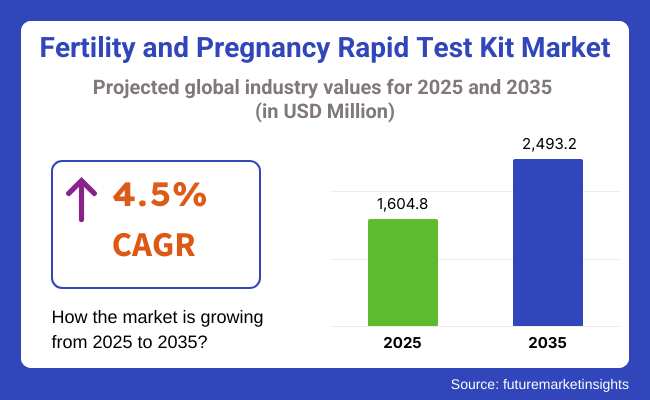

The fertility pregnancy rapid test kits market is expected to witness stable growth, with global sales projected to reach USD 1.60 billion in 2025. This reflects an increase from an estimated USD 1.51 billion in 2024. By 2035, the market is forecasted to expand to USD 2.49 billion, registering a CAGR of 4.5%. Rising consumer preference for home-based testing has fueled adoption across retail and online distribution channels. Increasing focus on reproductive health and earlier diagnosis continues to support steady year-over-year growth.

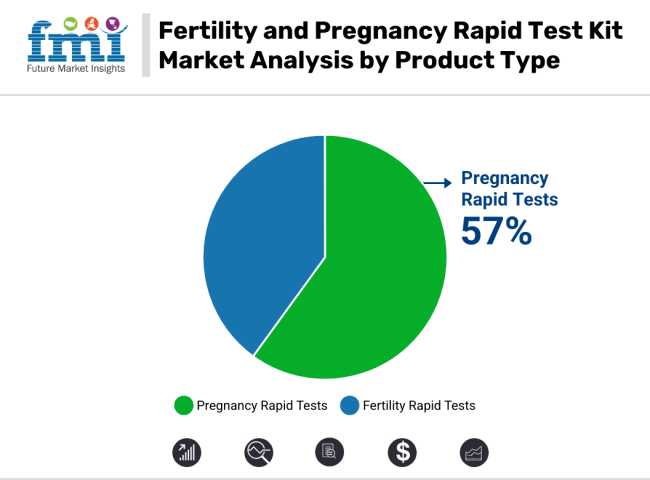

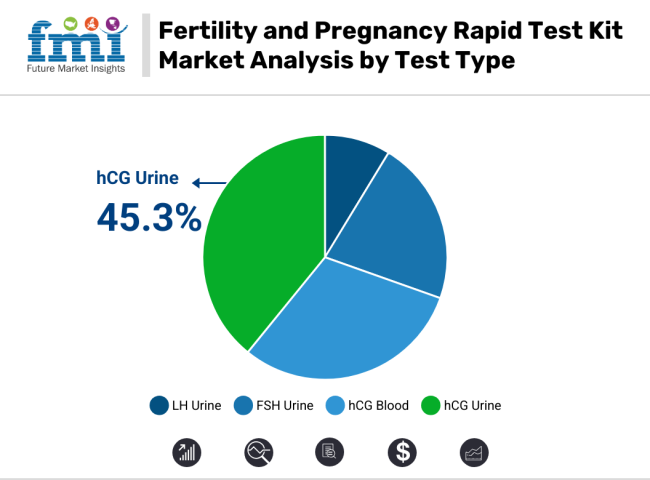

Pregnancy rapid test kits are expected to maintain their lead with a 57.0% market share in 2025, driven by their convenience, affordability, and quick result output. hCG urine-based tests will dominate the test type segment with a 45.3% share, given their early detection accuracy and widespread availability. Sales have gained traction across emerging markets where healthcare access is improving, supported by community health programs and digital health platforms.

In 2024, Clearblue, a brand by SPD Swiss Precision Diagnostics GmbH, introduced a Bluetooth-enabled pregnancy test in select global markets. The device connects to a smartphone app to guide users through testing and interpret results. This marked a pivotal move toward digitized home diagnostics. In 2025, Abbott announced the expansion of its diagnostics manufacturing facility in Malaysia to meet increasing demand in Asia, reflecting the market’s regional diversification strategy.

Commenting on this shift, Robert B. Ford, Chairman and CEO of Abbott, said during the company’s Q1 2025 earnings call: “We continue to see strong momentum in our rapid diagnostics business, particularly in consumer self-testing, as people increasingly take health into their own hands.” This statement underscores the market’s evolution toward consumer-centric innovation and real-time health insights.

The market outlook remains positive through 2035, supported by technological advancements, rising health awareness, and wider test accessibility. Digital integration, especially app-based features, is expected to reshape user engagement. Manufacturers are focusing on regulatory approvals, sensitivity enhancement, and AI-backed analytics to drive differentiation in a maturing diagnostic landscape.

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the fertility pregnancy rapid test kits industry outlook between 2024 and 2025 on a six-month basis is shown below.

By this examination, major variations in the performance of these markets are brought to light, and trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below compares the compound annual growth rate (CAGR) for the global fertility pregnancy rapid test kits industry analysis from 2024 to 2025 during the first half of the year. This overview highlights key changes and trends in revenue growth, offering valuable insights into market dynamics.

H1 covers January to June, while H2 spans July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.2%, followed by a slightly lower growth rate of 4.9% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 5.2% (2024 to 2034) |

| H2 | 4.9% (2024 to 2034) |

| H1 | 4.5% (2025 to 2035) |

| H2 | 4.0% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.5% in the first half and projected to lower at 4.0% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS.

By Product, Pregnancy rapid tests are projected to account for over 57% of the total market revenue in 2025. Their dominance is driven by the extensive use of hCG-based urine tests for early pregnancy detection. These tests are known for their cost-effectiveness, simplicity, and ability to provide results as early as six days before a missed period.

The growing preference for self-monitoring and increasing public education around reproductive health have further propelled adoption. Digital innovations from brands like Clearblue and FIRST RESPONSE™-including smart display readouts, Bluetooth-enabled apps, and dual-hormone detection-have redefined the consumer experience.

These tools provide added assurance, improved interpretability, and real-time tracking options. As consumers continue to prioritize convenience, privacy, and speed in diagnostics, the pregnancy rapid test segment is expected to maintain its leadership in the overall market.

By Test Type, The hCG urine test segment is projected to account for over 45.3% of the total revenue in the fertility and pregnancy rapid test kit market. Its leading position is underpinned by the test’s high sensitivity, low cost, and broad availability in both retail and clinical settings. Capable of detecting pregnancy as early as 6-8 days post-conception, hCG urine tests offer quick and accurate results without the need for professional interpretation.

Recent advancements have focused on improving test reliability through enhanced reagent specificity, error-proof device design, and integration with mobile platforms for result logging and cycle tracking. Companies like Clearblue and Proov have introduced next-generation formats aimed at increasing detection accuracy and user confidence.

As global demand grows for digitally enhanced, easy-to-use, and emotionally supportive diagnostic solutions, the hCG urine test segment is poised to remain a cornerstone of at-home pregnancy detection.

Awareness Initiatives Supporting Women’s Reproductive Health Driving the Market

Several companies have initiated awareness programs by educating and enabling women who encounter reproductive health disorders such as PCOS and PCOD. These plans have been instituted with the help of key producers to spread awareness relating to early treatment, treatment options, and managing lifestyle for effective fertility. Programs such as campaign drives, medication maintenance programs, and online education platforms play a vital role in addressing the stigma and misinformation surrounding these conditions.

Healthcare providers and organizations are also collaborating to enhance global fertility rates. Their combined efforts include promoting early screening, providing better healthcare access, and supporting women with personalized reproductive health strategies.

A notable example is Clearblue's 'Conceivinghood' campaign, designed to de-stigmatize the pre-pregnancy phase. This initiative empowers women by offering tools, education, and resources to take control of their fertility journey. By focusing on confidence and knowledge, the campaign ensures that women feel supported during this significant life stage.

These efforts highlight the importance of education and proactive healthcare, which are crucial in managing reproductive health conditions effectively. As awareness grows, such initiatives contribute significantly to the demand for fertility-related rapid test kits, enabling early detection and better health outcomes.

Demand for Fast, Self-contained Tests Driving the Market for Fertility Pregnancy Rapid Test Kit

The market is being transformed by the growing need for quick, self-contained fertility and pregnancy test kits. Increasingly, consumers are focused on convenience and privacy and use products that swiftly and easily provide accurate results at home. These products are mostly preferred by women who track their ovulation cycles to plan families or confirm pregnancy without seeing a doctor.

Their design places an emphasis on simplicity and efficiency, with very clear instructions requiring minimal steps in order to reach accurate outcomes. This ease makes them ideal for individuals navigating through time-sensitive windows of fertility or early pregnancy detection.

Technological advancements have further improved the functionality of these kits, which are more sensitive and reliable. These advancements thus give users an element of control and reassurance in key life events, such as planning a pregnancy or gaining insight into fertility health.

The online trend has also ensured the availability of self-contained kits that are delivered directly to a consumer's discreet purchase of products aimed at their convenience. This type of demand highlights a trend that favors personalized, stress-free solutions that save a consumer's valuable time. More so, consumer's continued hunt for fast and efficient, safe, and stress-free options spells huge growth for this fertility pregnancy rapid test kits market in the forthcoming years.

Opportunity for Cost Reduction and Insurance Coverage in Fertility Pregnancy Rapid Test Kits Market

The high price of fertility and pregnancy rapid test kits in countries such as the USA and Europe is a significant barrier to their widespread adoption. Currently, these devices are not included in most pregnancy coverage or health insurance policies, which makes them inaccessible to many people. These cost concerns may provide a large opportunity for market growth if addressed.

If the kits were made cheaper, it would be easier for more people to afford them and use them as a convenient solution for at-home fertility and pregnancy testing. This would be an even greater benefit to those who are low-income.

Second, inclusion in health care benefits policies would add to the acceptance of these appliances. Especially in the USA and Saudi Arabia where costs are significantly higher than elsewhere, reimbursement through health insurance plans will reduce user costs. This will make such indispensable diagnostic tools more accessible towards the use of them in family planning and monitoring reproductive health.

Hence, these initiatives will not only expand the market reach but also tend to assist healthcare systems by enabling early detection and proactive reproductive health management. Focusing on affordability and insurance integration, manufacturers along with policymakers can unlock major growth opportunities in the fertility and pregnancy rapid test kit market.

Unreliability of Results Restraining the Fertility Pregnancy Rapid Test Kits Market

The main issue with the unreliability of results makes it a significant challenge for the growth of the fertility and pregnancy rapid test kits market. Many physicians prefer laboratory testing over home test kits, which they believe has better accuracy and reliability compared to clinical diagnostics. They, therefore, recommend patients to go for laboratory tests and, hence, reduce the level of trust in at-home testing solutions.

False positives and negatives are the main reasons why consumers do not rely on home test kits. These false results may be caused by improper adherence to user instructions, unclear result windows, or technical limitations in the devices. Other issues such as insensitivity or hormonal interference can further contribute to unreliable outcomes, deterring widespread adoption of these kits.

This might create confusion in the minds of users, cause them emotional upset, and hence require further doctor visits. For manufacturers to surmount these problems, there is an urgent need for their products to be more accurate and user-friendly. Clear guidelines in using the test kits and heightened sensitivity of devices will help revitalize consumer confidence and increase home-based fertility and pregnancy rapid tests. Reliability is the backbone for the market's long-term success.

The global fertility pregnancy rapid test kits industry recorded a CAGR of 4.4% during the historical period between 2020 and 2024. The growth of the fertility pregnancy rapid test kits industry was positive as it reached a value of USD 1,534.6 million in 2024 from USD 1,293.3 million in 2020.

In recent years, the market of fertility and pregnancy rapid test kits has witnessed major transformations. When the test first began, they were not sophisticated but basic with little accuracy. Later on, however, advanced technologies in the area of diagnostic equipment gave birth to much more precise, consumer-friendly products.

This coupled with convenience along with a sense of personal privacy fueled demand towards an accessible home-testing product. As awareness on reproductive health improved, these tests were incorporated into family planning and early pregnancy detection. They were helpful to women in finding quick and reliable results without consulting a health provider.

Consumer preferences also changed during this period. As more people looked for non-invasive, at-home options, manufacturers responded by making tests more sensitive and easier to use, which increased consumer confidence. The increasing incidence of infertility issues and the growing interest in women's health also contributed to the increasing adoption of the market.

Several trends will impact the fertility and pregnancy rapid test kits market over the future horizon. The adoption of artificial intelligence (AI) and digital health technologies is likely to enhance the sensitivity and convenience of these tests while offering real-time insights and personalized results. Furthermore, the expansion of e-commerce and direct-to-consumer platforms is likely to bring these products closer to more users.

Tier 1 companies hold a dominant 66.4% share of the global market. Tier 1 companies often have a wide distribution network and dominate both retail and online platforms. They are also more likely to engage in large-scale partnerships, marketing campaigns, and are heavily involved in regulatory approvals.

Due to their large-scale operations and reputation, these companies are key drivers of market growth and innovation. Prominent Tier 1 players include Swiss Precision Diagnostic GmbH, Church & Dwight Co, Inc., bioMérieux SA, Quidel Corporation and Abbott

Tier 2 companies account for 8.3% of the global market, maintaining a strong presence in specific segments or regions. Tier 2 Players are smaller, regional companies or emerging players that still hold a notable position in the market but have a more limited geographic footprint compared to Tier 1 players.

These companies typically focus on specific markets or demographics and may offer competitive products at lower prices. Key players in this category include Mankind Pharma Ltd., Sugentech, Inc, Gregory pharmaceutical Holdings, Inc, Proov, and Piramal Pharma Ltd.

The section below covers the industry analysis for fertility pregnancy rapid test kits sales for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa is provided.

The United States is anticipated to remain at the forefront in North America, with a CAGR of 3.8% through 2035. In South Asia & Pacific, India is projected to witness the highest CAGR in the market of 6.6% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

| Germany | 4.8% |

| Italy | 3.6% |

| UK | 4.5% |

| China | 6.9% |

| India | 6.6% |

| Japan | 5.0% |

The United States dominates the global market with a high share in 2024. The United States is expected to exhibit a CAGR of 3.8% throughout the forecast period (2025 to 2035).

The demand for pregnancy and fertility rapid test kits has been significantly fueled by the rising preference for at-home healthcare solutions in the United States. Home-based diagnostics is a shift motivated by the increased need for convenience, privacy, and early detection among individuals managing fertility issues or planning pregnancies.

The need to understand one's fertility status and confirm pregnancies has been growing in people, who are increasingly looking for easy-to-use, reliable test kits. With the availability of products like LH urine, FSH urine, and hCG urine tests becoming more accessible, testing from home has become the norm for many.

Another factor contributing to a growing market is the increasing rates of delayed pregnancies and growing education about fertility issues. The availability of cost-effective and time-effective means of monitoring personal and pregnancy-related fertility factors has been driving the increased use of at-home, rapid testing. The widespread access of such kits in pharmacies, online retailers, and stores selling health care products helps sustain the growth of the market. In a market focusing on privacy, simplicity, and prompt results, it is highly expected that pregnancy and fertility rapid test kits will increase in popularity across the United States.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.8%.

In Germany, awareness of the issue of infertility and the wish for early pregnancy diagnosis are the biggest drivers for fertility and pregnancy rapid test kits. Over the past few years, the Germans have increasingly taken the initiative in monitoring their reproductive health due to the increasing infertility rates and shifting family planning trends.

There has been a change in the German market to self-testing products, including LH urine, FSH urine, and hCG urine tests. People are increasingly looking for a non-invasive, private, and convenient means of early confirmation of pregnancy and fertility monitoring. With fertility rates declining and the increasing delay of pregnancies due to career and lifestyle factors, at-home tests are now in greater demand, which offer fast and accurate results.

Moreover, Germany's well-educated population is highly receptive to using medical products that provide clear and actionable results. These rapid test kits cater to those who are seeking more control over their reproductive health without the immediate need for clinical visits. With growing awareness of fertility problems and increasing interest in family planning, the demand for fertility and pregnancy rapid test kits in Germany will continue to increase, and thus, these products are becoming integral to the modern approach toward reproductive health.

Japan occupies a leading value share in East Asia market in 2024 and is expected to grow with a CAGR of 5.0% during the forecasted period.

In Japan, there is a deep culture of self-care and wellness, and this aspect has generally aided the growth of the fertility and pregnancy rapid test kits market. Japanese consumers are constantly seeking control over their reproductive health and prefer convenient, accurate, and discreet ways of monitoring fertility and pregnancy.

The increasing use of at-home testing kits, such as LH urine, FSH urine, and hCG urine tests, is primarily due to the need for privacy and control over health-related decisions. Many people delay starting families because of career pressures or lifestyle choices, and therefore, the demand for early-stage fertility and pregnancy testing has increased.

These tests enable people to track hormone levels and even identify early pregnancy or ovulation from the comfort of their homes. Moreover, Japan's advanced healthcare system and tech-savvy population make it an ideal market for innovative home diagnostic products.

The growing need for fertility wellness and health alongside the Japanese embracement of an at-home test solution has ensured that fertility as well as pregnancy rapid test kits are increasingly gained. As trends continue to experience growth, increasing demand is guaranteed in these areas, especially committed to personalization in health care management.

The fertility and pregnancy rapid test kits market is highly fragmented, with numerous key players competing to establish their presence and drive market growth. Companies in this market are focusing on continuous product innovation and new launches to stay ahead of competitors and meet the growing demand for reliable, convenient, and accurate home testing solutions. These companies are investing in the development of advanced test kits, including those for early pregnancy detection and fertility monitoring, to address the diverse needs of consumers.

Recent Industry Developments in Fertility Pregnancy Rapid Test Kits Market

| Report Attributes | Details |

|---|---|

| Market Size (2024) | USD 1.5 billion |

| Current Total Market Size (2025) | USD 1.60 billion |

| Projected Market Size (2035) | USD 2.49 billion |

| CAGR (2025 to 2035) | 4.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million units for volume |

| Product Types Analyzed (Segment 1) | Pregnancy Rapid Tests, Fertility Rapid Tests |

| Test Types Analyzed (Segment 2) | LH Urine, FSH Urine, hCG Blood, hCG Urine |

| Distribution Channels Analyzed (Segment 3) | Pharmacy, Drugstore, Gynecology/Fertility Clinics, E-commerce, Hypermarkets & Supermarkets |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Germany, France, United Kingdom, Italy, China, Japan, India, South Korea, Australia, UAE, South Africa |

| Key Players influencing the Rapid Test Kit Market | Swiss Precision Diagnostic GmbH, Church & Dwight Co, Inc., bioMérieux SA, Quidel Corporation, Abbott, Mankind Pharma Ltd., Sugentech Inc., Gregory Pharmaceutical Holdings Inc., Proov, Piramal Pharma Ltd., iXensor Co., Ltd. |

| Additional Attributes | Dollar sales rise driven by demand for early pregnancy detection, hCG urine tests gaining preference for home convenience, digital kit innovation improving accuracy and ease-of-use, e-commerce channel expanding rural access, fertility kits seeing uptick in planned conception trends, regulatory support boosting OTC availability in emerging regions. |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of product, the industry is divided into pregnancy rapid tests and fertility rapid tests.

In terms of test type, the industry is divided into LH urine, FSH urine, hCG blood, and hCG urine.

In terms of distribution channel, the industry is segregated into pharmacy, drugstore, gynecology/fertility clinics, e-commerce and hypermarkets & supermarkets

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) have been covered in the report.

The global fertility pregnancy rapid test kits industry is projected to witness CAGR of 4.5% between 2025 and 2035.

The global fertility pregnancy rapid test kits industry stood at USD 1.5 billion in 2024.

The global fertility pregnancy rapid test kits industry is anticipated to reach USD 2.49 billion by 2035 end.

China is expected to show a CAGR of 6.9% in the assessment period.

The key players operating in the global fertility pregnancy rapid test kits industry include Swiss Precision Diagnostic GmbH, Church & Dwight Co, Inc., bioMérieux SA, Quidel Corporation, Abbott, Mankind Pharma Ltd., Sugentech, Inc, Gregory Pharmaceutical Holdings, Inc, Proov, Piramal Pharma Ltd. and iXensor Co., Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Test Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Test Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Test Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Test Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Distribution channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Test Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Distribution channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Test Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Distribution channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Test Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Distribution channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Test Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Distribution channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fertility Supplement Market Trends - Growth & Industry Forecast 2025 to 2035

Fertility Tracking Apps Market

Fertility Test Market Size and Share Forecast Outlook 2025 to 2035

Infertility Treatment Market Size and Share Forecast Outlook 2025 to 2035

Infertility Drugs Market Analysis - Size, Share & Forecast 2025 to 2035

Demand for Fertility Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Pregnancy Care Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pregnancy Snacks Market Analysis by Product Type, Nutritional Content, Distribution Channel, Packaging Format and Stage of Pregnancy Flavors Through 2035

Pre-Pregnancy Genetic Testing Market Size and Share Forecast Outlook 2025 to 2035

At-Home Pregnancy Testing Market Size and Share Forecast Outlook 2025 to 2035

Wearable Pregnancy Devices Market Trends and Forecast 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

Hip Kits Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Audio Kits Market

RT-PCR Kits Market Growth - Trends & Forecast 2023 to 2035

Lavage Kits Market

Organoids Kits Market

Capacitor Kits Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA