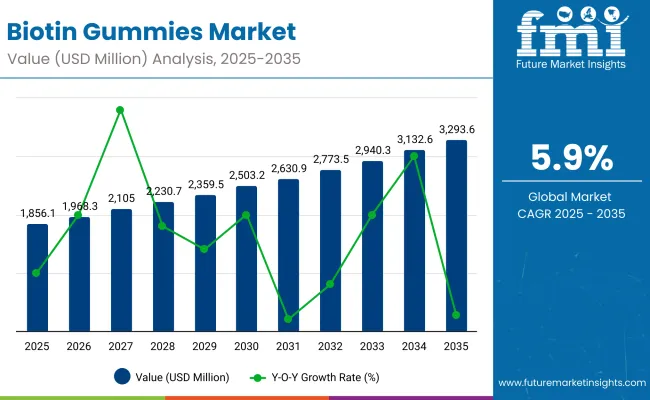

A market valuation of USD 1,856.1 million in 2025 is projected to be advanced to USD 3,293.6 million by 2035, reflecting an incremental gain of USD 1,437.5 million over the decade. This translates into a compound annual growth rate (CAGR) of 5.9%, signaling steady yet resilient category expansion.

Biotin Gummies Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1.86 billion |

| Market Forecast Value in (2035F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The first half of the forecast period, from 2025 to 2030, is expected to see the market progress from USD 1,856.1 million to USD 2,503.2 million, generating USD 647.1 million in additional value, which represents nearly 45% of the total ten-year increase. Growth in this phase is anticipated to be underpinned by the broadening acceptance of beauty-from-within supplementation and the consolidation of online retail as a dominant sales channel.

During the second half, from 2030 to 2035, a stronger pace of market expansion is anticipated, with USD 790.4 million added as the market moves from USD 2,503.2 million to USD 3,293.6 million. This acceleration is likely to be reinforced by deeper penetration into emerging economies, where rising disposable incomes and wellness awareness are forecast to stimulate demand. Product innovation aligned with sugar reduction, plant-based gelling agents, and clinically validated dosages is expected to sustain premium positioning and encourage repeat purchase rates.

In the context of this trajectory, market share shifts are likely to favor brands demonstrating regulatory compliance, robust supply chain agility, and Omni channel execution. As consumer trust becomes increasingly linked to transparency and third-party testing, long-term competitive advantage is expected to be secured by those investing in both product quality and educational outreach.

From 2020 to 2024, the Biotin Gummies Market was advanced from a niche wellness segment to a mainstream supplementation category, supported by strong consumer pull for beauty-from-within products. This period witnessed market leadership concentrated among established nutraceutical brands and specialized gummy supplement innovators, collectively accounting for the majority of global revenue. Differentiation was achieved through taste innovation, dosage standardization, and multi-ingredient fortification strategies, while online channels emerged as critical acquisition platforms.

By 2025, demand is projected to reach USD 1.86 billion, with growth increasingly shaped by clean-label reformulations, sugar reduction, and plant-based gelling innovations. Competitive dynamics are anticipated to shift toward brands demonstrating clinical validation, transparent sourcing, and Omni channel execution. Digital-first entrants are expected to challenge incumbents by leveraging influencer ecosystems, AI-personalized subscription models, and targeted micro-nutrient blending. Over the decade, long-term category winners are likely to be defined not solely by product innovation, but by the strength of consumer trust, supply chain agility, and the ability to scale personalization at a global level.

Growth in the Biotin Gummies Market is being supported by the convergence of rising wellness awareness, the popularity of beauty-from-within supplementation, and consumer preference for convenient, palatable dosage forms. The format’s taste appeal and ease of consumption have been leveraged to attract first-time supplement users, particularly in younger demographics. Advancements in gummy formulation technology have enabled the integration of clinically relevant biotin dosages alongside complementary nutrients, improving perceived efficacy.

Digital retail channels have been utilized to drive personalized marketing, influencer-led promotions, and subscription-based replenishment models. Clean-label reformulations, reduced sugar content, and plant-based gelling agents have been adopted to align with evolving dietary preferences. Regulatory compliance and transparent sourcing practices are expected to strengthen consumer trust, further sustaining adoption. As functional benefits are increasingly supported by clinical validation, demand is anticipated to accelerate in both mature and emerging markets, driving consistent revenue expansion across the forecast period.

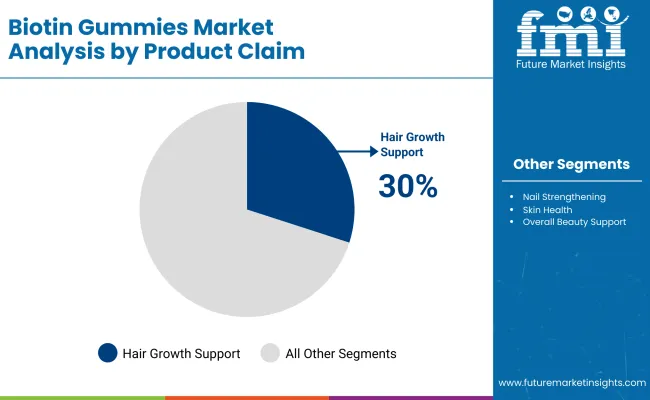

The Biotin Gummies Market has been comprehensively segmented to reflect how architecture taste, benefit signaling, and audience targeting are shaping demand. In flavor, consumer adherence is being strengthened by familiar berry and citrus profiles, while tropical and assorted mixes are being used to refresh repeat purchases and reduce taste fatigue. In product claims, growth is being catalyzed by hair-focused positioning, with spillover into nail and skin outcomes as multi-ingredient formats mature and substantiation improves.

In target demographics, engagement is being led by women aged 18-44, while adoption among men and teenagers is being expanded through gender-neutral branding and creator-led discovery. Through this structure, visibility is being provided into shifting taste preferences, proof-oriented claims, and age-specific need states that are expected to guide portfolio design, channel prioritization, and pricing ladders over the forecast horizon.

| Flavor Segment | Market Value Share, 2025 |

|---|---|

| Berry (Strawberry, Raspberry, Blueberry, Mixed Berry) | 40% |

| Citrus (Orange, Lemon, Grapefruit) | 18% |

| Tropical (Pineapple, Mango, Coconut) | 12% |

| Apple & Other Fruits | 10% |

| Mixed/Assorted Flavors | 20% |

Berry-forward profiles are being positioned as the default for broad appeal share around 40% of total market share in 2025, supported by natural flavor associations and high acceptance across age cohorts. Citrus notes are expected to benefit from “fresh/clean” cues and pairing with reduced-sugar recipes. Tropical variants are being used to drive novelty and incremental trial among younger consumers, while apple/other fruits and assorted mixes are being deployed to maintain variety across subscription cycles. Over the medium term, share stability is anticipated to favor brands standardizing natural colorants and sweeteners, with shelf resilience expected where heat/moisture stability is validated for warm-climate markets.

| Application | Market Value Share, 2025 |

|---|---|

| Hair Growth Support | 30% |

| Nail Strengthening | 20% |

| Skin Health | 25% |

| Overall Beauty Support | 15% |

| Energy & Metabolism Support | 10% |

Hair growth support is being retained as the anchor claim, share 30% of the market share underpinned by recognition of biotin’s role in keratin pathways and reinforced by before/after narratives. Nail strengthening is expected to sustain momentum in routines that bundle hair, nail, and skin outcomes. Skin health claims are being widened through co-formulation with collagen, minerals, and antioxidants, while “overall beauty support” SKUs are being positioned for simplicity seekers. Energy/metabolism claims are being used to reach wellness generalists through B-complex synergy. Over time, claim hierarchy is expected to correlate with clinical signaling, assay-interference risk communication, and retailer compliance requirements.

Clinical Validation Enhancing Category Credibility

Market adoption is being anchored by the growing portfolio of peer-reviewed clinical studies validating biotin supplementation’s measurable benefits for hair, skin, and nail health. Over the past five years, evidence-based positioning has been increasingly emphasized as both consumers and regulatory bodies demand transparency in dosage efficacy and safety. Brands are leveraging third-party laboratory verification and publishing assay results to substantiate claims, enabling the category to transition from trend-driven appeal to clinically grounded legitimacy. Retailer partnerships are being strengthened as evidence-backed products are seen as lower compliance risks and better suited for premium placement.

This validation is also allowing manufacturers to justify premium pricing strategies, particularly in mature markets where consumer skepticism can hinder uptake. Additionally, ongoing research into synergistic ingredient combinations is expected to extend biotin’s appeal into adjacent wellness categories, further solidifying its functional credibility. Competitive advantage over the forecast period is projected to favor companies that not only meet minimum compliance standards but also actively invest in longitudinal studies and dosage optimization trials. This proactive approach is anticipated to position such brands as thought leaders in the beauty-from-within segment, resulting in sustained shelf visibility, higher repeat purchase rates, and enduring consumer trust.

Cross-Category Innovation in Functional Formulations

The Biotin Gummies Market is experiencing accelerated expansion through the integration of biotin with complementary active ingredients, creating multifunctional formulations that address multiple beauty and wellness concerns simultaneously. By combining biotin with collagen peptides, zinc, adaptogens, and antioxidants, brands are able to target hair vitality, skin elasticity, nail strength, stress management, and overall energy metabolism in a single product. This cross-category innovation is enabling products to move beyond single-claim positioning, aligning with consumer demand for convenience, value-per-serving, and comprehensive health solutions.

The appeal is particularly strong in urban markets where time-pressed consumers seek simplified supplement regimens without sacrificing efficacy. Manufacturers capable of delivering stable, multi-active formulations without compromising taste, texture, or bioavailability are expected to secure strategic advantage. Technological advances in microencapsulation and controlled-release systems are further enabling ingredient compatibility while preserving potency over shelf life. As premiumization trends continue, multifunctional gummies are anticipated to command higher price points, especially when supported by clear on-pack benefit hierarchies and clinically validated claims. Over the forecast horizon, competitive differentiation is likely to favor players that excel in integrating functional diversity with clean-label credentials, effectively bridging the gap between indulgence, convenience, and therapeutic performance.

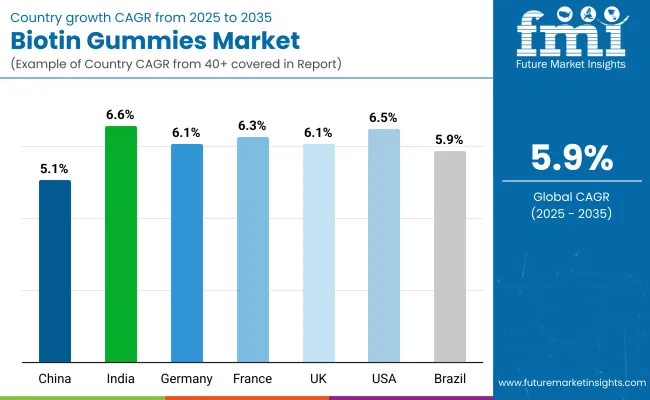

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.54% |

| Germany | 6.16% |

| France | 6.38% |

| China | 5.13% |

| India | 6.62% |

| Brazil | 5.91% |

The global biotin gummies market has been shaped by varied regional consumption patterns, regulatory environments, and consumer awareness of nutraceuticals. North America has remained the most mature market, with the United States (6.54% CAGR) leading growth through the dominance of direct-to-consumer (DTC) brands, subscription-based e-commerce models, and sustained demand for multifunctional beauty-from-within supplements.

Europe has registered steady progress, led by Germany (6.16%), France (6.38%), where biotin gummies have been increasingly positioned as part of holistic beauty and wellness regimes. Stronger regulatory oversight and consumer preference for vegan-certified and sugar-free formulations have shaped demand in these markets.

Asia-Pacific has been identified as the fastest-growing, with China (5.13%) and India (6.62%) emerging as pivotal growth centers. In China, expansion has been accelerated by clean-label demand, KOL-driven online marketing, and cross-border e-commerce platforms. India’s momentum has been attributed to rapid uptake in urban wellness retail, expanding preventive healthcare awareness, and increasing female consumer participation in beauty supplement categories.

In Latin America, Brazil (5.91%) has emerged as a growth hub, supported by expanding health-focused retail chains and rising popularity of beauty gummies among younger demographics.

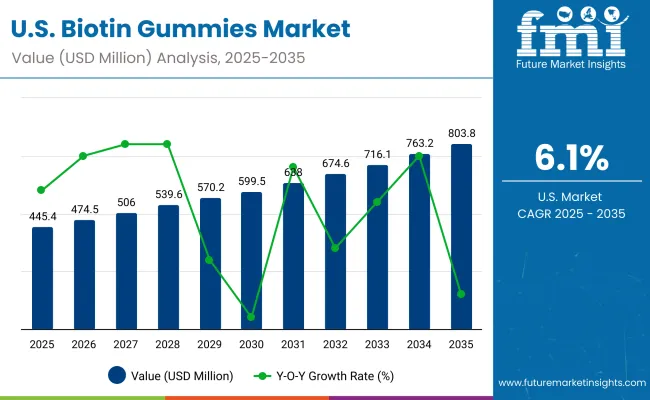

The USA biotin gummies market is projected to grow at a CAGR of 6.1% between 2025 and 2035, reaching substantial value expansion over the forecast period. Growth is supported by strong consumer adoption of beauty-from-within nutraceuticals, particularly among millennials and Gen Z who favor gummies for their palatable taste, convenience, and compliance advantages compared to capsules or tablets.

Hair health continues to dominate product positioning, with biotin widely marketed for hair growth, thickness, and strength. This segment accounts for the largest share, while nail health and skin radiance solutions are also gaining traction. Increasing awareness of metabolism andenergy support has further diversified demand, especially through multifunctional gummy formulations that combine biotin with collagen, hyaluronic acid, or other beauty actives.

Distribution is led by direct-to-consumer (DTC) e-commerce platforms, Amazon, and brand-owned websites, with offline presence in Walmart, Walgreens, and CVS reinforcing accessibility. Marketing via influencers and subscription-based models has enhanced repeat purchase rates and brand loyalty.

| Year | USA Biotin Gummies Market (USD Billion) |

|---|---|

| 2025 | 445.46 |

| 2026 | 474.5 |

| 2027 | 506.0 |

| 2028 | 539.6 |

| 2029 | 570.2 |

| 2030 | 599.5 |

| 2031 | 638.0 |

| 2032 | 674.6 |

| 2033 | 716.1 |

| 2034 | 763.2 |

| 2035 | 803.8 |

The Biotin Gummies Market in the United Kingdom is forecasted to expand at a CAGR of 6.11% between 2025 and 2035, supported by increasing consumer prioritization of beauty-from-within solutions and preventive wellness practices. Expansion has been strengthened by the UK’s clean-label supplement movement, where transparency, allergen-free formulations, and vegan certifications have become core purchase drivers. Specialty beauty retailers, e-commerce channels, and subscription-based platforms are being positioned as the leading distribution networks. Notable momentum has been observed in multifunctional gummy formats that combine biotin with collagen, hyaluronic acid, or vitamins C and E, catering to holistic skin, hair, and nail health. Rising awareness of nutritional gaps among younger demographics and an aging population has further reinforced market adoption.

The berberine market in India is projected to grow at a CAGR of 6.54% between 2025 and 2035, driven by expanding awareness of traditional botanicals in managing diabetes, cholesterol, and digestive disorders. India’s strong Ayurvedic heritage and integration of botanical extracts into modern nutraceutical formulations are reinforcing consumer confidence in berberine supplements. The proliferation of e-commerce marketplaces and regional nutraceutical brands is fueling accessibility, while private-label collaborations with global supplement firms are accelerating domestic capacity. Increased prevalence of metabolic syndrome and a surge in preventive healthcare spending have catalyzed demand for berberine capsules, tablets, and functional blends. Clean-label, vegan, and allergen-free positioning continues to gain traction among India’s younger urban population.

China’s biotin gummies market is projected to expand at a CAGR of 9.70% between 2025 and 2035, positioning it as one of the fastest-growing markets globally. The category has been reinforced by both traditional beauty beliefs and modern supplement innovation. Gummies have gained popularity across Tier 1 and Tier 2 cities, where consumers are adopting them as part of beauty-from-within and functional wellness regimens. Strong regulatory encouragement for standardized nutraceuticals, coupled with robust domestic gummy manufacturing infrastructure, has enabled China to emerge as both a leading consumer and a competitive exporter.

| Countries / Subregions | 2025 |

|---|---|

| UK | 19.15% |

| Germany | 21.88% |

| Italy | 9.42% |

| France | 14.62% |

| Spain | 10.56% |

| BENELUX | 6.19% |

| Nordic | 5.83% |

| Rest of Europe | 12% |

| Countries / Subregions | 2035 |

|---|---|

| UK | 19.40% |

| Germany | 20.73% |

| Italy | 10.73% |

| France | 13.58% |

| Spain | 11.92% |

| BENELUX | 5.26% |

| Nordic | 5.46% |

| Rest of Europe | 13% |

The biotin gummies market in Germany is projected to expand steadily, underpinned by consumers’ strong orientation toward scientifically validated, clean-label supplements. From your dataset, the skin health claim segment is highlighted with a CAGR of ~6.16% (2025-2035), suggesting that beauty-from-within positioning will remain a primary demand driver. Germany’s mature regulatory ecosystem favors transparent ingredient disclosure, vegan pectin-based formulations, and sugar-reduced innovations, reinforcing consumer trust in premium offerings.

Demographically, teenagers accounted for ~21.88% of consumption in 2025, a share expected to slightly decline to ~20.73% by 2035, signaling diversification toward adult and mid-life users. Pharmacy-led distribution remains dominant, but e-commerce is steadily scaling as German buyers increasingly engage with personalized wellness platforms. Over the forecast horizon, brands integrating recyclable packaging, third-party certifications, and omnichannel strategies are expected to secure competitive advantage.

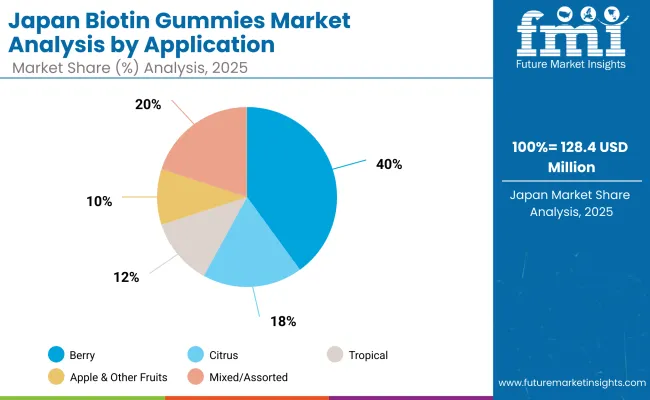

| Application Segment | Market Value Share, 2025 |

|---|---|

| Berry | 40% |

| Citrus | 18% |

| Tropical | 12% |

| Apple & Other Fruits | 10% |

| Mixed/Assorted | 20% |

The biotin gummies market in Japan is projected to reach USD 128.4 million in 2025, expanding steadily at a CAGR of 6.12% between 2025 and 2035. Market performance is strongly tied to Japan’s aging demographic, where beauty, hair, nail, and skin care remain critical consumer priorities. In 2025, hair and nail health accounts for 40% of the market, while skin health contributes 28%, together representing over two-thirds of demand. Growth has also been supported by the availability of pharmacy-led OTC channels, robust consumer trust in clinically validated supplements, and increasing focus on premium gummies enriched with collagen peptides, CoQ10, and ceramides. Rising urban lifestyles and preference for convenience-based supplementation continue to accelerate adoption.

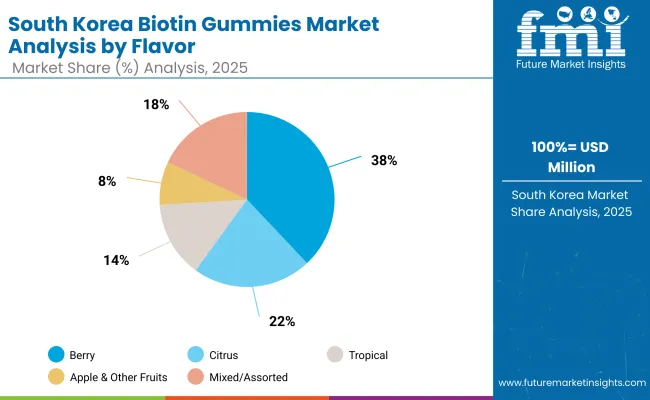

| Flavor | 2025 Share (%) |

|---|---|

| Berry | 38% |

| Citrus | 22% |

| Tropical | 14% |

| Apple & Other Fruits | 8% |

| Mixed/Assorted | 18% |

| Total | 100% |

The biotin gummies market in South Korea is positioned for strong growth, with berry flavors commanding the largest share at 38% in 2025, reflecting their alignment with consumer preferences for antioxidant-rich and naturally sweet formulations. Citrus-based gummies follow at 22%, supported by South Korea’s strong demand for vitamin C-enriched wellness solutions. Tropical flavors at 14% have benefited from premiumization trends and cross-category inspiration from beverages and functional snacks. Apple and other fruit flavors maintain an 8% share, offering niche opportunities in localized taste innovation. The fastest expansion is projected in the mixed/assorted category, with a CAGR of 9.0%, as multi-flavor packs gain traction among younger demographics seeking variety and playful consumption. This flavor-led diversification underpins broader opportunities in the country’s beauty-from-within segment.

Berry dominates with 38% share, leveraging antioxidant positioning and mainstream appeal. Mixed/assorted gummies, though smaller in share, lead growth with a 9% CAGR. Flavor diversification is shaping consumer engagement in South Korea’s beauty-driven nutraceutical culture.

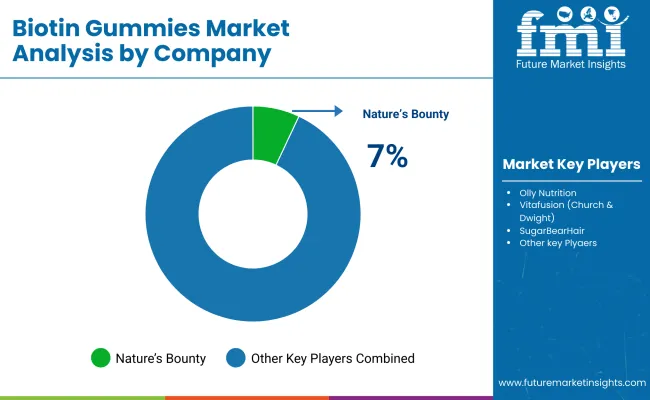

| Company | Global Value Share (%) |

|---|---|

| Nature’s Bounty | 7% |

| Olly Nutrition | 6% |

| Vitafusion (Church & Dwight) | 5% |

| SugarBearHair | 4% |

| Others | 78% |

The global biotin gummies market in 2025 is characterized by moderate fragmentation, shaped by innovation in beauty-from-within positioning, clean-label compliance, and flavor-based consumer appeal. USA-based leaders such as Nature’s Bounty, Olly Nutrition, and Vitafusiondominate premium and mass retail segments, leveraging strong brand equity, celebrity endorsements, and extensive distribution networks. Niche innovators like SugarBearHair have capitalized on influencer-led direct-to-consumer (DTC) channels, targeting younger demographics and creating high visibility through social media campaigns.

Asian manufacturers, particularly in India and China, play a growing role in private-label and contract manufacturing of gummies, focusing on vegan, halal, and sugar-free formats tailored for export markets. European firms are differentiating through collagen-infused and plant-based gummies, catering to rising demand for multifunctional supplements. Competitive strategies are shifting from price-based competition to format innovation, combination formulations (biotin + collagen/hyaluronic acid), and clinical substantiation to build consumer trust. Future leadership is expected to rely on R&D-driven biofunctional blends, e-commerce-first launches, and omnichannel retail penetration.

Key Developments in Biotin Gummies Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.89 Billion |

| Component | Single-ingredient Biotin Gummies, Biotin + Multivitamins, Biotin + Collagen, Biotin + Minerals (Zinc, Selenium, etc.) |

| Dosage Strength | Below 2,500 mcg, 2,500-5,000 mcg, 5,001-10,000 mcg, Above 10,000 mcg |

| Formulation | Standalone Biotin, Combination with Multivitamins, Combination with Collagen, Combination with Minerals |

| Type | Chewable gummies, Sugar-free gummies, Vegan/plant-based gummies, Functional gummies (fortified with additional nutrients) |

| End-use Industry | Nutraceuticals, Dietary Supplements, Cosmetics & Personal Care, Pharmaceutical/Medical Nutrition, Functional Food & Beverages |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Church & Dwight Co., Inc. (Vitafusion), Nature’s Bounty, GNC Holdings, Inc., NutraBlast, Olly Public Benefit Corporation, HUM Nutrition, Nature Made, Vital Proteins, SugarBearHair, and other regional players |

| Additional Attributes | Dollar sales by dosage strength and formulation, consumer preference for sugar-free and vegan gummies, growing demand in beauty-from-within supplements, rapid adoption in Asia-Pacific markets, strong retail and e-commerce growth, rising brand collaborations with influencers, increasing product launches in multivitamin- biotine blends, and innovations in clean-label and organic gummy formulations. |

The global Biotin Gummies Market is estimated to be valued at USD 1.89 billion in 2025, supported by rising demand for beauty-from-within and wellness supplements.

The Biotin Gummies Market is projected to reach USD 3.29 billion by 2035, reflecting sustained consumer adoption across hair, skin, and nail health applications.

The Biotin Gummies Market is expected to grow at a CAGR of 6.7% between 2025 and 2035, driven by innovation in sugar-free, vegan, and fortified formulations.

Key product types include sugar-free gummies, collagen-infused gummies, vegan plant-based gummies, fortified multivitamin gummies (with biotin), and other specialty formulations.

In 2025, sugar-free gummies are expected to hold the leading share, accounting for 64% of the South Korea market, highlighting consumer preference for clean-label and low-calorie options.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Biotin Supplement Market Analysis – Size, Share & Forecast 2025 to 2035

CBD Gummies Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

CoQ10 Gummies Market Analysis by Source, Distribution Channels, and Key Regions Through 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Ectoin Gummies Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA CBD Gummies Market Trends – Growth, Demand & Innovations 2025-2035

ASEAN CBD Gummies Market Growth – Trends, Demand & Innovations 2025-2035

Europe CBD Gummies Market Insights – Size, Share & Industry Trends 2025-2035

Jellies and Gummies Market Size and Share Forecast Outlook 2025 to 2035

Multivitamin Gummies Market Analysis by Source, End-user, Application, Sales Channel, Distribution Channel, and Region Through 2035

Nutraceutical Gummies Market Analysis - Size, Share, and Forecast 2025 to 2035

Dietary Fiber Gummies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA