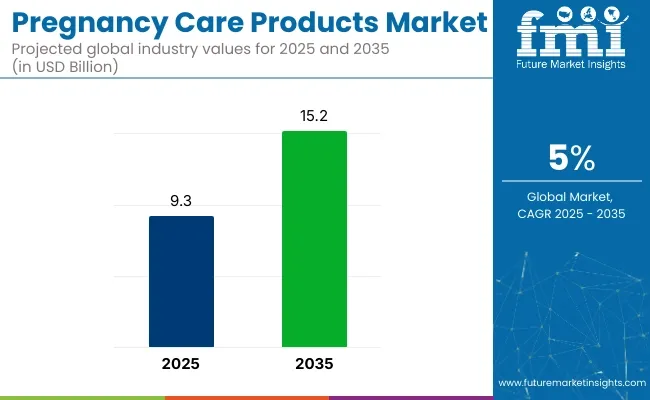

The global pregnancy care products market is set to grow from USD 9.3 billion in 2025 to USD 15.2 billion by 2035, which shows a 5% CAGR. The market is witnessing steady growth due to rising awareness among expecting mothers about the importance of prenatal health and personal care during pregnancy.

Increasing disposable income and the influence of social media and digital health platforms have made women more conscious about using specialized products like prenatal vitamins, maternity skincare, and nutritional supplements.

The growing availability of these products across e-commerce platforms and specialty maternity boutiques further fuels market expansion. Additionally, the rising number of late pregnancies and the focus on maternal wellness by healthcare providers are encouraging the adoption of premium, science-backed pregnancy care solutions worldwide.

The growing prevalence of pregnancy complications such as gestational diabetes, anemia, and nutritional deficiencies is driving the demand for targeted pregnancy care products. Women are increasingly opting for fortified prenatal supplements and specialized skincare to prevent stretch marks, pigmentation, and hormonal acne. Moreover, the trend of planned pregnancies and fertility treatments has expanded the consumer base for preconception and pregnancy-related products.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 9.3 billion |

| Projected Value (2035F) | USD 15.2 billion |

| Value-based CAGR (2025 to 2035) | 5% |

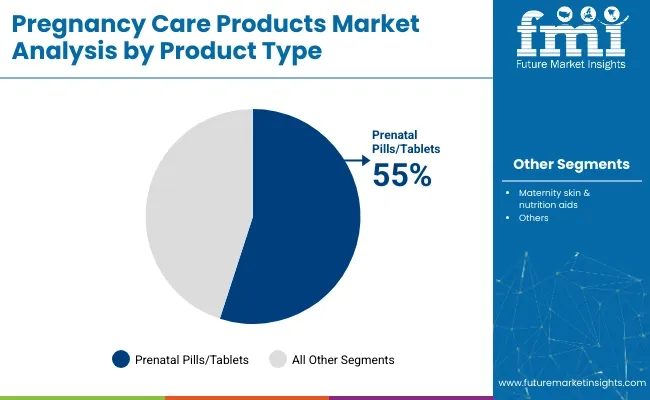

On the basis of product, the prenatal pills/tablets segment accounts for 55% share of the market in 2025. Moreover, the gummies segment is set to grow at 7.4% CAGR during the forecast period. With respect to end-user, the individual consumers (self-purchase) segment occupies 63% share. This segment is poised to grow at 6.4% CAGR during the study period of 2025 to 2035.

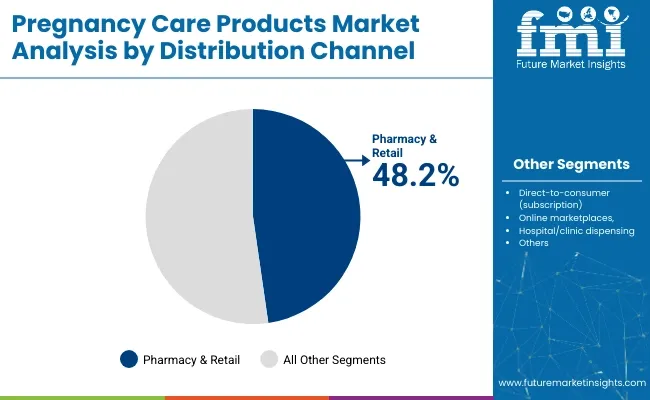

By product, the market is segmented into prenatal vitamins & supplements (pills/tablets, gummies, powders/sachets) and maternity skin & nutrition aids (creams/gels, oils/serums, lotions/balms). By distribution channel, the market is classified into pharmacy & retail chains, direct-to-consumer (subscription), online marketplaces, and hospital/clinic dispensing.

Based on end user, the market covers individual consumers (self-purchase), hospitals & healthcare facilities, pharmacies & drug stores, and e-commerce/specialty boutiques. Regionally, the market analysis spans across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

The prenatal pills/tablets segment accounts for 55% share of the market in 2025. Prenatal pills and tablets are preferred in pregnancy care products due to their convenience, precise dosage, and widespread availability.

The pharmacy & retail chains segment accounts for a market share of 48.2% in the pregnancy care products market by distribution channel. This leading position is driven by the widespread presence of brick-and-mortar stores, consumer trust in established pharmacy brands, and the convenience of immediate product availability.

The individual consumers (self-purchase) segment registers 63% market share and is slated to grow at 6.4% CAGR during the study period. Individual consumers, especially expectant mothers, are the leading purchasers of pregnancy care products due to increasing awareness of maternal health and wellness during pregnancy.

Recommendations from gynecologists and obstetricians are encouraging the adoption of prenatal vitamins and maternity skincare products. Rising trend of self-purchase among individual consumers as they actively seek personalized pregnancy care solutions.

Recent Trends in the Pregnancy Care Products Market

Challenges in the Pregnancy Care Products Market

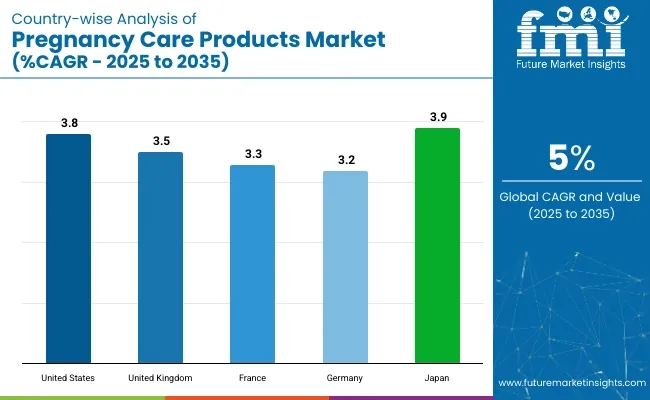

The USA pregnancy care products market is slated to grow at 3.8% CAGR during the study period. The market is growing due to increasing awareness among women about prenatal health, coupled with strong recommendations from healthcare professionals for the use of supplements and maternity skincare.

The UK pregnancy care products market is slated to grow at 3.5% CAGR during the study period. The market is driven by rising health consciousness among expecting mothers and the growing popularity of natural and organic products.

The French pregnancy care products market is slated to grow at 3.3% CAGR during the study period. The market is experiencing steady growth owing to the country’s strong emphasis on maternal health and wellness. French consumers prioritize high-quality, dermatologically tested skincare products and pharmaceutical-grade prenatal supplements.

The German pregnancy care products market is poised to expand at 3.2% CAGR during the study period. The demand for high-quality prenatal vitamins and natural skincare products has surged, supported by recommendations from gynecologists and midwives.

The Japanese pregnancy care products market is slated to expand at 3.9% CAGR during the study period. Japanese consumers value high-quality, functional products backed by scientific research, making pharmaceutical-grade prenatal supplements highly preferred.

The pregnancy care products market is highly competitive, with both multinational corporations and niche brands offering a wide range of products catering to maternal health and wellness. Leading players like Pharmavite, with its Nature Made range, dominate the prenatal vitamins and supplements category due to strong retail presence and healthcare endorsements.

Church & Dwight offers the Rainbow Light brand of supplements and Palmer’s maternity skincare products, addressing both nutrition and skin care needs during pregnancy. Johnson & Johnson, through its Belli brand, provides dermatologist-tested skincare solutions specifically formulated for expecting mothers, while Unilever also leverages the Palmer’s brand to capture a significant share of the maternity creams and lotions segment. These companies benefit from global distribution networks, strong brand reputation, and extensive product research, ensuring consumer trust and preference.

In addition to these established players, several specialized and emerging brands are strengthening their market positions by focusing on clean, organic, and eco-friendly offerings. Earth Mama Organics, Ritual, and Needed are notable for their focus on organic, non-GMO, and plant-based prenatal supplements and skincare products, appealing to health-conscious consumers seeking natural alternatives. Brands like Burt’s Bees Mama Bee and CeraVe (owned by L’Oréal) offer gentle skincare solutions that address common pregnancy-related skin concerns such as dryness and stretch marks.

Recent Pregnancy Care Products Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 9.3 billion |

| Projected Market Size (2035) | USD 15.2 billion |

| CAGR (2025 to 2035) | 5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value |

| Product Analyzed | Prenatal vitamins & supplements (pills/tablets, gummies, powders/sachets); maternity skin & nutrition aids (creams/gels, oils/serums, lotions/balms) |

| Distribution Channels Analyzed | Pharmacy & retail chains; direct-to-consumer (subscription); online marketplaces; hospital/clinic dispensing |

| End-users Analyzed | Individual consumers (self-purchase); hospitals & healthcare facilities; pharmacies & drugstores; e-commerce / specialty boutiques |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players Influencing the Market | Pharmavite (Nature Made), Church & Dwight (Rainbow Light / Palmer’s), Johnson & Johnson (Belli), Unilever (Palmers), Earth Mama Organics, Ritual, Needed, Burt’s Bees Mama Bee, CeraVe (L’Oréal), Vitacost |

| Additional Attributes | Dollar sales growth by product type, regional demand trends, competitive landscape, technological innovations |

The market is valued at USD 9.3 billion in 2025.

The market is set to grow at a CAGR of 5% CAGR during the study period.

Prenatal pills/tablets are being widely sold.

Major companies include Pharmavite (Nature Made), Church & Dwight (Rainbow Light & Palmer’s), Johnson & Johnson (Belli), Unilever (Palmers), and Earth Mama Organics.

Japan, set to grow at 3.9% CAGR during the study period, is poised for fastest growth.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pregnancy Snacks Market Analysis by Product Type, Nutritional Content, Distribution Channel, Packaging Format and Stage of Pregnancy Flavors Through 2035

Pre-Pregnancy Genetic Testing Market Size and Share Forecast Outlook 2025 to 2035

At-Home Pregnancy Testing Market Size and Share Forecast Outlook 2025 to 2035

Wearable Pregnancy Devices Market Trends and Forecast 2025 to 2035

Fertility Pregnancy Rapid Test Kits Market Analysis - Size, Share, and Forecast 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Pet Care Market Analysis – Demand, Trends & Forecast 2025–2035

Pet Care Packaging Market Insights - Growth & Forecast 2025 to 2035

Eye Care Supplement Analysis by Ingredients, Dosage Form, Route of Administration, Indication, Distribution channel and Region 2025 to 2035

Homecare Medical Devices Market Outlook – Industry Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA