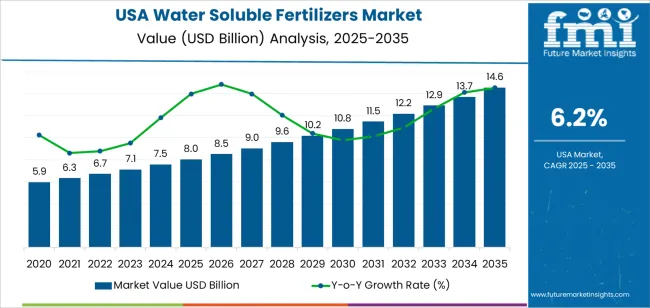

The demand for water soluble fertilizers in USA is valued at USD 8.0 billion in 2025 and is projected to reach USD 14.6 billion by 2035, reflecting a compound annual growth rate of 6.2%. Growth is shaped by increased adoption of controlled irrigation systems, fertigation practices and crop-specific formulations used across horticulture, high-value crop farming and greenhouse operations. Water soluble blends support precise nutrient delivery and compatibility with automated distribution methods, reinforcing stable procurement across commercial growers. As producers refine application schedules to maintain consistency in crop growth and output quality, fertilizer demand rises in alignment with expanding production cycles. These factors contribute to a steady upward trajectory across USA’s agricultural landscape throughout the forecast window.

The growth curve shows a gradual, consistent rise beginning at USD 5.9 billion in earlier years and reaching USD 8.0 billion in 2025 before advancing toward USD 14.6 billion by 2035. Annual values increase predictably, moving from USD 8.5 billion in 2026 to USD 9.0 billion in 2027 and continuing through USD 10.8 billion in 2031 and USD 12.9 billion in 2033. This pattern reflects stable integration of soluble nutrient systems across controlled-environment agriculture and field-based cultivation. As growers expand irrigation-linked fertilization and optimize nutrient mixes for yield uniformity, year-to-year demand remains consistent. The curve highlights a maturing but steadily advancing segment supported by routine crop management needs across USA.

Demand in the USA for water soluble fertilizers is projected to grow from USD 8.0 billion in 2025 to USD 14.6 billion by 2035, representing a compound annual growth rate (CAGR) of approximately 6.2%. Starting at USD 5.9 billion in 2020, the value increases steadily USD 7.5 billion by 2024, then USD 8.0 billion in 2025 and continues upward through USD 10.8 billion around 2030, reaching USD 14.6 billion by 2035. Growth is driven by increasing adoption of precision agriculture techniques (such as fertigation and foliar feeding), rising production of high value horticultural crops, and stronger emphasis on sustainable nutrient delivery systems that improve uptake efficiency and reduce waste.

The absolute value uplift from 2025 to 2035 is USD 6.6 billion. In the early years (2025 2030) the increase is primarily volume driven as more growers transition to water soluble systems and irrigation infrastructure expands. In the later half of the decade (2030 2035), value growth becomes increasingly important higher spec formulations, premium micronutrient blends, and tailored solutions for specialty crops command higher average selling prices. Suppliers with innovation in formulation and service model differentiation are best positioned to capture the full opportunity toward USD 14.6 billion by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 8.0 billion |

| Forecast Value (2035) | USD 14.6 billion |

| Forecast CAGR (2025–2035) | 6.2% |

The demand for water soluble fertilizers in USA has historically been driven by the growing use of high-value crops such as fruits, vegetables and greenhouse produce, which require precise nutrient delivery. In earlier periods farmers shifted away from bulk granular fertilizers to water-soluble formats because they offered improved absorption when applied via fertigation or drip irrigation systems. This trend was especially strong in regions with controlled‐environment agriculture, smaller acreage farms and greenhouse operations. Standard agricultural expansion and increased adoption of micro-irrigation supported this uptake and provided reliable volumes for soluble fertilizer supplies.

Looking ahead, future growth is expected to stem from sustainability targets, increased indoor and vertical farming, precision agriculture and nutrient-use efficiency mandates. As US growers adopt digital crop-management systems, sensors and variable-rate fertigation, water soluble fertilizers will benefit from ability to deliver tailored nutrient formulations. Expansion of organic and specialty crops, stricter environmental regulation around nutrient runoff and increasing controlled-environment agriculture will further support demand. Although cost and perception barriers remain among commodity crop producers, the alignment of advanced farming practices and regulatory pressure suggests steady growth going forward.

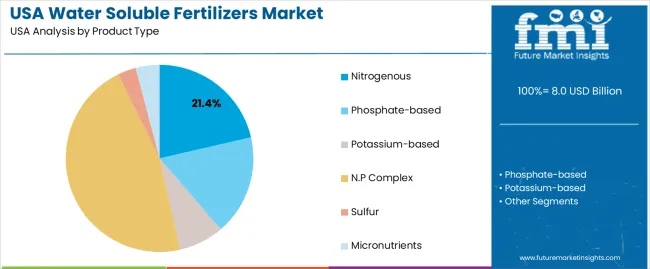

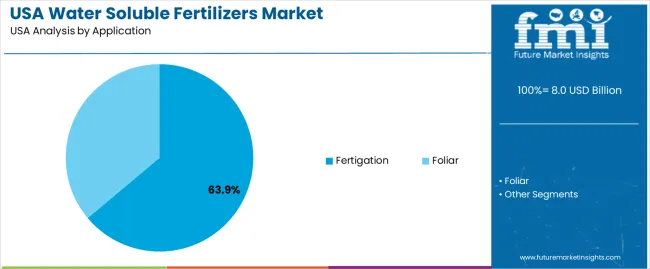

The demand for water soluble fertilizers in USA is shaped by the nutrient compositions selected for crop programs and by the application methods that determine how nutrients reach the root zone or foliage. Product types include nitrogenous, phosphate-based, potassium-based, N.P complex, sulfur and micronutrient formulations, each supporting different growth stages and soil conditions. Application methods such as fertigation and foliar feeding reflect varied irrigation structures and management practices. As growers focus on consistent nutrient delivery, predictable solubility and efficient use of inputs, the combination of formulation type and application method influences fertilizer use across USA’s agricultural sectors.

Nitrogenous fertilizers account for 21% of total demand across product type categories in USA. Their leading share reflects the essential role of nitrogen in supporting early vegetative growth, leaf development and overall plant vigor. Growers rely on nitrogenous formulations for dependable solubility and uniform distribution through irrigation systems. These products help maintain steady nutrient availability in crops that respond strongly to controlled nitrogen inputs. Their adaptability across soil types and climatic zones reinforces their use in vegetable production, horticulture and protected cultivation settings where precise nutrient timing improves outcomes.

Demand for nitrogenous fertilizers also rises as producers refine nutrient management practices to support controlled growth rates and rapid correction of deficiencies. Their compatibility with fertigation systems allows growers to adjust concentrations efficiently during seasonal shifts. Many operations value the predictable uptake patterns associated with these formulations, which help maintain uniform crop quality. As USA’s crop systems continue emphasizing consistent yield performance and efficient nutrient use, nitrogenous water soluble fertilizers remain a central component of fertilization strategies.

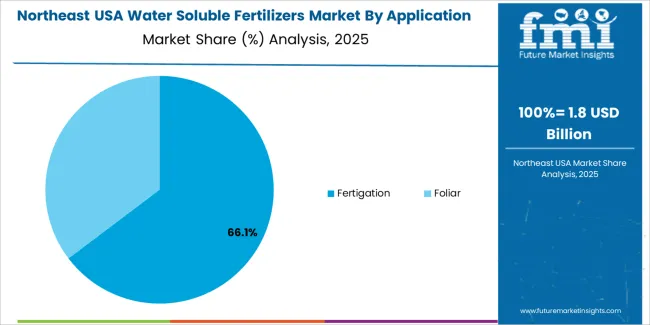

Fertigation accounts for 63.9% of total demand across application categories in USA. Its leading position reflects widespread reliance on irrigation-based nutrient delivery in specialty crops, greenhouse production and precision field systems. Fertigation enables controlled dosing directly into the root zone, improving nutrient uptake efficiency and helping growers respond to changing crop requirements. The method supports predictable application schedules and reduces waste associated with surface broadcasting. These characteristics make fertigation a preferred choice for growers managing water-sensitive crops and high-value production environments.

Demand for fertigation also grows as drip and micro-irrigation systems become more common across USA’s horticultural regions. The method enhances uniformity in nutrient distribution, supporting consistent growth patterns across large plant populations. Growers value the ability to tailor nutrient concentrations throughout different development stages using simple adjustments. Fertigation aligns with production systems seeking efficient input use and stable crop performance. As controlled agriculture and quality-focused cultivation expand, fertigation remains the dominant application shaping water soluble fertilizer demand across USA.

Demand for water-soluble fertilizers in the USA is influenced by shifts in controlled-environment agriculture, the spread of drip and micro-irrigation, and rising precision-fertigation practices in high-value crops. Greenhouse vegetable production, berry cultivation and specialty crop systems increasingly rely on soluble nutrients for dosing accuracy. At the same time, fertilizer price volatility, regional water-management constraints and uneven adoption of fertigation infrastructure shape how widely these products are used across USA commercial farms, horticulture operations and protected-agriculture facilities.

How Is the Shift Toward Controlled-Environment and High-Value Crop Production Shaping Demand?

A clear trend comes from the expansion of USA greenhouse vegetables, hydroponic leafy-greens farms and berry operations in states such as California, Arizona and the Northeast. These producers require nutrient mixes that dissolve consistently and support precision dosing through automated fertigation. Water-soluble fertilizers suit climates where irrigation water quality varies and growers need tighter control of EC, pH and micronutrient balance. This shift toward protected and high-value cultivation strengthens demand for soluble formulations rather than traditional granular options.

Where Do Growth Opportunities Emerge in the USA Fertigation and Specialty-Crop Landscape?

Opportunities arise in regions adopting drip-irrigation at scale, particularly the West and Southwest where water scarcity drives growers toward efficiency-focused practices. Expansion of controlled-environment farms for lettuce, tomatoes and strawberries also opens steady demand for soluble blends tailored to crop stage and local water chemistry. Specialty nurseries, urban vertical-farm operators and professional turf managers present further openings. Suppliers offering region-specific nutrient recipes, compatibility testing and advisory services can capture growth within these technical, fertigation-dependent segments.

What Practical Constraints Limit Wider Adoption of Water-Soluble Fertilizers in USA?

A key restraint is the uneven availability of fertigation infrastructure across USA field-crop regions, where many growers still rely on broadcast dry fertilizers. Upfront investment in pumps, injectors and filtration can deter smaller farms. Water-quality issues in some states, such as high bicarbonate content or variable salinity, complicate consistent dissolution and may require additional treatment. Fertilizer price swings and supply uncertainties also influence purchasing decisions. These constraints slow expansion beyond greenhouse, specialty-crop and irrigated-horticulture users.

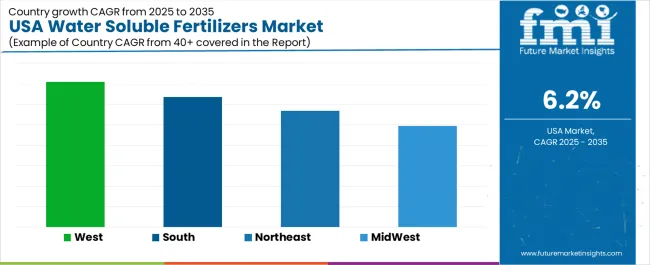

| Region | CAGR (%) |

|---|---|

| West USA | 7.1% |

| South USA | 6.4% |

| Northeast USA | 5.7% |

| Midwest USA | 4.9% |

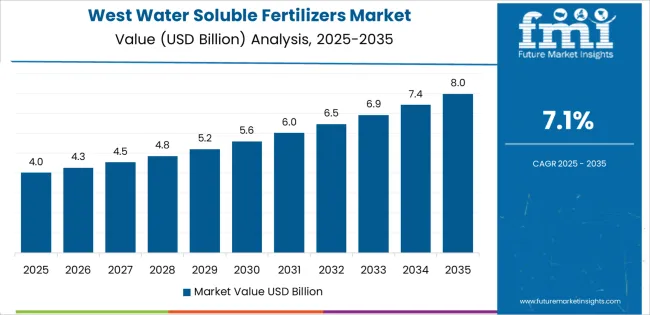

Demand for water soluble fertilizers in the USA is increasing across regions, with the West leading at 7.1%. Growth in this region reflects active horticulture, greenhouse operations, and high-value crop production that rely on controlled nutrient delivery. The South follows at 6.4%, supported by large agricultural areas adopting fertigation systems to improve efficiency. The Northeast records 5.7%, shaped by diversified farming and steady use of soluble nutrients in specialty crops. The Midwest grows at 4.9%, where greenhouse operations and irrigated farms integrate water soluble fertilizers at a measured pace. These regional patterns show broad national interest in nutrient-efficient practices aligned with intensive cultivation.

West USA is projected to grow at a CAGR of 7.1% through 2035 in demand for water soluble fertilizers. California, Washington, and surrounding agricultural regions are increasingly adopting fertilizers for high-value crops, horticulture, and precision farming. Rising focus on crop yield optimization, nutrient management, and efficient irrigation drives adoption. Manufacturers provide soluble fertilizers suitable for foliar application, fertigation, and soil enrichment. Distributors ensure accessibility across farms, nurseries, and agricultural cooperatives. Expansion in high-value crop production, greenhouse farming, and horticulture supports steady adoption of water soluble fertilizers in West USA.

South USA is projected to grow at a CAGR of 6.4% through 2035 in demand for water soluble fertilizers. Texas, Florida, and surrounding agricultural regions are increasingly using fertilizers for fruit, vegetable, and row crop cultivation. Rising focus on nutrient efficiency, crop quality, and irrigation management drives adoption. Manufacturers provide high-performance soluble fertilizers compatible with fertigation and foliar application systems. Distributors ensure availability across farms, nurseries, and agricultural supply chains. Expansion in horticulture, greenhouse production, and precision farming supports steady adoption of water soluble fertilizers across South USA.

Northeast USA is projected to grow at a CAGR of 5.7% through 2035 in demand for water soluble fertilizers. New York, Pennsylvania, and surrounding agricultural regions are gradually adopting fertilizers for high-value crops, vegetables, and specialty farming operations. Rising focus on crop productivity, nutrient management, and water-efficient fertilization drives adoption. Manufacturers provide soluble fertilizers suitable for foliar feeding, fertigation, and greenhouse applications. Distributors ensure accessibility across farms, nurseries, and agricultural cooperatives. Expansion in horticulture, greenhouse production, and precision farming supports steady adoption of water soluble fertilizers across Northeast USA.

Midwest USA is projected to grow at a CAGR of 4.9% through 2035 in demand for water soluble fertilizers. Illinois, Ohio, and surrounding agricultural regions are gradually adopting fertilizers for row crops, horticulture, and greenhouse cultivation. Rising demand for nutrient efficiency, crop quality, and irrigation management drives adoption. Manufacturers provide high-quality soluble fertilizers suitable for fertigation, foliar application, and soil enrichment. Distributors ensure accessibility across farms, nurseries, and agricultural suppliers. Expansion in horticulture, greenhouse production, and precision farming supports steady adoption of water soluble fertilizers across Midwest USA.

Demand for water soluble fertilizers in USA is growing as producers focus on precision nutrient delivery, especially in high-value crops such as vegetables, fruits and ornamentals. Controlled-environment agriculture, including greenhouses and vertical farms, depends on fertigation systems that require fertilizers dissolving quickly with predictable nutrient release. Drip irrigation continues to expand in western and southern states, increasing reliance on formulations that support efficient uptake and reduce nutrient losses. As producers seek consistent crop quality and improved yield stability, they turn to water soluble blends that allow precise adjustments through the growing cycle. Weather variability and soil-health concerns also encourage growers to adopt fertilizers that integrate smoothly with modern irrigation technologies, supporting broader use across both specialty and field production regions.

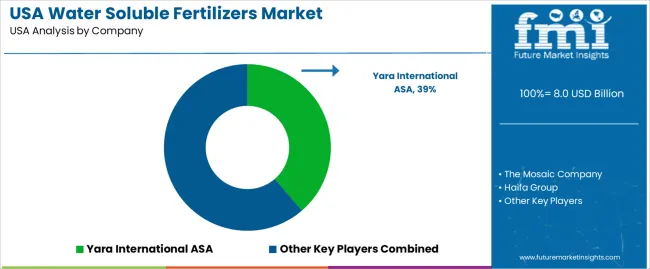

Key players shaping USA’s water soluble fertilizer environment include Yara International ASA, The Mosaic Company, Haifa Group, ICL Group and Deepak Fertilisers and Petrochemical. Yara and Mosaic offer broad nutrient programs aligned with USA agronomic practices, while Haifa and ICL supply specialized formulations for fertigation and greenhouse production. Deepak Fertilisers participates through export channels serving distributors that support horticulture and specialty-crop growers. USA distributors and blending facilities play a central role by tailoring nutrient mixes for regional conditions and irrigation systems used across diverse farming areas. This combination of international suppliers and domestic distribution networks influences how water soluble fertilizers are selected, adapted and applied throughout American specialty agriculture.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Nitrogenous, Phosphate-based, Potassium-based, N.P Complex, Sulfur, Micronutrients |

| Application | Fertigation, Foliar |

| Crop Type | Cereals & Pulses, Horticulture, Lawn, Turf & Ornamental, Others |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Yara International ASA, The Mosaic Company, Haifa Group, ICL Group, Deepak Fertilisers and Petrochemical |

| Additional Attributes | Dollar by sales by type, application, crop type, and region; regional CAGR and adoption trends; volume and value growth projections; growth driven by precision agriculture, controlled-environment agriculture, and rising use of fertigation and foliar feeding systems; specialty crop focus; regional water management and fertilizer application efficiency; increased use of organic farming and environmental regulation; adoption driven by weather variability and irrigation infrastructure expansion. |

The demand for water soluble fertilizers in usa is estimated to be valued at USD 8.0 billion in 2025.

The market size for the water soluble fertilizers in usa is projected to reach USD 14.6 billion by 2035.

The demand for water soluble fertilizers in usa is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in water soluble fertilizers in usa are nitrogenous, phosphate-based, potassium-based, n.p complex, sulfur and micronutrients.

In terms of application, fertigation segment is expected to command 63.9% share in the water soluble fertilizers in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Soluble Fertilizers Market Trends 2025 to 2035

Demand for Water Soluble Fertilizers in Japan Size and Share Forecast Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Pods and Capsules Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water-Soluble Retinol Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Polymer Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Detergent Pods Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Pods Packaging Market Analysis by Material Type, Product Type, End Use, Thickness Type, and Region Forecast Through 2035

Key Companies & Market Share in the Water Soluble Detergent Pods Sector

Competitive Breakdown of Water-Soluble Packaging Companies

Water Soluble Vitamins Market

Water-Soluble Flavors Market

USA Sea Water Pumps Market Trends – Growth, Demand & Forecast 2025-2035

Water Pod Soluble Machines Market Size and Share Forecast Outlook 2025 to 2035

Reusable Water Bottle Market Forecast and Outlook 2025 to 2035

Cold Water Soluble Creamer Market Growth - Base & Function Trends

Demand for Cold Water Soluble Starch in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Water Ionizer in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Water Treatment System in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA