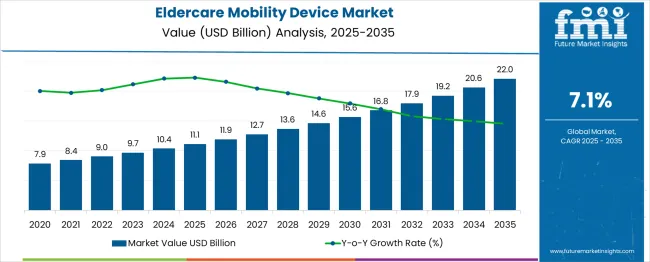

The eldercare mobility device market is set to expand from USD 11.1 billion in 2025 to USD 22 billion by 2035, growing at a CAGR of 7.1%. Annual increases in market value rise steadily, from USD 0.79 billion in 2026 to over USD 1.45 billion in 2035.

This consistent growth is underpinned by aging populations across OECD and Asia-Pacific regions, increased spending on assisted living infrastructure, and broader insurance coverage for mobility aids. Walkers, scooters, and smart wheelchairs are increasingly favored for their stability and digital features. Public health policy support and elderly independence initiatives also continue to drive procurement in both public and private care facilities.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 11.1 billion |

| Industry Value (2035F) | USD 22 billion |

| CAGR (2025 to 2035) | 7.1% |

The eldercare mobility device market plays a critical role across various assistive and healthcare segments. In the USD 9.8 billion mobility aids and equipment market, elder-focused devices account for 45-50%, reflecting their high usage among aging populations. Within the USD 12.1 billion personal mobility device market, 35-40% is attributed to eldercare solutions such as power scooters and manual wheelchairs.

Nearly 100% of the USD 10.4 billion senior mobility aid devices market directly aligns with eldercare applications. In the USD 33-38 billion eldercare assistive devices market, 25-30% is driven by mobility aids like walkers and rollators. Even in the expansive USD 868 billion elder care services and assistive device ecosystem, 1-2% is attributed to mobility devices, underscoring their essential daily role.

The eldercare mobility device industry has been segmented by product type, distribution channel, technology type, end user, and region. Product categories include wheelchairs, mobility scooters, walkers, and canes. Distribution channels encompass offline retail, e-commerce, and institutional supply. Technology segmentation includes manual and powered devices.

End users range from homecare settings to rehabilitation centers and hospitals. The industry spans across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, influenced by aging populations, chronic disease prevalence, and evolving eldercare infrastructure.

Wheelchairs held 31.6% of the market in 2025, driven by their critical role in addressing mobility limitations in geriatric care. Between 2025 and 2027, rising post-operative care needs in Europe and North America spurred adoption of lightweight and foldable models. From 2028 to 2030, government-sponsored disability programs in countries like Japan and Germany expanded access.

By 2035, advanced ergonomic designs and hybrid models integrating sensors for posture support entered mainstream eldercare settings. Wheelchairs continue to lead due to their versatility across homecare, hospitals, and nursing facilities.

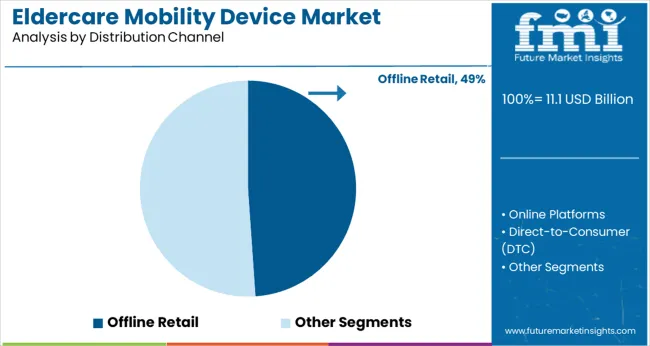

Offline retail accounted for 49% of the market in 2025, fueled by preference for in-person product trials, especially among elderly users and caregivers. Between 2025 and 2027, North American pharmacy chains like CVS and Europe’s Mediq stores expanded mobility product offerings.

From 2028 onward, healthcare equipment showrooms in urban India and Southeast Asia became critical for large-format assistive devices. Despite e-commerce growth, offline outlets retained dominance through personalized consultation, immediate product availability, and after-sales support-key factors for high-involvement eldercare purchases.

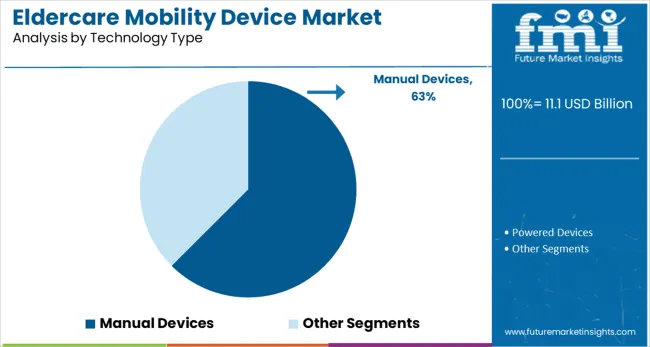

Manual mobility devices led with 63% share in 2025, supported by affordability, ease of maintenance, and user familiarity. Between 2025 and 2027, manual wheelchairs and walkers were favored across homecare environments in China, India, and Brazil. By 2030, eldercare NGOs and community care programs globally adopted manual aids for outreach and public health initiatives.

Though powered devices gained ground, manual variants remained the default for rural users, cost-sensitive patients, and those with limited access to electricity or service centers.

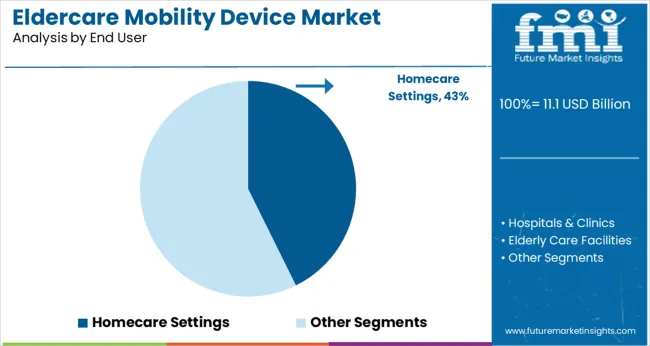

Homecare settings held 43% of the market in 2025, reflecting a shift toward aging-in-place models and decentralized eldercare. Between 2025 and 2028, Western countries experienced a rise in mobility device prescriptions for at-home recovery. In Japan and South Korea, insurers covered mobility aids for home-based geriatric patients.

By 2035, assistive devices were integrated into smart home ecosystems across Europe and North America, enhancing safety and mobility within residential environments. Homecare remained the focal point of demand due to its compatibility with lifestyle-based eldercare models.

The industry is expanding rapidly in response to global demographic shifts and healthcare system evolution. While innovation and supportive policies are advancing product offerings from smart wheelchairs to robotic aids-high costs, infrastructure gaps, and stigma-related resistance are slowing broader implementation.

Assistive Innovation Expands Eldercare Mobility Adoption

Eldercare mobility devices are being increasingly adopted due to rising geriatric populations and the need for improved quality of life in aging communities. Modern devices-ranging from foldable walkers to AI-powered motorized wheelchairs-enhance independence, reduce fall risk, and improve navigation in constrained home and care environments.

Integration with digital health platforms and lightweight material innovation has improved accessibility and comfort, making mobility aids more viable for long-term and at-home usage.

Cost, Access, and Social Stigma Remain Key Barriers

Despite increasing demand, the eldercare mobility device industry faces barriers due to high upfront costs, limited insurance coverage, and fragmented access in rural and low-income areas. Distribution is often concentrated in urban zones, leaving underserved populations without adequate support.

The social stigma and lack of awareness regarding modern mobility solutions prevent consistent adoption, even when devices are available. Long-term usage is also hindered by poor maintenance infrastructure and low product customization.

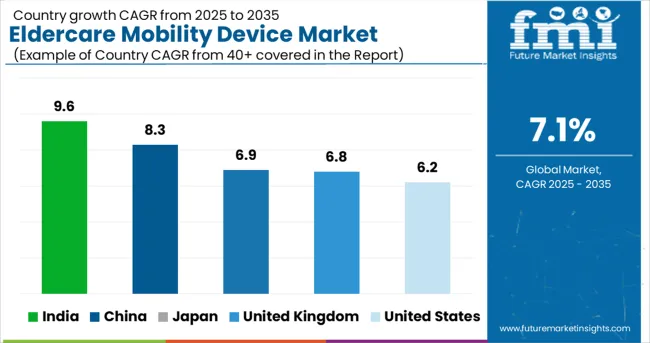

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 9.6 |

| China | 8.3 |

| Japan | 6.9 |

| United Kingdom | 6.8 |

| United States | 6.2 |

The eldercare mobility device market is projected to grow at a global CAGR of 7.1% from 2025 to 2035. India leads among the profiled nations with 9.6%, followed by China at 8.3%, both surpassing the global pace. These BRICS economies are responding to rapidly aging populations and rising demand for low-cost assistive technologies. Japan, the United Kingdom, and the United States trail slightly at 6.9, 6.8, and 6.2, respectively, despite well-established eldercare ecosystems.

India’s momentum is driven by local manufacturing hubs producing walkers, rollators, and motorized chairs at affordable price points. Government tenders and elder housing projects are also expanding access. China’s growth is fueled by large-scale procurement by public health agencies and growing adoption in secondary cities.

In contrast, OECD nations see slower gains due to saturated markets, higher unit costs, and slower innovation cycles in reimbursement-backed product categories. These five countries represent strategic benchmarks from a wider 40+ country analysis.

Demand for eldercare mobility device in the United States is growing at a CAGR of 6.2% between 2025 and 2035. Growth is expected to be driven by expanded home healthcare services, Medicaid-supported equipment reimbursements, and greater adoption of powered wheelchairs and rollators.

Between 2020 and 2024, demand was anchored by post-acute care centers and veterans hospitals, with regional spikes observed in states with aging populations such as Florida and Pennsylvania. New product innovation focused on ergonomic walkers and voice-assisted mobility aids.

The sale of eldercare mobility devices in the United Kingdom is expanding at a CAGR of 6.8% from 2025 to 2035. Sales will be supported by NHS procurement for aging-in-place services and increased availability of smart mobility aids through digital health platforms.

During 2020 to 2024, regional councils piloted device-sharing programs and lightweight rollators gained traction among seniors in assisted living. A shift toward modular and foldable designs contributed to higher adoption across care homes and home users.

Demand for eldercare mobility devices in India is projected to grow at a CAGR of 9.6% from 2025 to 2035. Growth will be driven by rising geriatric population in urban centers, increased health insurance penetration, and expansion of home-based rehabilitation services.

From 2020 to 2024, demand remained largely unorganized, with growth clustered around Tier 1 cities through hospitals and private eldercare startups. Demand for walkers, wheelchairs, and patient transfer aids surged after COVID-19, influencing the domestic manufacturing base.

The eldercare mobility device market in China is forecast to grow at a CAGR of 8.3% from 2025 to 2035. Increasing urbanization of elderly populations, coupled with long-term care pilot programs in provincial zones, will drive growth. Technologically advanced devices such as robotic walkers and sensor-enabled wheelchairs are being incorporated into senior care infrastructure. Between 2020 and 2024, procurement was driven by private eldercare chains and community clinics in major urban areas.

Sales of eldercare mobility devicesin Chinaare expected to expand at a CAGR of 6.9% from 2025 to 2035. Demand will be fueled by long-term care insurance reimbursements, compact urban mobility solutions, and robotic assistance in assisted living facilities. Between 2020 and 2024, consumption was steady, with emphasis on high-performance wheelchairs and multi-functional walkers tailored to apartment-based living. Manufacturers have focused on safety upgrades and battery-efficient motorized units for aging consumers.

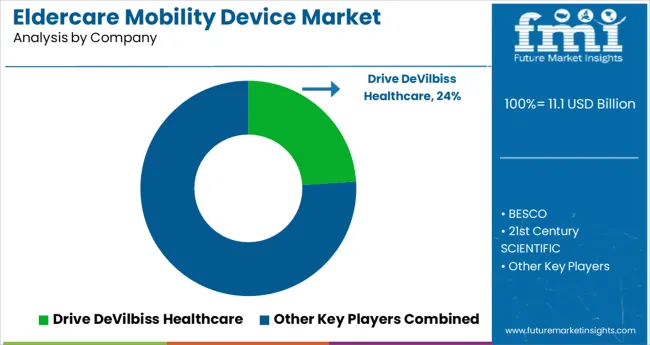

The eldercare mobility device market is anchored by established manufacturers of durable and user-focused solutions. Drive DeVilbiss Healthcare, INVACARE, and MEYRA dominate with a full range of mobility aids-power chairs, scooters, walkers-and support products targeting both home and institutional users.

Hoveround Mobility and GF Health Products specialize in user-friendly power chairs and lift-assist systems, catering to independence and comfort. BESCO and 21st Century Scientific focus on specialized clinical-grade devices and rehabilitation equipment, serving elderly care facilities and home health ecosystems.

Meanwhile, CAREX distributes a broad catalog of mobility and transfer solutions across retail and e-commerce platforms. LEVO and nova are innovating with home-access technologies and smart-care integrations, such as stairlifts with IoT compatibility. This mix of legacy brands and emerging innovators defines current competition in reliability, product scope, and tech-enabled elder mobility solutions.

Leading Company - Drive DeVilbiss HealthcareIndustry Share - ~24%

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 11.1 billion |

| Projected Industry Size (2035) | USD 22 billion |

| CAGR (2025 to 2035) | 7.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | Wheelchairs (Manual and Powered/Electric), Mobility Scooters (3-Wheel and 4-Wheel), Walkers & Rollators, Canes & Crutches, Stair Lifts & Lifting Chairs |

| Distribution Channels Analyzed (Segment 2) | Offline Retail (Medical Supply Stores, Pharmacies), Online Platforms, Direct-to-Consumer (DTC), Healthcare Providers & Distributors |

| Technology Types Analyzed (Segment 3) | Manual Devices, Powered Devices (Battery-operated, AI-enabled, IoT-connected) |

| End Users Analyzed (Segment 4) | Homecare Settings, Hospitals & Clinics, Elderly Care Facilities, Rehabilitation Centers |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | BESCO, 21st Century SCIENTIFIC, CAREX, Drive DeVilbiss Healthcare, GF Health Products, Hoveround Mobility, INVACARE, LEVO, MEDLINE, MEYRA, NOVA |

| Additional Attributes | Dollar sales, share by device type and technology, rising demand in homecare and assisted living, growth of AI-enabled and connected mobility solutions, regional elderly population trends |

This segment includes Wheelchairs (Manual and Powered/Electric), Mobility Scooters (3-Wheel and 4-Wheel), Walkers & Rollators, Canes & Crutches, and Stair Lifts & Lifting Chairs.

This includes Offline Retail (Medical Supply Stores, Pharmacies), Online Platforms, Direct-to-Consumer (DTC), and Healthcare Providers & Distributors.

The segment is categorized into Manual Devices and Powered Devices (Battery-operated, AI-enabled, IoT-connected).

The industry is segmented into Homecare Settings, Hospitals & Clinics, Elderly Care Facilities, and Rehabilitation Centers.

Regional analysis includes North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The industry is projected to reach USD 11.1 billion in 2025.

The industry is expected to grow at a CAGR of 7.1% from 2025 to 2035.

Wheelchairs are expected to capture 31.6% of the market in 2025.

The Asia Pacific region, particularly India, is projected to register a CAGR of 9.6% from 2025 to 2035.

The industry is projected to reach USD 22.0 billion by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Eldercare-Assistive Robots Industry Analysis in East Asia Size and Share Forecast Outlook 2025 to 2035

Eldercare Assistive Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobility On Demand (MOD) Market Size and Share Forecast Outlook 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Mobility Aids and Transportation Equipment Market is segmented by Product and Distribution Channel from 2025 to 2035

Ion Mobility Spectrometry Market

Micromobility Platform Market by Vehicle Type, Platform Type, End User, and Region through 2035

Micro Mobility Market Size and Share Forecast Outlook 2025 to 2035

Micro-mobility Charging Infrastructure Market – Trends & Forecast 2025 to 2035

4-Wheel Mobility Scooters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Managed Mobility Services Market Size and Share Forecast Outlook 2025 to 2035

Clinical Mobility Market Size and Share Forecast Outlook 2025 to 2035

Personal Mobility Devices Market Analysis - Trends, Growth & Forecast 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Smart Crop Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

BYOD and Enterprise Mobility Market Analysis and Forecast 2025 to 2035, By Security, Software, Deployment Type, End-Use, Organization Size, and Region

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA