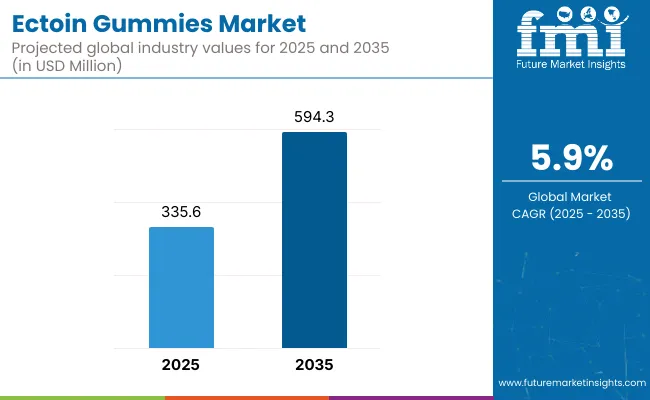

By 2035, the Ectoin Gummies Market is poised to surpass USD 594.3 million, growing from an estimated base of USD 335.6 million in 2025. This transition reflects a cumulative value addition of USD 258.7 million, marking a robust 77% increase in a ten-year span. A steady compound annual growth rate (CAGR) of 5.9% is expected to characterize this trajectory, underlining long-term resilience and growing consumer affinity toward science-backed ingestible skincare.

Ectoin Gummies Market Key Takeaways

| Metric | Value |

| Estimated Value in (2025E) | USD 335.6 million |

| Forecast Value in (2035F) | USD 594.3 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

The market’s doubling trend signals a growing recognition of ectoin’s cellular protection properties, particularly across wellness-focused consumers and preventative healthcare enthusiasts.

During the initial five-year phase (2025-2030), approximately USD 104 million in value is projected to be added accounting for 40.2% of the total decade growth. This early surge is likely to be fueled by rising demand across online retail channels, with preventive skincare and general wellness trends being rapidly mainstreamed. Ectoin gummies are expected to find strong resonance among digitally native consumers, supported by the influence of functional nutrition and clean-label positioning.

The second half of the forecast period (2030-2035) is anticipated to contribute USD 154.7 million, or 59.8% of total market expansion. Accelerated growth will likely be underpinned by clinical endorsements, regulatory validation across high-income countries, and integration of ectoin into personalized nutrition platforms. Subscription-based delivery models, practitioner-led channels, and neurodermatological use cases are expected to strengthen commercial maturity and long-term consumer retention for ectoin-based nutraceutical formats, particularly gummies.

From 2020 to 2024, the Ectoin Gummies Market evolved from an ingredient-centric innovation cycle into a consumer-facing nutraceutical format, with global awareness around ectoin’s cellular protection properties fueling early-stage growth. During this period, active ingredient suppliers and CDMO partnerships accounted for over 75% of value generation, driven by formulation development and early-phase product commercialization. Competitive differentiation centered on scientific validation, safety claims, and bioavailability, while brand-led consumer marketing remained limited to early adopters.

Demand is expected to rise to USD 335.6 million by 2025, with the revenue mix shifting toward consumer brands and personalized supplement platforms. By 2035, value creation will increasingly be driven by AI-curated stacks, beauty-from-within personalization, and clean-label formulation ecosystems. Traditional raw material leaders are adapting through co-branding and B2B2C models, while emerging D2C players are capturing share through subscription models, adaptive dosing, and lifestyle-led positioning.

Competitive advantage will continue to transition from ingredient purity alone to integrated offerings that emphasize regulatory transparency, clinical utility, and consumer personalization defining a new standard for performance-linked nutraceuticals.

Significant momentum has been observed in the Ectoin Gummies Market, primarily driven by growing consumer awareness regarding cellular health and oxidative stress protection. The increasing preference for oral skincare and ingestible beauty supplements has been influenced by the broader wellness convergence between nutrition and dermatology.

Ectoin, known for its cytoprotective and anti-inflammatory properties, has been positioned as a next-generation bioactive, particularly in regions where preventive health has gained mainstream adoption.

Clinical validation of ectoin's efficacy in reducing cellular damage, especially under environmental stressors like UV exposure and pollution, has been extensively highlighted in dermatological research. In parallel, online retail ecosystems have amplified product accessibility and education, fostering rapid adoption among tech-savvy and health-conscious consumers.

Innovation in gummy supplement delivery formats offering both taste and therapeutic appeal has further reinforced market traction. As regulatory frameworks evolve to support functional nutraceutical claims, a stronger foothold for ectoin-based products is expected across global healthcare and wellness sectors.

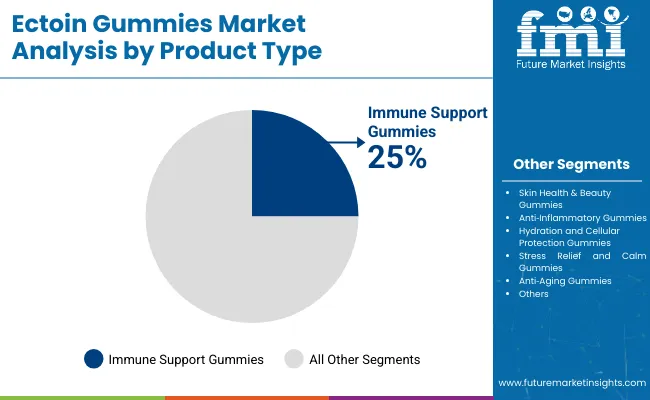

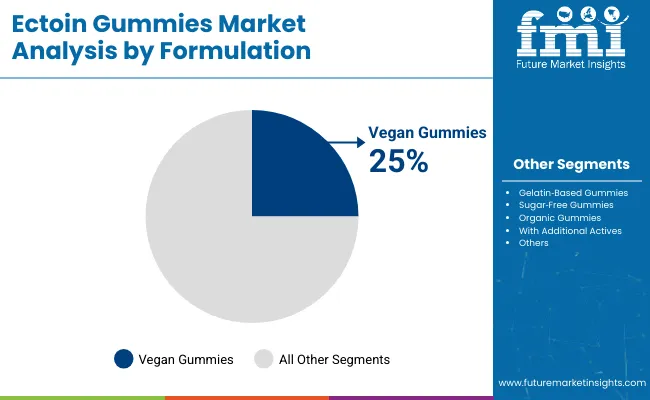

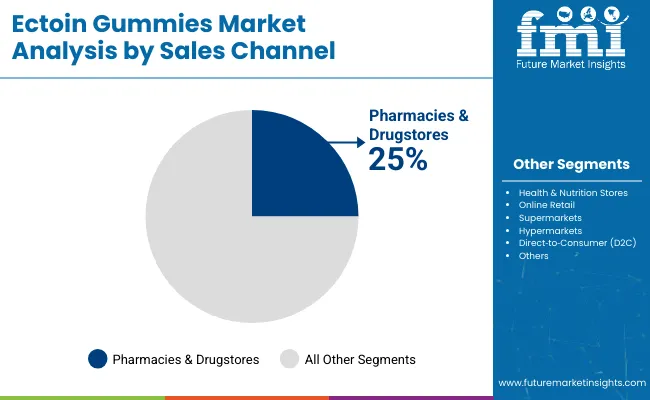

The Ectoin Gummies Market has been comprehensively segmented across product type, formulation type, and sales channel, reflecting a nuanced understanding of consumer health preferences and delivery innovations. The product type segmentation captures therapeutic intent, including immune support, beauty enhancement, anti-inflammatory functions, and cellular protection.

Formulation type distinguishes between consumer lifestyle preferences and dietary restrictions addressing needs for vegan, sugar-free, and organic formats. Meanwhile, sales channel segmentation identifies access points, from physical pharmacies and supermarkets to digital-first platforms such as online retail and direct-to-consumer (D2C) models. Each segment highlights the evolving consumer expectations and commercialization strategies that are shaping the trajectory of ectoin-based supplement delivery systems.

| Product Type | 2025 Share % |

|---|---|

| Immune Support Gummies | 25% |

| Skin Health & Beauty Gummies | 20% |

| Anti Inflammatory Gummies | 15% |

| Hydration & Cellular Protection Gummies | 10% |

| Stress Relief & Calm Gummies | 15% |

| Anti Aging Gummies | 15% |

The immune support gummies segment is expected to command 25% of market value in 2025, establishing itself as the dominant product type. Growth within this category has been influenced by heightened health consciousness post-pandemic and sustained demand for supplements that reinforce innate immunity.

Ectoin’s clinically studied protective effects against cellular stress and inflammation have positioned it favorably in immune-enhancing formats. The segment is likely to benefit from dual-function formulations that merge immune support with daily wellness, providing both preventative and therapeutic appeal. Continued innovation in flavor masking, dosing accuracy, and shelf-life stability is expected to sustain consumer trust and repeat purchase behavior.

| Formulation Type | 2025 Share % |

|---|---|

| Vegan Gummies | 25% |

| Gelatin Based Gummies | 30% |

| Sugar Free Gummies | 15% |

| Organic Gummies | 10% |

| With Additional Actives | 20% |

The gelatin-based formulation is projected to dominate with a 30% share in 2025, supported by its widespread manufacturing scalability and consumer familiarity. This formulation type has been widely adopted due to its flexibility in shaping, chewability, and active ingredient stability.

As ectoin remains sensitive to processing conditions, gelatin matrices have provided a reliable medium to ensure bioavailability and structural integrity. However, rising ethical and dietary shifts are encouraging reformulation efforts. Despite this, the gelatin-based segment is expected to remain relevant due to its cost-effectiveness, product stability, and broad consumer acceptance in both developed and emerging markets.

| Sales Channel | 2025 Share % |

|---|---|

| Pharmacies & Drugstores | 25% |

| Health & Nutrition Stores | 20% |

| Online Retail | 30% |

| Supermarkets & Hypermarkets | 15% |

| Direct to Consumer (D2C) | 10% |

Online retail is forecasted to capture the largest market share at 30% in 2025, emerging as the preferred distribution channel for ectoin gummies. The rapid adoption of e-commerce platforms has been enabled by consumers’ increasing comfort with self-care purchases, particularly those associated with skincare, immunity, and relaxation. Enhanced product education through digital content, influencer-led testimonials, and algorithm-driven personalization has further accelerated demand.

Subscription models, bundling offers, and auto-refill mechanisms are also supporting market retention. As transparency, lab-certification access, and ingredient traceability become standard, online platforms are expected to play a pivotal role in democratizing access to premium nutraceuticals like ectoin.

Although ectoin gummies are gaining attention for their skin health and cellular resilience benefits, market expansion continues to be shaped by evolving consumer expectations, regulatory scrutiny, and innovation pacing across supplement formats, personalization platforms, and wellness-driven retail ecosystems.

Integration of Ectoin into Personalized Nutritional Platforms

Demand has been shaped by the rising convergence of ectoin formulations with personalized nutrition diagnostics and DNA-based supplement recommendations. Ectoin’s ability to modulate stress proteins and cellular responses has been positioned as ideal for preventive care routines tailored to individual biochemistry.

Forward-thinking supplement brands have already embedded ectoin into AI-curated regimens that adjust dosage frequency based on real-time biomarker readings. This trend is being accelerated by increasing adoption of at-home blood tests and microbiome kits, enabling data-driven delivery of targeted actives.

The credibility of ectoin in both dermatological and systemic wellness applications has allowed it to stand apart in the bioactive hierarchy. As consumer expectations shift toward evidence-based and precision-oriented wellness solutions, platforms integrating ectoin are expected to expand significantly.

Convergence of Ectoin with Neurodermatology and Stress-Cognition Interventions

A key market trend has emerged from ectoin’s repositioning in neurodermatological applications, linking skin health with emotional well-being. Ectoin’s role in reducing cortisol-related skin sensitivity and maintaining cellular hydration under psychological stress has attracted formulators focusing on stress-adaptive nutrition.

Gummies combining ectoin with nootropic ingredients such as L-theanine and GABA are already being piloted for users facing chronic anxiety and burnout. This psycho-dermatological convergence is being actively explored in functional food R&D pipelines. Given rising mental health concerns globally, this dual-action model is expected to unlock new verticals for ectoin gummies especially in workplace wellness, academic performance, and adolescent stress management spaces.

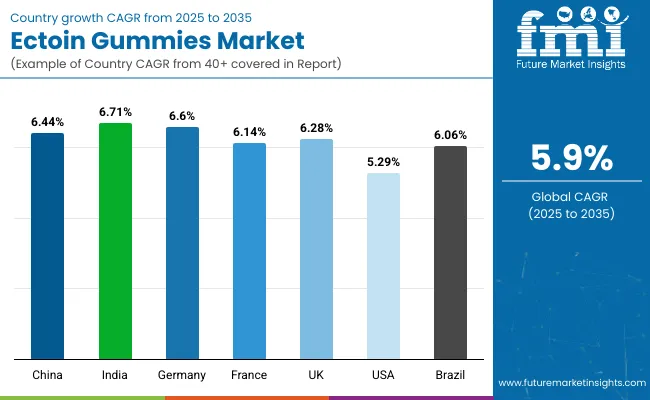

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 6.44% |

| India | 6.71% |

| Germany | 6.60% |

| France | 6.14% |

| UK | 6.28% |

| USA | 5.29% |

| Brazil | 6.06% |

The global Ectoin Gummies Market is experiencing varied growth trajectories across key economies, shaped by differences in nutraceutical regulation, preventive health uptake, and functional ingredient innovation pipelines. Regional momentum has been notably influenced by consumer access to premium wellness products, public health positioning of oral skincare, and digitized supplement delivery models.

India is expected to lead with a CAGR of 6.71%, supported by its rapidly growing urban wellness economy and increased investments in ingredient-backed nutraceuticals by D2C brands. Ectoin gummies are being adopted as lifestyle-focused, anti-pollution formats in high-density metros, where skin barrier protection has gained clinical and cosmetic attention.

Germany (CAGR: 6.60%) and the UK (6.28%) are forecasted to remain central to Europe’s growth narrative, due to their rigorous skincare supplement validation protocols and high demand for vegan, dermatologically endorsed formulations. Market penetration is further advanced through pharmacy-led consumer education and practitioner-guided trials.

China, at a CAGR of 6.44%, reflects strategic scale-up driven by TCM-modernization synergies, while France (6.14%) shows strong alignment with cosmeceutical crossover applications. Brazil (6.06%) and the USA (5.29%) are projected to deliver steady growth, fueled by evolving regulatory clarity and increasing premium shelf space for multifunctional gummies. A differentiated mix of science-driven branding and clean-label innovation will be critical in sustaining momentum across these diverse markets.

| Years | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| USA | 80.54 | 85.5 | 89.9 | 95.9 | 101.6 | 106.7 | 112.1 | 119.0 | 126.1 | 134.5 | 141.8 |

The Ectoin Gummies Market in the United States is projected to expand from USD 80.54 million in 2025 to USD 141.80 million in 2035, advancing at a CAGR of 5.8%. Growth is being shaped by clinical interest in ectoin’s cellular stress mitigation, as well as its ability to support dermal health under environmental pressure. This market’s progression has been bolstered by innovation in multi-functional nutraceuticals, with stress-relief, skin hydration, and immunity being bundled in a single daily format.

Widespread adoption of ectoin gummies has been increasingly observed within practitioner-led anti-aging clinics, where dermatologists and functional medicine professionals are recommending these products as part of long-term skin barrier management.

Additionally, dental wellness platforms and tele-nutrition services have started incorporating ectoin supplements into subscription kits targeted at oral mucosa hydration and systemic inflammation reduction. Partnerships between clinical labs and e-commerce players have further enabled tailored offerings based on skin sensitivity biomarkers.

A CAGR of 6.28% is forecasted for the UK’s Ectoin Gummies Market between 2025 and 2035, reflecting robust alignment with cosmeceutical wellness trends and dermatological supplementation. Growth is being supported by clinical preference for oral skin-barrier protection and consumer trust in bioactive-driven skincare formats.

India’s Ectoin Gummies Market is projected to grow at a CAGR of 6.71%, driven by increasing urban exposure to skin stressors and rising disposable income among wellness-conscious millennials. The functional gummies format has gained traction as a culturally palatable alternative to capsules or tablets.

With a CAGR of 6.44% forecasted between 2025 to 2035, China is expected to remain a pivotal player in shaping the global ectoin gummies landscape, particularly through scale and regulatory experimentation. The ingredient is being actively positioned within the next-gen TCM (Traditional Chinese Medicine) innovation framework.

| Countries | 2025 | 2035 |

|---|---|---|

| UK | 18.72% | 18.24% |

| Germany | 20.90% | 20.41% |

| Italy | 9.18% | 10.31% |

| France | 14.65% | 12.20% |

| Spain | 10.50% | 11.44% |

| BENELUX | 6.74% | 5.92% |

| Nordic | 5.81% | 5.20% |

| Rest of Europe | 13% | 16% |

A CAGR of 6.60% is projected for Germany’s Ectoin Gummies Market, supported by the country’s well-established footprint in both skincare innovation and high-purity nutraceutical manufacturing. Growth is expected to be strongly pharmacy-led, with physician trust playing a central role in adoption.

| Product Type | 2025 Share % |

|---|---|

| Immune Support Gummies | 26% |

| Skin Health & Beauty Gummies | 22% |

| Anti Inflammatory Gummies | 14% |

| Hydration & Cellular Protection Gummies | 10% |

| Stress Relief & Calm Gummies | 14% |

| Anti Aging Gummies | 14% |

The ectoin gummies market in South Korea is projected to reach a valuation of US$ 3.22 million by 2025. Among the leading product formats, gelatin-based gummies are expected to maintain the top position, capturing approximately 30% of the market share due to their established formulation base and consumer familiarity. Close behind, vegan gummies are gaining rapid momentum, accounting for nearly 28% of the market, and expanding at an impressive compound annual growth rate (CAGR) of 9.8%.

The vegan gummy segment, forecasted to expand at a CAGR of 9.8%, is expected to gain further momentum as plant-based and cruelty-free claims become central to consumer purchase decisions. Meanwhile, gelatin-based gummies are projected to retain substantial market presence due to familiarity, superior chewability, and established formulation infrastructure.

Gummies with additional actives, capturing 19% share, are being increasingly adopted in multifunctional SKUs that combine ectoin with ceramides, probiotics, or adaptogens catering to consumers seeking synergy between beauty, stress resilience, and immune modulation. Rapid urbanization and digital wellness platforms are reshaping purchase behavior, with personalization and ingredient traceability emerging as critical drivers of brand loyalty.

| Formulation Type | 2025 Share % |

|---|---|

| Vegan Gummies | 28% |

| Gelatin Based Gummies | 30% |

| Sugar Free Gummies | 14% |

| Organic Gummies | 9% |

| With Additional Actives | 19% |

The Ectoin Gummies Market in Japan is projected to reach USD 5.64 million in 2025, reflecting a strong orientation toward functional beauty, stress modulation, and graceful aging. The immune support segment, leading with 26% share, is expected to maintain its momentum through clinical positioning of ectoin as a cell-protective agent under oxidative and inflammatory stress. Meanwhile, skin health & beauty gummies, holding a 22% share, have seen rapid consumer adoption driven by Japan’s advanced dermaceutical culture, where oral beauty is considered an extension of topical regimens.

The anti-aging segment (14%) is supported by ectoin’s reputation for hydration retention and stress protein modulation, both highly valued in the country's wellness and longevity markets. Japanese consumers are displaying a strong preference for multi-functional nutraceuticals that align with aesthetic health goals, leading brands to focus on combining ectoin with collagen, hyaluronic acid, and plant-based antioxidants.

| Suppliers | Global Value Share 2025 |

|---|---|

| Bloomage Biotechnology | 26% |

| Others | 74% |

The Ectoin Gummies Market is moderately fragmented, comprising active ingredient pioneers, contract manufacturers, and brand-forward nutraceutical players operating across functional health domains. Ingredient innovation is being led by suppliers such as Mibelle Biochemistry and Lonza Group, who have positioned ectoin as a premium stress-protective molecule through patented extraction methods and clinical validation pipelines. Their partnerships with formulation experts and private-label manufacturers are enabling broad-spectrum integration into gummy formats.

Mid-sized operators like Ingredia S.A., Gelita AG, and Nutraceutix are supporting market growth through contract development and manufacturing services (CDMOs), offering formulation support, stability testing, and compliance advisory for functional confectionery. Their ability to tailor dosage forms and preserve bioactivity during thermal processing is viewed as a strategic advantage in a crowded delivery format space.

Brand-focused consumer players such as Goli Nutrition, Nature’s Way, SmartyPants Vitamins, and MaryRuth Organics are actively incorporating ectoin into beauty-from-within and stress-calm portfolios, leveraging influencer-led positioning and clean-label narratives. Innovation pipelines are increasingly focused on multi-ingredient stacking, sugar-free matrix engineering, and subscription-based distribution models.

Competitive advantage is expected to shift from standalone ingredient claims to ecosystem-led differentiation including personalized dosing platforms, biomarker-linked user feedback loops, and transparent sourcing protocols for next-gen nutraceuticals.

| Item | Value |

|---|---|

| Quantitative Units | USD 594.3 million (by 2035) |

| Product Type | Immune Support, Skin Health & Beauty, Anti-Inflammatory, Hydration & Cellular Protection, Stress Relief & Calm, Anti-Aging |

| Formulation Type | Gelatin-Based Gummies, Vegan Gummies, Sugar-Free, Organic, With Additional Actives |

| Sales Channel | Pharmacies & Drugstores, Health & Nutrition Stores, Online Retail, Supermarkets & Hypermarkets, Direct-to-Consumer (D2C) |

| Application Focus | Skin Barrier Protection, Anti-Stress Supplementation, Anti-Aging Support, Hydration Therapy, Immune System Modulation |

| Consumer Segments | Urban Millennials, Aging Adults, Beauty-Driven Consumers, Stress-Prone Professionals, Clean-Label Seekers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Mibelle Biochemistry, Lonza Group, Ingredia S.A., BASF (Nutraceuticals), Gelita AG, Nutraceutix, Goli Nutrition, Nature’s Way, SmartyPants Vitamins, MaryRuth Organics |

| Additional Attributes | Ingredient sourcing trends (biotech-origin ectoin), consumer shift toward vegan & sugar-free formats, functional layering (ectoin + adaptogens), rise of personalized gummy subscriptions, clean-label compliance, regulatory support in Europe and Asia, K-beauty and J-beauty influence on product design, ectoin’s proven dermal stress protection in nutraceutical use cases |

The global Ectoin Gummies Market is estimated to be valued at USD 335.6 million in 2025.

The market size for the Ectoin Gummies Market is projected to reach approximately USD 594.3 million by 2035.

The Ectoin Gummies Market is expected to grow at a CAGR of 5.9% between 2025 and 2035, reflecting a sustained demand for skin, stress, and immune health gummies.

The key product types in the Ectoin Gummies Market include Immune Support, Skin Health & Beauty, Anti-Aging, Hydration & Cellular Protection, Anti-Inflammatory, and Stress Relief & Calm Gummies.

In terms of formulation, Gelatin-Based Gummies are projected to command the largest share at 30% of the Ectoin Gummies Market in 2025, followed closely by Vegan Gummies at 28%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ectoin-Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

CBD Gummies Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

CoQ10 Gummies Market Analysis by Source, Distribution Channels, and Key Regions Through 2035

Biotin Gummies Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA CBD Gummies Market Trends – Growth, Demand & Innovations 2025-2035

ASEAN CBD Gummies Market Growth – Trends, Demand & Innovations 2025-2035

Europe CBD Gummies Market Insights – Size, Share & Industry Trends 2025-2035

Jellies and Gummies Market Size and Share Forecast Outlook 2025 to 2035

Multivitamin Gummies Market Analysis by Source, End-user, Application, Sales Channel, Distribution Channel, and Region Through 2035

Nutraceutical Gummies Market Analysis - Size, Share, and Forecast 2025 to 2035

Dietary Fiber Gummies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA