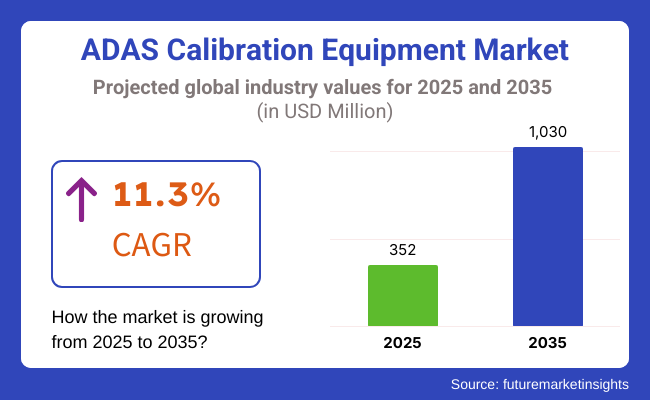

The global ADAS (Advanced Driver-Assistance Systems) calibration equipment market is projected to expand significantly from USD 352 million in 2025 to USD 1,030 million by 2035, registering a CAGR of 11.3% during the forecast period.

This robust growth reflects the accelerating integration of ADAS technologies across both passenger and commercial vehicles, with the United States, Germany, Japan, and South Korea emerging as the leading markets.

Carbon reduction initiatives, electrification of vehicles, and government mandates on automotive safety features are reinforcing the adoption of calibration solutions. Among equipment types, optical and radar-based calibration systems are gaining traction due to their compatibility with multiple sensor formats.

The core demand driver for ADAS calibration equipment lies in the need for precise, reliable sensor alignment across systems like collision avoidance, lane-keeping assistance, and adaptive cruise control. As ADAS features become standard in newer vehicles, both OEMs and aftermarket service centers are investing in advanced calibration tools to ensure these systems function as intended.

Enhanced vehicle safety requirements and consumer preference for driver-assist features are creating steady calibration demand post-manufacture, especially after windshield replacement, suspension upgrades, or minor collisions-all of which affect sensor accuracy.

>

>

Looking ahead, several forward-looking trends are shaping the trajectory of the ADAS calibration equipment landscape. AI-driven diagnostics, cloud-based calibration data management, and mobile calibration units are transforming traditional workflows, enabling faster, off-site, and more scalable solutions.

Additionally, the rise of electric vehicles and fully autonomous platforms is heightening the need for high-precision tools capable of handling complex multi-sensor environments. Strategic collaborations between OEMs and tool manufacturers are further accelerating innovation, allowing for greater calibration automation and integration across vehicle platforms.

The electrical testing services market is segmented by vehicle type, end user, and region. By vehicle type, the market includes passenger vehicles and commercial vehicles. In terms of end user, the key segments are automotive OEMs, Tier 1 suppliers, and service stations. Regionally, the market is divided into North America, Latin America, Europe, South Asia, East Asia, Oceania, and MEA (Middle East & Africa), following the same historical and projected timeline.

The passenger vehicles are expected to grow at a CAGR of 6.3% and are projected to account for approximately 58.3% of the market revenue share. Passenger vehicles are expected to experience the fastest growth due to rising consumer demand for advanced safety systems, electric powertrains, and infotainment features all of which require rigorous electrical testing.

The increasing adoption of EVs in the passenger segment is further fueling the demand for high-frequency testing of batteries, charging infrastructure, and power distribution systems. Additionally, as OEMs in this segment shift toward software-defined vehicles, the dependency on precise and regular electrical diagnostics has surged. In contrast, the commercial vehicles segment will see comparatively slower growth, constrained by longer vehicle life cycles and lower electrification rates, especially in developing economies.

| Vehicle Segment | Share (2025) |

|---|---|

| Passenger Vehicles | 58.3% |

The automotive OEMs segment is the most lucrative, expanding at a robust CAGR of 11.3% between 2025 and 2035. OEMs are increasingly investing in end-to-end electrical diagnostics during vehicle development, system validation, and quality assurance stages, particularly as vehicle architectures grow more complex and electrification accelerates.

The rise of EV platforms with high-voltage battery systems, advanced driver assistance systems (ADAS), and connected car modules mandates comprehensive electrical testing throughout the production lifecycle. On average, an OEM vehicle line undergoes over 40 distinct electrical test procedures per development cycle, creating sustained, high-volume service demand.

In contrast, Tier 1 suppliers, while critical to the component testing ecosystem, generally operate under cost-optimization constraints and depend on OEM-initiated testing contracts. Service stations, particularly in emerging markets, are more reactive and fragmented, offering lower testing standardization and smaller contract values. While their footprint is wide, their contribution to high-value, structured testing contracts remains limited in comparison to OEMs.

| End User Segment | CAGR (2025 to 2035) |

|---|---|

| Automotive OEMs | 11.3% |

Demand for the calibration equipment and services for ADAS is driven by the globally varying ADAS calibration regulations. The NHTSA has imposed stricter rates in North America, and automatic emergency braking (AEB) will be mandatory in all new vehicles in the region in 2027, placing greater demands on the accuracy of ADAS calibration.

The same goes for the European Union, where vehicles must meet Euro NCAP and General Safety Regulation (GSR) that enforce the likes of lane-keeping assist, adaptive cruise control, and blind-spot detection, thus making vehicle calibration to ensure compliance an absolute must.

China’s GB/T standards set rigid ADAS testing protocols that vehicles must meet to demonstrate that their systems achieve performance levels, while Japan’s MLIT maintains strict ADAS safety regulations as part of the country’s leap forward in autonomous driving technologies.

In contrast, India, South America and the Middle East have less-stringent restrictions. India’s AIS 140 standard does establish rules covering vehicle tracking and emergency response systems, but regulations around advanced driver assistance systems remain limited, impeding widespread adoption of calibration. In developed economies, fortunes may be reversed, as road safety initiatives will be more stringent, and ADAS compliance more rigorous in emerging economies.

Increased global ADAS regulations and the need for accurate calibration tools have helped improve demand in repair and service centers. AI-powered diagnostics and automated testing are changing that paradigm, ensuring ADAS sensors are calibrated properly. Because government regulations are increasingly requiring calibration following the repair of these devices, it is more important for companies to expand their range of technology to ensure they are in compliance with these changing regulations.

| Region | Regulation Stringency |

|---|---|

| North America (USA & Canada) | High - Mandatory ADAS compliance, strict safety norms, and regular calibration requirements. |

| European Union (EU) | High - Euro NCAP and GSR enforce stringent ADAS regulations and frequent calibration mandates. |

| China | High - GB/T standards require comprehensive ADAS compliance and testing protocols. |

| Japan | High - MLIT enforces ADAS safety regulations with stringent calibration procedures. |

| India | Low - Early-stage ADAS regulations, voluntary adoption, and minimal enforcement. |

| South America (Brazil, Argentina) | Low - Limited ADAS regulations, voluntary implementation, and evolving safety norms. |

| Middle East (UAE, Saudi Arabia) | Low - ADAS adoption driven by market demand, few formal regulations in place. |

| Africa (South Africa, Nigeria) | Low - ADAS regulations are minimal, with no widespread calibration requirements yet. |

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

| UK | 5.7% |

| European Union | 5.8% |

| Japan | 5.6% |

| South Korea | 6% |

The USA is experiencing remarkable growth in the ADAS calibration equipment market as a result of the increasing integration of advanced driver assistance systems (ADAS) in contemporary vehicles. The main factors stimulating the growth are; the rise in demand for vehicle safety features, strict regulatory standards, and autonomous vehicle development.

To guarantee the proper working and accuracy of ADAS sensors such as cameras, LiDAR, and radar systems, automotive service centres and OEMs are implementing advanced calibration tools. The companies in the market which provide total calibration of various car brands like Bosch, Autel, and Hunter Engineering are in the lead with their high-precision calibration systems. FMI is of the opinion that the USA ADAS calibration equipment market is slated to experience 6.1% CAGR during the study period.

Growth Factors in USA

| Key Factors | Details |

|---|---|

| High Adoption of ADAS Technologies | The USA car market is fast embracing ADAS technologies like lane drift warning and adaptive cruise control, which require accuracy calibration equipment. |

| Regulatory Support | Government regulations requiring the fitting of certain ADAS features on cars are driving demand for calibration tools. |

| Technological Advancements | Improvements in calibration and sensor technology are increasing the accuracy and efficiency of ADAS systems and contributing to market growth. |

The UK industry is growing with the increase of vehicle safety regulations, electric vehicles, and the investments being made toward autonomous driving technologies. The UK government's road safety and emission reduction campaign is the driving factor for the adoption of advanced calibration equipment. The demand for precise ADAS calibration rises as more vehicles come with lane departure warning, adaptive cruise control, and collision avoidance systems.

Companies are coming up with portable and AI-driven calibration tools which are not only reducing the time spent fixing the cars but also improving the efficiency of the service centres. FMI is of the opinion that the UK industry is set to expand at 5.7% CAGR during the study period.

Growth Factors in UK

| Key Factors | Details |

|---|---|

| Stringent Safety Regulations | The British government enforces strict safety standards on automobiles, which encourages the adoption of ADAS technologies and the related calibration software. |

| Growing Automotive Industry | The automotive sector growth focusing on advanced security features is increasing the demand for calibration tools. |

| Consumer Awareness | Increased public awareness of car safety technology results in higher take-up of vehicles with ADAS, thus enhancing the demand for calibration. |

In European Union, the ADAS calibration equipment market has been experiencing rapid development, primarily due to the stringent automotive safety regulations and the increasing implementation of ADAS in the new car models. Germany, France, and Italy are the top three nations which have embraced these notations due to high automotive production and innovations in the vehicle safety sector. FMI is of the opinion that the European Union industry is set to expand at 5.8% CAGR during the study period.

The Euro NCAP is helping car manufacturers to implement precise ADAS functionality which means the demand for advanced calibration systems will increase. Meanwhile, it is noticed that workshops and service centres are heavily investing in multifunctional calibration devices to meet the demands and perform a better work.

Growth Factors in European Union

| Key Factors | Details |

|---|---|

| Unified Safety Standards | The EU harmonized requirements of safety for harmonization seek to include the use of ADAS in automobiles, which demands the calibration hardware. |

| Automotive Manufacturing Hub | Europe's strong car production sector identifies advanced safety characteristics, increasing demand for calibration machines. |

| Research and Development Investments | Heavy investments in research and development on auto safety technology are a factor in developing and utilizing ADAS calibration tools. |

Japan has registered increased growth in the ADAS calibration equipment market showcasing its commitment to smart mobility solutions, autonomous driving R&D, & strict regulations. The high incidence of ADAS in cars from renowned producers like Toyota, Nissan, and Honda propels the needs for accuracy calibration systems.

The Japanese automobile and service industry are following the innovations route which speaks about the use of AI-powered and automated calibration tools to achieve better performance and efficiency. FMI is of the opinion that the Japanese ADAS calibration equipment market is set to observe 5.6% CAGR during the study period.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| Technological Prowess | Japanese leadership in automotive technology enables the development and deployment of sophisticated ADAS, which requires the utilization of premium calibration tools. |

| Aging Population | Expansion in an elderly population generates the need for ADAS equipped vehicles for added safety, thereby making the calibration market expand. |

| Government Initiatives | Regulations promoting road safety and the employment of advanced automotive technologies support the growth of the ADAS calibration equipment market. |

The ADAS calibration equipment market in South Korea is obtaining a significant leap due to new vehicle model ADAS accession and autonomous car driving technology development. Government programs to spur digital transformation in automobile industry are the drivers for this growth.

South Korean manufacturers manufacture high-tech calibration devices including AI and machine learning so that they achieve even higher calibration precision. The expansion of EV production and the connected car phenomenon boosts the market as these systems require very refined ADAS calibration for proper functioning. FMI is of the opinion that the South Korean market is set to observe 6% CAGR during the study period.

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| Emerging Automotive Market | South Korea's expanding automotive sector is increasingly integrating ADAS features, which has created an increase in calibration equipment demand. |

| Focus on Export | Being a key vehicle exporter, South Korea sees to it that its cars adhere to global standards of safety, requiring accurate ADAS calibration. |

| Innovation in Vehicle Technology | Ongoing developments in automotive safety technologies create demand for the latest calibration devices. |

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 352 million |

| Projected Market Size (2035) | USD 1,030 million |

| CAGR | 11.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD million |

| Vehicle Type Segments Analyzed | Passenger Vehicles, Commercial Vehicles |

| By End User Analyzed | Automotive OEMs, Tier 1 Suppliers, Service Stations |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Mahle GmbH, Robert Bosch GmbH, The Burke Porter Group, HELLA GmbH & Co., Autel Intelligent Technology Corp., Ltd., TEXA S.p.A, COJALI S.L., Launch Tech Co., Ltd., Hofmann Megaplan GmbH, BorgWarner Inc. |

| Additional Attributes | Market share by company, technological advancements, regulatory compliance, regional adoption insights, company profiles |

| Customization and Pricing | Available upon request |

Based on vehicle type the market is divided into commercial vehicles and passenger vehicles.

By end user, the market is divided into automotive OEMs, tier 1 suppliers, and service stations.

By region the market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The market is set to reach USD 352 million in 2025.

The global industry is estimated to be USD 1,030 million in 2025.

The USA, set to expand at 6.1% CAGR from 2025 to 2035, is slated to witness fastest growth.

Automotive OEM is a major end user.

The major players include Mahle GmbH, Robert Bosch GmbH, The Burke Porter Group, HELLA GmbH & Co., Autel Intelligent Technology Corp., Ltd., TEXA S.p.A, COJALI S.L., Launch Tech Co., Ltd., Hofmann Megaplan GmbH, and BorgWarner Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 13: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 28: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 58: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by End User, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 74: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 104: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 118: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 119: MEA Market Attractiveness by End User, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ADAS Sensors Market Growth - Trends & Forecast 2025 to 2035

ADAS Calibration-as-a-Service Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ADAS Market Growth - Trends & Forecast 2025 to 2035

Passenger Vehicle ADAS Market Size and Share Forecast Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Calibration Management Software Market Size and Share Forecast Outlook 2025 to 2035

Instrument Calibration Services Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA