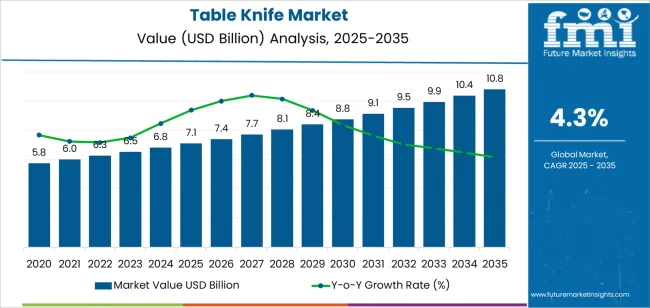

The table knife market is set to rise from USD 7.1 billion in 2025 to USD 10.9 billion by 2035, reflecting steady annual growth at a 4.3% CAGR. The early growth period through 2030 is driven by households upgrading kitchen tools and food service operators standardizing more durable and ergonomic table knives. Stainless steel continues to lead the market due to corrosion resistance, familiar handling, and dependable edge retention. Home users account for the largest share of demand as cooking at home becomes more habitual and kitchen quality expectations increase. The second growth phase from 2030 to 2035 contributes a larger share of the value expansion, supported by rising interest in premium table knives with balanced weight, improved blade geometry, and better handle design. Restaurants and hotels drive replacement cycles based on performance and durability, with a focus on knives that maintain sharpness over extended service use.

Revenue currently is driven by direct knife purchases and kitchen set upgrades. Value begins shifting toward premium steel blends, online direct-to-consumer offerings, maintenance products such as sharpening tools, and knife care programs. Competitive differentiation depends on blade composition, finishing precision, ergonomic comfort, and clarity in quality tiering rather than decorative styling. Stainless steel remains the core material, while ceramic and high-carbon steel are gradually gaining ground among users seeking performance-focused dining and food-preparation experiences.

Quick Stats for Table Knife Market

The latter half (2030-2035) will witness continued growth from USD 8,443.4 million to USD 10.9 billion, representing an addition of USD 2,426.4 million or 57% of the decade's expansion. This period will be defined by mass market penetration of premium cutlery technologies, integration with comprehensive food service platforms, and seamless compatibility with existing kitchen infrastructure. The market trajectory signals fundamental shifts in how households and food service facilities approach dining equipment and quality management, with participants positioned to benefit from growing demand across multiple material types and application segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New knife sales (household, commercial, institutional) | 58% | Replacement-driven, quality-focused purchases |

| Knife sets & collections | 24% | Gift purchases, kitchen upgrades | |

| Sharpening & maintenance services | 10% | Professional servicing, blade care | |

| Specialty & premium products | 8% | Chef knives, collector editions | |

| Future (3-5 yrs) | Premium stainless steel systems | 48-52% | Advanced metallurgy, ergonomic designs |

| Ceramic & specialty materials | 18-22% | Lightweight options, rust-free solutions | |

| Direct-to-consumer sales | 15-18% | Online channels, subscription services | |

| Sharpening subscriptions | 8-11% | Recurring maintenance, blade care programs | |

| Customization services | 6-9% | Personalized handles, custom engravings | |

| Professional training | 3-5% | Knife skills workshops, culinary programs |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 7.1 billion |

| Market Forecast (2035) | USD 10.9 billion |

| Growth Rate | 4.3% CAGR |

| Leading Technology | Stainless Steel |

| Primary Application | Home Segment |

The market demonstrates strong fundamentals with stainless steel knife systems capturing a dominant share through advanced durability capabilities and culinary performance optimization. Home applications drive primary demand, supported by increasing kitchen modernization and dining quality requirements. Geographic expansion remains concentrated in developed markets with established culinary infrastructure, while emerging economies show accelerating adoption rates driven by rising disposable income and quality dining standards.

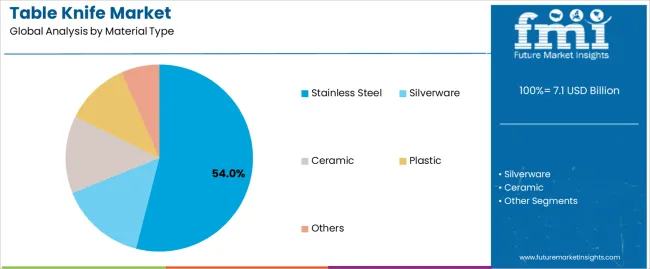

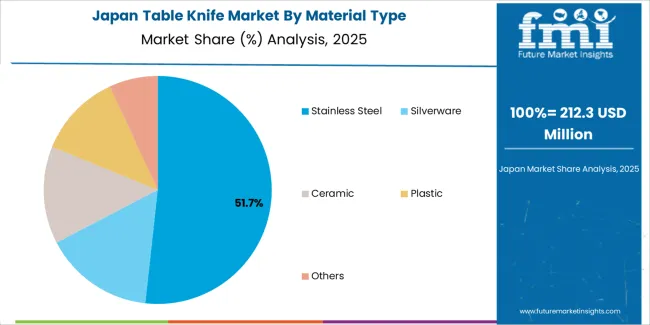

Primary Classification: The market segments by material type into stainless steel, silverware, ceramic, plastic, and others, representing the evolution from basic cutlery equipment to sophisticated dining solutions for comprehensive culinary performance optimization.

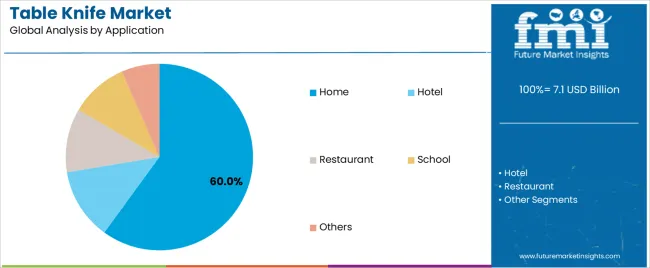

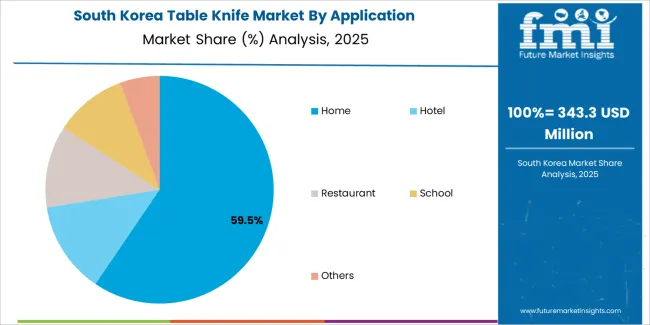

Secondary Classification: Application segmentation divides the market into home, hotel, restaurant, school, and others, reflecting distinct requirements for durability, operational efficiency, and dining quality standards.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by dining quality expansion programs.

The segmentation structure reveals technology progression from standard cutlery equipment toward sophisticated knife systems with enhanced durability and ergonomic capabilities, while application diversity spans from household kitchens to commercial food service operations requiring precise cutting performance solutions.

Market Position: Stainless Steel knife systems command the leading position in the table knife market with 54% market share through advanced durability features, including superior corrosion resistance, operational longevity, and culinary performance optimization that enable households and commercial facilities to achieve optimal cutting consistency across diverse dining and food service environments.

Value Drivers: The segment benefits from consumer preference for reliable knife systems that provide consistent cutting performance, reduced maintenance requirements, and operational durability optimization without requiring significant replacement frequency. Advanced design features enable balanced weight distribution, edge retention capabilities, and integration with existing kitchen equipment, where operational performance and hygiene compliance represent critical facility requirements.

Competitive Advantages: Stainless Steel knife systems differentiate through proven operational reliability, consistent cutting characteristics, and integration with professional culinary systems that enhance kitchen effectiveness while maintaining optimal quality standards suitable for diverse household and commercial applications.

Key market characteristics:

Silverware systems maintain a 22% market position in the table knife market due to their traditional appeal properties and premium dining advantages. These systems appeal to households and hotels requiring elegant presentation with competitive pricing for high-end dining applications. Market growth is driven by luxury market expansion, emphasizing reliable quality solutions and aesthetic appeal through optimized designs.

Ceramic knife systems capture 14% market share through specialized cutting requirements in modern kitchens, health-conscious households, and precision food preparation applications. These facilities demand lightweight knife systems capable of maintaining sharpness while providing effective cutting capabilities and rust-free operation.

Plastic knife systems maintain 7% market share through disposable requirements in institutional settings, school cafeterias, and bulk food service applications. These facilities prioritize cost-effective solutions capable of meeting basic cutting needs while maintaining safety standards.

Market Context: Home applications accounts 60% of the market share and demonstrate the highest growth rate in the table knife market with 5.1% CAGR due to widespread adoption of quality kitchen equipment and increasing focus on culinary experience optimization, home cooking enhancement, and dining quality applications that maximize meal preparation while maintaining convenience standards.

Appeal Factors: Home kitchen operators prioritize system versatility, quality performance, and integration with existing culinary infrastructure that enables coordinated meal preparation across multiple cooking activities. The segment benefits from substantial household investment and kitchen modernization programs that emphasize the acquisition of quality knife systems for cooking optimization and dining enhancement applications.

Growth Drivers: Kitchen upgrade programs incorporate quality knife systems as standard equipment for home cooking operations, while culinary interest growth increases demand for reliable cutting capabilities that comply with quality standards and minimize preparation complexity.

Market Challenges: Varying usage patterns and storage requirements may limit knife standardization across different households or cooking scenarios.

Application dynamics include:

Hotel applications capture significant market share through intensive food service requirements in accommodation facilities, banquet operations, and room service applications. These facilities demand durable knife systems capable of operating during high-volume service while providing effective cutting access and operational reliability capabilities.

Restaurant applications account for substantial market share, including dining operations, commercial kitchens, and food preparation requiring professional-grade capabilities for operational optimization and service efficiency.

Market Position: School applications command notable market position with 4.7% CAGR through institutional food service requirements that demand safety-focused knife systems.

Value Drivers: Educational facilities require safe, durable knife systems meeting requirements for student use, cafeteria operations, and institutional food service without excessive maintenance needs.

Growth Characteristics: The segment benefits from institutional procurement programs, safety standard compliance, and established food service operations that support widespread adoption and operational efficiency.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Rising home cooking & culinary interest (cooking shows, food culture) | ★★★★★ | Consumers invest in quality kitchen tools; home cooking trend creates consistent demand for premium knives and culinary equipment upgrades. |

| Driver | Restaurant industry expansion & hotel development | ★★★★★ | Growing food service sector requires commercial-grade cutlery; hospitality expansion drives bulk purchases and quality equipment demand. |

| Driver | Premium kitchen equipment trend & quality consciousness | ★★★★☆ | Consumers prioritize durability and performance; willingness to invest in quality knives expands premium segment and brand positioning opportunities. |

| Restraint | Price sensitivity & budget constraints (low-income segments) | ★★★★☆ | Mass market consumers defer premium purchases; increases price competition and slows quality knife adoption in price-conscious segments. |

| Restraint | Market saturation & long replacement cycles | ★★★☆☆ | Durable products have extended lifespans; limits repeat purchases and slows market growth in mature regions. |

| Trend | E-commerce growth & direct-to-consumer sales | ★★★★★ | Online retail channels expand market reach; digital platforms enable brand building, customer reviews, and convenient purchasing experiences. |

| Trend | Ergonomic design & handle innovation | ★★★★☆ | Comfort-focused products gain traction; advanced handle materials and balanced designs differentiate premium offerings and enhance user experience. |

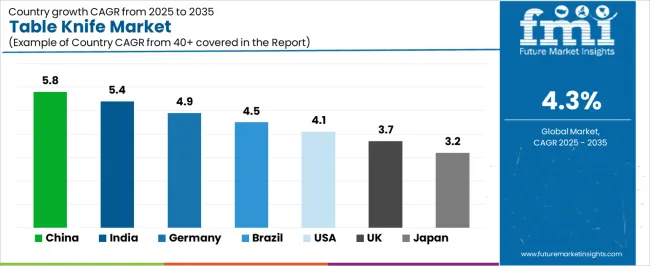

The table knife market demonstrates varied regional dynamics with Growth Leaders including China (5.8% growth rate) and India (5.4% growth rate) driving expansion through culinary modernization initiatives and household equipment development. Steady Performers encompass Germany (4.9% growth rate), Brazil (4.5% growth rate), and developed regions, benefiting from established culinary industries and advanced kitchen equipment adoption. Emerging Markets feature United States (4.1% growth rate) and United Kingdom (3.7% growth rate), where kitchen modernization and dining quality initiatives support consistent growth patterns.

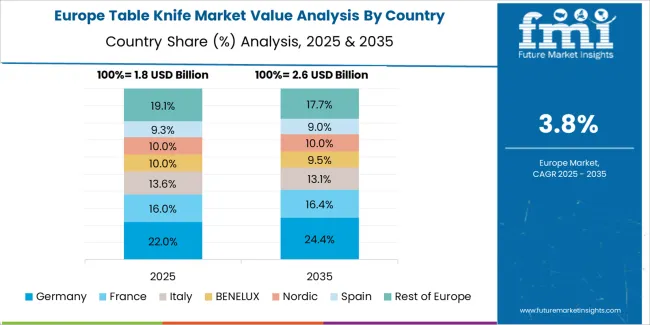

Regional synthesis reveals East Asian markets leading adoption through household expansion and culinary development, while North American countries maintain steady expansion supported by food service advancement and quality standardization requirements. European markets show moderate growth driven by culinary applications and premium product integration trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.8% | Lead with value-for-money | Intense local competition; price wars |

| India | 5.4% | Focus on middle-class households | Distribution challenges; brand awareness |

| Germany | 4.9% | Provide premium craftsmanship | High labor costs; niche market size |

| Brazil | 4.5% | Value-oriented products | Economic instability; import taxes |

| United States | 4.1% | Emphasize quality and durability | Market saturation; retailer consolidation |

| United Kingdom | 3.7% | Push premium positioning | Brexit trade impacts; consumer spending |

| Japan | 3.2% | Advanced traditional craftsmanship | Aging population; domestic focus |

China establishes fastest market growth through aggressive household modernization programs and comprehensive culinary equipment development, integrating advanced table knife systems as standard components in kitchen upgrades, hotel developments, and food service installations. The country's 5.8% growth rate reflects rising middle-class income and household consumption capabilities that mandate the use of quality cutlery systems in residential and commercial facilities. Growth concentrates in major urban centers, including Shanghai, Beijing, and Guangzhou, where kitchen modernization showcases integrated knife systems that appeal to consumers seeking advanced culinary capabilities and quality dining applications.

Chinese manufacturers are developing cost-effective knife solutions that combine domestic production advantages with advanced design features, including ergonomic handles and enhanced blade quality. Distribution channels through retail stores and e-commerce platforms expand market access, while rising disposable income supports adoption across diverse household and commercial segments.

Strategic Market Indicators:

In Delhi, Mumbai, and Bengaluru, urban households and hospitality facilities are implementing quality table knife systems as standard equipment for dining enhancement and food service applications, driven by increasing middle-class expansion and household modernization programs that emphasize the importance of quality kitchen equipment. The market holds a 5.4% growth rate, supported by rising disposable income and culinary awareness programs that promote quality cutlery systems for household and commercial facilities. Indian consumers are adopting knife systems that provide consistent cutting performance and durability features, particularly appealing in urban regions where dining quality and kitchen modernization represent priority household investments.

Market expansion benefits from growing hospitality sector capabilities and retail infrastructure development that enables widespread distribution of quality knife systems for household and commercial applications. Product adoption follows patterns established in kitchen equipment, where value-for-money and durability drive purchasing decisions and household deployment.

Market Intelligence Brief:

Germany establishes market leadership through comprehensive culinary tradition and advanced manufacturing expertise, integrating premium table knife systems across household, professional kitchen, and hospitality applications. The country's 4.9% growth rate reflects established cutlery industry heritage and mature quality product adoption that supports widespread use of precision knife systems in residential and commercial facilities. Growth concentrates in major manufacturing centers, including Solingen, Bavaria, and Baden-Württemberg, where cutlery craftsmanship showcases premium knife production that appeals to consumers seeking proven cutting quality capabilities and operational excellence applications.

German manufacturers leverage established brand reputation and comprehensive quality standards, including precision forging and traditional craftsmanship that create customer loyalty and market advantages. The market benefits from mature quality standards and consumer requirements that prioritize knife durability while supporting technology advancement and design innovation.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse household demand, including kitchen modernization in São Paulo and Rio de Janeiro, hospitality facility upgrades, and rising middle-class consumption that increasingly incorporates quality knife solutions for dining enhancement applications. The country maintains a 4.5% growth rate, driven by rising household income and increasing recognition of quality kitchen equipment benefits, including improved meal preparation and enhanced dining experiences.

Market dynamics focus on value-oriented knife solutions that balance quality performance with affordability considerations important to Brazilian consumers. Growing urban household expansion creates continued demand for kitchen equipment in residential infrastructure and household modernization projects.

Strategic Market Considerations:

United States establishes steady growth through comprehensive culinary culture and advanced retail infrastructure development, integrating table knife systems across household, restaurant, and institutional applications. The country's 4.1% growth rate reflects established kitchen equipment market maturity and quality product adoption that supports widespread use of cutlery systems in residential and commercial facilities. Growth concentrates in major urban centers and suburban markets, where kitchen modernization showcases established knife deployment that appeals to consumers seeking proven quality capabilities and durability applications.

American retailers leverage established distribution networks and comprehensive product selection, including specialty stores and e-commerce platforms that create customer convenience and market accessibility. The market benefits from mature consumer standards and quality expectations that prioritize knife performance while supporting brand competition and product innovation.

Market Intelligence Brief:

United Kingdom's culinary equipment market demonstrates sophisticated table knife deployment with documented consumer preference for quality products in household applications and hospitality facilities through integration with existing kitchen systems and dining infrastructure. The country leverages culinary tradition and quality consciousness to maintain a 3.7% growth rate. Urban centers, including London, Manchester, and Birmingham, showcase quality installations where knife systems integrate with premium kitchen equipment and dining experiences to optimize meal preparation and culinary effectiveness.

British consumers prioritize product quality and brand heritage in knife purchasing decisions, creating demand for established brands with proven performance, including European manufacturers and specialty cutlery producers. The market benefits from established retail infrastructure and a willingness to invest in quality kitchen equipment that provides long-term durability and performance benefits.

Market Intelligence Brief:

Japan's market growth is driven by traditional knife craftsmanship and culinary excellence, with table knife systems deployed across households, professional kitchens, and hospitality facilities. The country maintains a 3.2% growth rate through established cutlery heritage and precision manufacturing capabilities. Japanese manufacturers emphasize traditional forging techniques and material quality, creating demand for premium knife solutions with exceptional sharpness and balance characteristics.

South Korea's table knife market expansion benefits from comprehensive household modernization and culinary interest growth in urban households, restaurant operations, and food service facilities. The country's growth trajectory reflects rising disposable income and food culture development initiatives that promote quality knife adoption for dining enhancement and meal preparation optimization.

The table knife market in Europe is projected to grow from USD 2,587.1 million in 2025 to USD 3,888.6 million by 2035, registering a CAGR of 4.2% over the forecast period. Germany is expected to maintain its leadership position with a 38.6% market share in 2025, supported by its advanced cutlery manufacturing heritage and major production centers including Solingen and surrounding regions.

France follows with a 19.4% share in 2025, driven by comprehensive culinary tradition and quality dining culture in household and hospitality applications. The United Kingdom holds a 16.2% share through established retail infrastructure and quality product preferences. Italy commands a 12.8% share, while Spain accounts for 9.3% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 3.7% to 4.6% by 2035, attributed to increasing quality knife adoption in Nordic countries and emerging Eastern European households implementing kitchen modernization programs.

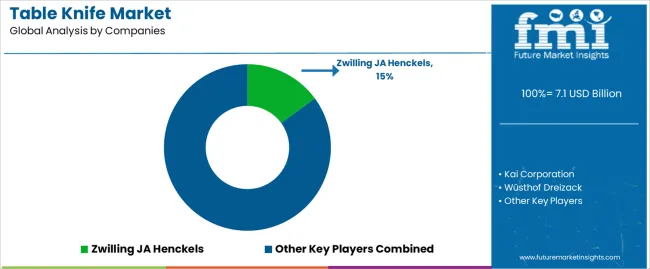

The competitive structure encompasses 25-35 credible players, with the top 5 holding approximately 42-48% by revenue. Leadership is maintained through brand reputation, distribution networks, and product innovation combining material quality, ergonomic design, and craftsmanship excellence capabilities. Basic blade manufacturing and standard handle designs are commoditizing, while margin opportunities exist in premium positioning, customization services, and integration into retail channels including specialty stores and e-commerce platforms.

Global platforms control distribution reach and established brand recognition with retail partnerships, providing broad availability and proven product quality across multi-region markets. Their typical blind spots include local market preferences and price-sensitive segment penetration that may limit market share growth. Technology innovators maintain R&D capabilities with advanced metallurgy and ergonomic designs, offering latest features first with attractive value proposition on durability enhancement, though they face distribution challenges in emerging markets and price competition from local manufacturers.

Regional specialists control local manufacturing, cultural alignment, and traditional craftsmanship, providing authentic products with competitive pricing and regional design preferences expertise. However, they encounter international expansion limitations and brand recognition challenges in global markets. Premium brand ecosystems maintain heritage positioning, quality standards, and specialty retail presence, achieving highest margins through brand loyalty and premium pricing, though market size limitations and luxury segment volatility represent typical challenges.

Mass market players focus on value positioning including functional designs, affordable pricing, and volume distribution through retail chains and supermarkets, winning price-conscious consumers with practical products and broad accessibility. Their scalability advantages face margin pressure and limited differentiation opportunities. The competitive environment emphasizes brand recognition, product quality, and distribution access as key differentiators, with successful players combining manufacturing excellence with comprehensive retail presence and consumer marketing expertise that addresses diverse requirements across household, commercial, and institutional sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD million |

| Material Type | Stainless Steel, Silverware, Ceramic, Plastic, Others |

| Application | Home, Hotel, Restaurant, School, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Brazil, France, South Korea, Australia, and 25+ additional countries |

| Key Companies Profiled | Zwilling JA Henckels, Kai Corporation, Wüsthof Dreizack, Yoshida Metal Industry, Victorinox, F. Dick, MAC Corporation, Lifetime Brands, Fiskars Corporation |

| Additional Attributes | Dollar sales by material type and application categories, regional adoption trends across East Asia, North America, and Western Europe, competitive landscape with cutlery manufacturers and kitchen equipment suppliers, consumer preferences for durability control and cutting performance, integration with kitchen platforms and dining systems, innovations in knife technology and material enhancement, and development of ergonomic cutlery solutions with enhanced performance and culinary optimization capabilities. |

The global table knife market is estimated to be valued at USD 7.1 billion in 2025.

The market size for the table knife market is projected to reach USD 10.8 billion by 2035.

The table knife market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in table knife market are stainless steel, silverware, ceramic, plastic and others.

In terms of application, home segment to command 60.0% share in the table knife market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tableware Market Size and Share Forecast Outlook 2025 to 2035

Tablet Hardness Testers Market Size and Share Forecast Outlook 2025 to 2035

Table Tents Market Size and Share Forecast Outlook 2025 to 2035

Tabletop CNC Milling Machines Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Table and Kitchen Linen Market Size and Share Forecast Outlook 2025 to 2035

Tablet Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tablets for Oral Suspension Market Analysis Size and Share Forecast Outlook 2025 to 2035

Tablet Press Machines Market Size and Share Forecast Outlook 2025 to 2035

Tablet Based E-Detailing Market Size and Share Forecast Outlook 2025 to 2035

Tablet And e-Reader Application Processor Market Size and Share Forecast Outlook 2025 to 2035

Tabletop Pizza Oven Market Size and Share Forecast Outlook 2025 to 2035

Tableau Services Market Size and Share Forecast Outlook 2025 to 2035

Tableland Tourism Market Size and Share Forecast Outlook 2025 to 2035

Table Linen Market Size and Share Forecast Outlook 2025 to 2035

Tablet Market Analysis by Product Type, End-Use, Operating System, and Region Through 2035

Market Share Distribution Among Tablets And Capsules Packaging Companies

Key Players & Market Share in Tablet Packing Machine Industry

Competitive Landscape of Tableware Providers

Tablets and Capsules Packaging Market Growth, Trends, Forecast 2025-2035

Tablet Counting Machine Market Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA