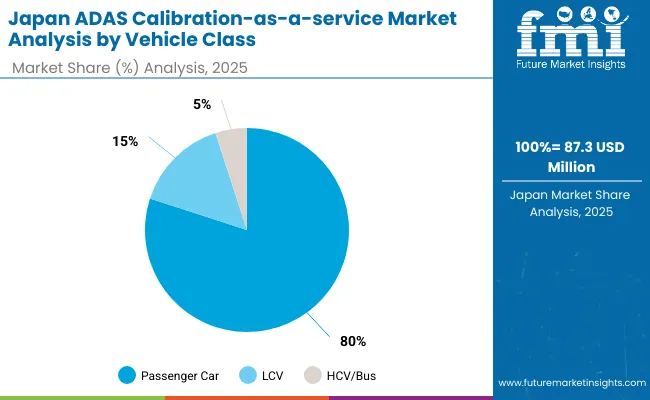

Passenger cars command an 80% share of the Japanese ADAS calibration-as-a-service market in 2025, the highest among major markets due to the country's mature passenger vehicle fleet and comprehensive ADAS adoption across all vehicle segments. Light commercial vehicles account for 15% of the market, driven by efficient urban logistics and delivery systems that increasingly incorporate advanced safety technologies. Heavy commercial vehicles and buses represent 5% of the market, with steady growth as commercial operators adopt ADAS systems to enhance fleet safety and operational efficiency.

OEM dealerships dominate the Japanese market with a 45% share, reflecting strong customer loyalty to manufacturer-authorized service providers and emphasis on technical precision and quality standards. Specialized centers account for 30% of the market, focusing on multi-brand service capabilities and advanced calibration technologies. Collision centers represent 20% of the market, while mobile specialists hold 5%, with growth potential in urban areas where convenience and efficiency are increasingly valued by customers seeking calibration services.

The ADAS calibration-as-a-service market is defined by competition among specialized service providers, collision repair networks, and automotive aftermarket companies. Companies are investing in advanced calibration equipment, mobile service capabilities, standardized procedures, and technician training to deliver precise, reliable, and cost-effective calibration solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening service portfolios and market presence.

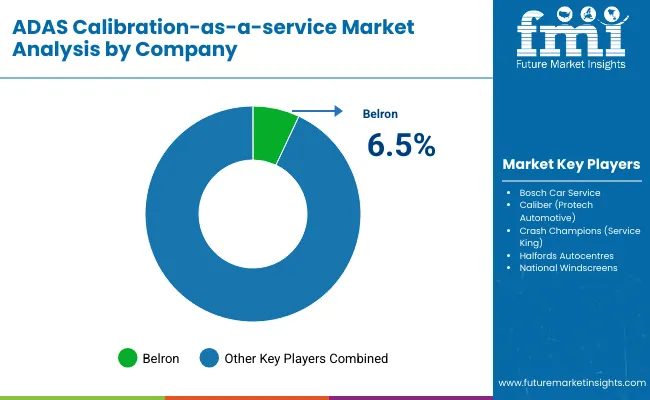

ABRA/Driven Brands (Glass America), USA-based, offers mobile and workshop-based ADAS calibration services with a focus on precision, speed, and technician expertise. Belron (Safelite/Autoglass/Carglass), operating globally, provides comprehensive calibration solutions integrated with automotive glass repair and replacement services. Bosch Car Service, Germany, delivers technologically advanced calibration services with standardized procedures and digital integration. Caliber (Protech Automotive), USA, emphasizes mobile service and nationwide coverage for collision repair centers.

Crash Champions (Service King), USA, offers calibration solutions integrated into full-service automotive repair operations. Halfords Autocentres, UK, provides workshop-based ADAS services with trained technicians. National Windscreens, UK, delivers calibration alongside windshield repair and replacement. Opus IVS, PG Glass (Belron SA), and Repco Authorised Service offer specialized calibration expertise, standardized procedures, and service reliability across global and regional networks.

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Calibration Type | Static (Target-based), Dynamic (Drive-in), Hybrid/Mobile Setups |

| Vehicle Class | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles/Buses |

| Provider Type | Specialized Centers, Collision Centers, OEM Dealerships, Mobile Specialists |

| Commercial Model | Per-job Pricing, Fleet Service Level Agreements, OEM Bundled |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | ABRA/Driven Brands (Glass America), Belron (Safelite / Autoglass / Carglass), Bosch Car Service, Caliber (Protech Automotive), Crash Champions (Service King), Halfords Autocentres, National Windscreens, Opus IVS, PG Glass (Belron SA), Repco Authorised Service |

| Additional Attributes | Dollar sales by calibration type, vehicle class, provider type, and commercial model, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established service providers and emerging mobile specialists, customer preferences for static versus dynamic calibration methods, integration with advanced diagnostic equipment and cloud-based calibration databases, innovations in mobile calibration units and portable equipment capabilities, and adoption of standardized calibration protocols and certification programs for enhanced service quality and technical consistency. |

By North America

By Europe

By East Asia

By South Asia & Pacific

By Latin America

By Middle East & Africa

The global ADAS calibration-as-a-service market is valued at USD 1,559.5 million in 2025.

The size for the ADAS calibration-as-a-service market is projected to reach USD 2,186.8 million by 2035.

The ADAS calibration-as-a-service market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key calibration type segments in the ADAS calibration-as-a-service market are static (target-based), dynamic (drive-in), and hybrid/mobile setups.

In terms of calibration type, static (target-based) segment is set to command 45.0% share in the ADAS calibration-as-a-service market in 2025.

In terms of vehicle class, passenger cars segment is set to command 70.0% share in the ADAS calibration-as-a-service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ADAS Calibration Equipment Market Growth – Innovations, Trends & Forecast 2025 to 2035

ADAS Sensors Market Growth - Trends & Forecast 2025 to 2035

ADAS Market Growth - Trends & Forecast 2025 to 2035

Passenger Vehicle ADAS Market Size and Share Forecast Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA