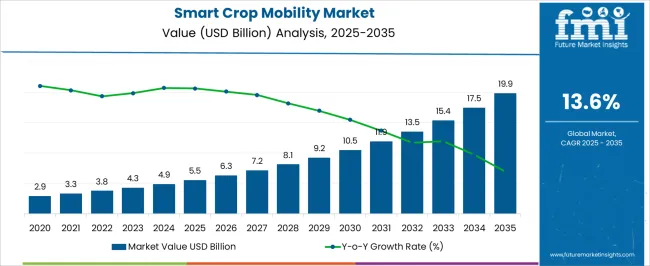

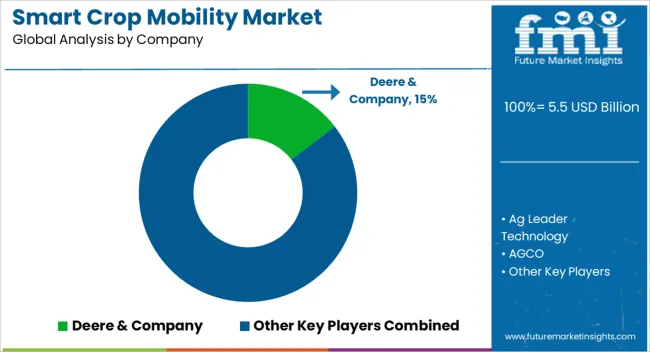

The smart crop mobility market is estimated to be valued at USD 5.5 billion in 2025 and is projected to reach USD 19.9 billion by 2035, registering a compound annual growth rate (CAGR) of 13.6% over the forecast period.

The market is fundamentally shaped by the integration of advanced machinery, robotics, IoT-enabled sensors, and autonomous mobility solutions, each contributing variably to overall market value. Autonomous tractors and robotic harvesters are increasingly prominent, enabling precise field operations, reducing labor dependency, and enhancing operational efficiency. Their adoption contributes substantially to market growth, reflecting both higher unit values and premium technological integration costs. IoT-enabled platforms and sensor-based mobility solutions also play a critical role, offering real-time crop monitoring, predictive analytics, and route optimization for machinery. These technologies enhance decision-making capabilities for growers, contributing to incremental revenue streams and positioning technologically advanced solutions as key revenue drivers.

GPS-guided navigation systems, machine learning algorithms, and connectivity modules further augment operational performance, thereby supporting technology-driven market adoption. Emerging technologies such as drone-assisted crop monitoring and AI-based fleet management are anticipated to capture increasing market share in later years, contributing to a compounded growth effect evident in the projected USD 19.9 billion by 2035. The differential adoption rates across small-scale farms versus commercial agribusinesses underscore technology-specific contributions, with high-end automated solutions representing the largest value addition. The technology contributions define both the pace and magnitude of market growth, shaping investment priorities, product development, and deployment strategies.

| Metric | Value |

|---|---|

| Smart Crop Mobility Market Estimated Value in (2025 E) | USD 5.5 billion |

| Smart Crop Mobility Market Forecast Value in (2035 F) | USD 19.9 billion |

| Forecast CAGR (2025 to 2035) | 13.6% |

The smart crop mobility market represents a specialized segment within the precision agriculture and agricultural robotics industry, emphasizing automation, data driven decision making, and optimized crop management. Within the overall agricultural machinery and equipment market, it accounts for about 4.9%, driven by adoption of autonomous vehicles, drones, and smart sensors in crop fields. In the precision farming solutions segment, it holds nearly 5.3%, reflecting demand for real-time monitoring, variable rate application, and crop health assessment. Across the agricultural robotics and automation market, the segment captures 4.1%, supporting labor efficiency and yield optimization.

Within the smart irrigation and field monitoring category, it represents 3.7%, highlighting integration with sensors, GPS, and AI driven analytics. In the sustainable farming and resource optimization sector, it secures 3.2%, emphasizing reduced input wastage and improved environmental outcomes. Recent developments in this market have focused on autonomous navigation, AI analytics, and IoT connectivity. Innovations include driverless tractors, crop scouting robots, and sensor equipped drones capable of mapping and analyzing crop health. Key players are partnering with agtech firms, IoT solution providers, and agricultural universities to enhance precision, efficiency, and scalability. Integration with cloud platforms allows predictive analytics and farm management dashboards, supporting real-time decision making. Additionally, electric and hybrid power systems are being adopted to reduce emissions and operating costs. These trends demonstrate how automation, digitalization, and resource optimization are shaping the smart crop mobility market.

The smart crop mobility market is gaining strong traction, driven by the integration of automation, data analytics, and precision agriculture technologies to enhance farming efficiency and sustainability. Agricultural technology publications and equipment manufacturer reports have emphasized the role of smart mobility solutions in reducing labor dependency, optimizing input usage, and improving crop yields.

Rising adoption of GPS-guided systems, AI-powered controls, and telematics has enabled farmers to carry out operations with greater precision, thereby lowering operational costs and environmental impact. Government programs supporting mechanization and smart farming, along with favorable financing options for agricultural machinery, have accelerated equipment penetration in both developed and emerging markets.

Furthermore, growing awareness of climate-resilient farming practices has prompted investments in equipment that can adapt to diverse terrains and crop conditions. Looking ahead, the market is expected to expand further as connectivity infrastructure improves in rural areas, enabling broader adoption of autonomous machinery and integrated farm management platforms. Key growth momentum is projected to come from autonomous tractors, field crop applications, and medium-sized farms, reflecting practical scalability and operational efficiency.

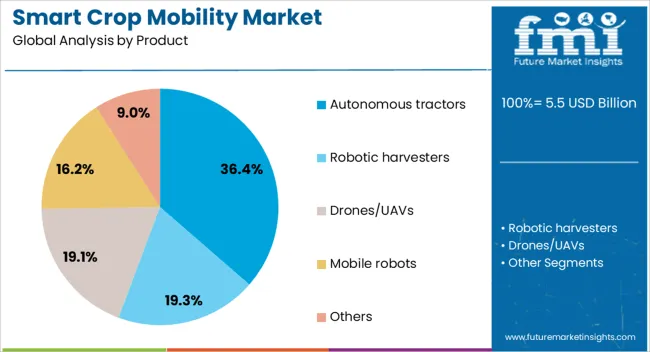

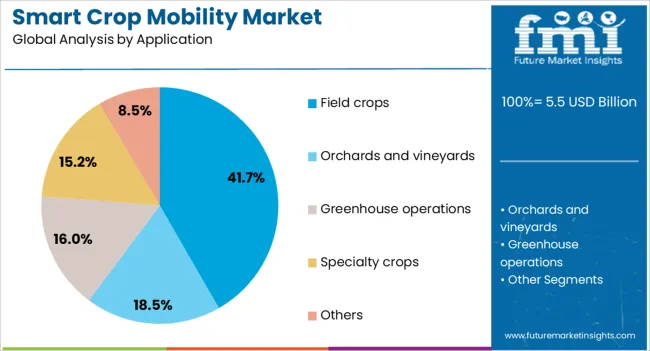

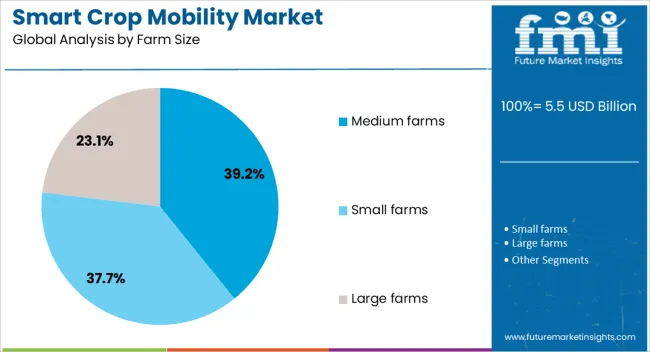

The smart crop mobility market is segmented by product, application, farm size, end use, and geographic regions. By product, smart crop mobility market is divided into autonomous tractors, robotic harvesters, drones/UAVs, mobile robots, and others. In terms of application, smart crop mobility market is classified into field crops, orchards and vineyards, greenhouse operations, specialty crops, and others. Based on farm size, smart crop mobility market is segmented into medium farms, small farms, and large farms. By end use, smart crop mobility market is segmented into farmers, agricultural cooperatives, government agencies, research institutions, and agribusiness companies. Regionally, the smart crop mobility industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The autonomous tractors segment is projected to hold 36.4% of the smart crop mobility market revenue in 2025, maintaining its lead due to its ability to automate labor-intensive tasks and enhance operational efficiency. These tractors are equipped with advanced navigation systems, machine learning algorithms, and precision control technologies, allowing them to operate with minimal human intervention. Manufacturers have focused on developing tractors that can perform multiple field operations, including seeding, tilling, and harvesting, in a single platform. Field trial data and farmer adoption surveys indicate significant reductions in fuel consumption and labor costs, along with improved operational timing, which is critical for crop health and yield. Additionally, the shortage of skilled agricultural labor in many regions has further increased demand for autonomous solutions. As connectivity and remote monitoring capabilities continue to advance, autonomous tractors are expected to remain a cornerstone of smart mobility solutions in agriculture.

The field crops segment is projected to account for 41.7% of the smart crop mobility market revenue in 2025, emerging as the primary application area due to the large-scale deployment potential of smart machinery in cereal, oilseed, and pulse cultivation. Field crops require extensive land coverage and precise timing for planting, irrigation, and harvesting, making them highly suitable for automation. Agricultural extension programs and equipment manufacturer demonstrations have showcased the productivity benefits of deploying smart mobility solutions in these crops, particularly in optimizing resource usage and reducing waste. Integration with satellite imagery and soil sensors has further enhanced decision-making, allowing targeted field operations that maximize yield potential. The scale and economic significance of field crops globally have encouraged both public and private investments in automation technologies tailored to these farming systems. As global demand for staple crops grows, the adoption of smart crop mobility for field crop management is expected to accelerate.

The medium farms segment is projected to capture 39.2% of the smart crop mobility market revenue in 2025, holding a leading position due to its operational capacity and adaptability to mechanization. Medium-sized farms often balance the resource availability of larger enterprises with the flexibility of smaller operations, making them prime candidates for adopting smart mobility solutions. Financing options, government subsidies, and cooperative purchasing programs have made advanced agricultural machinery more accessible to this segment. Industry field reports indicate that medium farms have leveraged smart mobility tools to achieve better cost-to-yield ratios, improve input management, and streamline field operations. Their size enables efficient utilization of autonomous tractors and connected equipment without the logistical challenges faced by large-scale operations. As rural connectivity and training programs expand, medium farms are expected to continue leading adoption rates in the smart crop mobility market.

The market has been witnessing significant growth due to the increasing adoption of automated and intelligent agricultural machinery. Smart crop mobility solutions, including autonomous tractors, robotic harvesters, and sensor-equipped field vehicles, are used to enhance farm productivity, reduce labor dependence, and optimize resource utilization. These systems integrate GPS, IoT, AI, and machine learning technologies to monitor crop conditions, soil health, and operational efficiency. Rising demand for precision agriculture, efficient land management, and sustainable farming practices has further accelerated adoption.

Smart crop mobility solutions are increasingly deployed in precision agriculture to enhance efficiency and optimize resource use. Autonomous tractors and robotic field vehicles are equipped with sensors, GPS, and machine learning algorithms to navigate fields, perform planting, fertilization, and irrigation tasks with minimal human intervention. Crop monitoring systems collect real-time data on soil moisture, nutrient levels, and plant health, allowing data-driven decision-making. Fertilizer, water, and pesticide applications are precisely calibrated, reducing waste and environmental impact. These innovations not only improve yield and crop quality but also support sustainability objectives. Integration with farm management software enables remote monitoring and analytics, enhancing operational planning and predictive maintenance of agricultural machinery.

The deployment of robotics and autonomous systems has transformed operational efficiency in modern farming. Robotic harvesters, seeding machines, and weeding systems reduce labor costs while maintaining consistent performance across large areas. These machines leverage AI-based image recognition, sensor feedback, and adaptive navigation to identify crop readiness, detect weeds, and avoid obstacles. Autonomous vehicles operate continuously, reducing downtime and optimizing the timing of farm operations critical for high-value crops. Integration with cloud-based data platforms allows for predictive maintenance, operational analytics, and workflow optimization. The scalability of these systems supports both smallholder farms and large agribusinesses, promoting widespread adoption of smart crop mobility solutions in diverse agricultural environments.

Smart crop mobility is instrumental in promoting sustainable agriculture and efficient resource management. Autonomous and sensor-equipped equipment ensures optimal application of fertilizers, water, and agrochemicals, minimizing environmental impact. Soil compaction and energy consumption are reduced through optimized navigation and task scheduling. Integration with IoT-based monitoring allows continuous tracking of environmental parameters, supporting sustainable crop management practices. Farms adopting smart mobility systems can reduce greenhouse gas emissions, conserve water, and enhance soil health while maintaining productivity. These technologies also enable compliance with sustainability certifications and environmental regulations, making them attractive to agribusinesses seeking eco-friendly solutions. Sustainable practices supported by smart crop mobility improve long-term farm resilience and profitability.

Despite the advantages, the smart crop mobility market faces challenges related to high initial capital investment, technical expertise requirements, and rural connectivity limitations. Autonomous machines require robust sensor systems, data processing capabilities, and maintenance support, which may be challenging for small-scale farms. Limited internet connectivity and precision GPS infrastructure in rural areas can constrain system performance. The regulatory frameworks for autonomous agricultural machinery vary across regions, affecting deployment speed. High costs of advanced robotics and AI integration may deter adoption without government subsidies or financing options. Addressing these challenges through policy support, affordable financing solutions, and technical training programs is essential for accelerating the adoption of smart crop mobility solutions globally.

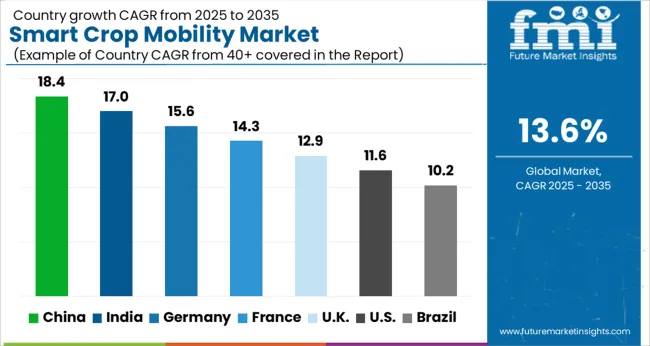

| Country | CAGR |

|---|---|

| China | 18.4% |

| India | 17.0% |

| Germany | 15.6% |

| France | 14.3% |

| UK | 12.9% |

| USA | 11.6% |

| Brazil | 10.2% |

China leads the market with a forecast growth rate of 18.4%, propelled by widespread adoption of autonomous farming machinery and precision agriculture technologies. India follows at 17.0%, driven by increasing mechanization and digitalization in agriculture. Germany records 15.6%, supported by integration of advanced robotics and smart irrigation solutions in modern farming systems. The United Kingdom maintains 12.9%, with innovation in data-driven crop management and research initiatives contributing to growth. The United States registers 11.6%, where adoption of autonomous tractors and AI-based crop monitoring supports steady market activity. These countries collectively represent a dynamic landscape shaping global production, deployment, and technological innovation in smart crop mobility. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 18.4%, driven by the rapid adoption of precision agriculture technologies. Farmers are increasingly deploying smart tractors, automated sprayers, and connected machinery to enhance operational efficiency, crop yield, and resource optimization. Technological advancements in GPS-guided navigation, IoT-enabled sensors, and AI-based monitoring systems are facilitating real-time decision-making and predictive analytics. Government initiatives promoting digital agriculture and sustainable farming practices further boost market adoption. Domestic manufacturers are investing in R&D to develop customized solutions suitable for varied crop types and terrain conditions, ensuring wider penetration across the Chinese agricultural sector.

India is expected to grow at a CAGR of 17.0%, supported by rising mechanization and technology-driven farming practices. The deployment of smart tractors, automated harvesters, and precision spraying equipment is increasing to reduce labor dependency and enhance productivity. IoT sensors, GPS-guided navigation, and data analytics platforms enable optimized irrigation, fertilization, and pest management. Government programs and subsidies promoting smart agricultural technologies accelerate adoption, while awareness among small and large-scale farmers about yield optimization is growing. Local manufacturers are innovating low-cost and adaptable solutions suitable for diverse crops, enhancing market penetration and creating opportunities for digital transformation in the Indian agriculture sector.

Germany is anticipated to grow at a CAGR of 15.6%, propelled by the adoption of advanced agricultural technologies in modern farms. Smart tractors, autonomous field robots, and precision spraying systems are increasingly used to improve crop management and operational efficiency. The integration of IoT-enabled devices, real-time data monitoring, and predictive analytics facilitates informed decision-making for farmers. Germany’s focus on sustainable agriculture, energy-efficient machinery, and innovation-driven farming solutions promotes widespread adoption. Investments in research, development, and pilot projects for automated crop mobility further strengthen the market outlook, enabling farms to optimize input utilization and achieve higher productivity with reduced environmental impact.

The market in the United Kingdom is projected to grow at a CAGR of 12.9%, supported by increasing digitalization in the agricultural sector. Adoption of connected tractors, automated irrigation systems, and precision farming equipment enhances productivity and resource efficiency. Farmers benefit from real-time crop monitoring, predictive analytics, and optimized input management. Government policies promoting smart farming, technology grants, and pilot programs accelerate market penetration. Local companies are innovating adaptable solutions for diverse crops and field conditions, enabling efficient adoption across small, medium, and large-scale farms. Rising awareness about environmental sustainability and reduction of operational costs is further encouraging the implementation of smart crop mobility technologies in the UK.

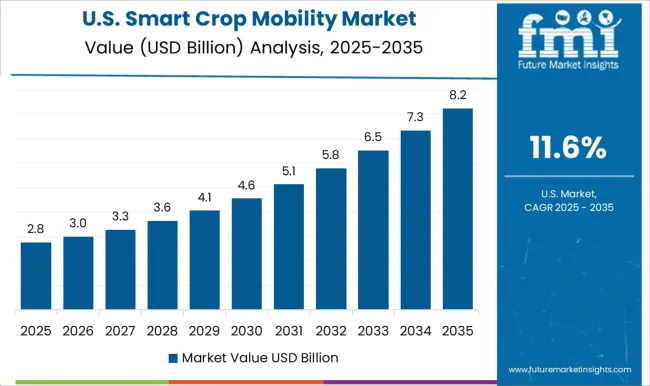

The United States is anticipated to grow at a CAGR of 11.6%, driven by technological integration in modern agricultural practices. The use of autonomous tractors, robotic harvesters, and precision spraying solutions is increasing to optimize crop yield and reduce labor costs. IoT-enabled sensors, AI-based decision support systems, and GPS-guided equipment facilitate efficient resource allocation and field monitoring. Government support through agricultural technology programs and incentives promotes adoption across both large-scale and mid-sized farms. Manufacturers focus on innovative, scalable solutions for diverse crops, enhancing market reach and operational efficiency. Rising emphasis on sustainable practices, data-driven decision-making, and cost-effective automation continues to expand Smart Crop Mobility adoption in the United States.

The market is witnessing substantial growth, fueled by the integration of advanced robotics, AI, and precision agriculture technologies into farming operations. Deere & Company and AGCO are leading the sector with robust autonomous tractors and smart machinery that enhance field efficiency while reducing operational costs. Ag Leader Technology and Raven Industries focus on precision guidance systems, data analytics, and automated control solutions, enabling farmers to optimize planting, fertilization, and harvesting processes. AgEagle Aerial Systems and Biz4Intellia specialize in drone-based monitoring and mobility solutions, providing real-time crop health insights and automated task management, which improve yield prediction and resource management. Blue River Technology emphasizes machine learning applications for selective spraying and crop monitoring, offering environmentally sustainable solutions.

CNH Industrial delivers integrated smart mobility platforms that combine connectivity, telemetry, and autonomous navigation, enhancing farm-wide operational efficiency. Syngenta and Yara contribute by integrating mobility solutions with agronomic data, fertilizer management, and crop protection strategies. These providers are transforming modern agriculture, enabling higher productivity, precise input usage, and sustainable farming practices through smart crop mobility innovations.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.5 billion |

| Product | Autonomous tractors, Robotic harvesters, Drones/UAVs, Mobile robots, and Others |

| Application | Field crops, Orchards and vineyards, Greenhouse operations, Specialty crops, and Others |

| Farm Size | Medium farms, Small farms, and Large farms |

| End Use | Farmers, Agricultural cooperatives, Government agencies, Research institutions, and Agribusiness companies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Deere & Company, Ag Leader Technology, AGCO, AgEagle Aerial Systems, Biz4Intellia, Blue River Technology, CNH Industrial, Raven Industries, Syngenta, and Yara |

| Additional Attributes | Dollar sales by vehicle type and application, demand dynamics across precision agriculture, logistics, and harvesting operations, regional trends in autonomous and connected farming adoption, innovation in automation, sensor integration, and energy efficiency, environmental impact of fuel use and soil compaction, and emerging use cases in smart farming, crop monitoring, and sustainable agriculture solutions. |

The global smart crop mobility market is estimated to be valued at USD 5.5 billion in 2025.

The market size for the smart crop mobility market is projected to reach USD 19.9 billion by 2035.

The smart crop mobility market is expected to grow at a 13.6% CAGR between 2025 and 2035.

The key product types in smart crop mobility market are autonomous tractors, robotic harvesters, drones/uavs, mobile robots and others.

In terms of application, field crops segment to command 41.7% share in the smart crop mobility market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA